Automotive OEM Coatings Market Report by Type (Solvent Borne, Waterborne, Powdered, and Others), Layer (Primer, Basecoat, Electrocoat, Clearcoat), Vehicle Type (Passenger Cars, Light Commercial Vehicles, Heavy Commercial Vehicles, and Others), Application (Interior, Exterior), and Region 2025-2033

Automotive OEM Coatings Market Size:

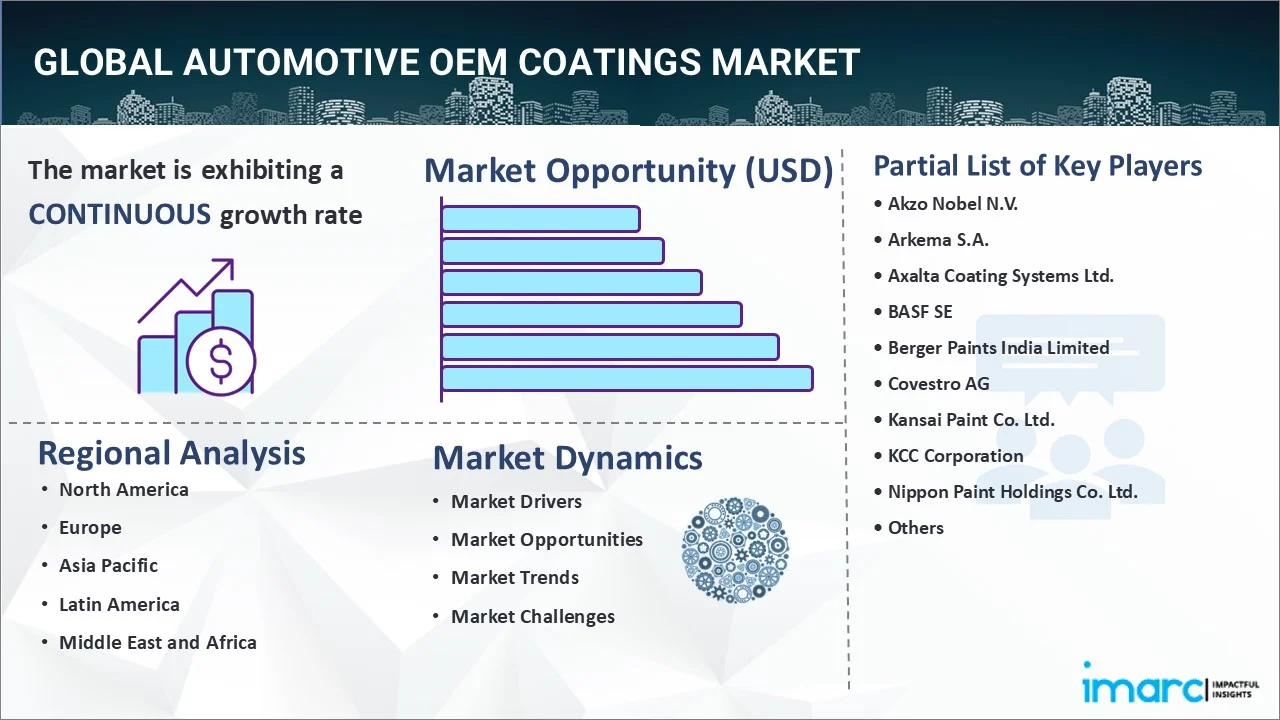

The global automotive OEM coatings market size reached USD 8.0 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 10.8 Billion by 2033, exhibiting a growth rate (CAGR) of 3.27% during 2025-2033. The market is experiencing steady growth driven by regulatory pressures necessitating the adoption of eco-friendly, low-VOC coatings, the growing automotive production and sales, particularly in emerging markets, and continuous technological advancements in coating formulations.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 8.0 Billion |

|

Market Forecast in 2033

|

USD 10.8 Billion |

| Market Growth Rate 2025-2033 | 3.27% |

Automotive OEM Coatings Market Analysis:

- Major Market Drivers: The rising demand for environmentally friendly, strong, and durable paints due to technological advances such as nanocoatings and high-solid formulations is driving the market. This is prompting low-VOC and waterborne coatings, which are more environmentally friendly compared to solvent-based coatings.

- Key Market Trends: One of the major automotive OEM coatings market trends includes the growing adoption of environmentally friendly coatings in line with global sustainability and regulatory compliance. Coating application processes such as electrophoretic deposition and powder coating that have been developed are enhancing productivity without waste of materials.

- Geographical Trends: Rapid industrial expansion coupled with higher automotive production, urbanization, and rising awareness programs are driving the market in Asia-Pacific. North America and Europe continue to be significant markets, due to stringent environmental norms and robust demand for cutting-edge coating technologies.

- Competitive Landscape: The market is witnessing competition at an intense level, which can be attributed to the rising investments in R&D, leading to innovations and improvement of coating solutions. Additionally, firms are joining forces and seeking partners to keep pace with current trends in the automotive sector. Some of the major market players in the automotive OEM coatings industry include Akzo Nobel N.V., Arkema S.A., Axalta Coating Systems Ltd., BASF SE, Berger Paints India Limited, Covestro AG, Kansai Paint Co. Ltd., KCC Corporation, Nippon Paint Holdings Co. Ltd., PPG Industries Inc., The Lubrizol Corporation and The Sherwin-Williams Company, among many others.

- Challenges and Opportunities: Adherence to strict environmental norms is a challenge; however, demands for constant innovation in environmentally friendly coatings create an opportunity. The increasing adoption of electric and hybrid-electric vehicles offers avenues for the development of custom coating solutions to accommodate new vehicle technologies.

Automotive OEM Coatings Market Trends:

Technological advancements and innovations

The rise in demand for automotive OEM coatings due to progressions in coating technologies is driving the market. Key automotive coatings breakthroughs such as nanocoating, waterborne, and high-solid formulations are transforming the market by providing wear-resistant, and environmentally friendly coating layers. These technologies offer additional rust-resistant and UV-stable protection from the elements, which helps vehicles last longer. In addition, the reduction in material waste and improvement productivity due to more innovative process methods such as electrophoretic deposition (EPD) and powder coating are also significantly supporting the market. Additionally, the escalating research and development spending by manufacturers in this area, to ensure long-lasting performance of high-quality coatings that meet industry requirements with a growing shift towards efficient and environmentally sustainable products is driving the market further.

Stringent environmental regulations

The market is supported by increased stringency in environmental regulations across the globe. Stringent enforcement of regulations to reduce volatile organic compound (VOC) emissions and promote eco-friendly materials is leading car manufacturers to shift from solvent-borne coatings to waterborne and low-VOC coatings, making them more eco-friendly. Meeting these regulations ensures that manufacturers avoid fines and helps develop an image as environmentally responsible. According to the automotive OEM coatings market analysis, the market is witnessing a large demand for environmentally friendly coatings that adhere to government norms, which encourages further innovation and growth. The global initiative for sustainability and environmental protection is driving greener coatings.

Growing automotive production and sales

The demand for OEM coatings is driven by the rising income of consumers around the globe, which in turn reflects higher global revenue generated via automotive sales primarily in developing regions. A growing number of urbanizations with rising disposable incomes and changes in adaptive lifestyles around the world are escalating demands for cars. In the coatings business, ensuring that premium coatings are of sound quality is essential to further beautifying and protecting automotive finishes. Moreover, the rebound in the automotive sector following the COVID-19 pandemic has supported fresh investments being made in manufacturing units and infrastructure, increasing the demand for OEM coatings. The market has grown as an increasing array of new vehicle models is launched, and electric and hybrid vehicles gain popularity. With the expansion of the automotive industry, it becomes necessary to use innovative and advanced types of coating solutions to meet future requirements for both manufacturers and consumers.

Automotive OEM Coatings Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global automotive OEM coatings market report, along with forecasts at the global, regional and country level from 2025-2033. Our report has categorized the market based on type, layer, vehicle type and application.

Breakup by Type:

- Solvent Borne

- Waterborne

- Powdered

- Others

Solvent borne accounts for the majority of the market share

The report has provided a detailed breakup and analysis of the market based on the type. This includes solvent borne, waterborne, powdered, and others. According to the report, solvent borne represented the largest segment.

Solvent borne coatings service is a major segment in the global automotive OEM coatings market, as it offers excellent performance characteristics and finds extensive use across regions. These coatings increase the adhesion and durability of a system but are also very strong even in environments with extreme conditions, which is why many automotive manufacturers find them to be appropriate. While the general trend is heading towards eco-friendly solutions, solvent-borne coatings are still prevailing as they represent a budget-saving and reliable solution. This is a good, reliable environmental option for performance duties in low-regulatory areas. However, ongoing advancements aim to lessen their environmental impact by developing low-VOC formulations to comply with global sustainability standards. Solvent-borne coatings play a vital role in the market, catering to diverse manufacturing needs. Evolving environmental considerations guide future modifications and enhancements, ensuring continuous development.

Breakup by Layer:

- Primer

- Basecoat

- Electrocoat

- Clearcoat

Clearcoat holds the largest share of the industry

A detailed breakup and analysis of the market based on the layer have also been provided in the report. This includes primer, basecoat, electrocoat, and clearcoat. According to the report, clearcoat accounted for the largest market share.

The largest layer segment in this market is clearcoat, which plays a vital role in providing the final finish and endowing protection to vehicles. It is the top layer of the paint job, providing a high gloss look and protecting the layers underneath from UV radiation, chemicals, and scratches. Clearcoat provides vehicles with an additional layer of strength and glossiness, which helps increase the life expectancy and beauty in cars thus making it indispensable for use within car production. Technology has dramatically improved clearcoat formulations, which now include the innovative combo of self-healing, anti-scratch, and hydrophobic properties. End customers are seeking impeccable finishes with a lasting aesthetic appearance for their vehicles. Furthermore, clearcoat plays an important part in the world of automotive quality standards which govern numerous coating parameters to ensure a car's good looks and durability over time. This is supporting the clearcoat segment to remain predominant in the market from both aesthetic and functional points of view.

Breakup by Vehicle Type:

- Passenger Cars

- Light Commercial Vehicles

- Heavy Commercial Vehicles

- Others

Passenger cars represent the leading market segment

The report has provided a detailed breakup and analysis of the market based on the vehicle type. This includes passenger cars, light commercial vehicles, heavy commercial vehicles, and others. According to the report, passenger cars represented the largest segment.

The passenger cars segment holds the largest market share based on vehicle type in the market. This can be attributed to its largest share in worldwide automotive production and sales. Increased urbanization, rising disposable incomes in developing nations, and a growing middle-class population have driven high demand for their mode of transport which is positively influencing the automotive OEM coatings market size. Passenger cars require thick paint layers to resist weathering and improve corrosion resistance which significantly increases life expectancy. The ongoing expansion in the automotive market and technological innovations related to car design as well as manufacturing processing drive up the flow of high-performance coatings. Additionally, the switch to electric and hybrid motors in passenger cars is encouraging coating manufacturers to develop dedicated solutions to meet the requirements of this new technology. Thus, the passenger car segment continues to be a significant influence, providing growth and innovation leadership in the market.

Breakup by Application:

- Interior

- Exterior

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes the interior and exterior.

Breakup by Region:

- North America

- United States

- Canada

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

Asia Pacific leads the market, accounting for the largest automotive OEM coatings market share

The report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Europe (Germany, France, the United Kingdom, Italy, Spain, Russia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, Asia Pacific represents the largest regional market for automotive OEM coatings.

Asia-Pacific represents the regional leader in the market, propelled by a robust manufacturing base for automobiles and an increasing consumer pool. China, India, and Japan are the primary automobile hubs that attract large investments in automotive production plants, thereby reinforcing a strong domestic market. Moreover, growth in the middle-class population and disposable incomes of consumers further lead to an increase in demand for passenger cars, thus fueling the automotive coatings market as well. The automotive OEM coatings market overview states that Asia-Pacific is the fastest urbanizing and industrializing region in the world, thereby driving the need for advanced coating solutions aimed at delivering enhanced aesthetics coupled with durability. The competitive dynamics in the region result in a high rate of innovation, thereby driving the preference for advanced coating technologies. The market in the Asia-Pacific region is also supported by favorable governmental norms and budgets for sustainable, and environment-friendly production.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape in the market. Detailed profiles of all major companies have also been provided. Some of the major market players in the automotive OEM coatings industry include:

- Akzo Nobel N.V.

- Arkema S.A.

- Axalta Coating Systems Ltd.

- BASF SE

- Berger Paints India Limited

- Covestro AG

- Kansai Paint Co. Ltd.

- KCC Corporation

- Nippon Paint Holdings Co. Ltd.

- PPG Industries Inc.

- The Lubrizol Corporation

- The Sherwin-Williams Company

(Please note that this is only a partial list of the key players, and the complete list is provided in the report.)

Key market players are leaning towards innovation, sustainability, and maintaining strategic partnerships to stay ahead. Companies are investing significant resources in research and development activities for creating advanced coating materials that provide enhanced features such as increased strength, higher abrasion resistivity capability, and eco-sustainability across surfaces better than traditional oil or solvent-based compounds. Additionally, they are also offering low VOC and waterborne coatings to comply with strict environmental norms, thereby expanding their product offerings. They often make strategic moves by acquiring or collaborating with other companies to access wider geographies and technologies. moreover, the automotive OEM coatings market insights suggest that these players are developing new production plants as well as improving distribution networks, especially in emerging countries to meet its increasing demand and establish their regional presence on a global scale.

Automotive OEM Coatings Market News:

- February 22, 2024: INEOS Automotive signed a global automotive refinish body and paint development agreement with the BASF Coatings division. The agreement is designed to establish a major long-term strategic collaboration that will allow the partners to exceed state-of-the-art in vehicle body repair and paint refinish.

- February 09, 2023: Sherwin-Williams, the leading paint and coatings manufacturer in North America, and Mercedes-AMG PETRONAS Formula One Team announced a new partnership. Sherwin-Williams, as an Official Team Partner of the Mercedes-AMG PETRONAS Formula One team, will provide approved paint and coatings for its F1 cars.

Automotive OEM Coatings Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Solvent Borne, Waterborne, Powdered, Others |

| Layers Covered | Primer, Basecoat, Electrocoat, Clearcoat |

| Vehicle Types Covered | Passenger Cars, Light Commercial Vehicles, Heavy Commercial Vehicles, Others |

| Applications Covered | Interior, Exterior |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Akzo Nobel N.V., Arkema S.A., Axalta Coating Systems Ltd., BASF SE, Berger Paints India Limited, Covestro AG, Kansai Paint Co. Ltd., KCC Corporation, Nippon Paint Holdings Co. Ltd., PPG Industries Inc., The Lubrizol Corporation, The Sherwin-Williams Company, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the automotive OEM coatings market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the global automotive OEM coatings market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the automotive OEM coatings industry and its attractiveness.

- The competitive landscape allows stakeholders to understand their competitive environment and provides insight into the current positions of key players in the market.

Key Questions Answered in This Report

The automotive OEM coatings market was valued at USD 8.0 Billion in 2024.

The automotive OEM coatings market is projected to exhibit a CAGR of 3.27% during 2025-2033.

The automotive OEM coatings market is driven by increasing demand for durable, eco-friendly coatings that offer enhanced protection, aesthetics, and corrosion resistance. Technological advancements in coating formulations, regulatory pressure for lower emissions, and rising consumer preferences for high-quality, visually appealing finishes contribute to market growth.

Asia Pacific currently dominates the market driven by a robust manufacturing base for automobiles and an increasing consumer pool in the region.

Some of the major players in the automotive OEM coatings market include Akzo Nobel N.V., Arkema S.A., Axalta Coating Systems Ltd., BASF SE, Berger Paints India Limited, Covestro AG, Kansai Paint Co. Ltd., KCC Corporation, Nippon Paint Holdings Co. Ltd., PPG Industries Inc., The Lubrizol Corporation, The Sherwin-Williams Company, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)