Automotive Plastics Market Size, Share, Trends and Forecast by Vehicle Type, Material, Application, and Region, 2025-2033

Automotive Plastics Market Size and Share:

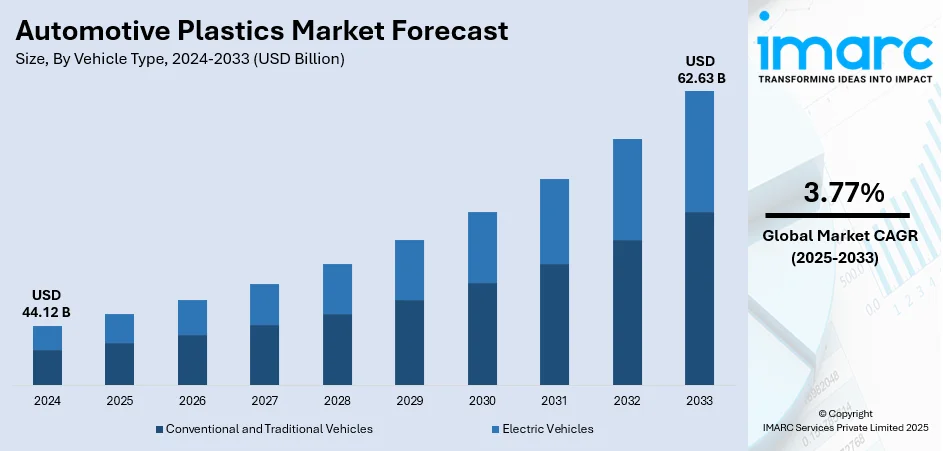

The global automotive plastics market size was valued at USD 44.12 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 62.63 Billion by 2033, exhibiting a CAGR of 3.77% from 2025-2033. Asia Pacific currently dominates the market, holding a market share of 48.1% in 2024. The dominance of the market is because of its strong manufacturing base, rapid industrialization, and increasing automotive production. The market benefits from cost-effective production, technological advancements, and a rising need for lightweight, fuel-efficient vehicles.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 44.12 Billion |

|

Market Forecast in 2033

|

USD 62.63 Billion |

| Market Growth Rate (2025-2033) | 3.77% |

The growing need for fuel-efficient and environment-friendly vehicles is leading to the adoption of lightweight materials, such as plastics. By lowering vehicle weight, plastics enhance fuel efficiency and decrease emissions, assisting automakers in complying with strict environmental standards while also improving vehicle performance and safety. Moreover, ongoing advancements in material science are enhancing the functions of automotive plastics. Innovative, high-performance plastics featuring enhanced strength, thermal resistance, and longevity empower manufacturers to create more intricate, efficient, and eco-friendly components, facilitating the incorporation of advanced materials in different vehicle parts. Besides this, plastics provide notable cost benefits compared to conventional materials such as metal, featuring reduced material expenses, simplified molding, and quicker manufacturing methods. These efficiencies assist car manufacturers in lowering production expenses while upholding quality, making plastics a compelling option for large-scale manufacturing in the automotive industry.

To get more information on this market, Request Sample

The United States is a crucial segment in the market, driven by advancements in material science, which are leading to the adoption of high-performance plastics in the automotive sector. Newer polymers and composites offer better durability, heat resistance, and strength, enabling manufacturers to integrate these materials into more complex automotive designs, improving vehicle performance and expanding the range of applications for plastics. Moreover, the rising production of electric vehicles (EVs) in the USA is driving the demand for advanced plastics, which are essential for lightweighting, improving battery efficiency, and meeting the unique demands of EV components. According to the U.S. Energy Information Administration (EIA), electric car sales in 2024 increased to 1.6 million, with their market share growing to over 10%. This rise in EV production supports automakers' shift toward more sustainable and efficient vehicle manufacturing.

Automotive Plastics Market Trends:

Advancements in Coating and Adhesion Technologies

Improvements in coating and adhesion technologies are enhancing the performance and durability of automotive components. The development of specialized primers and coatings that improve the adhesion between plastics and other materials enables manufacturers to use a wider variety of plastic materials, such as polypropylene and polycarbonate, in vehicle production. This ensures strong bonding with paint and coatings, addressing challenges that previously limited material choices. Improved adhesion reduces the need for additional processing steps, streamlining production and boosting efficiency. A key example of this innovation is the 2024 launch of AkzoNobel's ESP-950, a 2K solvent-borne primer designed for OEM plastic parts in the automotive industry. This primer was specifically formulated to address adhesion challenges in plastics like polypropylene and polycarbonate blends used in parts, such as bumpers and rocker panels, increasing production efficiency by reducing product switching and ensuring compatibility with existing paint lines.

Innovation in High-Performance Materials for Electric Vehicles (EVs)

The creation of advanced materials, especially for electric vehicles (EVs), is a crucial factor propelling the market growth as these materials enhance performance, durability, and efficiency, while meeting the unique demands of EV components. Improvements in resins and polymers that provide superior heat resistance, dimensional stability, and moisture resistance are crucial for fulfilling the unique requirements of EV parts. These materials not only mitigate problems like warping but also enhance the overall durability and functionality of vehicle parts, facilitating the manufacturing of larger and more intricate components. With the shift of the automotive sector towards EVs, the demand for materials that are efficient, dependable, and affordable is rising. Advancements in high-performance plastics are vital for this shift as exemplified by SABIC in 2025, through the introduction of the NORYL GTX LMX310 resin, a polyphenylene ether (PPE) blend intended for larger EV parts, like asymmetrical service flaps. This material provides excellent heat resistance, lower moisture absorption, and enhanced cost efficiency, contributing to SABIC's BLUEHERO electrification effort.

Focus on Sustainability and Environmental Goals

A growing emphasis on sustainability and environmental goals is bolstering the automotive plastics market growth as producers aim to reduce the environmental impact of vehicle production. There is a strong focus on developing plastics that are recyclable, biodegradable, and designed to reduce the automotive industry's carbon footprint. In response to stricter recycling and waste management regulations, automakers are increasingly adopting eco-friendly materials that meet these evolving standards. The shift towards sustainable plastics not only helps manufacturers comply with regulatory pressures but also appeals to environmentally conscious individuals. The integration of recycled materials into automotive production is further supporting a circular economy. For instance, in 2024, Polestar and MBA Polymers UK partnered to enhance the use of postconsumer recycled plastics in EV interiors. This collaboration included the use of MBA Polymers UK's ABS 4125 UL polymer, which contained over 95% recycled content, supporting sustainability goals and aligning with EU regulations for recycled plastic use in vehicles.

Automotive Plastics Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global automotive plastics market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on vehicle type, material, and application.

Analysis by Vehicle Type:

- Conventional and Traditional Vehicles

- Electric Vehicles

Conventional and traditional vehicles dominate the market with a share of 83.7%, because of their established presence and extensive production. These vehicles still represent a considerable portion of the worldwide automotive market, influenced by their low cost, efficiency, and large user base. The existing manufacturing methods and supply chains for traditional vehicles uphold the ongoing need for automotive plastics, especially for components that increase durability, decrease weight, and boost fuel efficiency. Moreover, the incorporation of high-tech plastic materials in conventional vehicles provides economical solutions that satisfy safety, visual, and practical needs. The growing user inclination towards internal combustion (IC) engine vehicles also plays a vital role in their market prevalence, as manufacturers prioritize enhancing performance by utilizing advanced plastics. The extensive variety of plastic uses in traditional vehicles guarantees their ongoing dominance in the automotive plastics industry.

Analysis by Material:

- Polyethylene (PE)

- Polypropylene (PP)

- Polyvinyl Chloride (PVC)

- Acrylonitrile Butadiene Styrene (ABS)

- Polyurethane (PU)

- Polymethyl Methacrylate (PMMA)

- Polycarbonate (PC)

- Polyamide

- Others

Polypropylene (PP) represents the largest segment, accounting for the market share of 43.2%, accredited to its excellent balance of properties, such as low weight, resilience, and resistance to chemicals. PP delivers exceptional performance in automotive uses where durability and strength are essential, while also reducing total vehicle weight, thereby improving fuel efficiency. Its adaptability enables it to be shaped into different forms and designs, making it ideal for numerous automotive parts, ranging from interior elements to exterior surfaces. Moreover, PP is economical, which makes it an appealing choice for large-scale manufacturing. Its capability to endure high temperatures and confront diverse environmental conditions further improves its suitability for automotive uses. The material's ability to be recycled corresponds with rising environmental issues and sustainability objectives, enabling manufacturers to comply with stricter regulations.

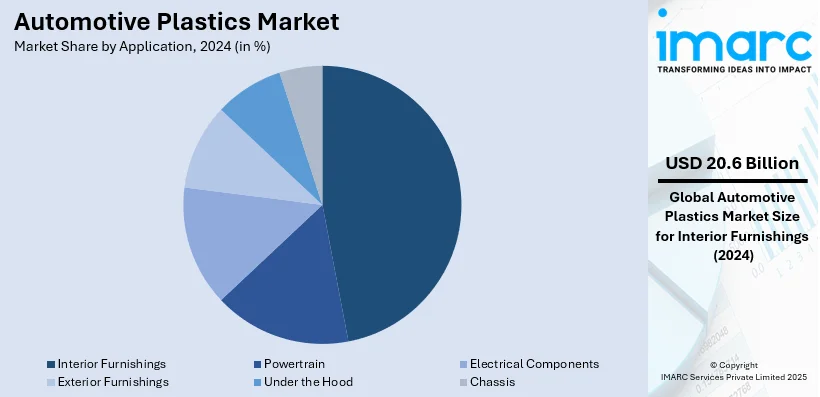

Analysis by Application:

- Powertrain

- Electrical Components

- Interior Furnishings

- Exterior Furnishings

- Under the Hood

- Chassis

Interior furnishings hold the biggest market share with 46.7%, as they play a vital role in improving vehicle comfort, appearance, and functionality. Plastics utilized in interior furnishings offer essential flexibility, durability, and lightweight characteristics that enhance the driving experience and vehicle aesthetics. The capacity of plastics to be effortlessly shaped into complex forms enables the development of elaborate designs and personalized attributes, which are becoming more popular among individuals. Moreover, automotive plastics used for interior applications provide outstanding sound insulation, thermal resistance, and a superior finish that improves the overall attractiveness of the interior. The increasing user demand for vehicle interiors focusing on comfort, style, and innovation is driving the need for advanced plastic materials. Additionally, the emphasis on eco-friendly materials and recyclability in car interiors supports the sector's ecological objectives, further enhancing the use of plastics in this application.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

Asia Pacific leads the market with a share of 48.1%, because of its swiftly expanding automotive sector, robust manufacturing framework, and economical production abilities. The area benefits from a substantial, skilled workforce and considerable investments in automotive technology, establishing it as an international center for automotive manufacturing. The rise of EV production further supports the adoption of automotive plastics, as EVs require high-performance materials for improved efficiency. User preference for lightweight and fuel-efficient vehicles is driving the increased use of advanced plastics in vehicle production. A report by the India Energy Storage Alliance projects that the EV industry in India will grow at a CAGR of 36% until 2026, highlighting the region's evolving automotive landscape. Additionally, the region's focus on sustainability and environmental goals is fostering the development of recyclable and eco-friendly plastics.

Key Regional Takeaways:

United States Automotive Plastics Market Analysis

In North America, the market portion held by the United States was 80.70%, owing to the growing focus on lightweight design, where high-performance polymers provide an optimal combination of durability and lower weight to assist manufacturers in achieving strict fuel efficiency and emissions goals. The transition towards EVs is catalyzing this demand, as car manufacturers look for resources that improve battery performance and increase driving distance. An industry report indicates that the count of EVs on US roads is projected to hit 26.4 million by 2030, representing over 10% of the total vehicles in use. Furthermore, the rising interest among individuals for refined interior designs and cohesive infotainment systems is encouraging the adoption of high-performance thermoplastics and engineered resins that combine luxury feel with long-lasting qualities. Additionally, many manufacturers are creating new products using sustainable materials, integrating recycled and bio-based plastics due to corporate responsibility goals and regulatory demands. Extremely effective manufacturing methods, including precision injection molding, resin transfer molding, and additive printing, are enhancing production speed and reducing waste.

North America Automotive Plastics Market Analysis

The North American automotive plastics industry is influenced by the robust automotive manufacturing sector and innovations in polymer production technology. The growing need for fuel-efficient, lightweight cars is leading to the adoption of advanced plastic materials, as they help lower overall vehicle weight and enhance fuel efficiency. Moreover, strict environmental regulations and user preferences for sustainable and recyclable materials are encouraging automakers to utilize eco-friendly plastics. The swift increase in EV usage, as stated by the IMARC Group, in 2024, the United States electric car industry was valued at USD 92.29 Billion, is driving the need for automotive plastics, as these vehicles frequently need specific materials for enhanced performance. Additionally, the increasing popularity of vehicle personalization and improved safety attributes is driving the need for top-notch, long-lasting plastics. Furthermore, the area's strong research abilities are allowing businesses to create new solutions and address the changing demands of the automotive sector, reinforcing North America’s role in the worldwide automotive plastics industry.

Europe Automotive Plastics Market Analysis

The expansion of the Europe automotive plastics market is primarily driven by a significant emphasis on sustainability, innovation, and strict environmental regulations. European car manufacturers face growing pressure to lower carbon emissions and enhance fuel efficiency, encouraging them to use lightweight materials like plastics. These materials contribute to lowering the overall weight of vehicles, which improves fuel efficiency and lessens environmental effects. The European Commission states that passenger cars and light commercial vehicles (vans) represent 16% and 3% of the overall carbon emissions in the European Union, respectively. Along with performance advantages, plastics provide design versatility, enabling manufacturers to produce intricate and contemporary components that meet user preferences for elegant, comfortable, and high-tech interiors. Moreover, Europe’s dedication to circular economy ideals is advancing the adoption of recyclable and bio-based plastics in vehicle manufacturing. The automotive sector in the region is also investing in research operations to enhance plastic formulations and integrate advanced materials into structural and functional components of vehicles. Furthermore, the increasing demand for elevated safety standards and improved in-vehicle features are driving the adoption of high-performance polymers with outstanding mechanical and thermal characteristics.

Asia Pacific Automotive Plastics Market Analysis

The automotive plastics market in the Asia Pacific is growing due to fast industrial development, rising vehicle manufacturing, and a higher demand for economical, fuel-efficient vehicles. According to the India Brand Equity Foundation (IBEF), the overall production of passenger vehicles, three-wheelers, two-wheelers, and quadricycles in India hit 24,76,915 units in March 2025. With regional economies on the rise, increased disposable incomes and urbanization are driving automobile sales, encouraging manufacturers to utilize lightweight materials like plastics to satisfy performance and efficiency requirements. Moreover, the growing user preference for contemporary car designs, upgraded interiors, and embedded technology features are greatly aiding the acceptance of advanced plastic parts. The area's rising emphasis on improving vehicle safety and adhering to developing crash performance criteria is driving the adoption of engineered plastics that provide durability and impact resistance. Additionally, the growing appeal of shared mobility and small vehicles in crowded urban regions is encouraging the utilization of lightweight and affordable materials like plastics to enhance space and efficiency.

Latin America Automotive Plastics Market Analysis

The automotive plastics market in Latin America is witnessing growth as the region steadily shifts towards electric and hybrid vehicles, encouraging the utilization of lightweight materials to enhance energy efficiency and functionality. For example, in Brazil, the number of EV registrations hit 177,000 units in 2024, showing notable growth compared to 2019, which had 41,000 units, according to recent industry reports. This figure is anticipated to hit 300,000 units by 2029 and 500,000 units by 2034. Moreover, governmental initiatives aimed at upgrading public transport fleets and decreasing vehicle emissions are impacting material selections, as plastics provide a viable option for reducing weight and enhancing durability. In addition, the presence of skilled workers and enhanced infrastructure are further fostering the development of automotive plastic production, establishing the area as a competitive contender in the worldwide automotive supply chain.

Middle East and Africa Automotive Plastics Market Analysis

The automotive plastics market in the Middle East and Africa is greatly affected by the rise in automotive assembly and manufacturing operations throughout the area, bolstered by initiatives for economic diversification and industrial growth. For example, Saudi Arabia intends to establish three to four original equipment manufacturers (OEMs) to produce over 400,000 passenger vehicles by 2030 within the nation, targeting a local gross value add (LGVA) of 40%, as reported by the Saudi Arabia Industrial Center. With governments focused on increasing domestic automotive manufacturing, the need for lightweight and economical materials like plastics is growing to enhance vehicle efficiency and reduce costs. Additionally, the increasing focus on sustainable practices and energy-efficient automobiles is motivating manufacturers to implement new plastic solutions that conform to changing environmental and performance criteria.

Competitive Landscape:

Major participants in the industry are concentrating on innovation, broadening their product ranges, and improving manufacturing capabilities to satisfy the increasing need for lightweight and eco-friendly materials. They are putting funds into research activities to enhance the performance, longevity, and recyclability of plastics used in vehicles. Furthermore, these firms are implementing cutting-edge manufacturing methods and technologies to boost productivity and reduce expenses. There is a notable demand for eco-friendly and biodegradable options to align with the automotive sector's transition toward sustainability and regulatory adherence. In 2025, Toyoda Gosei announced the development of a groundbreaking horizontal recycling technology for plastic automotive parts, utilizing 50% recycled plastic from end-of-life vehicles (ELVs). This new technology will be implemented in vehicles like the Toyota Camry and aims to reduce CO2 emissions by up to 40%. The initiative aligns with increasing environmental regulations and the push for a circular economy in the automotive industry.

The report provides a comprehensive analysis of the competitive landscape in the automotive plastics market with detailed profiles of all major companies, including:

- Asahi Kasei Corporation

- BASF SE

- Borealis AG

- Covestro AG

- Dow Inc.

- Koninklijke DSM N.V.

- Lanxess AG

- Lear Corporation

- LyondellBasell Industries N.V.

- Saudi Basic Industries Corporation

- Solvay S.A

- Teijin Limited

Latest News and Developments:

- July 2025: Star Plastics LLC confirmed the merger of Trivalence Technologies LLC into Star. Utilizing both virgin and recycled materials, Trivalence produces specially designed plastic resin compositions for various sectors, including automotive, construction, and electrical. With this merger, Star aims to enhance its overall capabilities, improving the company's technological expertise, product options, geographical reach, and market diversification.

- May 2025: Lumax Auto Technologies Ltd., a prominent distributor of automotive components, announced plans for the acquisition of the remaining 25% shares of IAC International Automotive India Pvt. Ltd. from the International Automotive Components Group. IAC India provides plastic interior components to India's prominent automakers. With this transaction, IAC India will become a fully owned subsidiary of Lumax.

- February 2025: The Global Impact Coalition (GIC) officially launched the very first Automotive Plastics Circularity pilot project in the world in partnership with Covestro, BASF, LG Chem, SABIC, Mitsubishi Chemical Group, SUEZ, LyondellBasell, and Syensqo. The revolutionary initiative aims to address the critical issue of recovering and recycling automotive plastic components from end-of-life vehicles (ELVs).

- February 2025: JRG Automotive Industries announced the successful acquisition of Stanley Engineered Fastening India’s (SEFI) two-wheeler functional plastics unit. This specialized unit develops automotive plastic injection-molded parts for two-wheeler original equipment manufacturers (OEMs). With this acquisition, JRG will be able to significantly expand its production capabilities by adding SEFI’s two operational production sites in Bangalore and Haryana to its portfolio.

Automotive Plastics Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Vehicle Types Covered | Conventional and Traditional Vehicles, Electric Vehicles |

| Materials Covered | Polyethylene (PE), Polypropylene (PP), Polyvinyl Chloride (PVC), Acrylonitrile Butadiene Styrene (ABS), Polyurethane (PU), Polymethyl Methacrylate (PMMA), Polycarbonate (PC), Polyamide, Others |

| Applications Covered | Powertrain, Electrical Components, Interior Furnishings, Exterior Furnishings, Under the Hood, Chassis |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Asahi Kasei Corporation, BASF SE, Borealis AG, Covestro AG, Dow Inc., Koninklijke DSM N.V., Lanxess AG, Lear Corporation, LyondellBasell Industries N.V., Saudi Basic Industries Corporation, Solvay S.A and Teijin Limited |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the automotive plastics market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global automotive plastics market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the automotive plastics industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The automotive plastics market was valued at USD 44.12 Billion in 2024.

The automotive plastics market is projected to exhibit a CAGR of 3.77% during 2025-2033, reaching a value of USD 62.63 Billion by 2033.

The automotive plastics market is growing attributed to the rising demand for lightweight materials, which improve fuel efficiency and lower emissions. Technological advancements in polymer processing, along with cost-effectiveness, are positively influencing the market. Additionally, increasing user preferences for durable, high-performance materials, and regulatory pressure for sustainable solutions is bolstering the market growth.

Asia Pacific currently dominates the automotive plastics market, accounting for a share of 48.1%. The dominance of the region is attributed to its strong manufacturing base, rapid industrialization, and increasing automotive production. The region benefits from cost-effective production, technological advancements, and a rising demand for fuel-efficient and lightweight, vehicles, making it a key player in the automotive plastics sector.

Some of the major players in the automotive plastics market include Asahi Kasei Corporation, BASF SE, Borealis AG, Covestro AG, Dow Inc., Koninklijke DSM N.V., Lanxess AG, Lear Corporation, LyondellBasell Industries N.V., Saudi Basic Industries Corporation, Solvay S.A, Teijin Limited, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)