Automotive Seat Market Size, Share, Trends and Forecast by Material Type, Seat Type, Vehicle Type, Vehicle Energy Source, and Region, 2026-2034

Automotive Seat Market 2025, Size and Share:

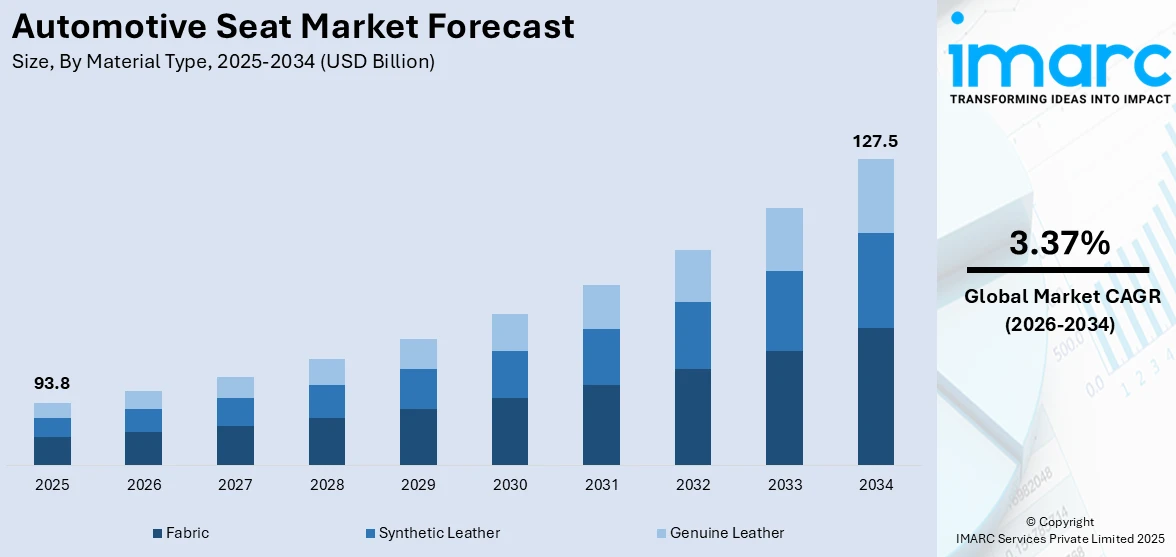

The global automotive seat market size was valued at USD 93.8 Billion in 2025. Looking forward, IMARC Group estimates the market to reach USD 127.5 Billion by 2034, exhibiting a CAGR of 3.37% from 2026-2034. Asia Pacific currently dominates the market, holding a market share of over 41.1% in 2025. The Asia Pacific market is experiencing robust growth, driven by rapid technological advancements, rising demand for luxury vehicles, implementation of stringent safety standards, and the increasing focus on passenger comfort and ergonomics.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

|

Market Size in 2025

|

USD 93.8 Billion |

|

Market Forecast in 2034

|

USD 127.5 Billion |

| Market Growth Rate 2026-2034 | 3.37% |

Automotive seats form an integral part of any car and serve the purpose of comforting the driver as well as the passengers. Other than that, comfort and personalization are fast gaining preference among people. Ergonomics, adjustability, luxury features like ventilation, heating, and massage functionality are becoming a preferred aspect for many in their cars. Such demands are specifically prominent in the premium and luxury car categories, wherein comfort forms one of the main distinguishing factors. Automakers are also using advanced materials such as memory foam, leather alternatives, and fabrics with antimicrobial properties to attract health-conscious and ecologically aware consumers. Apart from that, technological advancement is also changing the design and functionality of car seats. Smart seating systems equipped with sensors and electronic control units are emerging as better options, especially in connected and autonomous vehicles.

To get more information on this market Request Sample

The Unites States is emerging as a key region in the market driven by the evolving preferences of car owners and implementation of many regulatory statements. In the US, people increasingly seek vehicles equipped with advanced comfort features, especially in the mid-to-high-end automotive segments. Comfort, once primarily associated with luxury vehicles, is now becoming a standard expectation across various categories, including sports utility vehicles (SUVs), sedans, and trucks. Key features such as seat heating, ventilation, and massage functions are gaining popularity among American car owners, particularly those in regions with extreme weather conditions. For instance, heated seats are highly valued in colder climates, while ventilated seating systems are preferred in warmer regions. In recent days, autonomous vehicles are also in high demand due to their enhanced features. This is further driving the need for efficient automotive seats. The IMARC Group predicts that the US autonomous vehicle market will show growth rate (CAGR) of 27.5% from 2025-2032. This is considered to be another major reason to increase the need for automotive seats in the coming days.

Automotive Seat Market Trends:

Rapid Advancements in Automotive Seat Technology

The continuous technological improvements in seat manufacturing and design, as tastes tend to move towards the comfort and safety of seating, are further opening up good opportunities for market growth. Further to this, the development of seats with better ergonomics, adjustable lumbar support, massage functions, and memory settings are also supporting the market growth. For example, Mercedes-Benz provides the 2025 GLE 350 4MATIC SUV with multicontour front seats, which includes massage functions to comfort passengers. Another factor driving growth in the market is the use of advanced materials, such as lightweight composites, to reduce overall vehicle weight. According to studies, composite material usage can save up to 25% of seat weight, contributing to better fuel efficiency. Besides this, the growth of smart seats with sensors that track the occupant's health and alertness and automatically adjusts to provide maximum comfort is also bolstering the growth in this market. In addition, the increasing interest in autonomous and semi-autonomous vehicles promotes innovative design development for seating, adapting to the various cabin configurations.

Rising Demand for Luxury and Premium Vehicles

The demand for luxury and premium vehicles is rising due to the increasing concern for comfort and aesthetics, which is driving the market. As per an industrial report, in 2023, luxury vehicle sales in the United States reached around 650,100 units, and Tesla topped the list as the most-selling brand. In line with this, the inclusion of advanced seating options such as leather upholstery, electronic adjustability, and climate control capabilities is fueling the market growth. Additionally, increasing people's disposable income is providing a positive scenario to luxury vehicle sales growth and further impelling the market growth. This investment by manufacturers in research and development (R&D) of novel features to distinguish their products from other peers is also promoting market growth. Moreover, the demand is accelerating as people opt for customized and bespoke seats, rich in luxury, comfort, and functionality.

Implementation of Stringent Safety Regulations and Standards

The stringent government norms for the safety of passengers are impacting the automotive seats market greatly, which calls for advanced seating systems. For instance, the National Highway Traffic Safety Administration (NHTSA) has set new vehicle safety standards in the U.S., which demand that seating systems be compatible with advanced airbag technologies so that seats and restraint systems can reduce injury in the event of a crash. Automakers are investing in strong seat structures and the effective restraint systems in response to the regulations. In 2023, the U.S. government put side-impact airbags in a regulation that all vehicles must be installed by default, which pushed innovation of seat design for optimal airbag deployment. As a result, automotive seat manufacturers are investing in research to understand human anatomy and seating posture, leading to the development of seats that offer improved spinal support, adjustable headrests, and thigh support.

Rise in Need for Seats in Electric Vehicles (EVs)

The heightened application of automotive seats in the EV industry is creating a positive outlook for market growth due to the unique design and construction requirements. Additionally, the absence of a traditional internal combustion engine allows for more cabin space, thereby enabling innovative seating layouts and configurations, providing a thrust to market growth. In addition, new lightweight and compact seats can enhance the use of available space to support the market growth. Fraunhofer UMSICHT found that electric vehicle overall weight can be reduced to 10% with light-seat structures. The increasing concern about sustainability within the EV industry is also supporting the use of environment friendly material in seat manufacturing. The IMARC Group indicated that the global market for EV will reach US$ 3,877.2 billion by 2032. This will increase the requirement for efficient and comfortable automobile seats for EVs further.

Automotive Seat Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global automotive seat market, along with forecast at the global, regional, and country levels from 2026-2034. The market has been categorized based on material type, seat type, vehicle type, and vehicle energy source.

Analysis by Material Type:

- Fabric

- Synthetic Leather

- Genuine Leather

Fabric is one of the major segment of the market due to its cost-effectiveness, durability, and versatility in design and color options. It is used in a wide range of vehicles owing to its comfort, breathability, and ease of maintenance. Additionally, rapid advancements in fabric technology, such as spill resistance and improved wear characteristics, making it a practical choice for everyday use, are supporting the market growth. In addition to this, fabric offers a wide range of colors, patterns, and textures, allowing manufacturers to create distinctive interior designs. It also enables car manufacturers to cater to a broad spectrum of tastes of car owners, such as traditional, understated, modern, and vibrant designs. Fabric materials are also easy to clean and maintain for longer periods after rigorous usage thus creating a positive automotive seat market outlook.

Analysis by Seat Type:

- Bucket Seat

- Bench Seat

Bucket seats are characterized by their seating design, found in a wide range of vehicles, including passenger cars, sport utility vehicles (SUVs), and sports cars. They are designed to accommodate one person and are distinguished by their contoured shape, which offers enhanced comfort and support, particularly during longer drives or at higher speeds. Bucket seats provide better lateral support, keeping the driver and passengers securely in place, which is especially beneficial in performance or sporty driving scenarios. Additionally, they are equipped with advanced features such as adjustable lumbar support, electronic adjustability, memory settings, and integrated heating or cooling systems, catering to the growing consumer demand for comfort and luxury. Additionally, the individual design of bucket seats can make it easier for passengers to access the rear seats in two-door vehicles, as the seats can normally be folded or slid forward to create extra space.

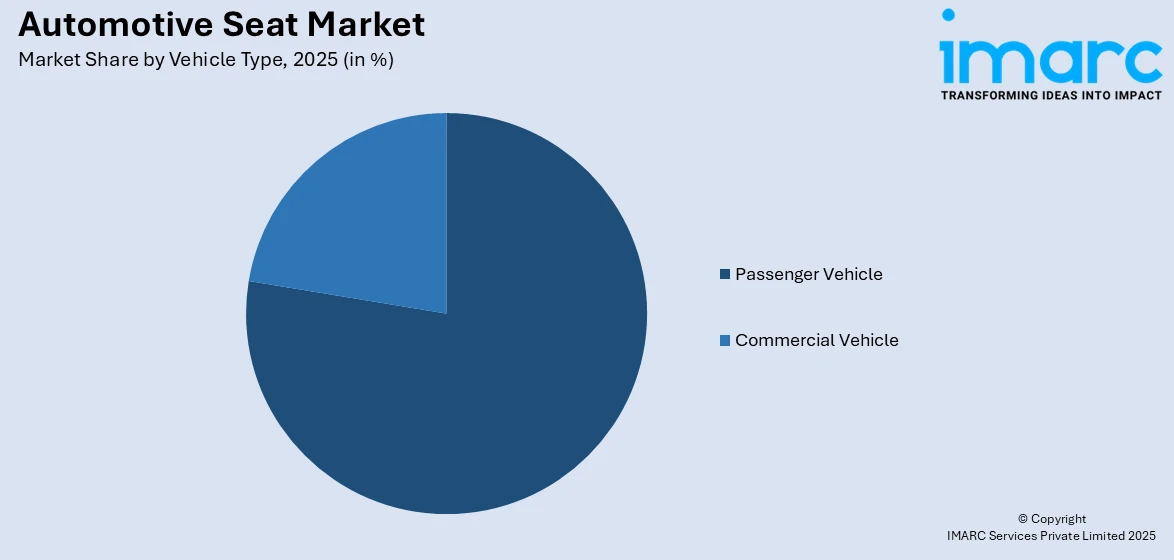

Analysis by Vehicle Type:

Access the comprehensive market breakdown Request Sample

- Passenger Vehicle

- Commercial Vehicle

Passenger vehicle leads the market with around 77.6% of automotive seat market share in 2025. Passenger vehicles hold the largest share of the market, driven by the high volume of global production and sales. It encompasses a broad range of vehicles, including sedans, SUVs, hatchbacks, and coupes. Moreover, the increasing demand for a wide variety of seating solutions in the passenger car segment tailored to different vehicle sizes, price points, and consumer preferences is favoring the market growth. Along with this, seats in passenger vehicles prioritize comfort, ergonomics, and aesthetic appeal, featuring advanced functionalities, such as electric adjustability, heating/cooling options, and memory settings in luxury models. Furthermore, the increasing focus on safety and the integration of smart technology in passenger vehicles, leading to the incorporation of advanced safety features in seats, such as built-in airbags and pressure sensors, is supporting the automotive seat market growth.

Analysis by Vehicle Energy Source:

- Gasoline

- Diesel

- Electric

- Others

Gasoline is dominating the market due to the longstanding dominance of gasoline-powered vehicles in the automotive industry. It covers a vast range of vehicles, such as compact cars and luxury SUVs, each requiring specific seating solutions to match their design and consumer expectations. Seats in gasoline vehicles are designed to offer a balance of comfort, functionality, and aesthetic appeal, catering to a broad consumer base. Moreover, the widespread adoption of gasoline vehicles ensuring a steady demand for a variety of seating types, such as basic, functional, advanced, and luxurious, is boosting the market growth. Gasoline engines are renowned for their robust performance, offering a combination of power, acceleration, and responsiveness that appeals to a wide range of drivers. High-performance gasoline vehicles, such as sports cars and luxury sedans, often deliver thrilling driving experiences with quick acceleration and smooth handling.

Regional Analysis:

To get more information on the regional analysis of this market Request Sample

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

Based on the automotive seat market forecast, Asia Pacific accounted for the largest market share of 41.1%. Asia Pacific leads the automotive seat industry driven by rising disposable incomes, urbanization, and the presence of leading global and local automobile manufacturers. Additionally, the diversified consumer base, driving the demand for various types of automotive seating solutions, is further supporting market growth. Other technological innovation and cost-effective manufacturing in the region for the development and production of automotive seats support the growth of the market. Further, the growing interest of electric vehicles (EVs) in the region is driving demand for lightweight seats. With carmakers looking to optimize the range of EVs by prioritizing lightweight and energy-efficient designs, seating systems are also witnessing significant innovation. Seat frames and components are incorporating lightweight materials like carbon fiber composites, high-strength steel, and advanced polymers. Such materials will enhance the vehicle's weight minimization with its structural integrity without compromising on safety. By 2023, Uno Minda sanctioned its innovative automotive seating system plant under the subsidiary, Uno Minda TACHI-S seating, at Bhagapur, Gujarat. The plant focused on manufacturing various types of passenger car mechanical components such as automotive seats.

Key Regional Takeaways:

United States Automotive Seat Market Analysis

The Unites States account 70.0% of the market share. The US automotive seats market is growing with new vehicle sales and automotive technologies improvements. Cox Automotive estimated U.S. auto sales to be 15.5 million units in 2023, an 11.6% increase from vehicles sold in 2022 to reach 13.9 million. The sales are further supported through supply chain improvements and stronger incentives for dealers. Other major automakers, including General Motors (GM), Hyundai, and Kia, also delivered strong sales performances. GM posted a 14% increase in sales to 2.6 million units, with Buick sales increasing by 61%. Hyundai saw an 11% increase in sales, with Ioniq 5 EV sales increasing by 48%. Kia also set a new sales record with a 13% YoY increase to 782,451 vehicles. The shift towards electric and hybrid vehicles is changing the demand for innovative automotive seating solutions, as automakers are integrating new technologies into their vehicles to meet consumer preferences for comfort, safety, and sustainability.

Europe Automotive Seat Market Analysis

Growing European automotive seats market is boosted through increased production and demand of better, ergonomic quality seats. According to a report released by the European Automobile Manufacturers Association (ACEA), the automobile sales in Europe reached a record 10.5 million during 2023. Electrical and hybrid automobiles are gradually changing seat designs, pushing for innovative features such as lightweight materials and integrated technologies like heated and cooling seats. The region's focus on sustainability is driving the use of eco-friendly materials in automotive seating. Key players like Faurecia and Magna International are leading in providing innovative solutions for the European market. As per an industrial report, in 2023, Germany, one of the largest automotive producers in Europe, accounted for approximately 30% of the region's automotive seat demand, supported by the robust production of brands like Volkswagen and BMW.

Asia Pacific Automotive Seat Market Analysis

Asia Pacific is the largest and fastest-growing market for automotive seats due to the increasing production of vehicles and growing consumer demand for comfort. According to an industrial report, in 2023, China alone accounted for almost 28% of global automotive production, greatly contributing to the demand for automotive seats in the region. The China Association of Automobile Manufacturers reports that more than 25 million vehicles were produced in the country in 2023. Advanced seating technologies like memory foam, lumbar support, and heated seats are in demand in the region, mainly in premium vehicles. The same is true in Japan and India, where quality, durable seats are sought as their automotive markets grow. There is an additional regional local manufacturer Toyota Boshoku and NHK Spring that fuels growth in regional markets. Additionally, interest in electric vehicles boosts the scope of seat design to more lightweight materials with sustainability aspects.

Latin America Automotive Seat Market Analysis

The Latin American automotive seats market is on the rise, driven by an expanding middle class population in the region and rising number of vehicle owners. Brazil is the biggest market in the region, with over 2.3 million vehicles sold in 2023, according to the National Association of Motor Vehicle Manufacturers, or ANFAVEA. The growing local production of vehicles in Brazil and Mexico contributes to the growing demand for high-quality automotive seats. Consumer preferences related to comfort, safety, and the latest technology in seating, including seat heating and memory foam, are driving further growth in the market. Demand for lower-cost, long-lasting seats is accelerating in the region as a growing vehicle fleet is the norm. This has led Lear Corporation and Adient among others to set up manufacturing sites in Latin America to serve those trends and accelerate the growth of this market.

Middle East and Africa Automotive Seat Market Analysis

The Middle East and African automotive seats market is developing due to rising vehicle sales and consumers' demand for comfort and features. According to an industrial report, in the United Arab Emirates, around 225,390 new passenger cars were sold in 2023, thus reflecting the growing automotive market in the region. The need for quality automotive seats is especially growing in the UAE, driven by its enlarged middle class and rising demand for high-value cars. Similarly, vehicle sales are increasing in countries such as Saudi Arabia, thereby driving the demand for advanced seating solutions in the region. The growing popularity of electric vehicles (EVs) is also transforming the market, since automakers are designing lightweight, comfortable, and ergonomic seats to meet EV requirements. As the automotive sector continues to grow in the region, companies such as Faurecia and Toyota Boshoku are taking advantage of demand for innovative and customized seating solutions to meet changing consumer needs.

Competitive Landscape:

The key players in the market are actively engaged in various strategic initiatives to strengthen their market position and address the evolving demands of the industry. They are heavily investing in research and development (R&D) to introduce innovative seating solutions that incorporate advanced materials, ergonomic designs, and smart technologies. Additionally, many companies are exploring the use of sustainable and eco-friendly materials in response to growing environmental concerns. Along with this, they are forming collaborations and partnerships with automotive manufacturers to tailor their products to specific vehicle models and consumer preferences. Furthermore, companies are also adapting to changing safety standards and consumer expectations regarding comfort and luxury, ensuring their products meet the highest quality and safety benchmarks. For instance, in 2024, Adient announced it has formed a joint development agreement Paslin is a machine integrator and an automation company. The partnership will aim at advancing technologies in automotive seating.

The report provides a comprehensive analysis of the competitive landscape in the automotive seat market with detailed profiles of all major companies, including:

- Adient plc

- Aisin Corporation

- Forvia SE

- Gentherm

- Lear Corporation

- Magna International Inc.

- Martur Fompak International

- NHK Spring Co. Ltd.

- RECARO Holding GmbH

- Tachi-S Co Ltd

- Toyota Boshoku Corporation

- TS Tech Co., Ltd

Latest News and Developments:

- December 2024: Adient, Jaguar Land Rover, and Dow announced that they have teamed up to produce closed-loop polyurethane foam seats for luxury vehicles. This industry-first initiative moves the circular economy forward and attempts to reduce the CO2 footprint of cars by using recycled components in the manufacturing process.

- April 2024: Toyota Boshoku Corporation announced that AUNDE Achter & Ebels GmbH has made a capital investment in its wholly-owned subsidiary, TB Kawashima Co., Ltd. It will then become an equity-method affiliate with a 20% voting rights stake, making it a strengthened automotive seat fabric business and partnership between the two.

- April 2024: TS Tech announced that they will be building a new plant in the Indian state of Rajasthan. A facility operated by TS Tech Sun Rajasthan Pvt. Ltd. will expand automotive seat production to meet growing demand by Maruti Suzuki.

Automotive Seat Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Material Types Covered | Fabric, Synthetic Leather, Genuine Leather |

| Seat Types Covered | Bucket Seat, Bench Seat |

| Vehicle Types Covered | Passenger Vehicle, Commercial Vehicle |

| Vehicle Energy Sources Covered | Gasoline, Diesel, Electric, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Adient plc, Aisin Corporation, Forvia SE, Gentherm, Lear Corporation, Magna International Inc., Martur Fompak International, NHK Spring Co. Ltd., RECARO Holding GmbH, Tachi-S Co Ltd, Toyota Boshoku Corporation, TS Tech Co., Ltd, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the automotive seat market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the global automotive seat market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the automotive seat industry and its attractiveness.

- The competitive landscape allows stakeholders to understand their competitive environment and provides insight into the current positions of key players in the market.

Key Questions Answered in This Report

An automotive seat is a critical component in vehicles, designed to provide comfort, support, and safety to drivers and passengers. Modern seats feature advanced ergonomics, adjustability, and technologies, catering to user preferences for comfort, luxury, and performance.

The automotive seat market was valued at USD 93.8 Billion in 2025.

IMARC estimates the global automotive seat market to exhibit a CAGR of 3.37% during 2026-2034.

The automotive seat market is driven by rising consumer demand for comfort and luxury, advancements in materials and technologies, increased adoption of electric and autonomous vehicles, and the implementation of stringent safety regulations globally.

The type includes material type, seat type and a vehicle type in the automotive seat industry.

In 2025, fabric represented the largest segment by material type, driven by its cost-effectiveness, durability, and versatile design options suitable for various vehicle categories.

Bucket seats lead the market by seat type, owing to their superior comfort, ergonomic design, and growing demand in premium and performance-oriented vehicles.

The passenger vehicle segment is the leading segment by vehicle type, driven by the high global production and increasing consumer preference for advanced comfort and safety features in cars.

The gasoline segment is the leading segment by vehicle energy source, driven by the widespread adoption of gasoline-powered vehicles and their continued demand across global markets.

On a regional level, the market has been classified into North America, Asia Pacific, Europe, Latin America, and the Middle East and Africa, wherein Asia Pacific currently dominates the global market.

Some of the major players in the global automotive seat market include Adient plc, Aisin Corporation, Forvia SE, Gentherm, Lear Corporation, Magna International Inc., Martur Fompak International, NHK Spring Co. Ltd., RECARO Holding GmbH, Tachi-S Co Ltd, Toyota Boshoku Corporation, TS Tech Co., Ltd, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)