Automotive Upholstery Market Size, Share, Trends and Forecast by Upholstery Materials, Fabric Type, Vehicle Type, Sales Channel, Application, and Region, 2025-2033

Automotive Upholstery Market Size and Share:

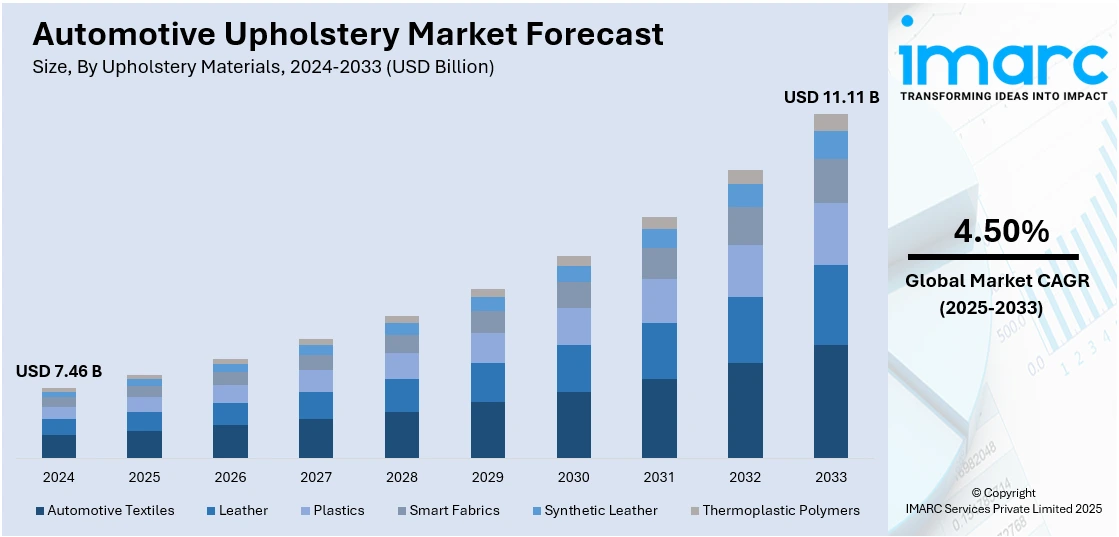

The global automotive upholstery market size was valued at USD 7.46 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 11.11 Billion by 2033, exhibiting a CAGR of 4.50% from 2025-2033. Asia Pacific currently dominates the market, holding a market share of 49.8% in 2024. At present, automakers are using more lightweight materials for vehicle components, which is impelling the market growth. Apart from this, the heightened focus on innovative ergonomic designs and materials for car upholstery due to the emphasis on comfort and convenience in their vehicles is contributing to the market growth. In addition, the rising popularity of electric vehicles (EVs) and autonomous vehicles is expanding the automotive upholstery market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 7.46 Billion |

|

Market Forecast in 2033

|

USD 11.11 Billion |

| Market Growth Rate (2025-2033) | 4.50% |

The car upholstery industry is growing rapidly, driven by several trends and forces. There is a growing emphasis on luxury and comfort by car owners, which is driving the demand for good quality, visually pleasing upholstery material. There is also an interest in innovations based on eco-friendly and sustainable materials, with more support for vegan leather and recycled textile. This change is driven by not just environmental factors but also by the need for greener automobile solutions. Technological advancements are contributing to the growth of the market. Smart textiles are being used by companies in automobile seat upholstery, providing functionalities like temperature control, antimicrobial treatment, and added durability. Such developments are improving the overall user experience while responding to the growing trend for luxury vehicle interiors.

To get more information on this market, Request Sample

The United States automobile upholstery industry is presently witnessing significant changes, as a result of changing trends and innovations in technology. People are more concerned about comfort and personalization, which is creating demand for high-quality upholstery materials like high-grade leather, synthetic fabrics, and environment friendly alternatives. Companies are investing efforts in creating sustainable materials like vegan leather and recycled fabric as a reaction to increasing environmental consciousness and demand for green products. Moreover, the adoption of new technologies is propelling the market growth. Car manufacturers are integrating intelligent textiles that provide functionalities such as temperature regulation, resistance to stains, and enhanced durability. These developments are addressing needs for more functional and comfortable in-car interiors. Vehicle customization is also driving the market with people choosing greater variations in terms of colors, texture, and finishes, permitting customized interior decor. In 2024, Rolls-Royace launched its first US design studio in Manhattan where high-end customers can invest in transforming series production models into unique statements.

Automotive Upholstery Market Trends:

Shift to lightweight materials

Automakers are using more lightweight materials for vehicle components. Advanced lightweight upholstery materials are in increasing demand due to their ability to not only improve fuel economy and enhance vehicle performance but also reduce environmental impact. Additionally, the move towards lighter materials in car interiors corresponds with regulatory requirements to lower greenhouse gas emissions and enhance overall vehicle efficiency. According to an article published by the U.S. Environmental Protection Agency in 2025, a simple passenger car creates around 4.6 metric tons of carbon dioxide every year. Automakers can meet strict emission standards and improve vehicle aerodynamics and energy efficiency by using light upholstery materials. Besides, lighter materials provide advantages like higher payload capacity, better control, and less damage to vehicle parts.

Increasing focus on comfort and ergonomic features

Automakers are investing in innovative ergonomic designs and materials for car upholstery due to the emphasis on comfort and convenience in their vehicles. This involves utilizing memory foams, breathable materials, and adjustable seating elements to offer passengers greater comfort on extended drives, ultimately contributing to the automotive upholstery market growth. The emphasis on comfort and ergonomics corresponds with changing desires for luxury and convenience amenities in vehicles. As per a report by the IMARC Group, the global luxury car market is expected to reach USD 662.3 Billion by 2033, growing at a CAGR of 3.9% during 2025-2033, indicating robust demand for premium upholstery. Car manufacturers are integrating more sophisticated technologies like massage features, heating, and ventilation systems into upholstery designs to enhance the driving experience.

Emergence of electric and self-driving cars

The heightened popularity of electric vehicles (EVs) and autonomous vehicles is strengthening the market growth. According to the International Energy Agency (IEA), there were nearly 17 million new electric cars were sold in 2024. At the close of 2024, the fleet of electric cars had grown to nearly 58 million, roughly 4% of the whole passenger car fleet and more than three times as many as the entire electric car fleet in 2021. EVs and autonomous vehicles commonly showcase modern interior layouts and high-quality fabrics to ensure passengers enjoy a lavish and cozy journey. The growing popularity of EVs and AVs is projected to lead to a higher demand for these materials. The emergence of these vehicles offers distinct chances for creativity in car upholstery. EVs frequently use advanced upholstery materials to match their eco-conscious image. Also, self-driving cars focus on providing comfort and convenience to passengers by incorporating advanced seating systems and high-end upholstery choices.

Automotive Upholstery Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global automotive upholstery market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on upholstery materials, fabric type, vehicle type, sales channel, and application.

Analysis by Upholstery Materials:

- Automotive Textiles

- Leather

- Plastics

- Smart Fabrics

- Synthetic Leather

- Thermoplastic Polymers

Plastics stand as the largest component in 2024, holding 42.2% of the market. Plastics are frequently used in automotive interiors due to their durability, cost-effectiveness, and versatility. Materials such as polyurethane (PU) and polyvinyl chloride (PVC) are widely used in vehicle interiors due to their easy maintenance and hard-wearing properties, making them suitable for use in high-wear areas such as seats, door panels, and armrests. These plastic-based materials are available in a variety of textures and colors, allowing for extensive customization. In addition, plastics are resistant to moisture, ultraviolet (UV) rays, and stains, which is why they are so popular in the automotive industry. Due to advances in sustainable production methods, some manufacturers are also using recycled plastics in interior decoration materials to meet the growing demand for eco-friendly options. Therefore, plastic interiors remain an important part of economy and mid-range vehicles, thereby offering a favorable automotive upholstery market outlook.

Analysis by Fabric Type:

- Non-woven

- Woven

Non-woven leads the market with 64.5% of market share in 2024. Non-woven materials are gaining popularity in the automotive upholstery industry because they are economical and simple to produce. They are produced by bonding fibers together using heat, pressure, or adhesives instead of knitting or weaving. Non-woven upholstery fabric is usually lighter in weight and less expensive compared to woven fabric, and this makes them widely used in mass-produced vehicles. They possess a number of benefits such as great durability, abrasion resistance, and superior moisture resistance. The fact that they can be made in bulk at reduced expense also makes them the best option for uses such as seat linings, door panels, and headliners in sub-compact and compact vehicles. They are also simple to customize non-woven materials when it comes to texture, color, and pattern, which means manufacturers are capable of responding to varying beauty demands without compromising on performance.

Analysis by Vehicle Type:

- Passenger Cars

- Commercial Vehicles

The passenger cars upholstery market is one of the major segments in the automotive industry, driven by increasing demand for comfort, aesthetics, and functionality. In this segment, upholstery materials such as leather, synthetic fabrics, and high-quality textiles are widely used to enhance the interior experience. Consumers often prioritize features like durability, comfort, and customization options, such as heated or cooled seats and advanced textile technologies like smart fabrics. The growing trend of electric and hybrid vehicles also contributes to the passenger car segment, as these vehicles often feature modern and eco-friendly interior designs.

The commercial vehicle upholstery market, which includes trucks, buses, and vans, is characterized by different needs compared to the passenger car segment. Upholstery materials for commercial vehicles are primarily focused on durability, easy maintenance, and cost-effectiveness. Materials such as vinyl, durable fabrics, and reinforced textiles are commonly used to withstand the rigors of heavy use, including long hours of wear, exposure to dirt, and extreme weather conditions. Additionally, commercial vehicles often prioritize functionality over aesthetics, with upholstery that is easy to clean and resistant to stains. According to the automotive upholstery market forecast, the increasing demand for fleet vehicles, particularly in logistics and transportation sectors, is expected to further drive the market.

Analysis by Sales Channel:

- OEM

- Aftermarket

OEM leads the market with 66.7% of market share in 2024. The OEM sales channel plays a major role in bolstering the growth of the market. Automakers are putting a strong focus on the quality and design of upholstery materials in their vehicles to set them apart and appeal to selective users. The OEM channel connects upholstery manufacturers with automakers to smoothly incorporate tailored upholstery solutions into new vehicle models through direct partnerships. Moreover, original equipment manufacturers frequently look for unique or customized upholstery choices to match their brand identity and fulfil particular design needs. The strong partnership between upholstery suppliers and original equipment manufacturers (OEMs) guarantees that vehicles have top-notch, cutting-edge upholstery materials that elevate the attractiveness and value of the vehicle, leading to expansion in the market.

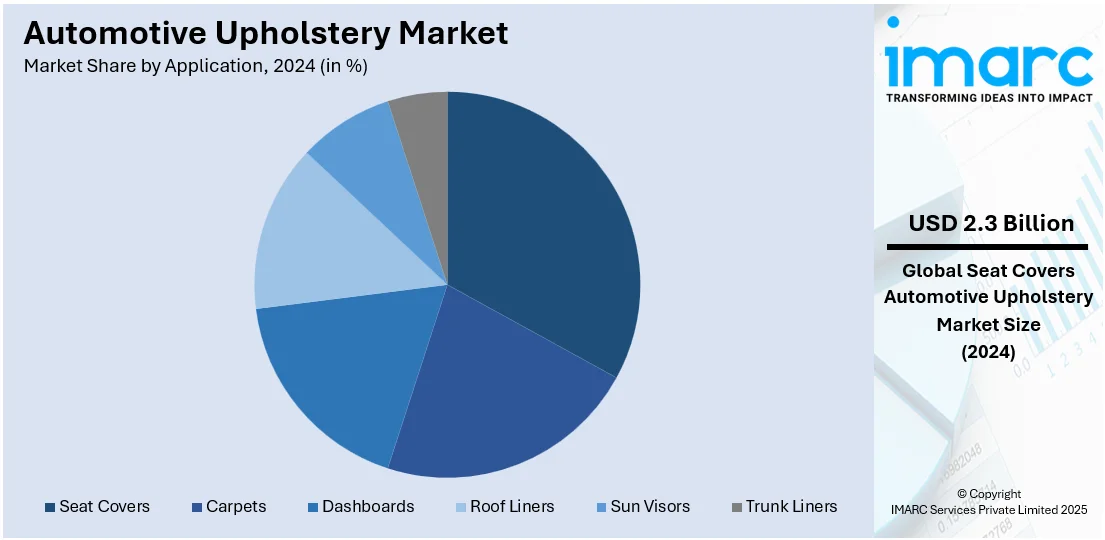

Analysis by Application:

- Carpets

- Dashboards

- Roof Liners

- Seat Covers

- Sun Visors

- Trunk Liners

Seat covers lead the market with around 31.4% of market share in 2024. The seat cover segment can be divided by material type, including fabric, leather, synthetic leather, and neoprene. Fabric seat covers are generally preferred because they are affordable, comfortable, and breathable, and are popular in economy and mid-size vehicles. On the other hand, leather seat covers are associated with premium vehicles due to their luxurious appearance, durability, and easy care. Synthetic leather is a cheaper alternative that offers similar benefits and is easier to use in mass-produced vehicles. Neoprene seat covers are widely used due to their water-resistance and durability and are often used in vehicles used in outdoor activities or in harsh conditions. Seat covers are also segmented by vehicle type, including commercial vehicles, passenger cars, and luxury vehicles. In automobiles, seat covers are designed with a focus on comfort, style, and wear resistance.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

Asia Pacific holds 49.8% of the market share. The Asia Pacific car upholstery industry is witnessing tremendous growth driven by the increasing user desire for vehicle personalization and comfort. Companies are gearing up to provide a range of materials, including green materials, to address the changing needs of eco-minded end users. As green practices gain popularity, automakers are launching car upholstery from recycled textiles, vegan leather, and biodegradable materials, following the increasing transition towards greener auto solutions. Meanwhile, technology is transforming the market as smart fabrics are being incorporated into car interiors. These fabrics are delivering temperature control, moisture-wicking, and even embedded sensors that improve the driving experience. The growing popularity of electric vehicles (EVs) in the region is also leading to the transformation, as manufacturers concentrate on delivering stylish interiors while highlighting sustainability to appeal to environmentally friendly consumers.

Key Regional Takeaways:

United States Automotive Upholstery Market Analysis

The United States holds 89.01% share of North America. The United States is primarily driven by the growing demand for premium and customized vehicle interiors. As disposable income rises, car buyers are increasingly prioritizing comfort, luxury, and personalization, which has led to a rise in demand for high-quality upholstery materials such as leather, premium fabrics, and sustainable options. According to the Bureau of Economic Analysis (BEA), in March 2025, disposable personal income in the United States increased to USD 102.0 Billion, recording a 0.5% growth. Additionally, the growing trend of vehicle customization is contributing substantially to industry expansion as consumers increasingly seek unique finishes and materials tailored to their preferences. Furthermore, environmental concerns are propelling the market toward eco-friendly and sustainable upholstery materials, such as vegan leather and recycled fabrics. The demand for advanced technologies, including heated and ventilated seats, integrated with premium upholstery, is also contributing to market growth. Other than this, the expansion of the automotive aftermarket sector, with consumers opting for upholstery upgrades in older vehicles, is a notable growth-inducing factor, providing opportunities for suppliers and manufacturers to meet diverse needs. As vehicle manufacturers increasingly focus on improving cabin aesthetics and comfort, the U.S. automotive upholstery market is poised for sustained growth.

Asia Pacific Automotive Upholstery Market Analysis

The Asia Pacific market is expanding due to rapid urbanization and increasing vehicle ownership, particularly in emerging markets such as China and India. As per estimates by Worldometers, 53.6% of the population of Asia lives in urban areas, equating to 2,589,655,469 individuals. As urban populations grow, the demand for personal vehicles is rising, driving the need for quality automotive interiors. Additionally, the growing middle class and higher disposable incomes are fueling demand for premium vehicle interiors, leading to increased spending on upholstery upgrades. For instance, in India, the disposable per capita income reached USD 2.54 Thousand in 2023 and is forecasted to reach USD 4.34 Thousand by 2029, as per the India Brand Equity Foundation. Besides this, the trend toward vehicle personalization is also gaining popularity, with consumers opting for unique interior designs. Furthermore, environmental concerns are propelling the market toward sustainable and vegan leather alternatives, as well as recycled materials, aligning with the region's increasing focus on sustainability in manufacturing.

Europe Automotive Upholstery Market Analysis

The Europe market is experiencing robust growth, fueled by advancements in automotive design and the growing importance of passenger comfort. As automakers focus on enhancing the overall in-car experience, there is an increasing emphasis on using high-quality, durable upholstery materials that provide long-term comfort and aesthetic appeal. The market is also influenced by the rapid adoption of smart textiles, such as upholstery with built-in sensors or climate control features, which are becoming highly sought after in premium and luxury vehicles. The trend toward sustainable and ethical consumption is also prompting automakers to explore biodegradable materials, water-based coatings, and other eco-friendly alternatives to traditional upholstery materials. Furthermore, the increasing popularity of autonomous vehicles is contributing to changes in interior design, including more customizable seating options and the integration of more advanced upholstery materials. For instance, the autonomous vehicles market in the United Kingdom (UK) reached USD 3.60 Billion in 2024 and is projected to reach USD 43.44 Billion by 2033, growing at a CAGR of 31.90% during 2025-2033. Other than this, the expansion of the European automotive aftermarket is a notable growth-inducing factor, with vehicle owners increasingly opting for interior upgrades and replacements to refresh the look and feel of their cars, thereby facilitating the expansion of the automotive upholstery market.

Latin America Automotive Upholstery Market Analysis

The Latin America market is significantly influenced by the rising demand for vehicle customization and improved interior aesthetics. Consumers are increasingly prioritizing comfort and luxury, particularly in mid- to high-end vehicles, driving the need for sophisticated upholstery materials. The rise of electric vehicles in the region is also influencing the market, with automakers exploring sustainable and lightweight materials for upholstery. For instance, in Brazil, there were registrations of 52,000 new electric vehicles in 2023, which was 33,000 more than 2022, recording a growth of 181.1%, as per industry reports. The growing automotive manufacturing base in the region is also contributing substantially to the demand for locally produced upholstery solutions, enhancing production efficiency and cost-effectiveness.

Middle East and Africa Automotive Upholstery Market Analysis

The Middle East and Africa market is being increasingly propelled by the growing demand for luxury and high-end vehicles, particularly in markets such as the UAE and Saudi Arabia, where preferences lean toward premium interior materials. According to a report published by the IMARC Group, the luxury car market in the Middle East is expected to reach USD 31,254.6 Million by 2033, growing at a CAGR of 4.68% during 2025-2033. The increasing focus on passenger comfort, aesthetics, and advanced features such as heated and ventilated seats has led to greater demand for quality upholstery. Besides this, the extreme weather conditions in the region, particularly heat, have created demand for heat-resistant and durable upholstery materials that enhance comfort. Rising tourism is also propelling the demand for vehicles with upscale interiors, further fueling market growth.

Competitive Landscape:

Market players in the industry are continuously innovating to meet evolving the demands and stay competitive. They are focusing on the development of sustainable materials, such as recycled fabrics, vegan leather, and eco-friendly synthetics, in response to the growing demand for environmentally conscious solutions. Companies are also investing in advanced technologies, integrating smart fabrics into upholstery, which offer features like temperature regulation, moisture control, and enhanced durability. Additionally, automakers are increasingly offering customization options, allowing consumers to personalize their vehicle interiors. Strategic partnerships and collaborations are common, as companies work to improve material quality, expand product offerings, and enhance manufacturing processes to cater to both luxury and mass-market segments.

The report provides a comprehensive analysis of the competitive landscape in the automotive upholstery market with detailed profiles of all major companies, including:

- Adient plc

- Antolin

- Asahi Kasei Corporation

- Forvia

- Lear Corp.

- Morbern

- Murtra Nonwovens

- Seiren Co., Ltd

- SUMINOE Co., Ltd.

- Toyota Boshoku Corporation

- Woodbridge

Latest News and Developments:

- May 2025: DaimlerChrysler, in collaboration with Brits Textiles, established a sisal textile plant in South Africa to produce natural fiber components for automotive applications. The plant manufactures sisal mats used in rear parcel shelves for the Mercedes-Benz C-Class, contributing to weight reduction and environmental sustainability.

- March 2025: Tata AutoComp Systems Ltd. announced plans for the acquisition of Artifex Interior Systems Ltd., a provider of numerous automotive interior solutions based in the United Kingdom. As part of this acquisition, Tata AutoComp will take over an 80% stake in the company.

- March 2025: ANDRITZ commissioned its first next-generation neXline airlay system in the U.S. at Carolina Nonwovens' Ohio facility. This line processes recycled fibers into nonwoven materials for automotive and industrial applications, enhancing sustainability and resource efficiency.

- February 2025: ShearComfort, a manufacturer of premium car seat covers, announced a major improvement to the online buying experience of car seat covers with the addition of Yotpo's AI Review Summaries. By offering AI-generated features of product reviews, this solution also aims to transform the way consumers search for automotive seat covers and guarantee a quick and knowledgeable purchasing experience.

- August 2024: Volkswagen established a partnership with German start-up Revoltech GmbH for the research and development of environmentally friendly materials that utilize industrial hemp. Starting in 2028, Volkswagen cars may use these as a sustainable surface material for various interior components, such as door panels and carpets.

Automotive Upholstery Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Upholstery Materials Covered | Automotive Textiles, Leather, Plastics, Smart Fabrics, Synthetic Leather, Thermoplastic Polymers |

| Fabric Types Covered | Non-woven, Woven |

| Vehicle Types Covered | Passenger Cars, Commercial Vehicles |

| Sales Channels Covered | OEM, Aftermarket |

| Applications Covered | Carpets, Dashboards, Roof Liners, Seat Covers, Sun Visors, Trunk Liners |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Adient plc, Antolin, Asahi Kasei Corporation, Forvia, Lear Corp., Morbern, Murtra Nonwovens, Seiren Co., Ltd, SUMINOE Co., Ltd., Toyota Boshoku Corporation, Woodbridge, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the automotive upholstery market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the global automotive upholstery market outlook.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the automotive upholstery industry and its attractiveness.

- The competitive landscape allows stakeholders to understand their competitive environment and provides insight into the current positions of key players in the market.

Key Questions Answered in This Report

The automotive upholstery market was valued at USD 7.46 Billion in 2024.

The automotive upholstery market is projected to exhibit a CAGR of 4.50% during 2025-2033, reaching a value of USD 11.11 Billion by 2033.

Key drivers of the automotive upholstery market include the increasing demand for vehicle customization, rising consumer focus on comfort and luxury, growing popularity of electric vehicles (EVs), and the shift towards sustainable materials such as vegan leather and recycled fabrics.

Asia Pacific currently dominates the automotive upholstery market, accounting for a share of over 49.8%. This is driven by rapid urbanization, rising vehicle ownership, and growing demand for eco-friendly and personalized automotive interiors.

Some of the major players in the automotive upholstery market include Adient plc, Antolin, Asahi Kasei Corporation, Forvia, Lear Corp., Morbern, Murtra Nonwovens, Seiren Co., Ltd, SUMINOE Co., Ltd., Toyota Boshoku Corporation, Woodbridge, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)