Automotive Wheel Speed Sensor Market Size, Share, Trends and Forecast by Sensor Type, Vehicle Type, and Region, 2025-2033

Automotive Wheel Speed Sensor Market Size and Share:

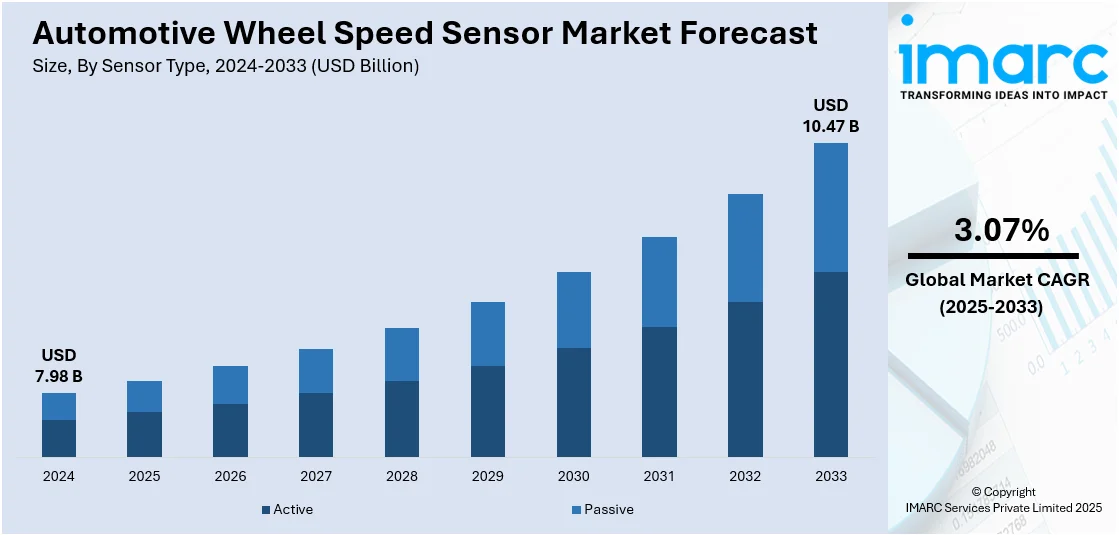

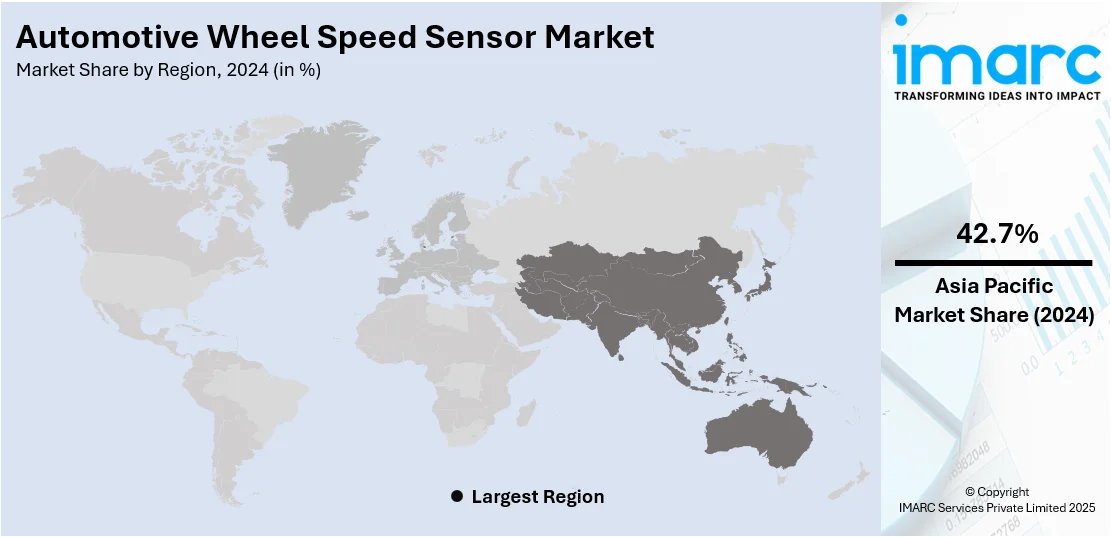

The global automotive wheel speed sensor market size was valued at USD 7.98 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 10.47 Billion by 2033, exhibiting a CAGR of 3.07% during 2025-2033. Asia Pacific dominated the market, holding a significant market share of 42.7% in 2024. Strong demand, manufacturing capabilities, and the growing electric vehicle sector are some of the key factors contributing to the automotive wheel speed sensor market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 7.98 Billion |

|

Market Forecast in 2033

|

USD 10.47 Billion |

| Market Growth Rate (2025-2033) | 3.07% |

The market for automotive wheel speed sensors is spurred by a number of important factors. The increasing use of advanced driver assistance systems (ADAS), which depend on precise wheel speed measurements for features such as anti-lock braking systems (ABS) and electronic stability control (ESC), is an important stimulus. Moreover, the increase in auto production and heightened emphasis on the vehicle safety standards enhance demand for these sensors. Regulatory standards, including more stringent safety guidelines and emission rules, add further to the necessity of wheel speed sensors in contemporary cars. The increasing trend toward electric vehicles (EVs) also adds to this, as EVs need high-performance sensors to ensure smooth operations. In addition, progress in sensor technology, enhancing precision, longevity, and cost, aids market growth, while the increasing trend of vehicles with connectivity provides new avenues for incorporating sensors in car systems.

To get more information on this market, Request Sample

In the United States, the automotive wheel speed sensor market growth is supported by the development of new sensors to support a wider range of vehicle models, including electric vehicles. These sensors play a vital role in monitoring wheel speed and supporting safety systems like ABS, TCS, and ESC for enhanced vehicle performance. For instance, in December 2024, Standard Motor Products (SMP) expanded its ABS sensor offerings, introducing 335 new part numbers to enhance coverage for various vehicle models. This expansion includes sensors for electric vehicles such as the 2022–2019 Kia Niro EV, 2022–2019 Toyota Prius Prime, and 2023–2019 Hyundai Nexo. These sensors are crucial for monitoring wheel speed and rotation, ensuring the proper functioning of critical safety systems like anti-lock braking systems (ABS), traction control systems (TCS), and electronic stability control (ESC).

Automotive Wheel Speed Sensor Market Trends:

Focus on Enhanced Vehicle Safety Systems

Increases in road traffic accidents and deaths are driving improvements in vehicle safety technology. With road crashes remaining a major cause of death in younger people, demand is growing for vehicle stability and driver control improvement systems. Wheel speed sensors, which are vital for anti-lock braking and traction control functions, are attracting more prominence as key components for today's vehicles. The focus on safety features, catalyzed by consumer interest and regulatory requirements, is driving the increased use of these state-of-the-art sensors. Consequently, the automotive sector is focusing on next-generation sensor technologies to further increase overall vehicle safety and minimize the chances of accidents. According to the CDC, road traffic crashes claim 1.19 million lives annually worldwide and are the leading cause of death for individuals aged 5-29.

Advancements in Wheel Monitoring and Safety Technology

Recent developments in wheel monitoring technology, enhancing vehicle safety and performance, are shaping the automotive wheel speed sensor market outlook. Innovations like wheel detachment detection systems are improving the ability to detect loose nuts by analyzing wheel-speed signals, adding an extra layer of security for drivers. In addition, the integration of cloud-based tire pressure monitoring and tire-wear monitoring systems is streamlining vehicle maintenance, reducing the risk of tire-related issues. These systems offer more efficient solutions by providing real-time data that can help improve vehicle safety, prevent accidents, and optimize overall vehicle performance. The expansion of these technologies underscores the growing focus on advanced sensor systems that combine safety, efficiency, and mobility, meeting both consumer expectations and industry standards for smarter, safer vehicles. For example, in March 2024, Sumitomo Rubber Industries introduced a wheel detachment detection feature in its SENSING CORE technology. It analyzes wheel-speed signals to detect loose nuts. SENSING CORE also expands into cloud-based TPMS and tire-wear monitoring, enhancing safety, efficiency, and mobility solutions.

Surge in Global Passenger Car Sales

The global passenger car market is seeing a notable rise in sales, driven by increased consumer demand and market recovery. Recent data highlights a significant rebound in vehicle purchases, reflecting improved economic conditions and greater consumer confidence. This growth is fueled by factors such as advancements in vehicle technology, including the shift toward electric vehicles, and expanding mobility solutions. As more consumers prioritize safety, efficiency, and innovation, automakers are responding with enhanced vehicle features and design. As per the automotive wheel speed sensor market forecast, due to growing interest in new cars across various markets, the automotive sector is positioned for continued expansion, with new sales likely to maintain an upward trajectory in the coming years. JATO Dynamics data and estimates for 151 markets indicate that 78.32 million new passenger cars were sold in 2024, reflecting a rise of nearly 7 million units from 2022, representing a 10% growth.

Automotive Wheel Speed Sensor Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global automotive wheel speed sensor market, along with forecasts at the global, regional, and country levels from 2025-2033. The market has been categorized based on sensor type and vehicle type.

Analysis by Sensor Type:

- Active

- Passive

Active stood as the largest sensor type in 2024, holding around 70% of the market, driven by the increasing demand for vehicle safety and advanced driver-assistance systems (ADAS). As vehicle manufacturers focus on enhancing safety features like anti-lock braking systems (ABS), electronic stability control (ESC), and traction control, the need for reliable and accurate wheel speed sensors has surged. The growing adoption of electric vehicles (EVs) and autonomous driving technology also fuels the demand for these sensors, as they play a critical role in the performance of such systems. Moreover, stricter government regulations regarding vehicle safety are pushing automakers to incorporate advanced sensors in their designs. These factors collectively contribute to the growth and development of the automotive wheel speed sensor market.

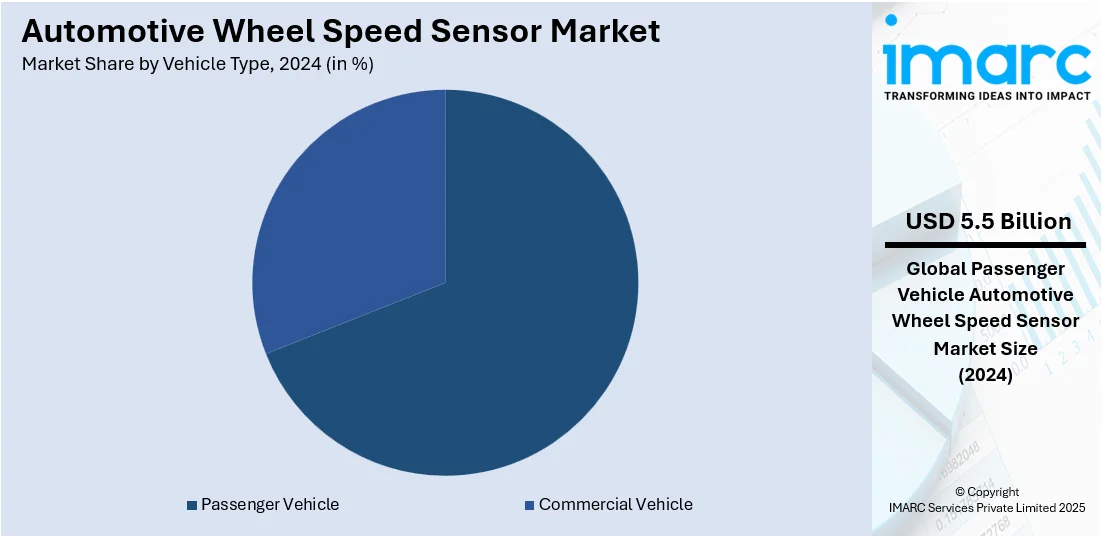

Analysis by Vehicle Type:

- Passenger Vehicle

- Commercial Vehicle

Passenger vehicle led the market with around 68.9% of market share in 2024 due to the increasing demand for safety features and technological advancements in modern vehicles. As consumers prioritize safety, automakers are incorporating wheel speed sensors in passenger vehicles for systems like anti-lock braking (ABS), electronic stability control (ESC), and traction control. These sensors are essential for enhancing vehicle safety, improving driving performance, and ensuring stability. Additionally, the growing popularity of advanced driver-assistance systems (ADAS) in passenger cars further accelerates the demand for these sensors. With stringent safety regulations and rising consumer expectations for high-performance vehicles, the passenger vehicle segment continues to drive the growth of the automotive wheel speed sensor market, making it a key focus for manufacturers.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, Asia Pacific accounted for the largest market share of over 42.7%. The region has the highest automotive production, with countries like China, Japan, and India being major global players. This massive manufacturing base drives the demand for advanced automotive components, including wheel speed sensors, which are crucial for safety features like anti-lock braking systems (ABS) and electronic stability control (ESC). Furthermore, the increasing consumer demand for vehicles, both conventional and electric, boosts the need for more sophisticated sensor technologies. The growing adoption of automated and electric vehicles in the region, alongside rapid advancements in sensor technology, has further propelled the market. With significant investments in research and development, coupled with a focus on improving vehicle safety and performance, Asia Pacific remains the dominant market for automotive wheel speed sensors.

Key Regional Takeaways:

United States Automotive Wheel Speed Sensor Market Analysis

In 2024, the United States accounted for 83.2% of the market share in North America. The United States automotive wheel speed sensor market is primarily driven by the increasing shift toward electrified powertrains in hybrid and electric vehicles. According to the Center for Sustainable Energy, as of March 2025, over 6.7 million plug-in electric vehicles have been sold in the U.S. since 2010, with battery electric vehicles accounting for 8.9% of light-duty vehicle sales in the third quarter of 2024. When including hybrids and plug-in hybrids, EVs represented 21% of total sales, further emphasizing the growing need for sophisticated sensor integration. Furthermore, stricter fuel efficiency and emission regulations compelling automakers to implement intelligent braking and traction control systems are propelling the market growth. Similarly, the rise of connected vehicles and over-the-air software updates enhancing real-time diagnostics and predictive maintenance is fostering market expansion. The acceleration of autonomous vehicle development, necessitating highly accurate wheel speed data for functions such as adaptive cruise control and lane-keeping assist, is supporting market demand. Additionally, rising consumer preference for premium vehicles with advanced safety features is encouraging higher product adoption. Moreover, the increasing adoption of fleet management solutions, enabling commercial vehicle operators to improve operational efficiency and reduce maintenance costs, is positively influencing the market.

Europe Automotive Wheel Speed Sensor Market Analysis

The Europe automotive wheel speed sensor market is expanding due to multiple regulatory, technological, and market forces. In line with this, the European Union’s stringent vehicle safety regulations, including mandatory advanced driver assistance systems (ADAS) under the General Safety Regulation, enhancing vehicle stability and braking performance, are impelling the market. Furthermore, the rapid expansion of electric vehicle (EV) infrastructure, supported by government incentives and strict CO₂ reduction targets, is further driving market growth. The European Bank for Reconstruction and Development (EBRD) is investing EUR 15 million in Eldrive to expand EV charging networks in Bulgaria, Lithuania, and Romania, with plans to operate 8,300 charging stations by 2028. Additionally, the region’s strong focus on autonomous driving research and regulatory support for Level 3 and Level 4 automation is further propelling market demand. The rising investments in vehicle-to-everything (V2X) communication technologies enhancing the need for real-time wheel speed data are stimulating the market appeal. Apart from this, a growing aftermarket demand due to extended vehicle lifespans and strict periodic technical inspections, is creating lucrative market opportunities.

Asia Pacific Automotive Wheel Speed Sensor Market Analysis

The Asia Pacific market is experiencing growth, propelled by rapid urbanization and rising disposable incomes, and increasing vehicle ownership. Under this, favorable government initiatives promoting road safety, such as mandatory anti-lock braking systems (ABS) and electronic stability control (ESC) regulations in countries like India and China, are accelerating product adoption. Similarly, the expanding electric vehicle (EV) market, supported by national subsidies and ambitious electrification targets, is fueling market expansion. China’s National Development and Reform Commission (NDRC) renewed its EV trade-in subsidy, maintaining a 20,000-yuan (USD 2,728) incentive, with 3.7 million buyers utilizing the program in 2024. Furthermore, expanding investments in smart transportation infrastructure, including intelligent traffic management and vehicle connectivity, are fostering market development. Additionally, increasing research and development (R&D) funding in sensor miniaturization and enhanced durability, improving sensor performance and lifespan is impelling the market. Moreover, rising domestic automaker presence, strong aftermarket demand, and stricter periodic inspections are driving sustained market growth.

Latin America Automotive Wheel Speed Sensor Market Analysis

The Latin America automotive wheel speed sensor market is growing, attributed to the enforcement of vehicle safety regulations, such as mandatory anti-lock braking systems (ABS). Similarly, the increasing penetration of electric and hybrid vehicles, supported by tax incentives and government policies, is further accelerating market demand. Furthermore, rising investments in local automotive manufacturing, enhancing sensor production are propelling the market growth. Thyssenkrupp is investing BRL 120 million (2024–2027) to modernize its Brazilian operations in the automotive industry, increase local sourcing, and expand camshaft and steering column production by 50%. Additionally, expanding road infrastructure projects are promoting vehicle sales, indirectly augmenting market appeal. Moreover, the rise of ride-hailing and fleet management services is increasing the need for advanced vehicle safety systems is fostering market expansion.

Middle East and Africa Automotive Wheel Speed Sensor Market Analysis

The Middle East and Africa market is majorly influenced by stricter vehicle safety regulations, including mandatory anti-lock braking systems (ABS). Furthermore, the growing demand for commercial vehicles, driven by large-scale infrastructure projects and logistics sector expansion, is increasing the market appeal. Similarly, rising investments in automotive manufacturing are strengthening local sensor production and market demand. Additionally, increasing consumer preference for premium and luxury vehicles with advanced safety features is encouraging higher product adoption. As per an industry report, luxury models accounting for over 3% of vehicles were sold in Saudi Arabia, surpassing the global average of 2%. Besides this, the expansion of connected vehicle technologies and smart mobility initiatives is accelerating the integration of intelligent wheel speed sensors is providing an impetus to the market.

Competitive Landscape:

The automotive wheel speed sensor market is witnessing notable developments through product launches, partnerships, collaborations, and significant research and development efforts. Companies are continuously advancing sensor technologies to enhance vehicle safety, performance, and integration with systems like ADAS and autonomous driving. Strategic partnerships and collaborations are increasingly common, enabling companies to combine expertise and drive innovation. Alongside this, government initiatives in various regions aim to improve vehicle safety standards, further driving demand. Raised funding is also supporting the development of next-generation sensors. Among these, product launches and research and development are the most prevalent practices, as companies strive to stay competitive and meet evolving market needs.

The report provides a comprehensive analysis of the competitive landscape in the automotive wheel speed sensor market with detailed profiles of all major companies, including:

- Astemo, Ltd

- Continental AG

- FTE automotive

- HELLA GmbH & Co. KGaA

- NTN Europe

- Robert Bosch GmbH

- Sumitomo Wiring Systems, Ltd.

- TE Connectivity

- VBOX Automotive

- ZF Friedrichshafen AG

Latest News and Developments:

- May 2025: Zipp unveiled its first-ever smart wheels, the 353 NSW and 303 SW, featuring integrated live tyre pressure sensors. These AXS-connected wheelsets offer real-time pressure monitoring via SRAM's ecosystem, with integration into head units like Hammerhead, Wahoo, and Garmin, enhancing cycling performance and convenience.

- April 2025: Schaeffler showcased its latest innovations in electrification and smart applications following its merger with Vitesco Technologies. The company presented a range of components, including bearings, ball-screw drives, solenoids, controllers, wheel sensors, and the production processes of e-motor stators and rotors, as well as coolant manifolds.

- September 2024: Pirelli and Bosch partnered to advance intelligent tire technology through Pirelli's Cyber Tire system. This system integrates in-tire sensors that monitor parameters like pressure, temperature, and load, transmitting real-time data to the vehicle's control systems via Bluetooth Low Energy (BLE).

- May 2024: Melexis launched the MLX90427, a magnetic position sensor for steer-by-wire applications. It features high EMC robustness, stray field immunity, and SPI output with four modes. Designed for automotive safety, it enables precise wheel speed sensing, gearbox shifting, and HMIs, supporting ASIL D integration for critical vehicle systems.

- May 2024: Infineon introduced the TLE5046SiC-AK-LR, a high-end GMR wheel speed sensor with direction detection, compliant with ASIL B(D) standards. It offers low jitter, a two-wire current interface, advanced stop-start capabilities, and maintains direction information, making it ideal for sophisticated vehicle control systems.

Automotive Wheel Speed Sensor Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Sensor Types Covered | Active, Passive |

| Vehicle Types Covered | Passenger Vehicle, Commercial Vehicle |

| Region Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Astemo, Ltd, Continental AG, FTE automotive, HELLA GmbH & Co. KGaA, NTN Europe, Robert Bosch GmbH, Sumitomo Wiring Systems, Ltd., TE Connectivity, VBOX Automotive, ZF Friedrichshafen AG, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the automotive wheel speed sensor market from 2019-2033.

- The automotive wheel speed sensor market research report provides the latest information on the market drivers, challenges, and opportunities in the global market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the automotive wheel speed sensor industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The automotive wheel speed sensor market was valued at USD 7.98 Billion in 2024.

The automotive wheel speed sensor market is projected to exhibit a CAGR of 3.07% during 2025-2033, reaching a value of USD 10.47 Billion by 2033.

The automotive wheel speed sensor market is driven by increasing demand for advanced driver assistance systems (ADAS), rising vehicle production, growing emphasis on safety, and the shift toward electric vehicles. Additionally, regulatory requirements for vehicle safety standards and technological advancements in sensor accuracy and reliability contribute to market growth.

Asia Pacific dominated the automotive wheel speed sensor market in 2024, accounting for a share of 42.7% due to high automotive production, increased vehicle demand, and technological advancements in sensor systems, particularly in countries like China, Japan, and India.

Some of the major players in the automotive wheel speed sensor market include Astemo, Ltd, Continental AG, FTE automotive, HELLA GmbH & Co. KGaA, NTN Europe, Robert Bosch GmbH, Sumitomo Wiring Systems, Ltd., TE Connectivity, VBOX Automotive, ZF Friedrichshafen AG, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)