Automotive Wiring Harness Market Size, Share, and Trends by Application, Material Type, Transmission Type, Vehicle Type, Category, Component, Region and Forecast 2026-2034

Automotive Wiring Harness Market Size and Share:

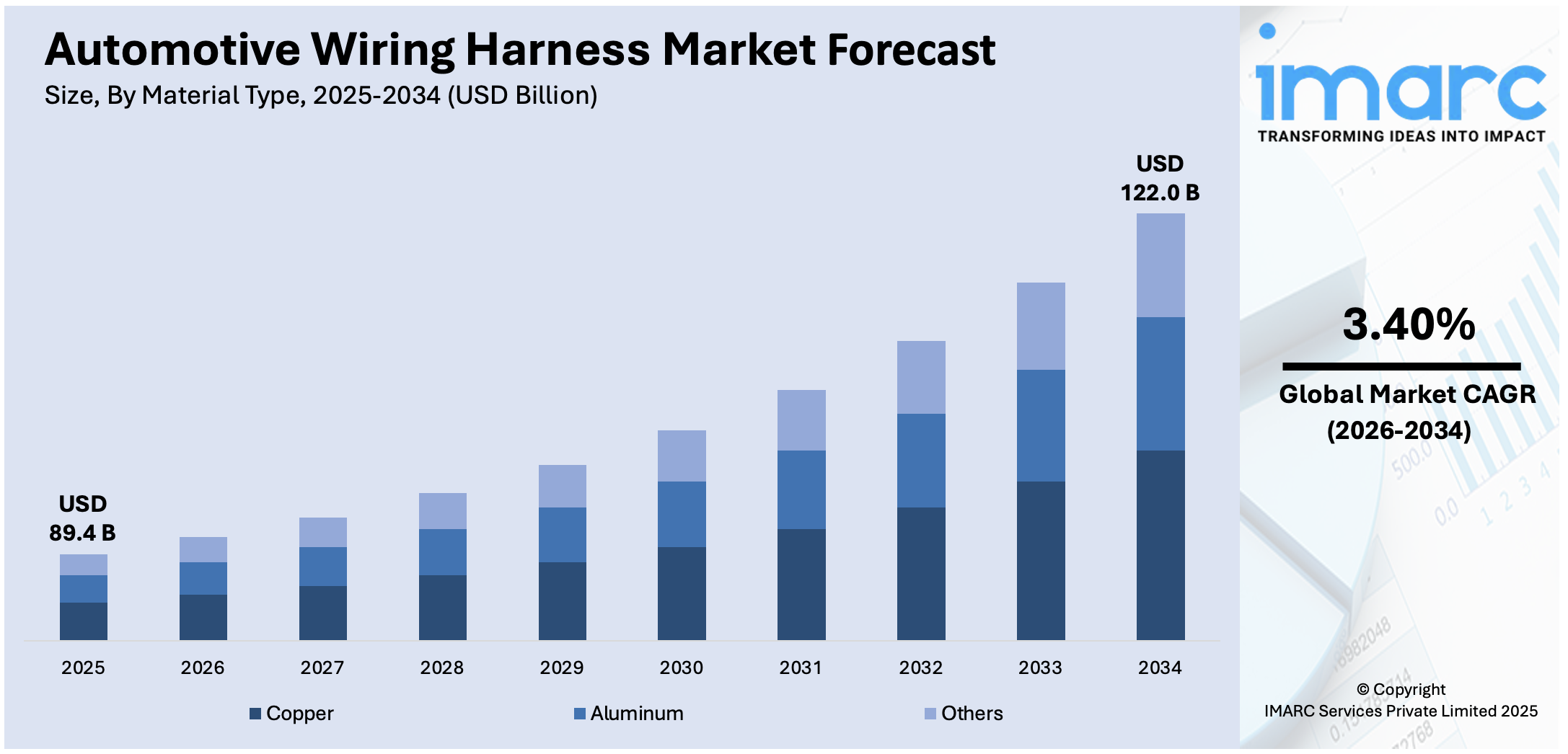

The global automotive wiring harness market size was valued at USD 89.4 Billion in 2025. Looking forward, IMARC Group estimates the market to reach USD 122.0 Billion by 2034, exhibiting a CAGR of 3.40% during 2026-2034. Asia Pacific currently dominates the market, holding a significant market share of over 46.7% in 2025. At present, Asia Pacific holds the largest automotive wiring harness market share, driven by cost-effective manufacturing and increasing adoption of electric vehicles (EVs).

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

|

Market Size in 2025

|

USD 89.4 Billion |

|

Market Forecast in 2034

|

USD 122.0 Billion |

| Market Growth Rate 2026-2034 | 3.40% |

The rapid adoption of electric vehicles (EVs) is one of the major factors bolstering the demand for advanced wiring harnesses. EVs require complex electrical systems to manage high-voltage power distribution and integrate various electronic components. Along with this, the increasing adoption of modern vehicles that incorporate advanced driver-assistance systems (ADAS) features such as adaptive cruise control, lane departure warning, and automatic emergency braking is enhancing the market growth. These systems rely on a network of sensors and electronic control units interconnected by wiring harnesses. Along with this, the imposition of stringent safety regulations and the rising consumer demand for safer vehicles that lead to the integration of numerous electronic safety features, is bolstering the expansion of the industry. For example, the U.S. Department of Transportation’s National Highway Traffic Safety Administration (NHTSA) finalized a new Federal Motor Vehicle Safety Standard in April 2024 that will make automatic emergency braking (AEB), including pedestrian AEB, standard on all passenger cars and light trucks by September 2029.

To get more information on this market Request Sample

The automotive wiring harness industry is one of the major markets in the United States, primarily due to increased adoption in the region, electrification of vehicles, rapid advancement of technology, and heightened focus on safety features. For example, in 2023, U.S. Electric vehicle (EV) sales reached 1.2 million units, taking up 7.6% of the total vehicle market, which is a 5.9% hike from 2022. This led to the need for more advanced wiring solutions to ensure safety and efficiency. Besides that, the government incentives introduced in the country, such as federal tax credits up to $7,500 under the Inflation Reduction Act, aimed at boosting EV adoption, are presenting lucrative opportunities for market expansion.

Automotive Wiring Harness Market Trends:

Increasing Integration of Advanced Electronics

The automotive industry is witnessing a significant transformation as vehicles increasingly incorporate advanced electronic systems to meet consumer demands for enhanced connectivity, comfort, and safety. This shift is driving the need for more sophisticated wiring harnesses capable of supporting high-speed data transmission and complex power distribution. For instance, in May 2024, Molex introduced the MX-DaSH family of data-signal hybrid connectors, which combine power, signal, and high-speed data connectivity in a single connector system. These connectors are designed to streamline the integration of advanced driver-assistance systems (ADAS), infotainment systems, and other electronic features in modern vehicles. Furthermore, the U.S. Department of Energy granted a USD 362 million loan to CelLink Corp to finance the construction of a plant in Texas aimed at producing flexible circuit wiring harnesses for electric vehicles (EVs) in April 2024. This initiative underscores the growing emphasis on developing lighter, more efficient wiring solutions that can handle the increased electrical demands of EVs while supporting the integration of advanced electronic features.

Increasing Vehicle Production

The growing vehicle manufacturing and sales are fueling this global market. As the quantity of vehicle manufacturing increases, so does the demand for wiring harnesses. Global motor vehicle production was estimated to be around 94 million units in 2023. Vehicle production is experiencing rapid growth in emerging markets, creating a higher demand for these components. Another factor contributing to the growth of the automotive wiring harness market is the increasing demand for electric vehicles. The complexity of wiring systems associated with such vehicles creates a huge demand in this respect. Advanced features in modern vehicles, such as advanced driver-assistance systems (ADAS), infotainment systems, and electronic safety systems, require more complicated wiring systems. Hence, the integration of such electronic systems and features into vehicles is directly driving the demand for highly advanced and robust wiring harnesses.

Ongoing Electrification of Vehicles

The sudden shift towards electric vehicles (EVs) as opposed to internal combustion engines (ICEs) is acting as another significant driver behind the growth of the automotive wiring harness industry. EVs need complex and superior wiring harnesses because of their extensive reliance on electrical systems for propulsion, energy efficiency, and various other functions. This is also driving the demand for automotive wiring harnesses. In 2023, electric three-wheelers (e3Ws) achieved a penetration rate of more than 50% in some countries, which represents massive growth over the category. This is encouraging many leading players to invest heavily in utilizing these harnesses to be a competitive edge. Advancements in semi-autonomous and fully autonomous vehicle technologies continue to change the automotive wiring harness market. Autonomous vehicles typically require high electrical signals to operate. Hence, the demand for substantial, efficient, and reliable wiring harness systems will be high, thereby boosting the market.

Rising Demand for Lightweight Vehicle

With the surging demand for reducing automobile weight by improving fuel efficiency and meeting required emission standards, various manufacturers are aiming to reduce the weight of vehicles. Electric vehicles, both plug-in hybrids as well as purely battery-electric models, are expected to account for nearly 20 percent of global light vehicle sales by 2030. Since wiring harnesses account for a significant proportion of a vehicle's overall weight, the demand for lightweight and small-size wiring harnesses with no loss to safety and functionality has been rising steadily. In addition, rapid advancements in technologies, including smart and high-speed wiring harness systems, are also fueling the market growth. Along with this, many new product developments in materials, design, and manufacturing processes to enhance efficiency and reduce costs are also contributing positively to the automotive wiring harness market outlook.

Automotive Wiring Harness Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global automotive wiring harness market, along with forecasts at the global, regional, and country levels from 2026-2034. The market has been categorized based on application, material type, transmission type, vehicle type, category, component, and region.

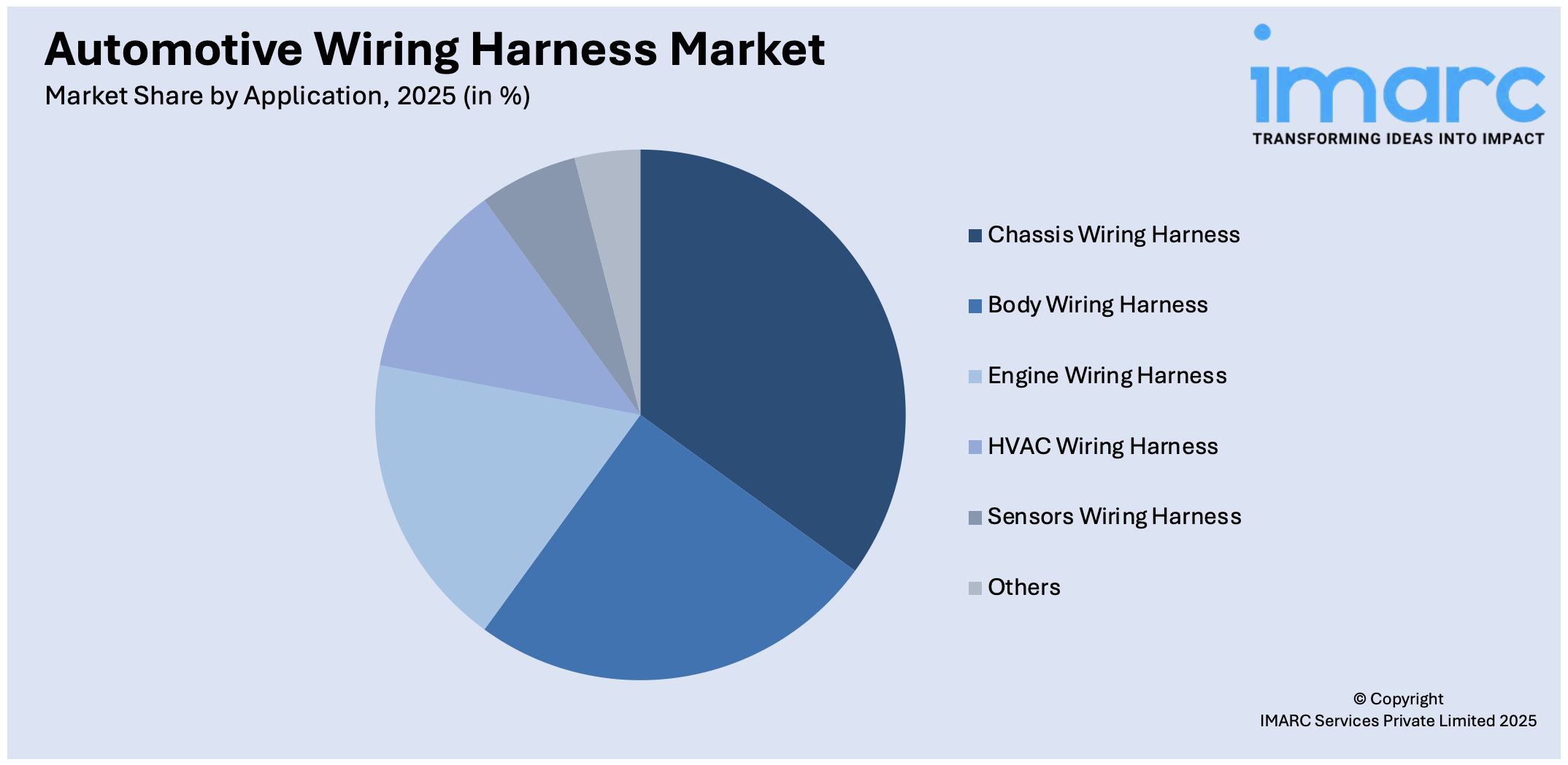

Analysis by Application:

Access the comprehensive market breakdown Request Sample

- Body Wiring Harness

- Engine Wiring Harness

- Chassis Wiring Harness

- HVAC Wiring Harness

- Sensors Wiring Harness

- Others

Chassis wiring harnesses lead the market with around 34.9% of the market share in 2025. A chassis wiring harness plays a critical role in ensuring efficient power distribution and signal transmission across essential vehicle systems. This segment caters to components such as brake systems, suspension, fuel systems, and steering, which are integral to the structural and functional framework of a vehicle. Moreover, the rising complexity of modern vehicles, including the incorporation of advanced braking systems like ABS and electronic stability control, has amplified the demand for sophisticated chassis wiring harnesses. Additionally, the ongoing shift toward lightweight materials and modular harness designs to improve fuel efficiency and performance is strengthening the market growth.

Analysis by Material Type:

- Copper

- Aluminum

- Others

Copper leads the market with around 86.2% of the market share in 2025. Copper’s dominance is due to its superior electrical conductivity, thermal performance, and reliability. Moreover, its ability to efficiently transmit electrical signals with minimal resistance makes it indispensable in powering critical vehicle systems, including engine controls, infotainment, and safety features. Besides this, the heightened reliance of the automotive industry on copper due to its durability and recyclability, aligning with sustainability goals and stringent regulatory standards, is fostering the market growth. Furthermore, the rising EV adoption, leading to the demand for high-voltage copper wiring harnesses is favoring the market growth.

Analysis by Transmission Type:

- Data Transmission

- Electrical Wiring

Electrical wiring leads the market with around 81.5% of the market share in 2025. It acts as the backbone for power and signal transmission across divergent automotive systems, such as lighting, infotainment, and advanced driver-assistance systems (ADAS). The market growth is also being catalyzed by an increasing demand for electric vehicles (EVs) and hybrid vehicles that heavily rely on intricate electrical wiring to manage high-voltage power and connectivity requirements. Besides this, the increasing inorganic integration of smart technologies and connectivity features by auto manufacturers is boosting the demand for advanced electrical wiring systems, therefore driving the market forward.

Analysis by Vehicle Type:

- Two Wheelers

- Passenger Cars

- Commercial Vehicles

Passenger cars lead the market with around 52.2% of the market share in 2025 due to their high production volumes and the increasing integration of advanced technologies. Moreover, the rising demand for comfort, safety, and connectivity features, such as infotainment systems, advanced driver-assistance systems (ADAS), and ambient lighting, which require intricate wiring solutions, is enhancing the market growth. Apart from this, the ongoing shift toward electric passenger cars that amplifies the demand for high-voltage wiring harnesses, as these vehicles require complex electrical architectures to manage battery systems and drivetrain components, is boosting the market growth.

Analysis by Category:

- General Wires

- Heat Resistant Wires

- Shielded Wires

- Tubed Wires

General wires lead the market with around 40.0% of the market share in 2025. According to the report, general wires accounted for the largest market share due to their extensive application across a wide range of vehicle systems. These wires are essential for transmitting power and signals in fundamental operations such as lighting, ignition, and charging systems. Moreover, their versatility and cost-effectiveness make them a preferred choice for automakers, especially in high-volume production scenarios. Apart from this, rapid advancements in insulation materials, which enhance durability and performance under varying operating conditions, are fueling the market growth.

Analysis by Component:

- Connectors

- Wires

- Terminals

- Others

Wires lead the market with around 42.2% of the market share in 2025. According to the report, wires accounted for the largest market share, driven by their indispensable role in connecting and powering various vehicle systems. These components form the foundation of electrical circuits, enabling efficient power transmission and communication between critical systems such as lighting, infotainment, safety mechanisms, and engine controls. Moreover, the increasing demand for high-performance, durable, and lightweight wires, especially with the rise of connected vehicles and ADAS technologies, is stimulating the market growth. Additionally, the growing focus of manufacturers on innovating with new materials and designs, such as aluminum-based wires and high-temperature insulation, to improve efficiency and sustainability is driving the market growth.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2025, Asia Pacific accounted for the largest market share of over 46.7%. The market in the Asia Pacific region is experiencing significant growth, driven by its strong automotive manufacturing base, rapid urbanization, and increasing vehicle ownership. Moreover, the large-scale production of passenger and commercial vehicles, coupled with rising demand for electric vehicles (EVs) in the region is fueling the market growth. Besides this, the presence of major automotive and wiring harness manufacturers, supported by cost-efficient labor and robust supply chains is bolstering the market growth. Furthermore, the growing middle class and government incentives for EV adoption that accelerate the demand for advanced wiring harness systems, is strengthening the market growth.

Key Regional Takeaways:

North America Automotive Wiring Harness Market Analysis

North America represents a significant segment in the automotive wiring harness market, driven by the region's advanced automotive manufacturing industry, strong adoption of electric and connected vehicles, and emphasis on technological innovation. Moreover, the high production and sales of passenger and commercial vehicles, coupled with the increasing integration of advanced driver-assistance systems (ADAS) and infotainment technologies, is catalyzing the market growth. Additionally, the imposition of stringent safety and emission regulations in the region that prompt automakers to adopt advanced wiring harness solutions to support compliance and enhance vehicle performance is fueling the market growth.

United States Automotive Wiring Harness Market Analysis

In 2024, the United States accounted for a share of 89.6% of the market in North America. The growing demand for electric and hybrid vehicles (EVs and HEVs) is the main factor propelling the automotive wire harness market in the US. The demand for sophisticated wiring harness systems to control the intricate electrical systems in EVs has increased because of the US government's efforts to reduce carbon emissions, which are backed by tax breaks and subsidies for EV adoption. It is anticipated that the U.S. EV industry would expand exponentially in the coming years. In line with this, with USD 7.5 billion allocated for EV charging facilities, the 2021 facilities Investment and Jobs Act gave electric mobility a boost. California has stated that it will prevent the sale of new internal combustion engine-powered automobiles by 2035, and the Inflation Reduction Act offered tax benefits for both new and old electric passenger cars as well as commercial vehicles.

The growing use of linked car technologies and advanced driving assistance systems (ADAS) is another important factor. The complexity of wire harness systems has increased as manufacturers incorporate technologies like infotainment systems, autonomous driving capabilities, and vehicle-to-everything (V2X) communication. To promote energy-efficient vehicle designs, the development of lightweight and highly efficient wiring systems is increasingly becoming a top priority.

The US auto aftermarket, which is worth nearly USD 400 billion, also contributes significantly. Stable demand is influenced by the replacement and improvement of wiring harnesses in older automobiles. The United States is a center for innovation in automotive wiring harness solutions, with major automakers and suppliers such as Tesla, Ford, and Aptiv having their headquarters there.

Asia Pacific Automotive Wiring Harness Market Analysis

The fast growth of the automotive sector in nations like China, Japan, India, and South Korea is advantageous for the Asia-Pacific automotive wire harness market. A major amount of the demand for wiring harnesses, especially for electric and connected vehicles, comes from China, the largest automaker in the world. China alone accounted for almost 60% of global EV sales in 2023, demonstrating the significant demand for cutting-edge wiring solutions.

The region’s growing middle-class population and increasing disposable incomes are driving the demand for passenger cars equipped with modern features like ADAS and infotainment systems, which rely on intricate wiring harness systems. As centers of innovation, South Korea and Japan provide high-performance, long-lasting, and lightweight wiring harness solutions to assist manufacturers throughout the world. With the help of government programs like the Faster Adoption and Manufacturing of Hybrid and Electric Vehicles (FAME) scheme, the Indian automobile industry is also expanding. High-quality wiring harnesses are becoming more and more in demand as Asia-Pacific automakers place a greater emphasis on incorporating cutting-edge technologies.

Europe Automotive Wiring Harness Market Analysis

Technological advancements, sales of high-end cars, increased electronic content in vehicles in the form of high-end infotainment system & telematics systems drives the wiring harness market in this region. The growing use of electric vehicles in the automotive industry is driving the growth of the market. According to European Environment Agency, there is a significant rise in the number of EVs sold in Europe. In total, 2.4 million new electric cars were registered in 2023, up from 2 million in 2022. Prevalence of various vehicle emission protocols force manufacturers to manufacture technically advanced, low-cost, and light-weight automotive wiring harness systems. Also, growth in vehicle standards contributed to the growth of the automotive wiring harness market in Europe.

High disposable income, along with stringent safety standards prescribed by government authorities and programs such as Europe NCAP combined with growing safety concerns among consumers have boosted the demand for safety solutions such as TPMS, ACC, night vision systems (NVS), and airbags., are likely to enhance the growth of the market, thereby, increasing the demand for automotive wiring harness market during the forecast period.

Latin America Automotive Wiring Harness Market Analysis

The expanding manufacturing and export of automobiles in nations like Mexico and Brazil is driving the automotive wire harness industry in Latin America. With significant expenditures in the fabrication of automobile wiring harnesses, Mexico in particular acts as a manufacturing hub for North American automakers. The region's growing use of electric vehicles, which is aided by government subsidies and growing environmental consciousness is further aiding to the market growth. Additionally, the emphasis on fuel-efficient vehicle designs is driving demand for wiring harnesses that are both lightweight and durable. It is anticipated that Brazil's push for hybrid and flex-fuel cars will increase demand for wiring harnesses in the area.

Middle East and Africa Automotive Wiring Harness Market Analysis

Growing investments in electric vehicle infrastructure and expanding automotive production in nations like South Africa and the United Arab Emirates are driving the automotive wire harness market in the Middle East and Africa. Despite still being in its infancy, EV adoption is increasing due to government programs that encourage sustainability. Furthermore, the need for complex wiring harness systems is raised by the incorporation of cutting-edge amenities like climate control, networking, and navigation systems in cars marketed in wealthy Middle Eastern markets. The growth of the regional market is further supported by the establishment of multinational collaborations and localized production capabilities.

Competitive Landscape:

The market is experiencing significant growth since numerous key players are focusing on innovation, strategic expansion, and partnerships to strengthen their positions. They are investing in advanced technologies to cater to the increasing demand for electric and connected vehicles, emphasizing lightweight and high-performance wiring solutions. Moreover, leading companies are putting efforts toward enhancing manufacturing efficiencies through automation and sustainable practices, such as adopting recyclable materials for wiring harness components. Besides this, they are working on expanding their global reach by establishing production facilities in high-growth regions and forming partnerships with automakers to align with new vehicle technologies. Additionally, they are developing modular and customizable wiring harness systems to meet the diverse requirements of modern vehicles, including electric, hybrid, and autonomous models.

The report has provided a comprehensive analysis of the competitive landscape in the automotive wiring harness market with detailed profiles of all major companies, including:

- Aptiv PLC

- Fujikura Ltd.

- Furukawa Electric Co., Ltd.

- Gebauer & Griller

- Lear Corporation

- Leoni AG

- Samvardhana Motherson International Ltd

- Spark Minda

- Sumitomo Electric Industries, Ltd.

- THB Group

- Yazaki Corporation

Recent Developments:

- April 2025: FORVIA showcased cutting-edge, AI-driven, sustainable automotive innovations at the Shanghai Auto Show 2025. Highlights include the Electric Fuse iConF, a first-of-its-kind intelligent, configurable electronic fuse. It is designed to reduces the complexity and weight of traditional wiring harnesses by enabling centralized power distribution. It uses predictive maintenance and proactive energy management to improve vehicle safety. It further facilitates higher levels of autonomous driving by providing intelligent power management for advanced systems.

- March 2025: Yazaki India, a prominent Japanese manufacturer specializing in wire harnesses, expanded its presence by securing approximately 1 million square feet of industrial space in the NCR region, Hosur, and Chennai. This move is part of a strategic partnership with Horizon Industrial Parks, the logistics division of Blackstone. Following the successful development of two eco-friendly facilities—each spanning 2.6 lakh sq. ft.—in Farukhnagar and Hosur, both certified IGBC Platinum, the company is now constructing a third unit covering 3.16 lakh sq. ft. in Chengalpattu, near Chennai. Designed to support over 2,000 employees, the upcoming plant will include rooftop solar installations and cater to leading clients in the automotive sector.

- January 2025: Leoni AG inaugurated a new plant in Agadir, Morocco, focused on producing wiring systems for trucks, powertrains, and off-road vehicles. The facility emphasizes digitalization, efficiency, and sustainability, incorporating energy-efficient technologies to minimize its CO2 footprint. With an investment exceeding €20 million, the plant supports production of complex, small-batch wiring systems tailored to commercial vehicles. Strategically located near major manufacturers, it will create over 3,000 jobs by 2027 and contribute to local community development through educational initiatives.

- January 2025: The US-Irish automotive technology supplier Aptiv inaugurated a new production plant in Tangier, Morocco, investing approximately 450 million Moroccan dirhams (USD 45 million). This facility is Aptiv’s eighth production unit in Morocco, reflecting the company’s strategic expansion in the North African market. Launched in 2023 within the industrial zone of Northwestern Tangier, the plant is expected to create over 3,000 jobs for Moroccans.

- May 2024: The Electrical Wire Processing Technology Expo (EWPTE) 2024 featured the debut of the “India Pavilion,” highlighting 15 Indian wire harness and cable assembly companies targeting the North American market. The Pavilion was inaugurated on May 15 with a ribbon-cutting ceremony led by David Bergman, Board Chair of the Wire Harness Manufacturer’s Association (WHMA).

Automotive Wiring Harness Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Applications Covered | Body Wiring Harness, Engine Wiring Harness, Chassis Wiring Harness, HVAC Wiring Harness, Sensors Wiring Harness, Others |

| Material Types Covered | Copper, Aluminum, Others |

| Transmission Types Covered | Data Transmission, Electrical Wiring |

| Vehicle Types Covered | Two Wheelers, Passenger Cars, Commercial Vehicles |

| Categories Covered | General Wires, Heat Resistant Wires, Shielded Wires, Tubed Wires |

| Components Covered | Connectors, Wires, Terminals, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Aptiv PLC, Fujikura Ltd., Furukawa Electric Co., Ltd., Gebauer & Griller, Lear Corporation, Leoni AG, Samvardhana Motherson International Ltd, Spark Minda, Sumitomo Electric Industries, Ltd., THB Group, Yazaki Corporation, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the automotive wiring harness market from 2020-2034.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global automotive wiring harness market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the automotive wiring harness industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

Automotive wiring harness are critical components in vehicles, designed to transmit power and data to various systems and components. They bundle multiple wires and cables, ensuring efficient electrical connections for functionalities like lighting, infotainment, safety systems, and engine operations, while enhancing vehicle performance and reliability.

The Automotive Wiring Harness market was valued at USD 89.4 Billion in 2025.

IMARC estimates the global Automotive Wiring Harness market to exhibit a CAGR of 3.40% during 2026-2034.

The rising adoption of electric vehicles (EVs), which demand complex and high-voltage wiring systems, is a primary driver. Additionally, the integration of advanced driver-assistance systems (ADAS), infotainment, and safety features in modern vehicles is boosting the market growth. Moreover, the imposition of stringent safety regulations and consumer preference for technologically advanced vehicles is fueling the market growth.

According to the report, chassis wiring harness represented the largest segment by application, due to the increasing integration of advanced electronics in modern vehicles.

Copper leads the market by material type owing to its superior electrical conductivity, durability, and heat resistance.

Electrical wiring is the leading segment by transmission type, driven by the rapid shift towards electric vehicles (EVs) and hybrid electric vehicles (HEVs) that rely on electrical power for propulsion and energy management.

According to the report, passenger cars represented the largest segment by vehicle type, due to the rising disposable income of individuals and the growing demand for passenger vehicles.

According to the report, general wires represented the largest segment by category, due to their increasing adoption in various applications, such as lighting, ignition systems, power windows and doors, and other electrical systems.

Wires represented the largest segment by component, due to the rising demand for high-quality and reliable wires to connect systems.

On a regional level, the market has been classified into North America, Asia Pacific, Europe, Latin America, and Middle East and Africa, wherein Asia Pacific currently dominates the global market.

Some of the major players in the global Automotive Wiring Harness market include Aptiv PLC, Fujikura Ltd., Furukawa Electric Co., Ltd., Gebauer & Griller, Lear Corporation, Leoni AG, Samvardhana Motherson International Ltd, Spark Minda, Sumitomo Electric Industries, Ltd., THB Group, Yazaki Corporation, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)