Autonomous Mobile Robots Market Size, Share, Trends and Forecast by Type, Battery Type, Vertical, and Region, 2025-2033

Autonomous Mobile Robots Market Size and Share:

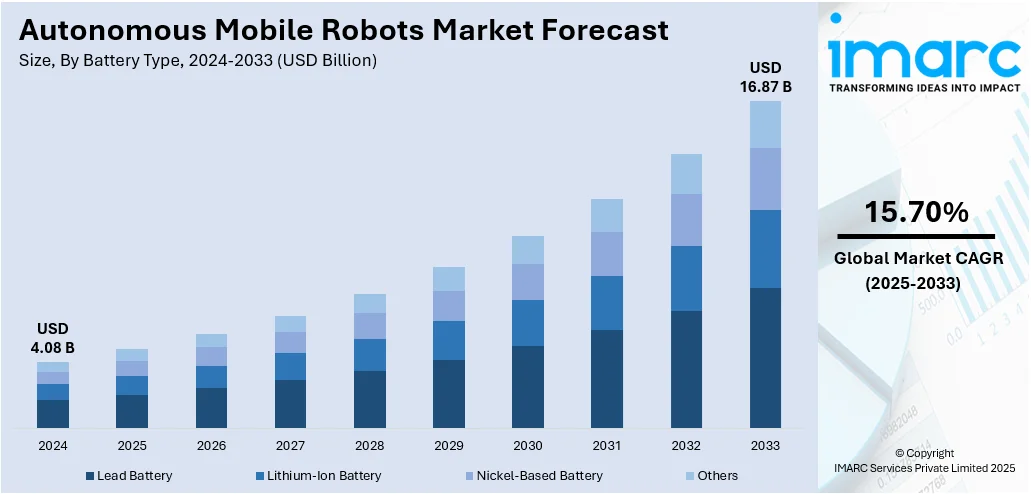

The global autonomous mobile robots market size was valued at USD 4.08 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 16.87 Billion by 2033, exhibiting a CAGR of 15.70% from 2025-2033. Europe currently dominates the market. The dominance of the region is because of its strong technological infrastructure, significant investments in automation, and supportive government initiatives. The region’s focus on Industry 4.0, advanced manufacturing practices, and stringent labor regulations also contribute to increased adoption across sectors such as logistics, automotive, and healthcare.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 4.08 Billion |

| Market Forecast in 2033 | USD 16.87 Billion |

| Market Growth Rate (2025-2033) | 15.70% |

Sectors are progressively embracing automation to enhance efficiency, lower operational expenses, and satisfy rising user needs. Autonomous mobile robots (AMRs) optimize routine activities, enhance efficiency, and reduce human mistakes, making them essential in industries like logistics, manufacturing, and retail. In addition to this, advancements in artificial intelligence (AI), machine learning (ML), and robotics allow AMRs to maneuver through intricate surroundings, make real-time decisions, and operate autonomously. These features improve robot efficiency, broaden application range, and speed up acceptance in various sectors. Besides this, ongoing labor shortages and increasing wages, particularly in developed economies, are encouraging firms to invest in AMRs. Robots occupy labor shortages, work around the clock, and lessen reliance on human workers, providing enduring cost reductions and consistent operations.

To get more information on this market, Request Sample

The United States plays a vital role in the market, driven by a strong innovation ecosystem, featuring extensive research in robotics, AI, and sensor technologies. This setting enhances AMR advancement, facilitating more intelligent, safer, and versatile robots appropriate for various industrial and commercial uses. Additionally, the swift growth of e-commerce is driving the need for effective warehousing and distribution solutions in the country. AMRs are essential for accelerating order fulfillment, monitoring inventory in real-time, and ensuring accurate deliveries, assisting companies in satisfying growing client demands. As reported by the Census Bureau of the Department of Commerce, retail e-commerce sales in the U.S. hit $300.2 billion during the first quarter of 2025, representing 16.2 percent of overall sales. The increase in online shopping emphasizes the immediate requirement for scalable automation, as AMRs are becoming crucial assets in contemporary fulfillment processes.

Autonomous Mobile Robots Market Trends:

Increasing Demand for Automation in Logistics and Warehousing

The growing need to enhance logistics and warehousing functions is a major factor driving the autonomous mobile robots market demand. Businesses encounter significant pressure to enhance efficiency, reduce operational expenses, and boost accuracy in managing inventory and fulfilling orders. AMRs offer a versatile, self-operating approach for moving products inside warehouses, decreasing reliance on human effort for monotonous, labor-intensive activities. The swift global growth of e-commerce is resulting in an increase in warehouse volumes, generating a significant demand for quicker and more dependable material handling systems. Labor shortages across numerous areas highlight the essential need for automation. In 2024, AFORMIC displayed its advanced customizable AMRs at MODEX in Atlanta, aimed at improving flexibility in intelligent manufacturing and warehousing. Driven by Qursor software from the AIUT Group, these robots facilitate real-time intralogistics and flexible automation, showcasing the emergence of AMRs as vital instruments in contemporary logistics settings, able to function around the clock and effortlessly blend with current warehouse systems.

Advancements in Rugged and Versatile AMR Technologies

Increased durability, greater payload capacity, and better speed allow AMRs to operate dependably in challenging environments, such as outdoor and industrial locations. These developments extend the scope of uses beyond conventional indoor storage to areas like agriculture, construction, and research. Assistance for sophisticated software structures and built-in capabilities such as wireless charging enhances operational effectiveness and minimizes downtime. As sectors pursue strong automation solutions capable of enduring tough environments while ensuring reliable performance, advanced AMRs fulfill changing requirements, accelerating adoption across various industries. In 2024, Clearpath Robotics (Canada), a Rockwell Automation company, announced the launch of the Husky A300, a rugged next-gen Autonomous Mobile Robot (AMR) for research and development. With enhanced speed, payload, and weather resistance, it supported ROS 2 and demanding field applications. The Husky AMP variant offered turnkey outdoor autonomy with integrated navigation and wireless charging.

Demand for High-Capacity and Fleet-Managed AMRs

The growing demand for self-sufficient mobile robots that can manage medium to heavy loads is offering a favorable autonomous mobile robots market outlook. Industries need AMRs capable of moving larger loads efficiently while maintaining speed and safety, enhancing material flow and minimizing manual labor. Combined fleet management systems that synchronize various robots concurrently improve operational scalability and efficiency, allowing organizations to optimize resource distribution and reduce downtime. These innovations enhance intricate industrial settings by optimizing the movement of parts and materials, boosting efficiency, and promoting safer working conditions. With increasing production demands and the desire to automate more complex logistics operations, the rise of durable, high-capacity AMRs featuring advanced fleet management is propelling the market growth. In 2024, Omron Automation introduced the MD Series of autonomous mobile robots (AMRs) designed for medium payloads of 650kg and 900kg. These robots offered enhanced speed (2.2 m/sec), safety features, and integrated fleet management for up to 100 units. The MD Series aimed to boost efficiency in part and material transport across industrial settings.

Autonomous Mobile Robots Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global autonomous mobile robots market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on type, battery type, and vertical.

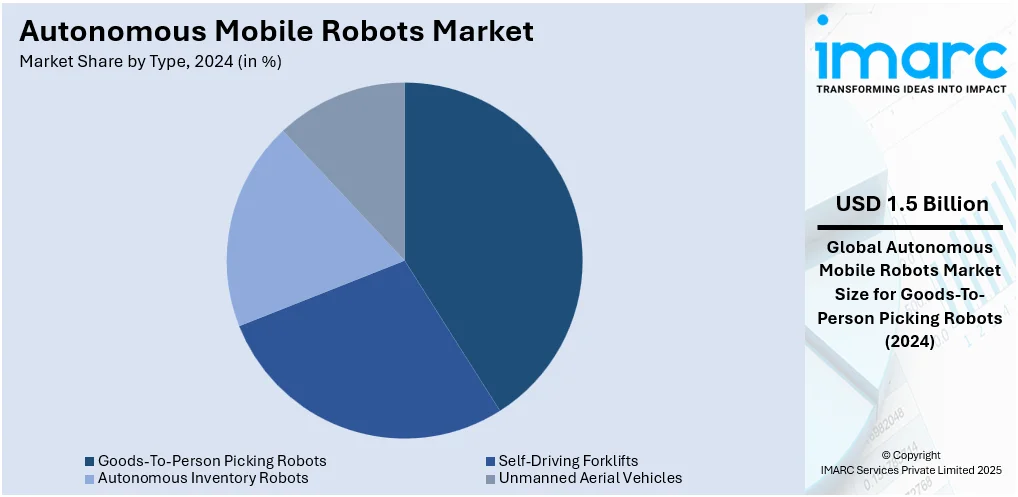

Analysis by Type:

- Goods-To-Person Picking Robots

- Self-Driving Forklifts

- Autonomous Inventory Robots

- Unmanned Aerial Vehicles

Goods-to-person picking robots stand as the largest component in 2024, holding 37.6% of the market, as they greatly improve operational efficiency, shorten picking duration, and lower human error in warehouse and fulfillment center activities. These robots automate the collection and transport of items to fixed workers, removing the necessity for staff to traverse long distances, thereby enhancing efficiency and decreasing exhaustion. Their adaptability and scalability render them perfect for the e-commerce and retail sectors that demand rapid order processing and regular updates in product offerings. Furthermore, the growing need for same-day and next-day deliveries is encouraging businesses to invest in systems capable of efficiently managing large order quantities swiftly and precisely. Goods-to-person robots enhance space utilization and inventory control, allowing companies to increase throughput without the need for additional physical infrastructure.

Analysis by Battery Type:

- Lead Battery

- Lithium-Ion Battery

- Nickel-Based Battery

- Others

Lead battery represents the largest segment owing to its affordability, established reliability, and extensive availability. It is utilized in multiple industries, providing a reliable and well-established energy storage option for AMRs. It has a comparatively low upfront cost relative to newer battery technologies, which makes it appealing for businesses looking for cost-effective automation solutions. Lead battery also delivers reliable performance in regulated settings like warehouses and manufacturing plants, where temperature and usage conditions are generally consistent. Moreover, its ability to be recycled and the existing recycling systems encourages its adoption, aligning with sustainability goals in many regions. The combination of cost-effectiveness, longevity, and compatibility with current systems ensures lead battery remains prominent in the market, especially in uses where rapid charging and high energy output are not essential.

Analysis by Vertical:

- Real Estate and Construction

- Power and Energy

- Defense and Security

- Manufacturing and Logistics

- Automotive

- Education and Research

- Others

In the real estate and construction sector, AMRs are increasingly being adopted for tasks like site surveying, transporting materials, and monitoring in real-time. These robots enhance safety by minimizing human exposure to dangerous environments and boost project efficiency with accurate navigation and task performance. Their capacity to gather and assess data supports advancement monitoring and site development.

The power and energy sector benefits from AMRs by employing them in the inspection, upkeep, and observation of essential infrastructure. AMRs minimize downtime and improve safety in both traditional and renewable energy plants by conducting regular inspections in dangerous or hard-to-reach locations. These robots utilize sensors and imaging technologies to identify faults, corrosion, or overheating in machinery, enabling prompt action.

In defense and security, AMRs are essential for surveillance, reconnaissance, and logistics. Their capacity to function in dangerous or hard-to-reach areas makes them essential for border patrol, bomb disposal, and support on the battlefield. Fitted with cutting-edge navigation, imaging, and communication technologies, AMRs improve situational awareness and lower the risk for human personnel.

Manufacturing and logistics are a crucial segment in the market. AMRs are extensively deployed in factories and warehouses to automate the handling of materials, management of inventory, and transportation within facilities. Their adaptability, scalability, and capability to collaborate with humans (cobotics) make them ideal for just-in-time (JIT) processes and high-throughput settings. These robots decrease reliance on labor, enhance precision, and reduce lead times, all while boosting safety in the workplace.

In the automotive industry, AMRs facilitate production lines, move components, and oversee inventory in real-time. Their connection with manufacturing execution systems (MES) and enterprise resource planning (ERP) platforms allows for automated task coordination, enhancing lean manufacturing and boosting workflow efficiency. AMRs also enable just-in-sequence (JIS) delivery, which is essential for automotive assembly lines.

In education and research, AMRs are utilized for experimentation, education, and innovation. Universities and laboratories utilize AMRs to research robotics algorithms, integrate ML and AI, and examine human-robot interaction. These platforms offer practical experience for students and researchers, promoting progress in autonomous technologies.

Others include healthcare, hospitality, agriculture, and retail, in which AMRs are becoming more popular for specific tasks. In the healthcare sector, they move medications and supplies throughout hospitals. In the hospitality sector, AMRs aid in room service and engaging with guests. Agriculture employs them for monitoring crops and harvesting, whereas in retail, they handle shelf scanning and replenishing stock. These diverse applications demonstrate the adaptability of AMRs across various use cases, driven by a common goal of enhancing operational efficiency, reducing costs, and delivering better user experiences.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

Europe leads the market because of its strong emphasis on technological advancement, extensive acceptance of automation, and favorable regulatory framework. The area's dedication to Industry 4.0 and smart manufacturing projects are leading to substantial investment in AMRs throughout sectors including logistics, automotive, pharmaceuticals, and food processing. Numerous countries in the region are utilizing AMRs, motivated by workforce shortages, increasing labor expenses, and the demand for operational effectiveness. For example, in 2024, UK start-up Phinxt Robotics raised £2 million to expand its AI-driven warehouse automation platform. Their decentralized edge AI software simplified and reduced the cost of deploying AMRs and AGVs through a subscription model. Moreover, the existence of major market participants, cutting-edge research institutions, and government-supported initiatives for digital transformation are bolstering the market growth. Besides this, Europe's focus on sustainability and effective resource management increases the demand for automation technologies that enhance energy efficiency and minimize waste.

Key Regional Takeaways:

United States Autonomous Mobile Robots Market Analysis

In North America, the market portion held by the United States was 89.10%, propelled by swift progress in AI and ML. Additionally, navigation algorithms and sensor integration, especially LiDAR, cameras, and ultrasonic systems, are improving the spatial awareness, autonomy, and dependability of AMRs, making them more feasible for dynamic settings. The rise of e-commerce and individual demand for same-day and next-day delivery are increasing investment in automated logistics and warehousing. Key companies like Amazon and Walmart are utilizing fleets of AMRs to accelerate sorting, picking, and package transportation. In June 2022, Amazon introduced its initial autonomous mobile robot, Proteus, intended for application in its numerous fulfillment and sort centers. Proteus employs advanced safety, perception, and navigation technologies from Amazon to autonomously move around Amazon facilities. Furthermore, the need for automation is becoming crucial due to labor shortages and rising wages in manufacturing, logistics, and distribution environments. This is catalyzing the demand for AMRs for minimizing costs and reliance on human labor. Robust governmental backing, including federal funding programs and established safety standards through entities like NIST and ANSI, is also fostering a favorable environment for AMR adoption.

Europe Autonomous Mobile Robots Market Analysis

The expansion of the Europe AMRs market is primarily driven by a combination of industry, technology, and policy factors. The growth of e-commerce in Europe is driving the need for effective order fulfillment, leading to AMRs being a desirable choice for automating warehousing, sorting, and intralogistics operations. The continent's firm dedication to Industry 4.0 and smart manufacturing provides AMR systems a fundamental edge as businesses aim for interconnected, data-oriented production settings. Additionally, the European Union’s emphasis on sustainability and carbon reduction is motivating companies to implement AMRs as part of more eco-friendly logistics solutions, decreasing fuel usage and energy waste relative to conventional material handling techniques. A 2024 report from the International Federation of Robotics (IFR) indicates that robot density in the EU rose by 5.2%, achieving 219 units for every 10,000 workers. Moreover, advancements in technology, including AI-enabled navigation, sophisticated sensor integration, and cloud and IoT-supported fleet management, are significantly improving AMR safety, independence, and effectiveness, leading to extensive acceptance. Apart from this, Europe’s varied linguistic and regulatory landscapes are promoting the creation of highly versatile and tailored AMR platforms, enhancing innovation in human-machine interaction and compliance technologies. Collaborative alliances among universities, robotics startups, and industry leaders are enhancing the pace of commercialization.

Asia Pacific Autonomous Mobile Robots Market Analysis

The AMRs market in the Asia Pacific is growing owing to rising urbanization and the progress of smart infrastructure in key cities. Moreover, the swift growth of the retail and hospitality industries, especially in nations like South Korea, Thailand, and Singapore, is driving the need for service-oriented AMRs capable of performing tasks like room service, cleaning, and inventory management. The Asia Pacific region's leadership in industrial robot deployments and strong local innovation is also cultivating a strong ecosystem for AMR advancement. For example, in 2023, Asia represented 70% of the total number of newly deployed robots worldwide, according to the International Federation of Robotics (IFR). Additionally, the region possesses a strong robot density of 182 units for every 10,000 individuals utilized in industrial manufacturing. Besides this, increasing funding from venture capital and international robotics companies into APAC startups is promoting innovation and speeding up the commercialization of various AMR applications in the area.

Latin America Autonomous Mobile Robots Market Analysis

The AMR market in Latin America is witnessing strong growth fueled by increasing infrastructure investments and a booming e-commerce sector, especially in manufacturing centers like Mexico and Brazil, where AMRs enhance material handling and order fulfillment processes. For example, according to the International Trade Administration (ITA), the e-commerce market in Brazil is seeing remarkable growth of 14.3% and is anticipated to exceed USD 200 Billion by 2026. Moreover, improved connectivity via the expansion of 4G and the rise of 5G infrastructure is facilitating superior communication between AMRs and centralized control systems, permitting real-time optimization. According to industry reports, Latin America achieved 67 million 5G network connections in Q3 2024, with a growth rate of 19%. Additionally, the growth of omnichannel retail and direct-to-consumer (DTC) delivery models in city regions is catalyzing the demand for AMRs in distribution centers and micro-fulfillment centers.

Middle East and Africa Autonomous Mobile Robots Market Analysis

The market for AMRs in the Middle East and Africa is influenced by swift economic diversification. The increasing use of robotics in healthcare, especially in hospitals and labs, is also encouraging the utilization of AMRs for activities like medication distribution and sanitation. In Saudi Arabia, the authorities aim to raise private sector involvement in healthcare from the existing 40% to 65% by the year 2030. This privatization is also anticipated to benefit the market in the area. Infrastructure development initiatives, such as airports, industrial areas, and ports, are incorporating AMRs to enhance efficiency and minimize manual work. Additionally, the area's enhancing digital connections and investment in AI and robotics education are fostering a favorable environment for AMR implementation, allowing both private and public sectors to embrace advanced automation technologies.

Competitive Landscape:

Major participants in the market are concentrating on ongoing innovation, improving robot intelligence, and broadening product ranges to address various industry requirements. For instance, in 2025, Konica Minolta and Mobile Industrial Robots (MiR) will launch two new autonomous mobile robots—the MiR MC250 Mobile Cobot and MiR1200 Pallet Jack—at CeMAT Australia 2025 in Sydney. These AI-powered robots aim to enhance logistics and material handling through automation and safety. Furthermore, joint ventures and strategic alliances allow them to expand market access and speed up technology implementation. Moreover, these firms emphasize client assistance and service offerings to guarantee smooth implementation and upkeep. Focusing on scalability, personalization, and safety attributes aids in tackling different operational issues. By prioritizing sustainability and minimizing costs, major stakeholders seek to enhance their competitive advantage and promote broad adoption of autonomous mobile robots in various industries.

The report provides a comprehensive analysis of the competitive landscape in the autonomous mobile robots market with detailed profiles of all major companies, including:

- ABB, Bleum

- Boston Dynamics

- Clearpath Robotics Inc.

- GreyOrange

- Harvest Automation

- IAM Robotics

- inVia Robotics, Inc.

- KUKA AG (Midea Group Co. Ltd.)

- Teradyne Inc.

Latest News and Developments:

- June 2025: Viscon Group launched the EVA Scoutr, an autonomous mobile scouting robot for sustainable crop protection applications across greenhouses. Featuring Level 4 autonomy, vision-based AI, and intelligent software capabilities, EVA provides producers with the ability to identify pests and illnesses early, minimize crop loss, and make significant progress toward a 100% sustainable future.

- May 2025: ABB announced the expansion of its line of completely autonomous mobile robots through the addition of 3D visual simultaneous localization and mapping (Visual SLAM) navigation and the intuitive AMR Studio programming tools to its Flexley Mover P604. This expansion is a significant step forward in ABB’s pursuit of more adaptable, effective, and user-friendly autonomous mobile robots.

- May 2025: OMRON officially launched the OL-450S, a low-profile, omnidirectional autonomous mobile robot (AMR) intended to enhance material handling safety, streamline operations, and maximize productivity. With its integrated lifting plate, sophisticated navigation, and centralized fleet administration, the OL-450S provides a comprehensive solution for automating material delivery in fast-paced industries, including semiconductor and electronics, automotive, food and home items, and medical.

- April 2025: Cartken, a prominent provider of autonomous robotic solutions, unveiled the Cartken Hauler, an autonomous mobile robot for indoor and outdoor material handling. Featuring a greater capacity for payloads, the Cartken Hauler was developed to automate material handling in a variety of indoor and outdoor settings, including manufacturing plants, distribution centers, warehouses, and corporate campuses.

- January 2025: SICK successfully completed the acquisition of Accerion to boost its portfolio of autonomous mobile robot (AMR) positioning technologies. The purchase of the software firm Accerion will provide clients with access to SICK's full suite of positioning solutions.

Autonomous Mobile Robots Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Goods-To-Person Picking Robots, Self-Driving Forklifts, Autonomous Inventory Robots, Unmanned Aerial Vehicles |

| Battery Types Covered | Lead Battery, Lithium-Ion Battery, Nickel-Based Battery, Others |

| Verticals Covered | Real Estate and Construction, Power and Energy, Defense and Security, Manufacturing and Logistics, Automotive, Education and Research, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | ABB, Bleum, Boston Dynamics, Clearpath Robotics Inc., GreyOrange, Harvest Automation, IAM Robotics, inVia Robotics, Inc., KUKA AG (Midea Group Co. Ltd.) and Teradyne Inc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the autonomous mobile robots market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global autonomous mobile robots market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the autonomous mobile robots industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The autonomous mobile robots market was valued at USD 4.08 Billion in 2024.

The autonomous mobile robots market is projected to exhibit a CAGR of 15.70% during 2025-2033, reaching a value of USD 16.87 Billion by 2033.

The autonomous mobile robots market is driven by advancements in AI, ML, and sensor technologies, enabling enhanced navigation and decision-making capabilities. Rising labor costs, increasing demand for automation, and the need for operational efficiency across industries further supports the market growth. Additionally, safety concerns and supply chain optimization are influencing broader adoption of these intelligent systems.

Europe currently dominates the autonomous mobile robots market, owing to strong technological infrastructure, significant investments in automation, and supportive government initiatives. The region’s focus on Industry 4.0, advanced manufacturing practices, and stringent labor regulations also contribute to increased adoption across sectors such as logistics, automotive, and healthcare.

Some of the major players in the autonomous mobile robots market include ABB, Bleum, Boston Dynamics, Clearpath Robotics Inc., GreyOrange, Harvest Automation, IAM Robotics, inVia Robotics, Inc., KUKA AG (Midea Group Co. Ltd.), Teradyne Inc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)