Bahrain PVC Pipes Market Size, Share, Trends and Forecast by Application, 2025-2033

Market Overview:

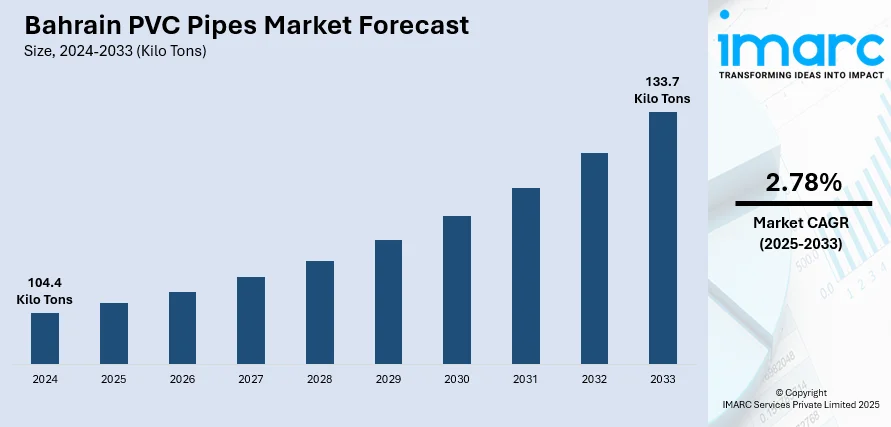

The Bahrain PVC pipes market size reached 104.4 Kilo Tons in 2024. Looking forward, IMARC Group expects the market to reach 133.7 Kilo Tons by 2033, exhibiting a growth rate (CAGR) of 2.78% during 2025-2033.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

104.4 Kilo Tons |

|

Market Forecast in 2033

|

133.7 Kilo Tons |

| Market Growth Rate 2025-2033 | 2.78% |

PVC pipes are made up of polyvinyl chloride (PVC), a chemical polymer resin. These pipes are made from a blend of PVC and other additives. PVC pipes have numerous applications in drain waste vent, water service lines, irrigation, sewers and other industrial installations. The PVC pipes are used extensively in electric systems due to its properties of heat and electrical insulation. Apart from that, these pipes have high resistance to chemicals and a high tensile strength to withstand very high fluid pressure, so they are widely used in long distance water supply and underground sewerage systems. They are strong and can withstand extreme movements, so can be used in earthquake prone areas without experiencing any damage. These pipes are also cost-effective, light-weight and long-lasting, which makes it widely acceptable over its competing piping materials. The PVC pipes are rapidly replacing the concrete and metal pipes as they can be used in cases of energy, gas, conduit, and other industrial applications too. The rapid economic growth in Bahrain is pushing the demand for better infrastructure thereby boosting the demand for PVC pipes in the region.

To get more information on this market, Request Sample

In Bahrain, the government is focusing on improving the country's infrastructure and is undertaking various construction projects. This is a key factor that will drive the market in this region. Also, the housing supply in Bahrain is too less as compared to the demand for housing, especially among the low and mid-income groups, hence there is a scope for increase in residential property development and this will provide a thrust to the PVC pipes market. Furthermore, the heightened awareness of consumers on the smaller environmental footprint of PVC pipes as compared to the other piping materials is expected to influence the market’s growth in this region.

Key Market Segmentation:

IMARC Group provides an analysis of the key trends in each sub-segment of the Bahrain PVC pipes market report, along with forecasts for the period 2025-2033. Our report has categorized the market based on application.

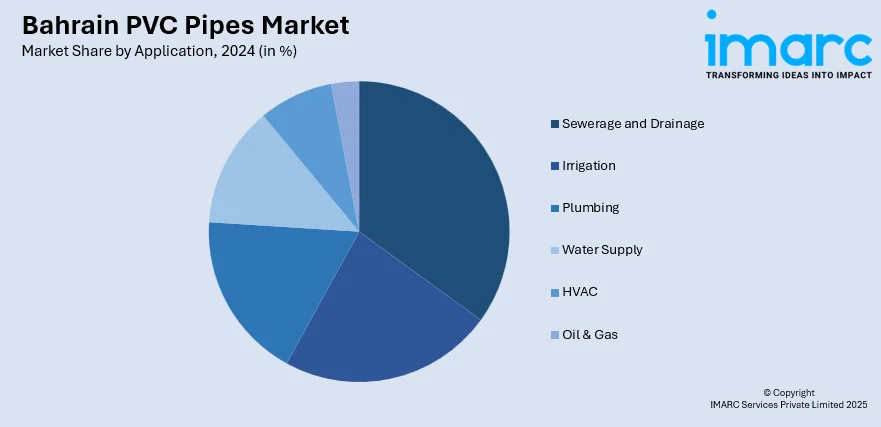

Breakup by Application:

- Sewerage and Drainage

- Irrigation

- Plumbing

- Water Supply

- HVAC

- Oil & Gas

On the basis of application, sewerage and drainage represent the largest segment.

Competitive Landscape:

The competitive landscape of the market has also been examined with some of the key players being Gulf Plastic, Bahrain National Plastics Company (BANAPCO), and Tylos Plastic Industries.

This report provides a deep insight into the Bahrain PVC pipes market covering all its essential aspects. This ranges from macro overview of the market to micro details of the industry performance, recent trends, key market drivers and challenges, SWOT analysis, Porter’s five forces analysis, value chain analysis, etc. The report also provides a comprehensive analysis for setting up a PVC pipe manufacturing plant. The study analyses the processing and manufacturing requirements, project cost, project funding, project economics, expected returns on investment, profit margins, etc. This report is a must-read for entrepreneurs, investors, researchers, consultants, business strategists, and all those who have any kind of stake or are planning to foray into Bahrain PVC pipes market in any manner.

Key Questions Answered in This Report

The Bahrain PVC pipes market reached a volume of 104.4 Kilo Tons in 2024.

We expect the Bahrain PVC pipes market to exhibit a CAGR of 2.78% during 2025-2033.

The rising utilization of PVC pipes in electrical fittings, owing to their excellent heat and electrical insulation properties, is primarily driving the Bahrain PVC pipes market.

The sudden outbreak of the COVID-19 pandemic had led to the implementation of stringent lockdown regulations across the nation resulting in the temporary halt in numerous construction activities, thereby limiting the demand for PVC pipes.

Based on the application, the Bahrain PVC pipes market can be bifurcated into sewerage and drainage, irrigation, plumbing, water supply, HVAC, and oil & gas. Among these, sewerage and drainage accounts for the majority of the total market share.

Some of the major players in the Bahrain PVC pipes market include Gulf Plastic, Bahrain National Plastics Company (BANAPCO), and Tylos Plastic Industries.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)