Barge Transportation Market Report by Type of Cargo (Dry Cargo, Liquid Cargo, Gaseous Cargo), Barge Fleet (Open Barge, Covered Barge, Tank Barge), Application (Coal and Crude Petroleum Products, Agricultural Products, Coke and Refined Petroleum Products, Metal Ores and Fabricated Metal Products, Chemicals, Rubber and Plastic, Nuclear Fuel, Food Products, Beverages, and Tobacco, and Others), Activities (Intracoastal Transportation, Inland Water Transportation), and Region 2025-2033

Barge Transportation Market Size:

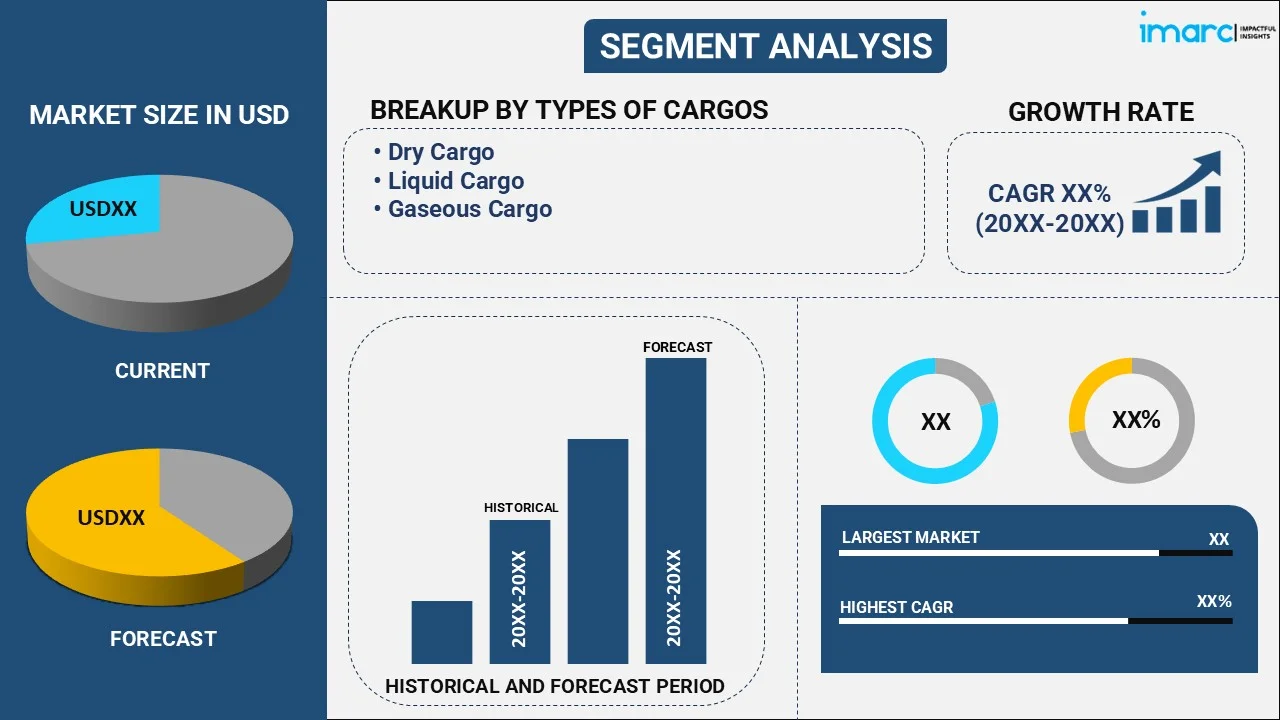

The global barge transportation market size reached USD 134.7 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 175.3 Billion by 2033, exhibiting a growth rate (CAGR) of 2.68% during 2025-2033. The market is experiencing steady growth driven by the increasing focus on cost-effective transportation systems, rising need to maintain environmental sustainability, and integration of advanced technologies in barge transportation, such as automated systems, digital connectivity, cargo tracking and monitoring, and fuel efficiency.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 134.7 Billion |

|

Market Forecast in 2033

|

USD 175.3 Billion |

| Market Growth Rate 2025-2033 | 2.68% |

Barge Transportation Market Analysis:

- Market Growth and Size: The market is witnessing stable growth, driven by the increasing trade activities, along with the escalating demand for cost-effective bulk cargo transport.

- Technological Advancements: Innovations in barge design, navigation systems, and cargo handling equipment are enhancing their efficiency and safety. Moreover, automation and digitalization are making them more responsive and efficient.

- Industry Applications: Barges find applications in various industries, including agriculture, energy, construction, and manufacturing.

- Geographical Trends: Europe leads the market on account of the well-developed network of inland waterways. However, North America is emerging as a fast-growing market due to the well-established infrastructure and accessibility of water routes.

- Competitive Landscape: Companies are investing in port facilities, terminals, and loading or unloading equipment to improve efficiency and accommodate larger cargo volumes.

- Challenges and Opportunities: While the market faces challenges, such as weather-related disruptions, it also encounters opportunities on account of the rising demand for eco-friendly transport.

- Future Outlook: The future of the barge transportation market looks promising, with the integration of advanced technologies. Moreover, the increasing focus on environmental sustainability is projected to propel the market growth.

Barge Transportation Market Trends:

Rising focus on cost-efficiency

The rising focus on cost-effective transportation systems is supporting the growth of the market. In line with this, barges offer a distinct cost advantage over other transportation modes, making them an attractive choice for companies seeking to optimize their shipping expenses. Moreover, barges have a higher cargo capacity as compared to trucks or trains, allowing them to transport large volumes of goods in a single journey. This benefits in reducing the need for multiple shipments and minimizing labor and fuel costs. Apart from this, barges are energy-efficient, as they require less fuel per ton-mile to transport goods. This not only reduces operational costs but also aligns with sustainability goals. In addition, barge transportation often benefits from economies of scale, especially when transporting bulk commodities over long distances. This cost advantage makes barges an attractive option for organizations looking to lower transportation expenses. Furthermore, barge transport relies on existing waterway infrastructure, such as rivers and canals, which often require fewer investments as compared to building and maintaining extensive road or rail networks.

Environmental sustainability

The growing adoption of barge transportation on account of the rising focus on maintaining environmental sustainability is offering a positive market outlook. In line with this, barge transportation is recognized as a greener and more eco-friendly mode of freight transport as compared to trucking or air cargo. Furthermore, barges emit fewer carbon emissions per ton-mile of cargo transported, making them a more eco-responsible choice. This aligns with the growing focus on sustainability in organizations. Besides this, the increasing need to reduce carbon footprint among companies is contributing to the growth of the market. Additionally, barge transportation often relies on inland waterways and canals, thereby reducing the strain on road infrastructure and congestion in urban areas. This contributes to cleaner air quality and less wear and tear on highways, promoting environmental sustainability. Apart from this, governing agencies of various countries are focusing on reducing greenhouse gas (GHG) emissions to reduce carbon footprint.

Technological Innovations

Technological innovations in barge transportation, such as automated systems, digital connectivity, cargo tracking and monitoring, and fuel efficiency are impelling the market growth. Additionally, automation plays a crucial role in optimizing barge operations. Automated navigation systems, including global positioning system (GPS) and advanced radar, improve route planning and collision avoidance, enhancing overall safety and navigation accuracy. Besides this, the integration of digital communication systems allows for real-time monitoring of barge locations, cargo status, and weather conditions. This enables improved decision-making and more responsive logistics management. Furthermore, the Internet of Things (IoT) devices and sensors are used to monitor cargo conditions, ensuring proper temperature control, humidity levels, and security during transport. In line with this, innovations in engine technology and propulsion systems benefit in improving fuel efficiency and reducing operational costs and carbon emissions. Moreover, barge companies are adopting cleaner technologies, such as exhaust gas cleaning systems and shore power connections, to reduce emissions and minimize their environmental footprint.

Barge Transportation Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the global, regional, and country levels for 2025-2033. Our report has categorized the market based on type of cargo, barge fleet, application, and activities.

Breakup by Type of Cargo:

- Dry Cargo

- Liquid Cargo

- Gaseous Cargo

Dry cargo accounts for the majority of the market share

The report has provided a detailed breakup and analysis of the market based on the type of cargo. This includes dry cargo, liquid cargo, and gaseous cargo. According to the report, dry cargo represented the largest segment.

Dry cargo barges are designed to transport non-liquid goods, such as bulk commodities, project cargo, and specialized dry cargo. In addition, bulk commodities, include coal, grains, minerals, ores, and aggregates. Dry cargo barges are well-suited for carrying these materials in large quantities. Project cargos are oversized or heavy items like machinery, equipment, or construction materials. Furthermore, specialized dry cargo barges may be used for project cargo transport.

Liquid cargo barges are designed to transport various types of liquids, including petroleum products and chemicals. In line with this, petroleum products are crude oil, gasoline, diesel, and other refined products. Tank barges are commonly used for the safe and efficient transport of liquid petroleum cargo. Besides this, hazardous and non-hazardous chemicals are transported in tank barges. These cargoes require specialized handling and safety measures.

Gaseous cargo barges are designed for the transportation of gases, including liquefied natural gas (LNG), Liquefied petroleum gas (LPG), and other gases. Moreover, LNG barges are used for the transport of natural gas in its liquid form, often for energy and industrial applications. Liquefied petroleum gas (LPG) carries gases like propane and butane, commonly used for heating, cooking, and industrial processes.

Breakup by Barge Fleet:

- Open Barge

- Covered Barge

- Tank Barge

Tank barge holds the largest market share

A detailed breakup and analysis of the market based on the barge fleet have also been provided in the report. This includes open barge, covered barge, and tank barge. According to the report, tank barge accounted for the largest market share.

Tank barges are specifically designed for the transportation of liquid cargo, including petroleum products, chemicals, liquid bulk cargo, and liquified gases. Additionally, tank barges play a crucial role in transporting crude oil, gasoline, diesel fuel, and various other liquid petroleum products. They are equipped to safely transport both hazardous and non-hazardous chemicals, meeting stringent safety and environmental regulations. They are also used for transporting other liquids like vegetable oils, molasses, and liquid fertilizers. In some cases, tank barges may be adapted to carry liquefied gases, such as liquefied natural gas (LNG) or liquefied petroleum gas (LPG).

Open barges are versatile and primarily used for transporting dry cargo, including bulk commodities, project cargo, and containers. Open barges are ideal for transporting materials like coal, grains, minerals, ores, and aggregates. Project cargos are used to carry oversized or heavy items, such as machinery, equipment, and construction materials. Moreover, some open barges are equipped to carry standard shipping containers, facilitating intermodal transportation, and serving containerized cargo.

Covered barges, also known as deck barges, have an enclosed or covered deck, providing protection to cargo from the elements. They can transport a wide range of goods, including machinery, equipment, packaged goods, and materials that require protection from weather conditions. They are also suitable for certain bulk commodities that need protection against moisture or other environmental factors.

Breakup by Application:

- Coal and Crude Petroleum Products

- Agricultural Products

- Coke and Refined Petroleum Products

- Metal Ores and Fabricated Metal Products

- Chemicals, Rubber and Plastic, Nuclear Fuel

- Food Products, Beverages, and Tobacco

- Others

Coal and crude petroleum products represent the leading market segment

The report has provided a detailed breakup and analysis of the market based on the application. This includes coal and crude petroleum products, agricultural products, coke and refined petroleum products, metal ores and fabricated metal products, chemicals, rubber and plastic, nuclear fuel, food products, beverages, and tobacco, and others. According to the report, coal and crude petroleum products represented the largest segment.

Coal and crude petroleum products encompass the transportation of coal for energy production and the movement of crude petroleum products, such as crude oil, which is a vital component of the energy sector. In addition, efficient and secure crude oil transportation by barge is essential for ensuring a stable supply of crude petroleum products.

Barges are widely used to transport agricultural products, such as wheat, corn, soybeans, rice, and other bulk agricultural commodities. Moreover, barges are particularly well-suited for transporting bulk agricultural products due to their large carrying capacity.

Barges play a significant role in transporting coke and refined petroleum products, such as gasoline, diesel fuel, jet fuel, and other petrochemical products. Furthermore, the transportation of refined petroleum products requires strict adherence to safety regulations to prevent spills and ensure the integrity of the cargo.

Metal ores and fabricated metal products play a crucial role in transporting bulk quantities of metal ores from mines to processing plants, smelters, and ports. Barges are utilized to move fabricated metal products from manufacturing facilities to distribution centers, construction sites, and industrial consumers.

Chemicals, rubber and plastic, nuclear fuel barges are essential for transporting various chemicals, both hazardous and non-hazardous, used in industrial processes, manufacturing, and agriculture. They are also used for transporting raw materials, finished products, and chemicals used in the production of rubber and plastic goods. Besides this, barges can transport nuclear fuel materials safely and securely for use in nuclear power plants and other applications in the energy sector.

Food products, beverages, and tobacco barges are used to transport food products, beverages like fruit juices, and tobacco products to distribution centers and markets.

Breakup by Activities:

- Intracoastal Transportation

- Inland Water Transportation

Inland water transportation exhibits a clear dominance in the market

The report has provided a detailed breakup and analysis of the market based on the activities. This includes intracoastal transportation and inland water transportation. According to the report, inland water transportation represented the largest segment.

Inland water transportation is the movement of cargo by barges along rivers, canals, lakes, and other inland waterways within the borders of the country. In addition, inland water transportation is commonly used for the transport of bulk commodities, including grains, coal, and petroleum products. It often connects industrial centers, agricultural regions, and ports, serving as a cost-effective and eco-friendly mode of transport for goods.

Intracoastal transportation involves the movement of barges along coastal waterways, such as those found along the coastlines of oceans and seas. It is especially relevant for regions with extensive coastlines and busy ports, as it provides a maritime route for the transport of goods.

Intracoastal transportation may be used for both bulk cargo and containerized cargo, depending on the specific needs of the coastal region. It is vital for the distribution of goods to coastal cities and regions, reducing reliance on overland transportation.

Breakup by Region:

- North America

- United States

- Canada

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

Europe leads the market, accounting for the largest Barge transportation market share

The market research report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Europe (Germany, France, the United Kingdom, Italy, Spain, Russia and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, Europe accounted for the largest market share due to the well-developed network of inland waterways, including major rivers like the Rhine, Danube, and Seine. In addition, the rising focus on environmental sustainability and reducing carbon emissions is supporting the market growth.

North America stands as another key region in the market, driven by the extensive network of navigable inland waterways with river systems like the Mississippi, Ohio, and Missouri rivers, facilitating the efficient movement of cargo. These waterways serve as vital ways for the transportation of bulk commodities, including grains, coal, petroleum products, and chemicals. The well-established infrastructure and accessibility of these water routes make barge transportation a cost-effective and reliable choice for many industries.

Asia Pacific maintains a strong presence in the market, with the increasing focus on the cost-effective movement of goods. In addition, rising concerns about carbon emissions are contributing to the growth of the market.

Latin America exhibits growing potential in the barge transportation market on account of the presence of significant river systems like the Amazon and Paraguay-Parana rivers. Besides this, the growing demand for bulk transportation systems due to the thriving agriculture and industrial sectors is offering a positive market outlook.

The Middle East and Africa region shows a developing market for barge transportation, primarily driven by the rising adoption of barge transportation for the movement of crude oil, petroleum products, and liquefied natural gas (LNG).

Leading Key Players in the Barge Transportation Industry:

Key players are investing in updating and modernizing their fleets with newer vessels equipped with advanced technology, improved fuel efficiency, and enhanced safety features. In addition, they are focusing on reducing their environmental impact. In line with this, companies are collaborating with other transportation modes, such as rail and trucking, to offer integrated supply chain solutions. Furthermore, major manufacturers are adopting digital technologies, including global positioning system (GPS) navigation, cargo tracking systems, and real-time data analytics, that help optimize operations, enhance safety, and improve customer service. Apart from this, companies are investing in port facilities, terminals, and loading or unloading equipment to improve efficiency and accommodate larger cargo volumes.

The market research report has provided a comprehensive analysis of the competitive landscape. Detailed profiles of all major companies have also been provided. Some of the key players in the market include:

- Alter Logistics (Goldstein Group Inc.)

- American Commercial Barge Line (American Commercial Lines Inc)

- Anderson Trucking Service Inc

- Bouchard Transportation Co. Inc.

- Campbell Transportation Company Inc (Blue Danube Incorporated)

- Heartland Barge Management LLC

- Ingram Marine Group

- Kirby Corporation

- McAllister Towing and Transportation Co. Inc.

- PACC Offshore Services Holdings Ltd.

- Poh Tiong Choon Logistics Ltd.

- SEACOR Marine Holdings Inc.

(Please note that this is only a partial list of the key players, and the complete list is provided in the report.)

Latest News:

- April 2, 2020: Kirby Corporation completed the acquisition of Savage Inland Marine’s (“Savage”) inland barge fleet. Savage is an operator of tank barges and towboats participating in the inland tank barge transportation industry in the United States.

- April, 2022: Campbell Transportation Company Inc (Blue Danube Incorporated), a fully integrated marine services company, acquired the marine assets of E Squared Marine Service LLC. The acquisition is the expansion of the tank barge operations of Campbell and provides an operating and fleeting location in Houston, Texas.

Barge Transportation Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types of Cargos Covered | Dry Cargo, Liquid Cargo, Gaseous Cargo |

| Barge Fleet Covered | Open Barge, Covered Barge, Tank Barge |

| Applications Covered | Coal and Crude Petroleum Products, Agricultural Products, Coke and Refined Petroleum Products, Metal Ores and Fabricated Metal Products, Chemicals, Rubber and Plastic, Nuclear Fuel, Food Products, Beverages, and Tobacco, Others |

| Activities Covered | Intracoastal Transportation, Inland Water Transportation |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Alter Logistics (Goldstein Group Inc.), American Commercial Barge Line (American Commercial Lines Inc), Anderson Trucking Service Inc, Bouchard Transportation Co. Inc., Campbell Transportation Company Inc (Blue Danube Incorporated), Heartland Barge Management LLC, Ingram Marine Group, Kirby Corporation, McAllister Towing and Transportation Co. Inc., PACC Offshore Services Holdings Ltd., Poh Tiong Choon Logistics Ltd., SEACOR Marine Holdings Inc., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the barge transportation market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the global barge transportation market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the barge transportation industry and its attractiveness.

- The competitive landscape allows stakeholders to understand their competitive environment and provides insight into the current positions of key players in the market.

Key Questions Answered in This Report

The global barge transportation market was valued at USD 134.7 Billion in 2024.

We expect the global barge transportation market to exhibit a CAGR of 2.68% during 2025-2033.

The rising demand for barge transportation for transporting bulk commodities, such as grains, coal, petroleum, etc., is primarily driving the global barge transportation market.

The sudden outbreak of the COVID-19 pandemic has led to the growing adoption of barge transportation services across several nations to transport essential items and medical aids, such as medicine and PPE kits.

Based on the type of cargo, the global barge transportation market has been segmented into dry cargo, liquid cargo, and gaseous cargo. Among these, dry cargo holds the majority of the total market share.

Based on the barge fleet, the global barge transportation market can be divided into open barge, covered barge, and tank barge. Currently, tank barge exhibits a clear dominance in the market.

Based on the application, the global barge transportation market has been categorized into coal and crude petroleum products, agricultural products, coke and refined petroleum products, metal ores and fabricated metal products, chemicals, rubber and plastic, nuclear fuel, food products, beverages, and tobacco, and others. Among these, coal and crude petroleum products currently account for the majority of the global market share.

Based on the activities, the global barge transportation market can be segregated into intracoastal transportation and inland water transportation. Currently, inland water transportation holds the largest market share.

On a regional level, the market has been classified into North America, Asia-Pacific, Europe, Latin America, and Middle East and Africa, where Europe currently dominates the global market.

Some of the major players in the global barge transportation market include Alter Logistics (Goldstein Group Inc.), American Commercial Barge Line (American Commercial Lines Inc), Anderson Trucking Service Inc, Bouchard Transportation Co. Inc., Campbell Transportation Company Inc (Blue Danube Incorporated), Heartland Barge Management LLC, Ingram Marine Group, Kirby Corporation, McAllister Towing and Transportation Co. Inc., PACC Offshore Services Holdings Ltd., Poh Tiong Choon Logistics Ltd., and SEACOR Marine Holdings Inc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)