Bench-top Dental Autoclaves Market Size, Share, Trends and Forecast by Product, Class, End User, and Region, 2025-2033

Bench-top Dental Autoclaves Market Size and Share:

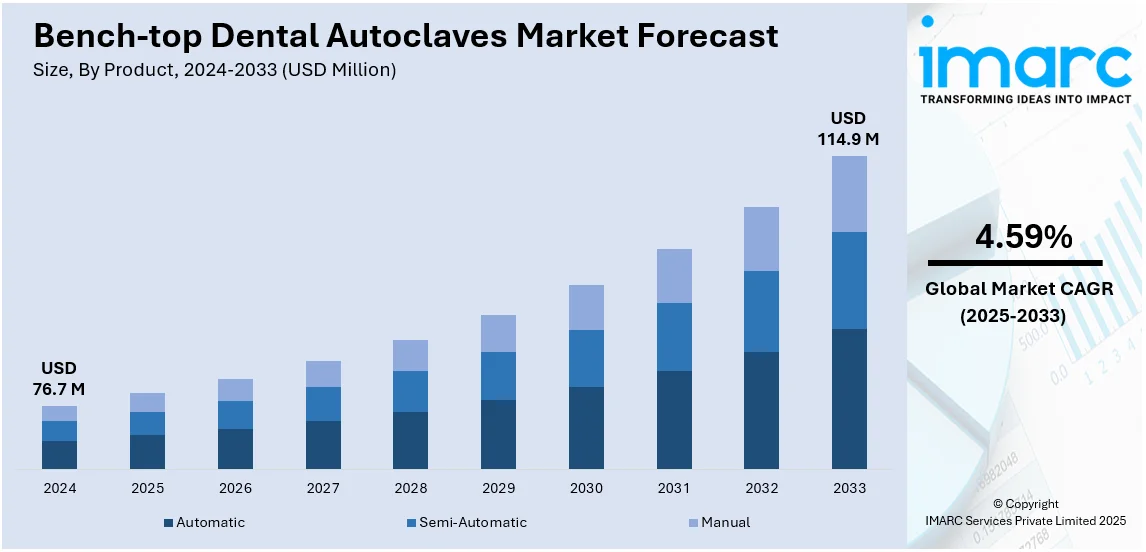

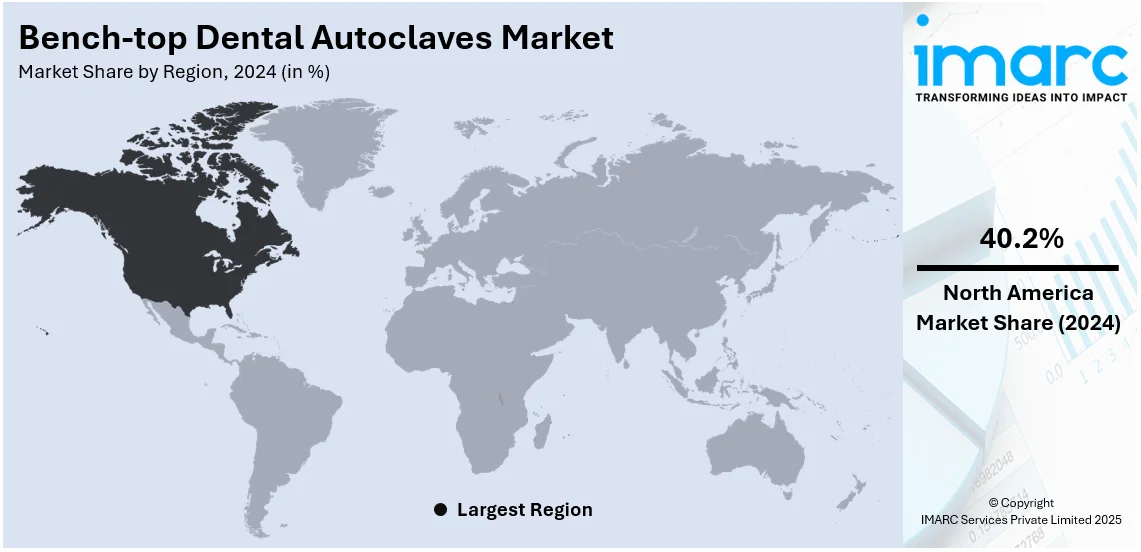

The global bench-top dental autoclaves market size was valued at USD 76.7 Million in 2024. Looking forward, IMARC Group estimates the market to reach USD 114.9 Million by 2033, exhibiting a CAGR of 4.59% during 2025-2033. North America represented the largest region of the market in 2024. This region's dominance is driven by advanced healthcare infrastructure, stringent infection control standards, widespread adoption of innovative technologies, and the growing number of dental clinics and procedures.

|

Report Attribute

|

Key Statistics |

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 76.7 Million |

| Market Forecast in 2033 | USD 114.9 Million |

| Market Growth Rate (2025-2033) | 4.59% |

The growing emphasis on infection control and sterilization in dental practices is one major driver of the bench-top dental autoclaves market. With rising awareness of patient safety and regulatory compliance, dental professionals are adopting advanced sterilization equipment to ensure hygiene standards are met. Bench-top autoclaves provide a compact and efficient solution for sterilizing dental instruments, making them ideal for clinics with space constraints. For instance, in 2024, Midmark Corp., a leading dental solutions provider, introduced next-generation M9 and M11 Steam Sterilizers, offering enhanced durability, user-friendly features, and improved compliance efficiencies to optimize instrument processing and documentation for care teams. The growing prevalence of dental procedures, coupled with stringent healthcare regulations mandating sterilization protocols, further fuels demand. Manufacturers are responding by introducing technologically advanced autoclaves with faster cycles and user-friendly features, enhancing their adoption across the dental industry.

The United States plays a pivotal role in the bench-top dental autoclaves market due to its advanced healthcare infrastructure, high dental procedure volume, and strict adherence to infection control regulations. Dental clinics in the U.S. prioritize patient safety, driving the demand for efficient sterilization equipment like bench-top autoclaves. The country's strong focus on technological innovation enables manufacturers to develop advanced autoclaves featuring rapid sterilization cycles, user-friendly interfaces, and compliance with stringent standards. For instance, in 2024, Flight Dental Systems introduced the Clave45+ Large Capacity Steam Sterilizer, featuring 45-liter capacity and advanced steam pulsing technology, revolutionizing sterilization efficiency for dental, veterinary, and medical facilities globally. Additionally, the well-established distribution networks and growing awareness of infection control protocols further enhance the adoption of bench-top dental autoclaves, solidifying the U.S. as a key market driver.

Bench-top Dental Autoclaves Market Trends:

Emphasis on Infection Control

The global bench-top dental autoclaves market is significantly driven by the increasing focus on infection control in dental practices. According to the World Health Organization (WHO), approximately 3.5 billion people worldwide were affected by oral diseases in 2019, with dental caries being the most common condition. The increased interest in patient safety has seen the need for reliable sterilization solutions. Often, dental procedures are quite close to patients, who are exposed to materials that are potentially infectious, hence the need for high levels of sterilization protocols. Elimination of pathogens can be realized through bench-top autoclaves, reducing the possibilities of cross-contamination. Dental practitioners are increasingly recognizing the pivotal role of autoclaves in maintaining aseptic conditions, ultimately contributing to better patient outcomes and practice credibility. As regulatory bodies emphasize infection prevention measures, dental professionals seek autoclaves that comply with rigorous standards, further bolstering market growth.

Rising Prevalence of Dental Disorders

The global prevalence of dental disorders and the growing number of dental procedures are pivotal factors driving the bench-top dental autoclaves market. Dental ailments, ranging from routine check-ups to complex interventions, require sterilized instruments to prevent infections. In the United States, the Centers for Disease Control and Prevention (CDC) reports that 65.5% of adults aged 18 and older had a dental exam or cleaning in the past year, highlighting the substantial volume of dental procedures performed annually. With a rising global population and increased awareness of oral health, the demand for dental procedures has surged. This surge translates into a greater need for efficient autoclave solutions that can rapidly and effectively sterilize instruments between patient sessions. The market is witnessing an upswing in demand for bench-top autoclaves that offer user-friendly controls and fast sterilization cycles, catering to the time-sensitive nature of dental practices.

Technological Advancements

The evolving landscape of dental technology plays a vital role in propelling the adoption of bench-top dental autoclaves. Recent technological advancements have revolutionized autoclave design, enhancing their functionality and user experience. Incorporation of digital controls, touch-screen interfaces, and real-time monitoring features simplifies the operation of autoclaves, making them more accessible to dental practitioners with varying levels of technical expertise. These innovations not only streamline the sterilization process but also ensure consistent and accurate results, reducing the potential for human error. As dental clinics strive for efficiency and precision, technologically advanced bench-top autoclaves stand out as essential tools, contributing to optimal patient care and reinforcing the market's growth trajectory. Further, according to a survey conducted by NexHealth, the dental profession is expected to grow by 10% to 12.1% in the next seven years by 2023. Over the next ten years, advancements in technologies and therapies that do not yet exist are expected to drive significant progress.

Bench-top Dental Autoclaves Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global bench-top dental autoclaves market report, along with forecast at the global, regional, and country levels from 2025-2033. Our report has categorized the market based on product, class, and end user.

Analysis by Product:

- Automatic

- Semi-Automatic

- Manual

Automatic leads the market due to their convenience, enhanced precision, and time efficiency compared to their semi-automatic counterparts. These devices streamline sterilization processes, making them essential in modern dental clinics. With user-friendly interfaces and automated cycles, they minimize human error and ensure consistent results, fostering trust among dental professionals. Advancements in technology, such as touch-screen controls and self-diagnostics, further contribute to their growing adoption. Additionally, the rising emphasis on infection control and adherence to stringent sterilization standards is driving demand. Automatic models are becoming a preferred choice for dental practitioners seeking efficiency and reliability in their sterilization procedures.

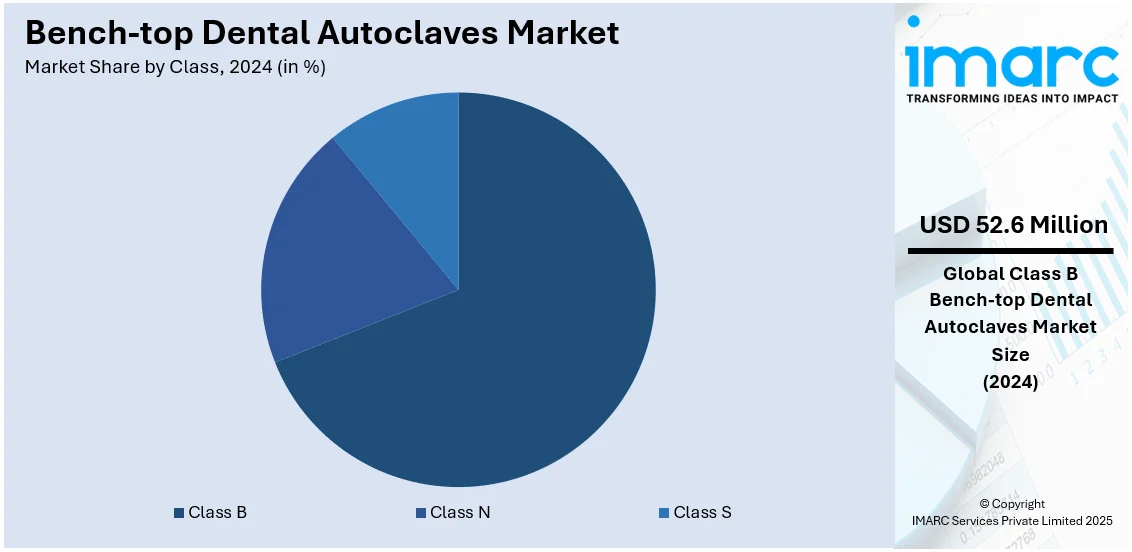

Analysis by Class:

- Class B

- Class N

- Class S

Class B leads the market since they are favored for their advanced capabilities, including the ability to sterilize a wide range of instruments, whether solid, hollow, or porous, meeting stringent international sterilization standards. Their vacuum technology ensures thorough steam penetration, making them highly effective for dental clinics prioritizing infection control. The increasing awareness of hygiene protocols and the growing adoption of complex dental procedures contribute to their dominance. Additionally, regulatory bodies often recommend or mandate Class B autoclaves, further boosting their demand. As dental practices continue to evolve, Class B autoclaves remain the preferred choice for reliable and efficient sterilization solutions.

Analysis by End User:

- Hospitals and Clinics

- Dental Laboratories

- Academic and Research Institutes

Hospitals and clinics lead the market. This leadership is attributed to their high demand for reliable and efficient sterilization equipment to ensure patient safety and meet strict infection control standards. These facilities handle significant volumes of procedures daily, requiring advanced autoclaves capable of sterilizing a variety of instruments efficiently. Bench-top models are particularly favored for their compact design, making them ideal for limited spaces in clinics while delivering robust performance. The rising number of healthcare facilities and heightened awareness of hygiene practices further drive adoption in this segment, solidifying hospitals and clinics as the largest consumers of bench-top dental autoclaves.

Regional Analysis:

- North America

- United States

- Canada

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Others

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, North America accounted for the largest region in the market. This leadership stems from the area's well-developed healthcare systems and widespread use of innovative medical advancements, and stringent infection control standards. Dental clinics and hospitals in the United States and Canada are increasingly investing in modern sterilization equipment to comply with regulatory guidelines and ensure patient safety. The growing number of dental procedures, coupled with heightened awareness about hygiene practices, further fuels demand. Additionally, the presence of leading manufacturers and a strong focus on research and development contribute to North America's leadership in the bench-top dental autoclaves market.

Key Regional Takeaways:

United States Bench-Top Dental Autoclaves Market Analysis

The U.S. bench-top dental autoclaves market is steadily growing, primarily driven by the development of new technologies and increased dental procedures. As of 2023, there are approximately 202,304 practicing dentists in the U.S., and as stated by the American Dental Association, there is a huge demand for sterilization equipment. This market is further boosted by the stringent healthcare regulations, which enforce the use of autoclaves in dental practices for infection control. There has been a trend in the US market toward more compact and energy-efficient models with digital controls. Market leaders such as Midmark and SciCan continue to innovate with regard to not only the regulatory standard compliance but also user-friendly product demands. Awareness of the importance of hygiene standards along with ongoing improvements in dental care also contribute to the market growth.

Europe Bench-Top Dental Autoclaves Market Analysis

The bench-top dental autoclaves market in Europe is expanding due to the fact that there is an increase in the health expenditure and a growing attention on sterilization in dental care. The report from the European Commission noted that healthcare spending in the EU would amount to EURO 1.6 Trillion (USD 1.69 Trillion) in 2023, which will induce investment in dental technologies. Country giants like Germany and France dominate the market with the number of dental clinics upgrading their equipment to the latest sterilization standards. Sustainability and reductions in environmental impact are also encouraged through the EU's green approach towards autoclaves, with companies like MELAG and W&H currently making changes regarding efficiency and energy-saving features in their products. Advanced systems for autoclaves are further supported by regulations from bodies such as the European Medicines Agency (EMA).

Asia Pacific Bench-Top Dental Autoclaves Market Analysis

The bench-top dental autoclaves market in Asia Pacific is rapidly growing due to improving disposable incomes and the penetration of dental care services. In April 2023, an investigation showed that over 90% of consumers from China had oral or dental issues, with tooth discoloration, bad breath, and gum diseases being the most common. Despite these, mainland China's number of dentists rose to 171,587 in 2018, which comprised 54.6% of the total trained dental personnel in the country. Yet, the dentist density of China, which stood at 0.129 per 1,000 people in 2018, is still lower than the standard set by the WHO, which is 0.2. This is an indication that dental care and sterilization equipment are still in demand because the oral health of people needs improvement. Countries like Japan and India are also showing growth in dental procedures and dental tourism, thereby driving the demand for high-end sterilization solutions. Local manufacturers and international players are also targeting to meet this demand.

Latin America Bench-Top Dental Autoclaves Market Analysis

Latin America bench-top dental autoclaves market is witnessing growth owing to an increased demand for dental care, increasing health care investment, and the improvement of the infrastructure. An industry report cited that Brazil, which is the biggest economy in this region, allocated USD 21.8 Billion in 2022 to modernize the health sector of the country, which also includes the dental facility. This investment helps upgrade the dental practices and thus increase the demand for high-quality dental autoclaves. Brazil has close to 383,000 licensed dental professionals, which has kept the concentration of dentists in the country at the global high level of approximately 168 per 100,000. This substantial dentist population creates a demand for higher-capacity sterilization equipment. Mexico and Colombia are also embracing high-end dental technologies, hence propelling the market further. The growth in the middle class and increased awareness on dental hygiene boost the market. Several local distributors and international manufacturers, such as Autoclaves España, have seen an opportunity in the rising demand. Latin America focuses on bettering healthcare systems and adopting global technological advancements, thus shaping the dental autoclave market.

Middle East and Africa Bench-Top Dental Autoclaves Market Analysis

Improving healthcare systems along with rising prevalence of dental clinics is primarily driving the market for bench-top dental autoclaves in the Middle East and Africa. Saudi Arabia assigned USD 50 billion to healthcare development for 2023, aiding the take-up of superior sterilizing equipment, reported the International Trade Administration. Demand for dental care is growing in the UAE, where close to 80% of residents reported having a dental issue in 2023, a research article stated. Regional health care leader South Africa maintains steady growth in dental sterilization due to the growth in the private health care industry. Local companies such as Sahara Medical team up with international companies to improve the products. Infection control guidelines from WHO are also compelling clinics to improve equipment and autoclaves. Government initiatives, such as Vision 2030 in Saudi Arabia, focus on modernization of healthcare and thus would support the growth in the dental autoclaves market in the region.

Competitive Landscape:

The bench-top dental autoclaves market is characterized by intense competition among established players and emerging manufacturers focused on innovation. Key market participants prioritize developing technologically advanced autoclaves with enhanced efficiency, faster sterilization cycles, and compact designs to meet the evolving needs of dental clinics. Companies leverage strategies such as product launches, partnerships, and geographic expansion to strengthen their market presence. Additionally, the increasing emphasis on compliance with strict sterilization regulations drives continuous advancements, further intensifying competition within the market. For instance, in December 2024, W&H Group showcased innovations at the 100th Greater New York Dental Meeting, featuring the Lexa Mini Class B sterilizer and Synea Power Edition handpieces for zirconia crowns.

The report provides a comprehensive analysis of the competitive landscape in the bench-top dental autoclaves market with detailed profiles of all major companies, including:

- Dentsply Sirona

- Flight Dental Systems

- Matachana

- MELAG Medizintechnik GmbH & Co. KG

- Midmark Corporation

- The W&H Group

- Tuttnauer

Recent Developments:

- Oct 2024: Dentsply Sirona continues to expand its digital capabilities with the launch of CEREC Software 5.3, which connects CEREC workflows to the DS Core cloud platform and the new Primescan intraoral scanner. In addition, it also integrates with Primescan AC and Primescan Connect. This integration allows dental professionals to upload designs to DS Core, streamline various workflows, and securely share files - all through a single, centralized platform.

- Sept 2024: Dentsply Sirona, the world's largest manufacturer of professional dental products and technologies, is proud to announce that its long term partner Dental Lifeline Network (DLN) is invited at its annual clinical education event DS World held in Las Vegas, with a dedicated booth. Participation at this event not only raises the profile of DLN and its cause but also provides an opportunity to engage with potential volunteers and supporters.

- Sep 2024: Dentsply Sirona’s next-generation intraoral scanner opens a new era of digital patient care, allowing scanning directly to the cloud on any internet-connected device.

Bench-top Dental Autoclaves Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Automatic, Semi-Automatic, Manual |

| Classes Covered | Class B, Class N, Class S |

| End Users Covered | Hospitals and Clinics, Dental Laboratories, Academic and Research Institutes |

| Regions Covered | North America, Europe, Asia Pacific, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Dentsply Sirona, Flight Dental Systems, Matachana, MELAG Medizintechnik GmbH & Co. KG, Midmark Corporation, The W&H Group, Tuttnauer, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the bench-top dental autoclaves market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global bench-top dental autoclaves market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the bench-top dental autoclaves industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

Bench-top dental autoclaves is a transformative force that empowers businesses to unearth invaluable insights from their data. Its sophisticated techniques enable organizations to make informed decisions and drive growth. Analyzing historical data and spotting trends helps anticipate future outcomes, contributing to strategic planning.

The bench-top dental autoclaves market was valued at USD 76.7 Million in 2024.

IMARC estimates the global bench-top dental autoclaves market to exhibit a CAGR of 4.59% during 2025-2033.

The rising integration of Artificial Intelligence (AI) and Machine Learning (ML) with bench-top dental autoclaves to achieve diverse business goals, gather information, and analyze unstructured and structured data, is primarily driving the global bench-top dental autoclaves market.

According to the report, automatic represented the largest segment by product, driven by its ease of use, enhanced efficiency, reduced human intervention, and ability to ensure consistent and reliable sterilization.

Class B leads the market by class as it offers advanced sterilization capabilities, including the ability to handle solid, hollow, and porous instruments.

The hospitals and clinics are the leading segment by end user, driven by their high demand for reliable sterilization solutions to support large volumes of procedures, strict adherence to infection control regulations, and the need to maintain patient safety through effective instrument sterilization processes.

On a regional level, the market has been classified into North America, Asia Pacific, Europe, Latin America, and Middle East and Africa, wherein North America currently dominates the global market.

Some of the major players in the global bench-top dental autoclaves market include Dentsply Sirona, Flight Dental Systems, Matachana, MELAG Medizintechnik GmbH & Co. KG, Midmark Corporation, The W&H Group, Tuttnauer, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)