Bicycle Market Size, Share, Trends and Forecast by Type, Technology, Price, Distribution Channel, End User, and Region, 2025-2033

Bicycle Market Size and Share:

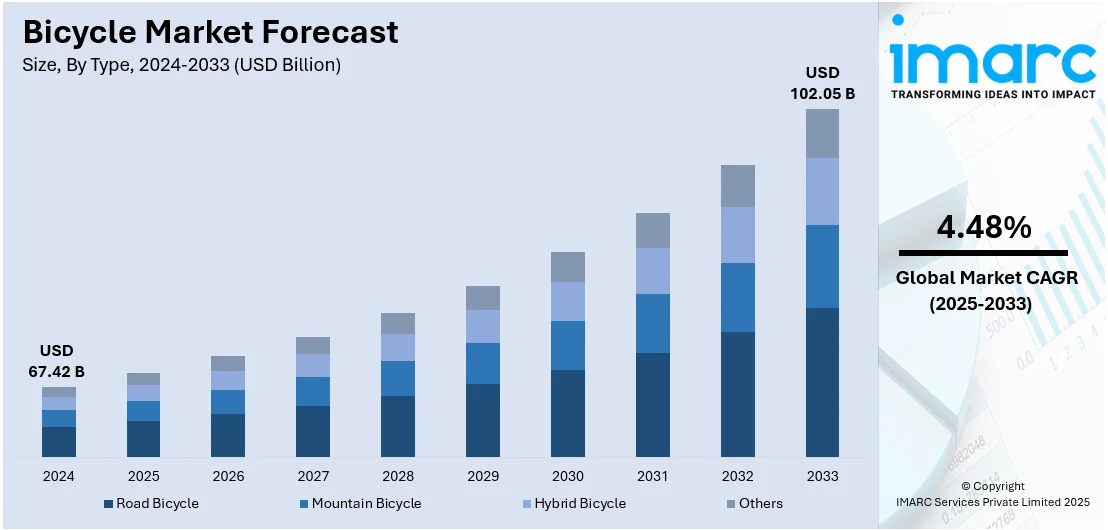

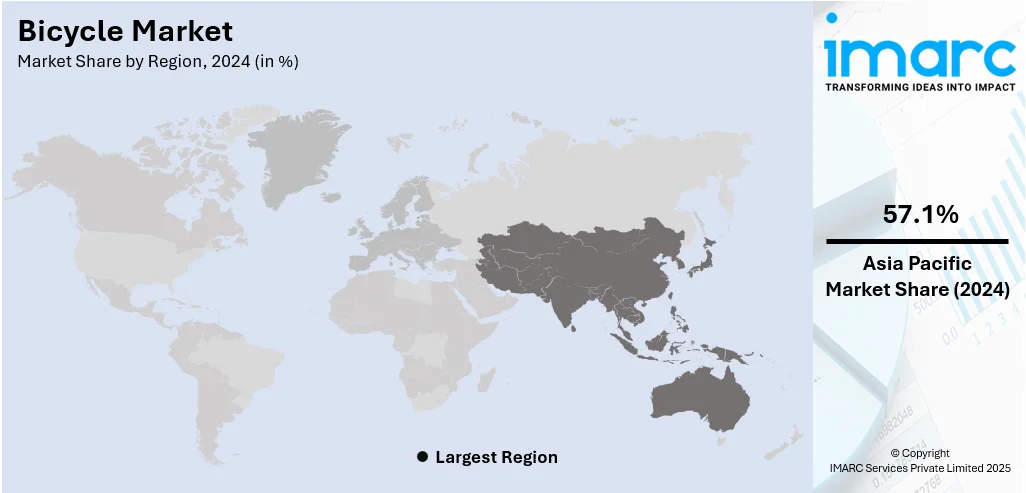

The global bicycle market size was valued at USD 67.42 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 102.05 Billion by 2033, exhibiting a CAGR of 4.48% during 2025-2033. Asia-Pacific currently dominates the market, holding a significant market share of 57.1% in 2024. The implementation of favorable policies by government bodies to minimize carbon emissions levels that are released from vehicles, coupled with the development of electric bicycles, is primarily bolstering the market. Rising health awareness and fitness trends are also boosting demand for cycling as a low-impact exercise option. Technological innovations, such as e-bikes, light-weight materials, and connected smart features, enhance convenience and appeal. Governments’ investments in cycling infrastructure, like dedicated lanes and bike-sharing systems, further support adoption and increase the bicycle market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 67.42 Billion |

| Market Forecast in 2033 | USD 102.05 Billion |

| Market Growth Rate 2025-2033 | 4.48% |

Expansion and enhancement of urban cycling infrastructure is one of the strongest drivers of the bicycle market, especially in countries focusing on sustainable mobility. In cities across Europe, such as Copenhagen and Amsterdam, investments in bicycle infrastructure like protected lanes, bike traffic signals, and special parking spaces, has rendered cycling safe and as the go-to mode of everyday transit. This has prompted other cities around the globe, such as New York, Paris, and Bogotá, to emulate similar models. In America, cities such as Portland and Minneapolis have adopted long-term cycling policies, incorporating bicycle commuting into public policy and urban planning. Measures have involved turning car lanes into bike lanes, adding greenways, and interconnecting neighborhoods through unbroken cycling corridors. This kind of infrastructure induces more to cycle and facilitates the development of ancillary industries such as bike rentals, repairs, and accessories. The result is a virtuous feedback cycle in which safer, more convenient urban places create further momentum for bicycle market demand.

To get more information on this market, Request Sample

The United States stands out as a key market disruptor, driven by its singular combination of innovation, consumer trends, and changing transportation policy. Long dependent on cars, the US is experiencing a cultural and infrastructural transformation as cities adopt cycling as a mode of urban transportation. Tech centers like San Francisco, Seattle, and Austin are incorporating bicycles into intelligent transportation networks, backed up by app-enabled bike-sharing networks and sustainable urban design. American consumers are also creating disruption through a demand for high-performing, multi-functional bicycles, ranging from mountain bikes, road bikes, and e-bikes, with state-of-the-art features such as GPS tracking, mobile integration, and customizable appearance. Furthermore, US-headquartered companies are pioneering innovation through the integration of traditional bicycle-making with intelligent technologies, direct-to-consumer business models, and advanced materials. This mindset disrupts established players in the world market. The increasing popularity of cycling among suburban and even rural communities throughout the US continues to challenge the market by broadening the customer base beyond conventional urban riders.

Bicycle Market Trends:

Growing Popularity of E-Bikes

The rise of electric bicycles (e-bikes), providing improved mobility and ease, is making cycling more attainable for people who might not have thought about it previously, including those with physical challenges or long-distance travelers. Incorporating an electric motor allows cyclists to travel longer distances, manage tough terrains, and achieve greater speeds with reduced effort. With advancements in battery technology, e-bikes are becoming more efficient, cost-effective, and suitable for daily use. This advancement in bicycle technology is attracting a wider range of users, including city commuters, leisure cyclists, and older individuals looking for a more convenient cycling experience, while also facilitating greater bicycle market growth. Over 4 billion people, or more than half of the world's population, currently reside in cities. This trend is expected to continue. Building on the increasing accessibility and appeal of e-bikes, new models like the Decathlon Btwin LD 940E Connect, launched in 2025, are pushing the boundaries of technology with advanced features and extended range to attract an even broader user base. It features a 250W Owuru motor, 600W peak power, and a 694 Wh battery providing up to 130 km of range. It includes features like CVT, Bluetooth connectivity, and a suspension fork.

Expansion of Bicycle Sharing Programs

Bicycle sharing initiatives are influencing the industry growth by enhancing the accessibility and convenience of cycling. According to the Bureau of Transportation Statistics, as of June 30, 2024, 54 docked bikeshare systems open to the general public operated 8,862 docking stations in the US. These initiatives, becoming more common in city settings, enable people to rent bicycles for brief periods without requiring ownership or upkeep. These initiatives promote casual biking by providing an inexpensive, adaptable option for city travel, especially for brief commutes or last-mile connections. With cities implementing bike-sharing programs and enhancing related infrastructure, an increasing number of individuals are engaging in cycling, contributing to the market growth. Bike-sharing programs are gaining popularity due to their convenience, affordability, and positive impact on the environment, particularly among those lacking the space, budget, or inclination to own a personal bicycle. According to the bicycle market forecast, he growth and effectiveness of these initiatives are leading to a higher demand for bicycles in various areas.

Improved Bike Infrastructure

With cities investing in specialized bike lanes, safer cycling paths, and bike-sharing initiatives, biking becomes increasingly accessible and attractive to a broader audience. As reported in 2023, as part of a larger initiative to encourage people to give up their vehicles, the French government unveiled a €2 Billion plan to enhance bike infrastructure. Upgraded infrastructure boosts safety and ease, targeting a key obstacle to embracing cycling, especially in city settings. As neighborhoods, workplaces, and recreational areas become more connected, cycling is being regarded as an effective means of transportation. This is catalyzing the demand for bicycles, as more individuals are motivated to include cycling in their everyday activities. In line with this trend, in 2025, Ridgewood Rides launched the "Complete the Connections" campaign to expand and improve bike infrastructure in Queens, addressing unsafe gaps and incomplete bike lanes. The campaign targets seven key corridors to create safer, continuous routes linking Ridgewood with neighboring communities. A public launch event and community bike ride was also planned for April 26 to raise awareness and gather support, further highlighting several bicycle market trends.

Bicycle Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global bicycle market, along with forecasts at the global, regional, and country levels from 2025-2033. The market has been categorized based on type, technology, price, distribution channel, and end user.

Analysis by Type:

- Road Bicycle

- Mountain Bicycle

- Hybrid Bicycle

- Others

Road bicycle stands as the largest component in 2024, holding 28.5% of the market. Mountain bicycles are extensively used in trekking, owing to the rising penetration towards adventure activities. Moreover, the majority of the population is switching toward the road and hybrid bicycles to commute shorter distances. This diverse range of product variants allows retailers and manufacturers to target specific consumer segments, thereby meeting the unique demands of numerous cycling enthusiasts.

Analysis by Technology:

- Electric

- Conventional

Conventional stands as the largest component in 2024, holding 72.2% of the market. Conventional bicycles provide an excellent means of exercise, which helps to improve cardiovascular health, muscle strength, overall fitness, etc. Furthermore, e-bikes can reach higher speeds with less effort, which can make commuting faster and more convenient.

Analysis by Price:

- Premium

- Mid-Range

- Low-Range

Mid-range leads the market with 71.9% of market share in 2024. According to the bicycle market outlook, the demand for bicycles across premium, mid, and low ranges vary based on several factors, including economic conditions, consumer preferences, and trends in cycling.

Analysis by Distribution Channel:

- Online Stores

- Offline Stores

Offline stores lead the market with 82.8% of market share in 2024. The sale of bicycles is increasing in both online and offline stores, as they cater to the needs of the consumers depending upon their preferences. Online bicycle stores offer the convenience of browsing and purchasing bikes from the comfort of home, 24/7, without the need to visit a physical store. Moreover, the growing penetration of high-speed internet is encouraging vendors to sell their products via online platforms, including Amazon, Ali Express, Flipkart, etc. On the other hand, offline stores allow customers to physically inspect and test ride bicycles before making a purchase, providing a tactile shopping experience.

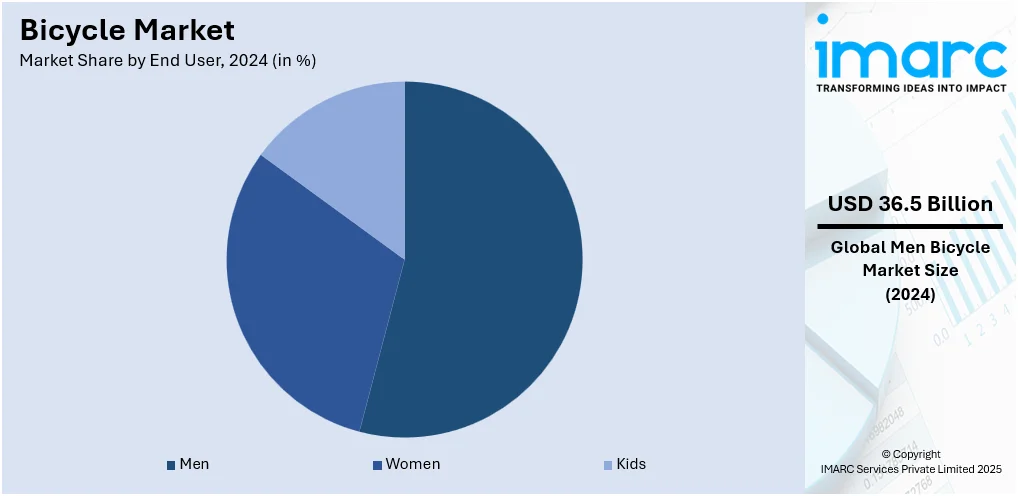

Analysis by End User:

- Men

- Women

- Kids

Men lead the market with 54.2% of market share in 2024. The elevating usage of bicycles among men, women, and kids is based on various factors including comfort, safety, trends, commuting and transportation choices, etc. As such, the number of men riding bicycles is higher than women and kids. According to the statistical data presented by the Department for Transport U.K., in 2019, on average, the U.K. male population made 25 cycling trips in a year than 10 cycling trips by the women in the same year.

Regional Analysis:

- North America

- United States

- Canada

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, Asia-Pacific accounted for the largest market share of 57.1%. Japan, Singapore, China, and other nations are placing a strong emphasis on developing the infrastructure required to facilitate and promote bicycle commuting. Some Japanese cities, like Tokyo, are renowned for having the fewest accidents, making them the best places to ride a bicycle in the city. Additionally, Chinese bicycle-sharing businesses are actively seeking to extend their operations in nations like Australia and India, which is anticipated to increase demand for bicycles during the projected timeframe.

Key Regional Takeaways:

United States Bicycle Market Analysis

In 2024, the United States accounted for over 93.60% of the bicycle market in North America. The United States bicycle market is primarily driven by the rising health consciousness among Americans, which encourages cycling as a preferred form of physical activity and a preventive measure for wellness. An industry report revealed that nearly one in three consumers in the US and Canada have adopted healthier lifestyles, prioritizing sleep, exercise, and nutrition, with 59% emphasizing the importance of healthy aging. In line with this, ongoing urban infrastructure improvements, including expanded bike lanes and dedicated cycling zones, are enhancing safety and market accessibility. The favorable government incentives at both the federal and state levels, promoting green transportation, are further propelling market growth by motivating eco-friendly commuting alternatives. Additionally, the rapid integration of bicycles into multimodal transport networks is improving last-mile connectivity, supporting seamless travel. The continual technological advancements in lightweight materials and innovative designs are attracting a diverse range of cyclists to the market. Moreover, the growing popularity of cycling tourism is opening new avenues for market expansion. Besides this, increased youth engagement through school and community cycling programs is fostering early adoption and nurturing sustained consumer interest in cycling, as per the bicycle market analysis.

Europe Bicycle Market Analysis

The bicycle market in Europe is experiencing growth due to the EU’s stringent carbon emission targets, which are promoting bicycles as a sustainable mobility solution. In line with this, increasing urban congestion in major cities is convincing residents to adopt more efficient personal transportation alternatives, which is impelling the market. According to the reports, London remains Europe’s most congested city, with drivers losing 101 hours to traffic, while Düsseldorf and Munich in Germany saw travel delays rise by over 20%. The numerous government-backed bike-to-work schemes and tax incentives are further promoting commuter participation in the market. Similarly, rising fuel prices are positioning bicycles as a cost-effective choice for daily travel. The expansion of smart cycling infrastructure, including digital parking and e-bike charging solutions, enhances user convenience and safety, bolstering market development. Additionally, a notable shift in older adults’ mobility preferences is leading to a rise in e-bike adoption, expanding the market's demographic reach. Moreover, the rise of cycling tourism and community-based cycling events is cultivating a strong cultural acceptance, thereby stimulating market appeal.

Asia Pacific Bicycle Market Analysis

The Asia Pacific market is largely driven by rapid urbanization across countries like China, India, and Indonesia, prompting demand for compact and sustainable mobility options. Furthermore, the region’s large youth demographic is fueling interest in recreational and fitness-oriented cycling. According to UNESCO, 60% of the world's youth reside in the Asia-Pacific area, which is home to almost 750 million people between the ages of 15 and 24. This indicates that the region's youthful population has been growing significantly. Similarly, increasing government investment in non-motorized transport infrastructure, such as dedicated cycle lanes and green corridors, is supporting the ongoing shift toward bicycle commuting. The widespread rise of shared mobility services in metropolitan areas is enhancing market accessibility and affordability. Additionally, the expansion of e-commerce platforms is improving product availability and regional market penetration. Apart from this, climate awareness and environmental education initiatives in schools and communities are instilling early adoption of eco-friendly transport, positioning bicycles as a long-term mobility solution.

Latin America Bicycle Market Analysis

The Latin America bicycle market is being influenced by the growing emphasis on reducing urban air pollution, encouraging cities to promote cycling as a low-emission alternative. In addition to this, economic constraints in several countries are making bicycles a practical and affordable mode of daily transportation. Furthermore, numerous government-led urban mobility reforms, including the expansion of dedicated cycling infrastructure, are further supporting market adoption. Moreover, increased interest in outdoor recreation and fitness, particularly among younger demographics, is stimulating demand for both traditional and electric bicycles across the region. As such, ITDP Brazil and Rio’s government assessed e-bike use in the city’s low-emission zones (LEZ), revealing over 3.4 million bikeshare trips (2021–2023), with 15% for deliveries, 36% of which used e-bikes, highlighting strong delivery adoption.

Middle East and Africa Bicycle Market Analysis

The market in the Middle East and Africa is gaining traction due to rising environmental consciousness, prompting regional authorities to promote sustainable transport alternatives such as cycling. Furthermore, increasing fuel prices and economic constraints across parts of the region are making bicycles an appealing low-cost mobility option. Similarly, the growing popularity of health and wellness activities is fostering recreational and fitness-oriented cycling among urban populations. Besides this, ongoing urbanization is contributing to increased traffic congestion, positioning bicycles as a practical solution for efficient short-distance travel, especially in densely populated cities. The 2025 Numbeo Quality of Life Index ranked Nigeria highest in traffic congestion with a score of 319.36, followed by Kenya at 271.25, highlighting severe urban transport challenges.

Competitive Landscape:

Several major companies in the bicycle industry are making strategic and sustainable investments to spur growth and address changing consumer needs. Top brands such as Giant Bicycles, Trek, and Specialized are heavily investing in research and development to develop lightweight, strong, and performance-focused designs. With the growing trend of green consumerism, most companies are greatly expanding their e-bike lines, incorporating smart technologies like GPS tracking, app connectivity, and pedal-assist technology. Sustainability is high on the agenda, with companies embracing recyclable material, energy-efficient production processes, and carbon-neutral targets. To build market reach, major players are expanding their global distribution networks and promoting direct-to-consumer sales through e-commerce portals. Collaborations with governments and municipalities to build urban cycling infrastructure are also critical, particularly to encourage cycling as a clean commuting option. Separately, health, fitness, and environment-focused marketing campaigns are successfully raising public awareness. Bicycle-sharing cooperations and sporting event sponsorships further enhance brand visibility. Overall, these initiatives demonstrate a three-pronged strategy involving product innovation, environmental stewardship, and customer involvement that sets the bicycle industry up for long-term growth in the context of growing demand for clean, healthy modes of transportation.

The report provides a comprehensive analysis of the competitive landscape in the bicycle market with detailed profiles of all major companies, including:

- Avon Cycles Ltd.

- Accell Group N.V.

- Benno Bikes LLC

- Dorel Industries Inc.

- Cervélo (Pon Holdings B.V.)

- Giant Manufacturing Co. Ltd.

- Merida Industry Co. Ltd.

- Kona Bicycle Company

- Olympus Bikes

- Specialized Bicycle Components Inc.

- SCOTT Sports SA (Youngone Corporation)

- Trek Bicycle Corporation (Roth Distributing Co. Inc.)

Latest News and Developments:

- June 2025: Batch Bicycles launched a 20-inch mountain bike for kids aged 6 and up. It features a 6061-alloy frame, Microshift Acolyte 8-speed drivetrain, mechanical disc brakes, and 2.6-inch tires. Available in holographic silver or chameleon, the bike retails for USD 520.

- June 2025: Tata launched the Stryder Zeeta Plus e-cycle at INR 39,999, offering a 100 km range, 250W motor, and 3-hour charging. Aimed at urban commuters, it features pedal assist, digital display, and waterproof battery. The e-bike supports green mobility and strengthens Tata’s presence in India’s electric transport sector.

- April 2025: Nextbike became one of Europe’s largest bike-sharing operators by acquiring nextbike Polska S.A. The merger strengthens its presence in countries like Poland, France, and Belgium. Nextbike aims to enhance urban mobility through MaaS integration, advanced technology, and localized services while supporting local economies and sustainable transport systems.

- March 2025: Jio unveiled an affordable smart electric bicycle designed for daily commuting. It features GPS navigation, 5G connectivity, regenerative braking, and over-the-air updates. Integrated with the Jio ecosystem, the e-bike offers real-time updates, safety features, and eco-friendly mobility, targeting students and urban commuters across India.

- October 2024: Chandigarh-based ZADD Bikes launched the Utility Hauler, an electric cargo bicycle designed for last-mile delivery and personal use. Featuring a 250W motor, dual disc brakes, and up to 160km range, it targets urban mobility needs. Prices start at INR 35,000, available via Amazon and zaddbikes.in.

Bicycle Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Road Bicycle, Mountain Bicycle, Hybrid Bicycle, Others |

| Technologies Covered | Electric, Conventional |

| Prices Covered | Premium, Mid-Range, Low-Range |

| Distribution Channels Covered | Online Stores, Offline Stores |

| End Users Covered | Men, Women, Kids |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Accell Group N.V., Avon Cycles Ltd., Benno Bikes LLC, Cervélo (Pon Holdings B.V.), Dorel Industries Inc., Giant Manufacturing Co. Ltd., Kona Bicycle Company, Merida Industry Co. Ltd., Olympus Bikes, SCOTT Sports SA (Youngone Corporation), Specialized Bicycle Components Inc., Trek Bicycle Corporation (Roth Distributing Co. Inc.), etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the bicycle market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the global bicycle market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the bicycle industry and its attractiveness.

- The competitive landscape allows stakeholders to understand their competitive environment and provides insight into the current positions of key players in the market.

Key Questions Answered in This Report

The bicycle market was valued at USD 67.42 Billion in 2024.

The bicycle market is projected to exhibit a CAGR of 4.48% during 2025-2033, reaching a value of USD 102.05 Billion by 2033.

The bicycle market is driven by growing environmental concerns, increased health awareness, urban traffic congestion, and rising fuel costs. Demand for electric bikes, government support for cycling infrastructure, and fitness trends also contribute significantly. Technological advancements and sustainable mobility solutions further propel market growth across urban and recreational segments.

Asia Pacific currently dominates the bicycle market, driven by increasing urbanization, government initiatives promoting eco-friendly transport, and rising health consciousness. High population density, improved cycling infrastructure, and affordability make bicycles a preferred mode of transport. Growing demand for e-bikes and strong manufacturing bases in countries like China and India also boost growth.

Some of the major players in the bicycle market include Accell Group N.V., Avon Cycles Ltd., Benno Bikes LLC, Cervélo (Pon Holdings B.V.), Dorel Industries Inc., Giant Manufacturing Co. Ltd., Kona Bicycle Company, Merida Industry Co. Ltd., Olympus Bikes, SCOTT Sports SA (Youngone Corporation), Specialized Bicycle Components Inc., Trek Bicycle Corporation (Roth Distributing Co. Inc.), etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)