Big Data Security Market Size, Share, Trends and Forecast by Component, Deployment Mode, Organization Size, Technology, End Use Industry, and Region, 2025-2033

Big Data Security Market Size and Share:

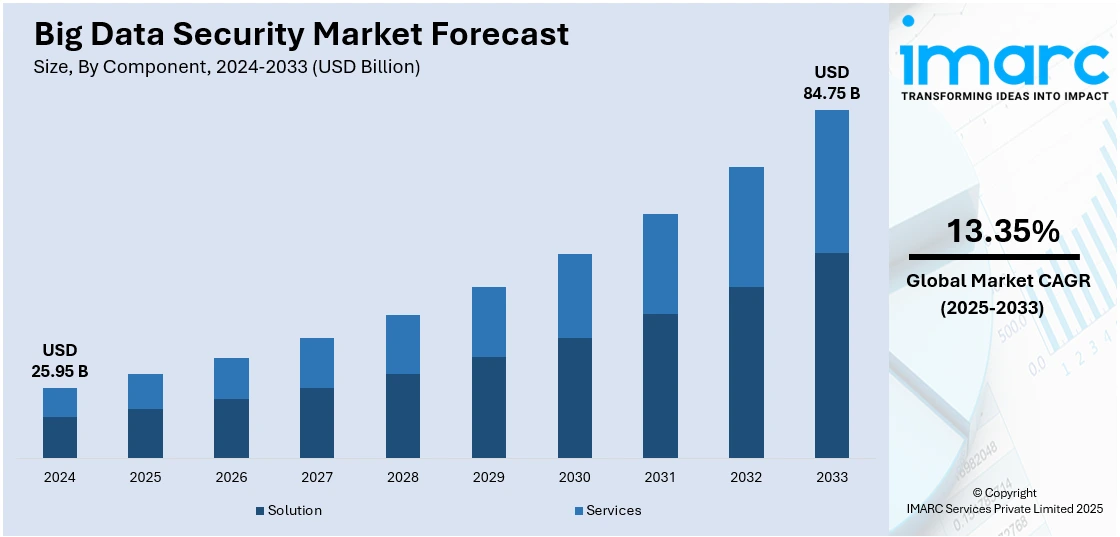

The global big data security market size was valued at USD 25.95 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 84.75 Billion by 2033, exhibiting a CAGR of 13.35% during 2025-2033. North America dominated the market in 2024. Advanced infrastructure, high industry demand, rising cyber threats, and technology adoption are some of the key factors contributing to the big data security market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 25.95 Billion |

|

Market Forecast in 2033

|

USD 84.75 Billion |

| Market Growth Rate 2025-2033 | 13.35% |

The market is primarily driven by the rapid growth of data volumes across industries, increasing the complexity of managing and protecting sensitive information. With businesses adopting advanced technologies like IoT, AI, and cloud computing, the risk of cyberattacks has also risen, necessitating robust security measures. The growing frequency of data breaches, ransomware attacks, and insider threats has made data security a top priority for organizations. Additionally, stringent regulations such as GDPR and CCPA require businesses to adopt comprehensive security strategies to ensure compliance. The integration of advanced encryption, identity management, and access controls helps mitigate risks associated with unauthorized data access. Moreover, the shift to digital transformation, reliance on remote work, and rising awareness of data privacy further support the big data security market growth.

To get more information on this market, Request Sample

In the United States, the big data security market is embracing innovations in unified data protection platforms, offering real-time security across cloud environments, GenAI, and SaaS. These advanced solutions are replacing traditional, fragmented data loss prevention tools with enhanced cloud protection, encryption, and safeguards against insider and identity-based threats. For instance, in April 2025, CrowdStrike unveiled Falcon Data Protection innovations, delivering unified, real-time data security across cloud, GenAI, and SaaS. Replacing fragmented DLP tools, the platform enhances big data security with runtime cloud protection, encrypted exfiltration prevention, and advanced GenAI safeguards, securing sensitive data from identity-based and insider threats.

Big Data Security Market Trends

Growing Cyberattack Risks in IT and Security

The big data security market is witnessing an increasing need for robust defense mechanisms as organizations face escalating cyberattack risks. A significant number of IT and security leaders are encountering frequent cyberattacks, with many experiencing multiple incidents within a year. Common attack methods include data breaches, malware, and cloud-related threats, with phishing and insider threats also becoming prominent concerns. These growing risks highlight the urgent need for advanced security solutions that can protect sensitive data, detect vulnerabilities, and mitigate potential threats. As the frequency and sophistication of attacks rise, the demand for comprehensive security strategies is intensifying, pushing businesses to adopt more resilient and adaptive security technologies. For example, Rubrik Zero Labs' research revealed that 90% of IT and security leaders faced cyberattacks, with nearly 20% experiencing over 25 attacks in 2024. Top attack vectors included data breaches (30%), malware (29%), cloud/SaaS breaches (28%), phishing (28%), and insider threats (28%).

Shift toward Remote and Hybrid Work Models

Based on the big data security market outlook, the industry is adapting to the growing shift in work environments, with a significant number of employees favoring remote and hybrid work setups. This change is driving an increased focus on securing distributed networks, cloud services, and data access points. As more organizations embrace flexible work options, there is a heightened need for comprehensive security solutions that can protect data across various locations and devices. This shift is prompting businesses to invest in advanced security technologies that support remote access, secure collaboration, and seamless data protection, ensuring that employees can work efficiently and securely from any location while minimizing the risks of data breaches and cyber threats. For instance, an industry report showed that around 91% of employees globally favor remote or mostly remote work, with 52% preferring hybrid set-ups and 27% opting for full-time remote arrangements.

Adoption of AI and Machine Learning in Cybersecurity

The market is increasingly leveraging AI and machine learning technologies to combat modern security threats. The big data security market forecast indicates that a growing number of organizations are adopting these advanced tools for intrusion detection and threat analysis. AI and machine learning are proving to be highly effective in identifying patterns, detecting anomalies, and responding to cyberattacks in real-time, thus improving the overall security posture. As cyber threats become more sophisticated, businesses are investing in AI-driven security solutions that can provide automated and proactive defense measures. This shift toward AI-powered cybersecurity is enhancing data protection, reducing human error, and helping organizations stay one step ahead of evolving security risks. For example, an industry survey found that 48.9% of global executives view AI and machine learning as effective against modern security threats, while 44% of organizations already use AI to detect intrusions.

Big Data Security Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global big data security market, along with forecasts at the global, regional, and country levels from 2025-2033. The market has been categorized based on component, deployment mode, organization size, technology, and end use industry.

Analysis by Component:

- Solution

- Data Discovery and Classification

- Data Authorization and Access

- Data Encryption, Tokenization and Masking

- Data Auditing and Monitoring

- Data Governance and Compliance

- Data Security Analytics

- Data Backup and Recovery

- Services

The solution segment plays a critical role in the big data security market as organizations increasingly adopt advanced technologies to protect large datasets. Solutions such as encryption, identity and access management (IAM), and intrusion detection systems are essential for safeguarding sensitive data from breaches and cyber threats, especially as data volume and complexity continue to expand. The services segment is equally significant, offering continuous support and expertise in securing big data environments. Services like consulting, implementation, and managed security services help businesses enhance their security infrastructure. With the rise of new cyber threats, these services ensure ongoing risk management and provide tailored solutions, helping companies maintain robust and scalable data protection.

Analysis by Deployment Mode:

- On-premises

- Cloud-based

The on-premises segment plays a crucial role in the big data security market, particularly for organizations that prioritize control over their data. With on-premises solutions, businesses can maintain full visibility and management of their security infrastructure, allowing them to implement tailored, in-house protection mechanisms. This setup is often favored by enterprises dealing with highly sensitive data or those that must comply with stringent regulatory requirements. The cloud-based segment is also a significant factor in the market, as more businesses transition to cloud environments for scalability and flexibility. Cloud security solutions offer enhanced data protection through features like automated updates, real-time monitoring, and disaster recovery. The cloud-based model allows organizations to benefit from cost-effective and scalable security measures, making it an attractive option for businesses of all sizes.

Analysis by Organization Size:

- Small and Medium-sized Enterprises

- Large Enterprises

The small and medium-sized enterprises (SMEs) segment significantly contributes to the big data security market as these businesses increasingly recognize the need for robust data protection solutions. SMEs, often with limited IT resources, are adopting affordable, scalable security solutions to protect their growing data. These businesses prioritize cost-effective and easy-to-deploy solutions, such as cloud-based security and managed services, to safeguard against cyber threats while ensuring compliance with data protection regulations. On the other hand, large enterprises are major players in the market due to their complex data environments and greater reliance on big data analytics. These enterprises require advanced, customized security solutions to manage vast datasets and ensure compliance with industry regulations. As these organizations expand globally, they invest in comprehensive security measures, including encryption, identity management, and AI-driven threat detection, to protect critical business data.

Analysis by Technology:

- Identity and Access Management

- Security Information and Event Management

- Intrusion Detection System

- Unified Threat Management

- Others

The identity and access management (IAM) segment is a major factor in the Big Data Security market, as organizations focus on ensuring secure access to sensitive data. IAM solutions help control who can access what data, enforcing strict authentication and authorization protocols to prevent unauthorized access. As big data environments grow, businesses are increasingly adopting IAM tools to manage user identities, roles, and permissions efficiently, thereby reducing the risk of data breaches. The security information and event management (SIEM) segment is equally important, providing real-time monitoring and analysis of security events. SIEM solutions aggregate and analyze data from various sources to identify potential threats, offering businesses the ability to detect and respond to security incidents quickly. As data volumes increase, SIEM systems are crucial for ensuring comprehensive security across big data ecosystems.

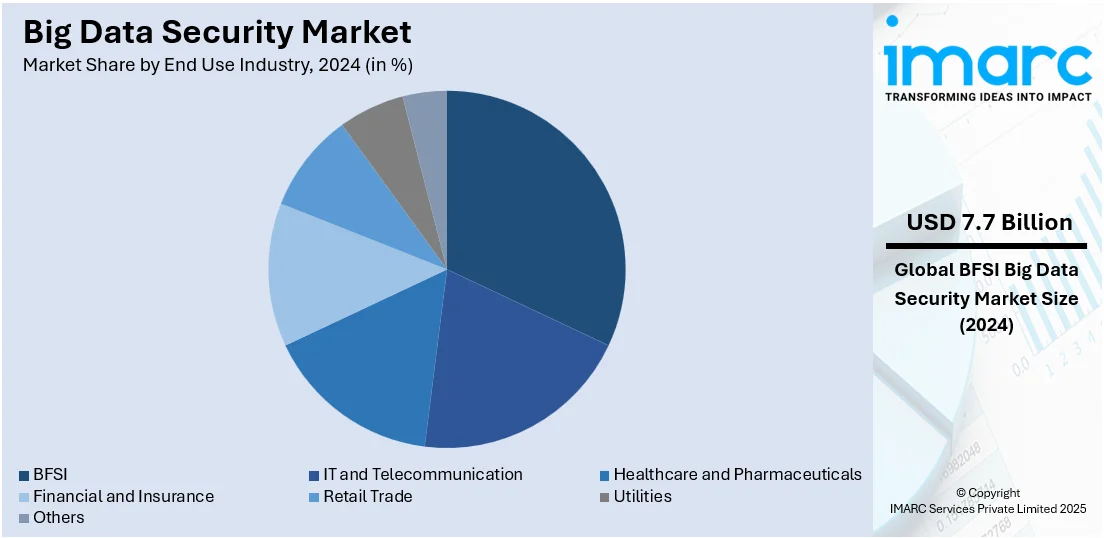

Analysis by End Use Industry:

- BFSI

- IT and Telecommunication

- Healthcare and Pharmaceuticals

- Financial and Insurance

- Retail Trade

- Utilities

- Others

The BFSI segment is a key driver in the big data security market due to the highly sensitive nature of the data handled within this sector. Financial institutions manage vast amounts of personal, transactional, and financial data, making them prime targets for cyber threats. As regulatory requirements around data protection tighten, BFSI organizations are increasingly adopting robust big data security solutions to safeguard against breaches, fraud, and cyberattacks. Advanced security measures, such as encryption, fraud detection, and real-time monitoring, are crucial in ensuring data integrity and compliance with industry standards. Additionally, with the rise of digital banking and fintech, BFSI companies are investing in scalable, secure solutions to protect their growing volumes of big data.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, North America accounted for the largest market share due to its advanced technological infrastructure and the presence of numerous data-driven industries, such as healthcare, finance, and retail. The region is home to leading cybersecurity and big data solution providers, driving the development and implementation of innovative security technologies. The growing frequency of cyberattacks, including data breaches, ransomware, and insider threats, has led to an increased demand for robust data protection measures. Additionally, the rapid adoption of cloud computing, IoT, and AI technologies in North America has heightened the need for secure big data solutions. With organizations increasingly relying on big data for decision-making, ensuring its security has become a priority, making North America a key player in the big data security market.

Key Regional Takeaways:

United States Big Data Security Market Analysis

The United States big data security market is primarily driven by the rise in digital transformation across key industries, increasing the need to protect vast, complex data ecosystems. In line with this, heightened risks from third-party software integrations and supply chain vulnerabilities are prompting stronger security investments and impelling the market. The growing deployment of 5G networks, expanding data traffic, and entry points, is further driving demand for real-time data protection. Furthermore, the widespread integration of DevOps and containerized applications requiring advanced data governance protocols is supporting market expansion. An industry report stated that 61.21% of companies using DevOps services technology software are from the United States, reflecting the country’s leading role in DevOps adoption. The increasing adoption of edge computing across healthcare and industrial automation sectors, enabling localized data processing, is elevating the need for edge-focused security solutions. Similarly, the rise in financial damages linked to ransomware incidents is encouraging enterprises to implement advanced protection frameworks, which, in turn, is shaping market dynamics. Moreover, shifting compliance mandates for cross-border data transfers demanding high-level security standards is augmenting product adoption.

Europe Big Data Security Market Analysis

The market in Europe is experiencing growth due to the rising focus on data sovereignty and localization regulations across EU member states. In accordance with this, the enforcement of GDPR mandating high standards of data privacy compliance is accelerating product adoption. Similarly, escalating cyber threats targeting public institutions and financial services are fostering demand for advanced threat detection and response solutions, strengthening market demand. The growing integration of IoT and connected technologies in smart city projects across Europe, amplifying the requirement for real-time data protection, is bolstering market development. Furthermore, enterprise shifts toward hybrid and multi-cloud environments necessitating unified security management are supporting market expansion. The rise of Industry 4.0 and digital manufacturing initiatives requiring secure data analytics pipelines is influencing sector growth. The Digital Europe Programme (DIGITAL) allocated over EUR 8.1 Billion (2021–2027) to strengthen EU capacities in AI, cybersecurity, supercomputing, semiconductors, and digital skills. It supports SMEs, public administration, and industry through European Digital Innovation Hubs and complements other EU funding initiatives. Besides this, increased funding through EU cybersecurity programs and national-level public-private initiatives is facilitating broader deployment across the region.

Asia Pacific Big Data Security Market Analysis

The Asia Pacific big data security market is progressing, attributed to the rapid expansion of digital infrastructure in emerging economies, necessitating enhanced data protection measures. In addition to this, the rise in mobile internet users and smart devices generating large volumes of sensitive data is supporting the adoption of scalable security solutions. An industry report states that in Asia, mobile phones accounted for 68.8% of total web traffic as of March 2024. Similarly, growth in cyberattacks on financial institutions and government systems is prompting proactive security strategies, which are influencing market demand. The widespread adoption of digital payments and e-commerce platforms requiring secure transaction environments is further fueling market growth. Moreover, government-led cybersecurity frameworks in countries like India and Australia that mandate stronger data governance are expanding implementation. Apart from this, increased deployment of AI-driven analytics in the telecom and manufacturing sectors is creating lucrative market opportunities.

Latin America Big Data Security Market Analysis

In Latin America, the big data security market is gaining momentum, propelled by accelerating digital transformation in the public and financial sectors. Similarly, the growth in ransomware incidents targeting regional enterprises is prompting the adoption of proactive threat detection solutions, which is fueling market development. An industry report highlights that the LATAM region has faced over 100 ransomware attacks since 2023. The manufacturing sector was most affected (18 attacks), followed by financial services and technology (10 each), while retail and logistics also faced significant disruptions. Furthermore, the expanding use of cloud services in nations like Brazil, Mexico, and Colombia, which require robust data control and encryption capabilities, is propelling market growth. Moreover, the enforcement of data privacy regulations such as Brazil’s LGPD encourages compliance-driven security investments, thereby expanding the market scope.

Middle East and Africa Big Data Security Market Analysis

The Middle East and Africa market is majorly influenced by the expansion of digital government programs, driving the need for secure data management systems. As such, Abu Dhabi approved a USD 3.54 Billion digital strategy for 2025–2027, aiming for full AI integration in public services by 2027. The initiative targets 100% process automation, sovereign cloud adoption, and a USD 6.53 Billion GDP increase. Furthermore, the rise of smart city infrastructure across Gulf nations, encouraging the deployment of real-time data protection technologies, is fueling market advancement. Additionally, the rapid growth of fintech and digital banking platforms across the region is increasing exposure to data breaches, augmenting market accessibility. Besides this, numerous partnerships with global cybersecurity firms aimed at developing localized security capabilities are positively influencing the market.

Competitive Landscape:

The big data security market is seeing significant advancements, particularly in product launches, strategic partnerships, collaborations, and funding. Companies are increasingly focusing on enhancing their offerings through new product innovations, often leveraging AI and advanced analytics for improved data protection. Partnerships and collaborations are common, as businesses align with technology providers to integrate secure data solutions. Additionally, funding for startups and established players is being raised to scale operations and develop cutting-edge security platforms. Research and development efforts continue to drive the market forward, while government initiatives are focusing on regulatory compliance and promoting secure data management practices.

The report provides a comprehensive analysis of the competitive landscape in the big data security market with detailed profiles of all major companies, including:

- Amazon Web Services, Inc.

- Check Point Software Technologies Ltd

- Cloudera, Inc

- Fortinet, Inc

- Imperva

- Microsoft Corporation

- Oracle Corporation

- Palo Alto Networks

- Splunk LLC

- Thales Group

- Trend Micro Incorporated

Latest News and Developments:

- April 2025: Salt Security launched MCP Server to enhance API protection using AI-driven insights and real-time posture gap analysis. Built on the MCP standard, it enables secure, natural language interaction with enterprise APIs, strengthening big data security by preventing over-permissioning, data leaks, and misuse in AI-integrated environments.

- April 2025: Blackpoint Cyber launched CompassOne, a unified security posture and response platform integrating big data security tools like MDR, cloud posture management, and vulnerability tracking. CompassOne offers end-to-end visibility, real-time threat response, and proactive risk management, helping organizations streamline cybersecurity operations and reduce tool sprawl within one platform.

- April 2025: Sentra launched its Data Security for AI Agents solution to safeguard sensitive data in AI-driven workflows. Supporting toolkits from Microsoft, Amazon, and OpenAI, the platform offers real-time monitoring, access controls, and exposure insights, strengthening big data security and compliance in increasingly autonomous enterprise AI environments.

- February 2025: BigID launched BigID Next, an AI-powered, modular data security platform addressing compliance, privacy, and AI risks. Designed for hybrid and multi-cloud environments, it offers advanced data classification, AI-assisted governance, and real-time risk controls, setting a new standard for enterprise big data security and regulatory compliance.

Big Data Security Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Components Covered |

|

| Deployment Modes Covered | On-premises, Cloud-based |

| Organization Sizes Covered | Small and Medium-sized Enterprises, Large Enterprises |

| Technologies Covered | Identity and Access Management, Security Information and Event Management, Intrusion Detection System, Unified Threat Management, Others |

| End Use Industries Covered | BFSI, IT and Telecommunication, Healthcare and Pharmaceuticals, Financial and Insurance, Retail Trade, Utilities, Others |

| Region Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Amazon Web Services, Inc., Check Point Software Technologies Ltd, Cloudera, Inc., Fortinet, Inc., Imperva, Microsoft Corporation, Oracle Corporation, Palo Alto Networks, Splunk LLC, Thales Group, Trend Micro Incorporated, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the big data security market from 2019-2033.

- The big data security market research report provides the latest information on the market drivers, challenges, and opportunities in the global market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the big data security industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The big data security market was valued at USD 25.95 Billion in 2024.

The big data security market is projected to exhibit a CAGR of 13.35% during 2025-2033, reaching a value of USD 84.75 Billion by 2033.

The big data security market is driven by the increasing volume of data, the rise in cyber threats, regulatory compliance requirements, and the need for businesses to protect sensitive information. Advancements in cloud computing, IoT, and AI also contribute to the growing demand for robust big data security solutions.

North America dominated the big data security market in 2024 due to advanced technological infrastructure, a high number of data-driven industries, strong cybersecurity frameworks, and stringent regulatory compliance requirements, driving demand for robust solutions.

Some of the major players in the big data security market include Amazon Web Services, Inc., Check Point Software Technologies Ltd, Cloudera, Inc., Fortinet, Inc., Imperva, Microsoft Corporation, Oracle Corporation, Palo Alto Networks, Splunk LLC, Thales Group, Trend Micro Incorporated, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)