Bio-Ethanol Prices, Trend, Chart, Demand, Market Analysis, News, Historical and Forecast Data Report 2025 Edition

Bio-Ethanol Price Trend, Index and Forecast

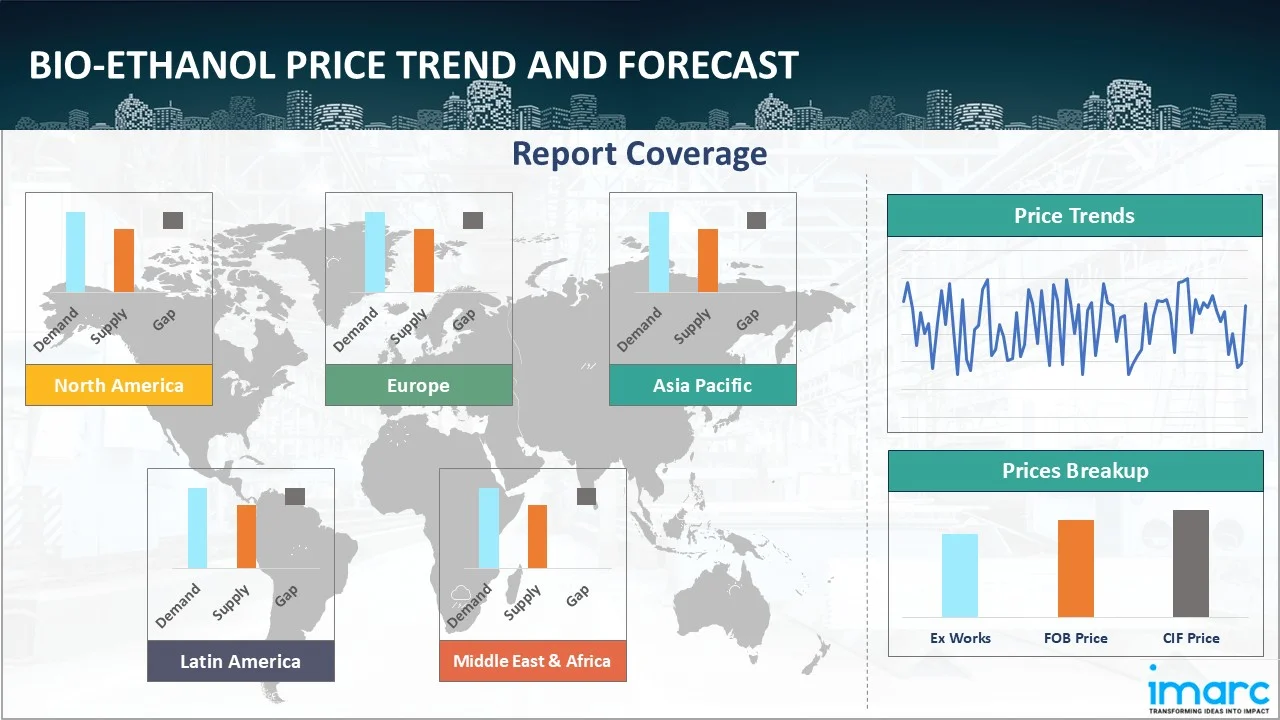

Track the latest insights on bio-ethanol price trend and forecast with detailed analysis of regional fluctuations and market dynamics across North America, Latin America, Central Europe, Western Europe, Eastern Europe, Middle East, North Africa, West Africa, Central and Southern Africa, Central Asia, Southeast Asia, South Asia, East Asia, and Oceania.

Bio-Ethanol Prices Outlook Q2 2025

- India: US$ 717/KG

- China: US$ 645/KG

- Germany: US$ 703/KG

- Brazil: US$ 741/KG

- South Korea: US$ 745/KG

Bio-Ethanol Price Chart

Get real-time access to monthly/quaterly/yearly prices, Request Sample

During the second quarter of 2025, the bio-ethanol prices in India reached 717 USD/KG in June. As per the bio-ethanol price chart, states like Gujarat saw substantial investments in biofuel infrastructure, including ethanol production facilities. These investments were part of a broader strategy to enhance domestic ethanol production capacity, reduce dependence on fossil fuels, and support rural economies. This contributed to the stabilization and gradual increase in bioethanol prices in India during Q2 2025, aligning with the country's renewable energy objectives and the EBP programme's goals.

During the second quarter of 2025, the bio-ethanol prices in China reached 645 USD/KG in June. The market price of corn-based ethanol in the Sichuan region saw a decrease. The primary reason for this decline was that the early orders had already been executed, leading to reduced demand for immediate procurement. Additionally, the influx of cheaper corn ethanol from other regions pressured the market, resulting in a price drop.

During the second quarter of 2025, bio-ethanol prices in Germany reached 703 USD/KG in June. Germany's bioethanol prices were influenced by the increasing environmental awareness and government incentives supporting renewable energy sources. The demand for bioethanol as a cleaner alternative to traditional fossil fuels rose, particularly in the transportation sector, where bioethanol blends were used to reduce carbon emissions.

During the second quarter of 2025, the bio-ethanol prices in Brazil reached 741 USD/KG in June. Brazil's bioethanol market experienced significant shifts due to the government's decision to increase the ethanol blend in gasoline. This policy change, approved by the National Energy Policy Council (CNPE), aimed to enhance energy independence and reduce fuel costs.

During the second quarter of 2025, the bio-ethanol prices in South Korea reached 745 USD/KG in June. South Korea relies heavily on imports for its bioethanol supply. Hence, fluctuations in global feedstock prices, such as corn, impacted the cost of imported ethanol. Additionally, disruptions in supply chains and changes in trade policies also affected the availability and pricing of bioethanol in South Korea.

Bio-Ethanol Prices Outlook Q1 2025

- India: US$ 706/MT

- China: US$ 630/MT

- Germany: US$ 681/MT

- Brazil: US$ 715/MT

- South Korea: US$ 755/MT

During the first quarter of 2025, the bio-ethanol prices in India reached 706 USD/MT in March. As per the bio-ethanol price chart, prices in India experienced fluctuations due to several factors, including government blending mandates, production volumes, and feedstock availability.

During the first quarter of 2025, bio-ethanol prices in China reached 630 USD/MT in March. Domestic production capacity struggled to keep pace with the rising demand, leading to increased reliance on imports. Besides, government policies supporting biofuel blending mandates also played a role in sustaining market demand and prices.

During the first quarter of 2025, the bio-ethanol prices in Germany reached 681 USD/MT in March. The implementation of more stringent renewable fuel standards increased demand for bio-ethanol as a biofuel component. Besides, higher greenhouse gas quotas for 2025 also boosted the demand for bio-ethanol, as it helped companies meet their emissions reduction targets.

During the first quarter of 2025, the bio-ethanol prices in Brazil reached 715 USD/MT in March. Brazil saw fluctuating bio-ethanol prices due to a mix of strong domestic demand, proposed increase in the ethanol blending ratio, and government policy changes. Besides, corn-based ethanol production saw significant growth, influencing overall prices.

During the first quarter of 2025, the bio-ethanol prices in South Korea reached 755 USD/MT in March. The overall market was affected by various factors, including feedstock costs like corn prices, seasonal demand changes, and varying blending requirements.

Regional Coverage

The report provides a detailed analysis of the market across different regions, each with unique pricing dynamics influenced by localized market conditions, supply chain intricacies, and geopolitical factors. This includes price trends, price forecast and supply and demand trends for each region, along with spot prices by major ports. The report also provides coverage of FOB and CIF prices, as well as the key factors influencing the bio-ethanol prices.

Global Bio-Ethanol Price Trend

The report offers a holistic view of the global bio-ethanol pricing trends in the form of bio-ethanol price charts, reflecting the worldwide interplay of supply-demand balances, international trade policies, and overarching economic factors that shape the market on a macro level. This comprehensive analysis not only highlights current price levels but also provides insights into historical price of bio-ethanol, enabling stakeholders to understand past fluctuations and their underlying causes. The report also delves into price forecast models, projecting future price movements based on a variety of indicators such as expected changes in supply chain dynamics, anticipated policy shifts, and emerging market trends. By examining these factors, the report equips industry participants with the necessary tools to make informed strategic decisions, manage risks, and capitalize on market opportunities. Furthermore, it includes a detailed bio-ethanol demand analysis, breaking down regional variations and identifying key drivers specific to each geographic market, thus offering a nuanced understanding of the global pricing landscape.

Europe Bio-Ethanol Price Trend

Q2 2025:

As per the bio-ethanol price index, adverse weather conditions in key producing countries, such as France and Ukraine, resulted in poorer harvests for corn. This reduced feedstock availability, leading to higher input costs for bioethanol producers and subsequently increasing market prices. Besides, congestion at major European ports and rail delays disrupted supply chains, causing temporary shortages and price fluctuations in the bioethanol market. These logistical challenges added to the upward pressure on prices during the quarter.

Q1 2025:

As per the bio-ethanol price index, in the first quarter of 2025, prices in Europe fluctuated due to a combination of regulatory changes, supply chain disruptions, and shifting demand. Stricter renewable fuel standards in Germany and improved greenhouse gas quotas initially drove prices, but these increases were later offset by weakened demand after the winter and logistical challenges.

| Region | Countries Covered |

|---|---|

| Europe | Germany, France, United Kingdom, Italy, Spain, Russia, Turkey, Netherlands, Poland, Sweden, Belgium, Austria, Ireland, Switzerland, Norway, Denmark, Romania, Finland, Czech Republic, Portugal, and Greece, among other European countries. |

North America Bio-Ethanol Price Trend

Q2 2025:

The US Renewable Fuel Standard (RFS) continued to drive demand for bioethanol by mandating the blending of renewable fuels with conventional transportation fuels. This policy ensured a consistent market for bioethanol, supporting price stability. In Canada, similar policies aimed at reducing greenhouse gas emissions and promoting renewable energy sources further bolstered demand. Besides, corn, the primary feedstock for bioethanol production in the US, experienced price fluctuations due to varying crop yields and input costs. Increased corn prices raised production costs, which, in turn, influenced bioethanol prices.

Q1 2025:

Bio-ethanol prices in North America fluctuated due to a combination of factors, including rising corn prices, strong export demand, and changes in domestic blending requirements. Besides, government regulations like the Renewable Fuel Standard (RFS) in the USA also influenced prices. Moreover, global events such as trade agreements and weather patterns impacted both supply and demand, influencing price movements.

| Region | Countries Covered |

|---|---|

| North America | United States and Canada |

Middle East and Africa Bio-Ethanol Price Trend

Q2 2025:

The report explores the bio-ethanol trends and bio-ethanol chart in the Middle East and Africa, considering factors like regional industrial growth, the availability of natural resources, and geopolitical tensions that uniquely influence market prices.

Q1 2025:

The report explores the bio-ethanol trends and bio-ethanol price chart in the Middle East and Africa, considering factors like regional industrial growth, the availability of natural resources, and geopolitical tensions that uniquely influence market prices.

| Region | Countries Covered |

|---|---|

| Middle East & Africa | Saudi Arabia, UAE, Israel, Iran, South Africa, Nigeria, Oman, Kuwait, Qatar, Iraq, Egypt, Algeria, and Morocco, among other Middle Eastern and African countries. |

Asia Pacific Bio-Ethanol Price Trend

Q2 2025:

In Q2 2025, bioethanol prices in the Asia-Pacific region, particularly in China, experienced fluctuations. In the Sichuan region, the market price for corn-grade ethanol fell due to a surge in corn availability. Traders' corn inventories were gradually decreasing, leading to reduced purchasing activity and further contributing to the price drop. Moreover, environmental concerns, stringent regulations related to greenhouse gas emissions, and government initiatives promoting bioethanol as a renewable and sustainable alternative to fossil fuels also influenced pricing trends.

Q1 2025:

Bio-ethanol prices in the Asia Pacific region fluctuated due to a mix of factors, including feedstock costs, demand from key industries, and logistical challenges. Rising raw material costs, particularly for corn and sugarcane, put upward pressure on prices, while strong demand from fuel blending and industrial applications in China also contributed to price changes early in the quarter.

| Region | Countries Covered |

|---|---|

| Asia Pacific | China, India, Indonesia, Pakistan, Bangladesh, Japan, Philippines, Vietnam, Thailand, South Korea, Malaysia, Nepal, Taiwan, Sri Lanka, Hongkong, Singapore, Australia, and New Zealand, among other Asian countries. |

Latin America Bio-Ethanol Price Trend

Q2 2025:

As per the bio-ethanol price index, Brazil's decision to increase the ethanol blend in gasoline, significantly impacted the market. Besides, fluctuations in energy markets affected production costs and export competitiveness, indirectly influencing regional price trends. Moreover, infrastructure limitations and logistical inefficiencies in certain Latin American countries impacted the supply chain and distribution of bioethanol. These challenges led to regional price disparities, with some areas experiencing higher costs due to transportation bottlenecks and limited access to production facilities.

Q1 2025:

As per the bio-ethanol price index, bio-ethanol prices in Latin America experienced fluctuations due to a combination of factors, including increased production, rising demand, and global market dynamics. Early in the quarter, prices were influenced due to strong domestic demand and exports, particularly from Brazil, supported by government initiatives like blending mandates and rising production.

| Region | Countries Covered |

|---|---|

| Latin America | Brazil, Mexico, Argentina, Columbia, Chile, Ecuador, and Peru, among other Latin American countries. |

Bio-Ethanol Price Trend, Market Analysis, and News

IMARC's latest publication, “Bio-Ethanol Prices, Trend, Chart, Demand, Market Analysis, News, Historical and Forecast Data Report 2025 Edition,” presents a detailed examination of the bio-ethanol market, providing insights into both global and regional trends that are shaping prices. This report delves into the spot price of bio-ethanol at major ports and analyzes the composition of prices, including FOB and CIF terms. It also presents detailed bio-ethanol prices trend analysis by region, covering North America, Europe, Asia Pacific, Latin America, and Middle East and Africa. The factors affecting bio-ethanol pricing, such as the dynamics of supply and demand, geopolitical influences, and sector-specific developments, are thoroughly explored. This comprehensive report helps stakeholders stay informed with the latest market news, regulatory updates, and technological progress, facilitating informed strategic decision-making and forecasting.

Bio-Ethanol Industry Analysis

The global bio-ethanol market size reached USD 10.7 Billion in 2024. By 2033, IMARC Group expects the market to reach USD 18.7 Billion, at a projected CAGR of 6.10% during 2025-2033.

- The global transition toward sustainable energy sources is significantly propelling the bio-ethanol market. As nations aim to reduce greenhouse gas emissions in accordance with climate agreements like the Paris Accord, bio-ethanol has emerged as a vital alternative to fossil fuels. The USA government's 2024 emissions projections indicate that, under current policies, net greenhouse gas (GHG) emissions are expected to decline by 29–46% by 2030. Produced from biomass such as corn, sugarcane, and cellulosic feedstocks, bio-ethanol offers a renewable, biodegradable, and lower-emission substitute for gasoline. Governments are actively promoting ethanol blending mandates and providing subsidies to encourage cleaner transportation fuels. The growing use of E10, E15, and even E85 blends in several countries underscores the expanding application of bio-ethanol in fuel supply chains. Furthermore, automotive manufacturers are aligning their technologies to accommodate ethanol-blended fuels, reinforcing the market’s momentum.

- Government regulations and ethanol blending mandates play a crucial role in stimulating demand for bio-ethanol globally. Numerous countries have introduced minimum blending requirements, such as 10% ethanol mixed with gasoline (E10) or higher, to reduce dependence on imported petroleum and enhance energy security. In major economies like the United States, Brazil, India, and members of the EU, policies supporting biofuel production are often accompanied by tax incentives, direct subsidies, and R&D grants. These measures aim to encourage investment in bio-refineries and improve agricultural income through increased feedstock demand. For instance, India’s Ethanol Blending Programme and the U.S. Renewable Fuel Standard are driving significant capacity expansions and market penetration.

- Abundant availability of agricultural feedstocks is a foundational driver of the bio-ethanol market. Crops like sugarcane, corn, wheat, and sorghum, along with lignocellulosic biomass such as agricultural waste and forestry residues, serve as essential inputs for ethanol production. Countries with extensive agricultural economies, including Brazil, the USA, China, and India, benefit from steady feedstock supplies, ensuring stable and scalable ethanol production. Additionally, rising farm productivity and improvements in crop yields have bolstered the cost-effectiveness of bio-ethanol. The development of second-generation (2G) ethanol technologies that utilize non-food biomass is further diversifying the feedstock base and alleviating food-versus-fuel concerns.

Bio-Ethanol News

The report covers the latest developments, updates, and trends impacting the global bio-ethanol industry, providing stakeholders with timely and relevant information. This segment covers a wide array of news items, including the inauguration of new production facilities, advancements in bio-ethanol production technologies, strategic market expansions by key industry players, and significant mergers and acquisitions that impact the bio-ethanol price trend.

Latest developments in the Bio-Ethanol industry:

- April 2025: The CEO of NIORDC, the fuel department of the Iranian Oil Ministry, announced that the Iranian Ministry of Industry opened the country's first bioethanol production plant at Kermanshah Refinery in western Iran to significantly reduce emissions and elevate the sustainability of the fuel sector.

- October 2024: Indonesia's state-owned oil corporation, Pertamina, started a pilot project for sorghum growing to be used as a bioethanol feedstock in response to the new government's energy self-sufficiency program. This will lessen dependency on imported wheat and other grains.

Product Description

Bio-ethanol is a renewable form of ethanol (ethyl alcohol) produced through the fermentation of biomass-derived sugars and starches. Commonly sourced from agricultural crops such as corn, sugarcane, wheat, and barley, it can also be made from lignocellulosic materials like crop residues and forestry waste, known as second-generation bio-ethanol. It is primarily used as a biofuel additive in gasoline, helping to reduce greenhouse gas emissions and reliance on fossil fuels. Blends such as E10 (10% ethanol, 90% gasoline) and E85 (up to 85% ethanol) are widely used in transportation to promote cleaner combustion and lower environmental impact.

Bio-ethanol’s significance lies in its ability to provide a sustainable, biodegradable, and low-carbon alternative to conventional fuels. It plays a vital role in achieving national energy security goals and in fulfilling international climate commitments.

Report Coverage

| Key Attributes | Details |

|---|---|

| Product Name | Bio-Ethanol |

| Report Features | Exploration of Historical Trends and Market Outlook, Industry Demand, Industry Supply, Gap Analysis, Challenges, Ammonia Price Analysis, and Segment-Wise Assessment. |

| Currency/Units | US$ (Data can also be provided in local currency) or Metric Tons |

| Region/Countries Covered | The current coverage includes analysis at the global and regional levels only. Based on your requirements, we can also customize the report and provide specific information for the following countries: Asia Pacific: China, India, Indonesia, Pakistan, Bangladesh, Japan, Philippines, Vietnam, Thailand, South Korea, Malaysia, Nepal, Taiwan, Sri Lanka, Hongkong, Singapore, Australia, and New Zealand* Europe: Germany, France, United Kingdom, Italy, Spain, Russia, Turkey, Netherlands, Poland, Sweden, Belgium, Austria, Ireland, Switzerland, Norway, Denmark, Romania, Finland, Czech Republic, Portugal and Greece* North America: United States and Canada Middle East & Africa: Saudi Arabia, UAE, Israel, Iran, South Africa, Nigeria, Oman, Kuwait, Qatar, Iraq, Egypt, Algeria, and Morocco* Latin America: Brazil, Mexico, Argentina, Columbia, Chile, Ecuador, Peru* *The list of countries presented is not exhaustive. Information on additional countries can be provided if required by the client. |

| Information Covered for Key Suppliers |

|

| Customization Scope | The report can be customized as per the requirements of the customer |

| Report Price and Purchase Option |

Plan A: Monthly Updates - Annual Subscription

Plan B: Quarterly Updates - Annual Subscription

Plan C: Biannually Updates - Annual Subscription

|

| Post-Sale Analyst Support | 360-degree analyst support after report delivery |

| Delivery Format | PDF and Excel through email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report presents a detailed analysis of bio-ethanol pricing, covering global and regional trends, spot prices at key ports, and a breakdown of FOB and CIF prices.

- The study examines factors affecting bio-ethanol price trend, including input costs, supply-demand shifts, and geopolitical impacts, offering insights for informed decision-making.

- The competitive landscape review equips stakeholders with crucial insights into the latest market news, regulatory changes, and technological advancements, ensuring a well-rounded, strategic overview for forecasting and planning.

- IMARC offers various subscription options, including monthly, quarterly, and biannual updates, allowing clients to stay informed with the latest market trends, ongoing developments, and comprehensive market insights. The bio-ethanol price charts ensure our clients remain at the forefront of the industry.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Why Choose Us

IMARC offers trustworthy, data-centric insights into commodity pricing and evolving market trends, enabling businesses to make well-informed decisions in areas such as procurement, strategic planning, and investments. With in-depth knowledge spanning more than 1000 commodities and a vast global presence in over 150 countries, we provide tailored, actionable intelligence designed to meet the specific needs of diverse industries and markets.

1000

+Commodities

150

+Countries Covered

3000

+Clients

20

+Industry

Robust Methodologies & Extensive Resources

IMARC delivers precise commodity pricing insights using proven methodologies and a wealth of data to support strategic decision-making.

Subscription-Based Databases

Our extensive databases provide detailed commodity pricing, import-export trade statistics, and shipment-level tracking for comprehensive market analysis.

Primary Research-Driven Insights

Through direct supplier surveys and expert interviews, we gather real-time market data to enhance pricing accuracy and trend forecasting.

Extensive Secondary Research

We analyze industry reports, trade publications, and market studies to offer tailored intelligence and actionable commodity market insights.

Trusted by 3000+ industry leaders worldwide to drive data-backed decisions. From global manufacturers to government agencies, our clients rely on us for accurate pricing, deep market intelligence, and forward-looking insights.

Request Customization

Request Customization

Inquire Before Buying

Inquire Before Buying

Speak to an Analyst

Speak to an Analyst Request Brochure

Request Brochure

.webp)

.webp)