Bio-plasticizers Market Size, Share, Trends and Forecast by Product, Application, and Region, 2025-2033

Bio-plasticizers Market Size and Share:

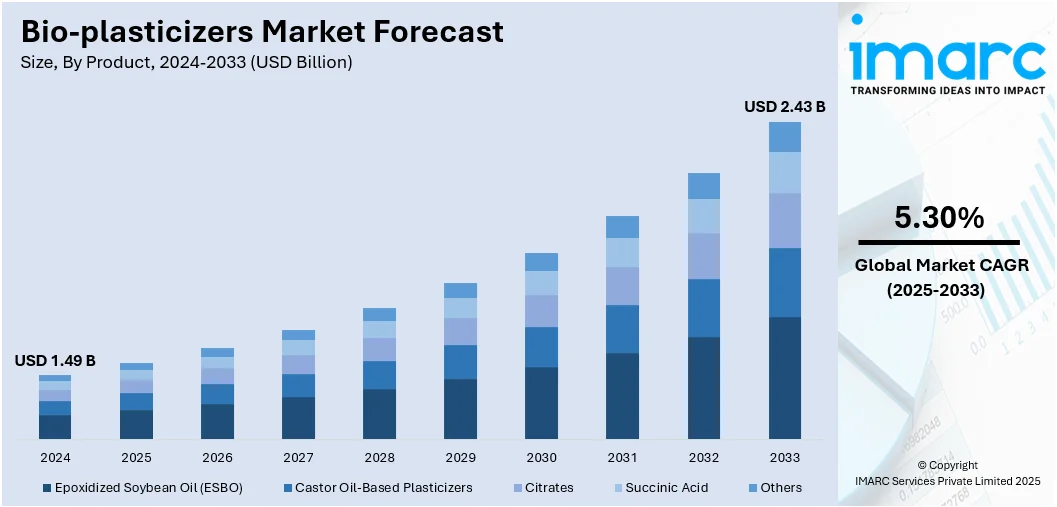

The global bio-plasticizers market size was valued at USD 1.49 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 2.43 Billion by 2033, exhibiting a CAGR of 5.30% from 2025-2033. North America currently dominates the market, holding a market share of 35.0% in 2024. The growing consciousness about the health and environmental effects of man-made plasticizers is driving the need for eco-friendly and non-toxic substitutes. Moreover, the enforcement of stringent environmental regulations and increasing limitations on phthalate-based plasticizer usage are contributing to the market growth. Additionally, advancements in bio-based chemistry technology are expanding the bio-plasticizers market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 1.49 Billion |

|

Market Forecast in 2033

|

USD 2.43 Billion |

| Market Growth Rate (2025-2033) | 5.30% |

The bio-plasticizers market is witnessing steady growth, driven by mounting environmental legislation and growing demand for eco-friendly and non-toxic substitutes to traditional plasticizers. With mounting concerns regarding the health and environmental effects of phthalate-based plasticizers, industries are shifting towards bio-based alternatives based on renewable feedstocks like vegetable oils, starch, and citric acid. This change is especially prevalent in industries like packaging, automotive, medical devices, and consumer goods, where compliance and safety are a top priority, thereby impelling the bio-plasticizers market growth. Advances in formulation technologies in bio-plasticizers are also increasing their range of performance, hence making them fit for various applications such as rubber and adhesives. Moreover, government policies with respect to the circular economy and decreasing carbon footprint are supporting the growth of the market.

To get more information on this market, Request Sample

The United States bio-plasticizers industry is experiencing continued growth due to mounting regulatory pressure and high demand for green and non-toxic substances. Regulatory agencies like the Environmental Protection Agency (EPA) and the Food and Drug Administration (FDA) are tightening rules on the application of phthalates and other toxic plasticizers, which is leading manufacturers to switch to bio-based alternatives. This regulatory environment is promoting the innovation and commercialization of bio-plasticizers from renewable feedstocks such as soybean oil, castor oil, and citric acid. In healthcare, bio plasticizers provide healthier substitutes for medical tubing and bags. Besides this, in the case of construction, bio-plasticizers are applied in flooring, wall coverings, and cables. In 2024, the Good Plastic Company broadcasted its expansion into North America with the opening of an office in New York City. The Netherlands-based company manufactures Polygood, surface panels made from 100% recycled and 100% recyclable plastic. The panels bring color to interior design, architecture, furniture, and retail displays. Each pattern originates from distinct waste sources like single-use cutlery, refrigerators, household appliances, or manufacturing components.

Bio-plasticizers Market Trends:

Increasing Demand for Non-Toxic and Sustainable Consumer Products

Growing consciousness about the health and environmental effects of man-made plasticizers is driving the need for eco-friendly and non-toxic substitutes. The trend is very strong in end-use markets like food packing, toys, medical devices, and personal care, where safety is paramount. Customers increasingly prefer products that are described as eco-friendly, biodegradable, or phthalate-free, where manufacturers have no choice but to reformulate with bio-plasticizers from renewable natural sources like vegetable oils, citric acid, and starch. Aside from being renewable and safer, such substitutes tend to offer comparable performance properties like flexibility, durability, and low volatility. This change in attitude is encouraging brands to enhance their green credentials and shrink their carbon impact by using sustainable ingredients. As the world's tastes remain in sync with green values, the need for bio-plasticizers will grow, creating long-term opportunities for manufacturers and spurring creativity in bio-based material science. As per the data provided by Globe Scan, almost half of Americans (49%) indicate they bought an eco-friendly product in the previous month, increasing from 43 percent in August 2024.

Stringent Environmental Regulations and Phthalate Restrictions

One of the leading bio-plasticizers market trends is the enforcement of stringent environmental regulations and increasing limitations on phthalate-based plasticizer usage. Authorities like the European Chemicals Agency (ECHA), the U.S. Environmental Protection Agency (EPA), and other regulatory authorities have placed bans or strict controls on many of the regularly used phthalates based on their toxicological profiles, with endocrine disruption and probable carcinogenicity. The US Environmental Protection Agency concludes in draft risk assessments published on June 4, 2025, that over a dozen applications of two prevalent phthalates, including diethylhexyl phthalate (DEHP) and dibutyl phthalate (DBP), present health hazards to workers due to inhalation exposure. These limitations have generated tremendous demand for safer, bio-based substitutes in the packaging, automotive, and healthcare sectors. Bio-plasticizers provide the benefit of being renewable, renewable-based, and generally low in toxicity, biodegradable, and having a smaller environmental footprint. Because of this, production companies are investing more in research and development (R&D) of bio-based plasticizers that are compliant without losing performance.

Breakthroughs in Bio-Based Chemistry and Material Innovation

Advancements in bio-based chemistry technology are playing a major role in offering a favorable bio-plasticizers market outlook. Ongoing R&D activities aim to enhance the functionality, affordability, and scalability of formulations of bio-based plasticizers. These developments are allowing bio-plasticizers to achieve or surpass the quality of traditional plasticizers in such important parameters as plasticity, thermal stability, and processability. For instance, enzymatic catalysis and chemical modification of natural oils are improving compatibility with rubber and PVC polymers. In addition, growth in investment in industrial biotechnology and green chemistry is opening new feedstocks and production methods that minimize reliance on petrochemical sources. Development of drop-in bio-based solutions also enables manufacturers to incorporate new materials into current systems without having to replace existing production systems. These developments not only increase the scope for potential applications of bio-plasticizers but also render them economically more feasible. IMARC Group predicts that the global PVC stabilizers market is projected to attain USD 6.93 Billion by 2033.

Bio-plasticizers Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global bio-plasticizers market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on product and application.

Analysis by Product:

- Epoxidized Soybean Oil (ESBO)

- Castor Oil-Based Plasticizers

- Citrates

- Succinic Acid

- Others

Epoxidized soybean oil (ESBO) stands as the largest component in 2024, holding 36.6% of the market. It is a commonly applied bio-plasticizer and stabilizer that is prized for its eco-friendliness, functional adaptability, and performance benefits. ESBO comes from renewable farm sources, and therefore, it is a less impactful option than petroleum plasticizers. It is biodegradable, non-toxic, and aids in lessening the dependence on fossil fuels. Its manufacture follows the principles of the circular economy and increasing industry requirements for environmentally friendly materials. The environmentally friendly character of ESBO facilitates regulatory compliance and allows manufacturers to achieve environmental standards. Along with its stabilizing action, ESBO serves as a plasticizer that makes the polymer more flexible and workable. It shows good compatibility with PVC and enhances the mechanical properties of end products such as elasticity, elongation, and softness. This bifold activity minimizes the quantity of added additives, providing cost savings in manufacturing operations.

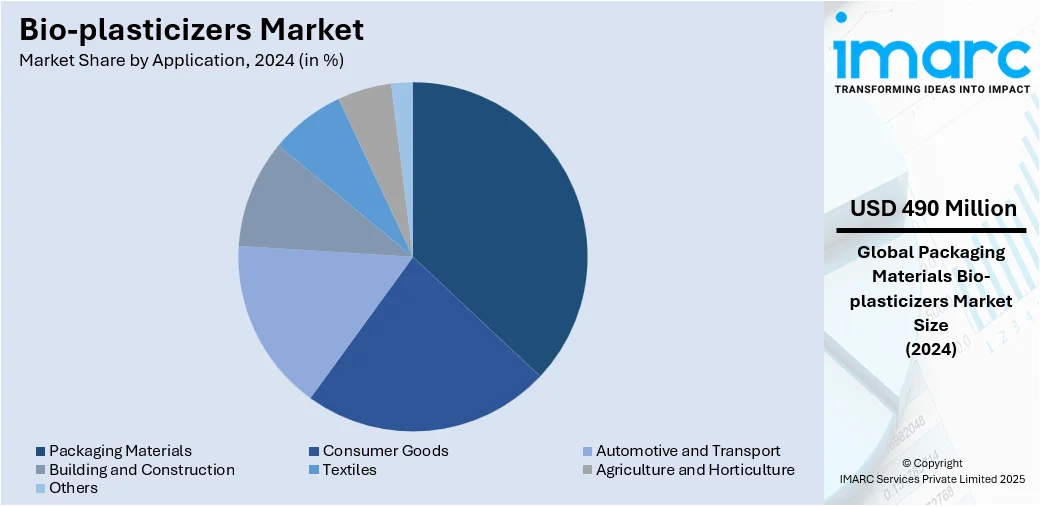

Analysis by Application:

- Packaging Materials

- Consumer Goods

- Automotive and Transport

- Building and Construction

- Textiles

- Agriculture and Horticulture

- Others

Packaging materials lead the market with 33.2% of market share in 2024. Bio-plasticizers are increasingly becoming necessary in the packaging sector because producers are looking for environment friendly replacements for the traditional, petroleum-derived additives. They are sourced from renewable materials like vegetable oils, citric acid, starch, and other biobased feedstocks. Bio-plasticizers are employed for their ability to improve flexibility, toughness, and processability of polymer-based packaging materials, especially in polyvinyl chloride (PVC) and other thermoplastics. Bio-plasticizers enhance the mechanical properties of films and sheets in flexible packaging, delivering elasticity and resilience for wrapping and sealing purposes. They also enhance transparency, tensile strength, and elongation properties needed in consumer products and food-grade packaging. As a result of their non-toxic and biodegradable nature, bio-plasticizers are particularly prized in food-contact uses where safety and regulatory compliance are key.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, North America accounted for the largest market share of 35.0%. The sector is experiencing steady growth, driven by heightened environmental awareness, regulatory pressure, and the rising demand for sustainable materials across key industries. Regulatory bodies like the U.S. Environmental Protection Agency (EPA) and Health Canada are enforcing stringent restrictions on traditional phthalate plasticizers due to their potential health and environmental risks. This has accelerated the shift toward bio-based alternatives, particularly in sectors like packaging, automotive, construction, and medical devices, where safety and regulatory compliance are critical. End-user preference for eco-friendly and non-toxic products is also playing a significant role in driving the market. Manufacturers are responding by incorporating bio-plasticizers derived from renewable resources, such as soybean oil, castor oil, and citric acid, into various polymer applications, especially in flexible PVC. Additionally, advancements in green chemistry and biotechnology are improving the performance and cost-effectiveness of bio-plasticizer formulations, making them increasingly competitive with synthetic counterparts.

Key Regional Takeaways:

United States Bio-plasticizers Market Analysis

The United States holds 85.60% share in North America. The market is primarily driven by the increasing need for sustainable materials, particularly in the automotive and construction sectors. An industry survey found that nearly 50% of Americans purchased an environmentally friendly product in the last month, showing a six-point increase since before the election. Also, there is strong consumer interest in sustainable products, with over one-third of consumers expressing a desire for more eco-friendly options in the market. In accordance with this, stringent environmental regulations aimed at reducing the use of harmful chemicals are encouraging the adoption of bio-based alternatives. The rising consumer awareness regarding the health and environmental risks associated with phthalates is further propelling market growth. Similarly, favorable government incentives and support for green products and technologies are expanding market opportunities. The growing adoption of bioplastics in the packaging industry, driven by eco-conscious consumer preferences, is contributing significantly to the market's expansion. Additionally, continual advancements in bio-based feedstock availability and production technologies are improving product efficiency. The rise in circular economy practices, which encourages the use of renewable, bio-based raw materials, is also strengthening market demand. Moreover, the increasing demand for bio-plasticizers in medical devices is enhancing market versatility.

Europe Bio-plasticizers Market Analysis

The European market is experiencing growth due to the rising demand for environmentally friendly alternatives in the construction industry, particularly for eco-conscious building materials. As reported, in April 2025, compared with March 2025, seasonally accustomed production in construction augmented by 1.7% in the euro area and by 1.4% in the EU. In line with this, the rising adoption of non-toxic, phthalate-free alternatives in medical devices and consumer goods is driving market expansion. Similarly, the European Union’s stringent regulations on hazardous chemicals are encouraging the shift toward bio-based solutions. The growing emphasis on circular economy principles, which promote the use of renewable and recyclable materials, is further supporting growth in the market. Furthermore, continual technological advancements in production processes are improving the efficiency and performance of bio-plasticizers, augmenting their sales. Besides this, the increasing demand for eco-friendly packaging solutions, particularly in the food and beverage industries, is providing an impetus to the market.

Asia Pacific Bio-plasticizers Market Analysis

The market in the Asia Pacific is largely driven by rapid urbanization and industrialization across emerging economies, which are increasing the demand for eco-friendly materials in various sectors. In addition to this, numerous government initiatives promoting sustainability and renewable resources are further accelerating market growth. Similarly, rising consumer awareness of the environmental and health risks associated with conventional plasticizers is propelling the ongoing shift towards bio-based alternatives. The region’s expanding automotive industry is also driving the need for sustainable plasticizers in interior components. NITI Aayog reported that India contributes 7.1% to its Gross Domestic Product (GDP) and 49% to its manufacturing GDP. The country ranks 4th in global vehicle production, with over 28 million units manufactured in the 2023–24 period. As a result, the demand for bio-plasticizers in the automotive sector is anticipated to grow significantly. Moreover, the expansion of the food packaging industry, fueled by consumer demand for safer and greener options, is further expanding the market scope.

Latin America Bio-plasticizers Market Analysis

In Latin America, the market is growing due to increasing regulatory pressures to reduce the use of harmful chemicals in consumer products. A survey revealed that 85% of respondents in Brazil support regulations that mandate a reduction in global plastic production. Similarly, the rising demand for sustainable packaging solutions, especially in the food and beverage industry, is driving market expansion. Furthermore, increasing investments in renewable energy are promoting the adoption of bio-based materials in construction, which is creating new market opportunities. Apart from this, the growing consumer preference for non-toxic materials in personal care products is also sustaining the market's growth trends.

Middle East and Africa Bio-plasticizers Market Analysis

The market in the Middle East and Africa is significantly influenced by the growing awareness of environmental sustainability, pushing industries to adopt eco-friendly alternatives. Furthermore, the region's increasing urbanization, leading to a higher demand for sustainable construction materials, is accelerating the use of these materials in building products. As such, Saudi Arabia leads the Arab world with 2,000 green building projects. The market is projected to reach USD 33 Billion by 2030, driven by sustainable practices, energy-efficient structures, and green materials, aligning with Vision 2030 goals. Additionally, rising government regulations aimed at reducing hazardous chemicals are driving the shift toward bio-based solutions. The expansion of the renewable energy sector, particularly in solar and wind technologies, is expanding the reach of bio-plasticizers in eco-friendly components.

Competitive Landscape:

Market players in the global bio-plasticizers market are actively engaging in strategic initiatives to strengthen their competitive position and meet the rising demand for sustainable solutions. Leading companies are investing in research to enhance the performance, compatibility, and cost-efficiency of bio-based formulations. Partnerships and mergers, and acquisitions (M&As) are also prominent, enabling firms to expand their technological capabilities and geographic reach. Several manufacturers are scaling up production capacities to address the growing needs of industries such as packaging, automotive, and healthcare. Additionally, market participants are focusing on regulatory compliance and product certification to appeal to environmentally conscious consumers and businesses. As per bio-plasticizers market forecasts, these efforts are expected to reflect a broader industry shift toward innovation and sustainability in plasticizer manufacturing.

The report provides a comprehensive analysis of the competitive landscape in the bio-plasticizers market with detailed profiles of all major companies, including:

- Avient Corporation

- BASF SE

- DIC Corporation

- Dow Inc.

- DuPont de Nemours Inc.

- Emery Oleochemicals LLC

- Evonik Industries AG

- Lanxess AG

- Matrica S.p.A.

- OQ Chemicals GmbH

- Roquette Freres

- Solvay S.A.

Latest News and Developments:

- February 2025: BASF expanded its sustainable plasticizer portfolio with ISCC PLUS certification. The new biomass-balanced (BMB) and Ccycled products, including Palatinol DOTP Advantage 50 and TOTM Advantage 50, use renewable and plastic waste-derived feedstocks. These bio-based plasticizers offer lower CO2 footprints without altering product quality.

- January 2025: Versalis launched NAREGLAX, a high-purity, bio-based plasticizer made with 38% plant-origin carbon from European vegetable oils. It's phthalate-free and suitable for PVC, NBR, and CR, offering good low-temperature flexibility, electrical insulation, low migration, and weather resistance for wires, cables, films, and packaging.

- October 2024: TekniPlex Healthcare launched ISCC PLUS-certified bio-based PVC compounds matching the performance of conventional medical-grade PVC. Made with renewable energy and bio-attributed materials, these drop-in alternatives cut CO₂ emissions by up to 90% and are suited for tubing, films, and components in medical applications, without compromising regulatory or functional standards.

- October 2024: Evonik Oxeno announced an expansion of production for its INA-based plasticizers, ELATUR CH (DINCH) and ELATUR DINCD, at its Marl facility to meet increasing demand. The company emphasizes sustainability, offering biobased and biocircular raw materials for these products, ensuring a reliable supply and high quality for European customers.

Bio-plasticizers Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Epoxidized Soybean Oil (ESBO), Castor Oil-Based Plasticizers, Citrates, Succinic Acid, Others |

| Applications Covered | Packaging Materials, Consumer Goods, Automotive and Transport, Building and Construction, Textiles, Agriculture and Horticulture, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Avient Corporation, BASF SE, DIC Corporation, Dow Inc., DuPont de Nemours Inc., Emery Oleochemicals LLC, Evonik Industries AG, Lanxess AG, Matrica S.p.A., OQ Chemicals GmbH, Roquette Freres and Solvay S.A. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the bio-plasticizers market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global bio-plasticizers market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the bio-plasticizers industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The bio-plasticizers market was valued at USD 1.49 Billion in 2024.

The bio-plasticizers market is projected to exhibit a CAGR of 5.30% during 2025-2033, reaching a value of USD 2.43 Billion by 2033.

Key drivers include increasing demand for non-toxic and eco-friendly materials, stringent environmental regulations restricting phthalate use, and advancements in bio-based chemistry that enhance performance and application versatility across industries such as packaging, automotive, and medical devices.

North America currently dominates the bio-plasticizers market, accounting for a share of 35.0% in 2024, driven by regulatory enforcement, sustainability initiatives, and high demand in the packaging and construction sectors.

Some of the major players in the bio-plasticizers market include Avient Corporation, BASF SE, DIC Corporation, Dow Inc., DuPont de Nemours Inc., Emery Oleochemicals LLC, Evonik Industries AG, Lanxess AG, Matrica S.p.A., OQ Chemicals GmbH, Roquette Freres, Solvay S.A., etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)