Biogas Market Report Size, Share, Trends and Forecast by Feedstock, Application, End Use, and Region, 2025-2033

Biogas Market Overview:

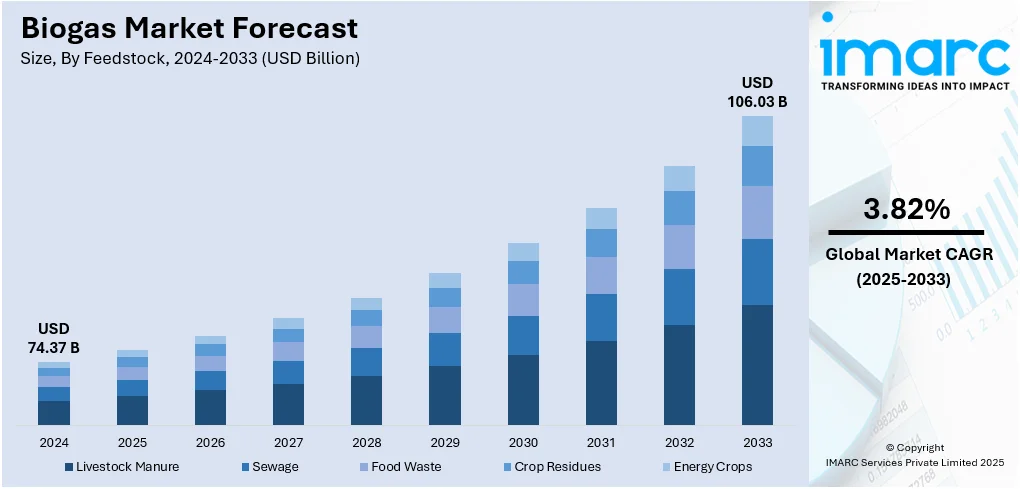

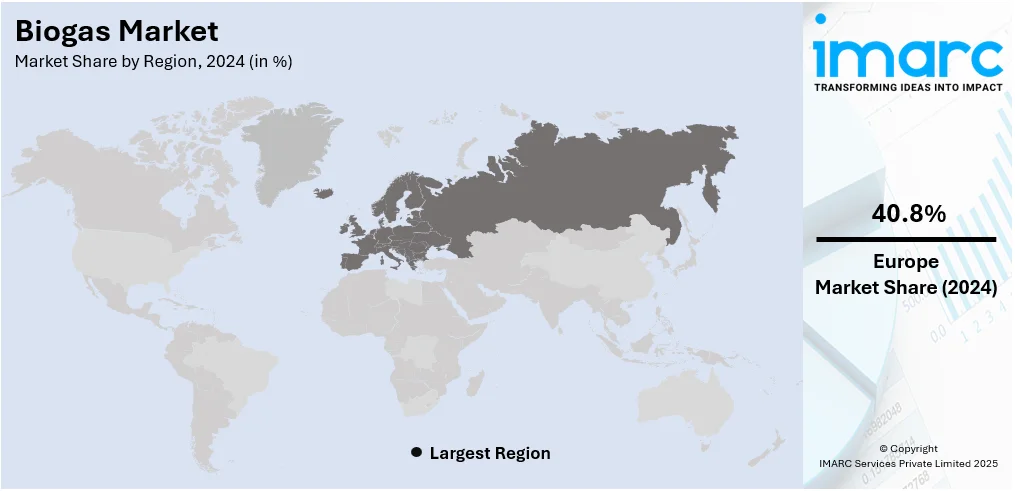

The global biogas market size was valued at USD 74.37 Billion in 2024. The market is projected to reach USD 106.03 Billion by 2033, exhibiting a CAGR of 3.82% during 2025-2033. Europe currently dominates the market, holding a significant market share of around 40.8% in 2024. The market is fueled by the escalating need for alternative energy sources and the mounting pressure to curb carbon emissions. Apart from that, the implementation of government incentives and policies encouraging the use of green energy technologies also fuels biogas production and use. Along with this, technological advancements in biogas, such as waste management system improvements and energy efficiency, also augments the biogas market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 74.37 Billion |

|

Market Forecast in 2033

|

USD 106.03 Billion |

| Market Growth Rate 2025-2033 | 3.82% |

The market is driven by increasing environmental concerns and the necessity to reduce the adverse impact of waste accumulation. Organic waste, posing a huge disposal problem, is efficiently handled by biogas as a waste-to-energy option. In addition, increased emphasis on circular economy principles promotes the employment of waste as a resource for energy production. Notably, in February 2025, AstraZeneca opened a biomethane plant in Lincolnshire, UK, in collaboration with Future Biogas under a 15-year contract. The plant will produce 100 GWh of green energy every year, meeting 20% of AstraZeneca's worldwide gas requirement. The project forms part of the firm's overall strategy of becoming net-zero by 2045, subject to its suppliers embracing green energy technology. The increased cost competitiveness of the biogas technology and the energy independence potential further drive its use. Also, the development of biogas storage and supply systems increases the ease of integrating them into established energy supply grids, fueling market growth and its scope of application across industries.

To get more information on this market, Request Sample

In the United States, the market is propelled by the country's focus on becoming energy-sustainable and minimizing carbon emissions. One of the significant biogas market trends is the implementation of national and state-level policies like renewable energy mandates, investments, and subsidies for clean energy technologies, supporting biogas development. Industry reports indicate that 2024 was a record year for the biogas industry, with 125 new biogas plants entering operation, totaling more than USD 3 billion in investment. This is a 17% rise in the number of projects and an investment increase of 40% over 2023. In addition to that, the increasing number of agricultural and food processing plants investing in biogas facilities to manage organic waste provides huge market potential. Furthermore, consumer demand for low-carbon energy substitutes increases demand for biogas as a greener and cleaner form of energy.

Biogas Market Trends:

Increasing Demand for Renewable Energy

The increasing demand for renewable energy is one of the most notable trends in the market. As climate change becomes a growing concern globally, there is a rising trend toward clean and sustainable forms of energy to decrease reliance on fossil fuels. According to industry reports, global energy demand grew by 2.2% in 2024, underscoring the urgency to transition toward cleaner sources. Moreover, governments and global agencies have framed ambitious goals for carbon neutrality and energy transition, which further increases the need for renewable energy options such as biogas. Biogas, being a renewable energy produced from organic wastes, is regarded as a viable substitute for conventional means of energy generation, i.e., coal and natural gas. In addition, biogas production enhances diversification of the energy mix, which enhances energy security and minimizes environmental effects. The trend is supported by beneficial policies, subsidies, and tax benefits to boost the installation of biogas infrastructure and enhance it as a competitive source of energy relative to traditional energy resources.

Increased Application of Biogas for Cooking

The rising use of biogas for cooking, as it produces fewer pollutants during cooking compared to any other fuel, is propelling the biogas market growth. Researchers estimated that gas stoves pump 2.6 Million tons of methane into the atmosphere each year, which is equivalent to 500,000 cars. In most developing nations, particularly in rural settings, the unavailability of clean and affordable cooking fuel is still a major challenge. Apart from this, biogas presents a low-cost and environmentally friendly alternative by processing organic waste materials, such as agricultural residues, manure from livestock, and food waste, to generate methane gas, which can be utilized as a cooking fuel. Biogas cooking not only helps in minimizing the reliance on conventional fuels like wood, charcoal, and LPG but also solves health problems associated with indoor air pollution resulting from biomass combustion. Besides, the extensive use of biogas systems in cooking helps to mitigate the emission of greenhouse gases and ensure sustainable waste management. As people become increasingly aware of the benefits, more businesses and households are using biogas as a cleaner option for cooking.

Technological Advancements in Biogas Production

Technological progress in biogas production has played an important role in enhancing the biogas market outlook. In the last few years, new technologies in the production process of biogas have increased efficiency and yield as well as the ability to transform organic waste into energy. Furthermore, continual advances in technology for anaerobic digestion, the main process utilized to generate biogas, have produced more efficient and cost-saving systems. Innovative biogas upgrading methods, such as photosynthetic CO₂ biofixation using microalgae, have demonstrated the ability to produce upgraded methane with CO₂ levels as low as 2% to 6%. Microbial electrolysis cell technology offers a sustainable and energy-efficient approach to biogas enhancement, while bioelectromethanogenesis has been shown to capture 13.2 g of CO₂ per day. Also, developments in biogas upgrading technology enable the cleaning of raw biogas to biomethane for injection into natural gas pipelines or for use as a fuel for vehicles. Such technological advancements not only enhance the economic viability of biogas production but also enhance its scalability for large-scale uses. As technology advances further, biogas is likely to become a more competitive and scalable clean energy option.

Biogas Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global biogas market, along with forecasts at the global, regional, and country levels from 2025-2033. The market has been categorized based on feedstock, application, and end use.

Analysis by Feedstock:

- Livestock Manure

- Sewage

- Food Waste

- Crop Residues

- Energy Crops

Energy crops lead the market in 2024. The sector contributes importantly to the growth and sustainability of the industry. These crops, grown specifically for their fast growth rates and high biomass output, like maize, switchgrass, and sorghum, offer a reliable and consistent supply of organic material perfectly suited for anaerobic digestion. In contrast to food waste or agricultural residues, energy crops have the potential to be optimized for peak biogas generation, increasing volume and methane content. Specialized cultivation enables greater supply chain control and quality, minimizing the likelihood of feedstock shortages. Energy crops also support the circular economy by processing renewable biomass to clean energy, minimizing the use of fossil fuels, and curbing greenhouse gas emissions. While governments and industries increasingly focus on renewable energy options, the role of energy crops in fueling and developing the biogas market keeps expanding, supporting the industry's long-term environmental and economic potential.

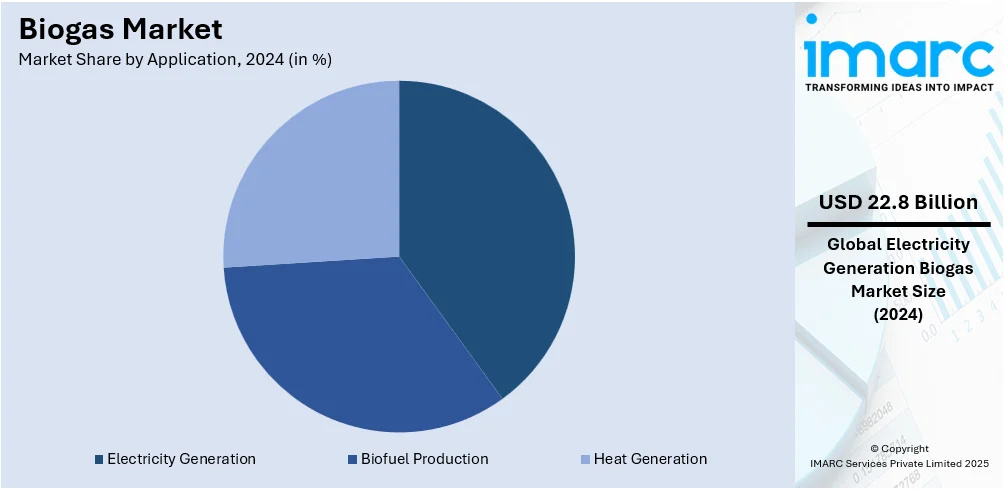

Analysis by Application:

- Electricity Generation

- Biofuel Production

- Heat Generation

Electricity generation leads the market with around 30.6% of market share in 2024. Biogas, being generated via the anaerobic breakdown of organic substrates, presents a renewable and sustainable energy source that can be efficiently converted to electricity. Using biogas for electricity generation reduces dependency on fossil fuels, and carbon emissions are lessened, allowing for cleaner electricity production. This utilization is particularly significant in rural and off-grid locations where conventional electricity is not readily available, and a decentralized and trusted power source is needed. Further, electricity production from biogas promotes grid stability through a constant power supply and has the potential to be combined with combined heat and power (CHP) systems for increased energy efficiency. With increasing global focus on renewable energy, electricity production is a fundamental use in the biogas industry that continues to spur technology development and policy incentives to promote a more sustainable energy future.

Analysis by End Use:

- Residential

- Commercial

- Industrial

Residential leads the market in 2024, reflecting increasing demand for clean and sustainable energy solutions at the domestic level. Biogas offers a green substitute for conventional energy sources like firewood, kerosene, and liquefied petroleum gas (LPG) for cooking and heating. Its use in the domestic environment decreases indoor air pollution, which is a serious health issue across much of the developing world. Also, utilizing biogas at home supports waste management through the transformation of organic waste from the home into energy, supporting circular economy practices. The cost-effectiveness and accessibility of small-scale biogas systems empower rural and peri-urban communities, boosting energy security and decreasing reliance on non-renewable energy sources. As environmental concerns increase and governments encourage the use of clean energy, the role of the residential sector in the biogas market increases further, contributing to sustainable development and enhanced living standards.

Regional Analysis:

- North America

- United States

- Canada

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, Europe accounted for the largest market share of over 40.8%, driven by robust environmental policies, leadership in adopting advanced technology, and increased targets for renewable energy. The implementation of policies such as greenhouse gas reduction and carbon neutrality has driven considerable investments in biogas infrastructure and research across the region. Germany, France, and the Netherlands are leading producers of biogas, backed by strong agricultural production bases that provide large quantities of feedstock like energy crops and farm residues. Europe's advanced regulation system, such as incentives and subsidies, promotes market development and the incorporation of biogas in the energy mix, particularly for power, heat, and fuel for transport. In addition, Europe's emphasis on sustainability and circular economy models supports greater biogas uptake as a leading renewable energy source. Therefore, Europe is not only a large market but also an epitome of biogas technology advancement and renewable energy best practices across the globe.

Key Regional Takeaways:

United States Biogas Market Analysis

In 2024, the United States holds a substantial share of around 83.30% of the biogas share in North America. The market in the United States is witnessing strong growth, driven by increasing emphasis on achieving energy independence and reducing greenhouse gas emissions. Federal and state-level incentives encourage investments in renewable energy projects, particularly those leveraging organic waste from agricultural, municipal, and industrial sources. According to industry reports, the U.S. administration has committed to reducing GHG emissions by 50–52% by 2030 and achieving net zero by 2050, reinforcing the urgency to scale biogas technologies as part of national decarbonization efforts. The shift towards circular economy practices is further promoting the adoption of biogas for electricity generation and vehicle fuel. Moreover, integration of biogas into the existing natural gas infrastructure is gaining traction, enhancing the market's scalability. Technological advancements in anaerobic digestion and gas upgrading systems are improving operational efficiency and expanding project viability. Additionally, growing interest from private investors and utilities in sustainable infrastructure is accelerating biogas facility development. The transportation sector’s focus on alternative fuels is also catalyzing demand for renewable natural gas derived from biogas. With a mature waste management system and progressive energy policies, the U.S. biogas market is poised for continued advancement.

Europe Biogas Market Analysis

The Europe market is expanding rapidly due to the region’s strong environmental regulations and ambitious carbon neutrality goals. Adoption of decentralized energy systems is increasing, particularly in rural and agricultural zones where biogas provides a sustainable power source. Asper industry reports, the region has set a new binding renewable energy target of at least 42.5% by 2030, a benchmark that is propelling the expansion of biogas infrastructure across member states. European directives promoting the use of bioenergy in heating and electricity are encouraging regional governments to fund biogas infrastructure. Innovation in biogas upgrading technologies is enhancing the quality of biomethane for injection into the gas grid, supporting wider adoption. The use of biogas in combined heat and power (CHP) applications is gaining momentum across various industrial settings, fostering energy efficiency. The region is boosting community-scale biogas plants to promote energy self-sufficiency and waste valorization, with increased utilization of organic waste streams and cross-border partnerships.

Asia Pacific Biogas Market Analysis

The market in Asia Pacific is evolving, driven by the region’s rising demand for clean energy amid rapid urbanization and industrialization. Government-led rural energy programs are promoting the use of biogas in off-grid areas for cooking and lighting, improving energy access. According to an industry report, clean energy investment in Southeast Asia reached USD 47 Billion in 2025, highlighting increasing financial momentum toward renewable technologies like biogas. Growing environmental concerns are encouraging industries to adopt biogas solutions for managing organic waste and reducing emissions. Urban municipalities are exploring biogas options to process increasing volumes of food and sewage waste sustainably. The agricultural sector is also seeing a shift towards biogas systems to manage livestock waste while generating additional income streams. The integration of biogas with smart farming practices is gaining popularity in regions, promoting operational sustainability, indoor air pollution reduction, and public health improvement.

Latin America Biogas Market Analysis

In Latin America, the market is gaining momentum, fueled by growing interest in diversifying energy sources and reducing dependence on fossil fuels. Regional governments emphasize waste-to-energy models as a solution to growing municipal and agro-industrial waste. According to industry reports, approximately 45% of urban solid waste is organic, primarily food scraps and garden waste, creating significant biogas generation potential from readily available feedstock. The abundance of organic waste from sugarcane, livestock, and food processing sectors is creating ample feedstock for biogas production. Biogas is being explored for cost-effective power generation in remote regions, supported by energy cooperatives, renewable energy hubs, and educational initiatives, predicting gradual growth in Latin America.

Middle East and Africa Biogas Market Analysis

The market in the Middle East and Africa is expanding gradually, propelled by efforts to enhance energy diversification and utilize organic waste efficiently. In many regions, agricultural waste and livestock residues are being converted into biogas to support rural electrification goals. As reported, NWC succeeded in producing 600 kWh of electricity from biogas at the Ajyal plant in Saudi Arabia to cover 30% of its own electricity consumption. The push for off-grid energy solutions is encouraging local adoption of small-scale biogas units. Biogas is being utilized in decentralized sanitation systems to enhance public hygiene and waste management, with educational outreach and pilot projects promoting its environmental and economic benefits.

Competitive Landscape:

The market is characterized by a combination of established companies and upstart startups working in the renewable energy space. Apart from this, firms are employing various tactics such as partnerships, mergers, and acquisitions in order to augment their market position and increase their production capacity. Besides this, technological innovations, including advancements in more effective biogas production techniques and better waste-to-energy technologies, are responsible for defining competition. Furthermore, the growing demand for environmentally friendly and affordable energy solutions fuels innovation in the market. Governments as well as regulatory agencies further impact competition through regulations, incentives, as well as subsidies to encourage green energy technologies. Market players are keenly engaging in research and development to increase biogas efficiency, decrease the cost of production, and comply with environmental standards. According to the biogas market forecast, the growing emphasis on lowering carbon imprints and shifting to renewable energy is predicted to drive competition across the globe, which will further drive innovation in biogas technology.

The report provides a comprehensive analysis of the competitive landscape in the biogas market with detailed profiles of all major companies, including:

- Air Liquide S.A.

- Engie SA

- EnviTec Biogas AG

- Gasum Oy

- Hitachi Zosen Inova AG (Hitachi Zosen Corporation)

- IES BIOGAS srl

- PlanET Biogas Group GmbH

- Scandinavian Biogas Fuels International AB

- TotalEnergies SE

- Wärtsilä Oyj Abp

- WELTEC BIOPOWER GmbH

- Xebec Adsorption Inc.

Latest News and Developments:

- April 2025: A pilot biogas plant was launched in Karachi to convert kitchen and animal waste into biogas and organic fertiliser. The facility processed 10 kg of garbage daily, generating 3 kg of biogas. The mayor supported scaling the initiative, while waste segregation and recycling plans were also underway.

- April 2025: Wärtsilä secured orders to supply bioLNG production systems for two large biogas projects in Finland. Each plant, backed by Suomen Lantakaasu Oy, will produce 25 tons of bioLNG daily from manure and food waste. The projects aimed to cut emissions from agriculture and transport and begin operations by 2026.

- March 2025: Kochi launched trial operations at its Brahmapuram compressed biogas plant, using cow dung as feedstock. Designed to process 150 Tons of food waste daily, the plant would supply gas to BPCL. The INR 80 Crore facility was completed ahead of schedule and included bio-segregation units to enhance organic waste management.

- January 2025: BPCL partnered with HDMC to develop an INR 68 Crore compressed biogas facility in Sivalli village, designed to process 144 Tons of wet waste daily. BPCL is committed to operating the plant for 25 years under a free lease, aiming to produce 5 tonnes of compressed biogas and promote sustainable waste use.

Biogas Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Feedstocks Covered | Livestock Manure, Sewage, Food Waste, Crop Residues Energy Crops |

| Applications Covered | Electricity Generation, Biofuel Production, Heat Generation |

| End Uses Covered | Residential, Commercial, Industrial |

| Region Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Air Liquide S.A., Engie SA, EnviTec Biogas AG, Gasum Oy, Hitachi Zosen Inova AG (Hitachi Zosen Corporation), IES BIOGAS srl, PlanET Biogas Group GmbH, Scandinavian Biogas Fuels International AB, TotalEnergies SE, Wärtsilä Oyj Abp, WELTEC BIOPOWER GmbH and Xebec Adsorption Inc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the biogas market from 2019-2033.

- The biogas market research report provides the latest information on the market drivers, challenges, and opportunities in the global market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the biogas industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

Biogas market was valued at USD 74.37 Billion in 2024.

Biogas market is projected to exhibit a CAGR of 3.82% during 2025-2033, reaching a value of USD 106.03 Billion by 2033.

The market is driven by the rising demand for renewable energy, increasing government support for green energy solutions, advancements in technology, environmental awareness, and the need to reduce greenhouse gas emissions. Additionally, the growing adoption of sustainable waste management practices and the potential for waste-to-energy solutions contribute significantly to market growth.

Europe currently dominates the biogas market with a market share of around 40.8%. The region’s strong emphasis on renewable energy policies, extensive investment in green infrastructure, government incentives, and established biogas production capacity are key drivers behind its market leadership. The region's commitment to sustainability and carbon reduction fuels further growth.

Some of the major players in the biogas market include Air Liquide S.A., Engie SA, EnviTec Biogas AG, Gasum Oy, Hitachi Zosen Inova AG (Hitachi Zosen Corporation), IES BIOGAS srl, PlanET Biogas Group GmbH, Scandinavian Biogas Fuels International AB, TotalEnergies SE, Wärtsilä Oyj Abp, WELTEC BIOPOWER GmbH and Xebec Adsorption Inc., among others.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)