Bioreactors Market Size, Share, Trends, and Forecast by Type, Usage, Scale, Control Type, and Region, 2025-2033

Bioreactors Market Size and Share:

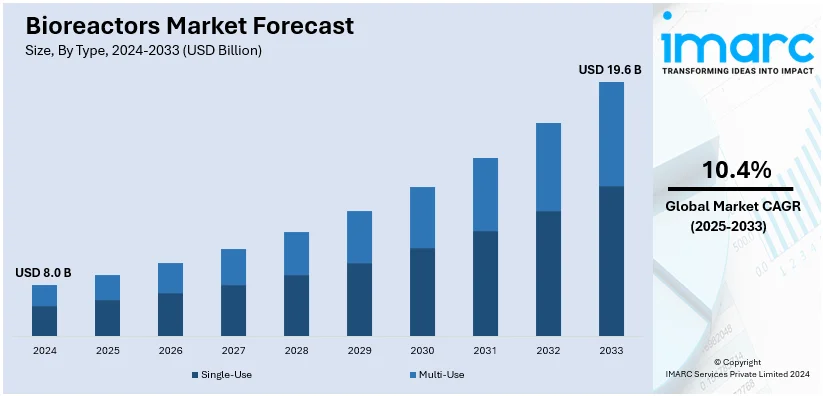

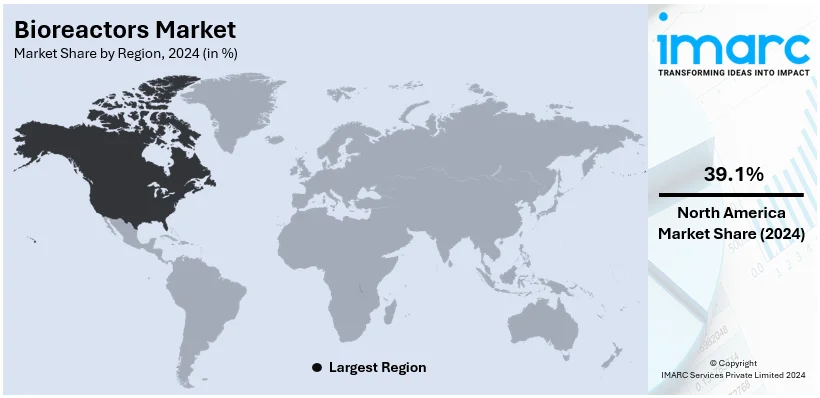

The global bioreactors market size was valued at USD 8.0 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 19.6 Billion by 2033, exhibiting a CAGR of 10.4% during 2025-2033. North America currently dominates the market, holding a significant market share of over 39.1% in 2024. The increasing adoption of effective treatment drugs, along with the rising need for preventive vaccines, is primarily propelling the bioreactors market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 8.0 Billion |

|

Market Forecast in 2033

|

USD 19.6 Billion |

| Market Growth Rate 2025-2033 | 10.4% |

The global bioreactors market is experiencing growth due to the rising demand for biologics, including monoclonal antibodies and vaccines. This can be attributed to the advancements in biopharmaceutical production. Along with this, the increasing adoption of single-use bioreactors, known for reduced contamination risks and operational costs, is further accelerating market growth. Rapid advancements in cell and gene therapy research, and growing interest in personalized medicine, are also propelling demand. Apart from this, government support for biologics manufacturing and favorable regulations for biosimilar production are contributing to the market's expansion. Moreover, technological improvements in automation and control systems are enhancing bioreactor performance, addressing the needs of the biotechnology and pharmaceutical industries, and fueling the market.

The United States stands out as a key market, driven by the growing focus on biosimilar production. This can be supported by the patent expirations of major biologics and the increasing affordability of these alternatives. In addition, the increasing prevalence of chronic diseases is encouraging biopharmaceutical investments, fueling the need for scalable and efficient bioreactor systems. As per 2024 research report by the CDC, in the United States, 129 million individuals have at least one major chronic disease defined by the US Department of Health and Human Services, such as heart disease, cancer, diabetes, obesity, or hypertension, with 42% having two or more and 12% having at least five. Chronic diseases account for five of the top 10 leading causes of death. Their prevalence has steadily increased over two decades and is expected to rise further. Besides this, expansion in bioprocessing applications, such as stem cell research and tissue engineering, is creating significant demand for specialized bioreactors. Concurrently, collaborations between academic institutions and biotech companies are accelerating advancements in biomanufacturing techniques. Furthermore, the increasing role of bioreactors in food and agricultural biotechnology is creating a positive bioreactors market outlook.

Bioreactors Market Trends:

Usage of Single-Use Bioreactors

Single-use bioreactors (SUBs) are gaining extensive popularity, owing to their benefits, such as flexibility, cost-effectiveness, reduced risk of contamination, etc. This, in turn, is stimulating the market. According to the IMARC, the global single-use bioreactors market size reached USD 3.4 Billion in 2023. Looking forward, IMARC Group expects the market to reach USD 11.1 Billion by 2032, thereby exhibiting a growth rate (CAGR) of 13.8% during 2024-2032. Moreover, unlike traditional stainless-steel bioreactors, SUBs adopt disposable bags, which aids in eliminating the need for extensive cleaning and sterilization between batches. In December 2023, Cellexus introduced airlift single-use disposable bioreactor systems that offer optimal aeration for the rapid growth of cells. This method of gentle agitation is usually suitable for microbial fermentation and cell culture. Besides this, key players are also producing innovative SUB designs, catering to both small-scale research and large-scale production needs, which is fueling the bioreactors market outlook. For instance, in February 2024, the contract development and manufacturing organization (CDMO), WuXi Biologics, announced the construction of a single-use site with approximately 54,000 L of disposable bioreactor capacity via an investment of roughly approximately USD 340 Million in Ireland. Additionally, in March 2024, Thermo Fisher Scientific™ launched a series of application-specific enhancements to the HyPerforma™ single-use bioreactor (SUB) product platform, each tailored to the unique requirements of intensified fed-batch, perfusion, and adherent cell cultures. Similarly, in March 2024, Distek, Inc. unveiled a single-use bioreactor (SUB) system for mammalian cell growth and recombinant protein production. Furthermore, continuous collaborations among prominent companies are projected to augment the market in the coming years. For example, in June 2024, Aragen Bioscience and Getinge announced the successful validation of the latter's single-use production reactors (SUPR). In line with this, the collaboration combined Getinge's innovative single-use technology and Aragen's expertise in biopharmaceutical manufacturing.

Advancements in Automation

On of the significant bioreactors market trends is continual advancements in automation. The widespread integration of novel control systems and automation with bioreactors is revolutionizing bioprocessing by enabling precise control over critical parameters, such as pH, temperature, dissolved oxygen, etc., and real-time monitoring. This is acting as a significant growth-inducing factor. For instance, in August 2023, Repligen Corporation and Sartorius introduced an integrated bioreactor system that comprises a fully compatible embedded XCell ATF software and hardware module offering predefined advanced control recipes with integrated process analytical technology (PAT). According to Gartner, by 2026, 30% of enterprises will automate over half of network activities, up from 10% in 2023, as AI-driven automation, including GenAI, boosts operational efficiency and agility. These advancements are increasingly applied in bioreactors, enhancing data-driven decision-making and process optimization. Additionally, the system aims to provide users with a streamlined way to control cell growth and enhance cell retention in perfusion processes without utilizing a separate cell retention control tower. Besides this, in September 2023, Automated Control Concepts (ACC), one of the innovators in biotechnology solutions, released its cutting-edge bioreactor control and data platform, Lab Owl, that allows for adjustment of multiple process parameters and precise monitoring, resulting in consistent and reproducible outcomes. Apart from this, in December 2023, Cultzyme launched a bioreactor intelligent operative nanotechnology (BION) system equipped with AI, hardware, and cloud computing to control the biomanufacturing process and achieve consistent outcomes more efficiently and at minimal costs. Furthermore, the escalating demand for advanced control systems, as they facilitate seamless scale-up from laboratory to production scale, which aids in ensuring consistent performance across numerous bioreactor sizes, is also increasing the bioreactors market revenue. For instance, in April 2024, Culture Biosciences created bioreactors with advanced control systems and real-time monitoring capabilities designed to accommodate Chinese Hamster Ovary (CHO) cells.

Development of Sustainable Bioprocessing

Sustainability is becoming a critical consideration in the market. Prominent players are focusing on minimizing energy consumption and waste generation, which is stimulating the bioreactors market growth. In October 2023, a team of researchers at the Nara Institute of Science and Technology and Fujita University introduced a hybrid in silico/in-cell controller (HISICC) that seamlessly integrates computerized feedforward control with genetically modified living cells, offering the potential for cost-effective and eco-friendly chemical and fuel production. Besides this, in November 2023, ADM and Solugen formed a strategic partnership to build an approximately 500,000-ft2 biomanufacturing facility to develop molecules to replace existing fossil fuel-based materials and scale its line of lower-carbon organic acids. For instance, the UK has invested approximately USD 14 Million in 21 cross-sector collaborations to advance sustainable biomanufacturing, focusing on bioreactor innovations and biocatalytic processes, such as scalable continuous flow reactors for paracetamol production. These initiatives aim to enhance the sustainability profile of biotechnology processes and support the UK's goal of achieving Net Zero by 2050. Moreover, bioreactor manufacturers are investing in several innovations in bioreactor design, such as more efficient mixing and aeration systems, which is elevating the popularity of greener bioprocessing solutions. For example, Boehringer Ingelheim offers bioprocess technology operations in animal health with an improved focus on environmental sustainability. In line with this, from continuously discussing and evaluating current practices to optimizing process chains for antigenic biological manufacturing, the company is strongly committed to minimizing its environmental footprint. Additionally, in March 2024, the UK Research and Innovation (UKRI) announced 21 cross-sector collaborations to drive advancements in sustainable biomanufacturing across the country.

Bioreactors Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global bioreactors market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on type, usage, scale, control type, and region.

Analysis by Type:

- Single-Use

- Multi-Use

Multi-use stands as the largest component in 2024, holding around 65.9% of the market. Multi-use bioreactors are the most versatile, cost-effective, and efficient bioreactors for diverse bioproduction processes. They are used in a wide range of pharmaceutical, biotechnology, and research applications because they can accommodate various cell culture and fermentation processes. Their design is robust, reusable, and scalable, making them ideal for large-scale manufacturing and experimental applications. Multi-use bioreactors are in line with the industry's demand for high-quality production and sustainable practices, as they reduce operational costs and ensure consistent performance. Their adaptability to advanced technologies further reinforces their position as the largest and most impactful segment in the bioreactors market.

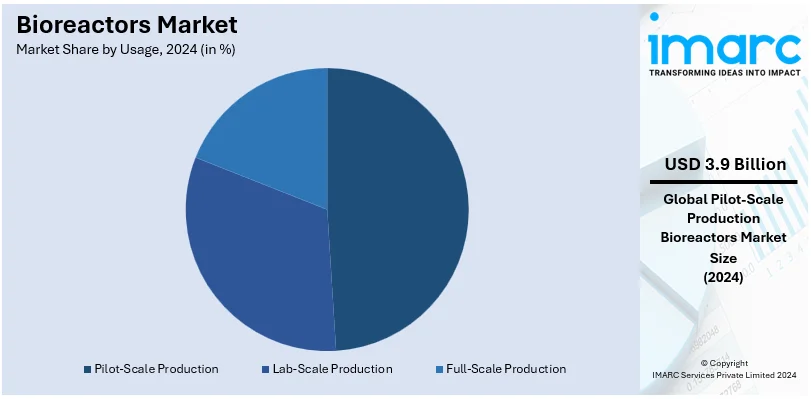

Analysis by Usage:

- Lab-Scale Production

- Pilot-Scale Production

- Full-Scale Production

Pilot-scale production leads the market with around 49.1% of market share in 2024. Pilot-scale production in bioreactors serves as a crucial intermediary step between laboratory research and full-scale manufacturing in the biopharmaceutical industry. This phase allows for the optimization of bioprocesses on a scale that closely mimics commercial production, providing valuable insights into process performance, scalability, and reproducibility. Pilot-scale bioreactors typically range from 50 to 500 liters in capacity. For instance, in January 2024, San Francisco-based SciFi Foods announced the successful completion of its first commercial bioreactor facility in San Leandro, California. They are used to test and refine production parameters such as cell growth, nutrient consumption, and product yield under conditions that replicate those of large-scale operations. Additionally, pilot-scale production facilitates regulatory compliance by generating data required for process validation and quality assurance. Companies like GE Healthcare and Sartorius offer advanced pilot-scale bioreactor systems equipped with sophisticated monitoring and control technologies, enabling precise control over critical process parameters and ensuring a seamless transition to large-scale manufacturing.

Analysis by Scale:

- 5L-20L

- 20L-200L

- 200L-1500L

- Above 1500L

200L-1500L leads the market with around 47.8% of market share in 2024. Bioreactors are designed in various scales to meet the needs of different stages of bioprocessing, from research and development to full-scale commercial production. Bioreactors in the 200L to 1500L range are used for pilot-scale production, providing a realistic simulation of commercial-scale operations and facilitating the validation of production processes. These bioreactors hold significant prominence in the biopharmaceutical sector due to their versatility and scalability. These systems bridge the gap between laboratory-scale research and large-scale manufacturing, enabling efficient process optimization and technology transfer. Their adoption is driven by the rising demand for biologics, including monoclonal antibodies and vaccines, which require consistent and reproducible production environments.

Analysis by Control Type:

- Manual

- Automated

Automated leads the market with around 65.9% of market share in 2024. Automated bioreactors are revolutionizing bioprocessing by integrating advanced control systems that enhance precision, efficiency, and scalability. They allow for real-time monitoring and control of critical parameters, including temperature, pH, dissolved oxygen, etc. The system's automation capabilities minimize human intervention, thereby reducing the risk of contamination and errors while optimizing cell growth and product yield. For example, in May 2024, a team of researchers at Florida International University developed an automated 3D-printed bioreactor to grow bone in the lab. Additionally, biopharmaceutical manufacturers offer versatile and robust solutions to enhance productivity and maintain high standards of quality and compliance. For instance, in September 2023, Automated Control Concepts (ACC), one of the leading innovators in biotechnology solutions, announced the development of its cutting-edge bioreactor control and data platform, Lab Owl, to redefine the landscape of bioprocessing.

Regional Analysis:

- North America

- United States

- Canada

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, North America accounted for the largest market share of over 39.1%. The North America bioreactors market is witnessing robust growth, fueled by the region's strong emphasis on biopharmaceutical research, development, and manufacturing. Additionally, advancements in bioprocessing technologies, such as single-use bioreactors and automation, are enhancing the efficiency and scalability of biomanufacturing processes. The presence of major pharmaceutical and biotechnology companies, coupled with supportive government initiatives and funding, is further propelling the bioreactors market demand. In February 2024, Thermo Fisher Scientific expanded its manufacturing capacity at its Missouri, U.S. site to produce complex biologic treatments for a range of diseases, including cancer, autoimmune conditions, and rare disorders. Furthermore, the North America bioreactors market is poised for continued growth, driven by technological advancements and increasing biopharmaceutical production demands. For instance, in March 2023, Micro Digital Co. signed a formal contract to supply bioreactors to expand its presence in North America.

Key Regional Takeaways:

United States Bioreactors Market Analysis

In 2024, US accounted for around 87.6% of the total North America bioreactors market. The United States is at the forefront of adopting bioreactor technology, significantly advancing its position in biotechnology and pharmaceutical manufacturing. Bioreactors are streamlining the production of biologics, including vaccines, monoclonal antibodies, and regenerative medicine solutions, addressing both domestic and global healthcare needs. Key advantages include higher production efficiency, scalability, and enhanced process control, enabling faster responses to medical demands. Innovations such as single-use bioreactors are reducing costs and contamination risks while supporting sustainability goals. For instance, The United States, as the world's third-largest importer of bioreactors with 191 shipments, primarily sources from Mexico, India, and Canada. This strategic importation supports advancements in biotechnology and pharmaceuticals, bolstering the nation's innovation and economic growth. Major states like California, Massachusetts, and North Carolina, with robust biotechnology clusters, are hubs for bioreactor deployment, fostering collaborations and driving R&D. These advancements are further strengthening the U.S. position as a leader in life sciences, with companies and research centers contributing to breakthroughs in personalized medicine and cell-based therapies. Bioreactors are transforming industries beyond healthcare, including biofuels and agriculture, enhancing resource management and sustainability efforts across diverse sectors.

Asia Pacific Bioreactors Market Analysis

The Asia-Pacific region is emerging as a significant hub for bioreactor adoption, driven by advancements in biotechnology and the region's focus on pharmaceutical and biopharmaceutical development. Countries such as China, India, Japan, and South Korea are leveraging bioreactor technologies to enhance vaccine production, biologics manufacturing, and regenerative medicine. These innovations are enabling cost-effective and scalable production processes, crucial for meeting the demands of growing healthcare markets. For instance, India imported 2,480 bioreactor shipments from March 2023 to February 2024, primarily from the United States, Switzerland, and Germany. This significant import activity underscores India's commitment to advancing its biotechnology sector, enhancing research capabilities, and fostering economic growth. The region’s favorable regulatory frameworks and substantial investments in research hubs, particularly in cities like Shanghai, Hyderabad, and Tokyo, are positioning Asia-Pacific as a leader in bioprocessing. The adoption of single-use bioreactors in South Korea's biopharmaceutical industry and China's focus on monoclonal antibody production exemplify the region's dynamic advancements. With strategic location advantages, including proximity to raw materials and skilled labor, Asia-Pacific is fostering sustainable biotechnology growth, meeting global supply demands, and addressing critical healthcare challenges.

Europe Bioreactors Market Analysis

The adoption of bioreactors in Europe is significantly transforming industries like pharmaceuticals and biotechnology by advancing production efficiency and sustainability. Bioreactors enable precise environmental control, enhancing the yield of biologics and biofuels while reducing waste and resource consumption. Europe, particularly Germany and Switzerland, leads in bioreactor innovation, leveraging advancements in automation and sensor technologies to optimize processes. Germany’s pharmaceutical hubs utilize bioreactors to streamline vaccine production, meeting global health demands rapidly. Similarly, Switzerland’s biotechnology sector has integrated bioreactors to enhance monoclonal antibody manufacturing, positioning the country as a leader in therapeutic advancements. Switzerland's export of bioreactors and effluent treatment equipment significantly benefits Europe by enhancing wastewater management and environmental sustainability. In 2024, Switzerland exported 2,474 shipments of MBR bioreactor treatment plant sections and related equipment, indicating robust trade activity in this sector. The widespread adoption across European countries, including the Netherlands and France, emphasizes the region's commitment to green technology and reduced carbon footprints. By fostering innovation hubs and research centers, Europe strengthens its position in global biotechnology, offering scalable solutions that address industrial and environmental challenges while maintaining a competitive edge in life sciences.

Latin America Bioreactors Market Analysis

The adoption of bioreactors in Latin America is revolutionizing biotechnology and sustainable production. Advancements in scalable cell culture and fermentation technologies enable efficient vaccine development and bio-based manufacturing. Countries like Brazil are leveraging bioreactors for ethanol production from sugarcane, enhancing renewable energy output. Similarly, Mexico utilizes bioreactors in pharmaceutical innovation, improving drug manufacturing. According to reports, The Mexico small-scale bioreactors market is projected to grow from USD 36.9 Million in 2018 to USD 154.1 Million by 2032, driven by increasing adoption in medical, food, agriculture, and energy sectors. These innovations position Latin America as a global hub for biotechnological progress. Strategically located near global trade routes, the region fosters economic growth through exports. States such as São Paulo and Jalisco exemplify leadership, driving technological adoption to support environmental sustainability and economic development.

Middle East and Africa Bioreactors Market Analysis

The Middle East and Africa are rapidly embracing bioreactors, revolutionizing biotechnology, and healthcare sectors. Bioreactors offer advantages such as enhanced cell growth, scalability, and precise environmental control, fostering innovation in pharmaceutical production and wastewater treatment. According to reports, the United Arab Emirates imported 12 bioreactor shipments, ranking 22nd globally. India led with 2,480 shipments, followed by Vietnam with 225, and the United States with 209. Advancements in single-use bioreactors and automation have streamlined operations, making them accessible to emerging markets. For instance, Saudi Arabia is utilizing bioreactors for vaccine manufacturing, ensuring local supply chains, while South Africa is employing them in biofuel production to address energy sustainability. Strategic positioning in these regions promotes economic diversification and self-reliance, making bioreactors a pivotal tool for regional growth.

Competitive Landscape:

The bioreactors market forecast indicates strong competition in the market, as key players iare focusing on innovation to enhance efficiency and scalability in bioprocessing. They are investing in advanced technologies such as single-use systems to meet the growing demand for flexible and cost-effective solutions. Companies are also expanding their portfolios to include modular and custom bioreactors tailored to specific applications such as cell and gene therapy. Along with this, partnerships with biotech firms and research institutions are strengthening R&D efforts, fostering the development of next-generation bioreactors. Additionally, manufacturers are leveraging automation and digital monitoring tools to improve process control and product quality.

The report provides a comprehensive analysis of the competitive landscape in the bioreactors market with detailed profiles of all major companies, including:

- 2mag AG

- bbi-biotech GmbH

- Bioengineering AG

- Eppendorf SE

- Getinge AB

- Infors AG

- Merck KGaA

- Pall Corporation (Danaher Corporation)

- Sartorius AG

- Solaris Biotechnology Srl

- Thermo Fisher Scientific Inc.

Latest News and Developments:

- October 2024, VFL Sciences, a Chennai-based company, unveiled its GreatFlo parallel bioreactors and fermentors. These systems are designed to enhance bioprocess scalability and efficiency, catering to industries like pharmaceuticals and biotechnology. The announcement was made during an event led by the Managing Director of BIRAC, Dr. Niraj Kumar. The GreatFlo systems aim to support advanced research in bioprocessing with cutting-edge technology.

- October 2024, Univercells Technologies by Donaldson introduced the Scale-X Nexo bioreactor, an innovative solution for cell culture processes. The bioreactor integrates scalable production capabilities with precision control for biopharmaceutical manufacturing. This launch emphasizes efficient bioprocess workflows while supporting the growing demand for cell and gene therapy advancements. The system is tailored for seamless scale-up from laboratory to industrial levels.

- June 2024: Aragen Bioscience and Getinge achieved successful validation of single-use production reactors (SUPR), emphasizing their compatibility for large-scale recombinant antibody production. This development marks a significant step toward cost-effective and flexible biopharmaceutical manufacturing. The SUPR technology enhances efficiency by reducing contamination risks and turnaround time. Their partnership underlines the shift toward innovative and scalable bioprocessing solutions.

- May 2024, Multiply Labs and Wilson Wolf Corporation announced their collaboration to automate the G-Rex® bioreactor for cell therapy manufacturing. This partnership focuses on integrating robotics to streamline and scale the production of advanced therapies. The G-Rex® bioreactor is pivotal in cell culture optimization, aiming to meet the increasing demand for cell-based treatments. The automation aims to reduce manual intervention, ensuring consistent and efficient therapeutic output.

- May 2024: Multiply Labs joined forces with Wilson Wolf to automate the G-Rex® bioreactors, aiming to revolutionize cell therapy manufacturing. This collaboration integrates robotics into bioreactor systems, optimizing the production of individualized therapies. The automation enhances consistency, scalability, and efficiency in manufacturing processes. It signifies a milestone in precision medicine, addressing the growing demand for advanced cell therapies.

- May 2024: Researchers at Florida International University unveiled an automated 3D-printed bioreactor designed to grow bone in laboratory settings. This innovation provides a groundbreaking approach to studying bone regeneration and developing therapeutic solutions. The bioreactor’s automation ensures precise control over the growth environment, accelerating research in regenerative medicine. It opens new avenues for personalized and efficient bone tissue engineering.

Bioreactors Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Single-Use, Multi-Use |

| Usages Covered | Lab-Scale Production, Pilot-Scale Production, Full-Scale Production |

| Scales Covered | 5L-20L, 20L-200L, 200L-1500L, Above 1500L |

| Control Types Covered | Manual, Automated |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | 2mag AG, bbi-biotech GmbH, Bioengineering AG, Eppendorf SE, Getinge AB, Infors AG, Merck KGaA, Pall Corporation (Danaher Corporation), Sartorius AG, Solaris Biotechnology Srl, Thermo Fisher Scientific Inc., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the bioreactors market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the global bioreactors market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the bioreactors industry and its attractiveness.

- The competitive landscape allows stakeholders to understand their competitive environment and provides insight into the current positions of key players in the market.

Key Questions Answered in This Report

The bioreactors market was valued at USD 8.0 Billion in 2024.

IMARC estimates the bioreactors market to exhibit a CAGR of 10.4% during 2025-2033, reaching a value of USD 19.6 Billion by 2033.

The bioreactors market is driven by the increasing demand for biologics, including monoclonal antibodies and vaccines, advancements in biopharmaceutical production, adoption of single-use bioreactors, growing interest in personalized medicine, and supportive government regulations for biosimilar manufacturing.

North America currently dominates the bioreactors market, accounting for a share exceeding 39.1%. This dominance is fueled by strong biopharmaceutical research, advancements in bioprocessing technologies, and the presence of major biotech firms in the region.

Some of the major players in the bioreactors market include 2mag AG, bbi-biotech GmbH, Bioengineering AG, Eppendorf SE, Getinge AB, Infors AG, Merck KGaA, Pall Corporation (Danaher Corporation), Sartorius AG, Solaris Biotechnology Srl, and Thermo Fisher Scientific Inc., among others.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)