Biotech Ingredients Market Size, Share, Trends and Forecast by Type, Application, and Region, 2025-2033

Biotech Ingredients Market Size and Share:

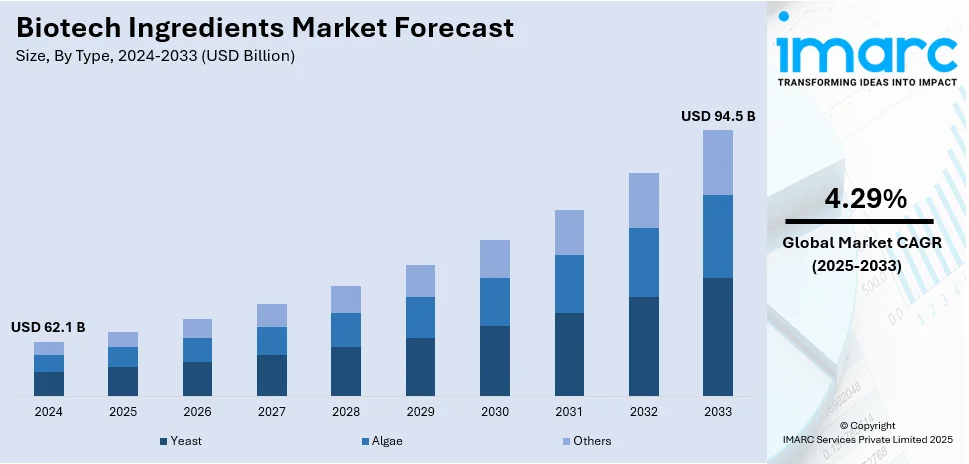

The global biotech ingredients market size was valued at USD 62.1 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 94.5 Billion by 2033, exhibiting a CAGR of 4.29% from 2025-2033. Europe currently dominates the market, holding a market share of over 37.6% in 2024. The biotech ingredients market share is expanding, driven by innovations in biotechnology, increasing demand for sustainable items across numerous sectors, and the expanding product applications in pharmaceutical and cosmetic industries, reinforced by rapid research efforts.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 62.1 Billion |

|

Market Forecast in 2033

|

USD 94.5 Billion |

| Market Growth Rate (2025-2033) | 4.29% |

The rising demand for natural and sustainable items in industries like food and beverage (F&B) is impelling the market growth. People prefer eco-friendly and plant-based alternatives, encouraging companies to develop biotech-derived ingredients. Besides this, advancements in biotechnology help to produce high-quality and lab-developed substances that replace synthetic or animal-based options. Additionally, the pharmaceutical industry drives the demand by using biotech ingredients in drug formulations and vaccines. Apart from this, in cosmetics, brands focus on bio-based active ingredients for skincare and personal care items. Stricter regulations on synthetic chemicals further encourage companies to shift toward biotech solutions.

The United States has emerged as a major region in the biotech ingredients market owing to many factors. The increasing demand for sustainable and natural alternatives in pharmaceuticals is fueling the biotech ingredients market growth. Individuals choose eco-friendly and bio-based products, motivating regional firms to invest in biotechnology. In cosmetics, brands adopt biotech-derived active ingredients for skincare and personal care, further replacing synthetic chemicals. The F&B industry also benefits from biotech processes to create healthier items. Besides this, strict regulations encourage companies to employ safer biotech-oriented solutions. Additionally, advancements in genetic engineering and fermentation technology make production more efficient and cost-effective. Moreover, government support for research in biotechnology assists in finding innovations, leading to the development of environment-friendly solutions. As per the information provided on the official website of the United States Government, in May 2024, the US Environmental Protection Agency (EPA), the US Food and Drug Administration (FDA), and the US Department of Agriculture (USDA) created a strategy to revise, simplify, and elucidate their regulations and oversight processes for biotechnology products. The strategy aimed to aid in achieving the President’s objectives of fostering public trust in the biotechnology regulatory framework while enhancing its transparency, predictability, coordination, and efficiency.

Biotech Ingredients Market Trends:

Rising Demand for Sustainable and Natural Ingredients

According to the biotech ingredients market research report, the increasing popularity of sustainable and natural ingredients is a crucial trend observed in the global market. People currently prefer bio-based products in sectors, such as F&B and pharmaceutical. This notable shift is primarily led by concerns related to environmental sustainability and increased prohibition of synthetic chemicals usage in various items. For instance, in January 2024, New Zealand announced a permanent ban on ‘Per- and Polyfluoroalkyl Substances’ (PFAS), a large and complex group of toxic synthetic chemicals used in cosmetics, which could cause testicular and kidney cancer and alteration in liver enzymes. The ban was said to take effect on December 31, 2026. Consequently, key players are actively investing in formulating biotech alternatives like plant-derived and fermentation-based ingredients. Such sustainable products not only mitigate the rising environmental apprehensions but also provide better safety solutions, presenting opportunities for manufacturers to address the changing customer preferences while improving both competitiveness and brand value.

Advancements in Biotechnology and Synthetic Biology

Innovations in biotechnology and synthetic biology are impelling the biotech ingredients market growth. New techniques, encompassing fermentation methodologies and gene editing, enable the effective formulation of excellent-quality ingredients with improved efficacy. Such advancements allow the development of specialized ingredients for specific applications in F&B production, pharmaceuticals, or cosmetics. In addition, synthetic biology is reducing reliance on conventional raw materials, minimizing environmental impact, and lowering the costs of manufacturing processes, thus supporting the market expansion. Furthermore, such technological improvements are encouraging more innovations in biotech ingredients, leading to a better sustainability profile. Companies are working to create better and reliable items and broaden their reach. For instance, in May 2024, Integrated DNA Technologies, a prominent genomics solutions provider, announced the expansion of its synthetic biology operations by unveiling a new 25,000-square facility, elevating its production capacity and upgrading its gene synthesis portfolio with diversified improved solutions.

Increasing Adoption in Personal Care and Cosmetic Industries

The personal care and cosmetic industries are rapidly integrating biotech ingredients into their product ranges, aligning with the escalating need for non-toxic, natural, and clean items. Biotech-based actives, such as hyaluronic acid, peptides, and enzymes, are notably gaining momentum for their better sustainability and exceptional efficacy. Moreover, such ingredients provide improved effectiveness, such as skin hydration or anti-aging benefits, in comparison to conventional synthetic analogs. In addition, this trend is encouraging manufacturers to expand and innovate their product offerings with bio-based compounds, forming new growth avenues for this evolving market within the personal care segment. For instance, in April 2024, Nuxe, a cosmetic care brand, launched Nuxuriance Ultra Alfa, its new range of anti-aging items, developed using innovative green technology and integrated with natural-origin ingredients, including alfalfa seed extract, hyaluronic acid, and Hemerocallis fulva, which is an orange day-lily extract.

Biotech Ingredients Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global biotech ingredients market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on type and application.

Analysis by Type:

- Yeast

- Algae

- Others

Algae accounted for 44.6% of the market share in 2024. According to the biotech ingredients market forecast, algae is anticipated to sustain its dominance as the widely employed type, principally due to its sustainable cultivation and excellent nutritional nature. Rich in essential fatty acids, antioxidants, and vitamins, algae-based ingredients are extensively leveraged in key sectors, such as F&B, pharmaceuticals, and cosmetics. For instance, in August 2024, the FDA approved Cresilon Inc’s Traumagel, an emergency treatment to control severe bleeding and treat bullet wounds. This pharmaceutical product was formulated using algae-derived hydrogel technology and was set to be commercially available in the same year. Moreover, their renewable profile and minimal impact on the environment position them as an ideal substance for the development of bio-based products. In addition, the increasing requirement for natural and eco-friendly ingredients has further enhanced the significance of algae within the market.

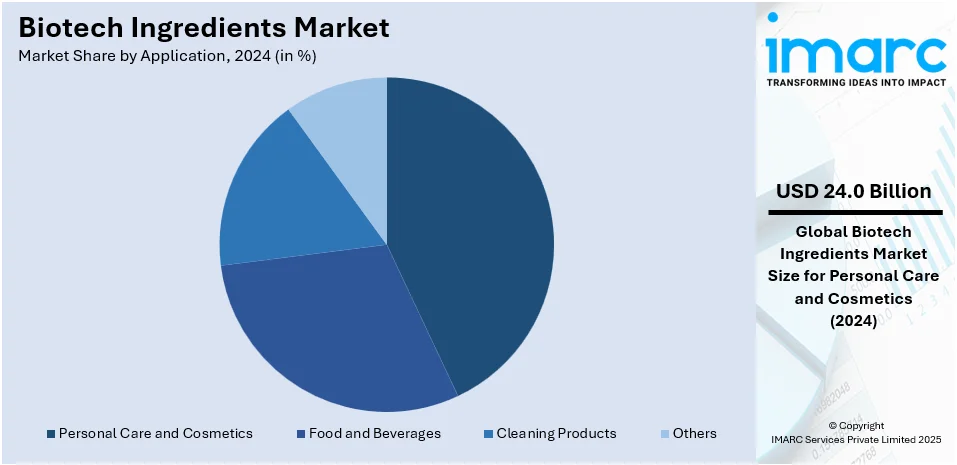

Analysis by Application:

- Food and Beverages

- Personal Care and Cosmetics

- Cleaning Products

- Others

Personal care and cosmetics hold 38.7% of the market share. The heightening demand for effective, sustainable, and safe cosmetics has significantly encouraged the adoption of biotech-based ingredients, including enzymes, hyaluronic acid, and peptides. Such substances provide improved effectiveness in anti-aging and skincare formulations, aligning with the growing trend of bio-based and natural personal care items. In addition, as cosmetic companies are currently focusing on sustainability as well as innovations, the utilization of biotech ingredients is rapidly amplifying, further strengthening this segment’s leadership in the market. For instance, in July 2024, Debut, a biotechnology and beauty company, signed an agreement with L'Oréal, a major cosmetics brand, to formulate bio-identical ingredients aimed at substituting traditionally extracted materials leveraged in L'Oréal's cosmetic products. Debut intended to employ its proprietary advanced biomanufacturing methods, integrating cell-free and fermentation technology, to develop new bio-based ingredients.

Regional Analysis:

- North America

- United States

- Canada

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

Europe, accounting for 37.6%, enjoys the leading position in the market. In the region, the strict regulations profiting natural and sustainable products across key industries, such as cosmetic and pharmaceutical, are propelling the market growth. Europe’s expanding biotechnology infrastructure, coupled with increased demand for environment friendly ingredients, fuels the market growth. Besides this, major countries, including France and Germany, support research and development (R&D) activities, emphasizing product innovations. In addition, the European Union’s focus on approving biotech ingredients, such as algae, while minimizing the utilization of toxic chemicals, further reinforces the area’s dominance in the dynamic market. For instance, in February 2024, the European Commission approved more than 20 algae species to be sold as food supplements or food items in the European region. This approval was anticipated to streamline the marketing authorization process for algae products, significantly reducing costs by around €10 Million for the algae sector within the region.

Key Regional Takeaways:

United States Biotech Ingredients Market Analysis

The United States holds 88.50% of the market share in North America. The well-established pharmaceutical industry base in the region is impelling the growth of the market. Shipment totals from pharmaceutical and medicine manufacturing, for instance, reached USD 367.3 Billion in 2022, according to the US Census Bureau. The sector had economic potency. It had more than 20,000 prescription drug products from the FDA which contributed to the requirement of active ingredients derived from biotech. The cosmetic industry also amounted to that number, with beauty and personal care exports from the US reaching more than USD 6 Billion in 2022 according to the Observatory of Economic Complexity. Advancements include bio-based ingredients, such as those derived through fermentation peptides and proteins from plant extracts, with companies like Thermo Fisher Scientific and DuPont focusing on making them consistently sustainable, as required by the US Environmental Protection Agency (EPA). For further handholding, there are federal incentives, which include the R& D tax credit under Internal Revenue Code Section 41 to support the industry.

Europe Biotech Ingredients Market Analysis

The market is growing on account of strict regulations on harmful additives and the increasing need for sustainable substitutes. In January 2024, the European Union declared changes to regulations and established guidelines concerning temporary rises/falls and official inspections on imports into the European Union of specific food items and feeds of non-animal origin from particular nations. Specific import guidelines apply to certain food products and animal feed from specific countries because of potential contamination by mycotoxins like Aflatoxin, pesticide residues, Pentachlorophenol, dioxins, microbial agents, Rhodamine B, and Sudan dye. Besides this, the REACH regulation of chemical substances employed in pharmaceuticals and cosmetics assures safety and motivates firms to spend money on bio-based substitutes. Germany, France, and Italy dominate biotech ingredient manufacturing, backed by robust R&D support from the Horizon Europe initiative. The region is also seeing greater use of fermentation-derived peptides and microbial enzymes in pharma. Players, such as BASF and Novozymes are concentrating on sustainable ingredient manufacturing to meet the EU's Green Deal goals, lowering dependence on petrochemical-based inputs.

Asia-Pacific Biotech Ingredients Market Analysis

The market is growing fast, driven by the increasing demand for pharmaceutical and personal care products. China's National Bureau of Statistics reported that the Chinese pharmaceutical market earned about USD 112 Billion in revenue in 2023, reflecting the industry's dominance in the region. Nations, such as India, are also fortifying their biotech capabilities under government programs supporting local production and exports. The market is also seeing greater investments in R&D, especially in biosimilars and active pharmaceutical ingredients (APIs). Japan and South Korea are leading the way, developing innovations in fermentation-based and synthetic biotech ingredients. User awareness about sustainable ingredients is also impacting market trends, with firms giving greater emphasis to eco-friendly production. Strategic alliances among regional and international players are further enabling technology transfer, and in the process increasing Asia Pacific's competitiveness in the international market.

Latin America Biotech Ingredients Market Analysis

The market is experiencing growth because of the usage of biotech ingredients in the pharmaceutical and cosmetic sectors. Brazilian Association of the Personal Hygiene, Perfumery, and Cosmetics Industry (ABIHPEC), for instance, reported that Brazil's cosmetics sector generated record-breaking export revenue in 2023, amounting to about USD 911.2 Million, demonstrating how the region is increasing its stake in the worldwide personal care industry. Countries like Mexico and Argentina are also investing in biotechnology-driven manufacturing, mainly in APIs and natural extracts. Other government initiatives include promoting domestic production to lessen import dependence. Increased awareness among the masses about sustainable and bio-based ingredients is driving the demand for green biotechnology solutions. With strong local production capabilities as well as a surge of collaboration with big biotech firms, Latin America is emerging as a key supplier for both the regional and international markets in biotech ingredients.

Middle East and Africa Biotech Ingredients Market Analysis

The market is witnessing growth because of increasing applications in pharmaceuticals and personal care products. According to an industry report, Saudi people spent an estimated USD 5.21 Billion on cosmetics in 2023, which reflected the burgeoning beauty and personal care industry in the region, creating the requirement for biotech-derived ingredients. Saudi Arabia's healthcare market also plays an important part, supported by the Saudi Vision 2030 initiative encouraging domestic biotech production. In Africa, developing regions, such as South Africa are making investments in biotech innovations in cosmetics and healthcare, with the government supporting local manufacturing. Brands are targeting sustainable and halal-approved biotech ingredients to meet demand. Regional and multinational companies' strategic partnerships are boosting technological development, making the Middle East and Africa a developing center for biotech ingredient production and usage.

Competitive Landscape:

Key players work on developing sustainable items to meet the high biotech ingredients market demand. Big companies are investing in research, developing advanced formulations, and expanding their product lines. They focus on sustainable and bio-based ingredients to meet the rising need for natural alternatives in pharmaceuticals and cosmetics. Many firms employ cutting-edge biotechnology like fermentation and genetic engineering, to create high-quality eco-friendly ingredients. They also work closely with regulatory bodies to ensure compliance with safety and environmental standards. By continuously innovating, enhancing production processes, and addressing user preferences, key players assist in making biotech ingredients more accessible and widely utilized across industries. Strategic partnerships and acquisitions also help them to strengthen their market presence and improve manufacturing efficiency. For instance, in August 2024, Bigelow Laboratory, US received USD 7 Million investment from the National Science Foundation to develop the Maine Algal Research Infrastructure and Accelerator (MARIA). MARIA aimed to improve research abilities with modern equipment, establishing it as a major hub for advancements in algae-based solutions for pharmaceutical, aquaculture, agriculture, and energy applications.

The report provides a comprehensive analysis of the competitive landscape in the biotech ingredients market with detailed profiles of all major companies, including:

- AbbVie Inc.

- Advanced Biotech

- Amyris Inc.

- Becton Dickinson and Company

- Bell Flavors & Fragrances Inc.

- Bruker Corporation

- Evolva AG

- Evonik Industries AG

- GlaxoSmithKline plc.

- International Flavors & Fragrances Inc.

- Merck KGaA

- Sanofi SA

Latest News and Developments:

- December 2024: Estée Lauder Companies (ELC) launched its BioTech Hub in Olen, Belgium, focused on creating bio-based ingredient alternatives. The establishment intended to create biomolecules from plant, yeast, and bacterial origins, enhancing sustainability and innovation throughout ELC’s skincare range via fermentation and advancements in bio-based materials.

- October 2024: Amyris obtained a USD 12.3M contract from BioMaP-C to create as many as three small-molecule drugs that were on the FDA's shortage list, utilizing synthetic biology and precision fermentation. The effort, supported by ASPR’s IBMSC, sought to strengthen the resilience of US pharmaceutical manufacturing via strategic collaborations and production that adhered to GMP standards.

- April 2024: Ole Hyva Luonnontuote, a well-known company focused on natural products, introduced Meri, a new line of cosmetics that replaced oil-based chemicals with molecules derived from seaweed. This collection featured shower gel, hand soap, shampoo, and hair conditioner. Furthermore, the algae-derived alginate, CAERULO, created by Origin by Ocean, was also employed in the sulfate-free Meri detergent line.

- April 2024: GreenCoLab, a leading biotech firm, presented its latest food and drink prototypes made from biotech ingredients, featuring algae burgers, a microalgae substitute for sturgeon roe, and craft beer brewed from microalgae. These prototypes incorporated seaweed, non-GMO chlorella, and tetraselmis (a green algae), positioning algae as a sustainable vegan component that promised to enhance the sensory, nutritional, and functional attributes of items.

- January 2024: Danstar Ferment AG, a subsidiary of Lallemand Inc., completed the purchase of Swiss biotech company Evolva AG. Evolva aimed to focus on natural ingredients from yeast for use in flavors, fragrances, health products, cosmetics, and protective applications.

Biotech Ingredients Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Yeast, Algae, Others |

| Applications Covered | Food and Beverages, Personal Care and Cosmetics, Cleaning Products, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | AbbVie Inc., Advanced Biotech, Amyris Inc., Becton Dickinson and Company, Bell Flavors & Fragrances Inc., Bruker Corporation, Evolva AG, Evonik Industries AG, GlaxoSmithKline plc., International Flavors & Fragrances Inc., Merck KGaA, Sanofi SA, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the biotech ingredients market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global biotech ingredients market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the biotech ingredients industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The biotech ingredients market was valued at USD 62.1 Billion in 2024.

The biotech ingredients market is projected to exhibit a CAGR of 4.29% during 2025-2033, reaching a value of USD 94.5 Billion by 2033.

People are choosing plant-based and biotech-derived ingredients over synthetic or animal-based options, encouraging companies to innovate. Besides this, advancements in biotechnology, such as fermentation and genetic engineering, make it easier to produce high-quality ingredients with better efficiency and fewer environmental impacts. Moreover, the pharmaceutical sector relies on biotech ingredients for drug formulations, vaccines, and biologics, fueling significant market growth.

Europe currently dominates the biotech ingredients market, accounting for a share of 37.6% in 2024, due to strong demand for sustainable products, strict regulations on synthetic chemicals, and heavy investments in research. The region's advanced biotech industry, eco-conscious users, and supportive government policies are further fueling the market growth across pharmaceutical, cosmetic, and F&B sectors.

Some of the major players in the biotech ingredients market include AbbVie Inc., Advanced Biotech, Amyris Inc., Becton Dickinson and Company, Bell Flavors & Fragrances Inc., Bruker Corporation, Evolva AG, Evonik Industries AG, GlaxoSmithKline plc., International Flavors & Fragrances Inc., Merck KGaA, Sanofi SA, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)