Blockchain in Manufacturing Market Size, Share, Trends and Forecast by Provider, Application, End User, and Region, 2025-2033

Blockchain in Manufacturing Market Size and Share:

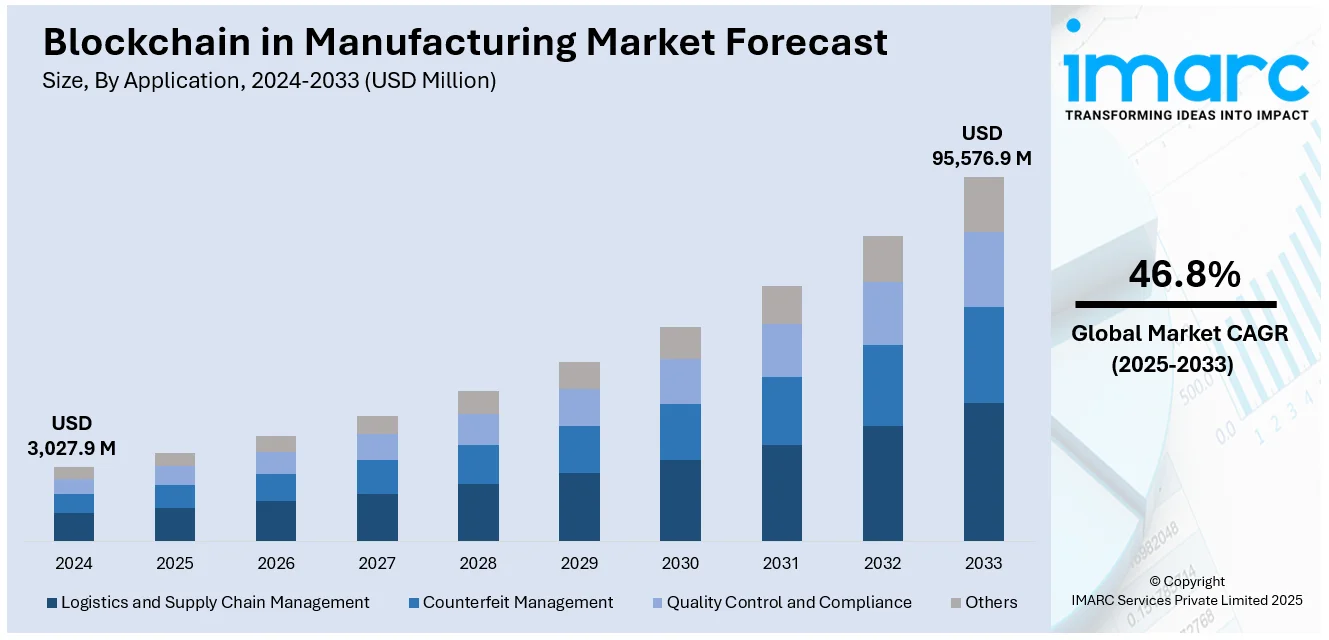

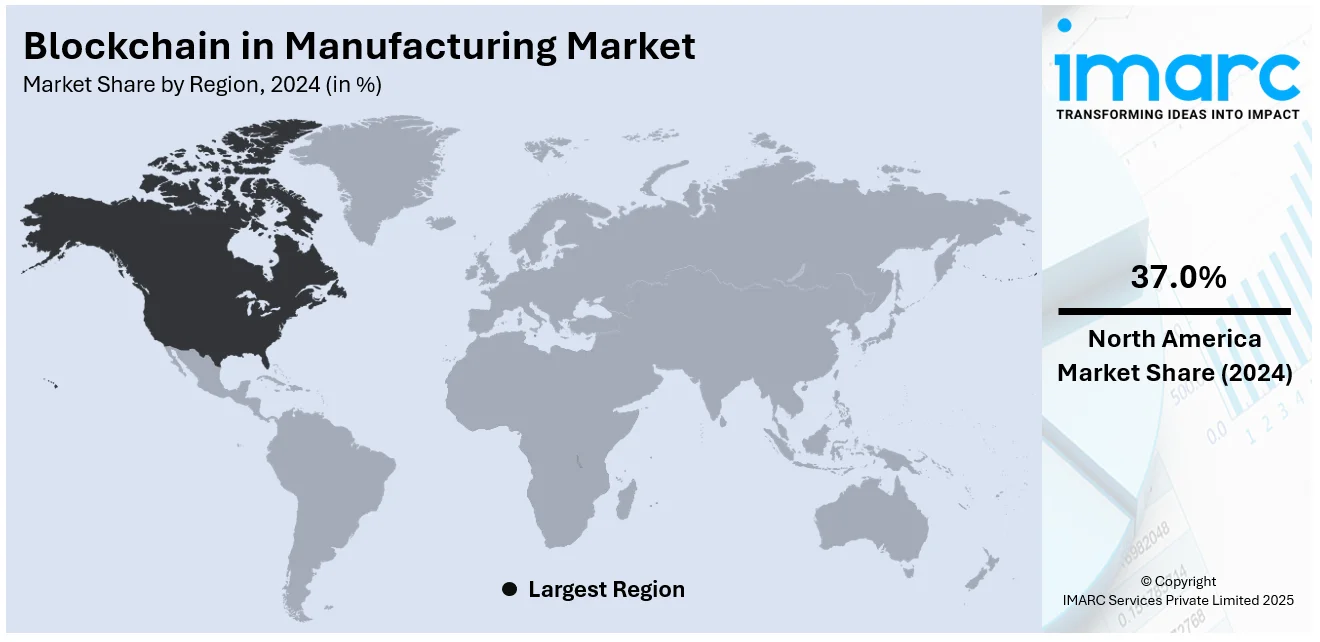

The global blockchain in manufacturing market size was valued at USD 3,027.9 Million in 2024. Looking forward, IMARC Group estimates the market to reach USD 95,576.9 Million by 2033, exhibiting a CAGR of 46.8% during 2025-2033. North America currently dominates the market, holding a significant market share of over 37.0% in 2024. The increasing utilization of blockchain for collaborative planning, forecasting, and replenishment (CPFR), continual rapid technological advancements in the manufacturing industry, and extensive research and development (R&D) activities by leading players are some of the major factors propelling the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033 |

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 3,027.9 Million |

| Market Forecast in 2033 | USD 95,576.9 Million |

| Market Growth Rate 2025-2033 | 46.8% |

The global blockchain in manufacturing market is majorly influenced by the magnifying requirement for traceability and transparency in supply chain network. As producers are actively navigating to minimize fraud risks and improve operational efficacy, blockchain technology provides a rigid and decentralized ledger that facilitates real-time product tracking, beginning from origin till end-user. In addition, the amplifying focus on quality assurance as well as regulatory adherence in key sectors, mainly including food production and pharmaceuticals further boosts the utilization of blockchain solutions. Furthermore, the notable emergence of the Internet of Things (IoT) and Industry 4.0 incentivizes the incorporation of blockchain with smart manufacturing methods, improving both partnerships among stakeholders and data security, thereby impacting the expansion of blockchain in manufacturing market share optimistically.

The United States plays a crucial role in the global blockchain in manufacturing landscape, principally influenced by a resilient culture of enhancements and its strong technological infrastructure. Critical manufacturing hubs established across the country are actively inclining towards blockchain services to upgrade operational efficacy, mitigate complications associated with fraud or counterfeiting scenarios, and significantly enhance transparency across supply chain networks. In addition to this, the notable emergence of pioneering technology startups as well as firms headed on blockchain development fosters a competitive landscape that accelerated the implementation of innovative services. As regulatory policies evolve to aid blockchain utilization, the U.S. is well-positioned to adopt this technology, fueling substantial innovations in the manufacturing segment. For instance, in December 2024, DMG Blockchain Solutions Inc., a leading blockchain technology company with robust presence in the U.S., announced the receival of US patent for its Cryptographic Taint Tracking that improves adherence and aids law implementation in company's aim to secure blockchain networks.

Blockchain in Manufacturing Market Trends:

Enhanced Traceability and Transparency

In conventional manufacturing methodologies, tracking the initial point and journey of finished products, raw materials, or components can be extremely complicated and at high risk of anomalies. The immutable and decentralized ledger system of blockchain guarantees that every movement or transaction is registered in an unalterable manner, developing an everlasting streak of information. This ability facilitates producers to accurately trace the complete lifecycle of a product, from its resources utilized to its ultimate destination. This escalated traceability not only aid in product recall management and quality control activities but also promote the adherence with several regulatory policies. For instance, the global automated industrial quality control market, valued at USD 0.47 Billion in 2024, is expected to reach USD 0.82 Billion by 2032, growing at a CAGR of 5.8%. In addition, stakeholders as well as customers are rapidly demanding for transparency in supply chains, striving to authenticate sustainable methods and ethical sourcing. Blockchain's transparent profile strengthens manufacturers to exhibit their allegiance to such principles, developing loyalty as well as trust among customers, which, in turn, elevates the blockchain in manufacturing market demand.

Counterfeit Prevention and Product Authentication

Counterfeit products not only lead to economic setbacks for enterprises but also present a severe risk to customer safety and health. For instance, according to the European Union Intellectual Property Office’s 2024 report, in Europe, counterfeit products result in an annual loss of €16 billion and nearly 200,000 jobs in toy, clothing, and cosmetics sectors. By deploying blockchain, manufacturers can develop a steadfast and safe record for every product's journey, from manufacturing to its distribution. This facilitates stakeholders as well as customers to validate both origin and legitimacy of products in real-time by leveraging RFID tags, QR codes, or certain other identifiers. The unmodifiable attribute of blockchain data guarantees that forgery activities can be swiftly highlighted, aiding to safeguard both manufacturers and customers, along with the brand prestige. Furthermore, as overseas markets proliferate, especially in e-commerce, guaranteeing the validity of products becomes rapidly complicated. Blockchain provides a resilient solution to this complication, consequently facilitating trust between manufacturers and consumers.

Streamlined Supply Chain and Efficiency Gains

Traditional supply chains involve multiple stakeholders, including suppliers, manufacturers, distributors, and retailers, leading to fragmented data and information silos. Blockchain's distributed ledger provides a shared platform where all participants can access and update information in real-time. According to a Center for Global Enterprise study, the adoption of blockchain technology in Digital Supply Chains (DSC) can streamline operations, leading to a 20% reduction in procurement costs. Smart contracts, automated and self-executing agreements built on blockchain, further streamline transactions, payments, and contract fulfillment. These features reduce paperwork, eliminate intermediaries, and accelerate processes, ultimately leading to cost savings and quicker time-to-market for manufacturers. The efficiency gains are particularly valuable in industries where rapid response to market demand is critical. Moreover, by enabling real-time data sharing and collaboration, blockchain facilitates better demand forecasting and inventory management, reducing wastage and optimizing resource allocation. This effectiveness is strengthening its need and consequently contributing to a positive blockchain in manufacturing market outlook.

Blockchain in Manufacturing Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global blockchain in manufacturing market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on provider, application, and end user.

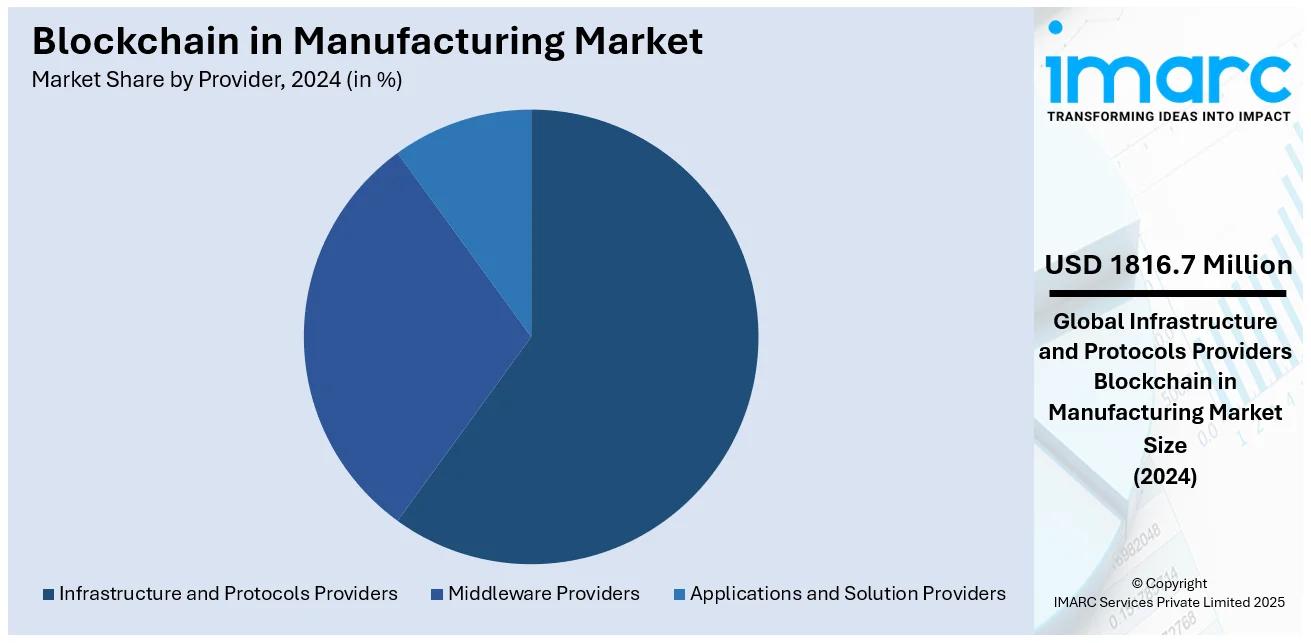

Analysis by Provider:

- Middleware Providers

- Infrastructure and Protocols Providers

- Applications and Solution Providers

Infrastructure and protocols providers stand as the largest provider in 2024, holding around 60.0% of the market. The infrastructure and protocols attributed to their foundational role in establishing the groundwork for successful blockchain integration in manufacturing. Manufacturers seeking to implement blockchain solutions often turn to these providers to establish a robust and reliable infrastructure that can handle the complexities of their supply chains. This is especially crucial in manufacturing, where traceability, security, and real-time data sharing are paramount. Additionally, the evolution of blockchain technology has led to a competitive market of infrastructure and protocol solutions, with providers continually innovating to offer enhanced scalability, interoperability, and security features. Furthermore, the collaboration between infrastructure and protocols providers is instrumental in shaping the overall blockchain ecosystem. As blockchain networks in manufacturing become increasingly interconnected and interdependent, the synergy between these two types of providers becomes crucial. Infrastructure providers ensure the seamless operation of the network, while protocols providers uphold the integrity of the data and transactions.

Analysis by Application:

- Logistics and Supply Chain Management

- Counterfeit Management

- Quality Control and Compliance

- Others

Logistics and supply chain management leads the market in 2024. Logistics and supply chain management play a pivotal role in manufacturing operations, encompassing the movement of raw materials, components, and finished products across various geographical locations and stakeholders. Blockchain's inherent characteristics of decentralization and transparency offer an effective solution to address these issues. By creating an immutable and tamper-proof record of every transaction, movement, and handover within the supply chain, blockchain ensures a high level of traceability and visibility. Moreover, the application of blockchain technology in logistics and supply chain management fosters greater collaboration and trust among different participants. Each party involved in the supply chain can access real-time, accurate information, eliminating discrepancies and disputes. This transparency leads to improved decision-making, optimized inventory management, and enhanced demand forecasting. Manufacturers can more effectively allocate resources, reduce excess inventory, and respond to market fluctuations promptly. This is especially crucial in the modern manufacturing landscape, where just-in-time production and responsiveness to customer demands are critical for staying competitive.

Analysis by End User:

- Automotive

- Aerospace and Defense

- Pharmaceutical

- Electronics and Semiconductor

- Others

Electronics and semiconductor lead the market in 2024. The electronics and semiconductor industry operates on the cutting edge of technology, with intricate supply chains and complex manufacturing processes that involve numerous components, suppliers, and collaborators. Integrating blockchain technology within this sector offers transformative potential that addresses critical challenges and capitalizes on opportunities for advancement. Furthermore, the integration of blockchain technology in the electronics and semiconductor sector fosters improved collaboration among various stakeholders. Manufacturers, suppliers, distributors, and even consumers can securely access shared data in real-time, leading to more informed decision-making and quicker responses to market demands. This collaborative approach enhances efficiency, streamlines production processes, and accelerates time-to-market for innovative products, crucial in an industry where technology evolution occurs rapidly. Moreover, the electronics and semiconductor sector's reliance on Intellectual Property (IP) protection aligns with blockchain's inherent security mechanisms. The technology's cryptography-based security features ensure that sensitive information related to designs, patents, and manufacturing processes remains safeguarded and only accessible to authorized parties.

Regional Analysis:

- North America

- United States

- Canada

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, North America accounted for the largest market share of over 37.0%. North America’s infrastructure fosters uninterrupted incorporation of blockchain into variety of critical sectors, mainly encompassing manufacturing, finance, healthcare, and supply chain. In addition to this, the regulatory frameworks in North America has been highly beneficial and supportive in context to cryptocurrency as well as blockchain development. For instance, as per industry reports, cryptocurrency sector in Canada is exhibiting significant expansion since 2023, with around 10% of the citizens possessing some type of cryptocurrency as of 2024. While policies continue to transform, many North American countries, especially Canada and the United States, have navigated through a proactive tactic to cater to the security as well as legal issues while enabling for rapid advancements. This regulatory coherence has appealed to several established enterprises and blockchain startups to the region, further bolstering its domination. Furthermore, the region has been facing heavy investments in blockchain technology, both from the government ventures and private sector. Major technology giants, firms, and financial institutions based in the region have attributed heavy resources to navigate and deploy blockchain services. Government-sponsored grants as well as programs have also facilitated the blockchain in manufacturing market growth in this leading region.

Blockchain in Manufacturing Industry Regional Takeaways:

Blockchain in Manufacturing Industry Analysis in United States

In 2024, United States accounted for 80.0% of the market share in North America. The growing adoption of blockchain in manufacturing is heavily influenced by the rapid expansion of the pharmaceutical sector. According to reports, the U.S. pharmaceutical sector is growing, with 2,325 brand-name manufacturers in 2023, marking a 7.8% rise from 2022. As the demand for drug production increases, there is a pressing need for traceability, transparency, and security in supply chains. Blockchain technology offers an ideal solution by enabling secure, immutable record-keeping that ensures the authenticity of products, reduces fraud, and enhances regulatory compliance. In the pharmaceutical industry, blockchain can provide end-to-end visibility from raw material sourcing to the final delivery of finished products. It also improves real-time data exchange among various stakeholders, including manufacturers, distributors, and regulatory bodies. This fosters better communication, reduces the risk of counterfeit drugs, and speeds up the approval process for new drugs, ensuring higher product safety standards. Additionally, blockchain enables more efficient management of intellectual property, reducing legal disputes and ensuring accurate patents and product data. The increasing integration of these technologies in pharmaceutical manufacturing continues to drive broader adoption across the sector.

Blockchain in Manufacturing Industry Analysis in Asia Pacific

The expansion of the automotive sector across Asia-Pacific has led to a rise in blockchain adoption in manufacturing. According to India Brand Equity Foundation, the Indian automobile industry experienced a significant 19% growth in FY24, reaching a value of USD 122.53 Billion, reflecting the expanding automotive sector. Blockchain’s ability to provide transparent, decentralized, and real-time data tracking aligns perfectly with the increasing complexity and scale of the automotive industry. As supply chains become more global, blockchain offers the ability to track components from suppliers to production facilities, reducing the risk of counterfeits and errors. Blockchain also facilitates better collaboration and secure transactions between multiple players in the automotive supply chain, from manufacturers to dealers. The growing demand for customized vehicles and more efficient production lines also spurs blockchain use to optimize processes, enhance product traceability, and improve the management of inventories. With better data integration and access, the technology accelerates innovation and reduces costs, positioning blockchain as a pivotal tool for the automotive manufacturing sector's future.

Blockchain in Manufacturing Industry Analysis in Europe

In Europe, the growth of industrial production has been a catalyst for the widespread adoption of blockchain technology within manufacturing. According to reports, the EU's industrial production grew by 8.5% in 2021 and continued to rise by 0.4% in 2022 compared to the previous year. As industries across sectors such as machinery, chemicals, and electronics evolve, manufacturers seek enhanced efficiency, traceability, and quality control in increasingly complex supply chains. Blockchain’s decentralized nature ensures that all transactions and production data are transparent and immutable, offering improved audit trails and reducing the risk of fraud. Manufacturers also benefit from blockchain's ability to streamline cross-border payments and contract execution, making international trade smoother and more efficient. Moreover, the ability to track materials and products in real-time contributes to waste reduction and optimized production schedules, driving cost savings. As manufacturing becomes more interconnected with global supply chains, blockchain is proving to be an essential tool for facilitating secure, transparent, and efficient processes that support high-quality production and compliance with industry standards.

Blockchain in Manufacturing Industry Analysis in Latin America

The rapid growth of the aerospace and defense sector in Latin America is propelling the adoption of blockchain in manufacturing. For instance, in 2023, Europe's aerospace and defense industry saw a 10.1% year-on-year growth, reaching approximately USD 314.3 Billion, following a 10.5% increase in 2022. With the increasing need for precision, quality assurance, and regulatory compliance in this highly specialized field, blockchain offers significant advantages in tracking complex component manufacturing processes. The integration of blockchain ensures secure, transparent data sharing across suppliers, manufacturers, and regulatory bodies, improving efficiency and reducing the potential for errors or fraud. Furthermore, the technology allows for real-time monitoring of the supply chain, providing a tamper-proof record of critical components, parts, and materials. This promotes higher levels of accountability, data integrity, and overall trust in the aerospace and defense manufacturing process. Blockchain is helping companies meet stringent security requirements while ensuring that the final products adhere to exact specifications.

Blockchain in Manufacturing Industry Analysis in Middle East and Africa

In the Middle East and Africa, blockchain adoption in manufacturing is expanding as the logistics and supply chain sectors experience rapid growth. According to reports, logistics in the Middle East is booming as GCC countries leverage their strategic location, with 30% of global trade passing through the Red Sea and Gulf of Aden, driving further expansion and diversification in the logistics and supply chain sector. Blockchain technology plays a vital role in enhancing supply chain transparency, reducing fraud, and improving real-time tracking of goods. As the region continues to develop its infrastructure and transportation networks, the need for efficient and secure logistics solutions becomes more crucial. Blockchain’s ability to provide tamper-proof transaction records and streamline communication between various entities within the supply chain fosters greater collaboration and trust. This holds particular significance for sectors like oil, gas, and chemicals, which operate intricate supply chains extending across various nations and engaging a diverse range of stakeholders. Blockchain facilitates regulatory compliance, streamlines inventory management processes, and enhances overall operational efficiency, offering a strategic advantage in the dynamic and fast-changing manufacturing sector.

Top Blockchain in Manufacturing Companies:

The market is represented by escalating implementation of decentralized technologies to significantly improve efficacy, transparency, and traceability across supply chains. Leading players encompass specialized blockchain solution providers and technology giants, actively emphasizing on advancements customized to industrial purposes. Tactical collaborations between manufacturing firms and blockchain companies are substantially bolstering technological innovations. Critical sectors, including electronics, automotive, and aerospace are major adopters, incorporating blockchain to upgrade operations, maintain adherence, and mitigate fraud issues. For instance, in August 2024, California implemented the first digitized vehicle title system in the U.S. by leveraging blockchain technology to mitigate fraud challenges. 42 million vehicle titles have already been successfully transferred electronically and by early 2025, a mobile application will replace the physical title, providing users with convenient access. Furthermore, the market is highlighted by heavy investments and elevating technological transformation, reflecting a competitive ecosystem where augmentation is attained through industry-specific customization, flexibility, and security.

The report provides a comprehensive analysis of the top companies in the blockchain in manufacturing market with detailed profiles of all major companies, including:

- Accenture plc

- Advanced Micro Devices Inc

- Amazon Web Services Inc. (Amazon.com Inc.)

- Infosys Limited

- Intel Corporation

- International Business Machines Corporation

- Microsoft Corporation

- Oracle Corporation

- SAP SE

- Wipro Limited

Latest News and Developments:

- December 2024: GCL Energy Technology and Ant Digital Technologies have launched the first blockchain-based Real World Asset (RWA) project in China’s photovoltaic industry, securing 200 Million yuan in cross-border financing. This breakthrough not only boosts GCL’s growth plans but also introduces a new financing model for Chinese photovoltaic companies aiming to fund green projects internationally. The collaboration marks a significant milestone in integrating blockchain technology into the manufacturing sector, particularly for sustainable energy projects.

- December 2024: The Worldwide Asset eXchange (WAX) partnered with Amazon Web Services (AWS) to launch the WAX AWS Cloud Development Kit (CDK). This toolkit enables developers to build custom Layer 2 blockchain solutions on WAX, leveraging AWS's cloud infrastructure for scalability and reliability in web3 applications, particularly in gaming.

- October 2024: Microsoft Azure expanded its BaaS offerings, providing cloud-based infrastructure that simplifies blockchain adoption for businesses. These services allow organizations to develop, host, and deploy blockchain applications without the need to build and maintain their own infrastructure, facilitating rapid prototyping and deployment of blockchain solutions.

- September 2024: Google Cloud has launched a new Blockchain RPC service, built on its infrastructure, to support Web3 developers. This service enables a streamlined, cost-effective, scalable, and reliable way to interact with blockchain data. It simplifies the management of node infrastructure, helping developers build and scale faster.

- September 2024: Shri S. Krishnan, Secretary of MeitY, launched the Vishvasya-Blockchain Technology Stack at an event hosted by the Ministry of Electronics and Information Technology (MeitY), Government of India. The stack is designed to offer Blockchain-as-a-Service, supporting various permissioned Blockchain applications. It features a geographically distributed infrastructure to enhance accessibility and scalability.

Blockchain in Manufacturing Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Providers Covered | Middleware Providers, Infrastructure and Protocols Providers, Applications and Solution Providers |

| Applications Covered | Logistics and Supply Chain Management, Counterfeit Management, Quality Control and Compliance, Others |

| End Users Covered | Automotive, Aerospace and Defense, Pharmaceutical, Electronics and Semiconductor, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Accenture plc, Advanced Micro Devices Inc., Amazon Web Services Inc. (Amazon.com Inc.), Infosys Limited, Intel Corporation, International Business Machines Corporation, Microsoft Corporation, Oracle Corporation, SAP SE, Wipro Limited, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the blockchain in manufacturing market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global blockchain in manufacturing market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the blockchain in manufacturing industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The blockchain in manufacturing market was valued at USD 3,027.9 Million in 2024.

IMARC estimates the market to reach USD 95,576.9 Million by 2033, exhibiting a CAGR of 46.8% during 2025-2033.

Key factors driving the market include the need for enhanced supply chain transparency, improved traceability, and secure data sharing. Additionally, blockchain’s ability to reduce fraud, streamline operations, and ensure real-time tracking of goods across the supply chain boosts its adoption in the manufacturing sector.

North America currently dominates the blockchain in manufacturing market, accounting for a share 37.0%. This dominance is driven by technological advancements, strong industry adoption, and a growing emphasis on supply chain transparency and security.

Some of the major players in the blockchain in manufacturing market include Accenture plc, Advanced Micro Devices Inc., Amazon Web Services Inc. (Amazon.com Inc.), Infosys Limited, Intel Corporation, International Business Machines Corporation, Microsoft Corporation, Oracle Corporation, SAP SE, Wipro Limited, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)