Blood Glucose Meters Manufacturing Plant Project Report 2026: Industry Trends, Plant Setup, Machinery, Raw Materials, Investment Opportunities, Cost and Revenue

Report Overview:

IMARC Group’s report, titled “Blood Glucose Meters Manufacturing Plant Project Report 2026: Industry Trends, Plant Setup, Machinery, Raw Materials, Investment Opportunities, Cost and Revenue” provides a complete roadmap for setting up a blood glucose meters manufacturing plant. It covers a comprehensive market overview to micro-level information such as unit operations involved, raw material requirements, utility requirements, infrastructure requirements, machinery and technology requirements, manpower requirements, packaging requirements, transportation requirements, etc. The report also provides detailed insights into project economics, including capital investments, project funding, operating expenses, income and expenditure projections, fixed costs vs. variable costs, direct and indirect costs, expected ROI and net present value (NPV), profit and loss account, financial analysis, etc.

Blood glucose meters are compact medical devices that measure the concentration of glucose in the blood. These meters are vital tools for individuals with diabetes, as they provide immediate insights into blood sugar levels, helping to regulate the condition through diet, exercise, and medication. Typically consisting of a digital display, a test strip holder, and lancing device, the meter functions by drawing a small blood sample, usually from a fingertip, onto a specially coated strip. The strip contains chemicals that react with glucose, triggering an electrical signal that is then analyzed by the meter, delivering a numerical result within seconds. This immediate access to vital information empowers individuals and healthcare professionals alike to make informed decisions regarding treatment and lifestyle, contributing to better management of diabetes.

The global market is primarily driven by the considerable rise in diabetes prevalence necessitating convenient monitoring tools. In line with this, continual technological advancements resulting in the development of more user-friendly and accurate devices are providing an impetus to the market. Also, the growing emphasis on preventive healthcare encourages regular monitoring, thereby driving the need for personal devices. Besides this, the incorporation of connectivity features, such as smartphone integration, contributes to a more personalized healthcare experience, which is creating a positive market outlook.

In addition to this, the increase in healthcare expenditure is supporting the accessibility of such devices among the masses, which is stimulating the market. Favorable government initiatives and regulations promoting diabetes awareness and management are also influencing market growth positively. The market is further propelled by the easy availability of disposable test strips and lancets across online and offline organized retail channels. Apart from this, strategic collaborations among manufacturers are fostering innovation and competitiveness in telemedicine and virtual healthcare support are creating lucrative opportunities in the market. Furthermore, an enhanced focus on developing eco-friendly materials and energy-efficient designs aligning with global sustainability goals is fueling the market.

Blood Glucose Meters Market Analysis:

The market for blood glucose meters is witnessing steady growth, driven by the global rise in diabetes cases, which are increasingly attributed to factors such as sedentary lifestyles, aging populations, and poor dietary habits. This surge has amplified the demand for efficient and reliable blood glucose monitoring systems. Blood glucose meters are user-friendly, portable devices that enable diabetes patients to measure their blood sugar levels at home or on the go. These meters have become essential tools for improving patient outcomes and preventing complications, as effective diabetes management hinges on continuous and accurate monitoring. For example, Abbott Laboratories recently launched a campaign promoting its glucose meter, Lingo, targeting not only diabetic individuals but also healthy consumers in the U.S., aiming to broaden the scope of personalized health data and extend the device’s reach beyond traditional diabetes care. Moreover, governmental and healthcare organizations are actively promoting diabetes awareness, thus impelling the market demand.

Technological advancements are continually improving blood glucose monitoring through portable medical devices. The latest blood glucose meters combine compact designs with enhanced features such as rapid results, a longer lifespan for blood samples, and seamless integration with smartphone apps for real-time tracking. An example of this innovation is the collaboration between DexCom and ŌURA, integrating glucose-monitoring data with ŌURA’s smart rings. This partnership offers users a holistic health view through advanced mobile applications. These technological enhancements simplify testing, increase accuracy, and provide a more streamlined user experience. Additionally, digital health platforms are helping patients monitor their glucose levels more effectively and make informed decisions alongside their healthcare providers. Furthermore, the growing demand for portable solutions that support health management, thereby significantly propelling the blood glucose meters market forward.

Blood Glucose Meters Market Trends:

Increased Integration with Digital Health Platforms

The rise of smart healthcare technologies has significantly impacted the market for blood glucose meters. This can be attributed to the emergence of smart healthcare technologies in the market for blood-powered glucose meters. Modern devices come equipped with bluetooth and wireless functionality, allowing easy integration with mobile applications and digital health platforms. For instance, Smart Meter introduced iGlucose Plus, the world’s first cellular-enabled glucose meter with notifications and multi-language support. The device features a clear color LED screen and offers Spanish language on-screen prompts, improving accessibility for a wide range of patient populations. This enables users to monitor glucose levels in real-time, share information with healthcare providers, and gain individualized insights. Furthermore, such integration enables remote monitoring, facilitating better diabetes management while minimizing the need for frequent in-person consultations. Additionally, the ability to set reminders, analyze trends, and store historical data on cloud platforms is driving consumer preference and supporting the market growth.

Growing Demand for Compact and Long-Lasting Devices

Portability and reliability have become critical factors for blood glucose meters as consumer lifestyles evolve. Users increasingly prefer compact, lightweight devices that fit easily into their daily routines, whether at home, work, or during travel. To meet this demand, manufacturers are incorporating advanced battery technologies, such as lithium-ion and rechargeable options, which offer extended usage time. For example, Beurer India launched the GL 22 Blood Glucose Monitor, introduced by cricketer Sourav Ganguly as the brand ambassador. The device combines German precision with advanced technology, specifically designed to meet the needs of the Indian market. These innovations ensure minimal interruptions in glucose monitoring, enhancing convenience and user satisfaction. Additionally, ergonomic designs and intuitive interfaces contribute to the growing appeal of such devices. The emphasis on durability and energy efficiency reflects a broader trend of user-centric innovation in diabetes care, which is providing an impetus to the market.

Latest Industry News:

The market is also being driven by increasing investments and capacity expansions:

- Nova Biomedical's New Generation StatStrip Glucose Hospital Meter received FDA 510(k) clearance, offering hospitals a reliable and accurate blood glucose monitoring solution.

- Dexcom invested $75 million in ŌURA, a health-tracking ring maker, to enhance the integration of blood glucose monitoring with wearable health technology.

The following aspects have been covered in the blood glucose meters manufacturing plant report:

- Market Analysis:

- Market Trends

- Market Breakup by Segment

- Market Breakup by Region

- Price Analysis

- Impact of COVID-19

- Market Forecast

The report provides insights into the landscape of the blood glucose meters industry at the global level. The report also provides a segment-wise and region-wise breakup of the global blood glucose meters industry. Additionally, it also provides the price analysis of feedstocks used in the manufacturing of blood glucose meters, along with the industry profit margins.

- Detailed Process Flow:

- Product Overview

- Unit Operations Involved

- Mass Balance and Raw Material Requirements

- Quality Assurance Criteria

- Technical Tests

The report also provides detailed information related to the blood glucose meters manufacturing process flow and various unit operations involved in a manufacturing plant. Furthermore, information related to mass balance and raw material requirements has also been provided in the report with a list of necessary quality assurance criteria and technical tests.

- Project Details, Requirements, and Costs Involved:

- Land, Location and Site Development

- Plant Layout

- Machinery Requirements and Costs

- Raw Material Requirements and Costs

- Packaging Requirements and Costs

- Transportation Requirements and Costs

- Utility Requirements and Costs

- Human Resource Requirements and Costs

The report provides a detailed location analysis covering insights into the land location, selection criteria, location significance, environmental impact, expenditure, and other blood glucose meters manufacturing plant costs. Additionally, the report provides information related to plant layout and factors influencing the same. Furthermore, other requirements and expenditures related to machinery, raw materials, packaging, transportation, utilities, and human resources have also been covered in the report.

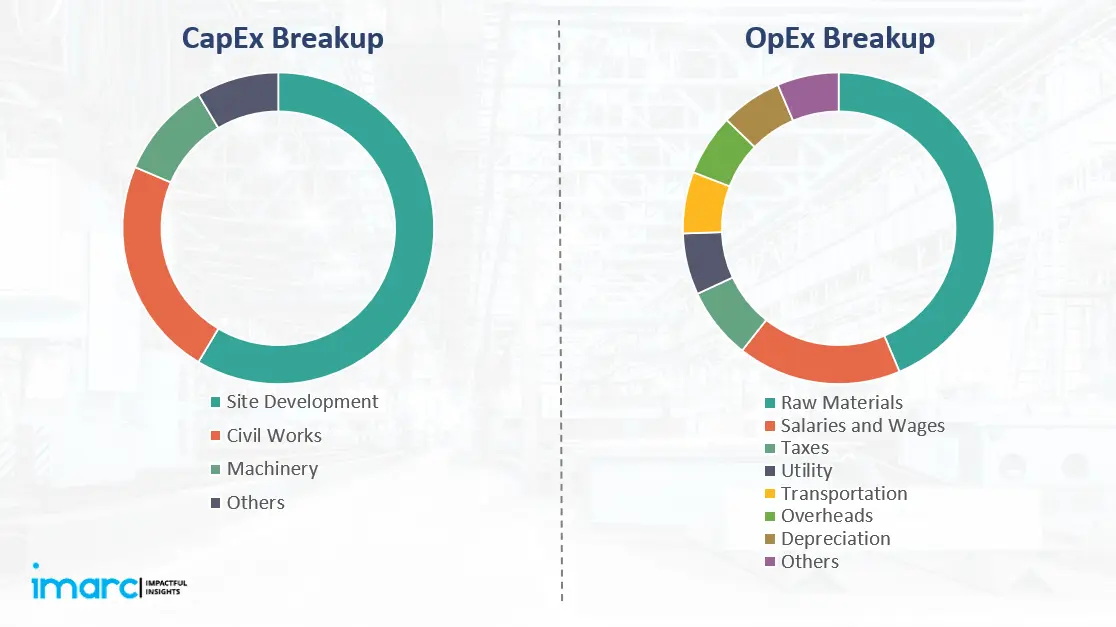

Capital Expenditure (CapEx) and Operational Expenditure (OpEx) Analysis:

- Project Economics:

- Capital Investments

- Operating Costs

- Expenditure Projections

- Revenue Projections

- Taxation and Depreciation

- Profit Projections

- Financial Analysis

The report also covers a detailed analysis of the project economics for setting up a blood glucose meters manufacturing plant. This includes the analysis and detailed understanding of blood glucose meters manufacturing plant costs, including capital expenditure (CapEx), operating expenditure (OpEx), income projections, taxation, depreciation, liquidity analysis, profitability analysis, payback period, NPV, uncertainty analysis, and sensitivity analysis. Furthermore, the report also provides a detailed analysis of the regulatory procedures and approvals, information related to financial assistance, along a comprehensive list of certifications required for setting up a blood glucose meters manufacturing plant.

Profitability Analysis:

| Particulars | Unit | Year 1 | Year 2 | Year 3 | Year 4 | Year 5 |

|---|---|---|---|---|---|---|

| Total Income | US$ | XX | XX | XX | XX | XX |

| Total Expenditure | US$ | XX | XX | XX | XX | XX |

| Gross Profit | US$ | XX | XX | XX | XX | XX |

| Gross Margin | % | XX | XX | XX | XX | XX |

| Net Profit | US$ | XX | XX | XX | XX | XX |

| Net Margin | % | XX | XX | XX | XX | XX |

Report Coverage:

| Report Features | Details |

|---|---|

| Product Name | Blood Glucose Meters |

| Report Coverage | Detailed Process Flow: Unit Operations Involved, Quality Assurance Criteria, Technical Tests, Mass Balance, and Raw Material Requirements Land, Location and Site Development: Selection Criteria and Significance, Location Analysis, Project Planning and Phasing of Development, Environmental Impact, Land Requirement and Costs Plant Layout: Importance and Essentials, Layout, Factors Influencing Layout Plant Machinery: Machinery Requirements, Machinery Costs, Machinery Suppliers (Provided on Request) Raw Materials: Raw Material Requirements, Raw Material Details and Procurement, Raw Material Costs, Raw Material Suppliers (Provided on Request) Packaging: Packaging Requirements, Packaging Material Details and Procurement, Packaging Costs, Packaging Material Suppliers (Provided on Request) Other Requirements and Costs: Transportation Requirements and Costs, Utility Requirements and Costs, Energy Requirements and Costs, Water Requirements and Costs, Human Resource Requirements and Costs Project Economics: Capital Costs, Techno-Economic Parameters, Income Projections, Expenditure Projections, Product Pricing and Margins, Taxation, Depreciation Financial Analysis: Liquidity Analysis, Profitability Analysis, Payback Period, Net Present Value, Internal Rate of Return, Profit and Loss Account, Uncertainty Analysis, Sensitivity Analysis, Economic Analysis Other Analysis Covered in The Report: Market Trends and Analysis, Market Segmentation, Market Breakup by Region, Price Trends, Competitive Landscape, Regulatory Landscape, Strategic Recommendations, Case Study of a Successful Venture |

| Currency | US$ (Data can also be provided in the local currency) |

| Customization Scope | The report can also be customized based on the requirement of the customer |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through email (We can also provide the editable version of the report in PPT/Word format on special request) |

Report Customization

While we have aimed to create an all-encompassing report, we acknowledge that individual stakeholders may have unique demands. Thus, we offer customized report options that cater to your specific requirements. Our consultants are available to discuss your business requirements, and we can tailor the report's scope accordingly. Some of the common customizations that we are frequently requested to make by our clients include:

- The report can be customized based on the location (country/region) of your plant.

- The plant’s capacity can be customized based on your requirements.

- Plant machinery and costs can be customized based on your requirements.

- Any additions to the current scope can also be provided based on your requirements.

Why Buy IMARC Reports?

- The insights provided in our reports enable stakeholders to make informed business decisions by assessing the feasibility of a business venture.

- Our extensive network of consultants, raw material suppliers, machinery suppliers and subject matter experts spans over 100+ countries across North America, Europe, Asia Pacific, South America, Africa, and the Middle East.

- Our cost modeling team can assist you in understanding the most complex materials. With domain experts across numerous categories, we can assist you in determining how sensitive each component of the cost model is and how it can affect the final cost and prices.

- We keep a constant track of land costs, construction costs, utility costs, and labor costs across 100+ countries and update them regularly.

- Our client base consists of over 3000 organizations, including prominent corporations, governments, and institutions, who rely on us as their trusted business partners. Our clientele varies from small and start-up businesses to Fortune 500 companies.

- Our strong in-house team of engineers, statisticians, modeling experts, chartered accountants, architects, etc. has played a crucial role in constructing, expanding, and optimizing sustainable manufacturing plants worldwide.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Frequently Asked Questions

Capital requirements generally include land acquisition, construction, equipment procurement, installation, pre-operative expenses, and initial working capital. The total amount varies with capacity, technology, and location.

To start a blood glucose meters manufacturing business, one needs to conduct a market feasibility study, secure required licenses, arrange funding, select suitable land, procure equipment, recruit skilled labor, and establish a supply chain and distribution network.

Blood glucose meters manufacturing requires raw materials such as electrochemical test strips, glucose oxidase or other enzyme reagents, plastic casings, LCD or LED displays, microcontrollers, batteries, circuit boards, electrodes, connectors, adhesives, packaging materials, and calibration solutions.

A blood glucose meters factory typically requires PCB assembly lines, microcontroller programming stations, sensor fabrication equipment, injection molding machines for plastic casings, display integration units, test strip production systems, calibration and quality-testing instruments, soldering stations, and automated packaging machinery.

The main steps generally include:

-

Design electronic circuitry and sensor integration

-

Fabricate or procure enzyme-based test strips

-

Assemble PCB, microcontroller, and display components

-

Integrate sensors into plastic meter casing

-

Program firmware and calibrate device accuracy

-

Conduct quality control and functional testing

-

Package, label, and store for distribution

Usually, the timeline can range from 18 to 36 months to start a blood glucose meters manufacturing plant, depending on factors like site development, machinery installation, environmental clearances, safety measures, and trial runs.

Challenges may include high capital requirements, securing regulatory approvals, ensuring raw material supply, competition, skilled manpower availability, and managing operational risks.

Typical requirements include business registration, environmental clearances, factory licenses, fire safety certifications, and industry-specific permits. Local/state/national regulations may apply depending on the location.

The top blood glucose meters manufacturers are:

-

Abbott Laboratories

-

DexCom

-

Roche (Accu-Chek)

-

Medtronic

-

LifeScan (OneTouch)

Profitability depends on several factors including market demand, manufacturing efficiency, pricing strategy, raw material cost management, and operational scale. Profit margins usually improve with capacity expansion and increased capacity utilization rates.

Cost components typically include:

-

Land and Infrastructure

-

Machinery and Equipment

-

Building and Civil Construction

-

Utilities and Installation

-

Working Capital

Break even in a blood glucose meters manufacturing business typically range from 5 to 8 years, depending on scale, regulatory compliance costs, raw material pricing, and market demand. Efficient manufacturing and export opportunities can help accelerate returns.

Governments may offer incentives such as capital subsidies, tax exemptions, reduced utility tariffs, export benefits, or interest subsidies to promote manufacturing under various national or regional industrial policies.

Financing can be arranged through term loans, government-backed schemes, private equity, venture capital, equipment leasing, or strategic partnerships. Financial viability assessments help identify optimal funding routes.

Inquire Before Buying

Inquire Before Buying

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Request Customization

Request Customization