Blood Plasma Derivatives Market Size, Share, Trends and Forecast by Type, Application, End User, and Region, 2025-2033

Blood Plasma Derivatives Market Size and Share:

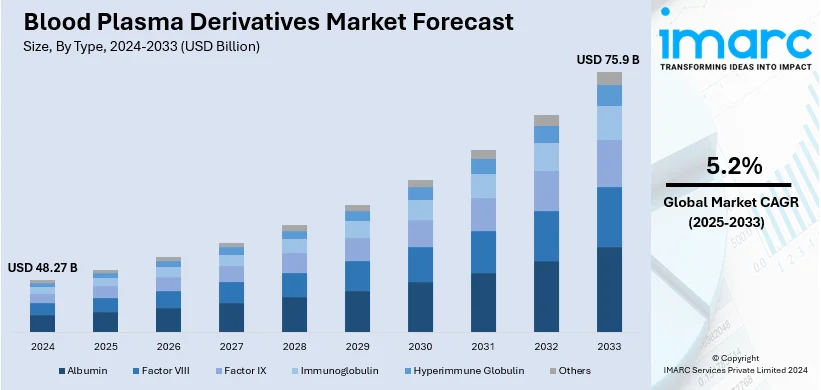

The global blood plasma derivatives market size was valued at USD 48.27 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 75.9 Billion by 2033, exhibiting a CAGR of 5.2% from 2025-2033. North America currently dominates the market, holding a market share of over 48.9% in 2024. The rising chronic disease prevalence, advanced plasma collection infrastructure, technological innovations, growing geriatric population, and expanding therapeutic applications are some of the factors driving the market growth in this region.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 48.27 Billion |

| Market Forecast in 2033 | USD 75.9 Billion |

| Market Growth Rate 2025-2033 | 5.2% |

The global blood plasma derivatives market is thriving due to the increasing prevalence of chronic and rare diseases, including hemophilia, immune deficiencies, and autoimmune disorders, requiring plasma-based therapies. Improvements in plasma fractionation technologies are making derivatives such as immunoglobulins, albumin, and clotting factors more efficient and available, thereby strengthening the market growth. Besides this, the surging demand for these therapies in emerging economies, along with improved health care infrastructure, is supporting the expansion of the market. Moreover, growing regulatory approvals of innovative plasma-based treatments and increasing awareness of their applications are boosting adoption worldwide. Apart from this, an aging population prone to conditions requiring plasma derivatives and growth in the use of advanced diagnostic capabilities that help identify relevant conditions in time further support the upward market movement.

The United States is now emerging as a key market, with a share of 75.90%. With an increasing number of patients suffering from blood disorders like hemophilia, which are affecting around 30,000 to 33,000 males in the USA, the demand for plasma-derived therapies has increased. Also, the aging population is also contributing, as older individuals are more susceptible to conditions treatable with plasma derivatives. Advancements in plasma collection and fractionation technologies have improved the efficiency and availability of these products. The U.S. plays a significant role in plasma collection, representing over 99% of North America's total plasma supply. This extensive collection network supports both domestic needs and global supply, further driving market growth.

Blood Plasma Derivatives Market Trends:

Increasing Demand for Immunoglobulins

Intravenous and subcutaneous immunoglobulin are types of immunoglobulins that play a significant role in the treatment of patients with autoimmune diseases, immunodeficiency syndromes, and complex conditions. WHO estimates that about 5% of cases in the whole population worldwide are due to autoimmune disorders, and this rate has doubled over the past decades. As cited by the NIH, there are about 20 million autoimmunity patients in the U.S. An increasing number of autoimmune and immunodeficiency diseases has raised the need for immunoglobulin therapy. Immunoglobulins are administered to such diseases as CIDP and primary immune deficiencies that necessitate long-term therapy. The intense investment that companies in blood plasma derivatives, including CSL Behring and Grifols, are undertaking in further research and an expansion in production capacity to keep abreast with the global needs of immunoglobulins is impelling the market demand.

Advancements in Plasma Collection and Processing

Advances in plasma collection and processing techniques significantly benefit the global blood plasma derivatives market. It is through plasma collection that therapies such as immunoglobulins and clotting factor concentrates are manufactured. For example, CSL Plasma has more than 350 plasma donation centers across the U.S., Europe, and Asia, thus forming a global network for plasma collection. This wide network of infrastructure has ensured that plasma is more accessible, hence enough quantities available for fractionation into life-saving treatments. Moreover, the International Quality Plasma Program certifies over 1,000 plasma donation centers, ensuring high quality in the collection process. The centers implement modern technologies, such as automated plasma collection systems. This increases efficiency by cutting the time per donation. To ensure a consistent flow of donors, it is necessary to induce the plasma donors themselves and cover the whole process with safety and efficiency.

Technological Innovations in Production

Advances in technology are revolutionizing the manufacture of blood plasma derivatives to make the entire process efficient and economical. For example, companies like CSL are now introducing dynamic pricing models, which would help maximize the plasma donation rate. It ensures CSL gets plasma consistently, thereby managing its operating expenses while providing market returns based on changing conditions. This strategy, coupled with high-tech fractionation, increases yield from each donation of plasma, thus enabling the preparation of more products from a donor. For instance, CSL Behring has invested in high-tech manufacturing facilities, including a USD 2 Billion investment in Melbourne, Australia, which includes a new global headquarters and a plasma fractionation plant. In addition, the automation of plasma collection and processing has significantly reduced the time taken to produce plasma-derived therapies with increased throughput. These innovations contribute to cost efficiency along with higher quality in the final products. The use of such technologies will ensure a constant supply of these essential therapies. This, in a way, will support the ever-expanding blood plasma derivatives market and the increasing world demand for such critical drugs.

Blood Plasma Derivatives Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global blood plasma derivatives market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on type, application, and end user.

Analysis by Type:

- Albumin

- Factor VIII

- Factor IX

- Immunoglobulin

- Hyperimmune Globulin

- Others

In 2024, immunoglobulin emerges as the largest segment in the blood plasma derivatives market, accounting for approximately 48.7% of the total market share. This dominance is attributed to its broad therapeutic applications in treating immune deficiencies, neurological disorders, and autoimmune diseases. The increasing prevalence of conditions such as primary immunodeficiency and chronic inflammatory demyelinating polyneuropathy drives its demand. Advances in production technologies and growing awareness of immunoglobulin therapies further contribute to its leading position. Additionally, the segment benefits from expanding healthcare access in emerging regions and a surge in plasma donations. As the aging population grows, requiring more treatments for age-related disorders, immunoglobulin continues to be a critical component fueling market expansion.

Analysis by Application:

- Hemophilia

- Hypogammaglobulinemia

- Immunodeficiency Diseases

- Von Willebrand's Disease

- Others

By 2024, hemophilia is likely to dominate the blood plasma derivatives market with the ever-escalating prevalence of hemophilia A and B and the regular administration of clotting factors derived from plasma. On top of that, remarkable technological progressions in treatments and more opportunities for easy access to state-of-the-art treatments provide a massive opportunity for expanding the market. In addition to this, improved awareness and early diagnosis of the diseases have increased patient numbers in the treatment cycle, increasing the market share for hemophilia applications in the blood plasma derivatives sector.

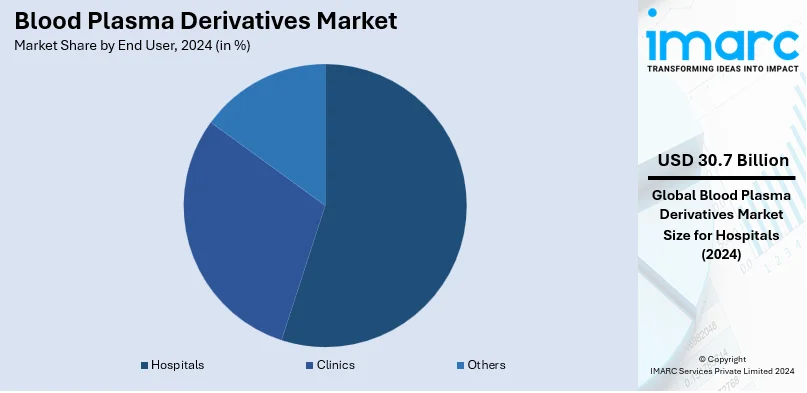

Analysis by End User:

- Hospitals

- Clinics

- Others

In 2024, hospitals dominate the blood plasma derivatives market, accounting for approximately 63.5% of the total market share. Their central role in administering plasma-based therapies for chronic and acute conditions such as hemophilia, immune deficiencies, and neurological disorders positions them as the primary end users. Hospitals' advanced infrastructure and access to skilled healthcare professionals ensure efficient plasma derivative administration, driving their significant share. The increasing prevalence of chronic diseases, coupled with rising hospital admissions for plasma-related treatments, further boosts demand. Additionally, hospitals often serve as the main point of care for critical cases requiring immunoglobulins or clotting factors, solidifying their leadership in the market

Regional Analysis:

- North America

- United States

- Canada

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

North America will have the largest market share in the blood plasma derivatives market in 2024, accounting for more than 48.9%. This is primarily due to well-established plasma collection networks, advanced healthcare infrastructure, and significant improvements in plasma fractionation technologies. The high prevalence of chronic and rare diseases such as hemophilia and immunodeficiencies in the region further boosts demand for plasma-derived therapies. Favorable government policies, extensive research and development activities, and increasing awareness about plasma-based treatments are contributing factors to the growth of the market. The robust supply chain and a growing geriatric population requiring advanced medical care are also burgeoning market expansion

Key Regional Takeaways:

United States Blood Plasma Derivatives Market Analysis

The U.S. blood plasma derivatives market is driven by the high prevalence of chronic and inherited conditions such as hemophilia, autoimmune diseases, and immunodeficiencies. According to the Centers for Disease Control and Prevention (CDC), 33,000 males are living with hemophilia in the U.S., requiring a consistent demand for clotting factor products. Autoimmune diseases affect 23.5 million Americans, which is fueling growth in immunoglobulin therapies. The U.S. leads globally in plasma-derived product innovation, with major players like Grifols and CSL Behring advancing treatment options. Growth is supported by a strong collection infrastructure; nearly 1,000 plasma donation centers now dot the landscape of the nation, Plasma Protein Therapeutics Association stated. Federal policies, Medicare and Medicaid coverage for treatments utilizing plasma, ensure that those requiring such treatment can access these treatments. Advanced fractionation technology has made production easier while improving treatment efficacy. With an aging population and increasing prevalence of chronic diseases, the U.S. continues to be a significant focal point for plasma-derived therapies, particularly with substantial R&D investment and public-private collaborations in response to evolving healthcare needs.

Europe Blood Plasma Derivatives Market Analysis

The market for blood plasma derivatives in Europe is growing due to the increasing demand for therapies to treat hemophilia, autoimmune diseases, and other inherited protein disorders. According to the World Federation of Hemophilia, in 2019, the prevalence of hemophilia A was estimated at 17.1 per 100,000 males and hemophilia B at 3.8 per 100,000 males. Europe has a large number of patients requiring clotting factor products. Autoimmune diseases, like rheumatoid arthritis and lupus, are becoming more prevalent. The therapies for primary and secondary immunodeficiencies, in terms of immunoglobulins, are also growing. For instance, Germany and France are heavily investing in plasma collection infrastructure to meet the demand for the increasing therapy. The EMA also ensures that the blood plasma derivatives are of good safety and efficacy standards and continues to promote innovation in the region. Moreover, aging in the populace of Europe increases demand for plasma-derived treatments such as chronic disorders, specifically over immune deficiencies.

Asia Pacific Blood Plasma Derivatives Market Analysis

The Asia Pacific region is experiencing significant growth in the blood plasma derivatives market due to the growing prevalence of chronic conditions, such as hemophilia and congenital immunodeficiencies. A 2016 World Federation of Hemophilia (WFH) survey reported that approximately 30% of the world's 184,723 people with hemophilia (PWH) resided in Asia Pacific, thus supporting the demand for clotting factor products. Autoimmune diseases have increasingly been reported in the region. The level of awareness of primary immunodeficiencies has also increased; one in 1,200 individuals in the world suffers from primary immunodeficiency, according to an industrial report. China has significantly invested in plasma collection and fractionation facilities. Japan has seen a sharp increase in immunoglobulin treatments for clinical applications such as Guillain-Barré syndrome, thereby increasing market demand. Business partnerships between local and global players ensure the availability of quality plasma-derived treatments to meet this demand.

Latin America Blood Plasma Derivatives Market Analysis

The blood plasma derivatives market in Latin America is prompted by the incidence of hemophilia and other inherited protein disorders. According to National Institutes of Health (NIH), In 2020, 2,863 patients with hemophilia were reported in the region, out of which 82% had hemophilia A and 18% had hemophilia B. Bogotá, Colombia, recorded the highest incidence of 8.3 cases per 100,000 inhabitants. Among hemophilia A patients, 60% presented with the severe form, mainly among men. Autoimmune diseases and primary immunodeficiencies are also prevalent, making it a drug to use immunoglobulin therapies. Countries such as Brazil are improving the collection and manufacturing of plasmas to supplement the increasing demand. Collaboration and cooperation between local and foreign pharmaceutical companies enhance easy access to highly sophisticated plasma derived products. Awareness campaigns and government's health programs improve diagnosis and treatment rates. With a focus on self-sufficiency and increased investments into plasma infrastructure, Latin America is tackling its healthcare challenges and the growing availability of plasma-derived therapies to more people.

Middle East and Africa Blood Plasma Derivatives Market Analysis

The blood plasma derivatives market in the Middle East and Africa is driven by the presence of hemophilia and other bleeding disorders. As per National Library of Medicine, estimated prevalence of hemophilia A and B, which are deficiency states for coagulation factors VIII (FVIII) and IX (FIX), ranges from 1.4 to 8.1 per 100,000 in countries such as Iraq, Iran, Egypt, and Saudi Arabia. The region depends on prophylaxis with intravenous recombinant or plasma-derived factor concentrates for the prevention of hemarthrosis and spontaneous bleeding episodes. The extended half-life (EHL) factor concentrates and subcutaneous therapies like emicizumab have reduced the treatment burden and significantly improved the quality of life of patients. Countries like South Africa and UAE are building plasma infrastructure to improve access to these therapies. Industry leaders such as Novo Nordisk host collaborative expert meetings, shedding light on the ongoing challenges in hemophilia care and guiding regional strategies to improve its management.

Competitive Landscape:

The global blood plasma derivatives market is characterized by intense competition, with key players focusing on innovation, strategic collaborations, and geographic expansion to strengthen their market positions. Major companies dominate the industry, leveraging their advanced R&D capabilities to introduce novel plasma-derived therapies. These firms also invest heavily in plasma collection infrastructure and advanced fractionation technologies to ensure a consistent supply of high-quality products. Strategic mergers and acquisitions, such as Takeda's acquisition of Shire, further consolidate market share. Emerging players in developing regions are gaining traction by expanding plasma collection centers and targeting unmet medical needs. Regulatory approvals for new therapies and increasing investments in clinical trials are shaping the competitive dynamics.

The report provides a comprehensive analysis of the competitive landscape in the blood plasma derivatives market with detailed profiles of all major companies, including:

- Baxter International Inc.

- Bayer AG

- CSL Limited

- Fusion Health Care Pvt. Ltd.

- Grifols S.A.

- Kedrion S.p.A.

- LFB S.A.

- Octapharma AG

- Sanofi S.A.

- Takeda Pharmaceutical Company Limited

Latest News and Developments:

- October 2024: Biotest revealed that it has formed an alliance with SteinCares to make the plasma-derived Factor VIII product, Haemoctin, available to patients in Latin America - Chile, Mexico, and Peru, for the treatment of hemophilia A.

- September 2024: CSL reported that the company sold its Wuhan plasma collection and fractionation operations. This is part of CSL's strategic shift and ongoing optimization of global operations.

- February 2024: Grifols has plans to read out several Phase III in 2024, including the long-term albumin treatment in decompensated cirrhosis, trimodulin for immunology and BT524 for acquired fibrinogen deficiency. Also planned are regulatory submissions for BT524.

- December 2023: PlasmaGen Biosciences announced that they have raised Rs 225 crore from Artian Investments and other investors to expand internationally, develop products, and fund working capital. The company recently inaugurated India's first plasma manufacturing facility in Bengaluru with an annual capacity of 500,000 liters.

- May 2023: PlasmaGen Biosciences announced that it has set up a cutting-edge manufacturing facility in Kolar, Bengaluru, to improve the supply of blood plasma-derived products such as albumin, immunoglobulins, and coagulation factors in India and emerging markets.

Blood Plasma Derivatives Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Albumin, Factor VIII, Factor IX, Immunoglobulin, Hyperimmune Globulin, Others |

| Applications Covered | Hemophilia, Hypogammaglobulinemia, Immunodeficiency Diseases, Von Willebrand's Disease, Others |

| End Users Covered | Hospitals, Clinics, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Baxter International Inc., Bayer AG, CSL Limited, Fusion Health Care Pvt. Ltd., Grifols S.A., Kedrion S.p.A., LFB S.A., Octapharma AG, Sanofi S.A. Takeda Pharmaceutical Company Limited., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the blood plasma derivatives market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global blood plasma derivatives market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the blood plasma derivatives industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

Blood plasma derivatives are products derived from human plasma through fractionation. These include immunoglobulins, albumin, and clotting factors, essential for treating conditions like hemophilia, immune deficiencies, and autoimmune disorders.

The blood plasma derivatives market was valued at USD 48.27 Billion in 2024.

IMARC estimates the global blood plasma derivatives market to exhibit a CAGR of 5.2% during 2025-2033.

Rising prevalence of chronic diseases, advanced plasma collection infrastructure, technological innovations, and expanding therapeutic applications are the primary growth drivers.

In 2024, immunoglobulin represented the largest segment by type, driven by its broad therapeutic applications in immune deficiencies and autoimmune diseases.

Hemophilia leads the market by application owing to its requirement for clotting factor products and improved treatment accessibility.

Hospitals are the leading segment by end user, driven by their infrastructure and expertise in administering plasma-based therapies.

On a regional level, the market has been classified into North America, Asia Pacific, Europe, Latin America, and Middle East and Africa, wherein North America currently dominates the global market.

Some of the major players in the global blood plasma derivatives market include Baxter International Inc., Bayer AG, CSL Limited, Fusion Health Care Pvt. Ltd., Grifols S.A., Kedrion S.p.A., LFB S.A., Octapharma AG, Sanofi S.A., Takeda Pharmaceutical Company Limited, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)