Boom Lifts Market Size, Share, Trends and Forecast by Engine Type, Product Type, End Use, and Region, 2025-2033

Boom Lifts Market Size and Share:

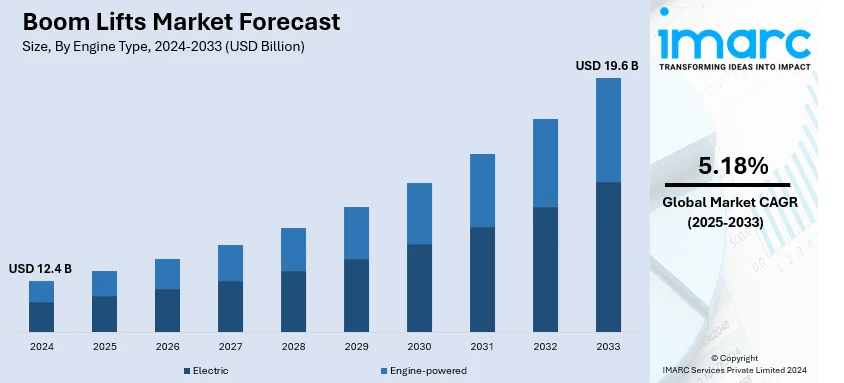

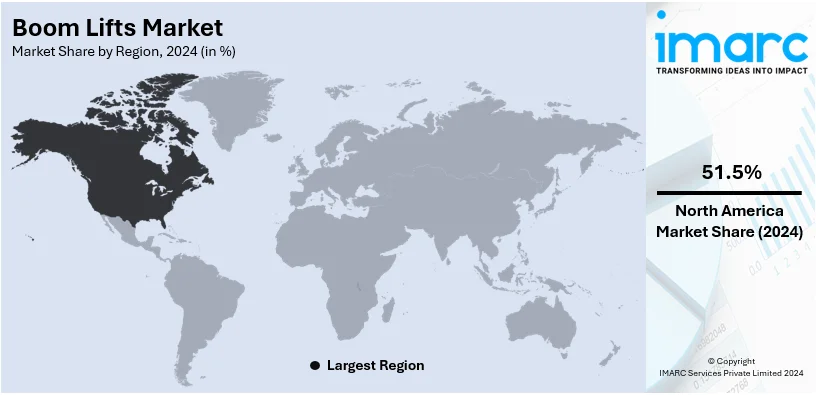

The global boom lifts market size was valued at USD 12.4 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 19.6 Billion by 2033, exhibiting a CAGR of 5.18% from 2025-2033. North America currently dominates the market, holding a market share of over 51.5% in 2024. This region is chiefly driven by resilient construction activity, upgraded infrastructure development, and elevated utilization of aerial work platforms for greater efficacy and safety.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 12.4 Billion |

| Market Forecast in 2033 | USD 19.6 Billion |

| Market Growth Rate 2025-2033 | 5.18% |

The global boom lifts market is majorly driven by increasing construction activities, infrastructure development, and rising demand for efficient material handling and elevated access solutions across industries. The growing emphasis on workplace safety and stringent regulations for worker protection are boosting the adoption of aerial work platforms. Moreover, technological advancements, including electric and hybrid boom lifts, address environmental concerns and expand their application scope. For instance, in April 2024, LGMG unveiled its latest hybrid boom lift AR65JE-H, which provides the flexibility of smooth transition between electric and hybrid modes via intelligent clutch control feature. This model offers seamless transmission as well as resilient power. Additionally, the growth of the rental market supports affordability and accessibility for small and medium enterprises. Expanding urbanization and industrialization in emerging economies further propel the market’s growth potential.

The United States plays a pivotal role in the global boom lifts market, driven by extensive infrastructure development, a strong focus on workplace safety, and rising demand for efficient material handling solutions. The country's robust construction industry and widespread adoption of advanced technologies in aerial work platforms further bolster its market position. For instance, as per industry reports, the U.S. construction industry stands as a key sector within the nation, significantly impacting the overall economy. In 2024, the industry's market size was estimated at around USD 2.1 trillion. Moreover, increased investment in renewable energy projects and urbanization also contribute to the growing use of boom lifts. Additionally, the U.S. rental market for boom lifts is expanding, supported by cost-conscious businesses seeking flexible and scalable access to high-performing equipment.

Boom Lifts Market Trends:

Construction and Urbanization Growth

The global boom lifts market is substantially driven by the surge in construction activities. As urban areas expand, the demand for new buildings, roads, bridges, and other infrastructure projects increases. For instance, according to the UN, today, more than half of the global population lives in urban areas, driving the demand for construction and infrastructure development. Boom lifts play a critical role in these projects, as they provide access to heights and spaces that are otherwise hard to reach. From construction and maintenance to repair and renovation, boom lifts are essential equipment for a wide range of tasks in the construction and infrastructure sectors. This sustained demand for construction and maintenance work fuels the need for versatile and efficient aerial access equipment like boom lifts.

Occupational Safety Regulations

Governments and regulatory bodies around the world are implementing stringent safety regulations to protect workers operating at heights. As companies strive to create safer working environments, there is an increasing emphasis on reducing accidents and injuries during construction, maintenance, and other tasks that involve working at heights. For instance, occupational safety regulations are crucial for preventing workplace injuries and fatalities, with 2.78 Million annual deaths linked to work-related causes, according to the UN Global Compact. Implementing safety measures for equipment like Boom Lifts can significantly reduce these risks, ensuring a healthier, safer work environment. Boom lifts offer a safer alternative to traditional methods, such as ladders and scaffolding, by providing stable platforms and enhanced maneuverability. Additionally, boom lifts contribute to improved efficiency. They enable workers to access elevated areas quickly and easily, reducing the time required to complete tasks. As regulations become more stringent and companies prioritize the well-being of their employees, the adoption of boom lifts as a safer and more efficient solution continues to grow.

Technological Advancements

The integration of technology into boom lifts is another critical factor driving the market. Manufacturers are focusing on innovations that enhance energy efficiency, versatility, and user-friendliness. Modern boom lifts come equipped with features such as telescopic and articulating arms, precise control systems, enhanced maneuverability, and advanced safety mechanisms. These innovations allow operators to navigate through complex job sites and reach heights with precision, making them an attractive choice for various applications. For instance, starting in 2023, EU regulations require new elevators to meet Ecodesign standards, reducing energy usage by up to 30%. This push for energy efficiency supports sustainable technologies like Boom Lifts, offering environmentally friendly and cost-effective solutions in urban mobility. Integration of IoT (Internet of Things) technology has further expanded the capabilities of boom lifts. IoT-enabled boom lifts provide real-time data on their operational status, maintenance requirements, and performance, allowing companies to optimize their usage, schedule maintenance, and reduce downtime. Such advancements enhance the value proposition of boom lifts, making them indispensable tools across multiple industries.

Boom Lifts Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global boom lifts market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on engine type, product type, and end use.

Analysis by Engine Type:

- Electric

- Engine-powered

Engine-powered stand as the largest engine type in 2024, holding around 66.0% of the market. This is attributed to their superior performance and adaptability in demanding environments. Equipped with high-capacity engines, this engine type provides the necessary power to handle heavy loads and challenging terrains, making them indispensable for outdoor applications such as construction, maintenance, and industrial projects. Their ability to operate efficiently in remote areas without access to electric charging infrastructure further strengthens their market position. In addition, continuous innovations in engine technology, including improved fuel efficiency and reduced emissions, align with global environmental standards, driving sustained demand. Furthermore, the preference for robust, reliable, and versatile equipment in high-intensity projects ensures that engine-powered boom lifts remain the leading segment by engine type.

Analysis by Product Type:

- Trailer Mounted Booms

- Vehicle Mounted Booms

- Crawler/Spider Booms

Vehicle mounted booms hold the largest market share by product type, majorly because of their exceptional mobility and operational efficiency. These lifts are mounted on trucks or similar vehicles, allowing for rapid deployment across multiple locations, making them ideal for construction, utility maintenance, and emergency response applications. Moreover, their ability to provide stability while extending to significant heights ensures safe and efficient access to hard-to-reach areas. The growing focus on urban infrastructure development and utility maintenance projects has further bolstered the demand for this segment. Additionally, with advancements in design, such as compact and lightweight models, vehicle-mounted boom lifts continue to cater to a diverse range of industries, solidifying their dominance in the global market.

Analysis by End Use:

- Rental

- Construction and Building

- Mining

- Transportation and Logistics

- Landscaping and Orchard Work

- Others

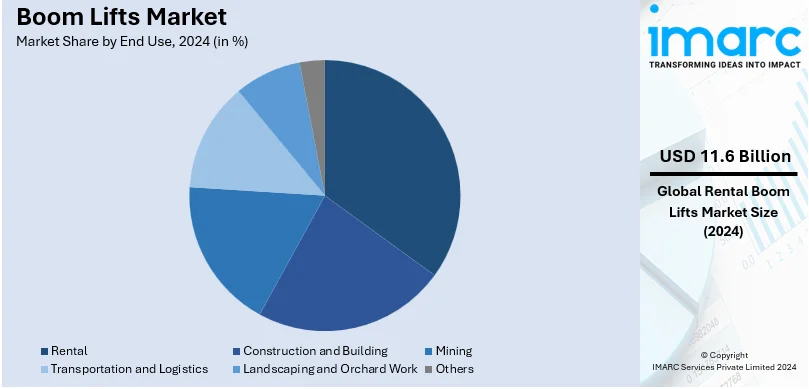

Rental leads the market with around 93.2% of market share in 2024. This segment is chiefly driven by its cost-effectiveness and operational flexibility. Renting boom lifts eliminates the need for significant capital investment, making advanced equipment accessible to a broader range of users, from small contractors to large enterprises. The ability to access a variety of models tailored to specific project needs further enhances the appeal of the rental market. In addition, rapid urbanization and infrastructure projects, particularly in emerging economies, have increased demand for short-term equipment solutions. Rental providers also offer maintenance and technical support, reducing downtime and operational risks for end-users. Furthermore, as businesses increasingly prioritize scalable and efficient solutions, the rental segment continues to secure the largest market share.

Regional Analysis:

- North America

- United States

- Canada

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Others

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, North America accounted for the largest market share of over 51.5%. This region is principally driven by extensive infrastructure development, robust construction activities, and widespread adoption of advanced equipment for workplace safety. The region's emphasis on productivity and efficiency in sectors such as construction, warehousing, and maintenance fuels consistent demand for boom lifts. Strong investments in urbanization projects, coupled with stringent safety regulations, further enhance market growth. For instance, in September 2024, provincial and federal governments, along with local partners, announced a substantial investment of more than $89 Million for clean transportation, energy-effective buildings, and clean energy across British Columbia, a Canadian Province. In addition, the presence of leading manufacturers and a well-established rental market supports the availability and accessibility of boom lifts. Moreover, increasing automation in material handling and industrial applications contributes to the sustained expansion of this market in North America.

Key Regional Takeaways:

United States Boom Lifts Market Analysis

In 2024, United States accounted for 95.60% of the market share in North America. This nation is leveraging advanced construction and industrial machinery across diverse sectors, including infrastructure development, warehousing, and agriculture, to enhance operational efficiency and safety. With widespread implementation in states like Texas, California, and Florida—key hubs for construction and logistics—these machines streamline tasks in both urban and rural projects. For instance, according to the Council of Supply Chain Management Professionals, the U.S. logistics industry, valued at USD 1.6 Trillion in 2019 (8% of GDP), thrives on an integrated supply chain network. Boom lifts enhance efficiency in this sector by streamlining warehouse operations and ensuring safe, high-reach access for goods handling. Their use reduces manual labor, improves accessibility to hard-to-reach areas, and ensures compliance with stringent safety regulations. In cities such as New York and Chicago, these solutions are vital for high-rise maintenance and renovation, while in agricultural regions like Iowa, they support crop management and storage operations. The adoption across industries is driven by economic growth, government infrastructure initiatives, and the rising demand for energy-efficient, versatile machinery. This technological shift benefits diverse sectors, fosters faster project completion, reduces risks, and positions the U.S. as a global leader in adopting smart industrial equipment.

Europe Boom Lifts Market Analysis

Europe is leveraging its robust infrastructure, advanced construction techniques, and commitment to sustainability to excel in industries such as construction, logistics, and maintenance. Countries like Germany, France, and the United Kingdom are at the forefront of innovation, utilizing cutting-edge equipment to enhance efficiency and safety in projects. According to CEIC data, Germany's urban population reached 65.7 Million in 2023, marking a 0.97% annual growth, fostering demand for boom lifts to efficiently support urban infrastructure development and high-density construction projects. In regions such as Scandinavia, emphasis on green construction aligns with the use of modern machinery, driving operational advancements. Italy and Spain, with their thriving tourism and historical restoration projects, have showcased notable success in preserving heritage sites while ensuring worker safety through modern access solutions. Urban hubs like London, Paris, and Berlin are utilizing advanced equipment for high-rise maintenance, streamlining operations in congested areas while adhering to stringent environmental regulations. The European Union's investment in smart city projects and renewable energy further boosts demand for versatile equipment, enabling seamless integration into various applications. This progress highlights Europe's strategic position as a leader in adopting innovative tools for diverse applications.

Asia Pacific Boom Lifts Market Analysis

Asia-Pacific is emerging as a key hub for advanced construction and industrial solutions, driven by rapid urbanization and infrastructure projects across countries such as China, India, and Japan. Regions like Southeast Asia, including Vietnam and Indonesia, are experiencing significant growth in real estate and industrial sectors. For instance, in August 2023, rapid urbanization and a booming real estate sector in Gujarat, with 1.10 lakh elevators as of March 2023 and 11,000 added in 2022-23, highlight a significant opportunity for boom lifts, enabling efficient construction and maintenance in high-demand cities like Ahmedabad, which leads with 41,000 lifts. Boom lifts are enhancing operational efficiency in skyscraper construction in Singapore and large-scale manufacturing plants in South Korea. These countries benefit from increased worker safety, streamlined operations, and access to challenging heights, critical for sectors like logistics and warehousing. With diverse terrains and urban landscapes, Asia-Pacific's adoption of these technologies is enabling faster project completion, reduced labor costs, and compliance with stringent safety regulations. Overall, the region is leveraging modern solutions to meet its growing industrial and construction demands.

Latin America Boom Lifts Market Analysis

Latin America is increasingly adopting advanced aerial work platforms across various industries, improving operational efficiency and safety. Countries like Brazil and Mexico are leading with major infrastructure projects that require reliable access solutions. These platforms are especially beneficial in the construction and energy sectors, enhancing mobility and enabling safe operations at height. In Brazil, government reforms are driving growth in the lift market, particularly with the upcoming MERCOSUR-EU trade agreement. Argentina's renewable energy projects use aerial work platforms for turbine maintenance, while Colombia incorporates them into urban development. Additionally, Colombia’s urban housing supply has been rising, but it remains insufficient to meet demand, with over 1.3 Million homes lacking in the country's housing stock, according to official statistics. This housing shortage serves as a key driver for the boom lift market, as increased construction activity demands efficient and safe access solutions. These innovations streamline workflows, reduce downtime, and help meet safety standards, positioning Latin America as a growing hub for modernized industrial and construction practices.

Middle East and Africa Boom Lifts Market Analysis

The Middle East and Africa region, spanning from Morocco in the west to Iran in the east, encompasses diverse landscapes including deserts, mountains, and coastal plains. This area is experiencing rapid urbanization and infrastructure development, particularly in countries like Saudi Arabia, UAE, and South Africa. Major cities in the region are witnessing significant construction activities, including high-rise buildings, transportation networks, and mega-events. For instance, Saudi Arabia started the Rua Al Madinah project in August 2022 to expand the Kingdom's tourism and pilgrimage industries. Notably, the infrastructure initiative aims to strengthen Madinah's reputation as a centre of Islamic culture. The building project is being designed and carried out by Rua Al Madinah Holding Company, which is owned by PIF and is in line with Saudi Arabia's Vision 2030. By 2030, the project will, among other things, renovate 1.5 Million square metres and create 47,000 hotel rooms. These projects require efficient and safe access to elevated work areas, enhancing productivity and worker safety. The construction boom is further supported by government initiatives and foreign investments, driving economic growth across the region.

Competitive Landscape:

The global boom lifts market features a competitive landscape dominated by key players focusing on innovation, strategic partnerships, and geographic expansion. For instance, in April 2024, Rentease announced the strategic acquisition of Haulotte’s large batch of 16m Diesel Articulated Boom HA16 RTJ. This collaboration reflects the importance of partnership efforts in facilitating innovation and bolstering market growth. Moreover, leading companies are investing in advanced technologies, such as electric and hybrid models, to address rising demand for sustainable equipment. Furthermore, collaborations with construction firms and rental services enhance market reach and customer accessibility. Continuous product enhancements, including safety features and performance improvements, are key strategies for maintaining competitive advantage. Besides this, regional and local manufacturers contribute by catering to niche markets with customized solutions. Additionally, strong distribution networks and aftersales support play a crucial role in sustaining market leadership, ensuring customer satisfaction and loyalty in this highly dynamic and evolving industry.

The report provides a comprehensive analysis of the competitive landscape in the boom lifts market with detailed profiles of all major companies, including:

- Dexterlifts Oy

- Dinolift Oy

- Galmon (S) Pte Ltd

- Haulotte Group SA

- JLG Industries, Inc. (Oshkosh Corporation)

- Leguan Lifts Oy (Avant Tecno Group)

- Niftylift (UK) Limited

- Skyjack Inc (Linamar Corporation)

- Teupen Maschinenbau GmbH

- Xuzhou Construction Machinery Group Co., Ltd.

- Zoomlion Heavy Industry Science&Technology Co., Ltd.

Latest News and Developments:

- November 2024, Zoomlion unveiled the ZA32RJE electric articulating boom lift at Intermat 2024, designed for overseas markets with a compact width of 3ft 11in and stowed height of 6ft 6in. It offers eco-friendly operation with non-marking tires, an electric drive system, and a work envelope reaching 15ft 1in up-and-over for indoor and outdoor use. The ZA45J diesel boom lift, featuring a 51ft 10in maximum working height and 660 lb platform capacity, excels in industrial applications with a dual control system and ANSI, CSA, and CE certifications.

- August 2024: JCB launched its first diesel-powered telescopic boom platform, the T 65D, during the Aerial Platform Association of India's conference in Goa. Manufactured at JCB's Jaipur facility, the T 65D boasts a platform height of 65 feet 4 inches, a reach of 56 feet 6 inches, and a maximum load capacity of 450 kg. Equipped with a JCB diesel engine and enhanced safety features, it aims to meet the growing demand in India's construction and industrial sectors.

- September 2024: Niftylift launched two new models, including its first-ever straight boom platform. The all-electric HR22 SE was developed in response to customer requests for a telescopic boom, offering enhanced versatility. The second model, an updated version of the HR12 4x4 boom lift, completes the upgrade of all Niftylift machines in this class. This includes the low-weight HR12LE, the narrow HR12N, and the narrow, electric HR12NE, providing a range of options to meet varying operational needs.

- November 2024: LGMG introduced the A43JE, an electric-powered articulating boom lift designed to offer exceptional reach, maneuverability, and efficiency. Built for narrow and confined job sites, the A43JE features a rotating jib as standard, enabling horizontal rotation that greatly enhances the lift’s versatility and reach. This feature allows operators to position the platform with precision, making it ideal for working in tight spaces. The A43JE provides a reliable solution for contractors and industrial applications where space is limited, ensuring maximum performance in challenging environments.

- April 2023: Mantall launched its electric articulated boom lift, HZ170JAC, at SMOPYC 2023 in Spain. This innovation emphasizes sustainability with zero emissions and offers superior maneuverability and efficiency. Its design caters to diverse industries requiring high-reach solutions. The HZ170JAC also showcases advanced safety features and ease of operation. Mantall's contribution highlights the growing shift toward environmentally conscious equipment.

Boom Lifts Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Engine Types Covered | Electric, Engine-Powered |

| Product Types Covered | Trailer Mounted Booms, Vehicle Mounted Booms, Crawler/Spider Booms |

| End Uses Covered | Rental, Construction and Building, Mining, Transportation and Logistics, Landscaping and Orchard Work, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Dexterlifts Oy, Dinolift Oy, Galmon (S) Pte Ltd, Haulotte Group SA, JLG Industries, Inc. (Oshkosh Corporation), Leguan Lifts Oy (Avant Tecno Group), Niftylift (UK) Limited, Skyjack Inc (Linamar Corporation), Teupen Maschinenbau GmbH, Xuzhou Construction Machinery Group Co., Ltd., Zoomlion Heavy Industry Science&Technology Co., Ltd., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the boom lifts market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global boom lifts market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the boom lifts industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

Boom lifts are versatile aerial work platforms designed to elevate workers and equipment to hard-to-reach areas. They feature extendable arms, offering flexibility for tasks like construction, maintenance, and warehousing. Available in various types, boom lifts enhance efficiency, safety, and accessibility across industrial, commercial, and residential applications.

The boom lifts market was valued at USD 12.4 Billion in 2024.

IMARC estimates the global boom lifts market to exhibit a CAGR of 5.18% during 2025-2033.

The market is driven by increasing construction activities, growing demand for efficient material handling, rapid urbanization, and advancements in boom lift technology. Additionally, the expansion of the rental industry and heightened focus on worker safety further contribute to market growth.

In 2024, engine-powered represented the largest segment by engine type, driven by their superior power, reliability, and suitability for demanding outdoor tasks.

Vehicle mounted booms lead the market by product type, driven by their versatility and ability to access hard-to-reach areas.

The rental is the leading segment by end use, driven by cost-efficiency and flexibility, as businesses are actively prioritizing short-term access over ownership.

On a regional level, the market has been classified into North America, Asia Pacific, Europe, Latin America, and Middle East and Africa, wherein North America currently dominates the global market.

Some of the major players in the global boom lifts market include Dexterlifts Oy, Dinolift Oy, Galmon (S) Pte Ltd, Haulotte Group SA, JLG Industries, Inc. (Oshkosh Corporation), Leguan Lifts Oy (Avant Tecno Group), Niftylift (UK) Limited, Skyjack Inc (Linamar Corporation), Teupen Maschinenbau GmbH, Xuzhou Construction Machinery Group Co., Ltd., Zoomlion Heavy Industry Science&Technology Co., Ltd., etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)