Bottled Water Market Size, Share, Trends and Forecast by Product Type, Distribution Channel, Packaging Type, and Region, 2026-2034

Bottled Water Market Size and Share:

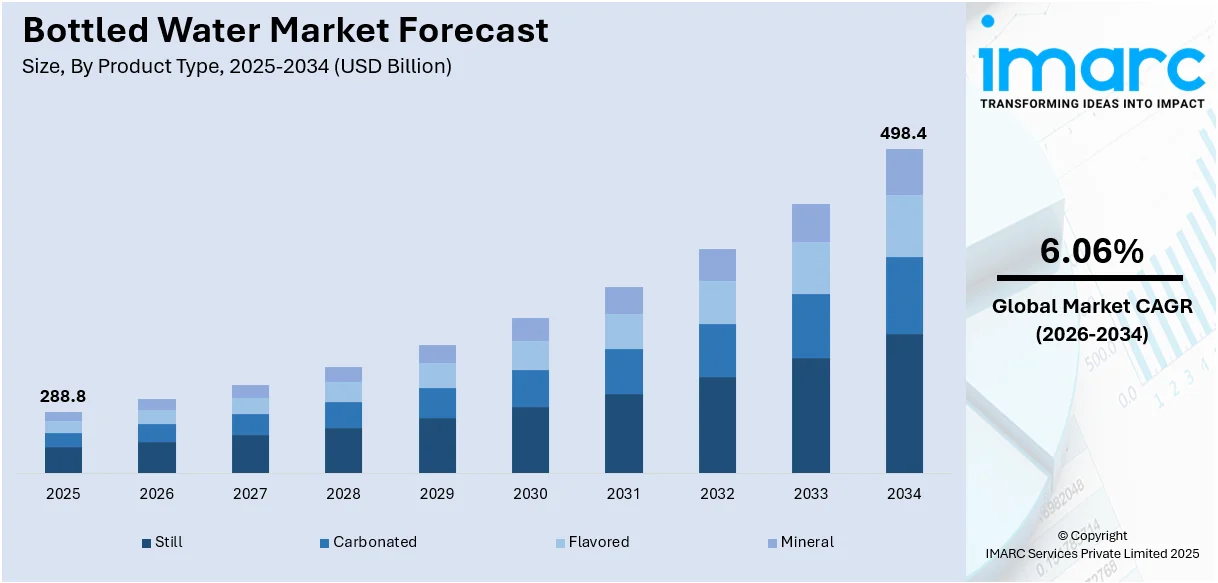

The global bottled water market size was valued at USD 288.8 Billion in 2025. Looking forward, IMARC Group estimates the market to reach USD 498.4 Billion by 2034, exhibiting a CAGR of 6.06% during 2026-2034. Asia-Pacific currently dominates the market, holding a significant market share of over 44.5% in 2025. The market is fueled by growing health awareness, environmental concerns, and a shift away from sugary drinks. The rising demand for premium and functional water, along with eco-friendly packaging and increasing urbanization, is boosting the bottled water market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 288.8 Billion |

| Market Forecast in 2034 | USD 498.4 Billion |

| Market Growth Rate 2026-2034 | 6.06% |

The increasing awareness about health and wellness among consumers has compelled them to switch from the consumption of sugary beverages toward healthier hydration alternatives. Other factors driving demand are rising water contamination concerns and lack of access to clean drinking water, especially in developing regions. According to Water, 2.2 billion individuals globally do not have access to safe, drinkable water in 2024. Convenience and on-the-go lifestyles have led to the increased consumption of bottled water, mainly among urban populations. Advancements in packaging technology, including eco-friendly and lightweight materials, have also made bottled water more attractive and sustainable. Marketing efforts emphasizing purity, mineral content, and origin also attract health-conscious consumers. In addition, premium and functional water categories, such as alkaline, vitamin-enriched, and flavored water, are also a result of evolving consumer preferences. Increasing disposable income across emerging markets and distribution expansion through online and retail distribution channels also supports the growth in the market.

To get more information on this market Request Sample

The United States has emerged as a key regional market for bottled water. Health awareness and less consumption of carbonated, sugary drinks have significantly propelled the United States bottled water market. In an ever-increasing push for hydration, consumers now prefer their water to be healthier as well. Consequently, increasing demand for tap water alternatives due to declining tap water quality and increasing concerns related to safety - particularly across regions with deteriorating infrastructures - increase demand even further. Convenience and portability are also important factors; busy lifestyles drive the preference for bottled water over traditional sources. The premium and functional water segments, such as alkaline, electrolyte-enhanced, and flavored water, are experiencing tremendous growth in the market due to diverse consumer preferences. Environmental sustainability is influencing the purchasing decision, and the manufacturers are adopting eco-friendly packaging and recycling initiatives.

Bottled Water Market Trends:

Increasing health and wellness consciousness

The rising health and wellness consciousness among individuals represents one of the key factors catalyzing the demand for bottled water. According to EY, 40% of Indian respondents stated that they will pay a premium for products promoting health and wellness which is higher than their global counterparts (29%). The increasing demand for alkaline and vitamin-infused water among fitness freaks is stimulating the bottled water market growth. According to the EY India’s report, ‘The Sunrise Consumer Health and Nutrition Sector’- around 94% of Indians are worried about their family's health against 82% globally, while 52% of respondents think changes in their approach to mental well-being will persist beyond COVID-19, globally it is just 39%.

Growing environmental concerns

The growing environmental concerns among the masses are encouraging them to purchase products with eco-friendly packaging. According to a survey by Aquasana, 52% of respondents noted they use a water filter because it's environmentally friendly, making this the most common reason among Americans in 2023 and up from 41% in 2022. This is further boosting the bottled water industry statistics. Bottled water companies are implementing eco-friendly production processes and experimenting with alternative packaging materials like glass, aluminum, and cardboard cartons as they are more recyclable and have a lower environmental impact compared to traditional plastic bottles. For instance, in August 2022, FIJI Water transitioned its iconic and best-selling 500ML and 330ML bottles to 100% recycled plastics (rPET) in the US, with its longstanding commitment to environmental sustainability. The move is a substantial step in reducing plastic waste and replaces almost 65% of FIJI Water’s bottle volume in the US with recycled material. This is further supporting the bottled water market research across the globe.

Convenience and on-the-go lifestyle

Rapid urbanization and the fast-paced lifestyles of individuals are also factors driving the market. At present, more than half of the world's population lives in cities, and this number is expected to increase to nearly 70% by 2050, as reported by the United Nations. The main reason for this is that bottled water provides an easy and trouble-free method for maintaining hydration in different environments like offices, gyms, and during trips, leading to market expansion. The increasing attention from different manufacturers to create and develop products that provide convenience to consumers such as resealable caps, portable packaging, and smart dispensers is boosting the market growth by improving the overall convenience of bottled water consumption. In March 2023, Hiru Corporation revealed a new multi-million-dollar co-packing deal with VOSS Water, known for its premium still and sparkling water products. This is likely to drive growth in the projected bottled water market for the next few years.

Innovation in Packaging and Products

Improvements in packaging, purification, and flavor infusion technologies, along with environment friendly alternatives such as atmospheric water harvesting, are playing a major role in driving the market. Packaging advances, including lightweight, biodegradable packaging containers and the use of biodegradable materials, appeal to eco-friendly customers looking for sustainable solutions. While the advancements in water purification methods, including reverse osmosis and ultraviolet (UV) filtration, guarantee better quality and safety of the product. Flavor infusion technologies introduce the possibility of producing an extensive range of flavored waters, responding to consumers' increasing interest in low-calorie and healthy drinking fluids. Moreover, atmospheric water extraction, a new technology with the capability to harvest water from the humidity of the air, presents a new solution to issues of water scarcity, also targeting ecologically and socially responsible consumers. Together, these innovations not only increase product attractiveness but also respond to changing consumer tastes, catalyzing demand in the packaged water industry.

Bottled Water Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global bottled water market report, along with forecasts at the global, regional, and country levels for 2026-2034. Our report has categorized the market based on product type, distribution channel and packaging type.

Analysis by Product Type:

- Still

- Carbonated

- Flavored

- Mineral

Still dominates the market in 2025, holding around 55.8% of the market. Still bottled water hydrates and does not contain the fizz and carbonation of sparkling water or soda, which helps to maintain hydration levels. Furthermore, growing health awareness among people is boosting the demand for still bottled water. Besides this, growing engagement of people in sports and fitness activities is driving the demand for energy drinks for post-workout rehydration, which is further supporting the demand for bottled water.

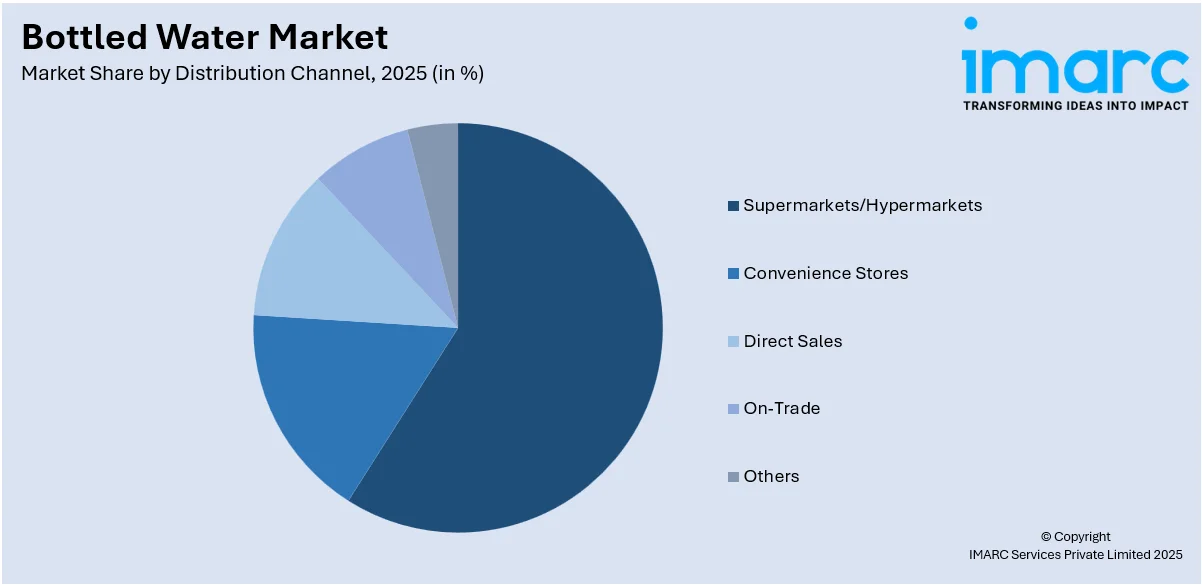

Analysis by Distribution Channel:

Access the comprehensive market breakdown Request Sample

- Supermarkets/Hypermarkets

- Convenience Stores

- Direct Sales

- On-Trade

- Others

Supermarkets and hypermarkets lead the market with around 59.4% of market share in 2025. Supermarkets/hypermarkets offer extensive shelf space as well as wide variety under one roof. Such spaces are considered as consumers first choice while seeking bottled water. It allows wide exposure of different brands, sizes as well as types of packaging that enables both competition and innovation with abundant consumer choice. Convenience stores simply provide ready access for high-paced lifestyles consumers seeking to acquire bottled water. Their strategic locations and extended hours of operation make them handy stops for impulse purchases of bottled water for the always-on-the-go consumer or traveler. Direct-to-consumer sales channels are those by which manufacturers directly connect with consumers. These offer transparency, a customized experience, and unique products that consumers will not find elsewhere. They enable brands to obtain insights into consumers and foster brand loyalty.

Analysis by Packaging Type:

- PET Bottles

- Metal Cans

- Others

PET bottles lead the market with around 80.0% of market share in 2025. PET bottles exist in various sizes, the smaller single serve, which is suitable for one individual use and the large container, suited for family consumption. The bottles can be fully recycled, giving the product an environmental friendliness aspect. They get recycled to form new bottles or in the process help reduce orders of virgin plastics and waste volume. For example, In October 2023, Coca-Cola India, a beverage firm, announced that it has launched fully recycled PET bottles for its flagship brand Coca-Cola in pack sizes of 250ML and 750ML across multiple markets in the country.

Regional Analysis:

To get more information on the regional analysis of this market Request Sample

- North America

- United States

- Canada

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2025, Asia-Pacific accounted for the largest market share of over 44.5%. According to UN-Habitat, urbanization continues to be a defining megatrend in the Asia Pacific region. 54% of the global urban population, more than 2.2 billion people, live in Asia. By 2050, the urban population in Asia is expected to grow by 50%-an additional 1.2 billion people. The increasing income levels of people are allowing them to spend more on premium bottled water brands, which also range from natural spring water to specific mineral content. Furthermore, the growing prevalence of water-borne diseases in numerous countries of the Asia Pacific region due to the increasingly polluted water levels is making the market stronger. According to the Economic Times, it is reported that the Delhi government issued an advisory dated July 2023 on dos and don'ts cautioning people about this increased risk of catching water-borne diseases in the form of diarrhea, dysentery, and cholera with the onset of rains.

Key Regional Takeaways:

United States Bottled Water Market Analysis

In 2025, the United States accounts for over 87.3% of bottled water market in North America. The U.S. bottled water market is motivated by increased health awareness among consumers who prefer healthier hydration over sugar-based beverages. In fact, a Yahoo News/YouGov poll of 1,746 U.S. adults found that 8% drink water rarely or never, 25% drink only 1-2 glasses per day, and 66% drink three or more glasses per day. This is a huge opportunity to address hydration gaps through convenient bottled water solutions. The increasing popularity of sparkling and flavored water helps build momentum. Quality concerns in some regions regarding the taste of municipal tap water compel consumers to opt for bottled water as a safe bet. Innovations in sustainable packaging like reusable and eco-friendly bottles attract environmentally conscious buyers. E-commerce platforms act as a growth engine as diverse product options are readily available. With more emphasis on health and wellness, bottled water has established itself as an all-time favorite among American consumers.

Asia Pacific Bottled Water Market Analysis

Rapid urbanization, an increase in disposable incomes, and a rising middle class population are some of the factors driving demand for bottled water in Asia Pacific. Contaminated water in the developing world raises concerns, hence people are inclined towards bottled water. Increased interest in fitness and wellness activities, especially by the youth, increases the demand for functional and flavored waters. E-commerce plays a crucial role in the growth of the market, with YouGov stating that 56% of consumers in Indonesia and 50% in Thailand generally prefer to shop online as opposed to visiting physical stores. This also opens up the accessibility of products and encourages engagement through digital channels. In addition, solid advertising campaigns and celebrity endorsements improve visibility and customer confidence. Lightweight and sustainable packaging innovations are also one of the new bottled water industry trends, largely as environmental awareness develops in the region.

Europe Bottled Water Market Analysis

Health and wellness and the high demand for naturals, particularly mineral and spring water, drive the European bottled water market. High awareness among consumers significantly drives demand for biodegradable packaging, well in line with stringent sustainability targets in the region. Oney is the leader in fractional payments in many European countries and had the firm Harris Interactive survey a representative sample of the population for the second edition of its barometer on better consumption with circular economy at the core. For 2022, 90% of Europeans had already made sustainability a primary factor in purchase decisions, pushing innovation in packaging, enhancing brand loyalty, among others. Urbanization and busy lifestyles also increase demand for on-the-go hydration solutions, especially in more densely populated regions. The market also saw increasing interest in functional waters containing vitamins and minerals, which appeals to consumers who are health-conscious. Demand is also sustained by the tourism and hospitality industries, especially during peak travel seasons. Strict regulations of the EU on the quality of bottled water improve consumer confidence, while e-commerce platforms and premium offerings expand accessibility and variety, driving market growth across the region.

Latin America Bottled Water Market Analysis

Concern for water quality is driving demand for bottled water in Latin America. In Brazil, 56% of consumers reported that their mental well-being was their priority, and 63% wanted foods and beverages that contained ingredients that promoted mental and emotional health, so demand for functional and enhanced water products is rising. The increasing urbanization and rising disposable incomes will further accelerate the market, where consumers increasingly prefer premium and convenient hydration solutions. Moreover, the region's warm climate sustains year-round consumption, whereas the improvement in retail and e-commerce platforms enhances access and product availability.

Middle East and Africa Bottled Water Market Analysis

Middle East and Africa bottled water demand is propelling due to the arid climate, limited availability of clean tap water, and a general need for safe hydration. The region's population lives in cities in around 64%, as per World Bank statistics, thus increasing the demand for portable and reliable drinking water solutions. The health consciousness and increasing desire for premium bottled water is catering to an increasingly affluent consumer base. Sustainable packaging is rising in popularity, and hospitality and tourism-both sectors are improving market growth, especially across the nations of the Gulf.

Competitive Landscape:

Key players in the global bottled water market are implementing various strategies to drive growth and meet evolving consumer demands. They are focusing on product innovation, introducing functional water options such as vitamin-infused, alkaline, and electrolyte-enhanced water to cater to health-conscious consumers. Sustainability is a major priority, with companies investing in eco-friendly packaging solutions, including biodegradable and 100% recycled PET bottles, to reduce environmental impact. Strategic marketing campaigns emphasizing purity, health benefits, and sustainable practices are enhancing brand visibility and consumer trust. Additionally, key players are expanding their distribution networks through both online and offline channels, ensuring greater product availability and convenience.

The report provides a comprehensive analysis of the competitive landscape in the bottled water market with detailed profiles of all major companies, including:

- Bisleri International Pvt. Ltd.

- Danone S.A.

- Gerolsteiner Brunnen GmbH & Co. KG

- Nestle S.A.

- Nongfu Spring (Yangshengtang Co. Ltd.)

- Otsuka Pharmaceutical Co. Ltd.

- PepsiCo Inc.

- Primo Water Corporation

- Tata Consumer Products Limited

- The Coca-Cola Company

Latest News and Developments:

- May 2025: Nestlé announced plans to sell its water division, including Perrier and S.Pellegrino, later this year, hiring Rothschild & Co. as advisor. Valued at over €5 billion, the sale aligns with CEO Laurent Freixe’s strategy to focus on around 30 core brands like Kit-Kat and Nescafe. Private equity firms such as Platinum Equity, Blackstone, and One Rock Capital have shown interest. Nestlé aims to retain a stake in the water business amid a tough bottled water market impacted by water scarcity and post-pandemic sales declines.

- March 2025: Bisleri International partnered with Schneider Electric’s Sustainability Business to boost energy efficiency and expand solar power under ‘Bisleri’s Greener Promise.’ The collaboration will install up to 13.6 MW of solar capacity across six plants in Maharashtra, Tamil Nadu, Karnataka, and Uttar Pradesh, increasing green energy use to nearly 33% and improving energy efficiency by 2.5%. This initiative aims to reduce carbon emissions by 16,000 tons annually. Bisleri also focuses on recycling, water conservation, and lightweighting PET bottles, cutting CO2 by 15,000 tons yearly, reinforcing its sustainable commitments.

- February 2025: IOTA Water launched in North India as India's first bottled water infused with advanced Oxygen Nanobubbles technology, developed by NICO Nanobubble India Co. This innovation enhances hydration by improving oxygen absorption, promoting wellness benefits beyond conventional bottled water. The product is priced for mass consumption, making high-quality, oxygen-enriched water accessible to everyday consumers, athletes, and health-conscious individuals.

- February 2025: Win Win Water launched 100% plant-based, fully biodegradable bottles made from Luminy® PLA, a sugarcane-derived bioplastic, addressing environmental issues of traditional plastics. These bottles, including lids and labels, decompose within 90 days in commercial composting facilities yet are durable for multiple reuses. The company offers naturally alkaline electrolyte spring water, emphasizing sustainability, ethical sourcing, and social responsibility.

- January 2025: CR Beverage, a leading bottled water brand in China, invested in three high-speed aseptic complete lines from Sidel to meet growing consumer demand for higher quality, healthier, and eco-friendly packaging. This move supports CR Beverage’s goal to expand its beverage portfolio.

Bottled Water Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Still, Carbonated, Flavored, Mineral |

| Distribution Channels Covered | Supermarkets/Hypermarkets, Convenience Stores, Direct Sales, On-Trade, Others |

| Packaging Types Covered | PET Bottles, Metal Cans, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Bisleri International Pvt. Ltd., Danone S.A., Gerolsteiner Brunnen GmbH & Co. KG, Nestle S.A., Nongfu Spring (Yangshengtang Co. Ltd.), Otsuka Pharmaceutical Co. Ltd., PepsiCo Inc., Primo Water Corporation, Tata Consumer Products Limited, The Coca-Cola Company, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the bottled water market from 2020-2034.

- The bottled water market research report provides the latest information on the market drivers, challenges, and opportunities in the global market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the bottled water industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

Bottled water refers to drinking water packaged in sealed containers, typically made of plastic or glass, for convenient consumption. It includes various types such as spring water, purified water, mineral water, and distilled water. Bottled water is often marketed for its purity, taste, and portability, catering to health-conscious and on-the-go consumers.

The bottled water market was valued at USD 288.8 Billion in 2025.

IMARC estimates the global bottled water market to exhibit a CAGR of 6.06% during 2026-2034.

The global bottled water market is driven by increasing health awareness, water quality concerns, rising disposable income, urbanization, convenience, and demand for premium and functional water products.

According to the report, still represented the largest segment by product type, driven by its widespread consumer preference for natural-tasting, calorie-free hydration and its availability across various retail and distribution channels.

Supermarkets/hypermarkets dominate the market due to their wide product selection, competitive pricing, and convenient one-stop shopping experience for consumers.

PET bottles represent the largest segment due to their lightweight, durability, cost-effectiveness, and recyclability, making them highly convenient and widely used for bottled water packaging.

On a regional level, the market has been classified into North America, Asia Pacific, Europe, Latin America, and Middle East and Africa, wherein Asia Pacific currently dominates the global market.

Some of the major players in the global bottled water market include Bisleri International Pvt. Ltd., Danone S.A., Gerolsteiner Brunnen GmbH & Co. KG, Nestle S.A., Nongfu Spring (Yangshengtang Co. Ltd.), Otsuka Pharmaceutical Co. Ltd., PepsiCo Inc., Primo Water Corporation, Tata Consumer Products Limited, The Coca-Cola Company, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)