Bouillon and Stock Cubes Market Report by Product Type (Vegetable, Fish, Meat, Poultry, Beef, and Others), Form (Cubes, Liquid, Powder, Granules, and Others), Distribution Channel (Supermarket and Hypermarket, Independent Grocery Stores, Online Retail, and Others), and Region 2025-2033

Bouillon and Stock Cubes Market Size:

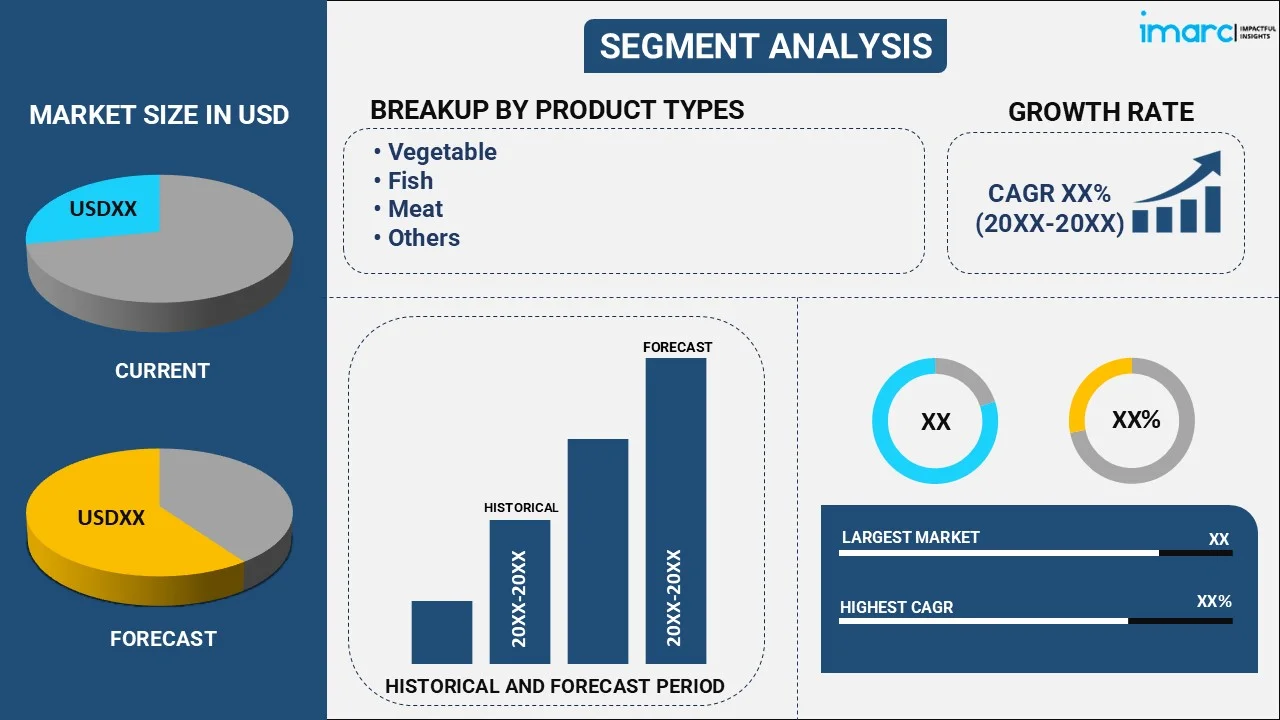

The global bouillon and stock cubes market size reached USD 10.0 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 14.7 Billion by 2033, exhibiting a growth rate (CAGR) of 4.4% during 2025-2033. The heightened need for convenient food products to simplify cooking process, increasing demand for food products devoid of preservatives, genetically modified organisms (GMOs) and other additives, and rising focus on health and wellness among the masses are facilitating the market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 10.0 Billion |

|

Market Forecast in 2033

|

USD 14.7 Billion |

| Market Growth Rate 2025-2033 | 4.4% |

Bouillon and Stock Cubes Market Analysis:

- Major Market Drivers: The global bouillon and stock cubes market is experiencing strong growth primarily due to the increasing demand for flavorful stock cubes to prepare several types of dishes. The rising availability of fortified stock cubes in offline and online distribution channels is also propelling the market growth.

- Key Market Trends: Certain major trends include rising availability of clean label and organic stock cubes and heightened innovation in flavors.

- Geographical Trends: North America is the biggest market for bouillon and stock cubes because of the increasing demand for plant-based stock cubes among the masses. The rising availability of exotic flavored stock cubes is offering a favorable bouillon and stock cubes market outlook.

- Competitive Landscape: Anhui Qiangwang Flavouring Food Co. Ltd., Edwards & Sons Trading Company Inc., Golden Bird Food Industries, Goya Foods Inc., Hormel Foods Corporation, Hügli Holding AG (Bell Food Group AG), Imana Foods (Pty) Ltd., Massel Australia Pty. Ltd., Morga AG, Proliver, Rapunzel Naturkost GmbH, The Kroger Co., Unilever plc, among many others are some of the major industry players.

- Challenges and Opportunities: Supply chain vulnerabilities and the adoption of strict food safety requirements are a few hurdles currently experienced by industry investors. However, prospects in the bouillon and stock cube business, such as the use of healthy ingredients and flavor innovation, are likely to overcome these hurdles.

Bouillon and Stock Cubes Market Trends:

Clean Label and Organic Offerings

The increasing demand for clean labels and organic food products is propelling the bouillon and stock cubes market growth. Consumers are constantly gravitating towards food products that are free from several genetically modified organisms (GMOs) and certified clean labels. Clean label consumables, which feature an adequate amount of natural and easily recognizable ingredients, are gaining traction and becoming a priority for shoppers looking to avoid artificial additives and preservatives. For instance, in August 2022, Veggiebel introduced organic and vegan bouillon cubes in several flavors like chicken, beef, fish, and pad Thai.

Increasing Innovation in Flavors

According to the bouillon and stock cubes market overview, flavor innovation is recognized as a dynamic trend improving the taste and quality of bouillon and stock cubes. Producers are also focusing on enhancing the overall flavors of their offerings in order to cater to evolving consumer tastes and preferences. They are also experimenting with a combination of exotic herbs and spices to differentiate their products and appeal to the palate that seeks diverse and authentic flavors. This trend is not only expanding the market but also encouraging culinary experimentation among consumers. In March 2021, Knorr announced that it would manufacture no salt stock cubes and mainly focus on the flavor.

Incorporation of Health Enhancing Ingredients

Health-enhancing ingredients are increasingly incorporated into bouillon and stock cubes, aligning with the consumer shift towards functional food products that provide diverse nutritional benefits beyond basic nutrition. Manufacturers are focusing on developing low sugar and salt, monosodium glutamate (MSG) free, and additives free. Additionally, there is a rise in the trend of incorporating super foods like turmeric and ginger into bouillon cubes to impart anti-inflammatory and digestive properties, thereby enhancing bouillon and stock cubes market revenue. These innovations are making stock cubes an attractive option for health-conscious people seeking convenient yet healthy solutions to improve the nutritional value of their meals. For example, Hormel Foods Corporation in 2023 announced the launch of innovative HERB-OX® Cold Water Dissolve Chicken Bouillon and HERB-OX® Cold Water Dissolve Beef Bouillon, which are the only cold-water dissolvable bouillon cubes in the market.

Bouillon and Stock Cubes Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the global, regional, and country levels for 2025-2033. Our bouillon and stock cubes market report has categorized the market based on product type, form, and distribution channel.

Breakup by Product Type:

- Vegetable

- Fish

- Meat

- Poultry

- Beef

- Others

Meat accounts for the majority of the market share

The report has provided a detailed breakup and analysis of the bouillon and stock cubes market based on the product type. This includes vegetables, fish, meat, poultry, beef, and others. According to the report, meat represented the largest segment.

Meat bouillon cubes are designed to provide a rich and deep flavor produced from cooked meat, which can improve the taste of a variety of foods. These cubes give a rich, umami flavor to soups, stews, sauces, and gravies, improving overall palatability without the need to cook meat for long periods of time. Meat bouillon cubes are a less expensive alternative to utilizing large amounts of fresh meat to prepare broth. They deliver a similar flavor at a lower cost, which is very useful for budget-conscious households. Furthermore, the growing popularity of protein-rich diets is catalyzing the bouillon and stock cubes demand. According to the IMARC Group, the worldwide protein ingredients market is estimated to reach US$ 64.2 billion in 2032.

Breakup by Form:

- Cubes

- Liquid

- Powder

- Granules

- Others

Cubes hold the largest share of the industry

A detailed breakup and analysis of the bouillon and stock cubes market based on the form has also been provided in the report. This includes cubes, liquid, powder, granules, and others. According to the report, cubes accounted for the largest market bouillon and stock cubes market share.

One of the most important advantages of bouillon cubes is their convenience. They eliminate the need to make stock from scratch, which is time-consuming and labor-intensive. This makes them especially useful for quick meal prep for cooks who may not have access to fresh ingredients. Bouillon cubes are economical and provide a low-cost alternative to purchasing fresh stock or components such as meat, bones, and vegetables required for preparing homemade broth. A single cube may make one liter of broth, giving it an economical option to flavor a variety of dishes.

Breakup by Distribution Channel:

- Supermarket and Hypermarket

- Independent Grocery Stores

- Online Retail

- Others

Supermarket and hypermarket represent the leading market segment

The report has provided a detailed breakup and analysis of the bouillon and stock cubes market based on the distribution channel. This includes supermarket and hypermarket, independent grocery stores, online retail and others. According to the report, supermarket and hypermarket represented the largest segment.

Supermarkets and hypermarkets are popular choices for buying bouillon cubes due to their focus on grocery items and convenient locations. These stores typically stock a diverse range of bouillon cube options, including different flavors such as beef, chicken, and vegetable and formulations (such as low-sodium or organic). The one-stop-shop nature of markets is particularly beneficial for consumers who prefer to do comprehensive shopping in a single visit. According to the IMARC Group, the global retail market is expected to reach US$ 46,304.9 Billion by 2032.

Breakup by Region:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

North America leads the market, accounting for the largest bouillon and stock cubes market share

The report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Europe (Germany, France, the United Kingdom, Italy, Spain, Russia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, North America represents the largest regional market for bouillon and stock cubes.

The North America bouillon and stock cubes market is driven by the growing preferences for organic and natural products. The demand for bouillon cubes made with organically sourced and non-GMO ingredients is rising, prompting manufacturers to adjust their product lines to include cleaner labels and more transparent ingredient lists. Health concerns, particularly regarding sodium intake, are influencing consumer choices. In response, manufacturers are developing low-sodium versions of bouillon and stock cubes that maintain flavor through the use of natural herbs, spices, and umami-rich ingredients. Moreover, the increasing adoption of vegan lifestyle habits is driving the demand for vegan stock cubes and enhancing bouillon and stock cubes market opportunities. Information revealed by the Good Food Institute (GFI) and the Plant Based Food Association (PBFA) based on retail sales data commissioned from SPINS projected that the 2023 US retail plant-based food market was worth $8.1 billion and 6 in 10 households in the US purchased plant-based food products in 2023.

Competitive Landscape:

- The market research report has also provided a comprehensive analysis of the competitive landscape in the market. Detailed profiles of all major bouillon and stock cubes companies have also been provided. Some of the major market players in the bouillon and stock cubes industry include Anhui Qiangwang Flavouring Food Co. Ltd., Edwards & Sons Trading Company Inc., Golden Bird Food Industries, Goya Foods Inc., Hormel Foods Corporation, Hügli Holding AG (Bell Food Group AG), Imana Foods (Pty) Ltd., Massel Australia Pty. Ltd., Morga AG, Proliver, Rapunzel Naturkost GmbH, The Kroger Co., Unilever plc, etc.

(Please note that this is only a partial list of the key players, and the complete list is provided in the report.)

- On the basis of bouillon and stock cubes market recent developments, for catering to changing consumer preferences, particularly towards healthier and more diverse food options, companies are innovating and expanding their product lines. This includes the introduction of low-sodium, organic, and no-MSG bouillon cubes. Key players are responding by improving their supply chain transparency, sourcing ingredients sustainably, and adopting eco-friendly packaging solutions. Forming partnerships and alliances with other food manufacturers can provide mutual benefits, such as expanded distribution networks, shared marketing costs, and enhanced product offerings. For example, Unilever Ethiopia, in 2023, launched locally innovated Knorr Mitin Shiro stock cubes, which represent the Ethiopian-style chickpea stew.

Bouillon and Stock Cubes Market News:

- December 2023: Unilever announced that it is broadening the scope of product innovation beyond ingredient restrictions and unlocking healthier foods with positive nutrition standards by following a study conducted by its Unilever Foods Innovation Center in Netherlands.

Bouillon And Stock Cubes Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Vegetable, Fish, Meat, Poultry, Beef, Others |

| Forms Covered | Cubes, Liquid, Powder, Granules, Others |

| Distribution Channels Covered | Supermarket and Hypermarket, Independent Grocery Stores, Online Retail, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Anhui Qiangwang Flavouring Food Co. Ltd., Edwards & Sons Trading Company Inc., Golden Bird Food Industries, Goya Foods Inc., Hormel Foods Corporation, Hügli Holding AG (Bell Food Group AG), Imana Foods (Pty) Ltd., Massel Australia Pty. Ltd., Morga AG, Proliver, Rapunzel Naturkost GmbH, The Kroger Co., Unilever plc, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the global bouillon and stock cubes market performed so far, and how will it perform in the coming years?

- What are the drivers, restraints, and opportunities in the global bouillon and stock cubes market?

- What is the impact of each driver, restraint, and opportunity on the global bouillon and stock cubes market?

- What are the key regional markets?

- Which countries represent the most attractive bouillon and stock cubes market?

- What is the breakup of the market based on the product type?

- Which is the most attractive product type in the bouillon and stock cubes market?

- What is the breakup of the market based on the form?

- Which is the most attractive form in the bouillon and stock cubes market?

- What is the breakup of the market based on the distribution channel?

- Which is the most attractive distribution channel in the bouillon and stock cubes market?

- What is the competitive structure of the market?

- Who are the key players/companies in the global bouillon and stock cubes market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the bouillon and stock cubes market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the global bouillon and stock cubes market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the bouillon and stock cubes industry and its attractiveness.

- The competitive landscape allows stakeholders to understand their competitive environment and provides insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)