Brazil 5G Services Market Size, Share, Trends and Forecast by Communication Type, End Use, and Region, 2026-2034

Brazil 5G Services Market Summary:

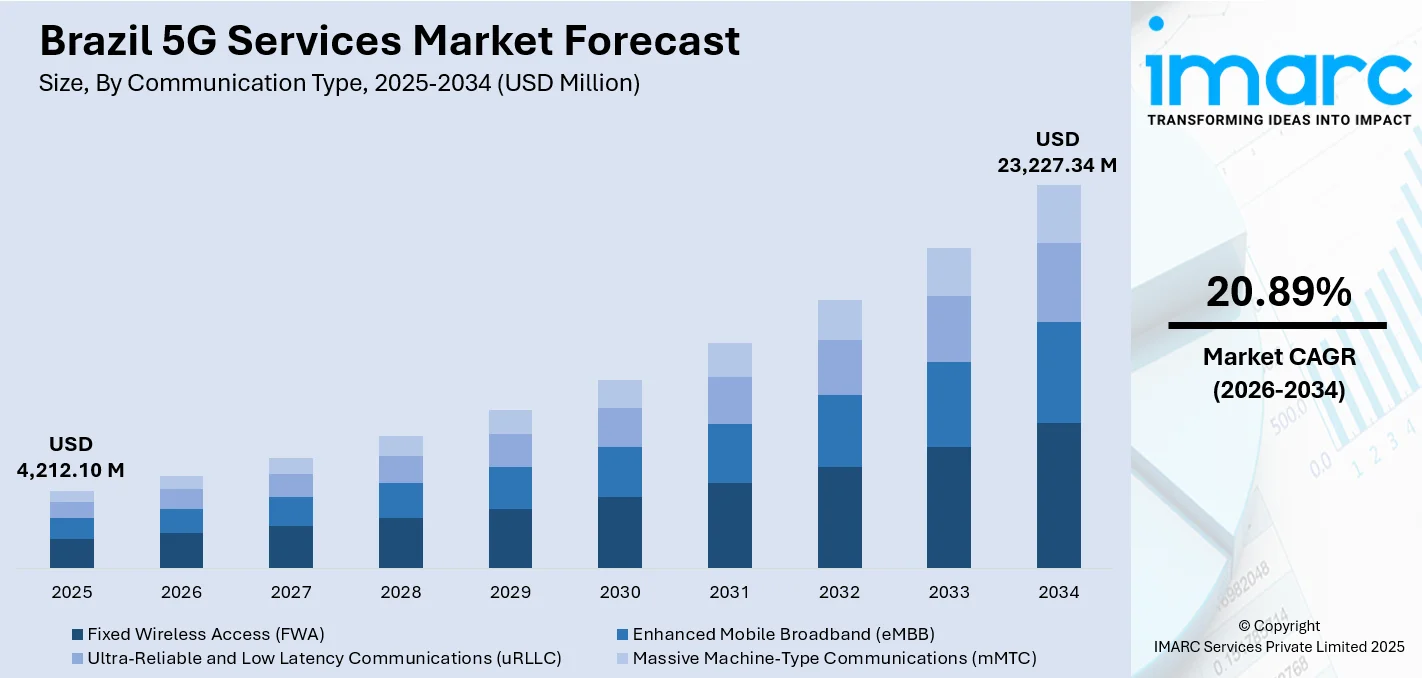

The Brazil 5G services market size was valued at USD 4,212.10 Million in 2025 and is projected to reach USD 23,227.34 Million by 2034, growing at a compound annual growth rate of 20.89% from 2026-2034.

The market expansion is fueled by accelerating standalone network deployments across all municipalities, increasing enterprise adoption of customized private network solutions, and surging consumer demand for data-intensive applications including high-definition streaming and immersive augmented reality experiences. Telecommunications operators are investing heavily in advanced infrastructure technologies while government initiatives support spectrum allocation and regulatory frameworks that facilitate rapid rollout across urban and underserved regions, collectively expanding the Brazil 5G services market share.

Key Takeaways and Insights:

-

By Communication Type: Enhanced mobile broadband (eMBB) dominates the market with a share of 44% in 2025, driven by the demand for high-definition video streaming and data-intensive multimedia applications.

-

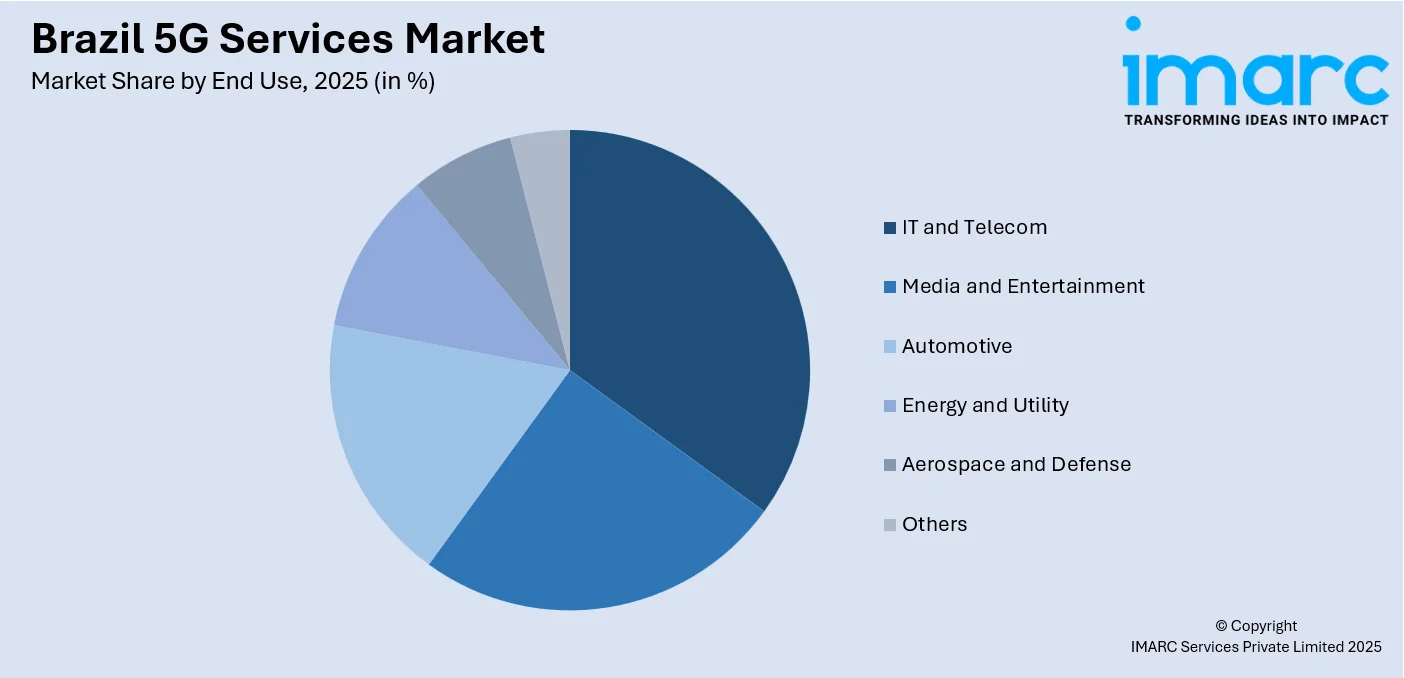

By End Use: IT and telecom lead the market with a share of 27% in 2025, supported by operators' network modernization investments and enterprise digital transformation initiatives.

-

By Region: Southeast region represents the largest segment with a market share of 42% in 2025, benefiting from concentrated urban populations and higher disposable incomes in metropolitan areas.

-

Key Players: Key market players are expanding network coverage, boosting speeds, tailoring advanced plans for businesses, adding smart connectivity features, improving customer support, and partnering with tech providers to launch innovative 5G applications that attract new users and increase revenue.

To get more information on this market Request Sample

The market represents a transformative phase in Brazil's telecommunications landscape where nationwide standalone network deployment has progressed beyond initial urban centers. All three major operators activated networks simultaneously in state capitals, establishing foundational infrastructure that now extends to hundreds of municipalities. Technology partnerships between telecommunications providers and equipment manufacturers are driving innovations in network architecture, including massive antenna arrays and virtualized radio access systems that enhance capacity and coverage efficiency. Enterprise segments show particularly strong growth trajectories as industries deploy tailored network solutions for manufacturing automation, logistics optimization, and critical communications infrastructure. The regulatory environment continues evolving to support competitive dynamics while ensuring universal connectivity objectives, with spectrum management frameworks enabling both large operators and regional providers to participate in network expansion across diverse geographic markets. In 2024, Carlos Slim, the Mexican tycoon and creator of América Móvil, has pledged $8 billion to transform Brazil’s telecommunications industry. This commitment took place during an important meeting with President Luiz Inácio Lula da Silva in Brasilia, indicating a transformative phase for the sector. Claro, which is under Slim's ownership, will spearhead this significant investment. The firm aims to enhance fiber optic networks, improve high-speed internet access, and implement 5G technology across Brazil. These initiatives seek to improve services for citizens and companies, greatly modernizing the country's digital framework.

Brazil 5G Services Market Trends:

Accelerated Standalone Network Deployment Across All Municipalities

Brazil has achieved remarkable progress in standalone network infrastructure rollout, with regulatory authorities clearing critical spectrum bands significantly ahead of original schedules. The completion of frequency allocation processes has enabled operators to activate advanced network capabilities across the entire country's municipal landscape, representing a major milestone in digital connectivity expansion. Major telecommunications providers have deployed thousands of cell sites spanning hundreds of cities, with population coverage exceeding expectations for this stage of network maturity. Network performance metrics show substantial improvements in both download and upload speeds as users spend increasing time connected to advanced generation networks, demonstrating successful transition from legacy infrastructure. In 2024, the National Telecommunications Agency (Anatel) sanctioned the licensing and activation of 5G technology stations in 395 more municipalities. This increases the total count of municipalities with 5G coverage to 3,678, encompassing around 181.3 million Brazilians, which is about 85 percent of the population.

Integration of Advanced Technologies with Fifth Generation Networks

Telecommunications operators are actively incorporating cutting-edge technologies to enhance network performance and user experience. Equipment manufacturers and service providers are conducting field trials of next-generation capabilities that aggregate multiple spectrum bands to achieve unprecedented data transmission speeds. These technological demonstrations showcase the potential for future network evolution while current deployments already incorporate intelligent systems for network management and optimization. Massive antenna configurations are being deployed to improve capacity in high-density environments, while beamforming technologies direct signals more efficiently to connected devices, enhancing both coverage quality and spectral efficiency across diverse deployment scenarios. In 2025, IHS Brazil, a member of the IHS Towers group, revealed that it has broadened its distributed antenna systems (DAS) initiative at Afonso Pena Airport in São José dos Pinhais, located in the Curitiba metropolitan area, in collaboration with Motiva Airports. IHS Brazil announced that the solution applied at Afonso Pena Airport incorporates DAS with fibre-to-the-antenna (FTTA), a system it had earlier installed on Line 5-Lilac of the São Paulo subway.

Expansion of Private Network Solutions for Enterprise Applications

Industrial and commercial enterprises are increasingly adopting customized fifth-generation network infrastructure for mission-critical operations. Manufacturing facilities, port operations, mining companies, and logistics providers are implementing dedicated network solutions that deliver tailored bandwidth, security parameters, and latency characteristics optimized for specific operational requirements. These private deployments enable advanced automation systems, robotics integration, and real-time monitoring capabilities that enhance productivity and operational efficiency. The regulatory framework now supports enterprise access to spectrum resources, facilitating deployment of campus networks that operate independently from public infrastructure while leveraging the same advanced technological capabilities. In 2024, Nokia has announced a private 5G trial at a manufacturing facility at the Institute of Immunobiological Technology (Bio-Manguinhos) in Rio de Janeiro, Brazil, as a connectivity platform to improve vaccine production.

Market Outlook 2026-2034:

The outlook for Brazil's fifth-generation services sector remains exceptionally strong as network infrastructure continues expanding into previously underserved regions while urban deployments increase density and capacity. The market generated a revenue of USD 4,212.10 Million in 2025 and is projected to reach a revenue of USD 23,227.34 Million by 2034, growing at a compound annual growth rate of 20.89% from 2026-2034. Enterprise adoption trajectories indicate sustained growth in private network implementations across manufacturing, energy, and transportation sectors, supported by government digital transformation initiatives and industry modernization investments.

Brazil 5G Services Market Report Segmentation:

|

Segment Category |

Leading Segment |

Market Share |

|

Communication Type |

Enhanced Mobile Broadband (eMBB) |

44% |

|

End Use |

IT and Telecom |

27% |

|

Region |

Southeast |

42% |

Communication Type Insights:

- Fixed Wireless Access (FWA)

- Enhanced Mobile Broadband (eMBB)

- Ultra-Reliable and Low Latency Communications (uRLLC)

- Massive Machine-Type Communications (mMTC)

Enhanced mobile broadband (eMBB) dominates with a market share of 44% of the total Brazil 5G services market in 2025.

Enhanced mobile broadband represents the foundational use case for fifth-generation wireless technology, addressing consumer and enterprise requirements for dramatically increased data transmission capabilities compared to previous network generations. This communication type delivers peak download speeds reaching multiple gigabits per second while maintaining low latency characteristics essential for seamless application performance. The technology supports bandwidth-intensive activities including ultra-high-definition video streaming, immersive virtual and augmented reality experiences, cloud-based gaming platforms, and real-time collaborative applications that require consistent high-throughput connectivity.

Consumer adoption of eMBB services has accelerated as device availability expands and operators deploy extensive network infrastructure across metropolitan and regional markets. Streaming video platforms, which represent a dominant share of mobile data consumption in Brazil, benefit significantly from the improved capacity and reduced buffering enabled by advanced network architecture. The technology also facilitates emerging applications in mobile commerce, video conferencing, and content creation that were previously constrained by bandwidth limitations on legacy networks. Enterprise users leverage Enhanced Mobile Broadband for field operations, remote workforce connectivity, and customer-facing applications that demand reliable high-speed access across diverse operational environments.

End Use Insights:

Access the comprehensive market breakdown Request Sample

- IT and Telecom

- Media and Entertainment

- Automotive

- Energy and Utility

- Aerospace and Defense

- Others

IT and telecom lead with a share of 27% of the total Brazil 5G services market in 2025.

The information technology and telecommunications sector represent the largest end-use category for fifth-generation services, encompassing both the infrastructure providers deploying networks and the enterprise customers implementing advanced connectivity solutions. Major telecommunications operators continue investing substantially in network modernization programs, transitioning legacy infrastructure to support advanced capabilities while expanding coverage footprints across urban and rural territories. These investments encompass radio access equipment, core network virtualization, edge computing infrastructure, and operational support systems that collectively enable delivery of enhanced service offerings to consumer and business customers.

Enterprise telecommunications customers within IT-intensive industries are driving adoption of advanced connectivity solutions for digital transformation initiatives. Cloud service providers require high-capacity, low-latency connections to deliver seamless access to distributed computing resources, while software companies leverage network capabilities for continuous integration platforms and global development collaboration. System integrators and managed service providers are developing specialized offerings that combine connectivity services with application platforms, cybersecurity solutions, and data analytics capabilities. The convergence of telecommunications infrastructure with information technology systems creates opportunities for innovative service models that address evolving customer requirements across multiple industry verticals while generating incremental revenue streams beyond traditional connectivity services.

Regional Insights:

- Southeast

- South

- Northeast

- North

- Central-West

Southeast exhibits a clear dominance with a 42% share of the total Brazil 5G services market in 2025.

The Southeast region encompasses Brazil's most economically developed states representing the country's largest concentration of population, industrial activity, and commercial enterprise. Metropolitan areas within this region serve as primary deployment targets for advanced telecommunications infrastructure due to dense user populations, high average revenue per subscriber, and strong demand for bandwidth-intensive services across consumer and business segments. Major telecommunications operators have prioritized network rollout in these markets, deploying extensive cell site infrastructure and activating advanced capabilities ahead of other geographic regions.

Economic characteristics of the Southeast region support accelerated technology adoption, with higher household incomes enabling device purchases and premium service subscriptions that drive revenue growth for telecommunications providers. Industrial clusters in manufacturing, financial services, and logistics sectors demonstrate particularly strong demand for enterprise connectivity solutions including private network deployments and managed service offerings. The region's established fiber-optic backbone infrastructure facilitates efficient backhaul connectivity for radio access networks, reducing deployment complexity and enabling rapid capacity expansion in response to growing data consumption. Government and municipal support for digital infrastructure development further accelerates deployment timelines while smart city initiatives create additional demand for Internet of Things connectivity and edge computing capabilities that leverage advanced network architecture.

Market Dynamics:

Growth Drivers:

Why is the Brazil 5G Services Market Growing?

Government Infrastructure Initiatives and Regulatory Support Framework

Federal and state government programs are actively promoting digital connectivity expansion through spectrum allocation processes, infrastructure development incentives, and regulatory frameworks designed to facilitate rapid network deployment across all regions. Regulatory authorities have established clear timelines and coverage obligations that ensure systematic technology rollout while maintaining competitive market dynamics among multiple service providers. Government investment in complementary infrastructure including fiber-optic backbone networks, especially in underserved regions, reduces barriers to wireless network expansion by providing essential backhaul connectivity for radio access systems. In 2025, the implementation of 5G data transmission technology in Brazil is progressing faster than expected, with coverage extending to 63.61 percent of the nation's territory. One of the significant steps taken by the Brazilian government is the premature opening of the 3.5 GHz band, which occurred 14 months before the planned timeline. Consequently, 5,570 municipalities across the nation obtained access to the independent 5G standalone network, allowing operators to start deploying it as planned.

Rising Demand for IoT and Industry 4.0 Applications

Industrial sectors across manufacturing, agriculture, logistics, and energy are implementing connected device ecosystems that require reliable, low-latency network infrastructure to support automation systems, sensor networks, and real-time monitoring platforms. Advanced cellular technology provides the connectivity foundation enabling massive device deployments with diverse performance requirements ranging from high-throughput video streams to low-power periodic data transmissions from distributed sensors. Manufacturing facilities are deploying smart production systems incorporating robotics, automated quality control, and predictive maintenance applications that depend on continuous network connectivity to coordinate operations and optimize resource utilization. IMARC Group predicts that the Brazil industrial automation market is projected to attain USD 10,404.11 Million by 2033. This will further drive the need for industry 4.0 solutions in the country.

Growing Mobile Data Consumption and Smartphone Penetration

User adoption of smartphones continues expanding across all demographic segments, with device capabilities increasingly supporting bandwidth-intensive applications that drive data consumption growth. a mobile phone for personal use, representing. Video streaming platforms represent dominant contributors to mobile traffic volumes, with users accessing high-definition and ultra-high-definition content across multiple devices throughout daily routines. Social media applications incorporating video features, live streaming capabilities, and augmented reality filters generate substantial data usage as content creation transitions from desktop environments to mobile platforms. The proliferation of connected devices beyond smartphones, including tablets, smartwatches, and wireless headphones, expands the addressable device ecosystem while creating opportunities for bundled service offerings that increase average revenue per household.

Market Restraints:

What Challenges the Brazil 5G Services Market is Facing?

High Infrastructure Deployment Costs and Geographic Complexity

Implementing advanced wireless infrastructure across Brazil's vast territory presents significant economic challenges, particularly in regions with low population density where capital investments per subscriber remain substantially higher than in urban markets. The technology requires considerably more cell sites than previous network generations to deliver equivalent coverage areas, multiplying equipment procurement costs, site acquisition expenses, and ongoing maintenance requirements. Geographic diversity including mountainous terrain, dense forests, and extensive river systems complicates site access and increases construction costs for tower infrastructure and fiber backhaul connections. Remote regions often lack existing telecommunications infrastructure, necessitating substantial investments in backbone connectivity before wireless access networks can be activated. Regulatory requirements for environmental permits and indigenous land considerations extend deployment timelines while adding administrative costs to network expansion programs in certain territories.

Limited Device Availability and Signal Coverage Constraints

Consumer access to compatible devices remains constrained by pricing dynamics and supply chain limitations, with advanced handsets commanding premium prices that exceed affordability thresholds for significant population segments. Network coverage patterns show substantial variation across municipalities, with many cities having partial deployment where services remain available only in specific neighborhoods or along major corridors rather than providing comprehensive territorial coverage. Users experience limited connection time to advanced networks even in deployed areas, spending majority of sessions on legacy infrastructure due to coverage gaps and capacity constraints during peak usage periods. Spectrum clearing processes required to activate critical frequency bands create dependencies on satellite television migration programs and coordination mechanisms that extend deployment timelines beyond initial license award schedules.

Regulatory and Municipal Permitting Complexities

Antenna installation processes involve navigating diverse municipal regulations across thousands of jurisdictions, each maintaining unique permitting requirements, zoning restrictions, and approval procedures that complicate systematic network deployment. Local government authorities often lack standardized frameworks for evaluating site applications, creating inconsistent approval timelines and unpredictable deployment schedules that hinder operators' ability to meet regulatory coverage obligations. Environmental licensing requirements add layers of bureaucratic review, particularly for sites in protected areas or near sensitive ecosystems, extending project timelines and increasing administrative costs. Infrastructure sharing arrangements between operators and electric utilities for pole access require coordination across multiple stakeholders with competing priorities and conflicting technical standards, delaying site activations and increasing deployment complexity.

Competitive Landscape:

The Brazil 5G services market demonstrates a consolidated competitive structure dominated by three major nationwide telecommunications operators that collectively serve the vast majority of subscribers while competing intensively across network quality, service pricing, and coverage expansion. These established providers leverage substantial capital resources, extensive existing infrastructure assets, and strong brand recognition to maintain market positions while regional operators pursue niche strategies targeting underserved municipalities and specific industry verticals. Competition manifests through network quality differentiation, with operators investing in advanced technologies and expanded coverage to attract premium subscribers willing to pay for superior connectivity experiences. Infrastructure sharing arrangements among competitors represent both collaborative and competitive dynamics, enabling cost-efficient deployment in challenging markets while potentially limiting individual operator differentiation. The regulatory environment maintains competitive balance through spectrum allocation processes, mandatory roaming agreements, and infrastructure access requirements that prevent dominant market positions from creating insurmountable barriers to new entrants or regional providers.

Recent Developments:

-

In December 2025, TIM is set to launch a 5G network at Brazil’s Estacao Comandante Ferraz in Antarctica, utilizing Nokia radio technology and satellite backhaul provided through a mix of Starlink’s LEO constellation and Hispasat’s GEO satellites. The research facility contains specialists in oceanography, glaciology, and meteorology. TIM established the project through a contract signed with Brazil's Ministry of Communications and the Navy on 26 November, according to BNAmericas.

Brazil 5G Services Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Communication Types Covered | Fixed Wireless Access (FWA), Enhanced Mobile Broadband (EMBB), Ultra-Reliable and Low Latency Communications (URLLC), Massive Machine-Type Communications (MMTC) |

| End Uses Covered | IT and Telecom, Media and Entertainment, Automotive, Energy and Utility, Aerospace and Defense, Others |

| Regions Covered | Southeast, South, Northeast, North, Central-West |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Brazil 5G services market size was valued at USD 4,212.10 Million in 2025.

The Brazil 5G services market is expected to grow at a compound annual growth rate of 20.89% from 2026-2034 to reach USD 23,227.34 Million by 2034.

Enhanced mobile broadband (eMBB) dominates the communication type segment with a 44% market share in 2025, driven by the heightened demand for high-bandwidth applications including ultra-high-definition video streaming, immersive gaming experiences, and augmented reality services that require substantial data throughput capabilities.

Key factors driving the Brazil 5G services market include government infrastructure development programs and spectrum allocation frameworks that accelerate deployment timelines, rapidly expanding Internet of Things adoption across industrial sectors requiring massive device connectivity, and surging mobile data consumption fueled by increasing smartphone penetration and bandwidth-intensive application usage patterns.

Major challenges include substantial infrastructure deployment costs and geographic complexity across diverse terrain requiring extensive cell site networks, limited consumer access to compatible devices combined with incomplete coverage patterns that constrain user adoption, and regulatory fragmentation across municipal jurisdictions creating permitting delays and administrative burdens for systematic network rollout programs.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)