Brazil Access Control Market Size, Share, Trends and Forecast by Component, Type, End User, and Region, 2026-2034

Brazil Access Control Market Summary:

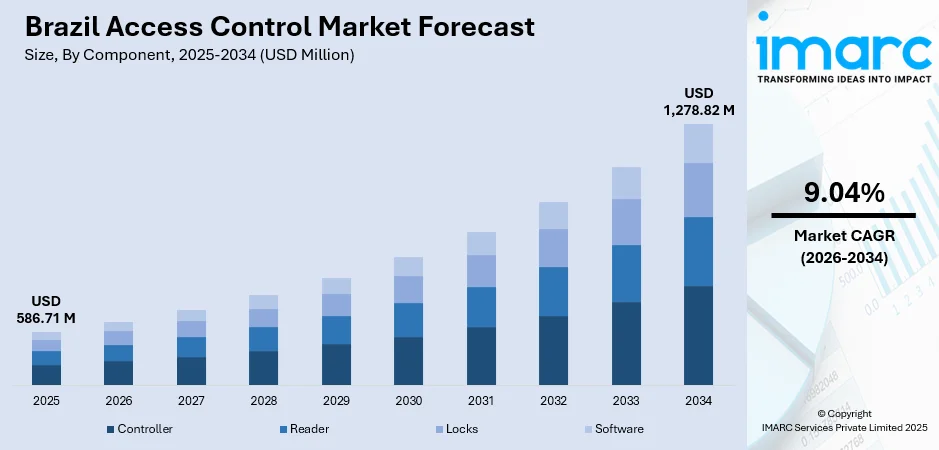

The Brazil access control market size was valued at USD 586.71 Million in 2025 and is projected to reach USD 1,278.82 Million by 2034, growing at a compound annual growth rate of 9.04% from 2026-2034.

The Brazil access control market is experiencing substantial growth, driven by escalating security concerns across the commercial, residential, and industrial sectors. Increasing adoption of advanced technologies, including biometric systems, Internet of Things (IoT)-enabled devices, and cloud-based access solutions, is transforming security infrastructure nationwide. Regulatory compliance requirements, smart city initiatives, and growing awareness about surveillance solutions continue to boost demand across diverse end user segments.

Key Takeaways and Insights:

- By Component: Controller dominates the market with a share of 32% in 2025, owing to its central role in managing access points, integrating with readers and locks, and enabling real-time monitoring. Growing demand for scalable security systems is fueling market expansion.

- By Type: Card-based leads the market with a share of 58% in 2025. This dominance is driven by widespread adoption across commercial and residential properties, cost-effectiveness compared to biometric alternatives, and seamless integration with existing infrastructure.

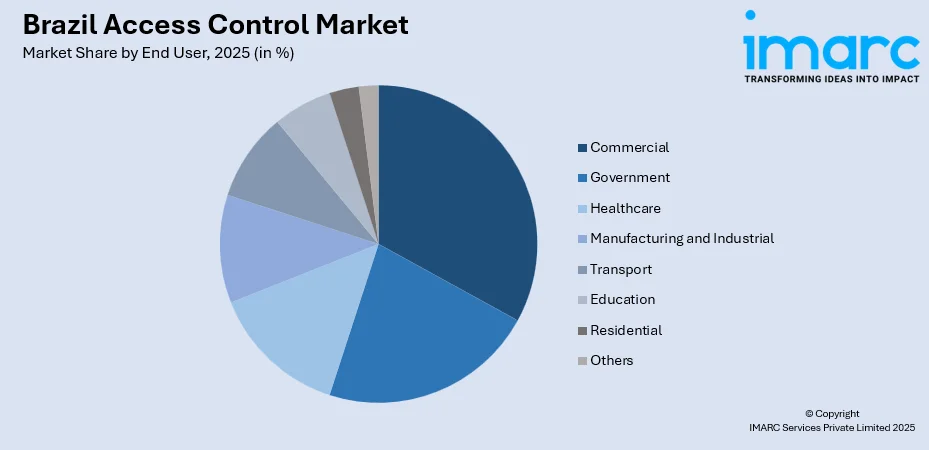

- By End User: Commercial represents the largest segment with a market share of 24% in 2025, reflecting the strong demand from office buildings, retail establishments, and corporate facilities seeking enhanced security and operational efficiency.

- By Region: Southeast comprises the largest region with 35% share in 2025, driven by the concentration of commercial activities in São Paulo and Rio de Janeiro metropolitan areas, higher infrastructure investments, and advanced technology adoption rates.

- Key Players: Key players drive the Brazil access control market by expanding product portfolios, improving biometric and cloud technologies, and strengthening nationwide distribution networks. Their investments in research and development (R&D) activities, strategic alliances, and after-sales support are fueling the utilization of access control technologies across diverse security segments.

To get more information on this market Request Sample

The Brazil access control market is advancing rapidly, as organizations across various sectors prioritize security infrastructure modernization and digital transformation. Rising urbanization, coupled with increasing crime rates in major metropolitan areas, has intensified demand for sophisticated entry management solutions that combine physical security with intelligent monitoring capabilities. The commercial sector leads adoption, with office buildings, shopping malls, and logistics facilities integrating advanced access systems to protect assets, employees, and sensitive information. In September 2023, the Brazilian government launched the Growth Acceleration Program (PAC), investing approximately USD 11 Billion in defense and security infrastructure, signaling strong public sector commitment to modernization. Smart city initiatives in São Paulo and Rio de Janeiro are driving integration of access control with broader urban security networks, creating demand for interoperable solutions. Cloud-based platforms are gaining traction among enterprises seeking scalable, remotely manageable security systems. The convergence of physical and digital security, supported by artificial intelligence (AI)-powered analytics and IoT connectivity, continues to reshape the Brazil access control landscape.

Brazil Access Control Market Trends:

Integration of IoT and Cloud-Based Access Solutions

The rapid digital transformation across Brazilian enterprises is accelerating adoption of IoT-connected and cloud-based access control systems. Organizations increasingly seek solutions enabling remote monitoring, real-time analytics, and centralized management across multiple locations. Cloud platforms reduce infrastructure costs while improving scalability, making them attractive for businesses of all sizes. This integration also supports seamless software updates, predictive maintenance, and faster response to security incidents through automated alerts. Growing emphasis on data-driven security and smart building initiatives further strengthens demand for IoT-enabled, cloud-managed access solutions across Brazil.

Biometric Technology Proliferation in Residential Complexes

Facial recognition and fingerprint authentication systems are gaining significant traction in Brazilian condominiums and residential communities seeking enhanced security and convenience. These technologies eliminate reliance on physical credentials while providing accurate identification and comprehensive access logs. Local integrators are customizing biometric readers to support multi-language interfaces and payment-linked visitor access. Condominium associations and property developers are ramping up investments in integrated security solutions to address high-footfall management and crime-deterrence challenges, transforming residential access control across major urban centers.

Smart City Integration and Government Modernization Initiatives

Urban development initiatives and smart city projects across Brazil require integrated security systems for public facilities, transit hubs, and government buildings. Major cities like São Paulo and Rio de Janeiro are embedding sophisticated access control into their smart city frameworks. The ‘Rio AI City’ initiative, which was introduced at the Web Summit Rio 2025 in April, sought to convert the Olympic Park into the biggest data processing center in Latin America. These initiatives encourage adoption of biometric and automated entry systems, creating opportunities for vendors to introduce innovative solutions addressing public safety requirements.

Market Outlook 2026-2034:

The Brazil access control market outlook remains robust, supported by sustained investments in infrastructure modernization, rising security awareness, and technological innovation across all sectors. Commercial real estate expansion continues to generate demand for sophisticated access management solutions. The market generated a revenue of USD 586.71 Million in 2025 and is projected to reach a revenue of USD 1,278.82 Million by 2034, growing at a compound annual growth rate of 9.04% from 2026-2034. Government initiatives promoting digitalization, biometric verification mandates for social services, and expanding e-commerce logistics operations are expected to sustain strong market momentum. Additionally, increasing adoption of mobile-based credentials and integration of access control with broader building management systems are expected to further enhance market growth and long-term adoption across Brazil.

Brazil Access Control Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Component | Controller | 32% |

| Type | Card-Based | 58%% |

| End User | Commercial | 24% |

| Region | Southeast | 35% |

Component Insights:

- Controller

- Reader

- Locks

- Software

Controller dominates with a market share of 32% of the total Brazil access control market in 2025.

Controllers serve as the central intelligence hub of access control systems, managing communication between readers, locks, and software platforms while processing authentication requests and maintaining access logs. Their critical role in system architecture drives consistent demand across commercial, industrial, and residential installations in Brazil. In February 2025, Brazil established its Federal Biometric Service, mandating systems for performing biometric checks against centralized databases, increasing requirements for sophisticated controller infrastructure.

The growing complexity of security requirements is pushing the adoption of advanced controllers capable of supporting multiple authentication methods, remote management, and integration with building automation systems. Enterprise customers particularly value controllers offering scalability and compatibility with emerging technologies, enabling future-proof investments that accommodate evolving security needs. Cloud-enabled controllers with edge processing capabilities are gaining traction as they enhance system resilience and reduce latency during authentication. Additionally, rising smart city projects and large-scale public infrastructure developments are expected to further boost controller deployments across Brazil.

Type Insights:

- Card-Based

- Contact

- Contactless

- Biometric-Based

- Fingerprint

- Face Recognition

- Face Recognition and Fingerprint

- Iris Recognition

- Others

Card-based leads with a share of 58% of the total Brazil access control market in 2025.

Card-based access control systems maintain dominant market position due to their proven reliability, cost-effectiveness, and ease of deployment across diverse facility types. Contactless smart cards have gained particular traction, offering improved hygiene and faster processing compared to traditional contact cards. Their long operational lifespan and low maintenance requirements further support widespread adoption across both new installations and system upgrades. Vendors also continue to innovate with enhanced encryption and secure chip technologies, reinforcing trust in card-based solutions.

The technology remains preferred for high-volume applications where speed and simplicity are paramount, including office buildings, educational institutions, and healthcare facilities. Integration capabilities with existing information technology (IT) infrastructure and compatibility with multi-factor authentication enhance card-based systems' appeal for organizations balancing security requirements with operational efficiency and budget considerations. Additionally, seamless interoperability with time and attendance systems improves workforce management. Growing acceptance of hybrid card-and-mobile credential models is also extending the relevance of card-based access control.

End User Insights:

Access the comprehensive market breakdown Request Sample

- Government

- Commercial

- Healthcare

- Manufacturing and Industrial

- Transport

- Education

- Residential

- Others

Commercial exhibits a clear dominance with a 24% share of the total Brazil access control market in 2025.

The commercial sector drives access control demand through diverse applications spanning corporate offices, retail establishments, shopping centers, and hospitality venues. As per IMARC Group, the Brazil commercial real estate market size was valued at USD 266.8 Billion in 2025. Rising security concerns, combined with hybrid work models reshaping facility management, are accelerating investments in sophisticated entry solutions. Commercial properties increasingly adopt integrated security platforms combining access control with video surveillance, visitor management, and building automation.

Additionally, commercial stakeholders emphasize systems that support mobile credentials, touchless entry, and real-time occupancy monitoring to improve convenience and safety. Retail chains adopt centralized access management to maintain consistent security policies across multiple outlets, while co-working operators require flexible permission settings for short-term tenants. Hospitality venues increasingly integrate access control with property management systems to streamline guest check-in and room access. These trends, combined with ongoing investments in smart buildings and digital infrastructure, are reinforcing sustained demand for advanced commercial access control solutions across Brazil.

Regional Insights:

- Southeast

- South

- Northeast

- North

- Central-West

Southeast represents the leading region with a 35% share of the total Brazil access control market in 2025.

Southeast dominates the Brazil access control market, anchored by São Paulo and Rio de Janeiro metropolitan areas that concentrate the nation's commercial, industrial, and financial activities. The region's advanced infrastructure, higher technology adoption rates, and concentration of multinational corporations create favorable conditions for sophisticated security investments. Smart city initiatives in both major metropolitan areas are embedding sophisticated surveillance and access control systems into urban frameworks, focusing on traffic monitoring, public space management, and safety assurance.

High population density and large-scale transportation hubs further elevate security requirements across offices, airports, metros, and mixed-use developments. The Southeast also benefits from a mature real estate market, where premium commercial and residential projects increasingly specify advanced access control during design and construction phases. In September 2025, ELLE Residences revealed its inaugural entry into South America with the launch of two significant luxury projects in São Paulo: Casa ELLE in Brooklin and the ELLE Collection in Boa Vista. Strong presence of system integrators and technology vendors accelerates deployment and aftersales support.

Market Dynamics:

Growth Drivers:

Why is the Brazil Access Control Market Growing?

Rising Security Concerns and Crime Prevention Initiatives

Rising security concerns and expanding crime prevention initiatives are strongly driving the growth of the Brazil access control market across the commercial, residential, and public sectors. Persistent urban crime rates and high-profile security incidents are encouraging organizations to invest in robust access management to protect people, assets, and sensitive information. In 2023, the murder rate in northern Brazil exceeded the national average by 41.5%. Businesses increasingly deploy electronic access systems to restrict unauthorized entry, monitor movement, and maintain detailed audit trails. Government-led crime prevention programs and public safety initiatives are also promoting installation of access control in transportation hubs, public buildings, and smart city projects. Residential complexes adopt controlled entry systems to enhance safety and property value. Integration of access control with video surveillance, alarms, and analytics improves threat detection and response, strengthening overall security effectiveness. Additionally, insurance requirements and corporate risk management practices push enterprises to upgrade legacy locks to advanced, centrally managed access control solutions, sustaining long-term market expansion across Brazil.

Government Infrastructure Investments and Smart City Development

Government infrastructure investments and smart city development are accelerating deployment of advanced, connected security systems across public and commercial assets. Large-scale investments in transportation networks, airports, metros, hospitals, and government buildings require reliable access management to ensure safety and operational control. The Brazilian Artificial Intelligence Plan (PBIA) 2024-2028, allocating R$ 23 Billion, is fostering AI adoption across sectors, including security. Smart city projects in São Paulo and Rio de Janeiro, such as the Rio AI City initiative aimed at transforming the city into Latin America's largest data center hub, are driving demand for networked security infrastructure. These initiatives encourage integration of access control with analytics, surveillance, and centralized command platforms. Municipal authorities increasingly deploy access systems for traffic facilities, public spaces, and utilities to enhance monitoring and emergency response. Long-term urban modernization programs ensure sustained demand for scalable, cloud-enabled access control solutions nationwide.

Digital Transformation and Biometric Mandate Compliance

Digital transformation and biometric mandate compliance are significantly fueling the growth of the Brazil access control market by accelerating adoption of advanced, identity-driven security solutions. As organizations digitize operations, they require integrated access systems that support centralized management, real-time monitoring, and seamless integration with IT and human resource (HR) platforms. Government-led biometric mandates for social services, workforce identification, and public security are pushing institutions to deploy biometric-enabled access control to ensure accurate identity verification and fraud prevention. Enterprises increasingly adopt fingerprint, facial recognition, and multimodal authentication to enhance security while improving user convenience. Compliance requirements encourage upgrades from legacy mechanical locks to electronic and software-based systems capable of secure data handling and audit trails. Additionally, cloud-based platforms enable scalable biometric deployments across multiple sites, supporting nationwide operations and remote management, thereby reinforcing sustained market growth across public and private sectors in Brazil.

Market Restraints:

What Challenges the Brazil Access Control Market is Facing?

High Implementation and Maintenance Costs

The upfront investment required for deploying advanced access control systems, particularly biometric and integrated security platforms, remains significantly higher than conventional alternatives. This cost barrier limits adoption among small and medium enterprises (SMEs) and organizations with constrained budgets. Ongoing maintenance, software licensing, and technical support add to total cost of ownership, challenging widespread market penetration outside major urban centers.

Privacy Concerns and Data Protection Challenges

Privacy concerns and data protection challenges inhibit the growth of the Brazil access control market by raising compliance complexity and implementation costs for end users. Strict data protection requirements discourage widespread adoption of biometric systems, particularly in smaller organizations. Fear of data breaches and regulatory penalties leads to delayed purchasing decisions, longer approval cycles, and preference for basic systems, slowing penetration of advanced, data-intensive access control technologies.

Limited Infrastructure in Remote and Rural Areas

Despite ongoing infrastructure development, many regions outside major metropolitan areas still face insufficient connectivity and technical support for advanced access control systems. Rural and semi-urban areas lack reliable internet connectivity required for cloud-based solutions and real-time monitoring capabilities. The concentration of skilled technicians and system integrators in São Paulo and Rio de Janeiro creates service gaps elsewhere, limiting market expansion beyond traditional urban cores and challenging vendors seeking nationwide coverage.

Competitive Landscape:

The Brazil access control market features a competitive landscape with international technology providers and regional integrators vying for market share. Companies are focusing on diversifying product offerings, enhancing biometric and cloud capabilities, and improving affordability to attract broader customer segments. Competition is driven by investments in local manufacturing, technology partnerships, and service network expansion, enabling faster deployment and support. Strategic acquisitions are reshaping market dynamics, with major players consolidating positions through capability additions. Vendors are tailoring solutions to regional requirements, focusing on privacy compliance and integration with existing infrastructure. Innovations in AI-powered analytics, mobile credentialing, and contactless technologies differentiate market leaders, while strong channel partnerships with system integrators and distributors enhance market reach across Brazil's diverse regional markets.

Brazil Access Control Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Components Covered | Controller, Reader, Locks, Software |

| Types Covered |

|

| End Users Covered | Government, Commercial, Healthcare, Manufacturing and Industrial, Transport, Education, Residential, Others |

| Regions Covered | Southeast, South, Northeast, North, Central-West |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Brazil access control market size was valued at USD 586.71 Million in 2025.

The Brazil access control market is expected to grow at a compound annual growth rate of 9.04% from 2026-2034 to reach USD 1,278.82 Million by 2034.

Card-based dominated the market with a share of 58%, driven by widespread adoption across commercial and residential properties in Brazil, cost-effectiveness, and seamless integration with existing infrastructure.

Key factors driving the Brazil access control market include rising security concerns, government infrastructure investments, smart city initiatives, digital transformation programs, and regulatory mandates for biometric verification.

Major challenges include high implementation costs for advanced systems, privacy concerns related to biometric data collection, limited infrastructure in remote areas, integration complexities with legacy systems, and skilled workforce availability outside major metropolitan centers.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)