Brazil Acrylonitrile-Butadiene-Styrene (ABS) Market Size, Share, Trends and Forecast by Type, Application, and Region, 2026-2034

Brazil Acrylonitrile-Butadiene-Styrene (ABS) Market Summary:

The Brazil acrylonitrile-butadiene-styrene (ABS) market size was valued at USD 580.72 Million in 2025 and is projected to reach USD 1,024.42 Million by 2034, growing at a compound annual growth rate of 6.51% from 2026-2034.

In Brazil, the market is driven by the expanding automotive sector, rising infrastructure development, and growing consumer electronics demand. Investments in lightweight vehicle components, sustainable manufacturing practices, and domestic polymer production are strengthening the market landscape. The government's industrial policies supporting local manufacturing, combined with increasing construction activities and urbanization across major metropolitan areas, are creating substantial opportunities for ABS applications.

Key Takeaways and Insights:

-

By Type: Opaque dominates the market with a share of 49% in 2025, owing to its versatile applications across automotive components, consumer electronics housings, and household appliances. Opaque ABS formulations offer solid color consistency, superior surface finish, and ease of molding that manufacturers prefer for producing dashboards, electronic enclosures, and durable consumer goods.

-

By Application: Automotive leads the market with a share of 41% in 2025. This dominance is driven by the growing demand for lightweight vehicle components, enhanced fuel efficiency requirements, and the expansion of both traditional and electric vehicle (EV) manufacturing facilities across Brazil's industrial corridors.

-

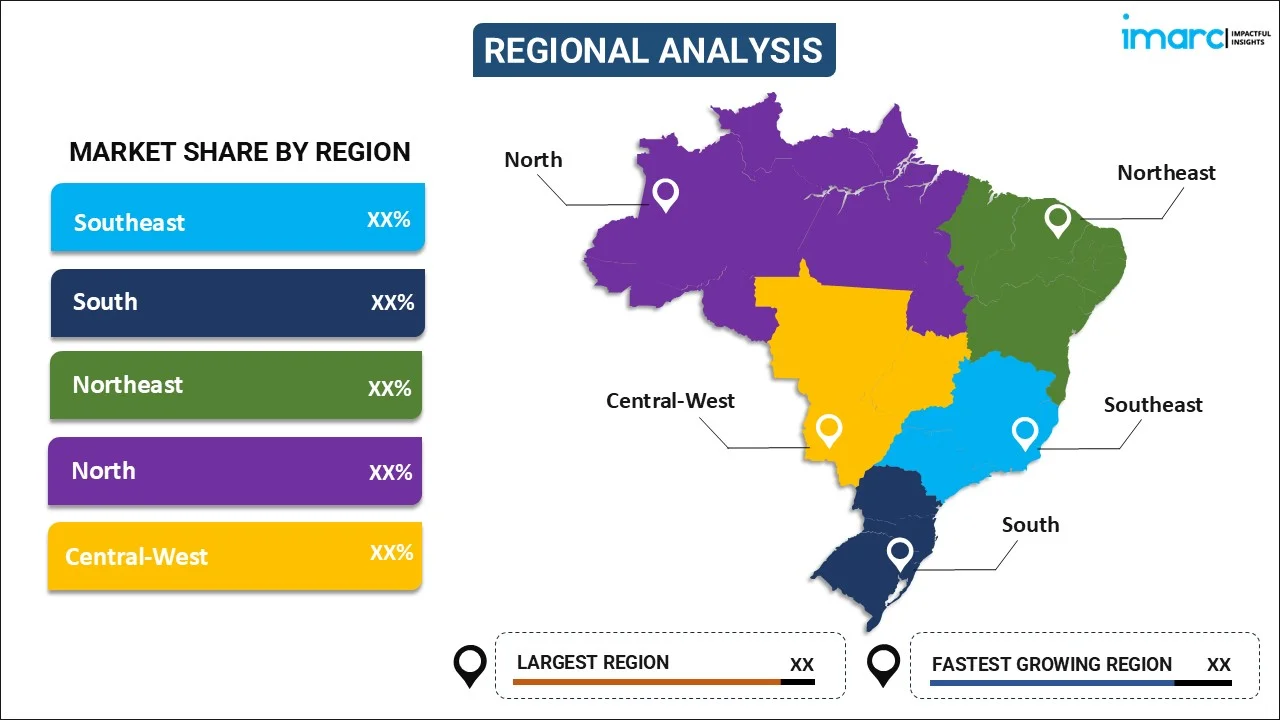

By Region: Southeast comprises the largest region with 40% share in 2025, driven by the concentration of petrochemical complexes in São Paulo, robust automotive manufacturing clusters, advanced electronics production facilities, and superior port infrastructure enabling efficient supply chain operations.

-

Key Players: Key players drive the Brazil ABS market by expanding production capacities, investing in sustainable polymer technologies, and strengthening distribution networks. Their focus on developing high-performance grades, forging strategic partnerships, and enhancing recycling capabilities supports market growth and environmental compliance.

The Brazil acrylonitrile-butadiene-styrene (ABS) market demonstrates robust expansion potential, as industrial sectors increasingly adopt engineering plastics for advanced manufacturing applications. The automotive industry's transition towards lightweight materials, combined with stringent fuel efficiency standards, positions ABS as a preferred choice for interior components, dashboard assemblies, and exterior trim pieces. According to Anfavea, Brazil's automobile sales increased by 14% in 2024 to reach 2.63 Million units, reflecting the strong demand trajectory that directly influences ABS consumption patterns. The thriving construction sector, supported by government infrastructure programs, creates additional demand avenues for ABS-based plumbing fittings, insulation materials, and building components. Consumer electronics manufacturers continue to expand production capabilities, with major appliance companies investing in local manufacturing facilities to serve the growing middle-class population. The petrochemical industry's commitment to expanding domestic polymer production, coupled with increasing investments in recycling infrastructure, ensures sustainable market development while reducing import dependence and supporting circular economy initiatives throughout the value chain.

Brazil Acrylonitrile-Butadiene-Styrene (ABS) Market Trends:

Expanding EV Manufacturing Ecosystem

The transition towards electric mobility is reshaping ABS demand patterns in Brazil, as automakers establish local production facilities. Chinese manufacturers, including BYD, are investing heavily in Brazilian manufacturing plants, with BYD's Camaçari facility expected to produce 150,000 vehicles annually. This shift requires lightweight, high-strength materials for battery housings, interior components, and structural elements, driving the market growth. Government funding programs provides substantial tax incentives supporting decarbonization initiatives and advanced material adoption.

Sustainable Polymer Development and Circular Economy Integration

Environmental consciousness is accelerating the adoption of recycled and bio-based polymer solutions across Brazilian industries. The Brazilian plastic recycling industry processed 1.55 million Tons of post-consumer plastic waste in 2024. Manufacturers are increasingly incorporating post-consumer recycled content into ABS formulations while developing advanced mechanical and chemical recycling technologies. Regulatory frameworks mandating reverse logistics systems and recycled content targets are compelling producers to invest in sustainable production methodologies.

Advanced Manufacturing Technology Adoption

Brazilian manufacturers are embracing Industry 4.0 technologies to enhance ABS processing efficiency and product quality. The integration of the Internet of Things (IoT), real-time monitoring systems, and predictive maintenance capabilities enables optimized production cycles and reduced material waste. As per IMARC Group, the Brazil IoT market size reached USD 21.7 Billion in 2025. Injection molding and extrusion technologies continue to advance, allowing manufacturers to produce complex geometries with improved dimensional stability. These technological improvements support the growing demand for high-precision components across the automotive, electronics, and consumer goods sectors.

Market Outlook 2026-2034:

The Brazil acrylonitrile-butadiene-styrene (ABS) market outlook remains positive, as industrial modernization and sustainable development initiatives drive demand across key application segments. The market generated a revenue of USD 580.72 Million in 2025 and is projected to reach a revenue of USD 1,024.42 Million by 2034, growing at a compound annual growth rate of 6.51% from 2026-2034. Strategic investments in domestic polymer production capacity, combined with infrastructure development programs allocating substantial funding for transportation and construction projects, create favorable conditions for sustained market expansion. The automotive sector's evolution towards electrification and hybridization strengthens ABS demand for lightweight components and advanced material applications across vehicle platforms.

Brazil Acrylonitrile-Butadiene-Styrene (ABS) Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Type | Opaque | 49% |

| Application | Automotive | 41% |

| Region | Southeast | 40% |

Type Insights:

-market.webp)

To get detailed segment analysis of this market, Request Sample

- Opaque

- Transparent

- Colored

Opaque dominates with a market share of 49% of the total Brazil acrylonitrile-butadiene-styrene (ABS) market in 2025.

Opaque maintains market leadership through its extensive utilization across automotive interiors, electronic device housings, and household appliance manufacturing. The segment benefits from superior color consistency, excellent surface finish characteristics, and cost-effective processing capabilities that appeal to manufacturers across diverse industrial sectors. Brazilian appliance manufacturers increasingly adopt opaque ABS for refrigerator components, washing machine housings, and air conditioning units, leveraging the material's durability and aesthetic versatility to meet consumer expectations for modern, visually appealing products.

The automotive industry's preference for opaque ABS grades in dashboard assemblies, door panels, and center consoles reinforces segment dominance. The segment's growth trajectory aligns with expanding vehicle production volumes and the shift towards lightweight interior materials that enhance fuel efficiency while maintaining structural integrity and premium aesthetic appeal. Additionally, ongoing innovations in ABS formulations, such as improved impact resistance and flame retardancy, are further boosting the adoption across emerging applications. Rising consumer demand for sustainable and recyclable materials also positions opaque ABS as a preferred choice for environmentally conscious manufacturers.

Application Insights:

- Appliances

- Electrical and Electronics

- Automotive

- Consumer Goods

- Construction

- Others

Automotive leads with a share of 41% of the total Brazil acrylonitrile-butadiene-styrene (ABS) market in 2025.

The automotive sector in Brazil leads the region in vehicle production, driving strong demand for ABS as a lightweight material that enhances fuel efficiency and overall vehicle performance. Manufacturers increasingly utilize ABS across a wide range of applications, including dashboards, bumper systems, wheel covers, lighting housings, and interior trim components. The material’s excellent impact resistance, dimensional stability, and surface quality make it a preferred choice for both functional and aesthetic requirements. This widespread adoption highlights ABS’s critical role in modernizing automotive manufacturing while meeting evolving performance standards.

The transition towards EVs creates additional demand for high-performance ABS grades suitable for battery housings and specialized components. As per IMARC Group, the Brazil EV market reached a volume of 146.0 Thousand Units in 2025. Major automakers are expanding Brazilian production capabilities, with plans for launching new vehicle models incorporating advanced polymer materials. This industrial expansion, supported by the government's Green Mobility and Innovation Program providing substantial tax incentives, ensures sustained automotive ABS demand throughout the forecast period.

Regional Insights:

To get detailed regional analysis of this market, Request Sample

- Southeast

- South

- Northeast

- North

- Central-West

Southeast exhibits a clear dominance with a 40% share of the total Brazil acrylonitrile-butadiene-styrene (ABS) market in 2025.

Southeast’s market leadership stems from its concentration of major petrochemical complexes, automotive manufacturing clusters, and electronics production facilities. São Paulo's industry recorded R$82.7 Billion in investments in 2024, twice as much as the year before, with the automotive sector spearheading investments in modernization, innovations, and production capacity expansion. The region hosts manufacturing facilities of major automakers and their supplier networks that consume significant ABS volumes. The region benefits from advanced port infrastructure at Santos, superior logistics connectivity, and proximity to end-user industries across the consumer electronics, appliance manufacturing, and construction sectors.

Continuous technological upgrades in manufacturing processes enhance product quality and reduce production costs, attracting both domestic and international ABS consumers. Strong collaborations between petrochemical producers and end use manufacturers ensure a reliable supply of high-quality raw materials, while government policies and incentives promote industrial growth across the region. These factors collectively solidify the Southeast as Brazil’s primary hub for ABS consumption, driving sustained market growth across the automotive, electronics, and household appliance sectors.

Market Dynamics:

Growth Drivers:

Why is the Brazil Acrylonitrile-Butadiene-Styrene (ABS) Market Growing?

Expanding Automotive Manufacturing and Electrification Investments

Brazil’s automotive industry serves as a major driver for ABS demand, as manufacturers increasingly adopt lightweight polymer solutions to enhance fuel efficiency, reduce emissions, and meet evolving environmental standards. Brazil manufactured 2.5 Million vehicles in 2024, reflecting a 9.7% rise from 2023, regaining its status as the eighth-largest vehicle producer globally, overtaking Spain. ABS is widely used in automotive applications for interior components, dashboards, trims, and structural elements due to its high impact resistance, durability, and ease of processing. The shift towards hybrid vehicles (HVs) adds new dimensions to demand, as manufacturers require specialized high-performance ABS grades for battery housings, thermal management systems, and protective casings. These components demand materials that can withstand heat, mechanical stress, and chemical exposure while maintaining precise dimensional stability. Domestic and international automakers are investing heavily in production facilities and innovation initiatives, reflecting strong confidence in the sector’s growth trajectory.

Infrastructure Development and Construction Sector Growth

Brazil’s construction and infrastructure sector continues to expand, driven by large-scale government programs, private investments, and rising urbanization across metropolitan regions. The Minha Casa Minha Vida housing program aimed to construct 2 Million affordable homes in Brazil by 2026, directly supporting ABS consumption in residential construction applications. ABS offers advantages, including mechanical strength, chemical resistance, ease of molding, and long-term durability, making it suitable for both residential and commercial construction applications. Housing initiatives and urban development projects further increase demand for standardized construction materials that meet modern building requirements while supporting rapid project timelines. In addition, ongoing investments in transportation, energy, and sanitation infrastructure require materials capable of withstanding harsh environmental conditions and operational stress. Manufacturers are increasingly integrating ABS into building solutions for its ability to combine functionality with lightweight properties, helping reduce installation and maintenance costs.

Consumer Electronics and Appliance Market Expansion

Growth opportunities for ABS are rising in the consumer electronics and household appliances sectors in Brazil due to increased urbanization, incomes, and middle-class desires for modern, sturdy, and attractive products. ABS is used in electronic devices and household appliances for housings, panels, internal components, and structural parts, offering toughness, impact resistance, and processability-the right mix that mass production requires. In consumer electronics, both opaque and transparent grades of ABS are utilized to provide functional protection with design flexibility, surface finish quality, and color options. Refrigerators, washing machines, kitchen devices, and small electronics rely on ABS to meet the demand for long-life and light construction. Manufacturers are looking to increase local production capabilities and improve their distribution networks to meet the growing demand for higher-end devices and smart home solutions. With ABS offering versatility, cost efficiency, and high aesthetic value, its use continues to increase across the segments of electronics and appliances, guaranteeing continuous growth in the Brazilian market.

Market Restraints:

What Challenges the Brazil Acrylonitrile-Butadiene-Styrene (ABS) Market is Facing?

Raw Material Price Volatility and Import Dependence

Fluctuations in petroleum-based feedstock prices create uncertainty for ABS manufacturers and end users, impacting production costs and profit margins across the value chain. Brazil’s reliance on imported monomers, such as acrylonitrile and styrene, exposes the market to currency exchange fluctuations and disruptions in global supply. These dynamics challenge manufacturers to maintain competitive positioning while managing costs, particularly when operating under fixed-price contracts or during periods of market instability.

Environmental Regulations and Sustainability Compliance Costs

Stricter environmental regulations requiring the use of recycled content and implementation of reverse logistics add significant compliance costs for ABS manufacturers and processors. Brazil’s evolving plastic packaging rules necessitate investments in recycling infrastructure and process adjustments to meet sustainability standards. Manufacturers, especially smaller enterprises, face difficulties balancing these regulatory demands with cost competitiveness while striving to maintain efficient operations and meet market expectations for environmentally responsible production.

Competition from Alternative Polymer Materials

ABS faces competitive pressure from alternative engineering plastics and polymer blends offering comparable or superior performance characteristics for specific applications. Polypropylene compounds, polycarbonate blends, and bio-based alternatives increasingly compete for market share in automotive, electronics, and consumer goods applications. The development of advanced material formulations by competing polymer manufacturers challenges ABS market positioning, requiring continuous innovations and performance enhancement to maintain application leadership.

Competitive Landscape:

In Brazil, the market features a competitive landscape, characterized by the presence of global petrochemical manufacturers and regional polymer producers. Market participants compete through product innovations, capacity expansion, and strategic partnerships to strengthen their positioning across key application segments. Companies focus on developing specialized high-performance grades meeting stringent automotive and electronics specifications while investing in sustainable production technologies. The emphasis on local manufacturing capabilities reduces import dependence and enhances supply chain resilience. Competitive strategies include expanding distribution networks, establishing technical service centers, and collaborating with end users to develop customized formulations addressing specific application requirements. Market consolidation activities and joint ventures enable participants to achieve economies of scale while accessing advanced technologies, supporting product portfolio diversification.

Brazil Acrylonitrile-Butadiene-Styrene (ABS) Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Opaque, Transparent, Colored |

| Applications Covered | Appliances, Electrical and Electronics, Automotive, Consumer Goods, Construction, Others |

| Regions Covered | Southeast, South, Northeast, North, Central-West |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Brazil acrylonitrile-butadiene-styrene (ABS) market size was valued at USD 580.72 Million in 2025.

The Brazil acrylonitrile-butadiene-styrene (ABS) market is expected to grow at a compound annual growth rate of 6.51% from 2026-2034 to reach USD 1,024.42 Million by 2034.

Opaque dominated the market with a share of 49%, due to its versatile applications in automotive, electronics, and household goods, offering high impact resistance, durability, and aesthetic flexibility that meet diverse industrial and consumer requirements.

Key factors driving the Brazil acrylonitrile-butadiene-styrene (ABS) market include expanding automotive manufacturing investments, infrastructure development programs, growing consumer electronics demand, sustainable polymer innovations, and supportive government industrial policies encouraging domestic production.

Major challenges include raw material price volatility, import tariff impacts on production costs, stringent environmental regulations requiring recycled content, competition from alternative polymer materials, and currency exchange fluctuations affecting profitability across the value chain.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)