Brazil Activewear Market Size, Share, Trends and Forecast by Product Type, Material Type, Pricing, Age Group, Distribution Channel, End User, and Region, 2026-2034

Brazil Activewear Market Summary:

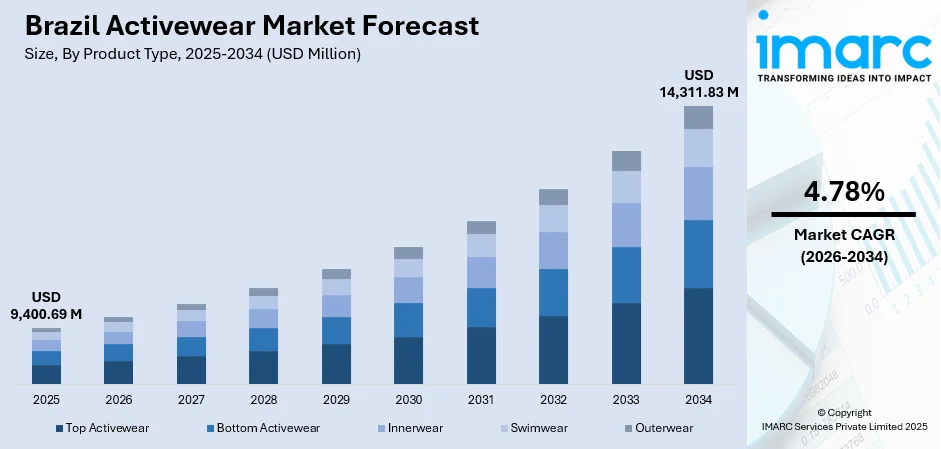

The Brazil activewear market size was valued at USD 9,400.69 Million in 2025 and is projected to reach USD 14,311.83 Million by 2034, growing at a compound annual growth rate of 4.78% from 2026-2034.

The increased popularity of athleisure as everyday fashion and consumers' growing health consciousness are driving the rapid rise of the Brazilian activewear market. Consumer preferences are changing as a result of growing urbanization, the rise of fitness culture, and the blending of modern appearance and practicality. Demand for wellness-focused lifestyles, outdoor exercise, and fitness centers is growing across the nation's many regions and demographics.

Key Takeaways and Insights:

-

By Product Type: Top activewear dominates the market with a share of 28% in 2025, owing to its versatility for both workout sessions and casual wear, widespread consumer preference for performance tops, and continuous fabric innovations enhancing comfort and moisture management during physical activities.

-

By Material Type: Cotton leads the market with a share of 31% in 2025. This dominance is driven by consumer preference for natural, breathable fabrics offering superior comfort, hypoallergenic properties, and Brazil's position as a leading cotton producer ensuring abundant domestic supply.

-

By Pricing: Economy represents the largest segment with a market share of 59% in 2025, reflecting the price-conscious purchasing behavior of Brazilian consumers and the widespread availability of affordable activewear options across retail channels catering to budget-oriented shoppers.

-

By Age Group: 16–30 years exhibit a clear dominance in the market with 40% share in 2025, driven by the strong fitness orientation among younger demographics, social media influence on athleisure trends, and increasing participation in gym activities and outdoor sports among millennials and Generation Z.

-

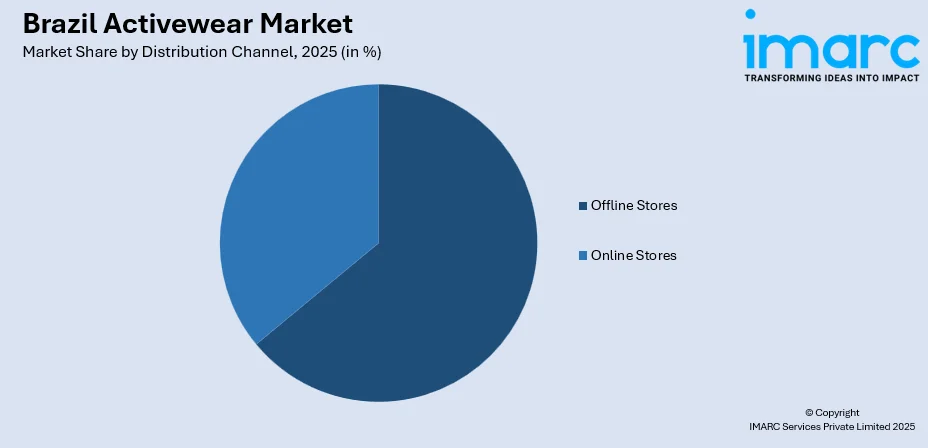

By Distribution Channel: Offline stores dominate the market with a share of 64% in 2025, owing to consumer preference for physical examination of fabric quality, sizing accuracy, with the well-established existence of department shops and specialty sportswear retailers in both urban and suburban areas.

-

By End User: Women represent the leading segment with a 46% share of the total Brazil activewear market in 2025, reflecting the rising female participation in fitness activities, growing demand for stylish and functional women's sportswear, and increasing focus on health and wellness among women.

-

By Region: Southeast is the biggest region with 33% share in 2025, driven by the concentration of Brazil's population in São Paulo and Rio de Janeiro metropolitan areas, higher disposable incomes, established fitness infrastructure, and premium retail presence.

-

Key Players: Key players drive the Brazil activewear market by expanding product portfolios, improving fabric technologies, and strengthening nationwide distribution networks. Their investments in digital marketing, sustainability initiatives, and partnerships with fitness centers boost brand awareness, accelerate consumer adoption, and ensure consistent product availability across diverse market segments.

To get more information on this market Request Sample

The Brazil activewear market is advancing as consumers increasingly embrace health-conscious lifestyles and active recreation pursuits. The fusion of athletic wear with everyday fashion has transformed purchasing patterns, with athleisure becoming a dominant trend across urban centers. Government initiatives promoting physical activity and preventive healthcare have strengthened public engagement with fitness programs. In December 2024, the Brazilian Football Confederation renewed its exclusive kit supply agreement with Nike, extending the partnership for twelve years through 2038, demonstrating the significant market potential within Brazil's sportswear sector. The growing proliferation of boutique gyms, specialized fitness studios, and outdoor exercise programs continues to broaden consumer access to activewear. Rising female participation in sports, coupled with social media influence on fitness trends, is reshaping product innovation and brand marketing strategies across the Brazil activewear market share.

Brazil Activewear Market Trends:

Rise of Athleisure as Everyday Fashion

As consumers increasingly use sportswear for everyday activities outside of traditional training settings, the athleisure movement has become a transformative force in the expansion of the Brazilian activewear sector. Brazilian consumers are wearing joggers, leggings, and performance shirts on a regular basis, which reflects a global trend toward cozy yet stylish apparel. Customers that value adaptability and self-expression are drawn to the market as a result of this merging of fashion and fitness. Sportswear has become even more common in daily life thanks to influencer marketing and fashion partnerships, and both domestic and foreign businesses have responded with adaptable collections.

Sustainability and Eco-Friendly Material Adoption

Environmental consciousness is reshaping product development across the Brazil activewear market as brands prioritize sustainable materials and ethical manufacturing processes. In July 2024, the Brazilian Volleyball Confederation partnered with Body Work to unveil national team uniforms designed with sustainable COOLMAX EcoMade fiber manufactured from one hundred percent textile waste, demonstrating industry commitment to circular economy principles. Consumers increasingly seek apparel made from recycled polyester, organic cotton, and plant-based fibers. The National Solid Waste Policy mandates textile companies report environmental footprints, accelerating industry-wide adoption of eco-friendly production standards.

Digital Integration and Connected Fitness Experiences

Brazilian consumers' interactions with fitness gear and sportswear are changing due to technological advancements, resulting in integrated wellness ecosystems. Wearable health devices, smart clothing, and digital fitness platforms are increasing customer involvement through individualized performance monitoring and tracking of physical activity. Members may easily track their exercise progress thanks to the increasing availability of wearable-compatible linked gym equipment. Younger, tech-savvy consumers are drawn to this merging of technology and sportswear, and the market for performance-focused clothing with digital capabilities is growing.

Market Outlook 2026-2034:

The Brazil activewear market demonstrates promising growth potential as health awareness intensifies and fitness culture becomes increasingly embedded in consumer lifestyles. Expanding urbanization, rising disposable incomes among middle-class populations, and continuous product innovations in fabric technology and design are expected to sustain market momentum. The market generated a revenue of USD 9,400.69 Million in 2025 and is projected to reach a revenue of USD 14,311.83 Million by 2034, growing at a compound annual growth rate of 4.78% from 2026-2034. The proliferation of e-commerce platforms, omnichannel retail strategies, and personalized shopping experiences will further strengthen consumer access to diverse activewear options across demographic segments and geographic regions.

Brazil Activewear Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Product Type | Top Activewear | 28% |

| Material Type | Cotton | 31% |

| Pricing | Economy | 59% |

| Age Group | 16–30 Years | 40% |

| Distribution Channel | Offline Stores | 64% |

| End User | Women | 46% |

| Region | Southeast | 33% |

Product Type Insights:

- Top Activewear

- Bottom Activewear

- Innerwear

- Swimwear

- Outerwear

Top activewear dominates with a market share of 28% of the total Brazil activewear market in 2025.

Top activewear maintains its leading position in the Brazil activewear market due to its exceptional versatility and multi-functional utility across fitness and casual settings. Performance tops, sports bras, tank tops, and athletic t-shirts offer consumers breathable comfort during workouts while remaining stylish for everyday wear. The segment benefits from continuous innovations in moisture-wicking technologies, quick-dry fabrics, and ergonomic designs that enhance athletic performance and movement flexibility, making these products essential components of active wardrobes. Consumers increasingly seek upper garments that provide temperature regulation and odor resistance for extended wear during various physical activities.

The dominance of top activewear reflects changing consumer preferences toward athleisure fashion that seamlessly transitions from gym to social settings. Brazilian fashion retailers have reported significant growth in their athletic apparel divisions, with performance tops representing a substantial portion of sportswear revenue across diverse retail channels. The rising popularity of fitness-inspired street style, combined with the tropical climate favoring lightweight, breathable upper garments, continues to drive sustained demand across urban and suburban markets throughout Brazil, supporting consistent segment expansion.

Material Type Insights:

- Nylon

- Polyester

- Cotton

- Neoprene

- Polypropylene

- Spandex

Cotton leads with a share of 31% of the total Brazil activewear market in 2025.

Cotton maintains its dominant position in the Brazil activewear market due to consumer preference for natural, breathable fabrics that provide superior comfort during physical activities. The material offers excellent moisture absorption, hypoallergenic properties, and soft texture against skin, making it ideal for activewear applications. Brazil's position as a leading global cotton producer ensures abundant domestic supply for textile manufacturing and garment production, supporting the widespread availability of cotton-based sportswear across retail channels. The natural fiber's temperature-regulating characteristics make it particularly suitable for the country's tropical climate conditions.

The preference for cotton-based activewear aligns with growing sustainability consciousness among Brazilian consumers seeking natural fiber alternatives to synthetic materials. Brazil's domestic textile industry benefits from integrated cotton supply chains, with national consumption continuing to expand steadily. The material's versatility allows manufacturers to create blended fabrics combining cotton with performance fibers, delivering enhanced stretch, durability, and moisture management properties while maintaining natural comfort. This adaptability enables brands to offer products that satisfy both eco-conscious consumers and performance-focused athletes.

Pricing Insights:

- Economy

- Premium

Economy exhibits a clear dominance with a 59% share of the total Brazil activewear market in 2025.

The economy segment's dominance reflects the price-sensitive purchasing behavior prevalent among Brazilian consumers seeking affordable yet functional activewear options. Non-luxury brands account for the vast majority of apparel sales in Brazil, demonstrating the strong consumer preference for value-oriented products. Mass-market retailers, hypermarkets, and discount sportswear chains have expanded their economy activewear offerings, providing accessible entry points for consumers across diverse income levels. The availability of budget-friendly options across multiple retail formats ensures widespread market penetration throughout urban and regional areas.

Economic considerations significantly influence purchasing decisions in Brazil's activewear market, particularly amid fluctuating economic conditions and varying disposable income levels. Domestic brands and private-label offerings have strengthened their market positions by delivering competitive quality at affordable price points, challenging international premium brands for consumer attention. The proliferation of promotional strategies, installment payment options, and seasonal discounts further supports economy segment growth by making activewear accessible to budget-conscious consumers. This pricing flexibility enables broader demographic participation in fitness-related apparel purchases, sustaining consistent demand across economic cycles.

Age Group Insights:

- 1–15 Years

- 16–30 Years

- 31–44 Years

- 45–64 Years

- More than 65 Years

16–30 years represent the leading segment with a 40% share of the total Brazil activewear market in 2025.

The 16-30 years age group drives the Brazil activewear market through strong engagement with fitness culture and athleisure fashion trends. This demographic demonstrates high health consciousness, with substantial participation in gym memberships, running activities, and outdoor fitness programs. Social media platforms amplify fitness influencer marketing, shaping purchasing decisions among younger consumers who prioritize both functionality and style. The desire for self-expression through athletic fashion motivates frequent purchases and experimentation with emerging brands and product innovations.

Young Brazilian consumers exhibit strong brand awareness and willingness to embrace new activewear technologies and fashion trends, making them primary targets for marketing campaigns. Urban centers concentrate this demographic due to vibrant fashion scenes, numerous fitness centers, and higher disposable incomes supporting discretionary spending on sportswear. The rising influence of digital fitness platforms and community-based workout programs further strengthens engagement with activewear products among millennials and Generation Z consumers. Their active presence on social networks creates viral trends that shape broader market preferences and purchasing patterns.

Distribution Channel Insights:

Access the comprehensive market breakdown Request Sample

- Online Stores

- Offline Stores

Offline stores hold the largest share at 64% of the total Brazil activewear market in 2025.

Offline retail channels maintain dominance in Brazil's activewear distribution landscape through established specialist sportswear retailers, department stores, and shopping center networks. Consumers prefer physical stores for examining fabric quality, ensuring proper sizing, and experiencing products before purchase. Major sporting goods retailers and clothing specialist chains provide comprehensive activewear assortments with knowledgeable staff assistance, creating personalized shopping experiences that build customer loyalty. The ability to try on garments and assess comfort levels remains essential for activewear purchases where fit significantly impacts performance.

The offline channel strength reflects Brazilian consumer shopping culture favoring tactile product evaluation and immediate gratification from in-store purchases. In January 2024, Brazil's retail sales volume grew by 2.5% from the previous month, with textiles, footwear, and clothing seeing an 8.5% increase. Department stores and hypermarkets supplement specialist retailers by offering economy activewear options across diverse price points, ensuring broad market accessibility and geographic coverage throughout metropolitan and regional areas. Shopping centers serve as popular destinations combining activewear retail with entertainment and dining, enhancing overall consumer engagement with sportswear brands.

End User Insights:

- Men

- Women

- Kids

Women dominate the market with a share of 46% of the total Brazil activewear market in 2025.

Women dominate the activewear market in Brazil due to growing participation rates in fitness activities and a high fashion orientation towards activeware. Rising female engagement levels in gym exercises, yoga classes, run competitions, and outdoor fitness activities trigger demand for fashionable and practical sportswear specifically designed for women. Growing notions of 'health and wellness' among women have led to activeware becoming a 'must have' category, moving beyond just fitness activities into the domain of fashionable wear. Women's shopping is now characterized by a desire for merging functionality and fashionable appeal.

The women's market is benefitting from different kinds of innovative products to meet different women with varying bodies and exercising interests. The Brazilian sportswear labels have introduced extensive lines of women's clothing that fulfill supportive and fashionable needs for fitness and casual wear. The overall trend of empowering women with fitness is further boosting market demand for performance-driven sportswear for women. The design of such sportswear is leaning toward comfort, fitness, and fashionable trends appealing to health-conscious females.

Regional Insights:

- Southeast

- South

- Northeast

- North

- Central-West

Southeast comprises the largest region with a 33% share of the total Brazil activewear market in 2025.

In Brazil, the Southeast region leads the activewear market due to demographic density, economic activities, and fitness infrastructure. This region is home to Brazil's biggest cities, where higher disposable incomes, well-organized fitness centers, and quality retailing enable higher consumption of activewear. Major cities are major fashion hubs which have plenty of sportswear retailers, fitness activities, and prominent labels that influence national trends. Urban lifestyle, diversity, and high awareness about fitness among people of the Southeast region enable continued demand for activewear products belonging to all market and pricing segments.

The region has exemplary transportation facilities, logistics, and retail developments to enable smooth distribution of products. Media coverage and other marketing efforts in the Southeast cities increase brand awareness and consumer knowledge in new active wear trends. The fact that headquarters, fitness organizations, and fashion shows add to the dominance of the region in shaping the overall market trends in the country. Popular sportswear brands in the country have a major presence in the Southeast markets with their franchises and online operations catering to health-conscious consumers.

Market Dynamics:

Growth Drivers:

Why is the Brazil Activewear Market Growing?

Rising Health and Fitness Awareness Among Consumers

The rising awareness about health and fitness among Brazilian consumers is triggering a substantial surge in the market for fitness wear. This is because people are now focusing on exercising as a form of preventive health and overall wellness. Rapid urbanization, growing affluent lifestyles, and increasing disposable incomes have encouraged Brazilians to take up fitness activities such as gym memberships, running exercises, and outdoor fitness activities. Spending on fitness activities among consumers is increasing gradually with growing adherence to health-conscious lifestyles. Health-conscious lifestyles among people have been encouraged further with health promotions on exercise and mental wellness on social media platforms.

Growth of E-commerce and Digital Retailing Channels

Rapid growth in e-commerce platforms is propelling a change in consumer usage and acquisition of activewear products, adding significantly to the growth of the market. Better internet connectivity, mobile shopping apps, sophisticated digital modes of payment, and improved logistical services have increased consumer confidence in making purchases on e-commerce platforms. However, the fashion e-commerce market is still on a steady rise, reflecting increased consumer familiarity and usage of digital platforms. Penetration of e-commerce into Brazil’s clothing market is on a steady rise and is expected to improve over a period of years ahead, as digital shopping platforms become more normalized.

Increased Female Participation in Sports and Fitness Activities

Increasing female participation in sports and fitness events is soon turning out to be a major contributing factor to the growth of sports apparel in Brazil. The participation of females in fitness routines has significantly increased, thus contributing to the rise of sports apparel designed specifically for females. The sports apparel market for females has been constantly expanding owing to efforts made by brands to introduce a variety of sports apparel ranges for different body types. Fitness culture in Brazil includes a substantial presence of females, thus making it a prominent aspect of fitness culture. Female consumers are a major contributor to the growth of sports apparel developments in terms of design, marketing, and distribution.

Market Restraints:

What Challenges the Brazil Activewear Market is Facing?

Economic Instability and Consumer Spending Constraints

The Brazilian sportswear market continues to face difficulties due to shifting consumer spending power and economic instability. Discretionary expenditure on non-essential things, such as sportswear, is impacted by inflationary pressures, fluctuations in interest rates, and unstable income. During recessions, price-conscious consumers may postpone purchases or switch to less expensive options, which could affect the performance of premium segments and the growth of the market value as a whole.

Availability of Counterfeit Products

The demand for genuine branded goods in the Brazilian market is greatly impacted by the pervasiveness of fake and knockoff sportswear products. Cheaper counterfeit items draw budget-conscious buyers while eroding customer confidence and brand value. Legitimate producers who invest in quality, innovation, and brand development face unfair competition due to the spread of counterfeit goods via unofficial retail channels and internet marketplaces.

Competition from Synthetic Fiber Alternatives

As customers balance comfort preferences against technical functionality, the competition between synthetic performance fabrics and natural cotton-based sportswear generates issues for market segmentation. Performance-focused consumers are drawn to petroleum-based synthetic textiles because of its improved stretch, durability, and moisture-wicking qualities. Manufacturers must balance pricing tactics, sustainability posture, and material choices across a range of consumer categories in order to compete.

Competitive Landscape:

The Brazil activewear market is characterized by an intense competitive environment with globally recognized sportswear brands competing with notable local brands. The major brands are competing in terms of innovation in activewear, building strong brands, and creating strong distribution networks. The Brazil activewear market is also experiencing innovation in terms of sustainability, technological advancements in fabrics, and customer service. Partnerships with fitness clubs, sports associations, and endorsements have also played an important role in creating brands in the Brazil activewear market.

Brazil Activewear Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Top Activewear, Bottom Activewear, Innerwear, Swimwear, Outerwear |

| Material Types Covered | Nylon, Polyester, Cotton, Neoprene, Polypropylene, Spandex |

| Pricings Covered | Economy, Premium |

| Age Groups Covered | 1–15 Years, 16–30 Years, 31–44 Years, 45–64 Years, More than 65 Years |

| Distribution Channels Covered | Online Stores, Offline Stores |

| End Users Covered | Men, Women, Kids |

| Regions Covered | Southeast, South, Northeast, North, Central-West |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Brazil activewear market size was valued at USD 9,400.69 Million in 2025.

The Brazil activewear market is expected to grow at a compound annual growth rate of 4.78% from 2026-2034 to reach USD 14,311.83 Million by 2034.

Top activewear dominated the market with a share of 28%, driven by versatility for both workout sessions and casual wear, consumer preference for performance tops, and continuous innovations in moisture-wicking technologies enhancing comfort.

Key factors driving the Brazil activewear market include rising health and fitness awareness among consumers, expansion of e-commerce platforms, growing female participation in sports activities, athleisure fashion trends, and continuous product innovations in fabric technology.

Major challenges include economic instability affecting consumer spending, availability of counterfeit products undermining brand value, competition from synthetic fiber alternatives, price sensitivity among consumers, and fluctuating raw material costs impacting manufacturing expenses.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)