Brazil Advanced Driver Assistance Systems Market Size, Share, Trends and Forecast by Solution Type, Component Type, Vehicle Type, and Region, 2026-2034

Brazil Advanced Driver Assistance Systems Market Summary:

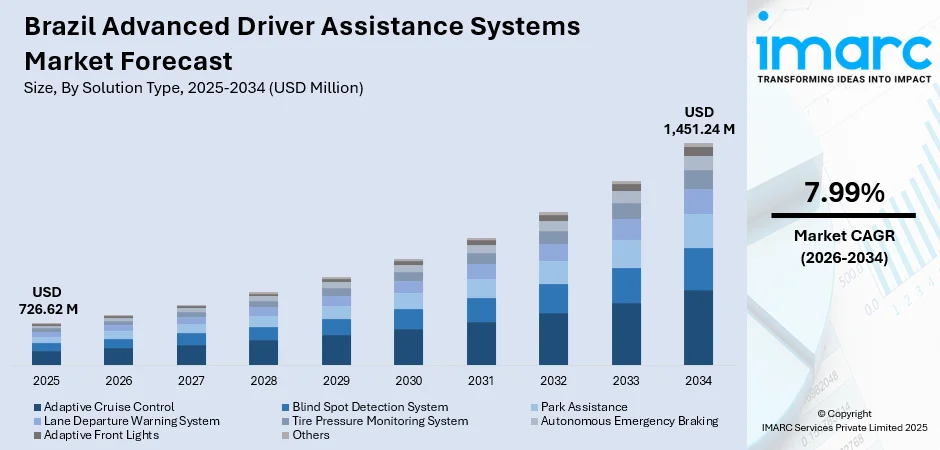

The Brazil advanced driver assistance systems market size was valued at USD 726.62 Million in 2025 and is projected to reach USD 1,451.24 Million by 2034, growing at a compound annual growth rate of 7.99% from 2026-2034.

The Brazil advanced driver assistance systems market is currently experiencing robust growth, which can be accredited to stringent government safety regulations mandating electronic stability control and automatic emergency braking in new vehicles. Rising consumer awareness regarding vehicle safety, increasing adoption of connected vehicle technologies, and substantial investments by global automotive manufacturers in local production facilities are accelerating market expansion throughout the nation.

Key Takeaways and Insights:

- By Solution Type: Autonomous emergency braking dominates the market with a share of 22% in 2025, owing to its critical role in collision prevention and regulatory mandates requiring AEB systems in all new vehicles. The implementation of CONTRAN Resolution 910/2022 mandating AEB in new cars from 2024 is accelerating adoption rates across passenger and commercial vehicle segments.

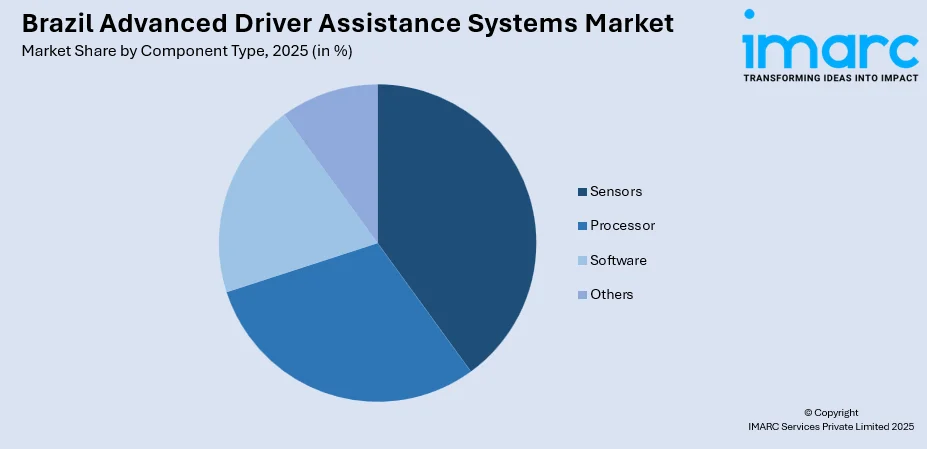

- By Component Type: Sensors lead the market with a share of 40% in 2025, driven by the fundamental requirement for accurate environmental perception in all ADAS applications. The integration of radar, camera, ultrasonic, and LiDAR sensors enables comprehensive vehicle surroundings detection, supporting functions from basic parking assistance to advanced autonomous driving capabilities.

- By Vehicle Type: Passenger cars represent the biggest segment with a market share of 68% in 2025, reflecting the substantial consumer demand for safety-equipped personal vehicles and automaker strategies to differentiate through advanced technology offerings. Rising middle-class incomes and insurance incentives for ADAS-equipped vehicles are encouraging widespread adoption.

- By Region: Southeast is the largest region with 35% share in 2025, driven by the concentration of major automotive manufacturing plants in São Paulo and surrounding industrial zones, higher disposable incomes among urban consumers, and advanced transportation infrastructure supporting connected vehicle technologies.

- Key Players: Key players drive the Brazil advanced driver assistance systems market by expanding product portfolios, improving sensor integration technologies, and strengthening partnerships with local automotive manufacturers. Their investments in research and development, localized production capabilities, and strategic collaborations accelerate innovation.

To get more information on this market Request Sample

The Brazil advanced driver assistance systems market is witnessing transformative growth as the convergence of regulatory mandates, technological innovation, and shifting consumer preferences reshapes the automotive landscape. Government initiatives requiring electronic stability control and automatic emergency braking in new vehicles have established a regulatory foundation that compels manufacturers to integrate advanced safety technologies. The increasing sophistication of sensor fusion technologies, combining radar, cameras, and ultrasonic systems, enables more reliable environmental perception and responsive driver assistance functions. Consumer awareness regarding vehicle safety has intensified, with Brazilian buyers increasingly prioritizing safety features when making purchasing decisions, particularly in the passenger car segment. The Mover program provides significant tax incentives for manufacturers investing in green mobility and safety technologies, further stimulating market development. Leading technology suppliers have announced collaborations to develop central vehicle computers integrating infotainment and ADAS functionalities on a single chip, demonstrating the technological advancement driving the Brazil advanced driver assistance systems market share expansion.

Brazil Advanced Driver Assistance Systems Market Trends:

Integration of Artificial Intelligence and Machine Learning Technologies

The incorporation of artificial intelligence and machine learning technologies is significantly enhancing the effectiveness of advanced driver assistance systems in Brazil. These technologies enable real-time assessment of traffic conditions, predictive monitoring of vehicle performance, and adaptive driving assistance customized for particular road situations. AI algorithms improve the precision of hazard detection, object recognition, and decision-making processes, which minimizes false alerts and boosts overall system reliability. Machine learning enables ADAS to continuously learn from driving behaviors, enhancing predictive safety functions.

Growth of Connected and Semi-Autonomous Vehicle Technologies

The rise of connected vehicle technologies and semi-autonomous driving features is fueling significant demand for ADAS in Brazil. Vehicles equipped with connectivity tools can communicate with infrastructure and traffic management systems, enabling safer navigation and real-time traffic updates. Semi-autonomous functionalities, including automated lane-keeping, adaptive cruise control, and hands-free driving in controlled settings, are increasingly appealing to consumers seeking convenience and safety. Both personal vehicles and commercial fleets are adopting these advancements to enhance efficiency.

Advancement of Human-Machine Interface Design for Enhanced Driver Interaction

Improving automotive HMI design is emerging as a key trend due to increasing consumer preference toward autonomous driving capabilities. Enhanced vision systems, advanced sensors, and connectivity infrastructure ensure easier interaction between drivers and vehicles. Voice-operated and driver monitoring systems using eye-tracking technologies represent contactless HMI solutions replacing traditional touch-based interfaces. These innovations enable drivers to maintain focus on the road while accessing vehicle functions seamlessly through digital light processing chips projecting high-contrast images.

Market Outlook 2026-2034:

The Brazil advanced driver assistance systems market is poised for sustained expansion as regulatory frameworks mature, technological capabilities advance, and consumer adoption accelerates throughout the forecast period. Government mandates requiring advanced safety features in new vehicles, combined with the Mover program’s substantial tax incentives for manufacturers investing in safety and green mobility technologies, establish favorable conditions for market growth. The market generated a revenue of USD 726.62 Million in 2025 and is projected to reach a revenue of USD 1,451.24 Million by 2034, growing at a compound annual growth rate of 7.99% from 2026-2034. Increasing investments by global automotive manufacturers, including Stellantis’s record EUR 5.6 Billion commitment to South American operations through 2030, signal strong confidence in regional market potential and will drive continued innovation.

Brazil Advanced Driver Assistance Systems Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Solution Type | Autonomous Emergency Braking | 22% |

| Component Type | Sensors | 40% |

| Vehicle Type | Passenger Cars | 68% |

| Region | Southeast | 35% |

Solution Type Insights:

- Adaptive Cruise Control

- Blind Spot Detection System

- Park Assistance

- Lane Departure Warning System

- Tire Pressure Monitoring System

- Autonomous Emergency Braking

- Adaptive Front Lights

- Others

Autonomous emergency braking dominates with a market share of 22% of the total Brazil advanced driver assistance systems market in 2025.

Autonomous emergency braking systems have emerged as the cornerstone of vehicle safety technology in Brazil, leveraging sophisticated sensor arrays to detect imminent collision risks and automatically apply braking force when drivers fail to respond adequately. The implementation of national regulatory mandates requiring AEB in all new vehicles has significantly accelerated market adoption, affecting a substantial volume of new vehicle registrations annually. These systems utilize radar, camera, and ultrasonic sensors to continuously monitor the road environment, processing data through advanced algorithms that distinguish between vehicles, pedestrians, and obstacles.

The effectiveness of AEB systems in reducing collision severity and frequency has made them particularly attractive to fleet operators seeking to minimize operational risks and insurance costs. Research demonstrates that AEB substantially reduces rear-end collisions, delivering significant safety benefits that justify regulatory requirements. Technological advancements continue to enhance system capabilities, with manufacturers developing low-speed city AEB systems for urban environments and high-speed inter-urban systems for highway applications, ensuring comprehensive protection across diverse driving conditions throughout the country.

Component Type Insights:

Access the comprehensive market breakdown Request Sample

- Processor

- Sensors

- Radar

- Ultrasonic

- LiDAR

- Others

- Software

- Others

Sensors lead with a share of 40% of the total Brazil advanced driver assistance systems market in 2025.

Sensors constitute the fundamental enabling technology for all ADAS functionalities, providing the environmental perception capabilities essential for accurate threat detection and response. The sensor segment encompasses radar systems for long-range detection, cameras for visual recognition and lane tracking, ultrasonic sensors for close-proximity measurements, and emerging LiDAR technologies for high-resolution three-dimensional mapping. The growing demand for sensor technologies reflects their critical importance in enabling advanced vehicle systems and supporting comprehensive driver assistance capabilities.

The evolution toward sensor fusion architectures, combining data from multiple sensor types through sophisticated algorithms, is significantly enhancing ADAS reliability and performance in complex driving environments. Camera and radar fusion enables cost-effective integration that supports scalable ADAS solutions, allowing automakers to create safer and smarter driving experiences across various price points. Continuous advancements in sensor miniaturization, accuracy, and affordability are driving broader adoption throughout the Brazilian automotive market, positioning sensors as indispensable components in the transition toward increasingly autonomous vehicle technologies.

Vehicle Type Insights:

- Passenger Cars

- Commercial Vehicles

Passenger cars exhibit a clear dominance with a 68% share of the total Brazil advanced driver assistance systems market in 2025.

The passenger car segment commands the largest share of the Brazil ADAS market, driven by substantial consumer demand for vehicles equipped with advanced safety technologies and automaker strategies to differentiate through technological innovation. Brazilian consumers are increasingly conscious of safety features and willing to pay premiums for vehicles offering lane departure warning, adaptive cruise control, and automatic emergency braking capabilities. The passenger car segment continues to demonstrate strong sales performance, reflecting sustained demand for personal mobility solutions equipped with modern safety systems.

Insurance companies increasingly offer reduced premiums for ADAS-equipped passenger cars, creating compelling financial incentives that accelerate consumer adoption beyond regulatory requirements. The growing availability of ADAS features across vehicle price segments, from compact cars to premium SUVs, is democratizing access to advanced safety technologies throughout Brazil's diverse consumer market. Major automakers are making substantial investments in Brazilian production facilities to launch new vehicle models equipped with comprehensive ADAS suites, reinforcing the passenger car segment's dominant position in the market.

Regional Insights:

- Southeast

- South

- Northeast

- North

- Central-West

Southeast represents the leading segment with a 35% share of the total Brazil advanced driver assistance systems market in 2025.

The Southeast region dominates the Brazil ADAS market, serving as the nation's primary automotive manufacturing hub with major production facilities concentrated in São Paulo, Minas Gerais, and Rio de Janeiro states. São Paulo represents the largest share of Brazil's total vehicle production, underscoring the region's manufacturing supremacy and strategic importance within the national automotive ecosystem. This industrial concentration creates natural advantages for ADAS adoption as newly manufactured vehicles increasingly incorporate advanced safety technologies directly from production lines.

Higher disposable incomes among urban consumers in metropolitan areas including São Paulo, Rio de Janeiro, and Belo Horizonte support premium vehicle purchases and aftermarket ADAS installations. The region's advanced transportation infrastructure and higher traffic densities create practical demand for collision avoidance and driver assistance technologies that enhance safety in congested urban environments. Major automotive manufacturers maintain engineering centers and technology development facilities in the Southeast, fostering innovation clusters that accelerate ADAS advancement. The concentration of skilled automotive workforce, established supplier networks, and robust logistics infrastructure further reinforces the Southeast's leadership position in driving ADAS market expansion throughout Brazil.

Market Dynamics:

Growth Drivers:

Why is the Brazil Advanced Driver Assistance Systems Market Growing?

Stringent Government Safety Regulations Mandating Advanced Safety Technologies

The imposition of stringent safety regulations by Brazilian governmental bodies represents a pivotal factor propelling market growth as authorities mandate the integration of essential ADAS features in new vehicles. National regulatory frameworks have established requirements for electronic stability control and automatic emergency braking in all new vehicles, creating substantial market demand across the automotive sector. These regulatory mandates push automobile manufacturers to incorporate advanced safety technologies as standard equipment rather than optional features. The increased emphasis on safety standards encourages automakers to exceed minimum requirements, differentiating their products through enhanced protection capabilities. Furthermore, the progression toward standardization of ADAS technologies helps overcome compatibility challenges and facilitates broader adoption across vehicle segments. As Brazilian regulations continue to evolve and align with global safety standards, the demand for ADAS is expected to increase substantially.

Substantial Investments by Global Automotive Manufacturers in Local Production

Major global automotive manufacturers are committing unprecedented investments to expand and modernize production facilities in Brazil, accelerating the integration of advanced driver assistance technologies into locally manufactured vehicles. In March 2024, Stellantis announced a record investment plan totaling EUR 5.6 Billion for South American operations through 2030, marking the largest investment in the history of Brazilian and regional automotive industry. This investment supports the launch of numerous new products, development of Bio-Hybrid technologies, and advancement of decarbonization initiatives including vehicles equipped with comprehensive ADAS suites. Similarly, other major automakers have allocated substantial capital for state factory upgrades and manufacturing modernization across their Brazilian operations. These significant capital deployments signal strong manufacturer confidence in the Brazilian market and demonstrate commitment to integrating advanced driver assistance technologies into locally produced vehicles.

Rising Consumer Awareness and Demand for Enhanced Vehicle Safety Features

Growing consumer awareness regarding the benefits of advanced driver assistance systems is stimulating market demand as Brazilian vehicle buyers increasingly prioritize safety when making purchasing decisions. Modern drivers seek features providing convenience, safety, and connectivity, with systems including adaptive cruise control and parking assistance becoming expected rather than luxury additions. This shift in consumer preferences compels manufacturers to incorporate more advanced driver assistance technologies across vehicle segments from entry-level to premium categories. Insurance companies increasingly offer reduced premiums for vehicles equipped with ADAS, providing compelling financial incentives that encourage consumer adoption beyond regulatory requirements. The rising number of road accidents and associated fatalities has heightened demand for advanced safety features, with consumers recognizing that ADAS technologies can significantly reduce collision severity and protect vehicle occupants. Brazil’s vehicle sales reached approximately 2.63 Million units in 2024, demonstrating robust market demand.

Market Restraints:

What Challenges the Brazil Advanced Driver Assistance Systems Market is Facing?

High Implementation Costs and Price Sensitivity Among Consumers

The substantial costs associated with implementing advanced driver assistance systems present significant barriers to widespread market adoption, particularly in price-sensitive consumer segments. Integration of sophisticated sensor arrays, processing units, and software systems adds considerable expense to vehicle manufacturing costs that manufacturers must either absorb or pass to consumers through higher retail prices. Cost constraints sometimes prompt manufacturers to remove advanced features from lower-priced vehicle versions, limiting ADAS availability in entry-level market segments where affordability remains paramount for purchasing decisions.

Infrastructure Limitations and Inconsistent Road Conditions

Inconsistent road infrastructure and varying surface conditions across Brazilian regions present challenges for ADAS technologies designed primarily for well-maintained highway environments. Lane markings, signage quality, and road surface conditions vary significantly between urban centers and rural areas, potentially affecting the reliability and effectiveness of camera-based lane departure warning and adaptive cruise control systems. The development of connected vehicle technologies requires supporting infrastructure including reliable communication networks that remain unevenly distributed throughout the country.

Limited Consumer Understanding of ADAS Capabilities and Limitations

Insufficient consumer understanding regarding the proper use and operational limitations of advanced driver assistance systems may hinder market development and create safety concerns. Many drivers lack comprehensive knowledge about how ADAS technologies function, potentially leading to over-reliance on systems designed to assist rather than replace attentive driving. Misconceptions regarding system capabilities could result in inappropriate use scenarios where technology limitations may compromise safety rather than enhance it. Educational initiatives from manufacturers are essential.

Competitive Landscape:

The Brazil advanced driver assistance systems market features a dynamic competitive environment characterized by the presence of established global automotive suppliers and technology innovators competing for market share. Leading Tier-1 suppliers leverage their extensive automotive relationships and manufacturing capabilities to deliver integrated ADAS solutions to original equipment manufacturers operating in Brazil. These companies invest substantially in research and development to enhance sensor technologies, improve software algorithms, and develop cost-effective solutions suitable for diverse vehicle segments. Strategic partnerships between technology providers and local automotive manufacturers accelerate innovation and enable customized solutions addressing Brazilian market requirements.

Brazil Advanced Driver Assistance Systems Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Solution Types Covered | Adaptive Cruise Control, Blind Spot Detection System, Park Assistance, Lane Departure Warning System, Tire Pressure Monitoring System, Autonomous Emergency Braking, Adaptive Front Lights, Others |

| Component Types Covered |

|

| Vehicle Types Covered | Passenger Cars, Commercial Vehicles |

| Regions Covered | Southeast, South, Northeast, North, Central-West |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Brazil advanced driver assistance systems market size was valued at USD 726.62 Million in 2025.

The Brazil advanced driver assistance systems market is expected to grow at a compound annual growth rate of 7.99% from 2026-2034 to reach USD 1,451.24 Million by 2034.

Autonomous emergency braking dominated the market with a share of 22%, driven by regulatory mandates requiring AEB in all new vehicles and demonstrated effectiveness in reducing collision severity.

Key factors driving the Brazil advanced driver assistance systems market include stringent government safety regulations, substantial manufacturer investments in local production, and rising consumer awareness.

Major challenges include high implementation costs limiting adoption in price-sensitive segments, inconsistent road infrastructure affecting system reliability, and limited consumer understanding of ADAS capabilities.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)