Brazil Advertising Market Size, Share, Trends and Forecast by Type, and Region, 2026-2034

Brazil Advertising Market Summary:

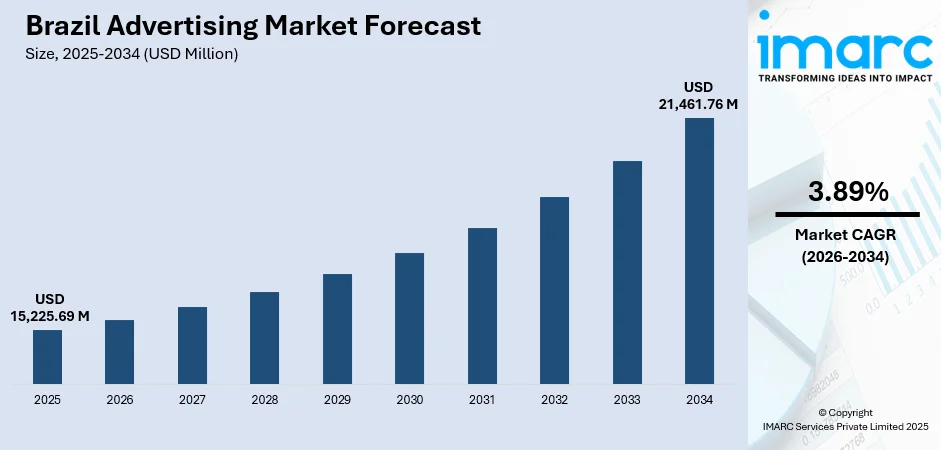

The Brazil advertising market size was valued at USD 15,225.69 Million in 2025 and is projected to reach USD 21,461.76 Million by 2034, growing at a compound annual growth rate of 3.89% from 2026-2034.

The market is driven by rising internet penetration, increasing smartphone adoption, and the growing preference for digital platforms among advertisers seeking precise audience targeting. The expansion of e-commerce and social media engagement has accelerated investment in online advertising channels. Additionally, the integration of programmatic buying technologies and influencer marketing strategies continues to reshape brand communication approaches, contributing to the Brazil advertising market share.

Key Takeaways and Insights:

-

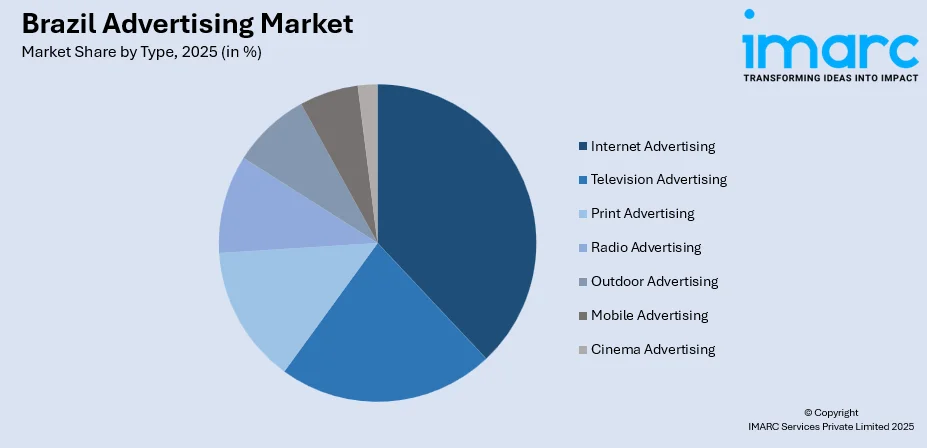

By Type: Internet advertising dominates the market with a share of 38.01% in 2025, owing to rising smartphone penetration, social media engagement, expanding e-commerce, and the capacity to deliver personalized content nationwide.

-

By Region: Southeast leads the market with a share of 32% in 2025, driven by corporate hubs, advanced digital infrastructure, higher consumer spending, dense urban population, and major advertising agencies in São Paulo and Rio de Janeiro.

-

Key Players: The Brazil advertising market exhibits moderate competitive intensity, with multinational advertising networks competing alongside established domestic agencies. Market participants differentiate through integrated creative-media capabilities, data-driven targeting solutions, and cross-platform campaign execution.

To get more information on this market Request Sample

The Brazil advertising market is experiencing transformative growth propelled by the rapid digitalization of consumer behaviour and media consumption patterns. Advertisers are increasingly reallocating budgets from traditional channels to digital platforms, recognizing the superior targeting capabilities and measurable returns offered by online advertising formats. According to sources, in the first half of 2025, Brazil’s advertising investments rose 12.5% to R$ 11.93 Billion, surpassing GDP growth; national ads led with R$ 8.23 Billion, mainly in TV and Internet. Moreover, the proliferation of mobile devices has fundamentally altered how brands connect with audiences, enabling real-time engagement through social media, streaming services, and mobile applications. Rising e-commerce adoption has created demand for performance-driven advertising solutions that directly influence purchase decisions. Additionally, the maturation of programmatic advertising technologies allows marketers to optimize campaigns dynamically, improving efficiency and relevance across diverse audience segments throughout the country. The integration of artificial intelligence and data analytics further enhances campaign personalization, while connected television and retail media networks create new avenues for brand engagement and consumer reach.

Brazil Advertising Market Trends:

Programmatic Digital Out-of-Home Expansion

Brazilian advertisers are increasingly adopting programmatic digital out-of-home advertising across urban centers, fundamentally reshaping public space marketing strategies. As per sources, in November 2025, VIOOH partnered with RZK Digital, expanding programmatic DOOH to 800 urban screens across Brazil, reaching over 75 Million monthly visitors and delivering four billion impressions. Further, this evolution enables real-time campaign adjustments based on location data, weather conditions, and audience demographics. Brands leverage connected digital displays in transit hubs, shopping centers, and street furniture to deliver contextually relevant messaging. The integration of programmatic capabilities with traditional outdoor media creates opportunities for dynamic creative optimization and unified cross-channel measurement, allowing marketers to blend physical and digital touchpoints within cohesive campaign frameworks.

Retail Media Network Integration

The convergence of advertising and retail commerce is accelerating as brands prioritize placement within e-commerce ecosystems and marketplace platforms. According to sources, in July 2025, THE LED acquired RETAIL MEDIA, expanding its in-store digital media network to over 8,000 screens across 2,200 stores and planning R$ 200 Million investments by 2028. Furthermore, advertisers recognize the value of reaching consumers at critical purchase decision moments, shifting investments toward sponsored product listings and display placements within online retail environments. This approach delivers higher relevance as promotional content appears alongside active shopping behavior. The emerging retail media infrastructure enables sophisticated targeting, attribution measurement, and direct correlation between advertising exposure and transaction outcomes, creating new opportunities for performance-driven brand building.

Influencer Marketing Maturation

Brazil's vibrant social media landscape continues driving the evolution of influencer-led brand promotion strategies. Marketers increasingly collaborate with content creators across platforms to reach engaged audiences through authentic, relatable messaging formats. As per sources, in November 2025, Casas Bahia launched the “Acelera CB” program to train 10,000 micro and nano influencers, generating over two thousand content pieces monthly and reaching 46 Million views. Moreover, the shift extends beyond celebrity endorsements toward micro-influencers and niche community leaders who deliver higher engagement rates within specific demographic segments. Brands develop long-term creator partnerships rather than transactional campaigns, enabling consistent storytelling that builds trust and emotional connections with target consumers while maintaining cultural relevance across diverse regional audiences.

Market Outlook 2026-2034:

The Brazil advertising market revenue is anticipated to demonstrate sustained expansion throughout the forecast period, supported by continued digital transformation and evolving consumer media habits. Digital advertising channels are projected to capture an increasing proportion of total market revenue as brands prioritize measurable, performance-oriented strategies. The integration of artificial intelligence in campaign optimization, creative development, and audience targeting will enhance advertising effectiveness. Connected television and streaming platforms represent significant growth opportunities as viewership migrates from traditional broadcast media. The market generated a revenue of USD 15,225.69 Million in 2025 and is projected to reach a revenue of USD 21,461.76 Million by 2034, growing at a compound annual growth rate of 3.89% from 2026-2034.

Brazil Advertising Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Type | Internet Advertising | 38.01% |

| End Use | Southeast | 32% |

Type Insights:

Access the comprehensive market breakdown Request Sample

- Television Advertising

- Print Advertising

- Newspaper Advertising

- Magazine Advertising

- Radio Advertising

- Outdoor Advertising

- Internet Advertising

- Search Advertising

- Display Advertising

- Classified Advertising

- Video Advertising

- Mobile Advertising

- Cinema Advertising

Internet advertising dominates with a market share of 38.01% of the total Brazil advertising market in 2025.

Internet advertising has established itself as the major market constituent in the Brazil advertising market, thereby identifying the basic transition that consumers are following with regard to media consumption habits. Internet advertising includes search ads, display advertising, social networking ads, video content, and native ads that can be delivered on both Web and mobile platforms. The penetration rate of smartphones and cheap mobile internet access has increased the reach of online audiences beyond the limitations of geographically restricted cities. The basic advantage being provided to the advertisers is related to consumer targeting.

The growth trajectory of internet advertising is supported by measurable performance metrics and return on investment transparency that traditional channels cannot match. Programmatic buying platforms have streamlined media purchasing processes while enabling real-time optimization based on campaign performance data. Social media platforms command substantial advertising investment due to high user engagement rates and advanced audience targeting tools. According to sources, in 2025, Brazil had 144 Million social media users, representing 67.8 percent of the total population, with 78.6 percent of internet users active on at least one platform. Moreover, video advertising across streaming services and social platforms delivers compelling creative impact while capturing consumer attention during entertainment consumption occasions. The continued evolution of targeting technology and measurement solutions reinforces internet advertising dominance.

Regional Insights:

- Southeast

- South

- Northeast

- North

- Central-West

Southeast dominates with a market share of 32% of the total Brazil advertising market in 2025.

Southeast maintains its position as the largest advertising market within Brazil, anchored by São Paulo and Rio de Janeiro metropolitan areas that serve as national economic and media centers. This region concentrates corporate headquarters, advertising agencies, media production facilities, and financial services institutions that drive substantial marketing expenditure. Advanced digital infrastructure enables sophisticated campaign execution across multiple platforms and formats. The high population density and elevated consumer spending power create attractive conditions for advertisers seeking efficient reach and frequency within target demographics.

The region particularly dominates as the financial and business capital, attracting significant advertising investment from multinational corporations and domestic brands alike. The concentration of creative talent and agency networks in this region facilitates campaign development and execution excellence. Regional consumers demonstrate high digital literacy and social media engagement rates that favor digital advertising formats. The mature retail infrastructure and e-commerce adoption create opportunities for integrated marketing approaches spanning digital and traditional channels. Premium media inventory availability and sophisticated measurement capabilities further reinforce Southeast regional market leadership.

Market Dynamics:

Growth Drivers:

Why is the Brazil Advertising Market Growing?

Expanding Digital Infrastructure and Internet Penetration

Brazil advertising market growth is fundamentally driven by expanding digital infrastructure that enables broader internet access across geographic regions. Improved telecommunications networks and affordable mobile data plans have extended digital connectivity beyond major urban centers into secondary cities and rural communities. As per sources, in 2025, Nokia partnered with TIM Brasil to expand 5G coverage across 15 states, increasing municipalities with ultra-fast connectivity and supporting digitalization for businesses and consumers. Furthermore, this infrastructure expansion creates larger addressable audiences for digital advertising campaigns while reducing the digital divide that previously limited market reach. The proliferation of connected devices including smartphones, tablets, and smart televisions provides multiple touchpoints for brand engagement. Enhanced network capabilities support bandwidth-intensive advertising formats such as video and interactive content that deliver superior creative impact compared to traditional static formats.

E-commerce Growth and Retail Media Development

The accelerating adoption of e-commerce platforms is creating substantial advertising market opportunities as brands compete for consumer attention within digital shopping environments. Online retail growth has transformed consumer purchasing behavior, shifting discovery and decision-making processes toward digital channels. In November 2025, Brazilian retailers Magazine Luiza and Americanas launched an e-commerce partnership, enabling mutual product sales on each other’s platforms, boosting digital reach and enhancing retail media advertising opportunities. Further, advertisers increasingly allocate budgets to retail media networks that enable product promotion at critical purchase consideration moments. This commerce-driven advertising approach delivers direct attribution between marketing investment and transaction outcomes.

Social Media Engagement and Content Consumption Patterns

Brazilian consumers demonstrate exceptionally high social media engagement rates that create attractive advertising opportunities across major platforms. The cultural affinity for social networking, video content consumption, and digital community participation provides brands with extensive reach and engagement potential. Advertisers leverage platform-specific creative formats including stories, reels, and live streaming to capture audience attention through entertainment-driven messaging approaches. The integration of shopping features within social platforms enables seamless transitions from brand discovery to purchase consideration. Influencer collaborations and user-generated content strategies amplify brand messaging through trusted voices within engaged communities, enhancing authenticity and emotional connection with target consumer segments.

Market Restraints:

What Challenges the Brazil Advertising Market is Facing?

Data Privacy Regulations and Compliance Requirements

The implementation of comprehensive data protection legislation has introduced operational complexities for digital advertising practices. Compliance requirements mandate explicit consumer consent for data collection and usage in targeting applications. Advertisers must invest in privacy-compliant infrastructure and processes while adapting audience targeting strategies to function within regulatory constraints. These requirements increase operational costs and potentially reduce targeting precision that enables efficient campaign delivery.

Economic Volatility and Budget Pressures

Macroeconomic fluctuations including inflation, currency volatility, and interest rate variations create uncertainty that affects advertising investment decisions. Economic pressures may prompt brands to reduce marketing expenditures or shift toward performance-focused strategies with immediate measurable returns. Consumer spending constraints during challenging economic periods can diminish campaign effectiveness as audiences become more price-sensitive and resistant to promotional messaging.

Advertisement Fraud and Brand Safety Concerns

Digital advertising faces persistent challenges from fraudulent traffic, invalid impressions, and brand safety risks that undermine campaign effectiveness and advertiser confidence. Sophisticated fraud schemes divert marketing budgets toward non-human traffic while inappropriate content adjacencies threaten brand reputation. Advertisers must invest in verification technologies and careful inventory selection to protect campaign integrity, adding complexity and cost to digital media execution.

Competitive Landscape:

The Brazil advertising market demonstrates moderate competitive intensity characterized by the coexistence of multinational advertising networks and established domestic agencies. Market participants compete through integrated service offerings spanning creative development, media planning, and digital execution capabilities. Leading agencies differentiate through data-driven audience insights, proprietary technology platforms, and specialized expertise in emerging channels including connected television and retail media. The competitive environment increasingly emphasizes measurable performance outcomes and return on investment accountability. Strategic partnerships between agencies and technology platforms enable enhanced targeting, measurement, and optimization capabilities. Market consolidation continues as larger networks acquire specialized capabilities while independent agencies carve niches through creative excellence and cultural expertise.

Recent Developments:

-

In September 2025, LG Ad Solutions launched in Brazil, appointing Renato Citelli as Commercial Director. The São Paulo-based team will drive Connected TV advertising innovation, offering data-driven, high-impact campaigns across LG Smart TVs to connect brands with Brazilian consumers at scale.

-

In August 2025, Programmatic advertising platform Mintegral entered Brazil, partnering with top agencies Catalyst, US Media, and Growth Genius. The expansion aims to provide locally tailored, high-performance mobile advertising solutions, leveraging global-scale machine learning to support Brazil’s rapidly growing mobile-first market.

Brazil Advertising Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered |

|

| Regions Covered | Southeast, South, Northeast, North, Central-West |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Brazil advertising market size was valued at USD 15,225.69 Million in 2025.

The Brazil advertising market is expected to grow at a compound annual growth rate of 3.89% from 2026-2034 to reach USD 21,461.76 Million by 2034.

Internet advertising held the largest Brazil advertising market share, driven by expanding digital infrastructure, rising e-commerce adoption, high social media engagement rates, programmatic advertising technology advancement, and growing investment in retail media networks.

Key factors driving the Brazil advertising market include expanding digital infrastructure, rising e-commerce adoption, high social media engagement rates, programmatic advertising technology advancement, and growing investment in retail media networks.

Major challenges include stringent data privacy regulations requiring compliance investment, economic volatility affecting advertising budgets, ad fraud and invalid traffic concerns, brand safety risks, measurement standardization gaps, and regional infrastructure disparities limiting digital reach.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)