Brazil Agribusiness Market Size, Share, Trends and Forecast by Product and Region, 2025-2033

Brazil Agribusiness Market Overview:

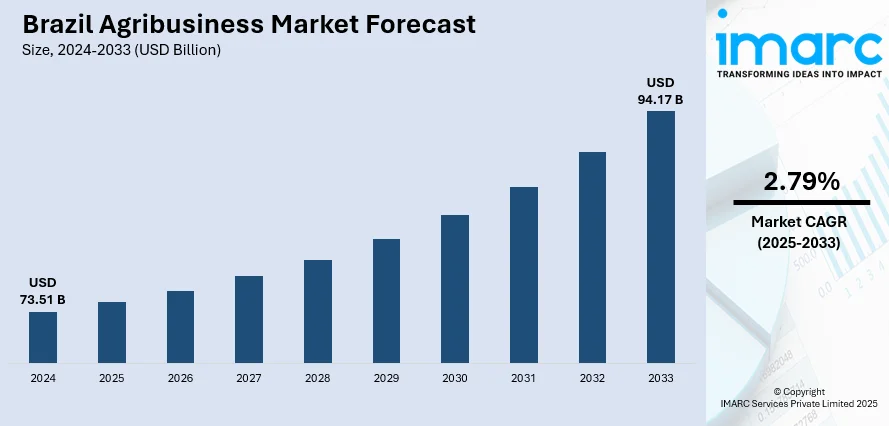

The Brazil agribusiness market size reached USD 73.51 Billion in 2024. The market is projected to reach USD 94.17 Billion by 2033, exhibiting a growth rate (CAGR) of 2.79% during 2025-2033. The abundance of fertile land not only increases agricultural productivity but also draws significant investments in mechanization, irrigation systems, and precision farming methods that further improve yields. Besides this, rising trade partnerships with countries in Europe and the Asia-Pacific region are contributing to the expansion of the Brazil agribusiness market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 73.51 Billion |

| Market Forecast in 2033 | USD 94.17 Billion |

| Market Growth Rate 2025-2033 | 2.79% |

Brazil Agribusiness Market Trends:

Vast availability of fertile land

The extensive presence of arable land is driving the market expansion, as it offers the essential groundwork for extensive, varied, and productive agricultural output. The increasing production of grains and oilseeds showcases the efficient use of Brazil's arable land to satisfy local needs. Brazil's National Supply Company (CONAB) indicated that the nation's 2024/25 grain yield was projected to hit 345.9 Million Tons, 47.7 Million Tons above the 2023/24 season, setting a new record, based on the state-run agency's 11th survey. Fertile soils support the cultivation of major crops, such as soybeans, corn, coffee, sugarcane, and fruits. This abundance of land not only boosts farm productivity but also attracts large-scale investments in mechanization, irrigation systems, and precision farming techniques that further enhance yields. The ability to scale up operations across vast farming areas allows Brazil to achieve significant economies of scale, lowering production costs. Furthermore, fertile land encourages the adoption of crop rotation and sustainable farming practices, ensuring long-term soil health and consistent productivity. Overall, the abundance of fertile land secures Brazil’s agricultural dominance, supports economic growth, and ensures its role as a major player in global food security.

To get more information on this market, Request Sample

Increasing export activities

Rising export activities are significantly impelling the Brazil agribusiness market growth, as the country continues to strengthen its position as one of the world’s leading exporters of soybeans, corn, sugar, coffee, beef, and poultry. As per the government data, in April 2025, Brazil shipped USD 15.03 Billion in agribusiness goods, a 0.4% increase compared to April 2024. The global demand for high-quality agricultural commodities is creating strong export opportunities and boosting revenues for farmers and agribusinesses. Trade partnerships with countries in the Asia-Pacific region, Europe, and the Middle East are expanding, providing Brazilian producers with stable and lucrative markets. Additionally, investments in port facilities, logistics, and storage infrastructure are improving the efficiency of export supply chains, enabling quicker and larger shipments. Rising exports not only enhance foreign exchange earnings but also encourage domestic producers to adopt modern farming practices, advanced machinery, and precision agriculture technologies to meet global standards. The international reputation of Brazilian agri-products for quality and competitiveness is also helping strengthen its export-driven growth. Overall, increasing export activities are fueling agribusiness expansion, attracting foreign investments, and reinforcing Brazil’s role as an important player in the global food supply chain.

Brazil Agribusiness Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on product.

Product Insights:

- Grains

- Wheat

- Rice

- Coarse Grains – Ragi

- Sorghum

- Millets

- Oilseeds

- Rapeseed

- Sunflower

- Soybean

- Sesamum

- Others

- Dairy

- Liquid Milk

- Milk Powder

- Ghee

- Butter

- Ice-cream

- Cheese

- Others

- Livestock

- Pork

- Poultry

- Beef

- Sheep Meat

- Others

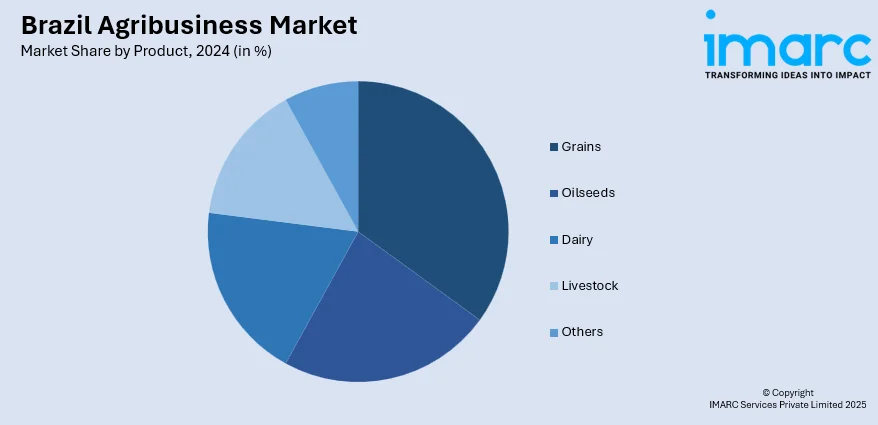

The report has provided a detailed breakup and analysis of the market based on the product. This includes grains (wheat, rice, coarse grains – ragi, sorghum, and millets), oilseeds (rapeseed, sunflower, soybean, sesamum, and others), dairy (liquid milk, milk powder, ghee, butter, ice-cream, cheese, and others), livestock (pork, poultry, beef, and sheep meat), and others.

Regional Insights:

- Southeast

- South

- Northeast

- North

- Central-West

The report has also provided a comprehensive analysis of all the major regional markets, which include Southeast, South, Northeast, North, and Central-West.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Brazil Agribusiness Market News:

- In August 2025, CNH became a member of the UN Global Compact Brazil Network to promote sustainable agriculture. Its involvement in Brazil linked the company to regional efforts, especially the ‘Platform for Sustainable Agriculture’. It emphasized SDG 2 (Zero Hunger and Sustainable Agriculture), SDG 12 (Responsible Consumption and Production), and SDG 13 (Climate Action).

- In July 2025, Regrow Ag teamed up with Embrapa, Brazil’s top agricultural research institution, to adapt the DNDC model for Brazil’s tropical soil and climatic conditions. The partnership aimed to improve the monitoring of greenhouse gas emissions and enhance carbon sequestration initiatives throughout Brazil’s vast agricultural industry.

Brazil Agribusiness Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered |

|

| Regions Covered | Southeast, South, Northeast, North, Central-West |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Brazil agribusiness market performed so far and how will it perform in the coming years?

- What is the breakup of the Brazil agribusiness market on the basis of product?

- What is the breakup of the Brazil agribusiness market on the basis of region?

- What are the various stages in the value chain of the Brazil agribusiness market?

- What are the key driving factors and challenges in the Brazil agribusiness market?

- What is the structure of the Brazil agribusiness market and who are the key players?

- What is the degree of competition in the Brazil agribusiness market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Brazil agribusiness market from 2025-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Brazil agribusiness market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Brazil agribusiness industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)