Brazil Agricultural Biologicals Market Size, Share, Trends and Forecast by Function, Crop Type, and Region, 2026-2034

Brazil Agricultural Biologicals Market Summary:

The Brazil agricultural biologicals market size was valued at USD 914.20 Million in 2025 and is projected to reach USD 1,332.75 Million by 2034, growing at a compound annual growth rate of 4.28% from 2026-2034.

Brazil's agricultural biologicals market is expanding as farmers increasingly adopt sustainable crop management solutions to enhance productivity while preserving environmental integrity. The country's vast agricultural landscape and biodiversity provide fertile ground for biological innovations that address pest control, nutrient management, and soil health improvement. Growing consumer preference for residue-free produce and stringent export requirements are compelling growers to integrate biological inputs into their farming practices.

Key Takeaways and Insights:

- By Function: Crop nutrition dominates the market with a share of 59% in 2025, driven by widespread adoption of nitrogen-fixing inoculants and phosphate-solubilizing biofertilizers that enhance soil fertility while reducing dependence on synthetic fertilizers.

- By Crop Type: Row crops lead the market with a share of 72% in 2025, owing to extensive soybean and corn cultivation where biological inputs optimize yields and support export compliance with international residue standards.

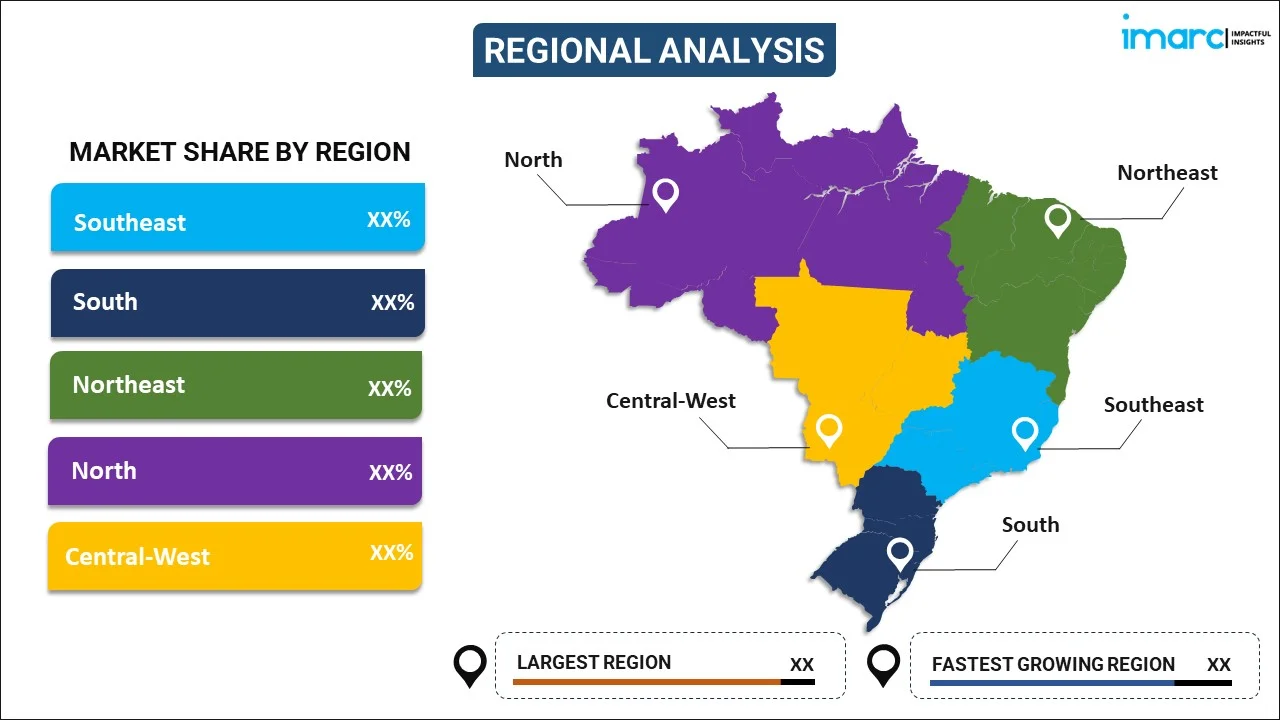

- By Region: Central-West represents the largest segment with a market share of 28% in 2025, attributed to the concentration of major soybean and corn production areas in Mato Grosso and Goiás, where large-scale commercial farms lead biological adoption.

- Key Players: The Brazil agricultural biologicals market exhibits a competitive landscape characterized by both multinational corporations and domestic innovators. Market participants compete through technological differentiation, product efficacy, and distribution network expansion, with increasing collaboration between agtech startups and established agricultural companies driving product development.

Brazil's position as a global agricultural powerhouse creates substantial demand for biological inputs that can sustainably enhance crop productivity across its diverse growing regions. The country's unique biodiversity offers extensive opportunities for discovering native microorganisms beneficial to agriculture, which research institutions and private enterprises are actively exploring. Government initiatives supporting sustainable agriculture, including the ABC+ Plan and the National Bioinputs Program, provide financial incentives and streamlined regulatory pathways that accelerate market development. For instance, Brazil has an estimated 351 million hectares of agricultural land, of which 156 million hectares are currently managed using bioinputs, according to the National Association for the Promotion and Innovation of the Biological Industry (ANPII Bio). This represents a 13.4% increase compared with 2023. During the most recent crop season, the bioinputs sector generated revenues of around R$ 5.7 billion (approximately USD 1.1 billion), and ANPII projects the industry to expand by nearly 60% by the end of the decade. The integration of biological solutions into integrated pest management strategies has gained significant traction, particularly as pest resistance to conventional chemicals increases. Digital agriculture advancements are enabling precision application of biologicals, optimizing their effectiveness while reducing input costs. Brazil's soybean growers have particularly embraced biological nitrogen fixation technologies, with nitrogen-fixing inoculants becoming standard practice in production systems, demonstrating how biological solutions can deliver both economic and environmental benefits at scale.

Brazil Agricultural Biologicals Market Trends:

Integration of Biologicals into Carbon Credit Programs

Brazilian farmers are increasingly incorporating biological inputs into their operations to qualify for carbon credit programs that reward sustainable agricultural practices. The ABC+ Plan and related initiatives provide financial reimbursements for verified biological spending, creating additional revenue streams for adopters. This convergence of environmental stewardship and economic incentive is transforming biologicals from optional inputs into strategic farm management tools. Soybean producers in the Cerrado region are leading this adoption, documenting soil-carbon gains through biological applications that qualify for preferential credit terms.

Rising Adoption of Bionematicides and Biocontrol Agents

The growing severity of nematode infestations across Brazilian croplands is driving substantial demand for biological control solutions. Bionematicides have emerged as critical tools in crop protection programs, particularly following regulatory restrictions on certain chemical nematicides. Biocontrol agents targeting corn leafhopper and sugarcane borers are experiencing rapid uptake as farmers seek alternatives to manage pest populations that have developed resistance to conventional treatments. Microbial consortia combining multiple beneficial organisms are gaining preference for their broad-spectrum protection capabilities. For instance, in September 2024, UPL Ltd., a global provider of sustainable agricultural solutions, participated in the 39th Brazilian Congress of Nematology, taking place in Foz do Iguaçu (PR) through September 5. A key focus for the company at the event is the introduction of Nimaxxa, Brazil’s first registered bionematicide combined with an agricultural biostimulant. The product is offered through UPL’s Natural Plant Protection (NPP) division, which specializes in innovative biological solutions for crop management.

Streamlined Regulatory Framework Accelerating Product Availability

Brazil's Ministry of Agriculture has implemented regulatory reforms that significantly reduce approval timelines for biological products, enhancing market accessibility for innovative solutions. The fast-track registration process for biopesticides has attracted increased investment from both domestic and international biological companies seeking to capitalize on the favorable regulatory environment. The recent Bioinputs Law provides clearer definitions and support mechanisms for biological product development, manufacturing, and commercialization, establishing a comprehensive framework that encourages market growth. For instance, in December 2024, Brazil enacted Federal Law No. 15,070/2024, known as the Bio-inputs Law, establishing a comprehensive regulatory framework for bio-inputs used in agriculture. The legislation governs key activities across the value chain, including manufacturing, import and export operations, logistics and storage requirements, as well as the proper handling and disposal of these products.

Market Outlook 2026-2034:

The Brazil agricultural biologicals market demonstrates robust growth potential driven by the convergence of regulatory support, technological advancement, and shifting farmer preferences toward sustainable production methods. Export market requirements for lower chemical residues continue compelling Brazilian growers to integrate biological solutions that maintain international competitiveness. Research collaboration between public institutions and private companies is accelerating the development of locally adapted microbial strains optimized for Brazilian soil and climate conditions. The emergence of on-farm biological production capabilities is expanding access to these inputs across diverse farming operations. The market generated a revenue of USD 914.20 Million in 2025 and is projected to reach a revenue of USD 1,332.75 Million by 2034, growing at a compound annual growth rate of 4.28% from 2026-2034.

Brazil Agricultural Biologicals Market Report Segmentation:

|

Segment Category |

Leading Segment |

Market Share |

|

Function |

Crop Nutrition |

59% |

|

Crop Type |

Row Crops |

72% |

|

Region |

Central-West |

28% |

Function Insights:

To get detailed analysis of this market, RequestSample

- Crop Nutrition

- Biofertilizer

- Biostimulants

- Organic Fertilizer

- Crop Protection

- Biocontrol Agents

- Biopesticides

The crop nutrition dominates with a market share of 59% of the total Brazil agricultural biologicals market in 2025.

The crop nutrition segment maintains market leadership as Brazilian farmers increasingly adopt biological alternatives to synthetic fertilizers for enhancing soil fertility and nutrient availability. Nitrogen-fixing inoculants have achieved near-universal adoption in soybean production, where they replace substantial quantities of synthetic nitrogen inputs while improving crop yields. Biostimulants containing plant growth-promoting bacteria and fungi are gaining traction for their ability to enhance nutrient uptake efficiency and improve plant resilience under environmental stress conditions. The expansion of phosphate-solubilizing biofertilizers addresses soil phosphorus availability challenges prevalent across Brazilian agricultural regions.

Government programs reimbursing qualified biological input expenditures have particularly boosted crop nutrition product adoption by reducing farmer investment risk. Research institutions continue developing locally adapted microbial strains optimized for Brazilian soil conditions, expanding the range of effective biological nutrition solutions. The integration of biostimulants with conventional fertilization programs enables farmers to reduce synthetic input volumes while maintaining or improving productivity. Carbon credit opportunities linked to biological nitrogen fixation create additional economic incentives driving segment growth.

Crop Type Insights:

- Cash Crops

- Horticultural Crops

- Row Crops

The row crops leads with a share of 72% of the total Brazil agricultural biologicals market in 2025.

Row crops dominate biological input consumption reflecting Brazil's position as a leading global producer of soybeans, corn, and other field crops cultivated across extensive acreage. Soybean production systems have pioneered biological adoption, with nitrogen-fixing inoculants becoming essential inputs that deliver both agronomic and economic benefits. The scale of row crop operations enables efficient biological application using existing farm equipment, facilitating integration into established production practices. Export market requirements for lower chemical residues create strong incentives for row crop producers to incorporate biological pest management solutions.

Corn production increasingly utilizes biological inputs for managing soil-borne pests and enhancing nutrient availability, particularly in double-cropping systems following soybeans. The emergence of pest resistance to conventional chemicals in row crop production drives demand for biological alternatives that provide sustainable control options. Large-scale adoption by commercial farming operations in the Central-West region demonstrates the viability of biological inputs in intensive production systems. Seed treatment applications of biological products have expanded significantly, protecting crops from early-season pest and disease pressure.

Regional Insights:

To get detailed analysis of this market, RequestSample

- Southeast

- South

- Northeast

- North

- Central-West

The Central-West exhibits clear dominance with a 28% share of the total Brazil agricultural biologicals market in 2025.

The Central-West region leads biological input consumption driven by its concentration of large-scale soybean and corn production operations that have adopted sustainable farming practices. Mato Grosso and Goiás states host commercially sophisticated farming enterprises that leverage biological solutions for competitive advantage in export markets. The region's progressive approach to agricultural technology adoption facilitates rapid uptake of innovative biological products. Strong agricultural extension networks and technical support infrastructure enable effective biological product utilization across diverse farm operations.

Environmental conditions in the Central-West, including distinct wet and dry seasons, create pest and disease pressure that biological solutions effectively address. Carbon credit programs have gained significant participation from Central-West farmers, linking biological adoption to direct financial returns. The concentration of agricultural research facilities and biologicals manufacturers in the region supports product development tailored to local conditions. Infrastructure investments improving cold chain logistics have enhanced biological product availability and shelf life across the region's expansive agricultural areas.

Market Dynamics:

Growth Drivers:

Why is the Brazil Agricultural Biologicals Market Growing?

Expanding Government Support and Regulatory Facilitation

Brazil's government has established comprehensive policy frameworks that actively promote biological input adoption through financial incentives, streamlined registration processes, and research funding. The ABC+ Plan allocates substantial resources to sustainable agriculture practices, including reimbursement mechanisms that reduce farmer costs associated with biological input purchases. Regulatory reforms implemented by the Ministry of Agriculture have significantly shortened approval timelines for biological products, enabling faster market access for innovative solutions. The National Bioinputs Program coordinates efforts across government agencies, research institutions, and private sector stakeholders to accelerate biological technology development and commercialization. These supportive policies create a favorable operating environment that attracts investment from both domestic entrepreneurs and international biological companies seeking growth opportunities in Brazil's dynamic agricultural sector.

Increasing Pest Resistance and Environmental Sustainability Concerns

The development of pest resistance to conventional chemical pesticides across Brazilian agricultural systems drives farmers toward biological alternatives that offer sustainable control mechanisms. Repeated application of the same chemical modes of action has accelerated resistance evolution in major crop pests, reducing the effectiveness of traditional pest management approaches. Biological solutions employing multiple mechanisms of action through microbial consortia and beneficial insects provide durable pest suppression while delaying resistance development. Environmental awareness among farmers regarding soil health degradation and beneficial organism preservation encourages the adoption of biological inputs that support ecosystem services. Consumer demand for produce with minimal chemical residues creates market premiums that compensate farmers for transitioning to biological crop protection strategies.

Growing Export Market Requirements and Quality Standards

Brazil's agricultural exports face increasingly stringent quality requirements from international markets, particularly regarding chemical residue levels on food commodities. In 2024, Brazil’s agribusiness sector achieved export revenues of USD 164.4 billion, marking the second-highest level recorded in the country’s historical data. European Union Maximum Residue Level standards and similar regulations in other importing regions necessitate reduced chemical input usage, which biological alternatives facilitate. Export-oriented production operations recognize biological inputs as strategic tools for maintaining market access and price premiums in discerning international markets. The traceability requirements accompanying export certifications align well with biological input documentation that demonstrates sustainable production practices. Competitive pressures in global agricultural commodity markets incentivize Brazilian producers to differentiate through sustainability credentials that biological adoption supports.

Market Restraints:

What Challenges is the Brazil Agricultural Biologicals Market Facing?

Cold Chain and Storage Infrastructure Limitations

Biological products containing living microorganisms require specific temperature conditions during transport and storage to maintain viability and efficacy. Brazil's expansive agricultural regions often lack adequate cold chain infrastructure, particularly in remote production areas where high temperatures can compromise product quality. These logistical challenges increase distribution costs and limit shelf life, affecting product availability during critical application windows.

Knowledge and Technical Expertise Requirements

Effective biological input utilization requires an understanding of proper application timing, environmental conditions, and integration with existing farm management practices. Farmers transitioning from conventional chemical programs often lack familiarity with biological product requirements and may experience inconsistent results during initial adoption phases. Technical support and extension service capacity constraints limit the dissemination of best practices necessary for successful biological implementation.

Variable Product Performance Under Field Conditions

Biological product efficacy can vary depending on soil conditions, climate factors, and interactions with existing microbial populations in specific field environments. This variability complicates product recommendations and may disappoint farmers expecting consistent performance comparable to synthetic alternatives. The complexity of biological systems makes standardization challenging, requiring ongoing research to optimize formulations for diverse Brazilian agricultural conditions.

Competitive Landscape:

The Brazil agricultural biologicals market features a dynamic competitive environment where established multinational agricultural input companies compete alongside innovative domestic manufacturers and agtech startups. Market participants differentiate through proprietary microbial strains, advanced formulation technologies, and distribution network reach across Brazil's geographically dispersed agricultural regions. Strategic partnerships between technology developers and established distribution channels enable rapid market penetration for novel biological solutions. Investment in research and development focuses on discovering native Brazilian microorganisms adapted to local conditions while optimizing production processes to improve product consistency and reduce costs. The competitive landscape increasingly emphasizes demonstrated field efficacy and technical support capabilities as farmers seek reliable biological solutions integrated into comprehensive crop management programs.

Recent Developments:

- May 2024: Bioceres Crop Solutions Corp. received authorization from Brazil’s Ministry of Agriculture and Livestock (MAPA – Ministério da Agricultura e Pecuária) for three new bio-insecticidal and bio-nematicidal products developed using inactivated cells from its proprietary Burkholderia technology platform.

- March 2024: Mosaic revealed plans to enter Brazil’s expanding biological inputs market, marking its initial move into this segment within the country. The step follows the company’s earlier expansion into biological solutions in the United States, which began in August 2023, and reflects a broader strategy to scale its presence in this fast-growing sector.

Brazil Agricultural Biologicals Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Functions Covered |

|

| Crop Types Covered | Cash Crops, Horticultural Crops, Row Crops |

| Regions Covered | Southeast, South, Northeast, North, Central-West |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Brazil agricultural biologicals market size was valued at USD 914.20 Million in 2025.

The Brazil agricultural biologicals market is expected to grow at a compound annual growth rate of 4.28% from 2026-2034 to reach USD 1,332.75 Million by 2034.

Crop nutrition dominated the market with 59% share in 2025, driven by widespread adoption of nitrogen-fixing inoculants and biofertilizers that enhance soil fertility while reducing synthetic fertilizer dependence.

Key factors driving the Brazil agricultural biologicals market include expanding government support through programs like ABC+ Plan, increasing pest resistance to conventional chemicals, growing export market requirements for lower residue levels, and rising farmer awareness of sustainable agriculture benefits.

Major challenges include cold chain infrastructure limitations affecting product viability during transport, technical expertise requirements for effective application, variable product performance under diverse field conditions, and competition from lower-cost conventional alternatives.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)