Brazil Agricultural Irrigation Machinery Market Size, Share, Trends and Forecast by Type, Application, and Region, 2026-2034

Brazil Agricultural Irrigation Machinery Market Summary:

The Brazil agricultural irrigation machinery market size was valued at USD 102.94 Million in 2025 and is projected to reach USD 166.82 Million by 2034, growing at a compound annual growth rate of 5.51% from 2026-2034.

The Brazil agricultural irrigation machinery market growth is primarily driven by the strategic position as one of the world's leading agricultural producers, necessitating advanced irrigation infrastructure to sustain competitive productivity levels. The country's commitment to modernizing agricultural practices is accelerating adoption of efficient water management technologies across diverse cropping systems. Government-sponsored credit programs and subsidized financing schemes are reducing capital barriers for farmers seeking to invest in irrigation equipment. The convergence of climate variability, extended dry seasons, and unpredictable rainfall patterns is catalyzing the demand for reliable irrigation solutions that ensure consistent crop yields.

Key Takeaways and Insights:

- By Type: Drip irrigation dominates the market with a share of 45% in 2025, driven by its superior water efficiency delivering precise moisture directly to plant root zones, reduced evaporation losses, and compatibility with fertigation practices that enable simultaneous nutrient application.

- By Application: Crop leads the market with a share of 84% in 2025, owing to the extensive cultivation of field crops, fruits, and vegetables requiring consistent irrigation for optimal yield performance across Brazil's diverse agricultural regions.

- Key Players: The Brazil agricultural irrigation machinery market exhibits moderate competitive intensity, with multinational irrigation equipment manufacturers competing alongside regional distributors offering localized solutions and after-sales support services. Some of the key players operating in the market include Irritec SpA, Nelson Irrigação Brasil, Netafim Brazil, and Rivulis.

The Brazil agricultural irrigation machinery market growth is driven by rising demand for efficient water management, expanding commercial farming, and increasing adoption of modern agricultural technologies. Farmers are investing in advanced irrigation systems to improve crop productivity, reduce water wastage, and manage rainfall variability across key farming regions. Government support programs, access to credit, and the expansion of high-value crops further encourage equipment upgrades. Industry events also play a role in accelerating market development. Agrishow 2025 that took place from April 27 to May 1, 2025, in Ribeirão Preto, São Paulo, Brazil, served as a major platform for showcasing irrigation technologies and machinery innovations. The event included manufacturers, distributors, and farmers, facilitating technology adoption and commercial partnerships. Such exhibitions strengthen market visibility, promote product demonstrations, and support knowledge exchange, contributing to sustained demand for irrigation machinery across Brazil’s agricultural sector.

Brazil Agricultural Irrigation Machinery Market Trends:

Technological Advancements

The adoption of advanced irrigation systems in Brazil is driven by innovations in automation, remote sensing, and real-time monitoring, which optimize water usage, reduce waste, and improve crop health. These systems provide precision irrigation capabilities that maximize efficiency, minimize labor costs, and enhance yields. In 2025, Komet Irrigation expanded its operations in Brazil by launching an Application Engineering & Digital Systems department, supported by a state-of-the-art Experience Hub in Paulínia, São Paulo. This hub focused on developing innovative irrigation solutions, offering real-time data to enhance productivity and profitability, further accelerating the adoption of these technologies across Brazil.

Growing Awareness about Water Conservation

Rising awareness about water conservation is encouraging farmers to adopt efficient irrigation technologies that reduce water wastage and support sustainable agricultural practices. Water scarcity, particularly in drought-prone regions, is becoming a critical issue. In 2025, São Paulo faced a severe water crisis, with its main reservoir falling below 18% capacity due to the lowest rainfall in a decade. This shortage affected 9 million people and led to statewide water rationing. In response, farmers are increasingly turning to drip irrigation and low-pressure sprinkler systems, which help conserve water, lower operational costs, and ensure crop productivity despite resource limitations.

Rising Popularity of Organic and Sustainable Farming

The increasing popularity of organic farming in Brazil is driving the demand for efficient and sustainable irrigation systems. Organic farms, which avoid synthetic fertilizers and chemicals, rely on precise water management to maintain crop health and soil integrity. In 2025, Brazil launched the Catalytic Capital for the Agricultural Transition (CCAT) investment fund, with a $50M anchor commitment aimed at accelerating sustainable farming, particularly in the Amazon and Cerrado regions. This fund supported deforestation-free soy and cattle production, further emphasizing the need for advanced irrigation technologies to meet the demands of eco-conscious, organic farming practices.

Market Outlook 2026-2034:

The Brazil agricultural irrigation machinery market demonstrates robust growth potential throughout the forecast period, underpinned by structural agricultural expansion and increasing water management sophistication. Market demand is strengthened by rising mechanization across large and mid-sized farms, the growing focus on crop yield optimization, and government-led initiatives supporting efficient water use. Adoption of advanced irrigation systems is also gaining popularity due to climate variability and the need to reduce resource losses. The market generated a revenue of USD 102.94 Million in 2025 and is projected to reach a revenue of USD 166.82 Million by 2034, growing at a compound annual growth rate of 5.51% from 2026-2034.

Brazil Agricultural Irrigation Machinery Market Report Segmentation:

|

Segment Category |

Leading Segment |

Market Share |

|

Type |

Drip Irrigation |

45% |

|

Application |

Crop |

84% |

Type Insights:

To get detailed segment analysis of this market Request Sample

- Sprinkler Irrigation

- Pumping Unit

- Tubing

- Couplers

- Spray/Sprinklers Heads

- Fittings and Accessories

- Drip Irrigation

- Valves

- Backflow Preventers

- Pressure Regulators

- Filters

- Emitters

- Tubing

- Others

- Pivot Irrigation

Drip irrigation dominates with a market share of 45% of the total Brazil agricultural irrigation machinery market in 2025.

Drip irrigation holds for the biggest market share due to its strong fit with water-scarce regions and high-value crops. Farmers rely on it to cut water losses, manage irregular rainfall, and maintain stable yields under shifting climate conditions.

Its adoption is also driven by efficiency gains in fertilizer use and lower operating costs over time. Government incentives, expanding horticulture, and the growing pressure to conserve water encourage producers toward drip systems over traditional flood or sprinkler methods.

Application Insights:

- Crop

- Field Crops

- Vegetables

- Fruits

- Non-Crop

- Turf and Ornamental

Crop leads with a market share of 84% of the total Brazil agricultural irrigation machinery market in 2025.

Crop (field crops, vegetables, and fruits) represents the largest segment, driven by the country’s extensive agricultural base and large-scale production of grains, fruits, and cash crops. Reliable irrigation systems help stabilize yields and support year-round farming activities.

This segment also benefits from increasing investment in high-value crop farming and export-oriented agriculture. Consistent water supply improves crop quality and productivity, encouraging farmers to adopt modern irrigation machinery to manage climatic variability and optimize land use.

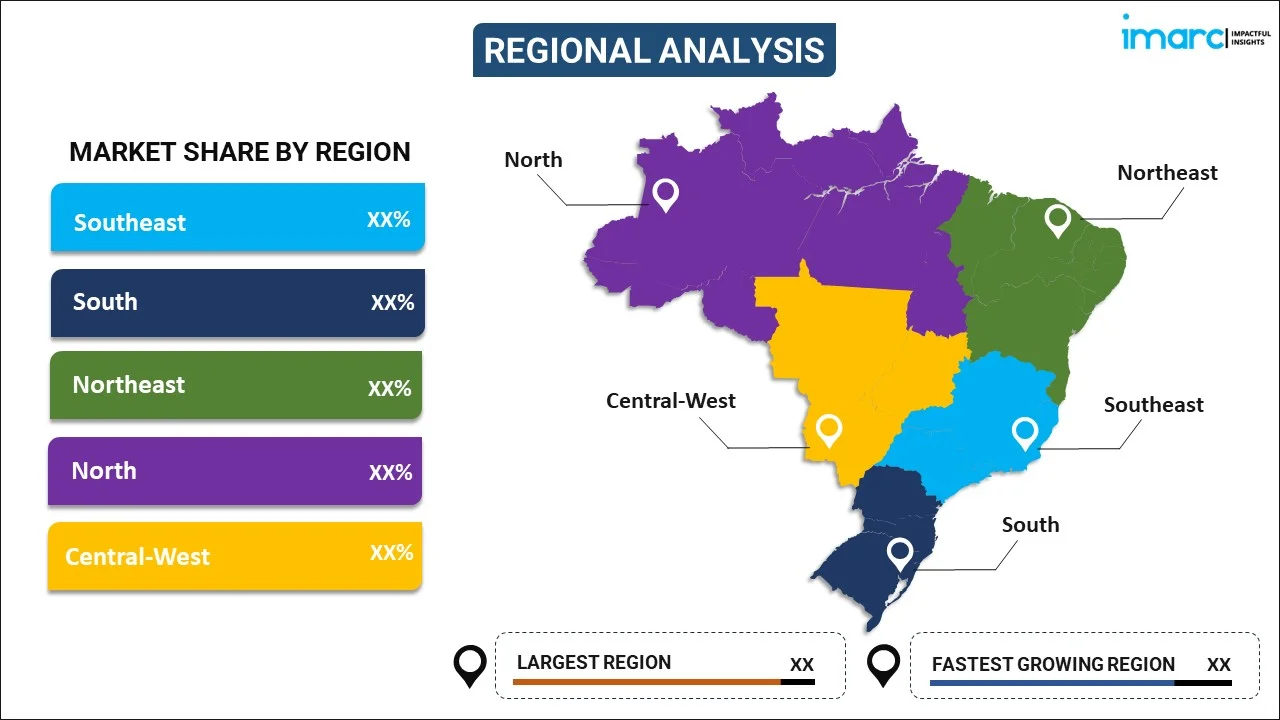

Regional Insights:

To get detailed segment analysis of this market Request Sample

- Southeast

- South

- Northeast

- North

- Central-West

Southeast benefits from advanced agricultural practices, strong agribusiness investment, and high technology adoption. Diverse crop production and efficient water management practices support sustained demand for modern irrigation machinery across major farming hubs.

South shows strong irrigation demand supported by well-developed farm infrastructure and high mechanization. Irrigation machinery enhances productivity in grains, rice, and horticulture, helping farmers achieve stable yields and improved input efficiency.

Northeast offers high growth potential due to expanding irrigated agriculture and rising export-oriented fruit production. Large irrigation projects and supportive public initiatives encourage steady adoption of efficient irrigation machinery.

North presents emerging opportunities with increasing commercial cultivation and agricultural expansion. Growing interest in productivity improvement and controlled water application supports gradual uptake of irrigation machinery for selected crops.

The Central-West stands out for large-scale commercial farming and multiple cropping cycles. Strong agribusiness activity and focus on yield optimization drive consistent investment in advanced irrigation machinery across extensive farmland.

Market Dynamics:

Growth Drivers:

Why is the Brazil Agricultural Irrigation Machinery Market Growing?

Expansion of Agricultural Financing

The Brazil agricultural irrigation machinery market is strongly driven by increased government-backed financing aimed at strengthening farm productivity and infrastructure. Access to affordable credit enables large producers and cooperatives to invest in modern irrigation systems that improve water efficiency and crop yields. In 2025, Brazil launched a new agricultural “Harvest Plan,” offering 516.2 billion reais in loans to support large agricultural producers and cooperatives. Such initiative directly supports capital-intensive purchases, including irrigation machinery, by reducing financial constraints. Stable funding availability encourages technology upgrades, accelerates equipment replacement cycles, and supports long-term investments in irrigated agriculture, reinforcing sustained market growth across key farming regions.

Growth of Export-Oriented Agricultural Products

Brazil's agricultural sector is heavily reliant on exports of high-demand commodities, such as soybeans, beef, and sugarcane, which necessitate consistent and high-quality crop production. To meet international standards for product quality, particularly regarding uniformity and size, advanced irrigation systems are essential. In 2024, Brazilian agribusiness exports totaled USD 164.4 billion, marking the second-highest value on record. This growth in global trade further emphasizes the need for efficient irrigation technologies, as Brazilian farmers strive to produce large quantities of high-quality crops that meet stringent export requirements, thereby driving the demand for modern irrigation machinery.

Government Incentives and Supportive Policies

The governing body is actively supporting sustainable agricultural practices through various financial initiatives, including policies aimed at promoting irrigation technology adoption. Programs offering low-interest loans and subsidies for the purchase of irrigation equipment help reduce the financial burden on farmers. In 2025, Brazil’s President Luiz Inácio Lula da Silva launched the 2025/2026 Harvest Plan, allocating BRL 516.2 billion (approximately USD 100 billion) to support agriculture and livestock, with a significant focus on sustainable practices. This plan, marking an increase of BRL 8 billion from the previous year, provides critical funding to enhance irrigation efficiency and agricultural productivity, further influencing the market growth.

Market Restraints:

What Challenges the Brazil Agricultural Irrigation Machinery Market is Facing?

High Initial Capital Investment Requirements

Substantial upfront investment costs associated with purchasing, installing, and commissioning irrigation systems present significant adoption barriers particularly for smallholder farmers and producers with limited capital reserves or credit access. Equipment costs combined with land preparation, electrical infrastructure, and water source development expenses create financial hurdles that delay or prevent irrigation technology adoption among price-sensitive agricultural producers.

Limited Credit Access for Smallholder Farmers

Despite favorable government financing programs, many small-scale farmers face bureaucratic complexities and documentation requirements that impede access to subsidized agricultural credit facilities. Limited financial literacy, insufficient collateral, and geographic isolation from banking institutions compound difficulties in securing loans necessary for irrigation equipment purchases, constraining market penetration among smallholder production segments.

Electrical Infrastructure Constraints in Agricultural Regions

Inadequate electrical grid coverage and power supply limitations in expanding agricultural frontier regions restrict irrigation system deployment by preventing equipment operation or imposing costly diesel generator dependencies. Grid connection constraints, substation capacity limitations, and unreliable electricity supply particularly affect mechanized irrigation systems requiring substantial power for pumping operations.

Competitive Landscape:

The Brazil agricultural irrigation machinery market exhibits a consolidated competitive structure characterized by established multinational equipment manufacturers competing alongside specialized regional distributors and service providers. Market participants differentiate through technology innovation, product quality assurance, financing facilitation, and comprehensive after-sales support services essential for maintaining operational equipment performance. The competitive landscape increasingly emphasizes digital connectivity integration, water efficiency optimization, and sustainability credentials as manufacturers respond to evolving farmer preferences and regulatory requirements. Strategic partnerships between equipment suppliers, financial institutions, and agricultural cooperatives facilitate market access while service network development across agricultural regions remains critical for sustained competitive positioning.

Some of the key players include:

- Irritec SpA

- Nelson Irrigação Brasil

- Netafim Brazil

- Rivulis

Recent Developments:

- October 2025: Agrishow 2026, Brazil's largest agricultural technology trade show, will be held from April 27 to May 1, 2026, in Ribeirao Preto, São Paulo. The event will showcase innovations in areas like precision farming, irrigation, machinery, and livestock management. It attracts global exhibitors and visitors from various agricultural sectors, providing a platform for the latest technological advancements.

Brazil Agricultural Irrigation Machinery Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered |

|

| Applications Covered |

|

| Regions Covered | Southeast, South, Northeast, North, Central-West |

| Companies Covered | Irritec SpA, Nelson Irrigação Brasil, Netafim Brazil, Rivulis, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Brazil agricultural irrigation machinery market size was valued at USD 102.94 Million in 2025.

The Brazil agricultural irrigation machinery market is expected to grow at a compound annual growth rate of 5.51% from 2026-2034 to reach USD 166.82 Million by 2034.

Drip irrigation dominates the market with 45% revenue share in 2025, driven by its superior water efficiency, reduced evaporation losses, and compatibility with fertigation practices enabling simultaneous nutrient application to crops.

Key factors driving the Brazil agricultural irrigation machinery market include automation, remote sensing, and real-time monitoring that optimize water use, cut waste, and lift yields. In 2025, Komet Irrigation launched a Digital Systems unit and Experience Hub in Paulínia, São Paulo, accelerating adoption nationwide.

Major challenges include high initial capital investment requirements, limited credit access for smallholder farmers facing bureaucratic complexities, electrical infrastructure constraints in agricultural frontier regions, and technical expertise gaps affecting system optimization and maintenance capabilities.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)