Brazil Agricultural Tractor Machinery Market Size, Share, Trends and Forecast by Engine Power, Application, and Region, 2026-2034

Brazil Agricultural Tractor Machinery Market Summary:

The Brazil agricultural tractor machinery market size was valued at USD 4,059.19 Million in 2025 and is projected to reach USD 5,421.65 Million by 2034, growing at a compound annual growth rate of 3.27% from 2026-2034.

Brazil's position as the world's second-largest agricultural exporter and one of the largest producers of soybeans, sugarcane, and corn drives sustained demand for agricultural tractor machinery. The market benefits from favorable government financing programs including Moderfrota and BNDES equalized credit lines that provide interest rates substantially below commercial benchmarks, enabling farmers to invest in modernized equipment. Rising agricultural labor costs combined with declining workforce participation in farming operations accelerate mechanization adoption across the country's diverse agricultural landscape, supporting the Brazil agricultural tractor machinery market share.

Key Takeaways and Insights:

- By Engine Power: Less than 80 HP dominates the market with a share of 47% in 2025, driven by strong demand from smallholder farms and family agricultural operations requiring compact, versatile machinery for diversified crop cultivation and cost-effective field operations.

- By Application: Row crop tractors lead the market with a share of 81% in 2025, owing to Brazil's dominance in soybean, corn, and cotton production requiring specialized tractors with replaceable driving wheels and precision agriculture capabilities for efficient large-scale row crop cultivation.

- Key Players: The Brazil agricultural tractor machinery market displays a concentrated competitive structure, supported by strong dealer networks, in-house financing options, and localized manufacturing. These factors enable competitive pricing, efficient distribution, and prompt after-sales service, reinforcing market consolidation and limiting entry opportunities for smaller participants.

The market's growth trajectory is anchored by Brazil's expanding agricultural frontier, particularly in the Cerrado region where large-scale grain operations demand high-capacity tractors with precision agriculture integration. Government support through the Plano Safra agricultural credit program continues to provide farmers with subsidized financing options, with the 2025/2026 program allocating approximately BRL 516.2 billion reais in rural credit including dedicated machinery financing through the Moderfrota program at preferential interest rates. Major manufacturers are responding to market opportunities through substantial capital investments, exemplified by John Deere's establishment of a Technology Development Center for tropical agriculture in Indaiatuba, with an investment of R$180 million. The center is designed to accelerate product development tailored to Brazil's unique agricultural conditions, including soil types, climate patterns, and connectivity challenges.

Brazil Agricultural Tractor Machinery Market Trends:

Integration of Precision Agriculture Technologies

Brazilian farmers are showing a growing preference for tractors integrated with advanced digital capabilities such as GPS guidance, telematics, connected sensors, and analytics-driven decision tools. These technologies support the adoption of precision agriculture by improving accuracy in input use, reducing inefficiencies, and enhancing overall farm productivity. Digital connectivity across machinery fleets enables real-time monitoring, predictive maintenance, and optimized field operations. As agriculture becomes increasingly data-driven, demand is shifting toward equipment that seamlessly integrates hardware and software to deliver consistent operational efficiency, cost savings, and improved yield outcomes across diverse farming systems.

Satellite Connectivity Solutions Addressing Rural Coverage Gaps

Connectivity collaborations between tractor manufacturers and satellite service providers are helping bridge rural internet gaps in Brazil, boosting demand for sensor-enabled machinery. With large areas of farmland lacking reliable cellular coverage, satellite broadband solutions are being deployed to support real-time communication and telematics functionality in remote locations. These initiatives allow farmers in isolated regions to access precision agriculture platforms, enabling data-driven management, enhanced operational efficiency, and seamless integration of connected equipment even where terrestrial networks are limited or unavailable.

Embedded Finance Models Expanding Market Accessibility

Manufacturers are increasingly blending equipment sales with in-house credit solutions to expand their reachable customer base. These embedded finance offerings shield farmers from elevated commercial interest rates while providing flexible payment terms aligned with seasonal crop calendars. Similar offerings by major agricultural machinery financiers smooth cash-flow pressures after the temporary pause in federal subsidies, supporting steady turnover of mid-horsepower machines particularly among family farms in the South and Southeast regions requiring accessible financing solutions.

Market Outlook 2026-2034:

The outlook for Brazil’s agricultural tractor machinery market remains strong, driven by the expansion of large-scale crop cultivation and increasing adoption of precision farming technologies. Greater access to subsidized financing supports farmers in upgrading and expanding their equipment fleets. Consolidation of farms in established agricultural regions encourages steady replacement cycles, while emerging frontier areas stimulate initial purchases of modern tractors and implements. Overall, growing mechanization, improved farm management practices, and the push toward technologically advanced operations continue to sustain demand and foster long-term market growth across the country. The market generated a revenue of USD 4,059.19 Million in 2025 and is projected to reach a revenue of USD 5,421.65 Million by 2034, growing at a compound annual growth rate of 3.27% from 2026-2034.

Brazil Agricultural Tractor Machinery Market Report Segmentation:

|

Segment Category |

Leading Segment |

Market Share |

|

Engine Power |

Less than 80 HP |

47% |

|

Application |

Row Crop Tractors |

81% |

Engine Power Insights:

To get detailed segment analysis of this market Request Sample

- Less than 80 HP

- 81-130 HP

- Above 130 HP

Less than 80 HP dominates with a market share of 47% of the total Brazil agricultural tractor machinery market in 2025.

Low-horsepower tractors serve the substantial base of smallholder farmers who cultivate diversified crops on limited acreage across Brazil's South and Southeast regions. These compact tractors provide versatility and cost-effectiveness for family farming operations requiring equipment suitable for multiple agricultural tasks, including cultivation, planting, and light transport activities. The segment maintains recurring demand as replacement cycles average approximately fifteen years, creating steady equipment turnover among price-sensitive operators who prioritize affordability and operational flexibility over high-capacity specifications.

Government support through agricultural programs has boosted mechanization among family farmers by providing accessible financing options for equipment. Low-interest loans and purchase limits tailored to smaller landholdings help small-scale producers acquire tractors suited to their operational needs and budgets. These measures encourage adoption of lower horsepower machinery, enabling efficient farm operations while keeping costs manageable. By aligning financial support with the requirements of family farms, such initiatives strengthen demand for appropriately sized tractors and promote wider mechanization across smallholder agricultural operations.

Application Insights:

- Row Crop Tractors

- Orchard Tractors

- Others

Row crop tractors lead with a share of 81% of the total Brazil agricultural tractor machinery market in 2025.

Row crop tractors' overwhelming market dominance reflects Brazil's position as a global leader in soybean, corn, and cotton production, with these export-oriented crops requiring specialized tractors featuring replaceable driving wheels of different tread widths and precision agriculture capabilities. The tractors are specifically tailored to meet diverse agricultural demands including plowing, harrowing, leveling, pulling seed drills, weed control, and running various machines essential for large-scale row crop cultivation. Brazil's double-cropping practices, where farmers harvest soybeans and seed corn within tight seasonal windows, necessitate reliable high-performance tractors capable of intensive operational schedules.

Precision guidance systems are now bundled in a significant portion of new row-crop units sold in Brazil, as farmers seek technologies that optimize field operations, reduce input waste, and maximize yields across extensive grain production areas. Brazil's National Supply Company projects soybean acreage expansion and corn acreage growth, directly increasing demand for high-capacity row crop tractors capable of managing larger production volumes efficiently across the country's expanding agricultural frontier.

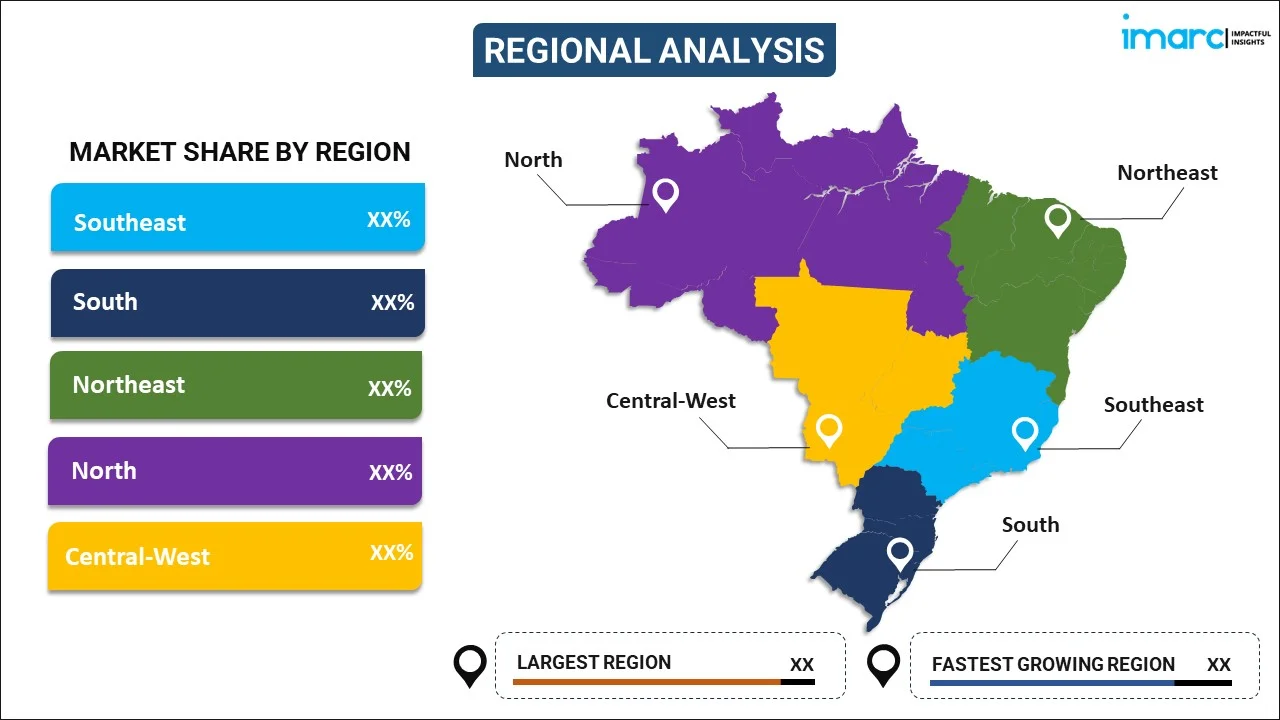

Regional Insights:

To get detailed segment analysis of this market Request Sample

- Southeast

- South

- Northeast

- North

- Central-West

In the Southeast, mechanization is driven by coffee, sugarcane, and citrus farming expansion. Farm consolidation, adoption of precision agriculture technologies, and improved rural financing encourage replacement of older machinery and investment in tractors and implements suited to both medium and large-scale operations.

The South’s strong soybean, corn, and rice production fuels demand for modern tractors. Cooperative-led equipment sharing, adoption of advanced farming practices, and accessible credit programs for small and medium farmers support mechanization and the uptake of technology-equipped machinery.

In the Northeast, demand is supported by the mechanization of sugarcane, cotton, and fruit farms. Government-backed financing schemes, expansion of irrigation, and growing adoption of small- to medium-horsepower tractors for smaller landholdings reinforce market growth.

The North sees growth from the mechanization of frontier agricultural lands, including soy and maize cultivation. Infrastructure development, government incentives, and increasing adoption of low- to mid-power tractors suitable for tropical conditions drive equipment demand.

In the Central-West, large-scale soybean, corn, and cotton farming sustains high demand for high-capacity tractors. Farm consolidation, steady replacement cycles, and adoption of precision agriculture tools and technology-enhanced machinery underpin strong market growth.

Market Dynamics:

Growth Drivers:

Why is the Brazil Agricultural Tractor Machinery Market Growing?

Favorable Government Financing Programs Supporting Agricultural Mechanization

The Brazilian government’s agricultural credit programs offer subsidized financing that lowers the cost of acquiring machinery, making modern tractors more accessible to farmers. Preferential interest rates and extended repayment terms aligned with crop cycles support both equipment replacement and new purchases. By reducing financial barriers, these initiatives encourage mechanization across small and medium-sized farms, enabling producers to invest in modern machinery without deferring purchases due to high commercial lending costs. Overall, such programs foster fleet modernization and sustained demand for tractors and agricultural implements throughout the country.

Rising Labor Costs and Declining Agricultural Workforce Participation

Brazil's agricultural sector faces structural labor challenges as workforce participation in farming continues to decline while real wages for farm workers increase steadily. The migration of rural populations to urban areas in search of alternative employment opportunities compounds labor availability constraints, making manual farming operations increasingly unfeasible and costly. Employers point to increasing labor expenses, which have risen around 10% in recent years, along with elevated interest rates, as primary challenges affecting their operations, according to Sinduscon-SP. This labor market dynamic creates compelling economic incentives for farmers to invest in tractors and mechanized equipment as substitutes for manual labor, particularly for time-sensitive operations including planting and harvesting where labor shortages can result in significant crop losses. Agricultural employment has declined as a percentage of total employment, further accelerating demand for machinery that enables fewer workers to manage larger cultivated areas efficiently and cost-effectively.

Expansion of Export-Oriented Agricultural Production

Brazil's status as a leading global agricultural exporter drives continuous demand for high-performance tractors capable of supporting large-scale production to meet international market requirements. The country's agricultural sector recorded exceptional growth, significantly outpacing other economic sectors and generating substantial income that enables farmers to invest in modern machinery and equipment upgrades. Record soybean and corn production projections, with expanding acreage across established and frontier agricultural regions, directly increase demand for tractors capable of managing larger production volumes efficiently. Brazil’s nationwide corn output from its three annual harvest cycles is forecast at about 5.46 billion bushels, reflecting a modest year-on-year decline of around 2 percent and representing nearly one-third of the total corn volume produced in the United States. The export-oriented nature of Brazilian agriculture creates competitive pressures for productivity improvements achievable through mechanization, with farmers seeking efficient equipment solutions to maintain profitability while meeting global commodity demands.

Market Restraints:

What Challenges the Brazil Agricultural Tractor Machinery Market is Facing?

Elevated Interest Rate Environment Constraining Non-Subsidized Purchases

Brazil's benchmark interest rate has climbed significantly, driving commercial equipment loans to elevated levels that constrain purchasing power among farmers unable to access subsidized credit programs. Bank data indicate substantial declines in non-subsidized loan applications, with mid-size growers delaying combine and tractor replacements until credit conditions stabilize. The elevated cost of borrowing particularly affects farmers who do not qualify for preferential financing programs, creating market segmentation between subsidized and commercial credit access.

Import Duties and Local Content Requirements Increasing Equipment Costs

Capital goods duties add substantially to the landed cost of advanced engines, transmissions, and precision agriculture components, making sophisticated technologies expensive for growers seeking state-of-the-art equipment. Local content requirements tied to subsidized credit programs create additional sourcing complexities for manufacturers incorporating imported components. The result is slower diffusion of high-specification drivetrains and precision agriculture systems, with persistent price gaps between domestically produced and imported machinery affecting technology adoption rates.

Currency Volatility Affecting Imported Component Costs

Exchange rate fluctuations inflate the cost of imported engines, transmissions, and hydraulic subsystems that comprise significant portions of tractor manufacturing bills of materials. Currency weakness against major trading currencies lifts landed costs for precision agriculture sensors, electronic control systems, and other imported components essential for modern tractor production. This volatility creates pricing uncertainty for both manufacturers and farmers, potentially affecting purchase timing decisions and overall market demand stability.

Competitive Landscape:

The Brazil agricultural tractor machinery market features a concentrated competitive structure, supported by multinational-scale operations with deep local integration. Leading participants differentiate through integrated offerings that combine equipment, financing, and digital solutions, addressing farmer requirements across the entire machinery lifecycle. Extensive dealer networks, localized manufacturing, and advanced precision agriculture technologies enhance service reach and operational efficiency. Product portfolios are tailored to regional farming conditions, while technology partnerships strengthen data-driven fleet and farm management capabilities. Domestic producers benefit from proximity to customers and flexible commercial terms. Financing has emerged as a critical competitive lever, with seasonal credit structures aligned to crop cycles, mitigating affordability constraints amid economic volatility.

Recent Developments:

- August 2025: Yanmar announced plans to build a new factory in Indaiatuba, São Paulo, with an investment of R$280 million. The 140,000 square meter facility will triple the company's current local factory size and increase tractor production capacity from 5,000 to 7,000 units per year, with phased completion expected by 2030.

- April 2025: CNH Industrial's New Holland brand unveiled more than 15 new agricultural products at Agrishow 2025 in Brazil, showcasing updated tractor models incorporating advanced transmission technologies, enhanced precision agriculture systems, and improved fuel efficiency tailored to Brazilian farming requirements.

Brazil Agricultural Tractor Machinery Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Engine Powers Covered | Less than 80 HP, 81-130 HP, Above 130 HP |

| Applications Covered | Row Crop Tractors, Orchard Tractors, Others |

| Regions Covered | Southeast, South, Northeast, North, Central-West |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Brazil agricultural tractor machinery market size was valued at USD 4,059.19 Million in 2025.

The Brazil agricultural tractor machinery market is expected to grow at a compound annual growth rate of 3.27% from 2026-2034 to reach USD 5,421.65 Million by 2034.

Less than 80 HP dominated with 47% market share in 2025, driven by strong demand from smallholder farms and family agricultural operations requiring compact, versatile machinery for diversified crop cultivation.

Key factors driving the Brazil agricultural tractor machinery market include favorable government financing programs such as Moderfrota and BNDES credit lines, rising agricultural labor costs accelerating mechanization adoption, and expansion of export-oriented agricultural production.

Major challenges include elevated benchmark interest rates constraining non-subsidized equipment purchases, import duties and local content requirements increasing equipment costs, currency volatility affecting imported component pricing, and limited rural connectivity infrastructure affecting precision agriculture adoption.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)