Brazil Air Operated Double Diaphragm Pumps Market Size, Share, Trends and Forecast by Pump Type, Valve Type, Material, Discharge Pressure, End User, and Region, 2026-2034

Brazil Air Operated Double Diaphragm Pumps Market Summary:

The Brazil air operated double diaphragm pumps market size was valued at USD 44.86 Million in 2025 and is projected to reach USD 65.53 Million by 2034, growing at a compound annual growth rate of 4.30% from 2026-2034.

The Brazil air operated double diaphragm pumps market is experiencing sustained growth, driven by escalating demand across the chemical processing, water treatment, and food manufacturing sectors. Industrial expansion, particularly in petrochemicals and mining, is reinforcing the need for reliable fluid transfer solutions capable of handling corrosive and viscous materials. Stringent environmental regulations are accelerating adoption of leak-proof and energy-efficient pumping systems.

Key Takeaways and Insights:

- By Pump Type: Metallic AODD pumps dominate the market with a share of 27% in 2025, owing to their exceptional durability, resistance to high temperatures, and suitability for handling aggressive chemicals in industrial environments. Their robust construction enables reliable operation across demanding applications in petrochemical facilities.

- By Valve Type: Ball valve leads the market with a share of 60% in 2025. This dominance is driven by superior sealing capabilities, excellent flow regulation, and quick operation that is critical in manufacturing processes requiring precise fluid control and minimal downtime.

- By Material: Cast iron exhibits a clear dominance in the market with 41% share in 2025, reflecting strong preference for durable, cost-effective, and wear-resistant pump housings that deliver reliable performance in heavy-duty industrial applications, including wastewater treatment.

- By Discharge Pressure: 5 bar - 10 bar prevails the market with a share of 38% in 2025, demonstrating the operational requirements of chemical transfer, food processing, and water treatment applications that demand moderate pressure capabilities for efficient fluid handling.

- By End User: Chemicals and petrochemicals comprise the largest segment with 25% share in 2025, driven by the sector's extensive fluid handling requirements for corrosive substances, volatile compounds, and high-viscosity materials across refining and processing operations.

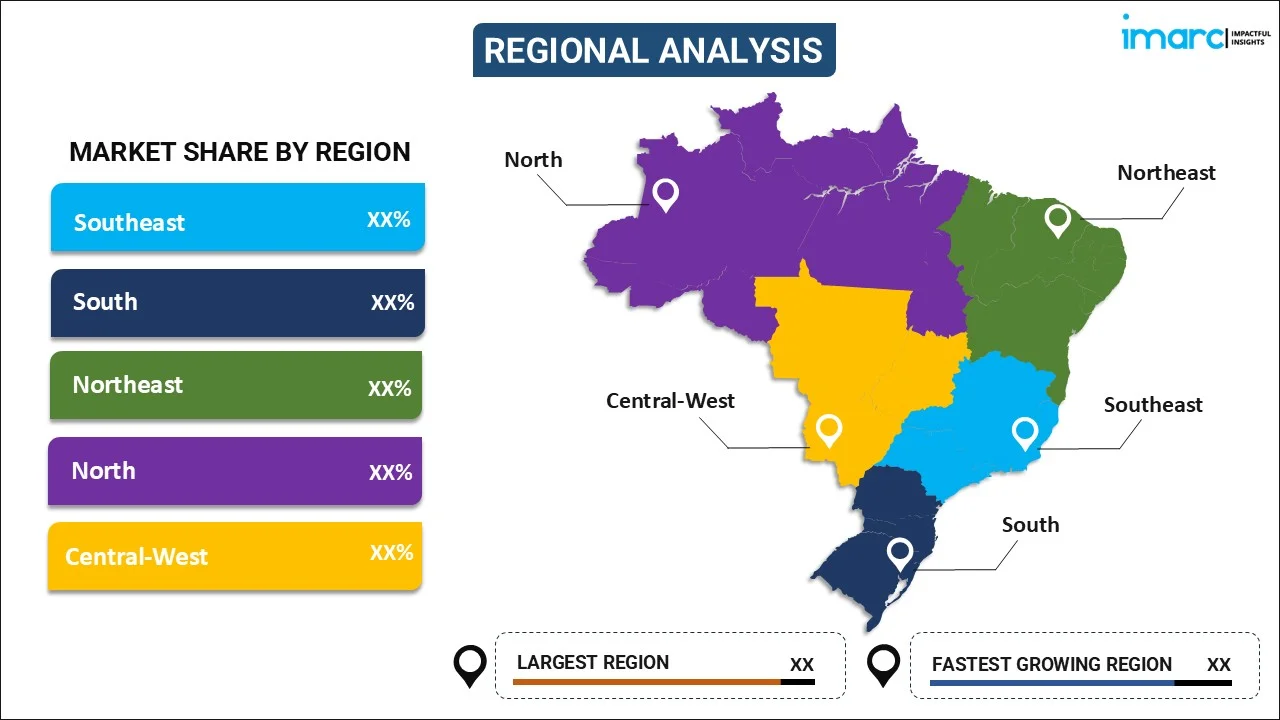

- By Region: Southeast represents the largest region with 37% share in 2025, propelled by the concentration of manufacturing industries in São Paulo and Rio de Janeiro metropolitan areas, advanced industrial infrastructure, and substantial investments in chemical and water treatment facilities.

- Key Players: Key players drive the market by expanding product portfolios, improving pump efficiency and durability, and strengthening nationwide distribution networks. Their investments in research and development (R&D), after-sales support, and partnerships with industrial clients boost awareness, accelerate adoption, and ensure consistent product availability across diverse end user segments.

In Brazil, the market is witnessing robust expansion, as the industrial sector increasingly prioritizes efficient and versatile fluid handling solutions. Air operated double diaphragm (AODD) pumps have gained substantial traction due to their ability to manage diverse fluid types, including abrasive slurries, viscous chemicals, and shear-sensitive materials, without compromising operational safety. The country's ambitious infrastructure modernization programs are creating significant demand for reliable pumping equipment. Brazilian President Luiz Inacio Lula da Silva announced a comprehensive infrastructure construction initiative aimed at boosting development beginning in July 2023. The public works initiatives would prioritize six sectors: transportation, urban development, social infrastructure, water, communications, and energy. Brazil's chemical industry continues to drive adoption of AODD pumps for hazardous fluid applications where leak-proof operation is essential. Additionally, rising automation across manufacturing facilities is accelerating the integration of pneumatically operated pumping systems that offer energy efficiency, reduced maintenance requirements, and compliance with stringent environmental regulations governing industrial effluent management and volatile organic compound (VOC) emissions throughout the nation.

Brazil Air Operated Double Diaphragm Pumps Market Trends:

Growing Integration of Smart Pump Technologies

The integration of Industrial Internet of Things (IIoT) capabilities into AODD pumping systems is transforming operational efficiency across Brazilian industries. As per IMARC Group, the Brazil IIoT market size reached USD 7,009.06 Million in 2025. Manufacturers are incorporating smart sensors for real-time monitoring of parameters, including vibration, temperature, and pressure, enabling predictive maintenance protocols. This connectivity allows operators to detect performance deviations early, minimizing unplanned downtime and extending pump service life.

Expansion of Water Infrastructure Development

In Brazil, the water sector is undergoing fundamental transformation, driven by regulatory reforms and infrastructure investments. In April 2025, Sabesp, Brazilian water and waste management company, signed a contract with Arcadis for a R$ 70 Billion government-led initiative to enhance water infrastructure across 375 municipalities in São Paulo, benefiting over 28 Million people. This massive investment in sanitation infrastructure is generating substantial demand for AODD pumps in wastewater treatment applications throughout the country.

Rising Demand from Mining Sector Expansion

Brazil's mining industry is experiencing significant investment growth, driving demand for durable pumping solutions capable of handling abrasive slurries and viscous materials. Mining investments are projected to reach USD 64.5 Billion between 2024 and 2028, representing a 28.8% increase from 2023-2027 projections. AODD pumps are increasingly preferred for their robust construction, leak-free operation, and ability to handle solids-laden fluids without damage. Their air-driven design enhances safety in hazardous mining environments where electric pumps pose risks.

Market Outlook 2026-2034:

The Brazil air operated double diaphragm pumps market is positioned for steady expansion, as industrial modernization initiatives gain momentum across the country's diverse manufacturing sectors. Growing emphasis on environmental compliance, particularly regarding effluent treatment and emission control, is driving adoption of leak-proof and energy-efficient pumping systems. The market generated a revenue of USD 44.86 Million in 2025 and is projected to reach a revenue of USD 65.53 Million by 2034, growing at a compound annual growth rate of 4.30% from 2026-2034. Infrastructure development programs, particularly in water treatment and sanitation, combined with petrochemical sector expansion and mining activities, are expected to sustain market momentum.

Brazil Air Operated Double Diaphragm Pumps Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Pump Type | Metallic AODD Pumps | 27% |

| Valve Type | Ball Valve | 60% |

| Material | Cast Iron | 41% |

| Discharge Pressure | 5 bar - 10 bar | 38% |

| End User | Chemicals and Petrochemicals | 25% |

| Region | Southeast | 37% |

Pump Type Insights:

To get detailed segment analysis of this market Request Sample

- Explosion-Proof AODD Pumps

- Metallic AODD Pumps

- Non-metallic AODD Pumps

- Sanitary AODD Pumps

- Submersible AODD Pumps

Metallic AODD pumps dominate with a market share of 27% of the total Brazil air operated double diaphragm pumps market in 2025.

Metallic AODD pumps have established themselves as the preferred choice across Brazil's industrial sector due to their exceptional durability and ability to withstand demanding operating conditions. These pumps, typically constructed from stainless steel, aluminum, or cast iron, deliver superior performance when handling corrosive chemicals, high-temperature fluids, and abrasive materials commonly encountered in petrochemical and mining operations. Brazil's chemical industry relies heavily on metallic pump solutions for safe and efficient fluid transfer processes.

The robust construction of metallic AODD pumps enables them to comply with Brazil's stringent industrial safety standards. Their resistance to impact and thermal stress makes them particularly valuable in refinery operations where volatile fluids require reliable containment. Additionally, the long service life and reduced maintenance requirements of metallic pumps contribute to lower total cost of ownership, making them an economically attractive option for industrial operators seeking dependable fluid handling solutions across diverse applications.

Valve Type Insights:

- Ball Valve

- Flap Valve

Ball valve leads with a share of 60% of the total Brazil air operated double diaphragm pumps market in 2025.

Ball valve has emerged as the dominant valve configuration in the market owing to its remarkable sealing capabilities and operational reliability. It excels in applications requiring higher pressure handling and precise fluid control, making it essential in chemical processing and petrochemical industries where containment integrity is paramount. The ball valve design facilitates quick operation and minimal flow restriction, characteristics that are critical for manufacturing processes demanding efficient fluid transfer and reduced cycle times across diverse industrial settings.

The preference for ball valves is further reinforced by their suitability for handling clean to moderately viscous fluids encountered in pharmaceutical and food processing applications. Ball valves offer excellent wear resistance and extended service intervals, reducing maintenance downtime and operational costs for end users across Brazil's expanding industrial base seeking dependable fluid handling equipment. Additionally, their compact design and compatibility with automated actuation systems make ball valves well suited for modern process control environments requiring high efficiency and consistent performance.

Material Insights:

- Aluminum

- Cast Iron

- Stainless Steel

Cast iron exhibits a clear dominance with a 41% share of the total Brazil air operated double diaphragm pumps market in 2025.

Cast iron maintains its position as the most widely adopted material for AODD pump construction in Brazil due to its exceptional strength, durability, and cost-effectiveness. This material delivers outstanding resistance to wear and abrasion, making it particularly suitable for wastewater treatment and mining applications where pumps encounter solid-laden fluids and harsh operating conditions. The mining pumps industry is thriving in Brazil, with cast iron construction being widely preferred for slurry handling applications requiring robust equipment performance.

The affordability of cast iron compared to stainless steel alternatives makes it an attractive choice for industrial operators managing budget constraints while maintaining quality standards. Cast iron pumps demonstrate excellent thermal stability and can withstand significant mechanical stress, ensuring reliable operation across extended service periods. Their proven track record in heavy-duty applications throughout Brazil's manufacturing and processing industries continues to reinforce market preference for this material in AODD pump construction.

Discharge Pressure Insights:

- Up to 5 bar

- 5 bar - 10 bar

- Above 10 bar

5 bar - 10 bar comprises the leading segment with a 38% share of the total Brazil air operated double diaphragm pumps market in 2025.

5 bar - 10 bar dominates the market, as it aligns with the operational requirements of the majority of industrial fluid handling applications. This moderate pressure capability serves chemical transfer, food and beverage (F&B) processing, and water treatment operations where controlled fluid movement is essential for process efficiency. This pressure range also supports safe handling of corrosive and sensitive fluids without compromising system integrity. Additionally, standardized components and widespread availability make installation, maintenance, and replacement more cost-effective for industrial users.

Pumps operating in this pressure range offer an optimal balance between performance capabilities and energy efficiency, making them economically viable for continuous operations across diverse manufacturing environments. The versatility of 5 bar - 10 bar pumps enables their deployment across multiple applications, including paint and coating transfer, solvent handling, and wastewater management. Their compatibility with both low-viscosity liquids and moderately thick fluids further enhances their appeal to industrial operators seeking flexible pumping solutions.

End User Insights:

- Chemicals and Petrochemicals

- Food and Beverage

- Oil and Gas

- Pharmaceuticals

- Water and Wastewater

Chemicals and petrochemicals prevail the market with a 25% share of the total Brazil air operated double diaphragm pumps market in 2025.

Chemicals and petrochemicals prevail the market in Brazil, driven by the industry's extensive requirements for handling corrosive, volatile, and hazardous fluids. AODD pumps are preferred in these applications due to their inherent safety features, including spark-free operation from compressed air power that complies with explosion-proof requirements. In November 2023, Petrobras announced a 2024-2028 investment plan of USD 102 Billion, representing a 31% increase from allocations for the 2023-2027 period, with significant portions directed towards refining and petrochemical operations requiring reliable pumping solutions.

The chemical and petrochemical industry's adherence to Brazil's National Solid Waste Policy and stricter VOC emission regulations has accelerated adoption of leak-proof AODD pumps for closed-loop chemical recirculation and solvent recovery processes. These pumps enable safe transfer of acids, caustics, and flammable liquids while minimizing environmental impact and worker exposure risks. The sector's continued expansion and modernization initiatives are expected to sustain strong demand for high-performance AODD pumping equipment across Brazil's industrial landscape.

Regional Insights:

To get detailed regional analysis of this market Request Sample

- Southeast

- South

- Northeast

- North

- Central-West

Southeast represents the largest region with 37% of the total Brazil air operated double diaphragm pumps market in 2025.

Southeast, encompassing states, including São Paulo, Rio de Janeiro, and Minas Gerais, stands as the most significant contributor to the Brazil air operated double diaphragm pumps market. This region's advanced industrial base, extensive urban infrastructure, and substantial investments in chemical processing and water management drive robust demand for fluid handling equipment. As of October 2024, São Paulo represented 40% of Brazil's industrial production capability, contributing 45.3% to the nation's industrial output.

The region benefits from well-established distribution networks, technical service capabilities, and proximity to major pump manufacturers and suppliers. Additionally, the Southeast's leading role in Brazil's petrochemical production and water utility operations creates sustained demand for AODD pumps capable of handling corrosive fluids and wastewater streams, reinforcing the region's dominant market position throughout the forecast period. The concentration of large manufacturing facilities and ongoing infrastructure modernization projects further accelerates equipment replacement and upgrade cycles.

Market Dynamics:

Growth Drivers:

Why is the Brazil Air Operated Double Diaphragm Pumps Market Growing?

Expanding Water and Wastewater Infrastructure Investments

Brazil’s commitment to achieving universal water and sanitation access is creating strong demand for pumping equipment nationwide. Large-scale public and private investments are being directed towards upgrading aging water networks, expanding sewage treatment facilities, and extending services to underserved urban and rural regions. These projects require pumping solutions capable of handling wastewater containing solids, sludge, and abrasive materials under variable operating conditions. AODD pumps are well suited for such applications due to their robust design, self-priming capability, and ability to operate reliably with minimal maintenance. Their flexibility allows utilities to manage fluctuating flow rates while meeting strict environmental and regulatory standards. As new treatment plants begin operations and existing facilities undergo modernization, demand for dependable, leak-free pumping systems is rising steadily. This sustained infrastructure push is expected to support long-term growth for AODD pump adoption across municipal and industrial water management applications.

Growth of Chemical and Petrochemical Processing Sectors

Brazil's chemical and petrochemical industries are experiencing significant expansion, driving demand for specialized pumping equipment capable of handling aggressive and hazardous fluids. The chemical industry was set to contribute approximately 2.5% to Brazil's GDP in 2024. Ongoing capacity expansions, process upgrades, and investments in domestic manufacturing are strengthening activities across refining, specialty chemicals, and downstream processing. These industries require pumps capable of safely transferring aggressive chemicals, volatile solvents, and viscous materials without compromising operational safety. AODD pumps are widely adopted in these environments due to their air-driven, spark-free operation and compatibility with a wide range of chemical media. Their ability to run dry, tolerate pressure fluctuations, and provide precise fluid control makes them ideal for demanding processing conditions. As regulatory scrutiny around safety and environmental compliance intensifies, chemical producers increasingly rely on AODD pumps to maintain efficiency while meeting strict handling and containment requirements, supporting sustained market demand.

Mining Industry Modernization and Expansion Programs

Brazil’s mining sector is undergoing rapid modernization, creating strong growth opportunities for AODD pumps across extraction and processing activities. Mining companies are expanding operations and upgrading infrastructure to support the production of critical minerals used in clean energy and advanced manufacturing applications. These developments are increasing demand for reliable pumping systems capable of handling abrasive slurries, thick tailings, and solids-laden fluids commonly encountered in mining environments. AODD pumps are perfect for such conditions due to their rugged construction, ability to run dry, and resistance to wear and clogging. Their air-driven design enhances safety in remote and hazardous locations where electrical equipment may pose operational risks. As mining operations scale production capacity and extend into deeper or more complex sites, operators require pumping solutions that ensure consistent performance under extreme conditions. This ongoing transformation is expected to sustain long-term demand for durable AODD pumps throughout Brazil’s mining industry.

Market Restraints:

What Challenges is the Brazil Air Operated Double Diaphragm Pumps Market Facing?

High Initial Equipment and Installation Costs

The upfront investment required for AODD pump systems, including installation and compressed air infrastructure, presents a significant barrier for small and medium-sized enterprises operating with limited capital budgets. While long-term operational savings exist through reduced maintenance and energy efficiency, many potential buyers hesitate without clear short-term financial incentives or accessible financing options. Currency volatility and import dependencies for specialized components further compound cost challenges for industrial operators.

Competition from Alternative Pumping Technologies

Electric diaphragm pumps and centrifugal pump systems offer alternative solutions that compete directly with AODD pumps in certain applications, particularly where compressed air availability is limited. Electric pumps provide advantages in energy efficiency and precise flow control that appeal to operators prioritizing operational cost reduction. The availability of established service networks for conventional pump technologies creates switching costs and reinforces competitive pressure in the Brazilian market.

Supply Chain Vulnerabilities and Component Availability

Dependence on imported components for specialized pump parts, including diaphragms and valve assemblies, creates supply chain vulnerabilities that can affect equipment availability and maintenance schedules. Global trade disruptions, tariff changes, and logistics challenges periodically impact the timely procurement of replacement parts, potentially causing extended downtime for end users. Limited local manufacturing capacity for certain high-performance materials further exacerbates these supply constraints.

Competitive Landscape:

The Brazil air operated double diaphragm pumps market features a moderately fragmented competitive structure with both international manufacturers and regional distributors serving diverse end user requirements. Global players leverage established brand recognition, extensive product portfolios, and advanced technical capabilities to capture significant market share across industrial segments. Competition is driven by product innovations, service quality, and distribution network strength. Companies are increasingly focusing on energy-efficient designs, improved diaphragm materials, and IoT-enabled monitoring capabilities to differentiate their offerings. Strategic partnerships, localized manufacturing, and after-sales service expansion are key tactics employed by market participants to strengthen their positions and capitalize on growing industrial demand throughout Brazil.

Brazil Air Operated Double Diaphragm Pumps Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Explosion-Proof AODD Pumps, Metallic AODD Pumps, Non-metallic AODD Pumps, Sanitary AODD Pumps, Submersible AODD Pumps |

| Valve Types Covered | Ball Valve, Flap Valve |

| Materials Covered | Aluminum, Cast Iron, Stainless Steel |

| Discharge Pressures Covered | Up to 5 bar, 5 bar - 10 bar, Above 10 bar |

| End Users Covered | Chemicals and Petrochemicals, Food and Beverage, Oil and Gas, Pharmaceuticals, Water and Wastewater |

| Regions Covered | Southeast, South, Northeast, North, Central-West |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Brazil air operated double diaphragm pumps market size was valued at USD 44.86 Million in 2025.

The Brazil air operated double diaphragm pumps market is expected to grow at a compound annual growth rate of 4.30% from 2026-2034 to reach USD 65.53 Million by 2034.

Metallic AODD pumps dominated the market with a share of 27%, due to their superior durability, corrosion resistance, and ability to handle high-pressure, abrasive, and chemically aggressive fluids, making them ideal for demanding applications in the mining, chemical processing, oil and gas, and wastewater treatment industries.

Key factors driving the Brazil air operated double diaphragm pumps market include expanding water and sanitation infrastructure investments, growth in the chemical and petrochemical processing sectors, mining industry modernization programs, and increasing adoption of energy-efficient pumping solutions.

Major challenges include high initial equipment and installation costs, competition from alternative pumping technologies, including electric diaphragm pumps, supply chain vulnerabilities for imported components, and currency volatility affecting procurement decisions.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)