Brazil Animal Feed Market Size, Share, Trends and Forecast by Form, Animal Type, Ingredient, and Region, 2025-2033

Brazil Animal Feed Market Overview:

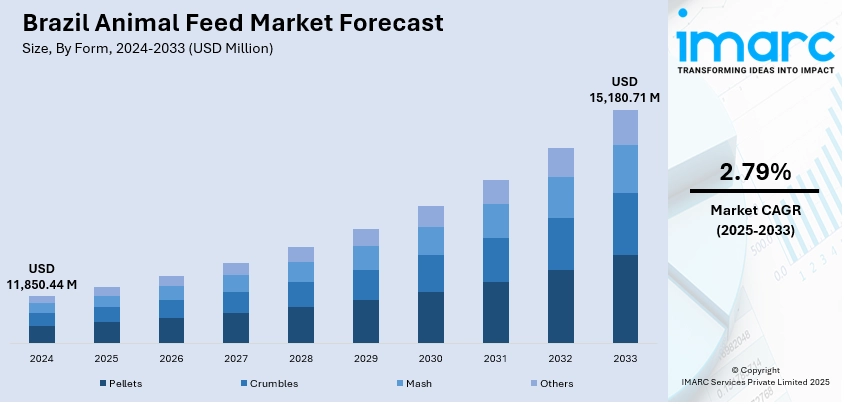

The Brazil animal feed market size reached USD 11,850.44 Million in 2024. The market is projected to reach USD 15,180.71 Million by 2033, exhibiting a growth rate (CAGR) of 2.79% during 2025-2033. The market is expanding, driven by increasing demand for sustainable, efficient feed solutions. The rise in poultry and livestock production, along with advancements in feed technology and alternative ingredients, is supporting Brazil animal feed market share and overall growth in the sector.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 11,850.44 Million |

| Market Forecast in 2033 | USD 15,180.71 Million |

| Market Growth Rate 2025-2033 | 2.79% |

Brazil Animal Feed Market Trends:

Technological Advancements Shaping Animal Feed

Technological developments are revolutionizing the animal feed industry in Brazil by increasing productivity and efficiency through creative methods. The sector is concentrating increasingly on utilizing technology to address problems, improve animal health, and satisfy the rising demand for higher-quality goods worldwide as precision farming gains traction. Innovative technologies including fermentation, gene editing, and advanced microbiome management are becoming popular and are anticipated to be crucial to the market's future. These developments not only increase feed efficiency but also support the sustainability of Brazil's agriculture industry as a whole. For instance, in December 2024, FOLIUM Science's BiomElix One was approved by Brazil's Ministry of Agriculture as an animal feed additive. This breakthrough product, developed using CRISPR-Cas technology, is designed to modulate the microbiomes of animals, improving gut health and boosting productivity. It specifically targets the issue of antimicrobial resistance by offering sustainable alternative to traditional antibiotics. BiomElix One has been shown to improve poultry productivity by enhancing gut microbiota, leading to healthier animals and more efficient feed conversion. This approval represents a significant step forward for the Brazil animal feed market, providing a cutting-edge solution to meet both industry needs and consumer demand for cleaner, more sustainable farming practices.

To get more information on this market, Request Sample

Sustainability-Driven Innovations

Sustainability has become a cornerstone driver in the Brazil animal feed market growth, as both industry players and consumers increasingly demand more eco-friendly and resource-efficient solutions. With the growing focus on environmental impact reduction and the need to optimize production processes, the drive for sustainability is stronger than ever. Companies are exploring innovative ways to improve feed efficiency, reduce waste, and utilize alternative ingredients that align with the circular economy model. This trend toward sustainability is shaping the future of animal feed production in Brazil, where the agriculture sector is a key economic pillar. For example, in June 2025, a significant partnership was formed between Enifer and FS to produce mycoprotei ns for pet food and aquaculture in Brazil, using corn ethanol side streams. This collaboration marks a major development in sustainable animal feed production. The initiative will generate 500 Tons of high-quality mycoproteins annually, utilizing a byproduct of ethanol production that would otherwise go to waste. By optimizing resource use and reducing environmental impact, this innovation reflects the growing demand for eco-conscious solutions in the Brazil animal feed market. This partnership is expected to drive Brazil Animal Feed market growth, as it offers a sustainable alternative to traditional feed ingredients, benefiting both businesses and the environment.

Brazil Animal Feed Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional level for 2025-2033. Our report has categorized the market based on form, animal type, and ingredient.

Form Insights:

- Pellets

- Crumbles

- Mash

- Others

The report has provided a detailed breakup and analysis of the market based on the form. This includes pellets, crumbles, mash, and others.

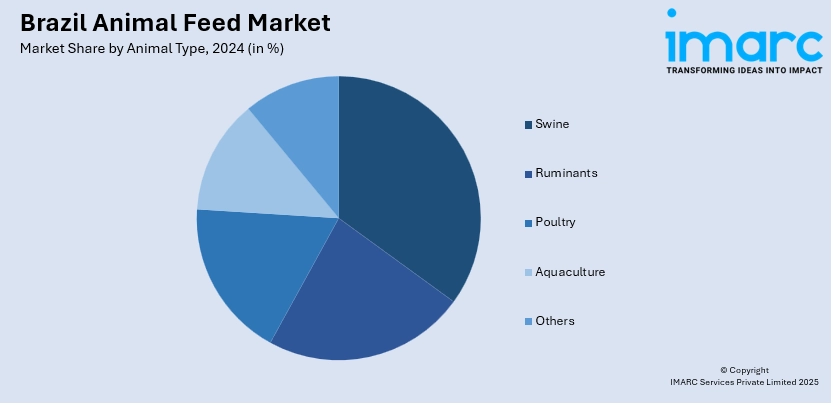

Animal Type Insights:

- Swine

- Starter

- Finisher

- Grower

- Ruminants

- Calves

- Dairy Cattle

- Beef Cattle

- Others

- Poultry

- Broilers

- Layers

- Brazils

- Others

- Aquaculture

- Carps

- Crustaceans

- Mackeral

- Milkfish

- Mollusks

- Salmon

- Others

- Others

The report has provided a detailed breakup and analysis of the market based on the animal type. This includes swine (starter, finisher, and grower), ruminants (calves, dairy cattle, beef cattle, and others), poultry (broilers, layers, brazils, and others), aquaculture (carps, crustaceans, mackeral, milkfish, mollusks, salmon, and others), and others.

Ingredient Insights:

- Cereals

- Oilseed Meal

- Molasses

- Fish Oil and Fish Meal

- Additives

- Antibiotics

- Vitamins

- Antioxidants

- Amino Acids

- Feed Enzymes

- Feed Acidifiers

- Others

- Others

The report has provided a detailed breakup and analysis of the market based on the ingredient. This includes cereals, oilseed meal, molasses, fish oil and fish meal, additives (antibiotics, vitamins, antioxidants, amino acids, feed enzymes, feed acidifiers, and others), and others.

Regional Insights:

- Southeast

- South

- Northeast

- North

- Central-West

The report has also provided a comprehensive analysis of all the major regional markets, which include Southeast, South, Northeast, North, and Central-West.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Brazil Animal Feed Market News:

- July 2025: Cargill announced its acquisition of Mig-Plus, a company specializing in animal nutrition solutions. This strategic move aimed to strengthen Cargill’s position in the Brazilian animal feed market . The acquisition is expected to enhance Cargill's offerings, boosting market growth and customer engagement in Brazil's feed sector.

- October 2024: dsm-firmenich inaugurated a new animal nutrition factory in Sete Lagoas, Brazil. The facility, producing 100,000 Tons of supplements annually, strengthens the company's position in the animal feed market. This expansion enhances herd health and productivity, contributing significantly to Brazil's growing agribusiness sector.

Brazil Animal Feed Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Forms Covered | Pellets, Crumbles, Mash, Others |

| Animal Types Covered |

|

| Ingredients Covered |

|

| Regions Covered | Southeast, South, Northeast, North, Central-West |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Brazil animal feed market performed so far and how will it perform in the coming years?

- What is the breakup of the Brazil animal feed market on the basis of form?

- What is the breakup of the Brazil animal feed market on the basis of animal type?

- What is the breakup of the Brazil animal feed market on the basis of ingredient?

- What is the breakup of the Brazil animal feed market on the basis of region?

- What are the various stages in the value chain of the Brazil animal feed market?

- What are the key driving factors and challenges in the Brazil animal feed market?

- What is the structure of the Brazil animal feed market and who are the key players?

- What is the degree of competition in the Brazil animal feed market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Brazil animal feed market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Brazil animal feed market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Brazil animal feed industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)