Brazil Anti-Counterfeit Packaging Market Size, Share, Trends and Forecast by Technology, Application, and Region, 2026-2034

Brazil Anti-Counterfeit Packaging Market Summary:

The Brazil anti-counterfeit packaging market size was valued at USD 2.68 Billion in 2025 and is projected to reach USD 5.47 Billion by 2034, growing at a compound annual growth rate of 8.26% from 2026-2034.

The market is driven by escalating economic losses from counterfeiting and piracy, stringent pharmaceutical serialization mandates under the National Medicine Control System (SNCM), and the rapid adoption of digital authentication technologies including RFID tags and QR codes. Additionally, increasing e-commerce penetration and heightened brand protection initiatives across pharmaceuticals, food and beverage, and consumer goods sectors are expanding the Brazil anti-counterfeit packaging market share.

Key Takeaways and Insights:

- By Technology: Covert technology dominates the market with a 34% share in 2025, driven by demand for invisible authentication features including security labels and specialized printing that cannot be easily replicated by counterfeiters.

- By Application: Pharmaceutical leads the market with a 27% share in 2025, propelled by mandatory serialization requirements under Brazil's SNCM regulations and ANVISA oversight.

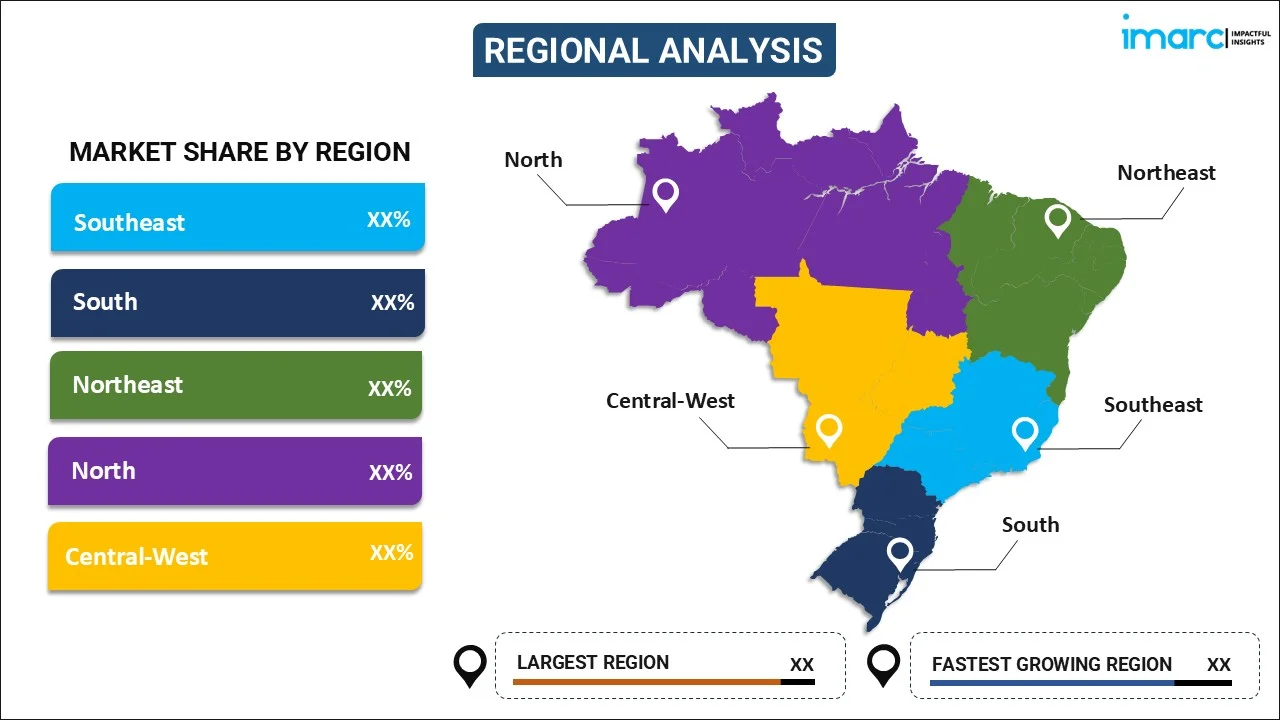

- By Region: Southeast represents the leading region with a 47% market share in 2025, driven by concentrated pharmaceutical manufacturing facilities, major consumer goods production centers, and established regulatory enforcement infrastructure in São Paulo.

- Key Players: The market features global authentication technology providers, domestic packaging manufacturers, and international security printing companies competing through innovation in digital verification solutions and integrated supply chain tracking systems.

Brazil's anti-counterfeit packaging market is experiencing robust expansion driven by the country's significant exposure to illicit trade and counterfeiting activities. The alarming growth in counterfeit goods has prompted manufacturers, brand owners, and regulatory authorities to invest heavily in advanced packaging authentication solutions. The pharmaceutical sector remains the primary adopter, with Brazil's National Medicine Control System achieving 100% serialization compliance by April 2024, requiring all supply chain members to implement track-and-trace capabilities. Meanwhile, the food and beverage industry, particularly alcoholic beverages, is increasingly deploying overt and covert authentication features. The Southeast region benefits from concentrated manufacturing activity in São Paulo and established regulatory enforcement infrastructure, positioning Brazil as Latin America's leading market for anti-counterfeit packaging technologies.

Brazil Anti-Counterfeit Packaging Market Trends:

Stringent Pharmaceutical Serialization Mandates Accelerating Market Adoption

Brazil's National Medicine Control System (SNCM), signed into law by ANVISA through Law No. 13,410, has established comprehensive serialization requirements across the pharmaceutical supply chain. The system mandates 2D barcodes containing unique serial numbers, national registration numbers, lot numbers, and expiry dates on individual medicine packs. These requirements have driven significant investments in authentication technologies as manufacturers ensure compliance with regulatory frameworks governing medicine traceability from production through patient delivery, fundamentally transforming packaging standards and supply chain visibility across the healthcare sector.

Rapid Digital Authentication Technology Integration

The market is witnessing accelerated adoption of RFID tags, QR codes, and blockchain-based track-and-trace systems to combat rising counterfeiting in pharmaceuticals, food, and luxury goods. Leading technology providers are expanding their manufacturing presence in Brazil to meet growing regional demand for intelligent labels and digital authentication solutions. These facilities produce diverse inlay designs serving industries including apparel, food, pharmaceutical, cosmetics, and automotive sectors. The integration of connected product platforms enables end-to-end supply chain transparency, allowing brands to track individual items from source to consumer while providing authentication capabilities that strengthen consumer trust and combat sophisticated counterfeiting operations.

Strengthened Regulatory Enforcement and Brand Protection Infrastructure

Brazilian authorities have significantly enhanced anti-counterfeiting enforcement mechanisms through coordinated institutional frameworks. In September 2024, the Brazilian Directory for Combating Trademark Counterfeiting implemented a registration system featuring over 270 companies representing more than 35,000 trademarks from 32 countries. The National Plan to Combat Piracy (2022-2025) has expanded institutional support across government agencies, enabling the Federal Revenue Service to strengthen control structures and conduct daily seizures of illegal goods at land borders, ports, and airports. These coordinated efforts between public institutions and private sector stakeholders demonstrate Brazil's commitment to protecting intellectual property rights and combating illicit trade.

Market Outlook 2026-2034:

The Brazil anti-counterfeit packaging market will witness continued regulatory tightening, with ANVISA expected to extend serialization requirements to additional product categories beyond pharmaceuticals. Growing e-commerce vulnerabilities and the proliferation of online marketplaces are creating new counterfeiting risks, driving demand for advanced authentication solutions. Technological advancements in covert authentication and increasing consumer awareness regarding product authenticity will further accelerate adoption. Additionally, cross-border cooperation initiatives between Brazilian authorities and international partners, along with expanded enforcement capabilities, will strengthen market fundamentals across all application segments. The market generated a revenue of USD 2.68 Billion in 2025 and is projected to reach a revenue of USD 5.47 Billion by 2034, growing at a compound annual growth rate of 8.26% from 2026-2034.

Brazil Anti-Counterfeit Packaging Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Technology | Covert | 34% |

| Application | Pharmaceutical | 27% |

| Region | Southeast | 47% |

Technology Insights:

.webp)

To get detailed segment analysis of this market Request Sample

- Covert

- Security Labels

- Invisible Printing

- Others

- Overt

- Holograms

- Color Shifting Inks

- Others

- Forensic

- Track and Trace

- Machine Readable Data

- RFID

- Others

Covert technology leads the market with a 34% share of the total Brazil anti-counterfeit packaging market in 2025.

Covert anti-counterfeit packaging technologies, encompassing security labels, invisible printing, and specialized authentication features, represent the dominant segment in Brazil's market. These solutions provide brand owners with hidden verification capabilities that remain undetectable to counterfeiters while allowing authorized parties to authenticate products using specialized equipment or chemical reactions. The segment's prominence reflects manufacturers' preference for solutions that do not alter product aesthetics while providing robust protection against increasingly sophisticated counterfeiting operations targeting high-value goods across pharmaceuticals, personal care, and luxury segments.

The covert technology segment continues expanding as brand owners seek multilayered protection strategies combining hidden features with visible deterrents. Security labels incorporating invisible inks, microtext, and chemical markers enable field verification while maintaining supply chain integrity. Brazil's Federal Revenue Service utilizes covert features during seizure operations, with around BRL 3 Million worth of counterfeit products identified and confiscated in June 2024 alone, demonstrating the critical role these technologies play in enforcement activities and brand protection initiatives across regulated industries.

Application Insights:

- Pharmaceutical

- Food and Beverage

- Apparel and Footwear

- Automotive

- Personal Care

- Electrical and Electronics

- Luxury Goods

- Others

The pharmaceutical dominates with a 27% market share of the total Brazil anti-counterfeit packaging market in 2025.

The pharmaceutical sector represents Brazil's largest application segment for anti-counterfeit packaging, driven by comprehensive regulatory mandates established through the National Medicine Control System (SNCM). Under Law No. 13,410 and implementing regulation RDC 157/2017, all pharmaceutical manufacturers, importers, distributors, and wholesalers must implement unit-level serialization with unique identifiers on individual medicine packages. The system requires tracking multiple supply chain events from manufacturing through patient delivery, creating unprecedented demand for authentication technologies and supporting infrastructure.

Brazil achieved full pharmaceutical serialization compliance following a phased implementation approach that gradually increased coverage requirements over successive years. The regulatory framework requires 2D barcodes containing Unique Medicine Identifiers (IUM) linking to transport package identifiers (IET) for aggregation purposes, ensuring complete supply chain visibility. Additionally, subsequent legislation mandated QR codes on all medicine package inserts, further enhancing traceability and enabling consumers to access comprehensive product information through digital platforms, strengthening authentication capabilities and building trust in pharmaceutical distribution channels.

Regional Insights:

To get detailed regional analysis of this market Request Sample

- Southeast

- South

- Northeast

- North

- Central-West

The Southeast represents the leading region with a 47% share of the total Brazil anti-counterfeit packaging market in 2025.

The Southeast dominates Brazil's anti-counterfeit packaging market through concentrated pharmaceutical manufacturing facilities, major consumer goods production centers, and sophisticated logistics infrastructure. São Paulo serves as the primary hub for both counterfeit product interception and authentication technology deployment, with the Federal Revenue Service and Civil Police conducting coordinated enforcement operations throughout the region. The presence of leading technology manufacturers in the area exemplifies the region's strategic importance for authentication solution production and market development, attracting continued investment from domestic and international players.

The region's dominance is further reinforced by its robust industrial ecosystem, hosting headquarters of major pharmaceutical companies, food and beverage manufacturers, and personal care brands requiring comprehensive anti-counterfeit solutions. Advanced transportation networks connecting major ports and distribution centers facilitate efficient supply chain monitoring and product authentication. Additionally, the Southeast benefits from proximity to key regulatory bodies and industry associations, enabling faster compliance adaptation and technology adoption. These structural advantages position the region as Brazil's primary driver for anti-counterfeit packaging innovation and implementation.

Market Dynamics:

Growth Drivers:

Why is the Brazil Anti-Counterfeit Packaging Market Growing?

Escalating Economic Losses from Counterfeiting and Piracy

Brazil faces substantial economic damage from counterfeit goods and piracy, creating urgent demand for authentication packaging solutions. According to the industry reports, economic losses from piracy and smuggling reached R$ 468 Billion in 2024, representing more than four times the amount recorded in 2014 when surveys began. Specific sector losses include clothing at R$ 87.4 Billion, alcoholic beverages at R$ 85.2 Billion, fuels at R$ 29 Billion, and personal hygiene products at R$ 21 Billion. These staggering figures have prompted manufacturers and brand owners across all industries to invest significantly in anti-counterfeit packaging technologies, driving sustained market growth as companies seek to protect revenue streams and maintain consumer trust.

Mandatory Pharmaceutical Serialization Requirements

Brazil's National Medicine Control System (SNCM) represents one of the world's most comprehensive pharmaceutical serialization mandates, fundamentally transforming packaging requirements across the healthcare supply chain. The system requires all pharmaceutical products to carry unique identifiers enabling track-and-trace capabilities from manufacturing through patient delivery. Implementation proceeded through graduated phases, progressively increasing compliance requirements for manufacturers, importers, distributors, and wholesalers until achieving full market coverage. The regulations mandate communication of multiple supply chain events, requiring all stakeholders across the pharmaceutical distribution network to deploy compatible authentication infrastructure and reporting systems.

Expansion of E-Commerce and Digital Distribution Channels

The rapid growth of e-commerce in Brazil has created new vulnerabilities for counterfeit product infiltration, driving increased adoption of authentication packaging. Online marketplaces and digital distribution channels present significant challenges for brand protection, as counterfeiters exploit the anonymity and reach of internet commerce. Brazilian companies increasingly deploy QR codes, serialization, and track-and-trace solutions enabling consumers to verify product authenticity before purchase. Law No. 14,338/2022 mandated QR codes on pharmaceutical package inserts, establishing a framework that other industries are adopting to enhance consumer engagement and combat online counterfeiting effectively.

Market Restraints:

What Challenges the Brazil Anti-Counterfeit Packaging Market is Facing?

High Implementation Costs for Small and Medium Enterprises

Small and medium-sized enterprises face significant financial barriers in adopting advanced anti-counterfeit packaging technologies. Serialization systems, RFID infrastructure, and integrated track-and-trace solutions require substantial capital investment in equipment, software, and training that smaller manufacturers struggle to afford.

Complex Supply Chain Integration Requirements

Implementing comprehensive anti-counterfeit solutions requires coordination across multiple supply chain partners, creating integration challenges. Different technology platforms, data formats, and reporting requirements complicate system interoperability, particularly for companies operating across diverse product categories and geographic regions.

Counterfeiters' Technological Sophistication

Counterfeiters continuously adapt to authentication technologies, developing increasingly sophisticated replication capabilities. This technological arms race requires brand owners to continuously upgrade their protection systems, increasing ongoing costs and creating uncertainty about solution effectiveness over extended timeframes.

Competitive Landscape:

The Brazil anti-counterfeit packaging market exhibits moderate fragmentation with participation from global authentication technology leaders, regional packaging specialists, and domestic security printing companies. Competition centers on technological innovation, integration capabilities, and regulatory compliance support. Leading providers are expanding local manufacturing presence to serve regional demand more effectively, establishing production facilities within Brazil to reduce lead times and strengthen customer relationships. The market features strategic partnerships between technology providers and pharmaceutical manufacturers navigating SNCM compliance requirements, while domestic players leverage local market knowledge and established distribution networks. Companies compete across multiple dimensions including product portfolio breadth, technical support services, and pricing strategies. The regulatory environment favors providers offering comprehensive solutions that address serialization, track-and-trace, and authentication requirements simultaneously. Additionally, growing emphasis on sustainability is driving innovation in eco-friendly authentication materials, creating new competitive differentiation opportunities for market participants.

Brazil Anti-Counterfeit Packaging Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Technologies Covered |

|

| Applications Covered | Pharmaceutical, Food and Beverage, Apparel and Footwear, Automotive, Personal Care, Electrical and Electronics, Luxury Goods, Others |

| Regions Covered | Southeast, South, Northeast, North, Central-West |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Brazil anti-counterfeit packaging market size was valued at USD 2.68 Billion in 2025.

The Brazil anti-counterfeit packaging market is expected to grow at a compound annual growth rate of 8.26% from 2026-2034 to reach USD 5.47 Billion by 2034.

Covert technology dominated with a share of 34%, driven by demand for invisible authentication features including security labels and specialized printing that cannot be easily detected or replicated by counterfeiters.

Key factors driving the Brazil anti-counterfeit packaging market include escalating economic losses from counterfeiting, mandatory pharmaceutical serialization requirements under SNCM, rapid digital authentication technology adoption, and strengthened regulatory enforcement mechanisms.

Major challenges include high implementation costs for small and medium enterprises, complex supply chain integration requirements across multiple partners, and counterfeiters' increasing technological sophistication requiring continuous system upgrades.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)