Brazil Aquaculture Market Size, Share, Trends and Forecast by Fish Type, Environment, Distribution Channel, and Region, 2025-2033

Brazil Aquaculture Market Overview:

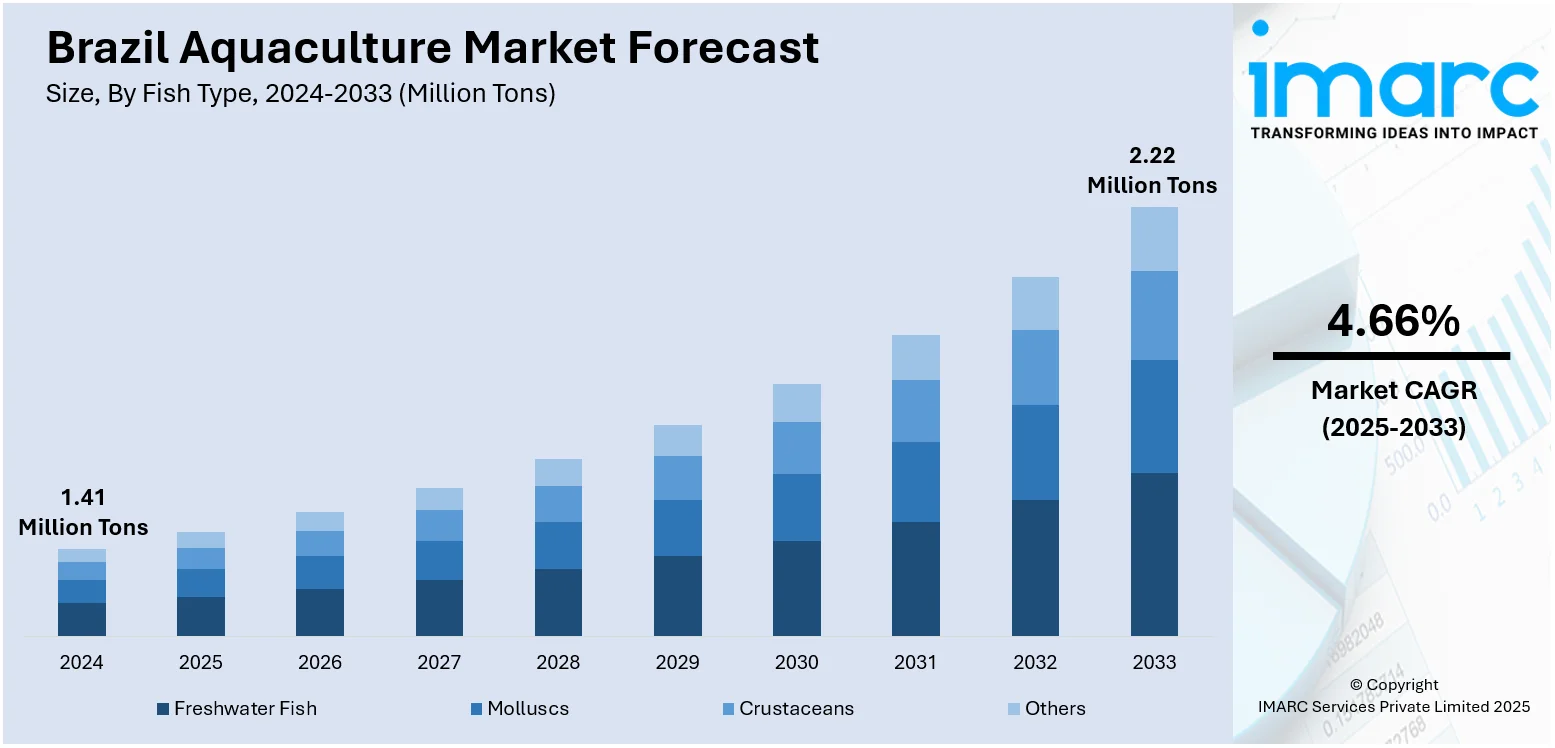

The Brazil aquaculture market size reached 1.41 Million Tons in 2024. Looking forward, the market is projected to reach 2.22 Million Tons by 2033, exhibiting a growth rate (CAGR) of 4.66% during 2025-2033. The market is driven by rising seafood demand, abundant freshwater resources, government support for sustainable fish farming, and increasing investments in aquaculture technologies. Growth in domestic consumption and export potential further accelerates Brazil aquaculture market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | 1.41 Million Tons |

| Market Forecast in 2033 | 2.22 Million Tons |

| Market Growth Rate 2025-2033 | 4.66% |

Brazil Aquaculture Market Trends:

Technological Integration

The Brazil aquaculture market is witnessing increased adoption of advanced technologies such as automated feeding systems, water quality monitoring sensors, and data analytics platforms. These innovations enhance production efficiency, reduce feed waste, and ensure optimal environmental conditions for farmed species. The integration of technology is particularly prominent in large-scale tilapia and shrimp farming operations, aiming to minimize operational costs and improve yield predictability. For instance, in February 2025, Brazilian Fish and the U.S.-based Center for Aquaculture Technologies (CAT) have partnered to commercialize genetically edited tilapia in Brazil. This genome editing accelerates genetic improvements, enhancing growth, feed efficiency, disease resistance, and fillet yield in a single generation, achievements that normally take 20 years via selective breeding. This innovation aims to boost sustainability, reduce feed waste, shorten grow-out periods, and improve competitiveness in Brazil’s aquaculture sector while providing healthier fish for consumers. The partnership highlights a major technological advance in industrial tilapia farming, supporting environmental stewardship and global food demand. With productivity as a top priority, the sector is expected to invest further in technology, fostering steady Brazil aquaculture market growth through improved sustainability and resource optimization.

To get more information on this market, Request Sample

Export-Oriented Expansion

Brazil is increasingly positioning itself as a major exporter of aquaculture products, particularly tilapia, to North American and European markets. For instance, Brazil’s aquaculture industry hit a record 968,745 tons in 2024, growing 9.21% from 2023. Tilapia led with 662,230 tons (+14.36%), making up 68.36% of total production. Exports doubled in volume to 13,792 tons, valued at $59 Million, mainly to the U.S., which accounted for 89% of exports. Rising global demand for sustainably farmed seafood has led to government efforts to align domestic production with international food safety and traceability standards. Several companies are acquiring certifications such as ASC and GlobalG.A.P., which are prerequisites for export. Infrastructure development in ports and cold chains also supports this shift. The favorable climate and availability of land further enhance Brazil’s competitiveness in the global seafood trade. As exports rise, the aquaculture sector is expected to attract more foreign investment, thus accelerating Brazil aquaculture market growth by expanding market access and increasing profitability.

Brazil Aquaculture Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on fish type, environment, and distribution channel.

Fish Type Insights:

- Freshwater Fish

- Molluscs

- Crustaceans

- Others

The report has provided a detailed breakup and analysis of the market based on the fish type. This includes freshwater fish, molluscs, crustaceans, and others.

Environment Insights:

- Fresh Water

- Marine Water

- Brackish Water

A detailed breakup and analysis of the market based on the environment have also been provided in the report. This includes fresh water, marine water, and brackish water.

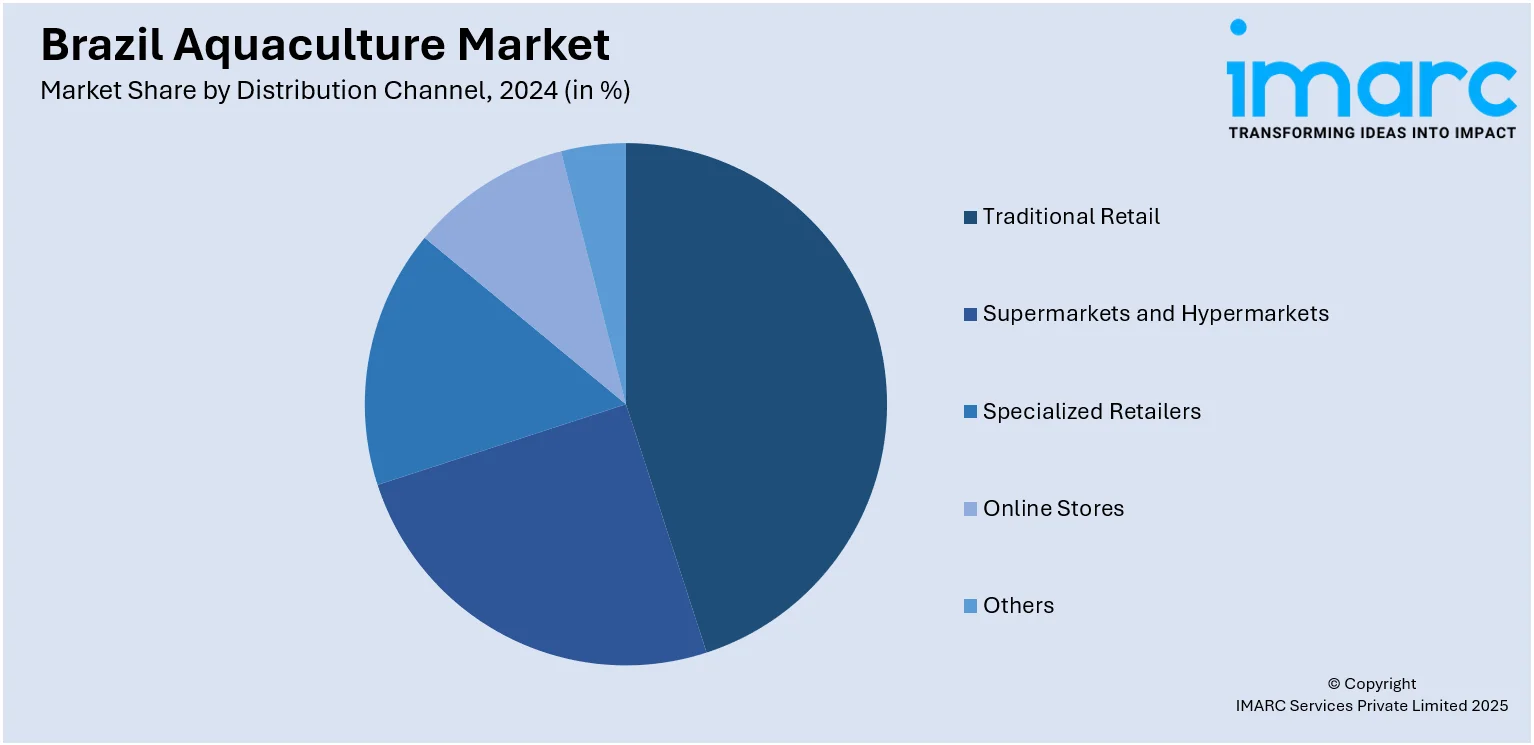

Distribution Channel Insights:

- Traditional Retail

- Supermarkets and Hypermarkets

- Specialized Retailers

- Online Stores

- Others

The report has provided a detailed breakup and analysis of the market based on the distribution channel. This includes traditional retail, supermarkets and hypermarkets, specialized retailers, online stores, and others.

Regional Insights:

- Southeast

- South

- Northeast

- North

- Central-West

The report has also provided a comprehensive analysis of all the major regional markets, which include Southeast, South, Northeast, North, and Central-West.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Brazil Aquaculture Market News:

- In July 2025, HIPRA launched immersion vaccination for Brazilian aquaculture during the online event “IMUNIDADE E BEM ESTAR PARA PEIXES,” attended by industry experts and nearly 900 participants. The vaccination offers cost-effective disease prevention for juvenile fish, improving immunity and production efficiency. HIPRA supports Brazilian fish farming with R&D, diagnostics, and local production.

- In November 2024, Onda, a Canadian aquaculture research firm, opened a new satellite facility in Brazil to conduct trials on whiteleg shrimp, aquaculture’s fastest-growing segment. Partnering with a local Brazilian farm, Onda aims to improve shrimp nutrition, growth, feed efficiency, survival, and disease resistance.

Brazil Aquaculture Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million Tons |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Fish Types Covered | Freshwater Fish, Molluscs, Crustaceans, Others |

| Environments Covered | Fresh Water, Marine Water, Brackish Water |

| Distribution Channels Covered | Traditional Retail, Supermarkets and Hypermarkets, Specialized Retailers, Online Stores, Others |

| Regions Covered | Southeast, South, Northeast, North, Central-West |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Brazil aquaculture market performed so far and how will it perform in the coming years?

- What is the breakup of the Brazil aquaculture market on the basis of fish type?

- What is the breakup of the Brazil aquaculture market on the basis of environment?

- What is the breakup of the Brazil aquaculture market on the basis of distribution channel?

- What is the breakup of the Brazil aquaculture market on the basis of region?

- What are the various stages in the value chain of the Brazil aquaculture market?

- What are the key driving factors and challenges in the Brazil aquaculture market?

- What is the structure of the Brazil aquaculture market and who are the key players?

- What is the degree of competition in the Brazil aquaculture market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Brazil aquaculture market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Brazil aquaculture market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Brazil aquaculture industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)