Brazil Armored Civilian Vehicles Market Size, Share, Trends and Forecast by Drive Type, Vehicle Type, and Region, 2026-2034

Brazil Armored Civilian Vehicles Market Summary:

The Brazil armored civilian vehicles market size was valued at USD 356.06 Million in 2025 and is projected to reach USD 558.08 Million by 2034, growing at a compound annual growth rate of 5.12% from 2026-2034.

The Brazil armored civilian vehicles market is experiencing robust growth, driven by heightened security concerns across urban centers. Rising demand for personal protection among business executives, high-net-worth individuals, and affluent families is accelerating market expansion. Technological advancements in lightweight materials and ballistic protection systems are enhancing product appeal. The establishment of vertically integrated domestic manufacturing capabilities is strengthening the market share.

Key Takeaways and Insights:

- By Drive Type: Wheel dominates the market with a share of 87% in 2025, owing to its superior maneuverability in urban traffic conditions, established service infrastructure, and compatibility with standard road networks. Wheel-driven vehicles offer enhanced operational flexibility and lower maintenance requirements for civilian applications.

- By Vehicle Type: SUV leads the market with a share of 32% in 2025, its adaptable design that merges passenger space with safety features, elevated ground clearance for diverse terrains, and substantial consumer demand among executives and families looking for top-notch security options.

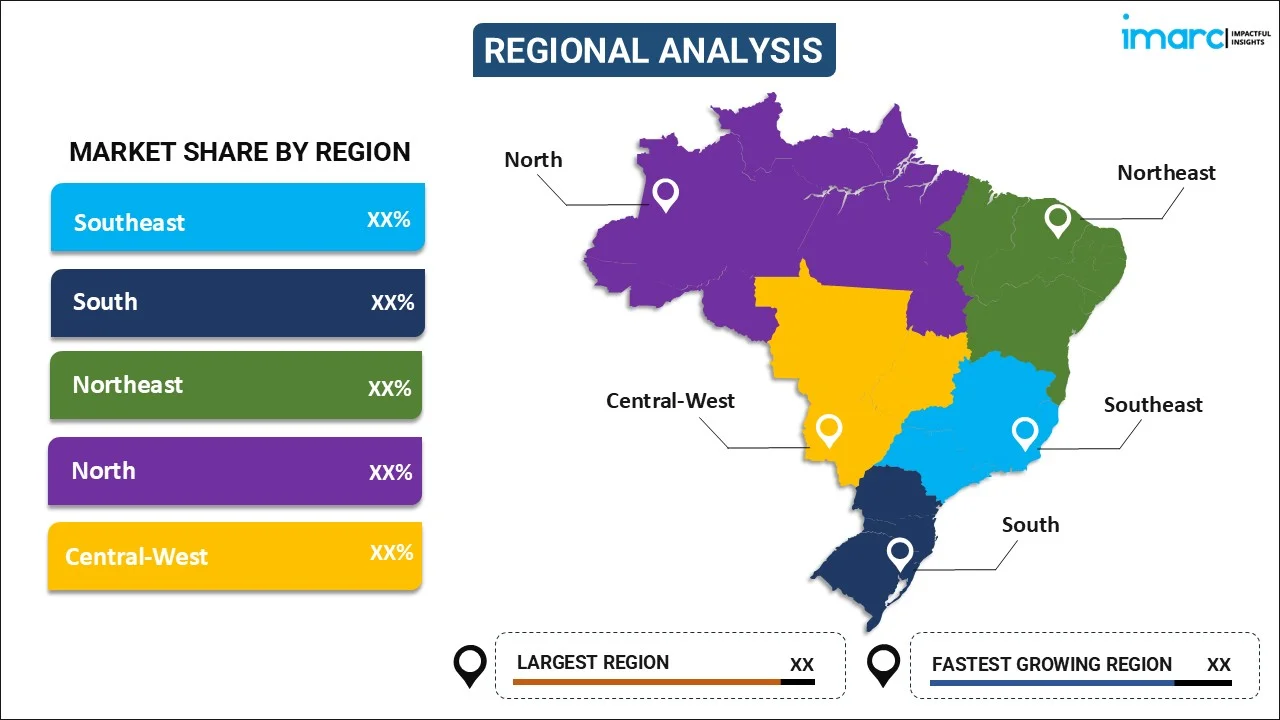

- By Region: Southeast represents the largest region with 38% share in 2025, reflecting the concentration of economic activity in São Paulo and Rio de Janeiro metropolitan areas, higher disposable incomes enabling premium vehicle purchases, and elevated security requirements in densely populated commercial centers.

- Key Players: Key players drive the Brazil armored civilian vehicles market by expanding production capacities, developing advanced ballistic protection technologies, and establishing strategic partnerships with international automotive manufacturers. Their investments in material innovations, manufacturing efficiency, and nationwide service networks boost market penetration and ensure consistent product availability across diverse consumer segments.

In Brazil, the market continues to demonstrate strong momentum, as the country has established itself as the global leader in civilian vehicle armoring. Brazil produced 34,402 armored vehicles in 2024, representing a 17% increase from 2023, with industry projections anticipating production to exceed 40,000 units in 2025. The market benefits from a sophisticated domestic manufacturing ecosystem, enabling local firms to produce ballistic glass, protective textiles, and polymer-based armor panels. This vertical integration has reduced import dependency while maintaining competitive pricing structures that expand market accessibility. Several certified armoring companies operate throughout the country, offering protection solutions ranging from entry-level packages to comprehensive security systems. The democratization of armoring services has transformed what was previously an exclusive product into an accessible security solution for middle and upper-middle-class consumers. Technological advancements in lightweight materials have improved vehicle performance while maintaining ballistic integrity, further supporting market growth across multiple vehicle categories and consumer segments.

Brazil Armored Civilian Vehicles Market Trends:

Democratization of Vehicle Armoring Services

The Brazil armored civilian vehicles market is witnessing significant democratization, as armoring services become increasingly accessible to broader consumer segments. Previously exclusive to ultra-wealthy individuals and corporate executives, protection solutions cater to middle and upper-middle-class families concerned about urban security. The expansion of certified service providers throughout major metropolitan areas in Brazil has created competitive pricing dynamics that benefit consumers seeking personal protection without premium pricing structures.

Development of Vertically Integrated Manufacturing Ecosystem

Brazil has developed a comprehensive domestic manufacturing ecosystem for armored vehicle components, supporting the market growth. Local firms produce ballistic glass, protective fabrics, and polymer-based armor panels domestically, reducing reliance on imported materials. This vertical integration has enabled Brazilian technology to compete internationally, with leading manufacturers securing partnerships with global automotive brands for armoring services across multiple continents. Skilled engineering capabilities and continuous research and development (R&D) investments further enhance product quality, customization flexibility, and export competitiveness.

Emergence of Innovative Service Business Models

The market is experiencing emergence of innovative business models, extending beyond traditional vehicle armoring services. New enterprises are leveraging armored vehicle fleets for rideshare transportation services, premium chauffeur offerings, and corporate mobility solutions. As per IMARC Group, the Brazil ride sharing market size reached USD 3,252.45 Million in 2025. These developments reflect evolving consumer preferences towards accessing protection services rather than outright vehicle ownership, creating additional revenue streams within the broader armored transportation ecosystem.

Market Outlook 2026-2034:

The Brazil armored civilian vehicles market is positioned for sustained expansion throughout the forecast period, supported by persistent security concerns and technological advancements in protection systems. The market generated a revenue of USD 356.06 Million in 2025 and is projected to reach a revenue of USD 558.08 Million by 2034, growing at a compound annual growth rate of 5.12% from 2026-2034. Continued investments in manufacturing capabilities, expansion of service networks, and development of advanced lightweight materials will support market momentum. The growing acceptance of armored vehicles among professional and family segments, combined with improving cost-efficiency ratios, is expected to broaden the addressable consumer base significantly. International partnerships and technology transfers will further strengthen Brazil's position as the global leader in civilian armored vehicle production.

Brazil Armored Civilian Vehicles Market Report Segmentation:

|

Segment Category |

Leading Segment |

Market Share |

|

Drive Type |

Wheel |

87% |

|

Vehicle Type |

SUV |

32% |

|

Region |

Southeast |

38% |

Drive Type Insights:

.webp)

To get more information of this market, Request Sample

- Wheel

- Track

Wheel dominates with a market share of 87% of the total Brazil armored civilian vehicles market in 2025.

Wheel leads the Brazil armored civilian vehicles market due to its strong alignment with everyday urban mobility requirements. Most armored civilian vehicles in Brazil are used for personal transport, executive travel, and family security within cities, where paved roads and dense traffic conditions prevail. Wheeled platforms offer superior driving comfort, smoother handling, and better speed performance compared to tracked alternatives. They can be easily integrated into conventional sedans and sport utility vehicles (SUVs), preserving vehicle aesthetics and usability.

Another key factor driving dominance is cost efficiency and operational practicality. Wheel-driven armored vehicles involve lower manufacturing, maintenance, and repair costs, making them more accessible to private buyers and corporate fleets. Maintenance services, spare parts availability, and skilled technicians for wheeled vehicles are widely accessible across Brazil. Additionally, wheeled platforms allow flexible armor customization based on threat levels without significantly increasing vehicle weight. Their compliance with road regulations and suitability for long-distance travel make them the preferred choice for security-conscious individuals, reinforcing their leadership in the market.

Vehicle Type Insights:

- Sedan

- Trucks and Buses

- SUV

- Limousine

- Others

SUV leads with a share of 32% of the total Brazil armored civilian vehicles market in 2025.

SUV represents the preferred platform for armored civilian applications in Brazil due to its versatile design accommodating protective installations without compromising passenger comfort. SUV offers inherent advantages, including higher ground clearance, spacious interiors suitable for ballistic panel integration, and robust structural frames supporting additional weight. Industry partnerships reflect this preference, with major automotive manufacturers establishing dedicated armoring programs with certified Brazilian providers offering extended warranties on installation services.

The SUV segment attracts diverse consumer demographics, ranging from corporate executives to affluent families, prioritizing comprehensive protection. SUVs also provide enhanced visibility and commanding driving positions that improve situational awareness in urban traffic environments. Their powerful engines and advanced suspension systems effectively manage the added weight of armor while maintaining performance and ride quality. Growing consumer preference for premium SUVs aligns with the demand for discreet security solutions that blend luxury with protection.

Regional Insights:

To get more information of this market, Request Sample

- Southeast

- South

- Northeast

- North

- Central-West

Southeast exhibits a clear dominance with a 38% share of the total Brazil armored civilian vehicles market in 2025.

Southeast commands market leadership, driven by the concentration of Brazil's economic activities within São Paulo and Rio de Janeiro metropolitan areas. São Paulo maintains one of the largest armored vehicle fleet nationally, reflecting the region's elevated security requirements and substantial purchasing power concentration. São Paulo reported 72,255 thefts and robberies of passenger and utility vehicles in 2024, averaging 221 incidents daily, sustaining demand for protective solutions among residents navigating urban environments regularly.

Southeast benefits from proximity to leading armoring manufacturers and comprehensive service infrastructure supporting vehicle protection needs. Established armoring clusters in São Paulo enable faster installation timelines, better quality control, and access to skilled technicians with specialized expertise. High concentration of corporate headquarters, financial institutions, and high-net-worth individuals further supports sustained demand for armored vehicles. Dense urban traffic conditions and frequent intercity travel also increase perceived security risks, reinforcing adoption.

Market Dynamics:

Growth Drivers:

Why is the Brazil Armored Civilian Vehicles Market Growing?

Persistent Urban Security Concerns Driving Protection Demand

The Brazil armored civilian vehicles market experiences sustained growth fueled by persistent security concerns across major urban centers. Brazilian cities present elevated risk environments where residents spend considerable time commuting through congested traffic, creating vulnerability to criminal activity, including armed robbery and vehicle theft. As per Traffic Congestion Ranking - Annual Report 2024, in Sao Paulo, the maximum traffic congestion index (TCI) reached a value of 195.62 in 2023. Public security consistently ranks among the foremost concerns in national opinion surveys, driving consumer investment in personal protection solutions. The psychological impact of security incidents, amplified through social media and news coverage, reinforces demand for ballistic protection among families and professionals. Urban residents increasingly view vehicle armoring as essential protection infrastructure comparable to residential security systems, supporting continued market expansion.

Technological Advancements in Lightweight Ballistic Materials

Continuous innovations in ballistic materials and protection technologies support the market growth by improving product performance and accessibility. Brazilian manufacturers have developed sophisticated lightweight armor solutions utilizing advanced aramid fibers, polymer-based panels, and specialized ballistic glass that preserve vehicle handling characteristics while providing comprehensive protection. These technological advancements have enabled armoring installations that maintain near-original vehicle performance, addressing historical concerns about degraded handling and increased fuel consumption. Material innovations have simultaneously reduced production costs, expanding market accessibility to broader consumer segments. The integration of advanced protection systems with minimal weight penalties continues to attract consumers prioritizing both security and driving experience. Ongoing R&D efforts are also enhancing durability and lifespan of armored components under varied climatic conditions. Additionally, modular armor designs allow customization based on threat levels, increasing adoption among diverse end user profiles.

Expanding Middle-Class Consumer Base and Pricing Accessibility

The democratization of armoring services through competitive pricing has significantly expanded the addressable consumer base, supporting market growth. Protection systems previously exclusive to ultra-wealthy individuals have become accessible to middle and upper-middle-class consumers as manufacturing efficiencies and competitive dynamics reduce service costs. Flexible financing arrangements and growing availability of pre-armored certified used vehicles further enhance accessibility. This pricing evolution transforms vehicle armoring from exclusive luxury into accessible security infrastructure, broadening market participation substantially. Rising urban security concerns reinforce this trend, encouraging proactive investments in personal safety solutions. Authorized armoring workshops offer standardized packages with transparent pricing, improving consumer confidence and trust. Greater awareness through digital platforms and word-of-mouth recommendations continues to normalize armored vehicles as practical protection choices rather than exceptional purchases, sustaining long-term demand growth.

Market Restraints:

What Challenges the Brazil Armored Civilian Vehicles Market is Facing?

High Initial Investment Requirements

Despite pricing improvements, the initial investment required for vehicle armoring remains substantial, limiting market penetration among price-sensitive consumer segments. Comprehensive protection systems require significant expenditure beyond base vehicle costs, creating barriers for consumers unable to allocate additional security budgets. The combined cost of vehicle acquisition and armoring services positions protected transportation beyond reach for considerable portions of the population.

Regulatory Compliance and Documentation Requirements

The armoring process involves extensive regulatory compliance, including mandatory authorization from Brazilian Army authorities, before protection installations can commence. Documentation requirements, certification processes, and registration updates create administrative complexity, extending delivery timelines and increasing operational costs. These regulatory frameworks, while ensuring quality standards, add procedural barriers that may discourage potential consumers from pursuing protection solutions.

Ongoing Maintenance and Service Complexities

Armored civilian vehicles require specialized maintenance procedures and periodic inspection of ballistic components, creating ongoing ownership complexities. Service requirements, including ballistic glass replacement, armor panel inspection, and electronic system calibration, necessitate access to certified facilities with trained technicians. Geographic limitations in service infrastructure outside major metropolitan areas present challenges for vehicle owners requiring maintenance support in regional locations.

Competitive Landscape:

The Brazil armored civilian vehicles market exhibits a competitive landscape, characterized by established domestic manufacturers maintaining market leadership through technological excellence and comprehensive service capabilities. Leading companies compete through production capacity expansion, material innovation investment, and strategic partnerships with international automotive manufacturers. The market structure includes large-scale manufacturers capable of processing hundreds of vehicles monthly alongside specialized regional providers offering customized solutions. Competition increasingly focuses on service differentiation, including warranty terms, processing timelines, and after-sales support networks. International partnerships and technology export arrangements demonstrate Brazilian industry competitiveness within global armored vehicle markets.

Brazil Armored Civilian Vehicles Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Drive Types Covered | Wheel, Track |

| Vehicle Types Covered | Sedan, Trucks and Buses, SUV, Limousine, Others |

| Regions Covered | Southeast, South, Northeast, North, Central-West |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request |

Key Questions Answered in This Report

The Brazil armored civilian vehicles market size was valued at USD 356.06 Million in 2025.

The Brazil armored civilian vehicles market is expected to grow at a compound annual growth rate of 5.12% from 2026-2034 to reach USD 558.08 Million by 2034.

Wheel dominated the market with a share of 87%, reflecting superior maneuverability in urban environments, established service infrastructure, and compatibility with standard road networks preferred by civilian consumers.

Key factors driving the Brazil armored civilian vehicles market include persistent urban security concerns, technological advancements in lightweight ballistic materials, expanding middle-class consumer accessibility, and development of vertically integrated domestic manufacturing capabilities.

Major challenges include high initial investment requirements for armoring services, regulatory compliance and documentation complexities, ongoing specialized maintenance needs, and geographic limitations in service infrastructure outside major metropolitan areas.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)