Brazil Automotive Actuators Market Size, Share, Trends and Forecast by Actuator Type, Vehicle Type, Application Type, and Region, 2026-2034

Brazil Automotive Actuators Market Summary:

The Brazil automotive actuators market size was valued at USD 543.75 Million in 2025 and is projected to reach USD 843.53 Million by 2034, growing at a compound annual growth rate of 5.00% from 2026-2034.

The Brazil automotive actuators market is experiencing notable growth driven by the country's accelerating vehicle production, rising adoption of advanced driver assistance systems (ADAS), and the rapid transformation toward electric mobility. Rising user demand for enhanced driving comfort, improved fuel efficiency standards, and increasing integration of electronic systems in vehicles are reshaping market dynamics. The convergence of government incentives supporting green mobility initiatives and substantial foreign investments in local manufacturing capabilities is creating significant opportunities for actuator manufacturers across the automotive value chain.

Key Takeaways and Insights:

- By Actuator Type: Electrical actuators dominate the market with a share of 52% in 2025, driven by their superior energy efficiency, lower heat and noise emissions, flexible installation options, and the growing compatibility with electric and hybrid vehicle platforms expanding across Brazil.

- By Vehicle Type: Passenger car leads the market with a share of 69% in 2025, reflecting strong user preference for personal mobility solutions and sustained demand from Brazil's expanding middle-class population seeking vehicles equipped with advanced comfort and safety features.

- By Application Type: Brake actuator represents the largest segment with a market share of 30% in 2025, owing to mandatory safety requirements, integration with advanced braking systems, and the growing adoption of electronic parking brake technologies across vehicle segments.

- Key Players: The Brazil automotive actuators market exhibits moderate competitive intensity, characterized by multinational automotive component suppliers competing alongside regional manufacturers through strategic partnerships, technological innovation, and expanding product portfolios across price segments.

The Brazil automotive actuators market is driven by the accelerating transition toward vehicle electrification and advanced automotive manufacturing. As automakers increasingly integrate electric and electronic systems into vehicles, the demand for actuators used in powertrain control, braking systems, thermal management, and interior automation continues to rise. Electric vehicles (EVs) rely heavily on precise and efficient actuators to manage battery systems, steering, and safety functions. In 2025, General Motors officially launched electric vehicle production at its Ceará plant in Brazil, in partnership with the Comexport Group, beginning production of the Chevrolet Spark EUV, with the Captiva EV planned for 2026. This initiative formed part of GM’s R$7 billion investment to electrify its Brazilian operations. Such large-scale investments significantly increase local demand for automotive actuators, supporting the market growth through higher production volumes, technological upgrades, and localization of advanced vehicle components across Brazil’s automotive supply chain.

Brazil Automotive Actuators Market Trends:

Growth in Vehicle Production Volumes

Brazil’s automotive actuators market is influenced by notable rise in domestic vehicle production across passenger and commercial segments. Expansion of local manufacturing capacity and established supplier networks increases actuator demand across braking, seating, transmission, and comfort applications. In 2024, Brazil produced 2.55 million vehicles and recorded sales of 2.64 million units, reflecting strong manufacturing activity. Rising production volumes directly increase actuator installations per vehicle. As automakers broaden model portfolios and strengthen localization strategies for domestic and export markets, actuator suppliers benefit from consistent order flows, reinforcing sustained market growth over the forecast period.

Advancement in Electric and Hybrid Vehicles

The growth of electric and hybrid vehicles in Brazil is catalyzing the demand for electrical actuators due to their essential role in electronically controlled vehicle systems. Electrified platforms depend on electrical actuators for braking, power management, thermal regulation, and interior operations, requiring high precision and system compatibility. In 2025, BYD produced its first fully electric vehicle in Brazil at its Camaçari facility in Bahia, with the BYD Dolphin Mini marking the start of local EV manufacturing. As automakers expand electrified model portfolios and upgrade platforms, actuator content per vehicle increases, supporting sustained growth opportunities within Brazil’s automotive actuators market.

Growth in Commercial Vehicle and Fleet Demand

The expansion of logistics networks, infrastructure projects, and e-commerce activity in Brazil is driving the demand for commercial vehicles equipped with advanced control systems. Modern commercial vehicles increasingly rely on actuators for electronic braking, transmission management, and safety functions to ensure operational reliability. In 2024, commercial vehicle production in Brazil reached 169,001 units, reflecting a 39.5% increase from 121,133 units in 2023, according to ANFAVEA. This recovery highlights rising fleet investments. As fleet operators prioritize efficiency and safety, adoption of advanced actuator technologies continues to expand beyond the passenger vehicle segment.

Market Outlook 2026-2034:

The Brazil automotive actuators market demonstrates robust growth potential throughout the forecast period, underpinned by sustained vehicle production expansion and technological advancement in automotive systems. Demand is supported by rising adoption of electric features, safety modules, and comfort functions across passenger and commercial vehicles, alongside investments by OEMs and suppliers operating within domestic manufacturing ecosystems. The market generated a revenue of USD 543.75 Million in 2025 and is projected to reach a revenue of USD 843.53 Million by 2034, growing at a compound annual growth rate of 5.00% from 2026-2034.

Brazil Automotive Actuators Market Report Segmentation:

|

Segment Category |

Leading Segment |

Market Share |

|

Actuator Type |

Electrical Actuators |

52% |

|

Vehicle Type |

Passenger Car |

69% |

|

Application Type |

Brake Actuator |

30% |

Actuator Type Insights:

To get detailed segment analysis of this market Request Sample

- Electrical Actuators

- Hydraulic Actuators

- Pneumatic Actuators

Electrical actuators dominate with a market share of 52% of the total Brazil automotive actuators market in 2025.

Electrical actuators represent the largest segment due to their precise control, faster response times, and compatibility with modern vehicle electronics. Their integration supports advanced comfort, safety, and powertrain functions across passenger and commercial vehicles.

Rising adoption of electric and hybrid vehicles further strengthens demand for electrical actuators. Automakers favor these systems for improved energy efficiency, reduced mechanical complexity, and easier integration with automated and software-driven vehicle architectures.

Vehicle Type Insights:

- Passenger Car

- Commercial Vehicle

Passenger car leads with a market share of 69% of the total Brazil automotive actuators market in 2025.

Passenger car holds the biggest market share owing to higher production volumes and strong domestic demand for personal mobility. Increased integration of comfort, safety, and electronic features drives greater actuator usage per vehicle.

This segment also benefits from rising urbanization and user preference for feature-rich vehicles. Automakers continue expanding passenger car offerings with advanced systems, increasing the need for actuators across braking, seating, climate control, and power management applications.

Application Type Insights:

- Throttle Actuator

- Seat Adjustment Actuator

- Brake Actuator

- Closure Actuator

- Others

Brake actuator exhibits a clear dominance with a 30% share of the total Brazil automotive actuators market in 2025.

Brake actuator dominates the market, driven by its critical role in vehicle safety systems. The growing adoption of anti-lock braking, electronic stability control, and advanced driver assistance features increases demand across passenger and commercial vehicles.

Stricter safety regulations and rising user awareness further support the dominance of the segment. Automakers prioritize reliable braking performance, leading to higher integration of advanced brake actuators to enhance control, responsiveness, and overall driving safety.

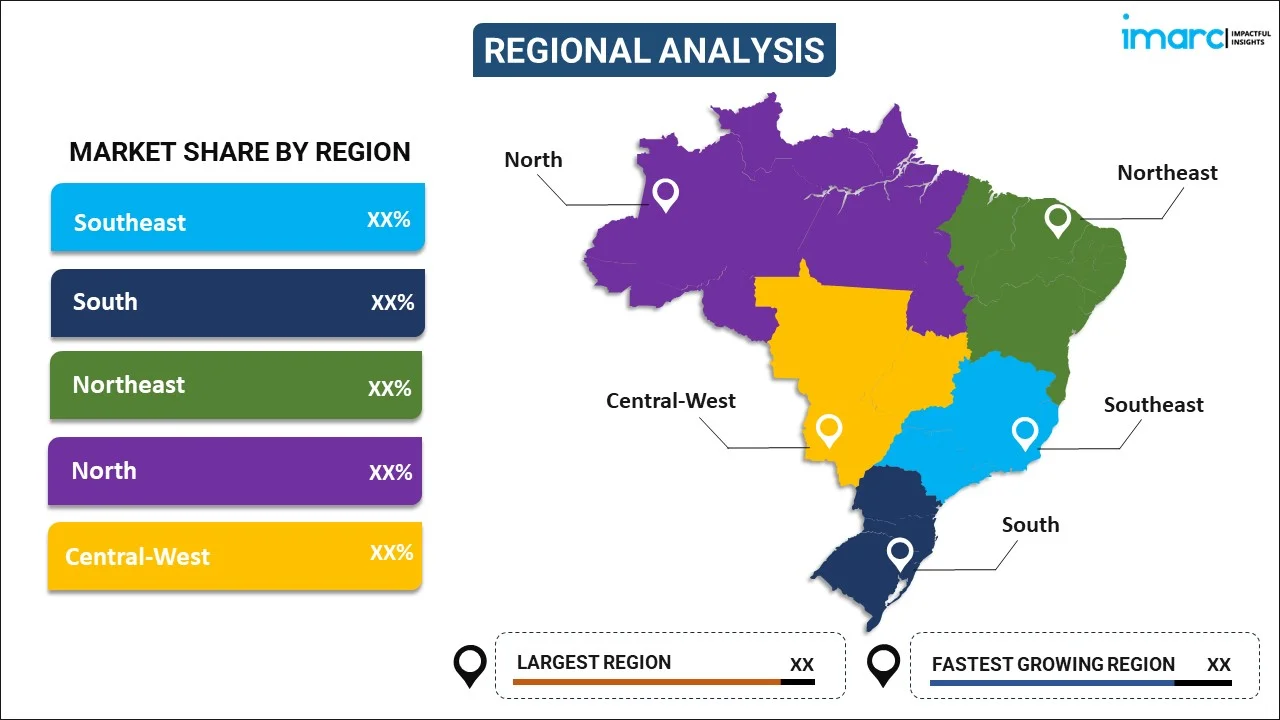

Regional Insights:

To get detailed segment analysis of this market Request Sample

- Southeast

- South

- Northeast

- North

- Central-West

Southeast benefits from a strong automotive manufacturing base, high vehicle production volumes, and the presence of leading OEMs. Well-developed supplier networks and technological capabilities support steady growth in automotive actuator demand.

South shows positive momentum due to established component manufacturing, skilled workforce availability, and the growing adoption of advanced automotive technologies. Export-oriented production further supports consistent demand for automotive actuators.

Northeast presents growth opportunities driven by rising vehicle sales, expanding industrial infrastructure, and supportive government incentives. Increasing urban mobility and localized manufacturing initiatives contribute positively to market development.

North offers potential supported by infrastructure development and the growing demand for vehicles used in logistics and regional transport. Expanding economic activities create favorable conditions for gradual growth in actuator adoption.

Central-West benefits from strong agricultural and logistics activities, driving the demand for commercial vehicles. Fleet expansion and regional economic growth support increasing adoption of automotive actuators.

Market Dynamics:

Growth Drivers:

Why is the Brazil Automotive Actuators Market Growing?

Rising Adoption of Advanced Driver Assistance Systems (ADAS)

The growing adoption of advanced driver assistance systems (ADAS) in Brazil is steadily increasing the integration of high-precision actuators across vehicle platforms. ADAS applications, including electronic braking assistance, adaptive cruise control, and automated parking, rely on accurate actuator response to ensure safety and functional reliability. This trend is reflected in new model introductions, such as Renault’s launch of the Kwid E-Tech EV in Brazil in 2025, which featured 11 Level-1 ADAS functions alongside an electric powertrain designed for urban mobility. As such technologies become more common in affordable vehicles, actuator demand continues to increase across the market.

Expansion of Automotive Exports

Brazil’s automotive export activity continues to support higher vehicle production volumes and sustained demand for automotive actuators, as export-oriented models typically require advanced safety, comfort, and electronic systems that increase actuator usage per unit. This trend is reflected in Brazil’s strong export performance, with Anfavea reporting total vehicle exports of 398,500 units in 2024. Such export volumes encourage manufacturers to maintain consistent output and compliance with international standards. As a result, actuator suppliers benefit from stable, long-term demand driven by Brazil’s expanding role in global automotive supply chains.

Growing Demand for Hydraulic Actuators in Heavy-Duty Applications

The Brazil automotive actuators market is supported by the growing demand for hydraulic actuators in applications requiring high force, durability, and load-handling capability. Hydraulic actuators are widely used in braking systems, suspension, and commercial vehicle operations where reliability under demanding conditions is critical. This demand trend is reflected in the Brazil automotive hydraulic actuators market, which was valued at USD 46.93 million in 2025 and is projected to reach USD 63.52 million by 2034 as per the IMARC Group. The steady expansion highlights continued adoption across commercial vehicles, construction-related transport, and heavy-duty segments, supporting overall actuator market growth in Brazil.

Market Restraints:

What Challenges the Brazil Automotive Actuators Market is Facing?

High Development and Manufacturing Cost Barriers

The development and manufacturing of advanced automotive actuators require significant investment in research and development (R&D), which raises entry barriers for market participants. High costs associated with advanced materials, precision manufacturing processes, and complex electronic integration increase overall production expenses, limiting pricing flexibility and affecting competitiveness, particularly for small and mid-sized manufacturers operating within the market.

Supply Chain Vulnerabilities and Import Dependencies

Brazil’s automotive actuators market faces notable challenges arising from reliance on imported components and raw materials. Limited local production of specialized actuator parts exposes manufacturers to global supply disruptions, exchange rate volatility, and changes in import tariffs. These factors increase cost uncertainty, complicate production planning, and place pressure on margins across the automotive actuator supply chain.

Economic Volatility Impacting Automotive Industry Investment

Macroeconomic uncertainties, including interest rate volatility, inflationary pressures, and currency depreciation, create a challenging environment for investments within Brazil’s automotive sector. Economic instability influences consumer purchasing capacity and delays manufacturer expansion decisions. These conditions can reduce vehicle production levels, thereby moderating demand for automotive actuators during periods of constrained economic activity.

Competitive Landscape:

The Brazil automotive actuators market exhibits moderate competitive intensity characterized by the presence of multinational tier-one suppliers competing alongside regional manufacturers across diverse product categories. Market dynamics reflect strategic positioning, ranging from premium innovation-driven offerings emphasizing advanced performance characteristics to value-oriented products targeting cost-conscious original equipment producers. Competition is increasingly shaped by technological capabilities in electrical actuator development, manufacturing efficiency, local production presence, and strategic partnerships with vehicle manufacturers. The competitive landscape is evolving as suppliers invest in R&D facilities within Brazil to address the growing demand for specialized actuators supporting EV platforms and advanced driver assistance system integration.

Brazil Automotive Actuators Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Actuator Types Covered | Electrical Actuators, Hydraulic Actuators, Pneumatic Actuators |

| Vehicle Types Covered | Passenger Car, Commercial Vehicle |

| Application Types Covered | Throttle Actuator, Seat Adjustment Actuator, Brake Actuator, Closure Actuator, Others |

| Regions Covered | Southeast, South, Northeast, North, Central-West |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Brazil automotive actuators market size was valued at USD 543.75 Million in 2025.

The Brazil automotive actuators market is expected to grow at a compound annual growth rate of 5.00% from 2026-2034 to reach USD 843.53 Million by 2034.

Electrical actuators dominate the market with a 52% market share in 2025, driven by their energy efficiency, lower noise emissions, compact designs, and growing compatibility with electric and hybrid vehicle platforms expanding across Brazil.

Key factors driving the Brazil automotive actuators market include the rising domestic vehicle production across passenger and commercial segments. In 2024, Brazil produced 2.55 million vehicles and sold 2.64 million units, driving higher actuator demand across braking, seating, transmission, and comfort systems as localization and output expand.

Major challenges include high development and manufacturing costs, supply chain vulnerabilities and import dependencies, economic volatility affecting automotive sector investments, limited local manufacturing capabilities for specialized components, and competitive pressures from global suppliers.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)