Brazil Automotive Hydraulic Actuators Market Size, Share, Trends and Forecast by Vehicle Type, Application Type, and Region, 2026-2034

Brazil Automotive Hydraulic Actuators Market Summary:

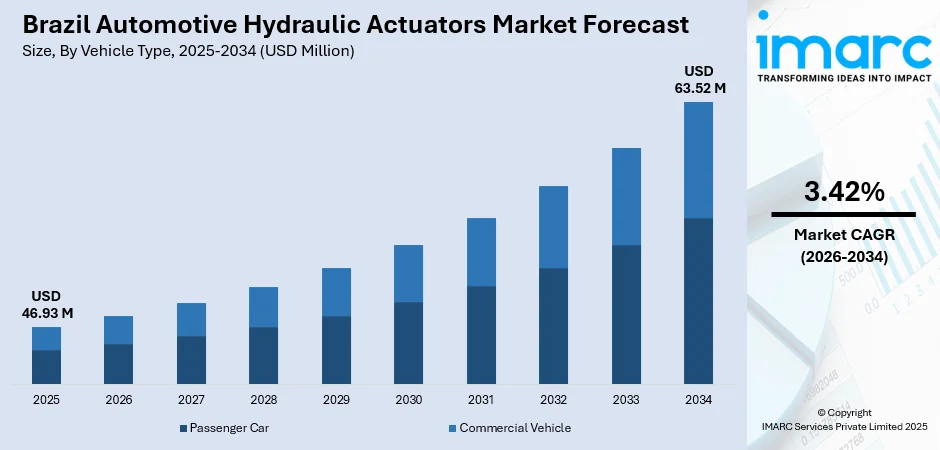

The Brazil automotive hydraulic actuators market size was valued at USD 46.93 Million in 2025 and is projected to reach USD 63.52 Million by 2034, growing at a compound annual growth rate of 3.42% from 2026-2034.

The Brazil automotive hydraulic actuators market is advancing steadily, as automotive manufacturers prioritize enhanced vehicle safety, precision control, and operational efficiency across diverse applications. Rising vehicle production volumes, stringent government safety regulations mandating advanced braking and stability systems, and growing consumer demand for comfortable driving experiences are strengthening market adoption.

Key Takeaways and Insights:

- By Vehicle Type: Passenger car dominates the market with a share of 67.3% in 2025, driven by Brazil's robust passenger vehicle production volumes, mandatory safety system implementations, and growing consumer preference for vehicles equipped with advanced comfort and braking features.

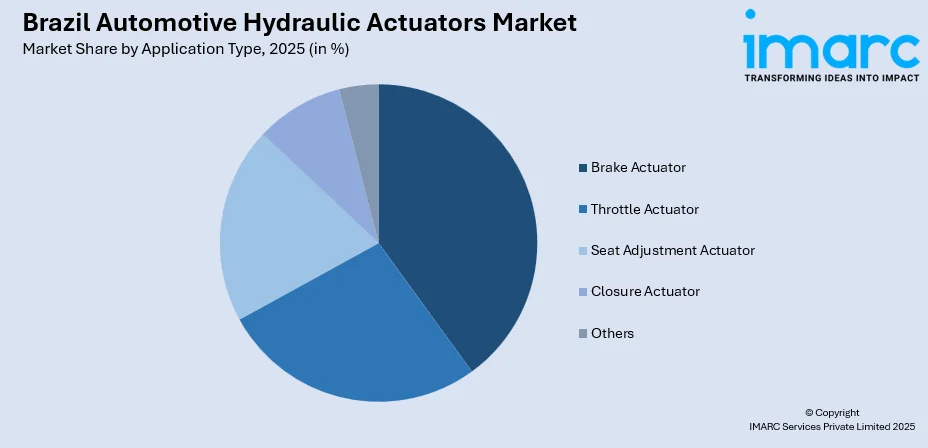

- By Application Type: Brake actuator leads the market with a share of 40.8% in 2025, owing to regulatory mandates requiring anti-lock braking systems and electronic stability control across all new vehicles, ensuring critical safety compliance and enhanced stopping performance.

- By Region: Southeast represents the largest segment with a market share of 54.8% in 2025, supported by the concentration of major automotive manufacturing facilities in São Paulo and surrounding industrial zones, established supply chain networks, and proximity to key automotive original equipment manufacturer (OEM) production centers.

- Key Players: The Brazil automotive hydraulic actuators market exhibits moderate competitive intensity, with multinational automotive component suppliers competing alongside regional manufacturers, focusing on technological innovations, supply chain optimization, and strategic partnerships to strengthen market positioning.

To get more information on this market Request Sample

The Brazil automotive hydraulic actuators market is experiencing transformational growth, as vehicle electrification trends and safety mandates reshape demand patterns across segments. Brazil vehicle production totaled 2.55 Million units in 2024, with the country reclaiming its position as the world's eighth-largest vehicle producer, reflecting a 9.7% annual increase that contributed to expanded automotive component demand. Government programs supporting automotive modernization, including the Mover initiative providing tax incentives for decarbonization investments, are catalyzing manufacturing upgrades that incorporate advanced hydraulic actuation technologies. Technological innovations in hydraulic actuation systems, increasing integration with advanced driver assistance features, and substantial investments in automotive manufacturing infrastructure are reshaping the competitive landscape, positioning Brazil as a key hub for hydraulic actuator deployment across Latin America and supporting sustained market expansion.

Brazil Automotive Hydraulic Actuators Market Trends:

Rising Integration of Safety-Critical Hydraulic Systems

The Brazil automotive hydraulic actuators market is witnessing accelerated integration of safety-critical hydraulic systems as regulatory requirements intensify across vehicle categories. Brazil mandated electronic stability control (ESC) and autonomous emergency braking (AEB) on all new vehicles, starting in 2024, creating substantial market opportunities for brake system suppliers. Manufacturers are developing advanced hydraulic actuators that seamlessly integrate with electronic stability programs and autonomous emergency braking functions, ensuring compliance while enhancing vehicle safety profiles. This regulatory-driven adoption is expanding hydraulic actuator installations across passenger and commercial vehicle platforms.

Commercial Vehicle Sector Recovery

The commercial vehicle segment is experiencing robust recovery following regulatory transitions, generating renewed demand for heavy-duty hydraulic actuation solutions. Brazil's commercial vehicle production in 2024 witnessed a strong recovery to 169,001 units in total, representing an increase of 39.5% compared with 2023. This production surge directly translates into elevated requirements for high-performance hydraulic brake actuators, clutch systems, and power steering components designed for demanding commercial applications, supporting Brazil automotive hydraulic actuators market growth.

Technological Advancements in Electro-Hydraulic Solutions

Automotive manufacturers are increasingly adopting electro-hydraulic actuation systems that combine hydraulic reliability with electronic precision control capabilities. These hybrid solutions offer enhanced responsiveness, improved energy efficiency, and compatibility with advanced driver assistance platforms. In March 2024, Stellantis, the sales leader in Brazil and South America, announced a €5.6 Billion investment initiative for South America, marking the largest in the region's automotive history. The funding would facilitate the introduction of over 40 new products during this timeframe, along with the advancement of new bio-hybrid technologies, groundbreaking decarbonization technologies throughout the automotive supply chain, and key new business prospects.

Market Outlook 2026-2034:

The Brazil automotive hydraulic actuators market is positioned for sustained growth, driven by favorable macroeconomic conditions and strategic industry investments. Continued government support for automotive manufacturing modernization, expanding production capacities, and increasing adoption of safety-mandated hydraulic systems will sustain market momentum. The market generated a revenue of USD 46.93 Million in 2025 and is projected to reach a revenue of USD 63.52 Million by 2034, growing at a compound annual growth rate of 3.42% from 2026-2034. The integration of hydraulic actuators with electronic control architectures and growing aftermarket replacement demand further reinforce positive revenue trajectories.

Brazil Automotive Hydraulic Actuators Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Vehicle Type | Passenger Car | 67.3% |

| Application Type | Brake Actuator | 40.8% |

| Region | Southeast | 54.8% |

Vehicle Type Insights:

- Passenger Car

- Commercial Vehicle

Passenger car dominates with a market share of 67.3% of the total Brazil automotive hydraulic actuators market in 2025.

The passenger car segment maintains commanding market leadership owing to Brazil's position as Latin America's largest passenger vehicle market and sustained production growth trajectories. Manufacturers prioritize hydraulic actuator integration for braking, seat adjustment, and closure applications to meet consumer expectations for comfort and safety. This robust consumer demand necessitates continued investments in hydraulic actuation components across passenger vehicle platforms, ensuring segment dominance throughout the forecast period.

Rising urbanization and improving living standards are increasing the preference for personal vehicles, directly supporting actuator demand. As per macrotrends, in Brazil, the urban population in 2023 stood at 185,356,223. Automakers are also upgrading vehicle designs with advanced hydraulic systems for smoother steering response and better braking efficiency. In addition, replacement and maintenance demand is higher for passenger cars due to daily usage, creating a steady aftermarket. Compared with trucks or buses, passenger cars require more interior comfort mechanisms powered by actuators. This combination of higher volume production, feature upgrades, and strong aftersales activity explains the dominance of passenger cars in the Brazil automotive hydraulic actuators market.

Application Type Insights:

Access the comprehensive market breakdown Request Sample

- Throttle Actuator

- Seat Adjustment Actuator

- Brake Actuator

- Closure Actuator

- Others

Brake actuators lead with a share of 40.8% of the total Brazil automotive hydraulic actuators market in 2025.

Brake actuators dominate the market because braking is a critical safety function installed in every vehicle. All passenger and commercial vehicles depend on hydraulic braking systems, ensuring consistent demand. Increasing focus on road safety, better braking performance, and regulatory pressure for safer vehicles strengthens the need for reliable and durable brake actuators across different vehicle categories.

Rapid urbanization and rising traffic congestion increase accident risk, pushing manufacturers and consumers to prioritize advanced braking systems. Automakers continuously improve braking response, stability control, and stopping efficiency, which further raises demand for high-quality brake actuators. The large number of vehicles on the road also creates strong replacement demand for brake components in the aftermarket. Moreover, fleet operators invest heavily in brake maintenance to reduce accident liability and downtime. Combined with innovations in braking technology, these factors secure brake actuators’ leading share in Brazil’s automotive hydraulic actuators industry.

Regional Insights:

- Southeast

- South

- Northeast

- North

- Central-West

Southeast exhibits a clear dominance with a 54.8% share of the total Brazil automotive hydraulic actuators market in 2025.

The Southeast maintains decisive market leadership owing to its concentration of automotive manufacturing infrastructure, established supplier networks, and proximity to major consumer markets. Major automotive OEMs operate production facilities throughout the São Paulo metropolitan region, creating substantial demand for hydraulic actuator components. The region's well-developed transportation infrastructure facilitates efficient supply chain operations supporting automotive production requirements.

The Southeast’s dominance is further strengthened by the presence of major automotive clusters and aftermarket service networks. High vehicle ownership in metropolitan areas increases demand for maintenance and replacement of hydraulic components. In addition, proximity to ports and highways allows faster sourcing of raw materials and distribution of finished products. Technology adoption is also higher in this region, with manufacturers focusing on performance upgrades in braking and steering systems. Government incentives and private investments continue to attract automotive-related projects, reinforcing Southeast Brazil’s leadership in the hydraulic actuators market.

Market Dynamics:

Growth Drivers:

Why is the Brazil Automotive Hydraulic Actuators Market Growing?

Expanding Vehicle Production Volumes Supporting Component Demand

Brazil's automotive manufacturing sector is experiencing revitalized growth that directly supports hydraulic actuator demand across vehicle categories. The country's position as Latin America's largest vehicle producer creates substantial requirements for braking, steering, and comfort-related hydraulic components. In total, a historic USD 22 Billion in planned investments was revealed in the industry in 2024, with funding taking place until 2032. These investments encompass manufacturing facility upgrades, new production lines, and technology modernization initiatives that incorporate advanced hydraulic actuation systems. The expansion of domestic production capacity ensures sustained demand for hydraulic actuators as automakers increase output volumes to serve both domestic and export markets.

Stringent Safety Regulations Mandating Advanced Braking Systems

Government regulatory frameworks requiring enhanced vehicle safety features are driving accelerated adoption of hydraulic actuators in braking applications. Mandatory implementation of anti-lock braking systems, electronic stability control, and autonomous emergency braking across new vehicle registrations creates non-discretionary demand for hydraulic brake actuators. These regulatory requirements align Brazil with global safety standards, compelling automakers to integrate compliant hydraulic actuation systems across all production platforms. The phased implementation of safety mandates ensures continued market expansion as manufacturers update existing models and develop new vehicles incorporating required safety technologies.

Major Automaker Investments in Brazilian Manufacturing

Major automaker investments in Brazilian manufacturing are strongly driving the automotive hydraulic actuators market by increasing local vehicle production and component demand. In Sao Paulo, the Chinese firm GWM purchased the Mercedes-Benz facility in Iracemápolis, intending to invest 2 Billion dollars by 2032. As global and domestic manufacturers expand or modernize plants, output of passenger cars and commercial vehicles rises, directly boosting the need for hydraulic systems used in braking, steering, and transmission functions. New factories adopt advanced production technologies, which require high-performance actuators to meet quality and safety standards. Investments also encourage localization of component sourcing, supporting domestic actuator suppliers and reducing reliance on imports. Tier-1 suppliers expand capacities to serve automakers closely, improving supply reliability and pricing competitiveness. In addition, manufacturing upgrades support the launch of new vehicle models with improved safety and comfort features, increasing actuator usage per vehicle. Overall, sustained capital inflows into vehicle manufacturing strengthen supply chains and accelerate market growth for hydraulic actuators across Brazil.

Market Restraints:

What Challenges the Brazil Automotive Hydraulic Actuators Market is Facing?

Transition Towards Electromechanical Alternatives

The automotive industry's gradual transition towards electromechanical actuation systems presents competitive challenges for hydraulic components. Electric actuators offer advantages, including reduced weight, simplified installation, and elimination of fluid leakage concerns that appeal to manufacturers developing next-generation vehicle platforms. This technological shift may constrain hydraulic actuator growth opportunities in specific applications where electric alternatives demonstrate superior performance characteristics.

Import Dependency and Supply Chain Vulnerabilities

Brazil's reliance on imported hydraulic actuator components and specialized materials creates supply chain vulnerabilities affecting market stability. Currency fluctuations, trade policy uncertainties, and logistics disruptions can impact component availability and pricing. Limited domestic manufacturing capabilities for certain high-precision hydraulic components necessitate continued import dependence, exposing the market to external supply disruptions.

Maintenance and Operational Complexity

Hydraulic actuation systems require specialized maintenance procedures and fluid management practices that increase total ownership costs. The potential for hydraulic fluid leakage, contamination risks, and the need for trained service technicians present operational challenges. These factors may influence automaker decisions when evaluating actuation technologies for new vehicle programs.

Competitive Landscape:

The Brazil automotive hydraulic actuators market features a moderately consolidated competitive structure with multinational Tier-1 suppliers maintaining significant market presence alongside specialized regional manufacturers. Leading global players leverage extensive research and development (R&D) capabilities and comprehensive product portfolios, spanning braking, steering, and auxiliary hydraulic applications. Competition centers on technological innovations, manufacturing quality, supply chain reliability, and cost competitiveness as automakers evaluate component suppliers. Strategic partnerships between international suppliers and domestic distributors facilitate market access while localization initiatives aim to reduce import dependencies. Emerging trend of employing integrated electro-hydraulic solutions is prompting suppliers to expand product development investments addressing evolving vehicle architecture requirements.

Brazil Automotive Hydraulic Actuators Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Vehicle Types Covered | Passenger Car, Commercial Vehicle |

| Application Types Covered | Throttle Actuator, Seat Adjustment Actuator, Brake Actuator, Closure Actuator, Others |

| Regions Covered | Southeast, South, Northeast, North, Central-West |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Brazil automotive hydraulic actuators market size was valued at USD 46.93 Million in 2025.

The Brazil automotive hydraulic actuators market is expected to grow at a compound annual growth rate of 3.42% from 2026-2034 to reach USD 63.52 Million by 2034.

Passenger car held the largest revenue share of 67.3%, driven by mandatory safety regulations requiring ABS implementation across all new vehicles, ensuring reliable braking performance and regulatory compliance throughout Brazil's automotive market.

Key factors driving the Brazil automotive hydraulic actuators market include expanding vehicle production volumes, stringent government safety regulations mandating advanced braking systems, major automaker investment programs, growing commercial vehicle sector recovery, and increasing consumer demand for enhanced comfort and safety features.

Major challenges include competitive pressure from electromechanical actuation alternatives, import dependency creating supply chain vulnerabilities, maintenance complexity requirements, currency fluctuation impacts on component costs, and the need for continued technological innovation to address evolving vehicle architecture requirements.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)