Brazil Bancassurance Market Size, Share, Trends and Forecast by Product Type, Model Type, and Region, 2026-2034

Brazil Bancassurance Market Summary:

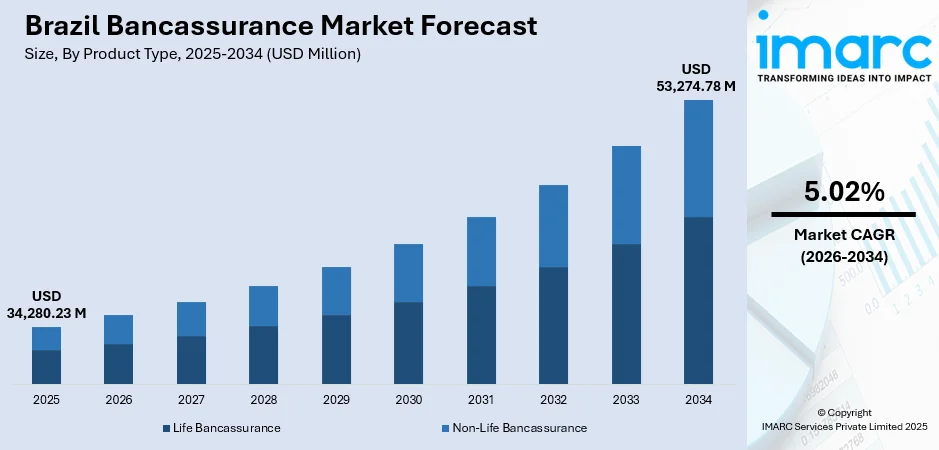

The Brazil bancassurance market size was valued at USD 34,280.23 Million in 2025 and is projected to reach USD 53,274.78 Million by 2034, growing at a compound annual growth rate of 5.02% from 2026-2034.

The market is driven by dominant bank-owned insurance groups that leverage extensive branch networks and captive insurers to scale cross-selling and create stable revenue streams. Large Brazilian banking conglomerates maintain vertically integrated structures enabling direct control over product design, pricing, and claims workflows. Rapid digitalization, open finance frameworks, and strategic partnerships with fintechs are lowering distribution costs while enabling microinsurance offerings and personalized products across mobile platforms and correspondent banking networks, further augmenting the Brazil bancassurance market share.

Key Takeaways and Insights:

- By Product Type: Life Bancassurance dominates the market with a share of 60% in 2025, driven by the long-term income protection nature of life products and their suitability for bank cross-selling to customers actively managing savings.

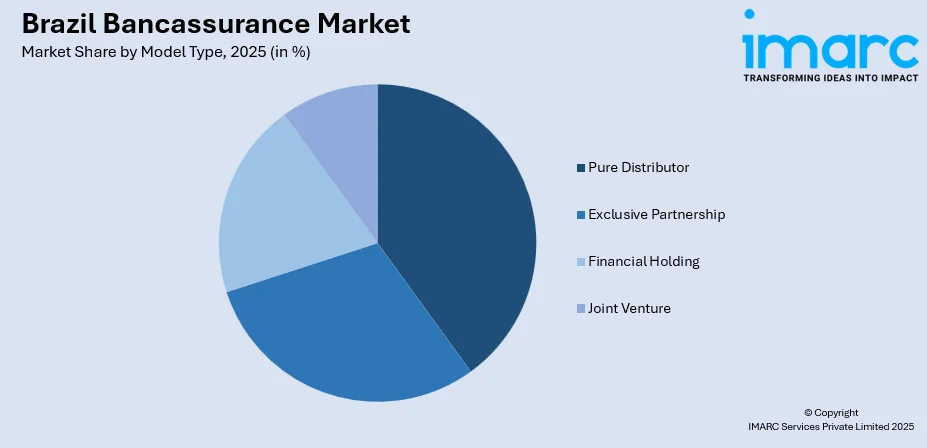

- By Model Type: Pure Distributor leads the market with a share of 39% in 2025, reflecting the prevalence of exclusive distribution agreements where banks act as primary sales channels for partner insurance companies.

- Key Players: The Brazil bancassurance market exhibits moderate to high competitive intensity, characterized by large banking conglomerates competing alongside multinational insurers and emerging insurtech startups across multiple product segments and customer tiers.

To get more information on this market Request Sample

The Brazilian bancassurance sector benefits from a regulatory environment that permits banks to own full equity stakes in insurers, facilitating deeper integration between banking and insurance operations. The four largest banking groups maintain extensive distribution networks spanning thousands of branches nationwide, enabling efficient cross-selling of insurance products to established customer bases. Digital transformation initiatives are reshaping customer acquisition and retention strategies through API ecosystems, AI-enhanced underwriting, and mobile-first product offerings that expand reach to digitally native and underbanked population segments.

Brazil Bancassurance Market Trends:

Integrated Bank-Owned Insurance Models Driving Cross-Selling Efficiency

Large Brazilian banking groups have pursued fully integrated insurance models, combining extensive branch networks, captive insurers, and shared customer databases to create efficient cross-selling platforms. These vertically integrated structures give banks direct control over product design, pricing, and claims workflows, allowing rapid product rollouts and improved margin capture across life, health, and property lines. Branch personnel and dedicated bancassurance teams receive support from centralized underwriting units and standardized suitability frameworks that enhance persistency. Brazilian insurers reached record revenues of BRL 207.6 Billion in property and personal insurance in 2024, reflecting the strength of bank-insurance integration.

Digital Distribution and Open Insurance API Adoption

Digital transformation and regulatory advances in open banking have reshaped how bancassurance products are discovered, priced, and purchased. Banks and insurers are deploying API ecosystems, data-driven underwriting, and AI-enhanced recommendation engines to deliver contextually relevant offers within mobile apps and internet banking platforms. Brazil's Open Insurance framework enables data portability and fosters customer-centric innovations, while simplified e-underwriting and instant e-signature flows enable near real-time issuance of term, travel, and microinsurance products. Pix processed over 6 Billion transactions monthly as of December 2024, demonstrating the digital infrastructure supporting embedded financial services.

Regulatory Sandbox Fostering Insurtech Innovation

SUSEP’s regulatory sandbox has become a practical launchpad for fresh ideas in the insurance sector, opening space for flexible experimentation and faster product development. It encourages newer players to test digital models that improve underwriting accuracy, strengthen risk evaluation, and simplify internal processes. These firms are steadily reshaping long-standing practices by introducing AI-driven tools that help insurers operate with greater precision. The resulting environment supports stronger partnerships, fuels creativity, and gives the bancassurance segment a steady flow of new solutions.

Market Outlook 2026-2034:

The Brazil bancassurance market is positioned for sustained expansion driven by ongoing digital transformation, financial inclusion initiatives, and the increasing sophistication of bank-insurance partnerships. The integration of open finance frameworks with bancassurance distribution channels will enable more personalized product offerings and streamlined customer experiences. The market generated a revenue of USD 34,280.23 Million in 2025 and is projected to reach a revenue of USD 53,274.78 Million by 2034, growing at a compound annual growth rate of 5.02% from 2026-2034. Growing awareness of financial protection among the expanding middle class, combined with regulatory modernization through the new Insurance Contract Law, will continue supporting market expansion across both life and non-life product categories.

Brazil Bancassurance Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Product Type | Life Bancassurance | 60% |

| Model Type | Pure Distributor | 39% |

Product Type Insights:

- Life Bancassurance

- Non-Life Bancassurance

Life bancassurance dominates with a market share of 60% of the total Brazil bancassurance market in 2025.

The life bancassurance segment maintains its leading position due to the inherent compatibility between life insurance products and bank distribution channels. Life insurance and pension products align naturally with banking relationships, as customers actively managing savings and investments are receptive to long-term income protection offerings. The major banking groups dominate sales of popular pension products including VGBL and PGBL policies. Bank branch personnel leverage existing customer relationships to introduce these vital financial planning products, while centralized underwriting units ensure suitability and reduce mis-selling risks.

Life bancassurance benefits from tax-efficient pension wrappers and rising longevity awareness among Brazilian consumers. The segment captures roughly three-quarters of total life premium inflows through bank channels, reflecting the effectiveness of cross-selling strategies and embedded product approaches. Corporate bancassurance channels covering payroll-deductible solutions and mortgage-linked protections further strengthen life product penetration through contractual integration with banking services. The expansion of formal employment and rising health-plan beneficiaries, creates additional demand for life and protection products distributed through banking relationships.

Model Type Insights:

Access the Comprehensive Market Breakdown Request Sample

- Pure Distributor

- Exclusive Partnership

- Financial Holding

- Joint Venture

Pure distributor leads the market with a share of 39% of the total Brazil bancassurance market in 2025.

The pure distributor model maintains its dominant position in Brazil's bancassurance landscape, characterized by banks acting as primary distribution channels for insurance products without owning equity stakes in the insurers. This model enables banks to leverage their extensive branch networks and customer relationships while partnering with specialized insurance companies that bring underwriting expertise and product development capabilities.

The pure distributor model offers flexibility for both banks and insurers, allowing insurance companies to access established customer bases without building proprietary distribution infrastructure. Recent exclusive distribution agreements demonstrate the model's continued relevance, as evidenced by CNP Seguradora's 20-year partnership with Banco de Brasília for consortium and capitalization product distribution to 7.8 million customers. This arrangement enables CNP Assurances to expand its Brazilian presence through the CNP Seguradora brand while BRB benefits from enhanced product offerings. The model supports variable commission structures and cost-sharing arrangements that align incentives between distribution partners.

Regional Insights:

- Southeast

- South

- Northeast

- North

- Central-West

The Southeast region dominates the Brazil bancassurance market, driven by the concentration of corporate headquarters, financial institutions, and higher median incomes in major metropolitan areas. This region hosts the bulk of bancassurance volumes and exhibits early adoption of Open Insurance APIs, reinforcing digital channel success and premium product penetration.

The South region represents a significant bancassurance market supported by strong agricultural activity, cooperative banking traditions, and relatively higher income levels. The region benefits from well-established bank branch networks and demonstrates strong demand for life insurance, pension products, and rural coverage solutions distributed through banking channels.

The Northeast region presents substantial growth opportunities for bancassurance providers seeking to expand financial inclusion initiatives. Rising formal employment, government transfer programs, and expanding correspondent banking networks are driving increased insurance awareness and demand for affordable protection products among previously underserved population segments.

The North region exhibits emerging bancassurance potential characterized by expanding banking infrastructure and growing demand for microinsurance products. Geographic challenges and lower population density have historically limited traditional distribution, creating opportunities for digital bancassurance solutions and mobile-first insurance offerings targeting remote communities.

The Central-West region demonstrates growing bancassurance activity driven by agribusiness expansion and increasing urbanization in key economic centers. Strong agricultural sector performance supports demand for rural insurance products, while expanding banking presence in developing urban areas creates opportunities for life and property coverage distribution.

Market Dynamics:

Growth Drivers:

Why is the Brazil Bancassurance Market Growing?

Vertically Integrated Bank-Insurance Structures Enabling Scale

Large Brazilian banking groups have established fully integrated insurance models that combine extensive branch networks, captive insurers, and shared customer databases to create highly efficient cross-selling platforms. These vertically integrated structures provide banks with direct control over product design, pricing, and claims workflows, facilitating rapid product rollouts and improved margin capture. Insurance revenues contribute significantly to bank profitability, providing stable income streams that complement traditional lending activities. The alignment between banking operations and insurance subsidiaries supports portfolio diversification, strengthens customer lifetime value, and enables differentiated segmentation strategies across premium and mass-market customer tiers.

Rising Middle Class and Financial Literacy Driving Protection Demand

Brazil's expanding middle class and improving financial literacy are creating sustained demand for bancassurance products as consumers increasingly recognize the value of insurance for financial security. Formal employment reached 1.5 Million in 2025, lifting disposable incomes and enabling households to purchase multi-line coverage. Higher disposable incomes allow consumers to allocate resources toward life, health, and property insurance products conveniently offered through their banking relationships. Corporate uptake of group coverage as an employee retention lever in tight labor markets further drives enrollment growth.

Digital Transformation and Open Finance Frameworks

Digital transformation and regulatory advances in open finance have fundamentally reshaped bancassurance product distribution, discovery, and purchase processes. Banks and insurers are deploying API ecosystems, data-driven underwriting, and AI-enhanced recommendation engines to deliver contextually relevant offers within mobile apps and internet banking platforms. Brazil's Open Insurance framework mandates data portability, enabling new entrants to personalize pricing and reduce acquisition costs. Simplified e-underwriting and instant e-signature flows enable near real-time issuance of term, travel, and microinsurance products, expanding reach to digitally native and underbanked population segments while lowering unit distribution costs across channels.

Market Restraints:

What Challenges the Brazil Bancassurance Market is Facing?

Economic Volatility and Currency Fluctuations

Brazil’s insurance market carries ongoing pressure from unstable economic conditions that influence pricing decisions, operating budgets, and claims-related outflows. Currency swings disrupt planning cycles and complicate efforts to maintain predictable costs, especially for products tied to external inputs. These shifts weaken purchasing power and force bancassurance providers to continually adjust offerings to preserve affordability, retain customers, and sustain overall portfolio performance in an unpredictable financial environment.

Legacy System Integration Challenges

Many traditional insurers continue operating with inefficient and siloed legacy systems that are incompatible with modern insurtech solutions. Integrating new technologies with existing infrastructure proves complex, expensive, and time-consuming, slowing digital transformation efforts essential for competitive bancassurance operations. The need to connect multiple data systems, comply with open finance requirements, and deliver seamless customer experiences across channels creates ongoing technical and operational challenges.

Regulatory Complexity and Compliance Requirements

Brazil’s evolving insurance regulatory structure places sustained pressure on insurers as they adapt to new legal expectations and procedural rules. Recent changes require updates to contract models, customer communication standards, and internal review protocols. These shifts demand heavier investment in compliance systems, staff training, and governance processes, increasing operational workloads and requiring insurers to continuously refine practices to meet expanding transparency and consumer protection obligations.

Competitive Landscape:

The Brazil bancassurance market exhibits a concentrated competitive structure dominated by large banking conglomerates with integrated insurance operations competing alongside multinational insurers and emerging technology-driven entrants. The top insurers collectively control substantial market share. Competition intensifies through digital transformation investments, strategic partnership agreements, and product innovation targeting underserved customer segments. Industry consolidation trends reflect the push for scale in distribution and technology capabilities, with various insurtech startups driving operational efficiency and product innovation through artificial intelligence and automation solutions.

Brazil Bancassurance Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Life Bancassurance, Non-Life Bancassurance |

| Model Types Covered | Pure Distributor, Exclusive Partnership, Financial Holding, Joint Venture |

| Regions Covered | Southeast, South, Northeast, North, Central-West |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Brazil bancassurance market size was valued at USD 34,280.23 Million in 2025.

The Brazil bancassurance market is expected to grow at a compound annual growth rate of 5.02% from 2026-2034 to reach USD 53,274.78 Million by 2034.

Life bancassurance held the largest share at 60% in 2025, driven by the natural alignment between life insurance and banking relationships, strong pension product demand, and effective cross-selling through extensive branch networks.

Key factors driving the Brazil bancassurance market include vertically integrated bank-insurance structures enabling efficient cross-selling, rising middle-class demand for financial protection, and digital transformation through open finance frameworks.

Major challenges include economic volatility and currency depreciation affecting claims costs, legacy system integration difficulties slowing digital transformation, and regulatory complexity from comprehensive new insurance legislation requiring operational adjustments.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)