Brazil Biogas Market Size, Share, Trends and Forecast by Feedstock, Application, End Use, and Region, 2026-2034

Brazil Biogas Market Summary:

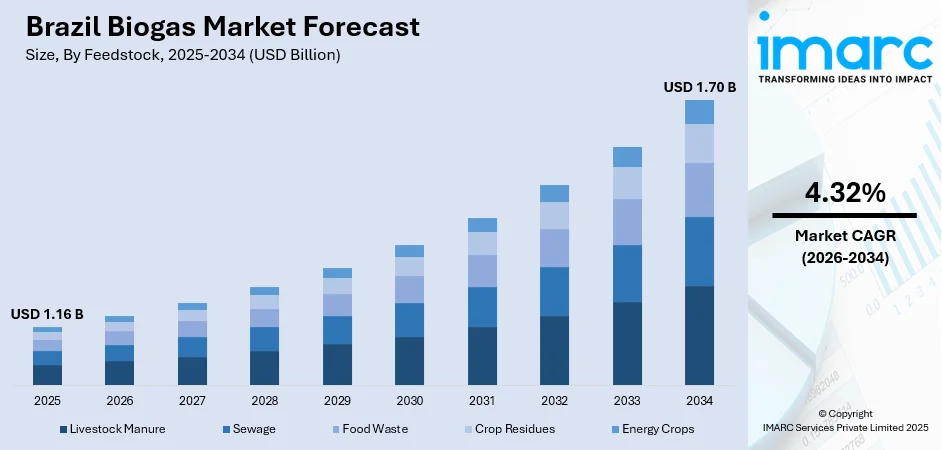

The Brazil biogas market size was valued at USD 1.16 Billion in 2025 and is projected to reach USD 1.70 Billion by 2034, growing at a compound annual growth rate of 4.32% from 2026-2034.

The market is driven by comprehensive regulatory frameworks mandating biomethane blending targets, substantial industrial integration connecting biogas production with established energy value chains, and strategic infrastructure development enabling pipeline injection capabilities. Growing emphasis on circular economy models, agricultural waste monetization, and decarbonization initiatives further accelerates adoption. The integration of biogas production with the country's established agricultural and energy sectors continues expanding the Brazil biogas market share.

Key Takeaways and Insights:

- By Feedstock: Livestock manure dominates the market with a share of 43% in 2025, driven by Brazil's position as a leading global beef and livestock producer generating extensive organic waste streams ideal for anaerobic digestion processes and biofertilizer co-production.

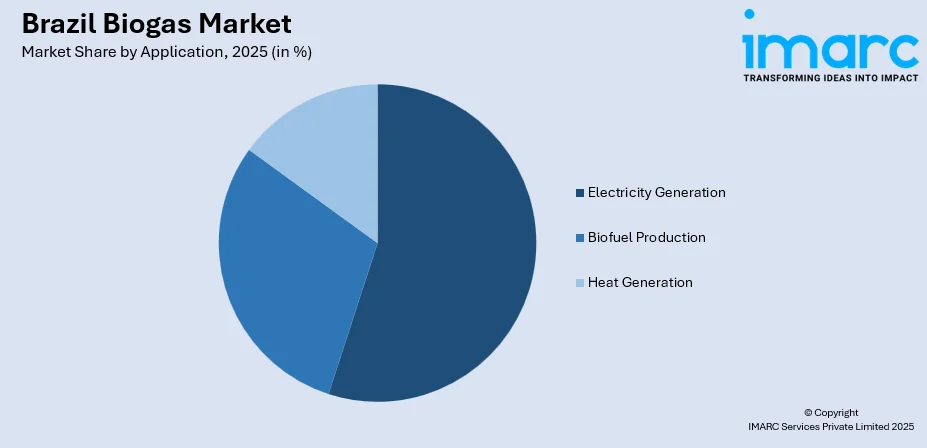

- By Application: Electricity generation leads the market with a share of 55% in 2025, owing to favorable grid connection policies, growing industrial power demand, and integration with existing energy infrastructure enabling reliable baseload renewable electricity supply nationwide.

- By End Use: Industrial represents the largest segment with a market share of 65% in 2025, propelled by major corporate procurement programs, decarbonization mandates, and strategic initiatives to replace fossil fuel consumption with renewable biomethane across manufacturing operations.

- Key Players: The market compete by strengthening feedstock supply chains, advancing digestion technologies, and expanding biomethane upgrading capabilities. Companies focus on integrated project development, long term partnerships with agricultural producers, and scalable solutions that enhance efficiency while supporting the country’s broader renewable energy and circular economy objectives.

To get more information on this market Request Sample

The Brazil biogas market is experiencing robust expansion driven by the convergence of favorable policy frameworks, abundant feedstock availability, and growing industrial demand for renewable energy alternatives. The country's prominent position in global agricultural production generates substantial organic waste streams from livestock operations, sugarcane processing, and food manufacturing facilities, providing consistent feedstock supplies for biogas production. Recently, a major development in 2025, BP announced plans to develop at least nine biomethane projects in Brazil, leveraging feedstock from its ethanol operations, underscoring strong private‑sector commitment to biogas/biomethane. Government initiatives promoting decarbonization and emissions reduction have established clear market mechanisms and mandatory blending targets that encourage investment in biogas infrastructure. Industrial sectors are increasingly adopting biomethane as a viable substitute for natural gas, driven by corporate sustainability commitments and circular economy objectives. The integration with existing natural gas distribution networks enables cost-effective market access while agricultural producers benefit from additional revenue streams through waste monetization and biofertilizer production.

Brazil Biogas Market Trends:

Biomethane Integration with Natural Gas Networks

The market is witnessing accelerated integration of biomethane into existing natural gas distribution infrastructure, enabling seamless energy delivery across industrial and commercial sectors. Pipeline injection capabilities are expanding as quality standards and certification mechanisms mature, facilitating broader market access for biogas producers. For example, in November 2025, Comgás, Brazil’s largest piped‑gas distributor, launched a second public call for biomethane supply, aiming to double its renewable‑gas purchases after the first round secured around 200,000 m³/day from certified producers. This integration supports energy security objectives while reducing dependency on imported fossil fuels. Distribution companies are establishing dedicated biomethane procurement programs, creating stable offtake agreements that encourage production capacity investments and technology upgrades across the value chain.

Agricultural Sector Circular Economy Adoption

Agricultural enterprises are increasingly embracing circular economy models that transform waste management challenges into revenue-generating opportunities. Livestock operations, sugarcane mills, and food processing facilities are implementing integrated biogas systems that convert organic residues into renewable energy while producing high-quality biofertilizers. For example, a recent joint project by Geo Biogás & Tech and UISA will build a biogas plant in Mato Grosso that utilises sugarcane residues and agro‑industrial waste to generate electricity, biomethane, and biofertiliser, delivering energy for tens of thousands of people and closing the waste‑to‑resource loop. This approach reduces synthetic fertilizer dependency, lowers operational costs, and addresses environmental compliance requirements. The agricultural sector's adoption of biogas technology strengthens rural economies by diversifying farm income sources and creating employment opportunities in equipment installation, maintenance, and operations management.

Technology Advancement in Upgrading Systems

Sophisticated gas purification and upgrading technologies are gaining prominence as producers seek to convert raw biogas into pipeline-quality biomethane meeting stringent specifications. Advanced membrane separation, pressure swing adsorption, and water scrubbing systems are being deployed to achieve higher methane concentrations and remove impurities. A 2025 study reports over 800 biogas plants in Brazil (17 producing biomethane, 7 regulator‑approved) and notes that upgrading technology, with membrane separation at large sites and PSA at smaller ones, is closely linked to plant scale and gas composition. These technological improvements enable broader market applications including vehicle fuel production and industrial heating applications. Innovation in monitoring systems and process automation enhances operational efficiency while reducing maintenance requirements and improving overall plant economics.

Market Outlook 2026-2034:

The Brazil biogas market is positioned for sustained revenue growth throughout the forecast period, supported by strengthening regulatory frameworks, expanding industrial adoption, and continuous infrastructure development. Revenue generation will accelerate as mandatory biomethane blending requirements take effect and corporate decarbonization initiatives drive procurement expansion. Technological advancements in upgrading systems and production efficiency improvements will enhance project economics, attracting increased investment flows. The market revenue trajectory reflects growing recognition of biogas as an essential component of Brazil's renewable energy portfolio and decarbonization strategy. The market generated a revenue of USD 1.16 Billion in 2025 and is projected to reach a revenue of USD 1.70 Billion by 2034, growing at a compound annual growth rate of 4.32% from 2026-2034.

Brazil Biogas Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Feedstock | Livestock Manure | 43% |

| Application | Electricity Generation | 55% |

| End Use | Industrial | 65% |

Feedstock Insights:

- Livestock Manure

- Sewage

- Food Waste

- Crop Residues

- Energy Crops

The livestock manure dominates with a market share of 43% of the total Brazil biogas market in 2025.

Livestock manure represents the dominant feedstock segment, capitalizing on Brazil's extensive cattle ranching and pork production operations that generate abundant organic waste suitable for anaerobic digestion. The country's position as a leading global meat exporter ensures consistent feedstock availability throughout the year, supporting stable biogas production volumes. Large-scale livestock operations increasingly view biogas systems as essential waste management infrastructure that addresses environmental compliance requirements while generating renewable energy revenues.

The segment benefits from established waste collection logistics within concentrated animal feeding operations, reducing feedstock transportation costs and improving project economics. Biofertilizer co-products from manure digestion provide additional value streams, replacing expensive synthetic fertilizers and improving soil health. Government programs supporting rural development and agricultural modernization have facilitated technology adoption among livestock producers seeking to diversify income sources and reduce operational costs through energy self-sufficiency initiatives.

Application Insights:

Access the comprehensive market breakdown Request Sample

- Electricity Generation

- Biofuel Production

- Heat Generation

The electricity generation leads with a share of 55% of the total Brazil biogas market in 2025.

Electricity generation commands the largest application share, driven by favorable grid connection policies and growing demand for renewable baseload power across industrial and commercial sectors. Biogas-fired combined heat and power systems provide reliable electricity generation with high-capacity factors, complementing intermittent renewable sources like solar and wind. For example, a 2024 project by GNPW Group together with EVA Energia transformed a large pig‑farming operation in Mato Grosso into a clean‑energy hub: 47 biodigesters convert pig waste into biogas, powering a 2.5 MW facility that meets the farm’s electricity demand, with surplus electricity exported to the grid. The application benefits from established regulatory frameworks governing distributed generation and net metering arrangements that improve project financial viability.

Industrial facilities are increasingly deploying on-site biogas power generation to reduce electricity procurement costs and improve energy security. The application segment benefits from mature technology platforms with proven reliability and well-understood operational requirements. Grid operators value biogas electricity for its dispatchability characteristics, enabling demand response capabilities that support system stability during peak consumption periods while contributing to renewable energy portfolio targets.

End Use Insights:

- Residential

- Commercial

- Industrial

The industrial exhibits a clear dominance with a 65% share of the total Brazil biogas market in 2025.

The industrial segment dominates end-use applications, reflecting substantial demand from manufacturing facilities seeking renewable energy alternatives to reduce carbon footprints and meet sustainability commitments. Major corporations across food processing, beverages, chemicals, and materials sectors are implementing biomethane procurement programs as part of comprehensive decarbonization strategies. Industrial consumers value biomethane's compatibility with existing natural gas equipment, enabling fuel switching without significant capital investments.

Process heat applications in industrial operations represent significant consumption volumes as facilities replace fossil fuel combustion with renewable biomethane. The segment benefits from corporate sustainability reporting requirements that incentivize renewable energy adoption and emissions reduction initiatives. Long-term offtake agreements between industrial consumers and biogas producers provide revenue certainty that supports project financing and capacity expansion investments throughout the value chain.

Regional Insights:

- Southeast

- South

- Northeast

- North

- Central-West

The Southeast region dominates the Brazil biogas market, driven by concentrated industrial activity, established natural gas infrastructure, and proximity to major consumption centers. São Paulo and Minas Gerais host significant livestock operations and food processing facilities providing abundant feedstock while dense pipeline networks enable efficient biomethane distribution to industrial consumers.

The South region represents a significant biogas production hub, capitalizing on intensive pig farming operations and agricultural cooperatives that generate substantial organic waste volumes. Strong cooperative organizational structures facilitate collective investment in biogas infrastructure while established rural electrification networks support distributed power generation applications.

The Northeast region exhibits growing biogas development potential, supported by expanding sugarcane production and livestock operations generating increasing organic waste volumes. Regional development initiatives prioritize renewable energy deployment to address energy access challenges while reducing dependency on electricity imports from other regions.

The North region represents an emerging biogas market with development concentrated around agricultural processing facilities and municipal waste management applications. Limited natural gas infrastructure constrains biomethane distribution options, directing production toward on-site electricity generation and localized thermal applications serving industrial and commercial consumers.

The Central-West region offers substantial growth potential driven by massive cattle ranching operations and expanding agricultural production generating significant organic waste streams. Infrastructure development initiatives are improving connectivity while large-scale livestock facilities increasingly adopt integrated biogas systems addressing environmental compliance requirements and energy cost management.

Market Dynamics:

Growth Drivers:

Why is the Brazil Biogas Market Growing?

Regulatory Framework Strengthening and Policy Support

The market is experiencing unprecedented policy momentum as comprehensive legislative frameworks establish clear market mechanisms, mandatory targets, and structured compliance pathways. National programs mandating biomethane blending in natural gas supplies create guaranteed demand that encourages production capacity investments and infrastructure development. In September 2025, Brazil regulated Law No. 14,993/2024 through Decree No. 12,614/2025, creating a program requiring natural gas suppliers to meet 2026 greenhouse‑gas targets via biomethane supply or tradeable certificates. Certificate-based compliance systems enable flexible market participation while ensuring emission reduction objectives are achieved. Regulatory institutions provide oversight of production standards and commercialization activities, ensuring quality control and market integrity. These policy frameworks align with ambitious climate commitments and international pledges, positioning biogas as a critical component of national decarbonization strategies and renewable energy portfolios.

Agricultural Waste Abundance and Feedstock Availability

Brazil's prominent position as a leading global agricultural producer generates extensive organic waste streams that provide abundant feedstock for biogas production through anaerobic digestion processes. The country's massive livestock operations, sugarcane processing facilities, and food manufacturing industries produce consistent waste volumes suitable for year-round biogas generation. The Brazil agriculture market reached USD 131.0 Billion in 2025 and is projected to grow to USD 175.2 Billion by 2034, reflecting a CAGR of 3.28% during 2026–2034 (IMARC Group), highlighting the expanding scale of agricultural activities and the corresponding potential for feedstock availability. Agricultural producers increasingly recognize opportunities to monetize waste streams while accessing biofertilizer co-products that reduce dependency on expensive synthetic fertilizers. The geographic distribution of agricultural activities across multiple regions ensures feedstock availability nationwide, supporting distributed biogas production that serves local energy demands while reducing transportation costs and logistics complexity.

Industrial Decarbonization and Corporate Sustainability Initiatives

Growing corporate commitments to emissions reduction and sustainability objectives are driving substantial industrial demand for renewable energy alternatives including biomethane. Major corporations across multiple sectors are launching comprehensive procurement programs to secure long-term biomethane supplies as part of decarbonization strategies addressing scope one and two emissions. For instance, in Brazil, Yara International began production of renewable‑based ammonia in December 2024, using biomethane derived from sugarcane waste, demonstrating how industrial value chains are leveraging biomethane to reduce lifecycle emissions. Industrial consumers value biomethane's drop-in compatibility with existing natural gas infrastructure, enabling rapid fuel switching without significant capital investments or operational disruptions. Corporate sustainability reporting requirements and stakeholder expectations are accelerating adoption timelines while public commitments create accountability mechanisms that ensure continued demand growth throughout the forecast period.

Market Restraints:

What Challenges the Brazil Biogas Market is Facing?

High Capital Investment Requirements

Biogas production facilities require substantial upfront capital investments for anaerobic digesters, gas handling equipment, upgrading systems, and grid connection infrastructure. The capital-intensive nature of project development creates financing challenges, particularly for smaller agricultural producers lacking established credit relationships or collateral assets. Extended project development timelines and complex permitting requirements increase pre-operational costs while delaying revenue generation commencement. Investment recovery periods may extend beyond typical financing terms, limiting access to conventional lending sources.

Infrastructure Connectivity Limitations

Geographic distribution of biogas production potential does not always align with existing natural gas pipeline networks, creating connectivity challenges that limit market access for remote facilities. Infrastructure gaps require costly pipeline extensions or alternative distribution solutions that reduce project economics and extend investment recovery timelines. Grid connection limitations in rural areas constrain electricity generation applications while transportation logistics for biomethane delivery increase operational costs for facilities lacking pipeline access.

Feedstock Supply Chain Complexity

Consistent feedstock procurement presents operational challenges as organic waste availability fluctuates seasonally and depends on agricultural production cycles beyond biogas operators' control. Transportation logistics for bulky organic materials increase operational costs while storage requirements for maintaining stable digester feed rates add infrastructure complexity. Competition for feedstock resources from alternative waste management solutions and biofertilizer applications may constrain supply availability while increasing procurement costs during periods of elevated demand.

Competitive Landscape:

The Brazil biogas market exhibits a fragmented competitive structure characterized by diverse participant categories including agricultural cooperatives, industrial waste processors, energy utilities, and specialized biogas developers. Market participants differentiate through feedstock sourcing capabilities, technology partnerships, and offtake agreement portfolios that provide revenue certainty. Vertical integration strategies enable leading participants to control value chain segments from feedstock procurement through energy distribution, improving operational efficiency and margin capture. Strategic partnerships between agricultural producers and energy sector participants facilitate project development while sharing risks and combining complementary capabilities. Competition intensifies around attractive feedstock sources and grid connection opportunities as market growth attracts new entrants. Technological capabilities in gas upgrading and operational optimization represent key competitive differentiators as producers seek to maximize output quality and production efficiency.

Recent Developments:

- In February 2025, Waga Energy, a France-based company, launched a São Paulo subsidiary to convert landfill gas into Renewable Natural Gas (RNG) using its WAGABOX® technology, supporting Brazil’s waste-to-gas potential and national decarbonization goals under the Fuel of the Future framework.

- In 2025, Air Liquide announced its first biomethane-purification unit at the Cariacica landfill (Espírito Santo), processing 2,500 m³/h of biogas to produce ~155 GWh/year of biomethane for injection into the natural gas network, boosting clean energy access and international technology deployment in Brazil’s waste-to-gas sector.

Brazil Biogas Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Feedstocks Covered | Livestock Manure, Sewage, Food Waste, Crop Residues, Energy Crops |

| Applications Covered | Electricity Generation, Biofuel Production, Heat Generation |

| End Uses Covered | Residential, Commercial, Industrial |

| Regions Covered | Southeast, South, Northeast, North, Central-West |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Brazil biogas market size was valued at USD 1.16 Billion in 2025.

The Brazil biogas market is expected to grow at a compound annual growth rate of 4.32% from 2026-2034 to reach USD 1.70 Billion by 2034.

Livestock manure held the largest feedstock share of 43%, driven by Brazil’s large cattle ranching and livestock operations that generate substantial organic waste ideal for anaerobic digestion. Its high availability, consistency, and suitability for biogas production make it the most relied upon resource in the market.

Key factors driving the Brazil biogas market include regulatory framework strengthening with mandatory biomethane blending targets, abundant agricultural feedstock availability, industrial decarbonization initiatives, infrastructure integration with natural gas networks, and circular economy adoption across agricultural operations.

Major challenges include high capital investment requirements for production facilities, infrastructure connectivity limitations in remote agricultural regions, feedstock supply chain complexity, extended project development timelines, financing access constraints, and competition for organic waste resources from alternative applications.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)