Brazil Biostimulants Market Size, Share, Trends and Forecast by Form, Crop Type, and Region, 2026-2034

Brazil Biostimulants Market Summary:

The Brazil biostimulants market size was valued at USD 73.45 Million in 2025 and is projected to reach USD 160.99 Million by 2034, growing at a compound annual growth rate of 9.11% from 2026-2034.

The Brazil biostimulants market is experiencing robust growth driven by the increasing emphasis on sustainable agricultural practices and the need to enhance crop productivity across the country's vast agricultural landscape. The rising adoption of organic farming methodologies, coupled with growing awareness among farmers about the environmental and economic benefits of biological inputs, is propelling market expansion. Government initiatives promoting the use of natural agricultural inputs and the integration of biostimulants into precision farming techniques are further contributing to the market's upward trajectory, strengthening the Brazil biostimulants market share.

Key Takeaways and Insights:

- By Form: Amino acids dominate the market with a share of 25% in 2025, driven by their critical role in enhancing plant protein synthesis, enzyme activity, and stress tolerance during adverse environmental conditions.

- By Crop Type: Cash crops lead the market with a share of 40% in 2025, owing to the strong demand for premium quality coffee, cotton, and sugarcane destined for export markets commanding higher prices.

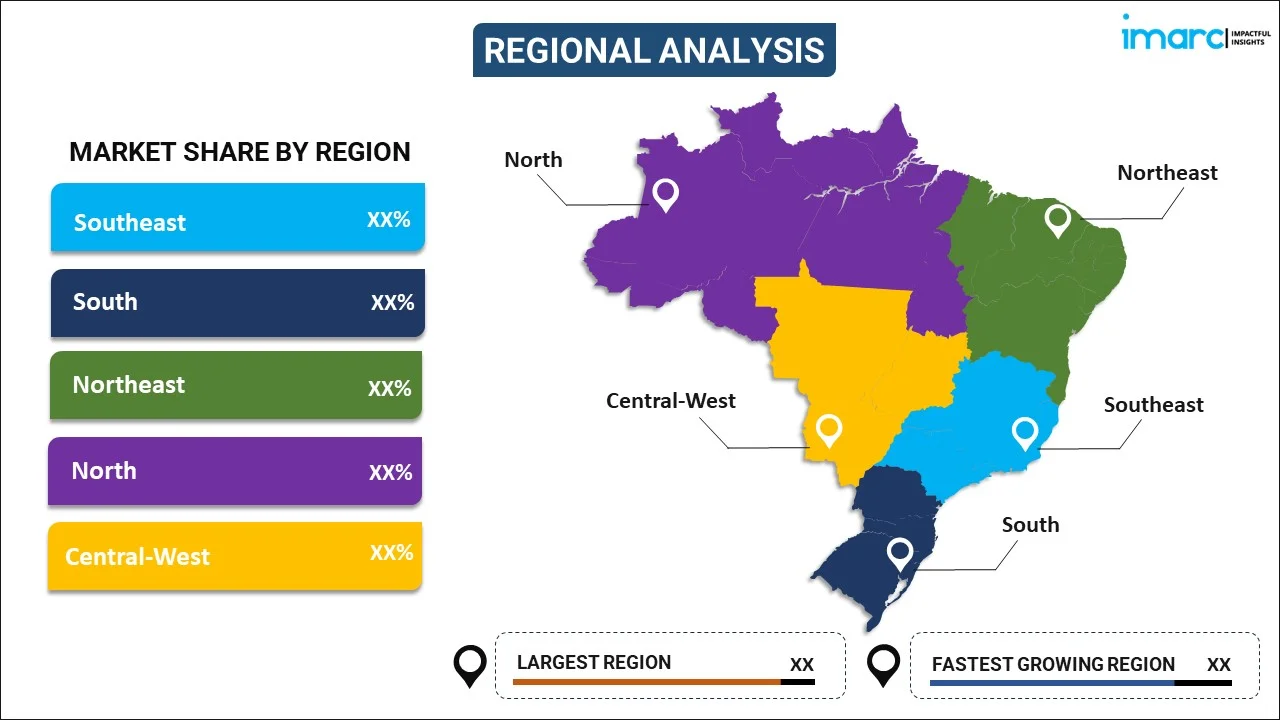

- By Region: Southeast represents the largest segment with a market share of 31% in 2025, attributed to the concentration of major agricultural production centers, advanced farming infrastructure, and established distribution networks.

- Key Players: The Brazil biostimulants market exhibits a moderately fragmented competitive structure with both multinational corporations and regional manufacturers competing across price segments and product categories, driving innovation and product diversification.

Brazil has become a global leader in biostimulant adoption, driven by its status as a major agricultural producer with extensive cultivated farmland. The market benefits from progressive government policies, including the National Bioinputs Program launched in 2020 to expand biological product adoption and promote sustainable agriculture. The passage of the Bioinputs Law (Law No. 15,070/2024) in December 2024 established a comprehensive regulatory framework for bioinputs, providing legal certainty and reinforcing Brazil's commitment to sustainable agriculture. For instance, Brazil approved a record 162 bioinput products in 2025, the highest annual figure in the country's history, demonstrating the accelerating pace of market development. The integration of biostimulants with precision agriculture technologies and the growing export demand for organic produce are creating substantial opportunities for market participants seeking to capitalize on Brazil's agricultural transformation.

Brazil Biostimulants Market Trends:

Integration of Biostimulants with Precision Agriculture Technologies

The integration of biostimulants with precision agriculture is transforming farming practices across Brazil. Farmers increasingly rely on technologies such as soil sensors, data analytics, and variable-rate application systems to optimize biostimulant use, enhancing effectiveness while minimizing input costs. These approaches allow for more targeted nutrient delivery, improved crop performance, and greater operational efficiency. The combination of advanced agronomic tools and biostimulant applications supports sustainable productivity gains, making precision-guided farming a key driver of adoption for these crop-enhancing products throughout the country.

Growing Preference for Natural and Organic Biostimulant Formulations

Brazilian farmers are showing growing interest in biostimulants derived from natural sources, reflecting a broader emphasis on sustainable and chemical-free agriculture. Producers, particularly those targeting export markets, prioritize organic and bio-based formulations to meet rigorous international quality standards. This shift highlights the increasing importance of environmentally friendly inputs that support soil health and crop resilience. The trend toward natural biostimulants demonstrates a commitment to sustainable production practices and aligns with global consumer demand for safe, eco-conscious agricultural products.

Rising Adoption of Amino Acid-Based Products for Stress Management

Amino acid-based biostimulants are gaining significant traction due to their effectiveness in helping plants cope with environmental stresses caused by climate variability. These products enhance plant metabolism, improve stomatal function, and support cellular water balance during drought and heat conditions. According to a McKinsey study titled 'The Mind of the Brazilian Farmer 2024,' the use of biofertilizers and biostimulants in grain crops in Brazil's Cerrado region increased from 34% to 73%, with applications now covering 60% of the planted area, demonstrating the rapid adoption of stress-management solutions.

Market Outlook 2026-2034:

The Brazil biostimulants market outlook remains highly favorable, driven by the country's commitment to sustainable intensification of agricultural production and the growing integration of biological inputs into mainstream farming practices. The implementation of the new Bioinputs Law is expected to streamline product registration processes and encourage investment in research and development. Brazil's position as a global agricultural powerhouse, combined with increasing demand for residue-free food products in international markets, positions the biostimulants sector for sustained expansion. The market generated a revenue of USD 73.45 Million in 2025 and is projected to reach a revenue of USD 160.99 Million by 2034, growing at a compound annual growth rate of 9.11% from 2026-2034.

Brazil Biostimulants Market Report Segmentation:

|

Segment Category |

Leading Segment |

Market Share |

|

Form |

Amino Acids |

25% |

|

Crop Type |

Cash Crops |

40% |

|

Region |

Southeast |

31% |

Form Insights:

To get more information on this market, Request Sample

- Amino Acids

- Fulvic Acid

- Humic Acid

- Protein Hydrolysates

- Seaweed Extracts

- Others

Amino acids dominate with a market share of 25% of the total Brazil biostimulants market in 2025.

Amino acid-based biostimulants have become vital in enhancing plant growth and resilience across Brazilian agriculture. They support protein synthesis, boost enzyme activity, and improve key metabolic processes, contributing to overall plant health and productivity. These products are increasingly used to help crops manage environmental stresses, including temperature fluctuations and soil nutrient limitations. Applied through seed treatment or foliar sprays, amino acids strengthen antioxidant metabolism, enhance stress tolerance, and improve plant performance, making them essential tools for sustaining productivity in challenging agricultural conditions.

Amino acids play a critical role in maintaining cellular water balance and regulating stomatal function, helping plants withstand drought and other environmental pressures common in Brazilian agriculture. Their use supports crop resilience by mitigating the effects of abiotic stress and improving overall physiological performance. Ongoing research continues to refine formulations and application methods to maximize efficacy for different crop types. By tailoring amino acid applications to specific environmental and crop needs, farmers can enhance stress tolerance, optimize growth, and maintain consistent yields under challenging conditions.

Crop Type Insights:

- Cash Crops

- Horticultural Crops

- Row Crops

Cash crops lead with a share of 40% of the total Brazil biostimulants market in 2025.

Cash crops such as coffee, cotton, and sugarcane represent a key application segment for biostimulants in Brazil, driven by the high economic value of these commodities. Biostimulant use in these crops focuses on enhancing product quality, improving stress tolerance, and boosting yields to maximize profitability for farmers. Export-oriented producers, in particular, adopt these solutions to maintain competitive advantage in international markets, where quality and sustainability increasingly influence pricing and demand.

Coffee cultivation has become a prominent area for biostimulant application, as these products support plant growth and improve resilience to environmental stressors like high sunlight and temperature extremes. Regions with intensive coffee production benefit from enhanced crop performance, while research continues to explore biostimulant use in other crops such as cotton, soybeans, corn, and fruits. By promoting stress tolerance and consistent development, biostimulants help ensure sustainable and high-quality coffee yields across Brazil’s growing regions.

Regional Insights:

To get more information on this market, Request Sample

- Southeast

- South

- Northeast

- North

- Central-West

The Southeast region exhibits a clear dominance with a 31% share of the total Brazil biostimulants market in 2025.

The Southeast region's leadership position in the Brazil biostimulants market is driven by its concentration of major agricultural production centers, particularly in São Paulo, Minas Gerais, and surrounding states. The region hosts most of Brazil's coffee production, which occupies a total area of 1.69 million hectares, representing 89% of the national coffee growing area. The presence of advanced agricultural infrastructure established distribution networks, and proximity to major research institutions including EMBRAPA facilities, supports high adoption rates for innovative agricultural inputs including biostimulants.

The Southeast region also benefits from a higher concentration of technically advanced farmers who are early adopters of sustainable agricultural practices. Key production regions including São Paulo, Paraná, and Minas Gerais house highly industrialized agriculture with established partnerships between public research institutions and private players contributing to indigenous product development. Vittia, one of Brazil's leading biological input manufacturers, operates multiple industrial units and distribution centers across the Southeast, including facilities in São Joaquim da Barra, Ituverava, Serrana, and Artur Nogueira in São Paulo state.

Market Dynamics:

Growth Drivers:

Why is the Brazil Biostimulants Market Growing?

Strong Government Support and Progressive Regulatory Framework

The Brazilian government has shown a strong commitment to advancing sustainable agriculture through policy measures and regulatory reforms that support the biostimulants sector. Initiatives aim to promote the adoption of biological products and encourage sustainable farming practices through coordinated efforts across the agricultural value chain. Comprehensive legislation now provides a clear framework for the production, registration, import, export, and commercialization of bioinputs, offering legal certainty and streamlined processes. These measures, combined with research support and targeted financial programs, are fostering growth and innovation in the biostimulants market.

Expanding Sustainable and Organic Farming Practices

The growing emphasis on sustainable agriculture and organic farming practices across Brazil is driving increased adoption of biostimulants as essential components of integrated crop management systems. Farmers are increasingly seeking alternatives to synthetic chemical inputs that can enhance productivity while meeting environmental sustainability goals. According to the National Plan for the Development of Organic Agriculture (PNDAP), the government aims to double the organic crop area in Brazil, creating substantial opportunities for biostimulant adoption. Brazil ranks fourth worldwide in terms of organic acreage, with over one million hectares of organic crops. The Brazilian Association of Organic Agriculture (ABO) actively advocates for sustainable practices, promoting biostimulant adoption among farmers seeking organic certification and premium market access.

Climate Change Adaptation and Stress Tolerance Needs

The increasing frequency and intensity of climate-related stresses affecting Brazilian agriculture are driving demand for biostimulants that can enhance crop resilience. Drought conditions, extreme temperatures, and irregular rainfall patterns have become more common, necessitating the use of products that help plants withstand adverse environmental conditions. Biostimulants aid in mitigating the impacts of extreme weather events by enhancing the ability of plants to tolerate stress conditions through improved nutrient uptake, water use efficiency, and activation of natural defense mechanisms. The ABC+ Programme (Low Carbon Agriculture Plan) provides technical and financial support for sustainable practices, encouraging biostimulant adoption as part of climate-smart agriculture strategies. Brazil's coffee industry has experienced significant climate impacts, with the Brazil coffee market size reaching 4.4 Million Tons in 2025 and projected to reach 7.0 Million Tons by 2034, underscoring the urgent need for stress-tolerance solutions.

Market Restraints:

What Challenges the Brazil Biostimulants Market is Facing?

Quality Variability in On-Farm Biostimulant Production

The increasing trend of biostimulants production on farms in Brazil has raised the issue of quality and product consistency. Processors in the region do not necessarily have consistent quality controls, meaning that there is inconsistency in nutrient analysis and that the chances of contamination are high. This discrepancy may destroy the confidence of the farmers and the growth of the market until such standards of compliance are established in all segments of production.

Limited Farmer Awareness and Technical Knowledge

Some manufacturers are still not aware of the complete advantages of biostimulants, or they do not know how to apply them properly to achieve the best outcomes. The technical side of the biostimulants integration into the current farming systems is so technical that it needs a specific level of knowledge, which might not be easily accessible to every farmer. The knowledge gap especially applies to the smallholder operations, which may not have access to technical advisory services and training programs.

Climate Variability Affecting Product Efficacy

Extreme weather conditions such as persistent droughts, floods, and abnormal rainfall distribution may also interfere with agricultural production and lower the performance of the biostimulant usage. Climate variability also poses the challenge of farmers not knowing when to apply and at what dosage, which may reduce the projected returns on biostimulant investments in unfavorable conditions.

Competitive Landscape:

The Brazil biostimulants market exhibits a moderately fragmented competitive structure characterized by the presence of both established multinational corporations and dynamic regional manufacturers. Companies differentiate themselves through product innovation, native-strain expertise, and field-level technical service rather than manufacturing scale alone. The competitive landscape is marked by strategic investments in research and development, expansion of distribution networks, and partnerships with agricultural cooperatives and research institutions. Market participants are increasingly focusing on developing crop-specific formulations tailored to Brazilian agricultural conditions, leveraging the country's rich biodiversity for indigenous product development. The structure invites consolidation while simultaneously lowering barriers for startups bringing targeted microbial solutions to specific crops or climates.

Recent Developments:

- May 2025: UPL Ltd. revealed a collaboration with peptide-focused company Elemental Enzymes, initially targeting the Brazilian market. Under this agreement, a new bioprotection solution for corn and soybean cultivation will be distributed to growers in Brazil starting in 2026, with plans to expand availability to additional international markets in 2027.

- September 2024: FMC Corporation, a global leader in agricultural sciences, entered a partnership with Ballagro Agro Tecnologia Ltda., a specialist in fungi-based biosolutions, to offer Brazilian growers an extensive range of innovative biological products. This collaboration forms part of FMC’s strategic initiative to expand its biologicals portfolio in key markets, including Brazil, enhancing access to advanced solutions that support sustainable crop production and address evolving agricultural challenges.

Brazil Biostimulants Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Forms Covered | Amino Acids, Fulvic Acid, Humic Acid, Protein Hydrolysates, Seaweed Extracts, Others |

| Crop Types Covered | Cash Crops, Horticultural Crops, Row Crops |

| Regions Covered | Southeast, South, Northeast, North, Central-West |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Brazil biostimulants market size was valued at USD 73.45 Million in 2025.

The Brazil biostimulants market is expected to grow at a compound annual growth rate of 9.11% from 2026-2034 to reach USD 160.99 Million by 2034.

Amino acids dominated the market with a 25% share in 2025, driven by their effectiveness in enhancing plant stress tolerance, protein synthesis, and enzyme activity, particularly in crops facing climate-related challenges.

Key factors driving the Brazil biostimulants market include strong government support through the National Bioinputs Program and new Bioinputs Law, expanding sustainable and organic farming practices, and increasing climate change adaptation needs requiring stress-tolerance solutions.

Major challenges include quality variability in on-farm biostimulant production, limited farmer awareness and technical knowledge about proper application methods, climate variability affecting product efficacy, and the need for standardized quality control measures across production segments.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)