Brazil Blood Glucose Monitoring Market Size, Share, Trends and Forecast by Type and Region, 2026-2034

Brazil Blood Glucose Monitoring Market Summary:

The Brazil blood glucose monitoring market size was valued at USD 358.01 Million in 2025 and is projected to reach USD 630.41 Million by 2034, growing at a compound annual growth rate of 6.49% from 2026-2034.

The market is being driven by the escalating prevalence of diabetes across all Brazilian regions, increased awareness regarding effective glycemic management, and favorable demographic shifts including an expanding elderly population. The growing adoption of advanced monitoring technologies, particularly continuous glucose monitoring systems offering real-time data insights, is further propelling market expansion. Additionally, improvements in healthcare infrastructure, rising disposable incomes in urban areas, and ongoing efforts to enhance accessibility of diabetes care devices through both public and private healthcare channels are contributing to sustained market momentum throughout the Brazil blood glucose monitoring market share.

Key Takeaways and Insights:

- By Type: Self-Monitoring Blood Glucose Devices dominate the market with a share of 70% in 2025, supported by cost-effectiveness, broad market availability, and long-standing adoption among people with diabetes who rely on routine daily testing to maintain effective glycaemic control.

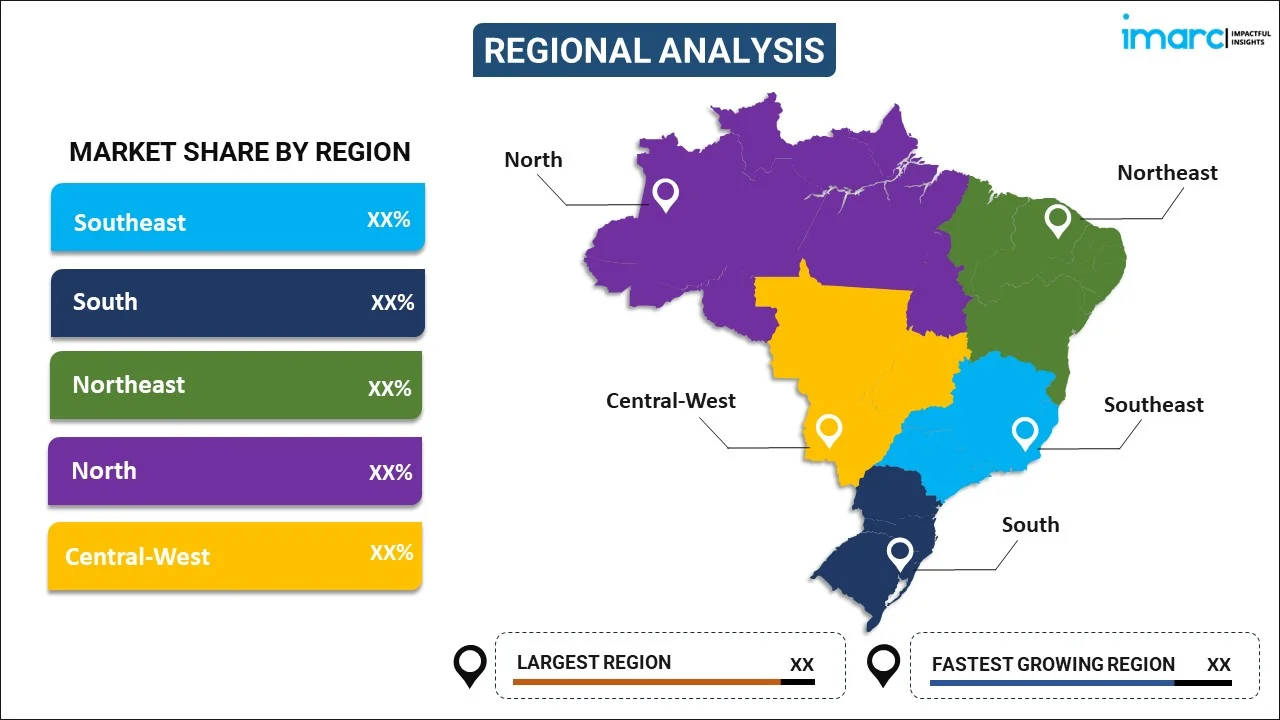

- By Region: Southeast leads the market with a share of 39% in 2025, attributed to the concentration of healthcare infrastructure, higher diabetic population density in metropolitan areas like São Paulo and Rio de Janeiro, and greater access to advanced monitoring technologies.

- Key Players: The Brazil blood glucose monitoring market exhibits moderate to high competitive intensity, characterized by the presence of established multinational corporations alongside regional distributors competing across technology segments and price points to capture market share.

The Brazil blood glucose monitoring market represents a critical component of the nation's broader diabetes care ecosystem, addressing the healthcare needs of an estimated 16.6 million adults living with diabetes. The market landscape is shaped by evolving technological innovations, shifting consumer preferences toward convenient monitoring solutions, and supportive government healthcare policies through the Unified Health System (SUS). Self-monitoring blood glucose devices continue to dominate market share due to their accessibility and cost-effectiveness, though continuous glucose monitoring systems are experiencing accelerated adoption among patients seeking enhanced glycemic control. The Southeast region leads the market due to its advanced healthcare infrastructure and higher concentration of individuals living with diabetes. Other regions offer strong growth potential as access to healthcare services and diagnostic tools continues to improve. Government-supported programs that provide glucose monitoring devices and supplies to eligible patients further expand accessibility, increasing overall adoption of blood glucose monitoring solutions across diverse population groups.

Brazil Blood Glucose Monitoring Market Trends:

Integration of Digital Health Technologies with Glucose Monitoring Systems

The market is witnessing increased integration of mobile health applications and digital platforms with traditional glucose monitoring devices, enabling patients to track glucose trends, share data with healthcare providers remotely, and receive personalized insights for improved diabetes management. This digital transformation is enhancing patient engagement and adherence to monitoring protocols. Research conducted at the Federal University of Sergipe in 2024 demonstrated that diabetes patients using FreeStyle Libre systems through the SUS achieved significant improvements in glycemic parameters when combined with structured digital education programs and multidisciplinary support.

Growing Preference for Minimally Invasive and Pain-Free Monitoring Solutions

Brazilian consumers are demonstrating increasing preference for glucose monitoring devices that minimize discomfort and reduce the frequency of fingerstick testing, driving demand for flash glucose monitoring and continuous monitoring systems that offer alternative sampling sites and extended wear periods. This trend is particularly pronounced among younger diabetic patients and those requiring intensive monitoring regimens. The Brazilian Diabetes Society guidelines now incorporate recommendations for advanced monitoring technologies to achieve optimal hemoglobin A1c targets below seven percent, reflecting evolving clinical standards.

Expansion of Point-of-Care Testing in Pharmacy and Retail Settings

The retail distribution of blood glucose monitoring devices is expanding beyond traditional healthcare facilities into pharmacy networks and consumer retail channels, improving accessibility and convenience for patients seeking over-the-counter monitoring solutions. This trend is supported by regulatory frameworks permitting broader distribution of diabetes management devices. Brazil's pharmacy chains are increasingly establishing specialized diabetes care sections offering comprehensive monitoring device portfolios, educational resources, and pharmacist-guided consultations to support patient self-management.

Market Outlook 2026-2034:

The outlook for the Brazil blood glucose monitoring market remains favorable, driven by the growing burden of diabetes, ongoing technological innovation, and wider access to healthcare services. Advances in monitoring technologies are improving accuracy, convenience, and ease of use, encouraging broader adoption across patient groups. Continuous glucose monitoring solutions are expected to gain greater traction as affordability improves and awareness increases among clinicians and patients, supporting long-term market expansion and more effective diabetes management. The market generated a revenue of USD 358.01 Million in 2025 and is projected to reach a revenue of USD 630.41 Million by 2034, growing at a compound annual growth rate of 6.49% from 2026-2034.

Brazil Blood Glucose Monitoring Market Report Segmentation:

|

Segment Category |

Leading Segment |

Market Share |

|

Type |

Self-Monitoring Blood Glucose Devices |

70% |

|

Region |

Southeast |

39% |

Type Insights:

To get detailed segment analysis of this market, Request Sample

- Self-monitoring blood glucose devices

- Glucometer Devices

- Test Strips

- Lancets

- Continuous blood glucose monitoring devices

- Sensors

- Durables (Receivers and Transmitters)

Self-monitoring blood glucose devices dominates with a market share of 70% of the total Brazil blood glucose monitoring market in 2025.

Self-monitoring blood glucose devices remain the cornerstone of diabetes management in Brazil, offering patients an established, reliable, and cost-effective method for regular glycemic monitoring. The widespread availability of glucometer devices, test strips, and lancets through pharmacy networks and public health programs ensures consistent patient access across all socioeconomic segments. These devices are particularly valued for their portability, ease of use, and immediate results delivery, enabling patients to make timely dietary and medication adjustments.

The segment benefits from established distribution infrastructure through Brazil's SUS, which provides glucose monitors and test strips without charge to registered diabetic patients under national regulations published in 2007. This government-supported access mechanism significantly expands market penetration while ensuring continued device utilization among cost-sensitive patient populations. The segment also benefits from ongoing product innovations focused on reducing sample volumes, accelerating testing times, and improving accuracy metrics to enhance patient compliance.

Regional Insights:

To get detailed segment analysis of this market, Request Sample

- Southeast

- South

- Northeast

- North

- Central-West

Southeast leads the market with a share of 39% of the total Brazil blood glucose monitoring market in 2025.

The blood glucose monitoring market in Southeast Brazil is driven by a high concentration of urban populations, advanced healthcare infrastructure, and a strong presence of hospitals, diagnostic centers, and specialty clinics. Higher awareness of diabetes management, supported by specialist availability and routine screening practices, encourages regular glucose monitoring. The region’s relatively higher disposable incomes and health insurance penetration also support the adoption of advanced monitoring technologies, including portable and user-friendly devices for long-term diabetes care.

Market growth is further supported by the rapid adoption of innovative monitoring solutions and integrated diabetes care models. Healthcare professionals are placing greater focus on continuous glucose monitoring, digital tracking of patient data, and interactive engagement tools to enhance blood sugar management and overall treatment effectiveness. Expanding outpatient care, home-based monitoring, and telemedicine services reinforce demand for reliable and convenient glucose monitoring devices. Strong distribution networks and faster uptake of new technologies position the Southeast as a key driver of overall market expansion.

Market Dynamics:

Growth Drivers:

Why is the Brazil Blood Glucose Monitoring Market Growing?

Rising Diabetes Prevalence and Expanding Diagnosed Patient Population

Brazil is experiencing a substantial and rising diabetes burden, with the number of diagnosed adults increasing markedly over recent years. This sustained growth reflects changing lifestyles, aging demographics, and improved disease detection, placing increasing pressure on the healthcare system and driving demand for effective diabetes management and monitoring solutions. The prevalence of type 2 diabetes among Brazilians aged over 25 years has risen from 10.8 percent in 2006 to 13.7 percent in 2020, with projections suggesting prevalence could reach 27.0 percent by 2036. This expanding patient population directly translates to increased demand for glucose monitoring devices and supplies, creating sustained market growth momentum. Additionally, several people living with diabetes in Brazil remain undiagnosed, representing substantial untapped market potential as screening initiatives expand.

Demographic Aging and Associated Chronic Disease Burden

Brazil is undergoing a pronounced demographic transition marked by a steadily aging population, with older adults accounting for a growing share of society. This age group faces a significantly higher risk of diabetes and related complications, increasing the need for continuous and proactive disease management. As people age, diabetes care typically requires more frequent monitoring, tighter glycemic control, and long-term clinical oversight. These demographic dynamics are driving sustained demand for blood glucose monitoring devices and related technologies. The rising health burden associated with diabetes also reinforces the importance of accessible, accurate monitoring solutions to support early intervention and reduce long-term complications across the healthcare system.

Technological Advancements and Enhanced Patient Convenience

Ongoing technological innovations in glucose monitoring devices are expanding market accessibility and improving patient compliance with monitoring protocols. Advances include factory-calibrated sensors eliminating fingerstick calibration requirements, extended wear periods reaching 14 days or longer, smartphone connectivity enabling remote data sharing, and real-time predictive alerts warning users before hypoglycemic or hyperglycemic events. These improvements address historical barriers to monitoring adherence while enabling more effective diabetes management. The integration of continuous glucose monitoring data with insulin delivery systems through automated insulin delivery algorithms represents a significant advancement toward personalized diabetes care, reducing the burden of constant decision-making for patients requiring intensive insulin therapy.

Market Restraints:

What Challenges the Brazil Blood Glucose Monitoring Market is Facing?

High Costs of Advanced Monitoring Technologies

The elevated costs associated with continuous glucose monitoring devices and their recurring sensor consumables present significant barriers to widespread adoption, particularly among price-sensitive patient populations in developing regions. Limited reimbursement coverage for advanced monitoring technologies through public healthcare programs restricts accessibility to patients who could benefit from enhanced glycemic control.

Regional Healthcare Infrastructure Disparities

Significant variations in healthcare infrastructure quality and availability across Brazilian regions create uneven market development, with North and Northeast regions experiencing lower device penetration rates despite growing diabetes prevalence. Limited access to specialized diabetes care providers and diabetes education programs in rural and remote areas constrains patient awareness and appropriate device utilization.

Patient Compliance and Health Literacy Challenges

Poor patient adherence to prescribed glucose monitoring rates is one of the threats that have remained unresolved, especially with the elderly groups who might have problems with the use of modern monitoring systems. Poor health literacy in terms of correct use of the device, interpretation of the data and proper responses to the monitoring outcomes can reduce the clinical value of monitoring investments.

Competitive Landscape:

The Brazil blood glucose monitoring market has an average to high competitiveness intensity, which is typified by the existence of multinational medical device corporations that operate in the market, and regional distributors and local market entrants. The top competitors hold good market share by regularly innovating their products, forming strategic alliances with health organizations and having well-established distribution channels that cut across the spectrum between the state and the private healthcare medium. The technological differentiation, pricing strategies and the quality of after-sales services are the core elements of competition, with manufacturers paying more attention to the digital health integration possibilities and connected device ecosystems to increase customer retention. The market structure indicates a concentrated market that is characterized by a lack of new market entrants and only the established brands in the traditional self-monitoring devices segment, whereas the new continuous glucose monitoring segment shows both competitors and new market entrants that are interested in tapping the growth opportunities.

Recent Developments:

- June 2024: MicroTech Medical’s AiDEX CGMS successfully obtained regulatory approval from Brazil’s National Health Surveillance Agency (ANVISA) and entered into a strategic distribution agreement with local glucose device provider Medlevensohn. These developments formally establish the AiDEX continuous glucose monitoring system’s presence in the Brazilian market, enabling its commercial rollout and broader accessibility across the country.

Brazil Blood Glucose Monitoring Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered |

|

| Regions Covered | Southeast, South, Northeast, North, Central-West |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Brazil blood glucose monitoring market size was valued at USD 358.01 Million in 2025.

The Brazil blood glucose monitoring market is expected to grow at a compound annual growth rate of 6.49% from 2026-2034 to reach USD 630.41 Million by 2034.

Self-monitoring blood glucose devices led the largest market share at 70% in 2025, driven by their established usage patterns, affordability, and widespread availability through both public and private healthcare distribution channels.

Key factors driving the Brazil blood glucose monitoring market include rising diabetes prevalence across all age groups, demographic aging patterns increasing chronic disease burden, technological advancements enhancing device convenience and accuracy, and expanding healthcare accessibility initiatives.

Major challenges include high costs of advanced continuous monitoring technologies limiting accessibility, regional disparities in healthcare infrastructure affecting device penetration rates, patient compliance barriers particularly among elderly populations, and limited reimbursement coverage for newer monitoring solutions.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)