Brazil Carbon Black Market Size, Share, Trends and Forecast by Type, Grade Wise Application, and Region, 2025-2033

Brazil Carbon Black Market Overview:

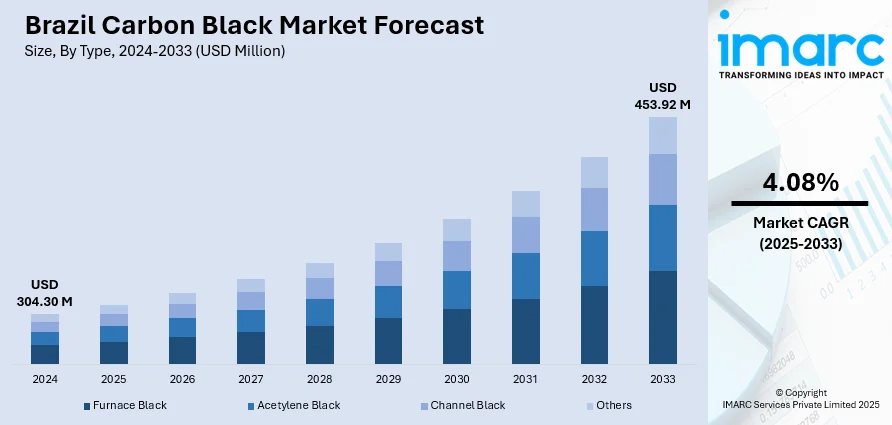

The Brazil carbon black market size reached USD 304.30 Million in 2024. Looking forward, the market is projected to reach USD 453.92 Million by 2033, exhibiting a growth rate (CAGR) of 4.08% during 2025-2033. The market is driven by Brazil’s robust tire production, growing plastics industry, and expanding construction sector. Infrastructure development and widespread use of polymeric construction materials further fuel demand across coatings and sealants. Regulatory alignment with sustainability trends is also encouraging the adoption of cleaner carbon black grades, further augmenting the Brazil carbon black market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 304.30 Million |

| Market Forecast in 2033 | USD 453.92 Million |

| Market Growth Rate 2025-2033 | 4.08% |

Brazil Carbon Black Market Trends:

OEM Tire Production and Export-Oriented Rubber Manufacturing

Brazil hosts a thriving automotive and tire manufacturing sector, led by global players like Bridgestone, Pirelli, and Continental, as well as domestic firms such as Borrachas Vipal. With vehicle production centered in industrial hubs like São Paulo and Minas Gerais, carbon black demand remains consistently high for original equipment tires and aftermarket rubber products. The material is essential in reinforcing treads, enhancing abrasion resistance, and improving performance under Brazil’s variable climatic conditions. In October 2024, the Brazilian Climate & Carbon Conference (BCCC) took place in São Paulo, bringing together experts to discuss opportunities in the carbon market, highlighting Brazil’s commitment to sustainable practices in the industry. Additionally, tire exports to Latin America, Africa, and the U.S. contribute to external demand for high-dispersion and reliable carbon black inputs. The country’s established automotive ecosystem, supported by policy incentives, a skilled labor base, and domestic petrochemical infrastructure, further reinforces stable consumption of carbon black across vehicle components, conveyor belts, and molded rubber parts. The Brazil carbon black market growth is deeply rooted in its integrated vehicle and rubber value chains, where domestic consumption and regional exports jointly sustain long-term demand.

To get more information on this market, Request Sample

Rapid Expansion in Plastic Converting and Masterbatch Applications

Brazil’s polymer processing industry has seen rapid development across flexible packaging, agriculture films, industrial containers, and household goods. For instance, RadiciGroup High Performance Polymers inaugurated a new production site in Brazil in March 2025, expanding production capacity by about 15% and enhancing efficiency, safety, and environmental sustainability to serve markets such as automotive, electrical, electronics, and consumer goods. Black masterbatch, heavily reliant on carbon black, plays a vital role in manufacturing UV-resistant plastic components, especially in outdoor applications such as geomembranes, pipes, irrigation tubing, and garbage bags. In states like Rio Grande do Sul and Santa Catarina, large-scale converters produce agricultural films tailored for sugarcane, coffee, and citrus plantations, all of which require high-UV durability to perform in Brazil’s tropical and subtropical climates. The growth of precision agriculture and water management has further driven demand for long-life, carbon black–reinforced polymer systems. Additionally, black masterbatch is increasingly used in consumer packaging, rigid containers, and pipe extrusion, applications where color uniformity and outdoor performance are critical. Domestic producers are adopting cleaner, low-PAH grades of carbon black that meet regional sustainability standards and enable better recycling compatibility, aligning with Brazil’s expanding focus on circular plastics and regulatory compliance.

Brazil Carbon Black Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on type and grade wise application.

Type Insights:

- Furnace Black

- Acetylene Black

- Channel Black

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes furnace black, acetylene black, channel black, and others.

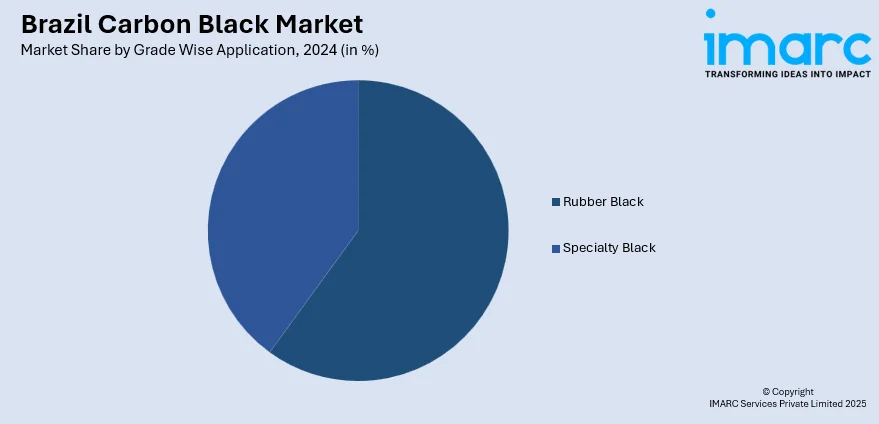

Grade Wise Application Insights:

- Rubber Black

- Tire Treads

- Inner Liner and Tubes

- Conveyor Belts

- Hoses

- Others

- Specialty Black

- Plastics

- Ink and Toners

- Paint and Coatings

- Wires and Cables

- Others

The report has provided a detailed breakup and analysis of the market based on the grade wise application. This includes rubber black (tire treads, inner liner and tubes, conveyor belts, hoses, and others) and specialty black (plastics, ink and toners, paint and coatings, wires and cables, and others).

Regional Insights:

- Southeast

- South

- Northeast

- North

- Central-West

The report has also provided a comprehensive analysis of all major regional markets. This includes Southeast, South, Northeast, North, and Central-West.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Brazil Carbon Black Market News:

- In April 2025, Univar Solutions expanded partnership with Cabot Corporation in Brazil to distribute specialty carbon black products for rubber applications, supporting growing demand in automotive and industrial sectors, aiming to meet rising demand for high-performance rubber applications.

Brazil Carbon Black Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Furnace Black, Acetylene Black, Channel Black, Others |

| Grade Wise Applications Covered |

|

| Regions Covered | Southeast, South, Northeast, North, Central-West |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Brazil carbon black market performed so far and how will it perform in the coming years?

- What is the breakup of the Brazil carbon black market on the basis of type?

- What is the breakup of the Brazil carbon black market on the basis of grade wise application?

- What is the breakup of the Brazil carbon black market on the basis of region?

- What are the various stages in the value chain of the Brazil carbon black market?

- What are the key driving factors and challenges in the Brazil carbon black market?

- What is the structure of the Brazil carbon black market and who are the key players?

- What is the degree of competition in the Brazil carbon black market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Brazil carbon black market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Brazil carbon black market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Brazil carbon black industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)