Brazil Carbon Credits Market Size, Share, Trends and Forecast by Type, Project Type, End-Use Industry, and Region, 2026-2034

Brazil Carbon Credits Market Overview:

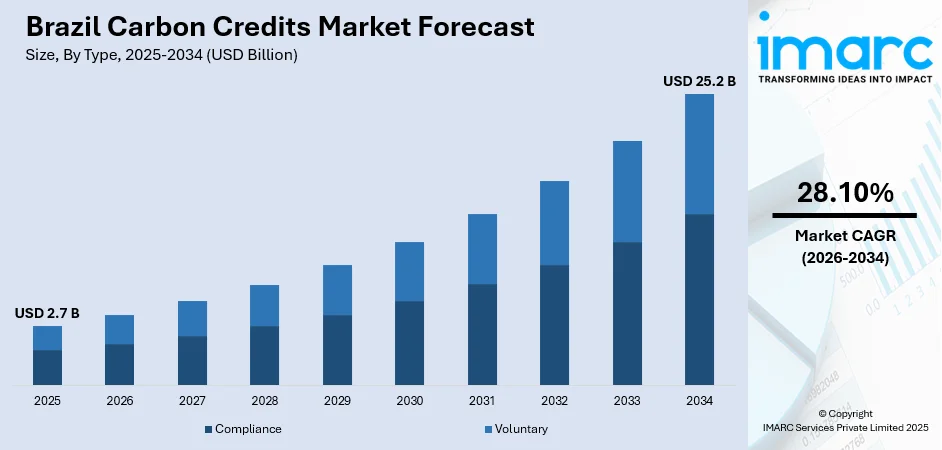

The Brazil carbon credits market size reached USD 2.7 Billion in 2025. Looking forward, IMARC Group expects the market to reach USD 25.2 Billion by 2034, exhibiting a growth rate (CAGR) of 28.10% during 2026-2034. The market is experiencing significant growth mainly driven by the rising demand for sustainable solutions and the country's rich biodiversity. Regulatory developments, such as a national carbon pricing system, is also contributing positively to the market growth across the country.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 2.7 Billion |

| Market Forecast in 2034 | USD 25.2 Billion |

| Market Growth Rate 2026-2034 | 28.10% |

Brazil Carbon Credits Market Trends:

Growth in Regulatory Development

The government of Brazil is strongly developing a framework for regulation in carbon markets, aligning it with international commitments on climate change. The creation of a national carbon price mechanism is an essential part of the evolving carbon credits market Brazil, aimed at rewarding emission reductions across sectors. It is developed in a way that will increase market transparency and credibility, engaging both voluntary players as well as compliance-regulated actors. By establishing stringent rules, Brazil aims to increase the credibility of its carbon credits, making itself a credible participant in the global carbon trading market while maintaining environmentally friendly practices. As per an article on Eco-Business in 2024, Brazil is quickly establishing a carbon emissions trading system prior to COP30 to cut emissions and finance rainforest conservation. The system was patterned after the EU's carbon pricing system. In hopes of discouraging pollution and generating funds for nature projects, the nation hoped to reduce emissions by 53% by 2030.

To get more information on this market Request Sample

Expansion of Forest Conservation Projects

Brazil's conservation efforts in the forest, especially by REDD+ (Reducing Emissions from Deforestation and Forest Degradation) schemes, are growingly being regarded as crucial to the global market of carbon credits. These programs, including Brazil reforestation carbon credits, aim to limit emissions by protecting forests and sustainably managing the forest. REDD+ promotes conservation through the provision of economic incentives to keep essential ecosystems such as the Amazon, which significantly contributes to sequestering carbon. As increasing numbers of organizations look to carbon offsets to achieve climate targets, Brazil's high biodiversity and extensive forest cover make it a prime source of credits, stimulating investment in conservation and boosting the nation's environmental profile. For example, in December 2023, the government of Brazil put forward the establishment of a global fund named "Tropical Forests Forever" at the COP28 climate conference. The fund will mobilize USD 250 Billion from sovereign wealth funds, investors, and the oil sector to fund forest protection in 80 tropical forest nations. The initiative proposes to pay countries yearly for the hectares of forests protected or restored, supporting carbon offset Brazil strategies. The fund also proposes penalties for deforestation-prone countries.

Brazil Carbon Credits Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2026-2034. Our report has categorized the market based on type, project type, and end-use industry.

Type Insights:

- Compliance

- Voluntary

The report has provided a detailed breakup and analysis of the market based on the type. This includes compliance, and voluntary.

Project Type Insights:

- Avoidance/Reduction Projects

- Removal/Sequestration Projects

- Nature-based

- Technology-based

A detailed breakup and analysis of the market based on the project type have also been provided in the report. This includes avoidance/reduction projects, and removal/sequestration projects (nature-based, technology-based).

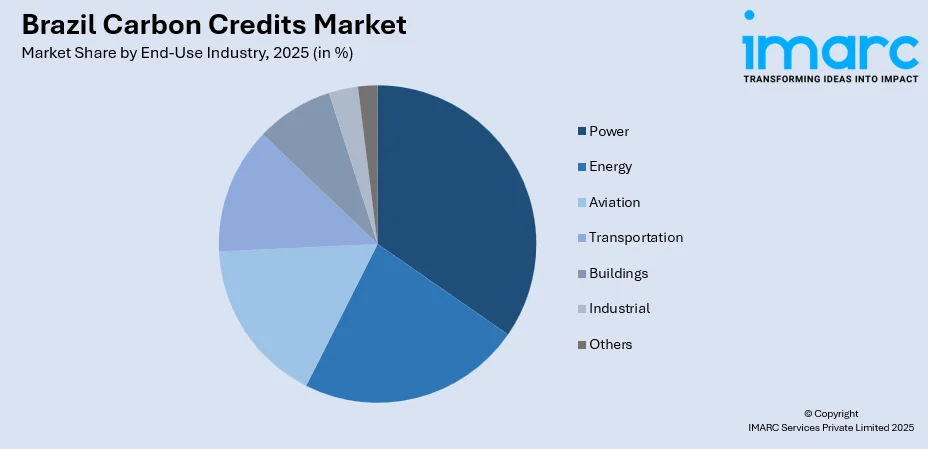

End-Use Industry Insights:

Access the comprehensive market breakdown Request Sample

- Power

- Energy

- Aviation

- Transportation

- Buildings

- Industrial

- Others

A detailed breakup and analysis of the market based on the end use have also been provided in the report. This includes power, energy, aviation, transportation, buildings, industrial, and others.

Regional Insights:

- Southeast

- South

- Northeast

- North

- Central-West

The report has also provided a comprehensive analysis of all the major regional markets, which include Southeast, South, Northeast, North, and Central-West.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Brazil Carbon Credits Market News:

- In May 2025: AgriCapture launched its first rice carbon project in Brazil’s Rio Grande do Sul, in partnership with NatCap. By introducing methane-reducing irrigation methods, the initiative enabled local farmers to access international carbon markets, strengthening Brazil’s role in nature-based carbon credit generation.

- In December 2024: Brazil enacted Law 15,042/2024, establishing the SBCE carbon market. It targeted 5,000 firms emitting over 10,000 tCO₂/year, mandating emissions reporting and enabling carbon credit trading. This boosted regulatory clarity and positioned Brazil as a key player in global markets.

- In September 2024, Google made its first purchase of nature-based carbon removal credits from a Brazilian startup, Mombak, to buy 50,000 metric tons of carbon removal credits by 2030. Mombak focuses on purchasing degraded land from farmers and ranchers or partnering with them to replant native species in the Amazon rainforest.

- In September 2024, Amazon and five other companies committed $180 million to purchase carbon offset credits to protect the Amazon rainforest in Brazil's Para state. The credits will be bought through the LEAF Coalition, with the funds supporting forest conservation and benefitting local communities. This marks a significant step in combating climate change and comes amidst a global slowdown in carbon credit demand, with tech giants also investing in nature-based solutions.

Brazil Carbon Credits Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Compliance, Voluntary |

| Project Types Covered |

|

| End-Use Industries Covered | Power, Energy, Aviation, Transportation, Buildings, Industrial, Others. |

| Regions Covered | Southeast, South, Northeast, North, Central-West |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Brazil carbon credits market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Brazil carbon credits market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Brazil carbon credits industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The carbon credits market in Brazil was valued at USD 2.7 Billion in 2025.

The Brazil carbon credits market is projected to exhibit a CAGR of 28.10% during 2026-2034, reaching a value of USD 25.2 Billion by 2034.

The market is driven by the country’s abundant forest resources, growing international demand for nature-based carbon offsets, supportive regulatory frameworks, and participation in global climate agreements. Increased corporate net-zero commitments and interest from foreign investors are also accelerating market development. Advancements in monitoring technologies and government-backed conservation initiatives further support the scalability and credibility of Brazil’s carbon credit sector.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)