Brazil Carbon Fiber Market Size, Share, Trends and Forecast by Type, Raw Material, Application, and Region, 2026-2034

Brazil Carbon Fiber Market Summary:

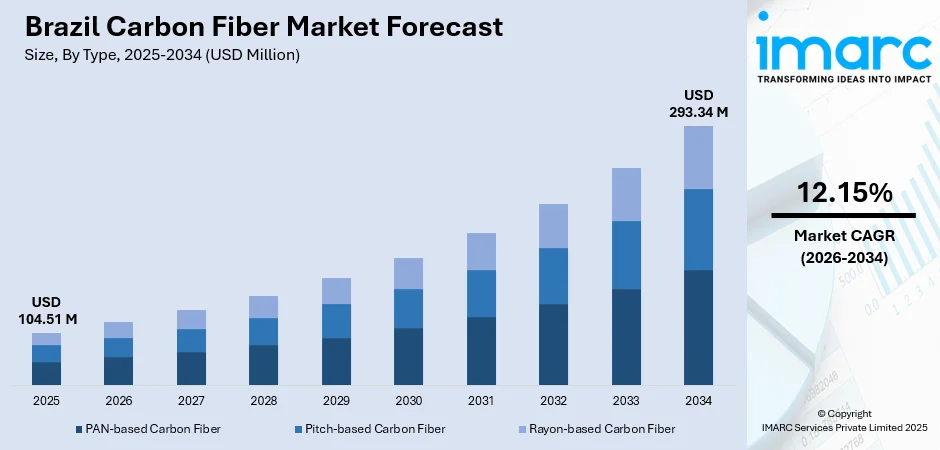

The Brazil carbon fiber market size was valued at USD 104.51 Million in 2025 and is projected to reach USD 293.34 Million by 2034, growing at a compound annual growth rate of 12.15% from 2026-2034.

The expansion of the Brazil carbon fiber sector is driven by accelerating demand from automotive manufacturers implementing lightweighting strategies to comply with stricter emissions standards, alongside significant growth in wind energy infrastructure requiring high-performance composite materials for turbine blade construction. Furthermore, the aerospace industry's ongoing modernization efforts and increasing adoption of carbon fiber composites for aircraft structural components contribute substantially to market momentum.

Key Takeaways and Insights:

- By Type: PAN-based carbon fiber dominates the market with a share of 84.3% in 2025, driven by its superior tensile strength, cost-effectiveness compared to pitch-based alternatives, and widespread applicability across aerospace structures, automotive components, and sporting goods manufacturing.

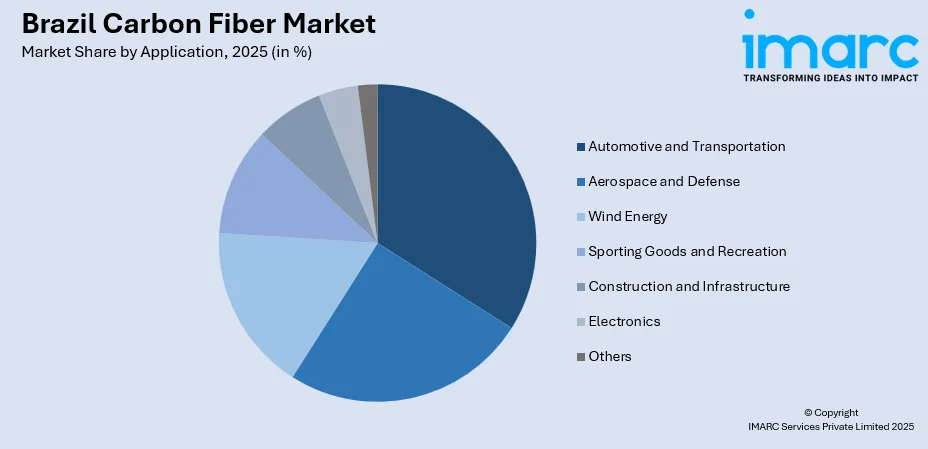

- By Application: Automotive and transportation lead the market with a share of 33.8% in 2025, owing to Brazil's Green Mobility and Innovation Program incentivizing lightweight vehicle production and the automotive industry's shift towards hybrid vehicles (HVs) requiring weight reduction for enhanced battery efficiency.

- By Region: Southeast represents the largest segment with a market share of 43.2% in 2025, This dominance is attributed to the concentration of major automotive manufacturing facilities in São Paulo, established aerospace production centers, and robust industrial infrastructure supporting composite materials processing.

- Key Players: Key players drive the market by investing in advanced production technologies, expanding local manufacturing capacity, offering technical support, forming industry partnerships, and developing customized solutions. Their innovations and marketing strategies enhance adoption across the automotive, aerospace, and industrial sectors.

To get more information on this market Request Sample

The Brazil carbon fiber market benefits from converging factors, including government commitment to renewable energy expansion, automotive industry modernization, and aerospace sector growth. In February 2025, Embraer revealed intentions to invest around USD 3.5 Billion by 2030 in its growth strategy, emphasizing enhanced aircraft manufacturing, international expansion, and the advancement of sustainable technologies. The declaration was presented at the ‘Mission 6 of the New Industry Brazil (Nova Indústria Brasil/NIB)’ event in Brazil, which was attended by President Luiz Inácio Lula da Silva and various other officials. This substantial investment signals strong future demand for advanced composite materials, including carbon fiber in Brazil's aerospace manufacturing ecosystem. Additionally, offshore wind legislation creates substantial long-term demand opportunities for carbon fiber composite materials in wind turbine blade manufacturing.

Brazil Carbon Fiber Market Trends:

Rising electric vehicle (EV) production

Increasing EV production in Brazil is fueling the demand for carbon fiber due to its lightweight and high-strength properties, which improve battery efficiency and vehicle range. As per IMARC Group, the Brazil EV market size reached 146.0 Thousand Units in 2025. Manufacturers are incorporating carbon fiber in body panels, chassis, and structural components to reduce overall weight and enhance energy efficiency. As EV adoption is growing, automakers are seeking materials that balance performance, safety, and sustainability. This rising focus on lightweight construction is directly driving carbon fiber consumption, supporting market growth across Brazil’s emerging EV industry.

Offshore Wind Energy Infrastructure Development

The wind energy sector represents a rapidly emerging application segment for carbon fiber composites in Brazil. Brazil's Federal Senate passed the country's offshore wind bill in December 2024, paving the way for the offshore wind sector to establish itself in the country and deliver clean, secure, and green energy. Lightweight carbon fiber reduces transportation and installation costs while enhancing blade efficiency and longevity.

Aerospace Manufacturing Capacity Expansion

The expansion of aerospace manufacturing capacity in Brazil is driving carbon fiber demand due to the material’s lightweight, high-strength properties, which improve fuel efficiency and performance in aircraft components. As domestic aerospace companies scale production of commercial and military aircraft, they increasingly use carbon fiber in fuselage panels, wings, and structural parts. Rising investment in local aerospace infrastructure and technological capabilities encourages adoption of advanced composites. In August 2025, Akaer, a Brazilian leader in aerospace and defense innovation, alongside Deutsche Aircraft, the German OEM advancing sustainable regional aviation, launched the Forward Fuselage Assembly Line for the D328eco regional turboprop aircraft at Akaer’s facilities in São José dos Campos, Brazil.

Market Outlook 2026-2034:

Market momentum will be sustained by continued government support for vehicle decarbonization, substantial renewable energy infrastructure investments, especially in offshore wind development, and aerospace industry modernization initiatives. The market generated a revenue of USD 104.51 Million in 2025 and is projected to reach a revenue of USD 293.34 Million by 2034, growing at a compound annual growth rate of 12.15% from 2026-2034. The convergence of multiple growth drivers, including foreign direct investment (FDI) in manufacturing facilities, domestic capacity building efforts, and expanding application scope across the industrial sector, positions the market for sustained revenue growth.

Brazil Carbon Fiber Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Type | PAN-based Carbon Fiber | 84.3% |

| Application | Automotive & Transportation | 33.8% |

| Region | Southeast | 43.2% |

Type Insights:

- PAN-based Carbon Fiber

- Pitch-based Carbon Fiber

- Rayon-based Carbon Fiber

PAN-based carbon fiber dominates with a market share of 84.3% of the total Brazil carbon fiber market in 2025.

PAN-based carbon fiber leads the Brazil market due to its superior tensile strength, stiffness, and lightweight properties, making it ideal for high-performance applications. It is preferred in the aerospace, automotive, and wind energy sectors where durability, structural integrity, and efficiency are critical, ensuring consistent demand over other types.

PAN-based carbon fiber’s dominance is also driven by its versatility and adaptability in manufacturing processes, including prepreg, filament winding, and molding techniques. Compared to alternatives like pitch-based fibers, PAN fibers offer better mechanical properties, thermal stability, and compatibility with various resins. Brazilian industries, especially aerospace and EV manufacturing, favor PAN fibers for structural components and performance-critical parts. Strong availability from local and international suppliers, combined with established production know-how, reinforces its position as the preferred choice, sustaining market leadership and driving continued adoption across multiple sectors.

Raw Material Insights:

- Polyacrylonitrile (PAN)

- Petroleum Pitch

- Coal Tar Pitch

Polyacrylonitrile (PAN) is widely used in aerospace, automotive, wind energy, and sporting goods, where lightweight and durable materials are critical. PAN fibers offer superior performance, thermal stability, and compatibility with various resins. Their adaptability across multiple manufacturing processes, such as prepreg, filament winding, and molding, ensures strong industrial demand and consistent market growth.

Petroleum pitch-based carbon fiber is valued in Brazil for its cost-effectiveness and high thermal and electrical conductivity. It is primarily used in industrial applications, including electrodes, heat-resistant components, and specialty engineering materials. While it offers lower mechanical strength than PAN fibers, its unique conductivity properties make it suitable for energy storage, electronics, and thermal management solutions. Steady adoption in niche sectors ensures petroleum pitch fibers maintain a stable market presence.

Coal tar pitch-based carbon fiber is mainly utilized for its exceptional thermal stability and high modulus, making it suitable for aerospace, defense, and high-performance structural applications. In Brazil, it is preferred for components requiring rigidity and heat resistance. Despite limited use compared to PAN fibers, coal tar pitch fibers are critical for specialized applications where lightweight, high-strength, and temperature-resistant materials are essential, supporting a niche yet strategically important market segment.

Application Insights:

Access the comprehensive market breakdown Request Sample

- Aerospace and Defense

- Automotive and Transportation

- Wind Energy

- Sporting Goods and Recreation

- Construction and Infrastructure

- Electronics

- Others

Automotive and transportation lead with a share of 33.8% of the total Brazil carbon fiber market in 2025.

The automotive and transportation segment's market leadership reflects Brazil's substantial vehicle manufacturing base and ongoing industry transformation towards lightweight, fuel-efficient designs. Brazil’s MOVER Program, initiated in June 2024, established tougher environmental regulations and offered incentives that prompted over USD 26 Billion in investments from automakers, simultaneously pushing traditional manufacturers to swiftly adjust in response to competition from EV-centric Chinese companies. These government incentives directly stimulate carbon fiber adoption as manufacturers seek advanced materials to achieve mandated emissions reduction targets.

Carbon fiber composites are increasingly utilized in automotive structural components, body panels, and EV battery enclosures where weight reduction translates directly to improved fuel efficiency and extended range. The combination of regulatory pressure and performance benefits positions this application segment for continued leadership throughout the forecast period.

Regional Insights:

- Southeast

- South

- Northeast

- North

- Central-West

Southeast exhibits a clear dominance with a 43.2% share of the total Brazil carbon fiber market in 2025.

Southeast leads the carbon fiber market due to its high concentration of industrial hubs, including automotive, aerospace, and renewable energy manufacturing. The region benefits from better infrastructure, access to skilled labor, and proximity to suppliers and ports, facilitating production, distribution, and adoption of carbon fiber across multiple industries.

The Southeast’s dominance is further reinforced by the presence of key manufacturers, research centers, and technology-driven companies that support innovation and customized solutions. High demand from automotive and aerospace clusters drives large-scale procurement and consistent market growth. Additionally, robust logistics networks and established industrial ecosystems reduce costs and delivery times, making the region more attractive for carbon fiber production and application. Government incentives and private investments in advanced materials also encourage expansion, solidifying Southeast Brazil’s role as the primary driver of the country’s carbon fiber market.

Market Dynamics:

Growth Drivers:

Why is the Brazil Carbon Fiber Market Growing?

Government Decarbonization Initiatives Driving Automotive Lightweighting

The Brazilian government's commitment to reducing vehicular carbon emissions through comprehensive policy frameworks creates substantial demand stimulus for carbon fiber composites in automotive manufacturing. In January 2024, a provisional measure was released by the Brazilian government to create the National Green Mobility and Innovation Program, targeting a decrease in carbon emissions from the nation's vehicle fleet through tax incentives, which are projected to be BRL 3.5 Billion in 2024, BRL 3.8 Billion in 2025, BRL 3.9 Billion in 2026, BRL 4 Billion in 2027, and BRL 4.1 Billion in 2028. These substantial financial incentives encourage manufacturers to adopt advanced lightweight materials, including carbon fiber composites, to achieve mandated efficiency improvements. The program's well-to-wheel emissions measurement approach and mandatory recycled content requirements further accelerate material innovations and carbon fiber adoption across vehicle production platforms.

Renewable Energy Infrastructure Expansion

Brazil's substantial wind energy development presents significant growth opportunities for carbon fiber applications in turbine blade manufacturing. As of December 2024, IBAMA's catalog of environmental investigation applications indicated that there were 103 offshore wind initiatives in the permitting process, representing a potential installed capacity of 244.6 GW in Brazil. This massive pipeline of renewable energy projects creates long-term demand visibility for carbon fiber composite materials essential for manufacturing efficient, large-scale turbine blades. The passage of offshore wind legislation establishes regulatory certainty that encourages domestic and international investment in supporting supply chains, including carbon fiber composite production and processing capabilities.

Aerospace Industry Modernization and Capacity Growth

The modernization and capacity growth of Brazil’s aerospace industry are significantly driving the market expansion in Brazil. As domestic manufacturers expand production of commercial and military aircraft, there is a growing demand for lightweight, high-strength materials to improve fuel efficiency, payload capacity, and structural performance. Carbon fiber composites are increasingly used in fuselage panels, wings, tail sections, and interior components due to their durability, corrosion resistance, and weight reduction benefits. Investments in new production facilities, advanced manufacturing technologies, and skilled workforce development enable greater adoption of carbon fiber in both established and emerging aerospace companies. Additionally, Brazil’s focus on exporting aerospace products encourages compliance with global quality standards, which often require advanced composite materials. Rising research and development (R&D) initiatives and collaborations with international aerospace firms further boost market penetration, making carbon fiber a critical material in supporting the country’s growing aerospace sector.

Market Restraints:

What Challenges the Brazil Carbon Fiber Market is Facing?

High Production and Material Costs

Carbon fiber remains significantly more expensive than conventional structural materials, creating adoption barriers in cost-sensitive market segments. The material's premium pricing limits penetration in mass-market automotive applications where manufacturers must balance performance benefits against competitive cost pressures.

Technical Complexity in Manufacturing

Carbon fiber production and processing involve advanced technologies, such as precise temperature control, polymer stabilization, and composite layup. Brazil faces challenges in developing skilled labor and technical expertise to manage these processes efficiently. Manufacturing defects can reduce material performance, limiting adoption in critical applications like aerospace or automotive. Complex production also increases operational costs and reduces scalability.

Intense Competition from Alternative Materials

Carbon fiber faces competition from cheaper materials, such as aluminum, steel, and fiberglass, which are easier to source and process in Brazil. These alternatives offer acceptable performance at lower cost for many applications, reducing incentive to adopt carbon fiber. Industries with budget constraints often prioritize cost efficiency over performance, limiting market penetration. Substitutes also have established supply chains and local manufacturing support, making them more convenient.

Competitive Landscape:

The Brazil carbon fiber market features a moderately concentrated competitive structure with international composite material manufacturers and specialized fabricators serving diverse end-use applications. Market participants compete on product quality, technical support capabilities, and supply chain reliability to secure positions in automotive, aerospace, and industrial segments. Strategic partnerships between global carbon fiber producers and regional converters facilitate market development and technology transfer. Companies are investing in expanded processing capabilities and application engineering expertise to capture growth opportunities across emerging application segments, including renewable energy and EV manufacturing.

Brazil Carbon Fiber Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | PAN-based Carbon Fiber, Pitch-based Carbon Fiber, Rayon-based Carbon Fiber |

| Raw Materials Covered | Polyacrylonitrile (PAN), Petroleum Pitch, Coal Tar Pitch |

| Applications Covered | Aerospace & Defense, Automotive & Transportation, Wind Energy, Sporting Goods & Recreation, Construction & Infrastructure, Electronics, Others |

| Regions Covered | Southeast, South, Northeast, North, Central-West |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Brazil carbon fiber market size was valued at USD 104.51 Million in 2025.

The Brazil carbon fiber market is expected to grow at a compound annual growth rate of 12.15% from 2026-2034 to reach USD 293.34 Million by 2034.

PAN-based carbon fiber dominates the market with 84.3% share, owing to its superior tensile strength characteristics, cost-effectiveness compared to pitch-based alternatives, and broad applicability across aerospace structures, automotive components, and industrial applications where high strength-to-weight ratios are essential.

Key factors driving the Brazil carbon fiber market include government decarbonization initiatives, accelerating renewable energy infrastructure development, particularly in offshore wind projects, aerospace industry modernization and capacity expansion, and the growing adoption of EVs requiring weight reduction for enhanced range and efficiency.

Major challenges include high production and material costs limiting adoption in price-sensitive segments, limited domestic carbon fiber manufacturing capacity creating import dependency, technical workforce constraints in specialized composite fabrication, supply chain vulnerabilities to currency fluctuations and international trade dynamics, and infrastructure limitations for processing aerospace-grade composite materials.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)