Brazil Commercial Aviation Market Size, Share, Trends and Forecast by Aircraft Type, Service Type, End User, and Region, 2025-2033

Brazil Commercial Aviation Market Overview:

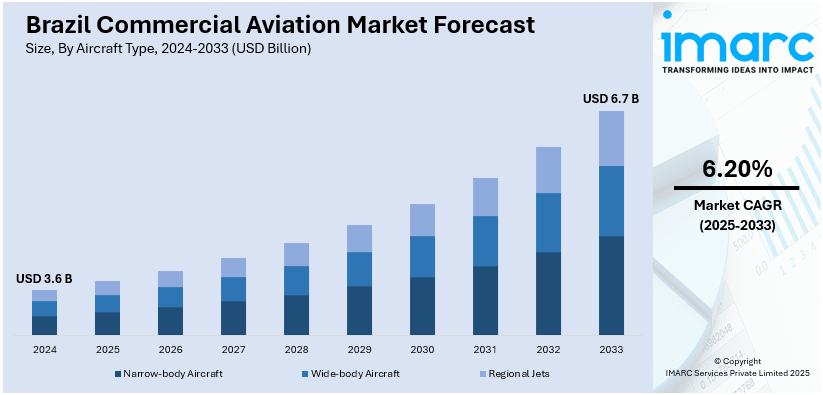

The Brazil commercial aviation market size reached USD 3.6 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 6.7 Billion by 2033, exhibiting a growth rate (CAGR) of 6.20% during 2025-2033. The market is driven by rising domestic travel demand, government infrastructure investments, and fleet modernization efforts by airlines to enhance fuel efficiency. Additionally, economic recovery, increasing low-cost carrier operations, and expanding regional connectivity contribute to market growth, while sustainability initiatives and emerging air mobility solutions further shape the industry's future.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 3.6 Billion |

| Market Forecast in 2033 | USD 6.7 Billion |

| Market Growth Rate 2025-2033 | 6.20% |

Brazil Commercial Aviation Market Trends:

Rising Domestic and International Travel Demand

As per the EBC, Brazil experienced 112.6 million domestic and international air passengers in 2023. Growing domestic and international travel demand is a major driver of the market owing to urbanization and better economic conditions domestically are fueling demand for air travel between major cities, with most preferring flights over long bus rides due to convenience and time savings. Globally, the tourism comeback is also in favor of Brazil as a high-value destination of international visitors. Added to the Brazilians visiting abroad in large numbers for recreational purposes, studying, and trade, it leads to additional airline demand for increased frequency, introducing new routes, and updating fleet capacities to attract customers to planes in terms of comfort, safety, and the environmental concerns in traveling.

Burgeoning E-Commerce Sector

The booming e-commerce industry is largely influencing the commercial aviation industry in Brazil due to an increase in demand for air cargo transport services. Since smartphones are increasingly being adopted and internet services are easily accessed, more individuals prefer shopping online. Citizens of the country are becoming increasingly in need of services being delivered promptly and effectively. Logistics operators and airlines are under pressure to expand their cargo space to meet the increasing needs of people for faster deliveries. Airlines are also cashing in on the trend by simplifying their cargo operations while some of them are assigning specific flights to carrying cargo along with passenger services. Apart from this, large e-commerce companies are also collaborating with airlines to facilitate fast delivery of products. The business aviation sector benefits from increased freight traffic as the e-commerce industry expands, especially during the country's peak shopping periods. According to the IMARC Group study report, the Brazilian e-commerce market size is projected to grow at a CAGR of 13.32% during 2024-2032.

Brazil Commercial Aviation Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on aircraft type, service type, and end user.

Aircraft Type Insights:

- Narrow-body Aircraft

- Wide-body Aircraft

- Regional Jets

The report has provided a detailed breakup and analysis of the market based on the aircraft type. This includes narrow-body aircraft, wide-body aircraft, and regional jets.

Service Type Insights:

- Passenger Transportation

- Cargo Services

A detailed breakup and analysis of the market based on the service type have also been provided in the report. This includes passenger transportation and cargo services.

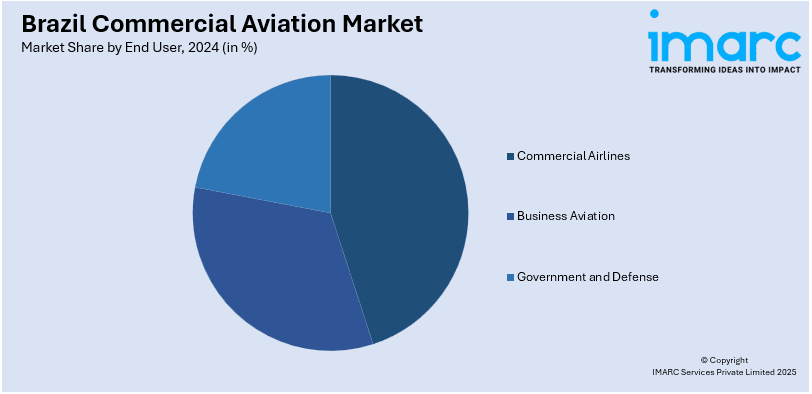

End User Insights:

- Commercial Airlines

- Business Aviation

- Government and Defense

The report has provided a detailed breakup and analysis of the market based on the end user. This includes commercial airlines, business aviation, and government and defense.

Regional Insights:

- Southeast

- South

- Northeast

- North

- Central-West

The report has also provided a comprehensive analysis of all the major regional markets, which include Southeast, South, Northeast, North, and Central-West.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Brazil Commercial Aviation Market News:

- 26 September 2024: Brazil's Total Linhas Aereas, a small cargo and charter carrier, announced it would be the first non-Asian firm to purchase aircraft from China's state-owned plane maker. Total and the Commercial Aircraft Corporation of China (COMAC) will meet in October to discuss a possible order for up to four C919 planes.

- 30 September 2024: The International Air Transport Association (IATA) and the Brazilian National Civil Aviation Agency (ANAC Brazil) joined forces to enhance safety supervision in Brazil's air transportation industry with a memorandum of understanding (MoU) for the IATA Operational Safety Audit (IOSA) and IATA Standard Safety Assessment (ISSA) programs to aid and supplement ANAC's supervision of airline operations. This MoU is a major milestone in upgrading the safety levels of Brazil's air transport industry.

Brazil Commercial Aviation Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Aircraft Types Covered | Narrow-Body Aircraft, Wide-Body Aircraft, Regional Jets |

| Service Types Covered | Passenger Transportation, Cargo Services |

| End Users Covered | Commercial Airlines, Business Aviation, Government and Defense |

| Regions Covered | Southeast, South, Northeast, North, Central-West |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Brazil commercial aviation market performed so far and how will it perform in the coming years?

- What is the breakup of the Brazil commercial aviation market on the basis of aircraft type?

- What is the breakup of the Brazil commercial aviation market on the basis of service type?

- What is the breakup of the Brazil commercial aviation market on the basis of end user?

- What is the breakup of the Brazil commercial aviation market on the basis of region?

- What are the various stages in the value chain of the Brazil commercial aviation market?

- What are the key driving factors and challenges in the Brazil commercial aviation?

- What is the structure of the Brazil commercial aviation market and who are the key players?

- What is the degree of competition in the Brazil commercial aviation market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Brazil commercial aviation market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Brazil commercial aviation market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Brazil commercial aviation industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)