Brazil Commercial Insurance Market Size, Share, Trends and Forecast by Type, Enterprise Size, Distribution Channel, Industry Vertical, and Region, 2025-2033

Brazil Commercial Insurance Market Overview:

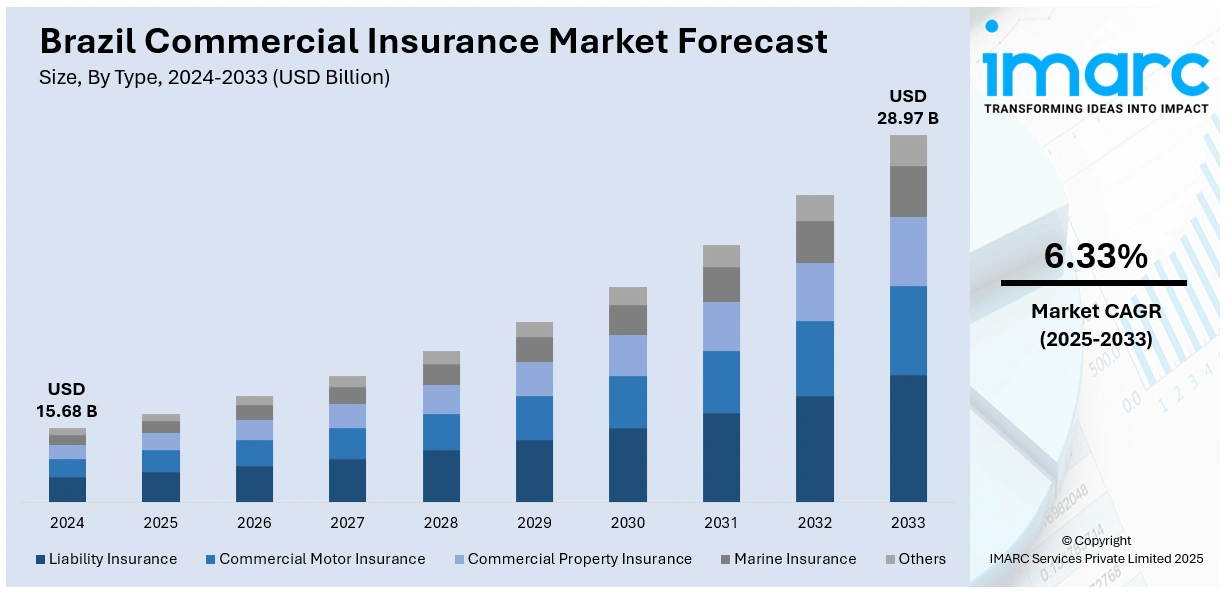

The Brazil commercial insurance market size reached USD 15.68 Billion in 2024. The market is projected to reach USD 28.97 Billion by 2033, exhibiting a growth rate (CAGR) of 6.33% during 2025-2033. Economic stabilization, modernization of regulatory frameworks, growth in SME and agribusiness demand, and digital innovation in coverage and claims processes are key drivers. Expansion of parametric and cyber insurance offerings further reshape evolving Brazil commercial insurance market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 15.68 Billion |

| Market Forecast in 2033 | USD 28.97 Billion |

| Market Growth Rate 2025-2033 | 6.33% |

Brazil Commercial Insurance Market Trends:

Digital Underwriting and Insurtech Collaboration

Brazil’s commercial insurance sector is rapidly advancing digital underwriting platforms, employing data analytics, AI, and real‑time risk scoring to enhance efficiency and precision—spurring Brazil commercial insurance market growth. Insurtech startups collaborate with traditional carriers to co‑develop scalable solutions targeted at SMEs and informal businesses in urban and rural regions. Digital portals streamline policy issuance, while usage‑based modules allow flexible commercial coverage. Claims processing automation via mobile and web apps reduces turnaround times and improves customer experience. Partnerships extend to payment platforms and fintechs, easing integration and distribution. For instance, in 2024, Brazil’s insurance M&A activity hit a nearly 30-year high with 42 deals, a 27% increase from 2023, driven by consolidation in distribution channels, especially insurance brokers. As competition intensifies and clients demand speed and transparency, digital transformation becomes a central enabler of growth and differentiation within Brazil’s commercial insurance industry.

To get more information on this market, Request Sample

Regulatory Modernization and Modular Products

Brazil’s National Private Insurance Superintendence (SUSEP) is enabling innovation via regulatory modernization, including sandbox programs for parametric and modular commercial insurance products, fueling Brazil commercial insurance market growth. Insurers pilot usage‑based, on‑demand, and modular coverage packages tailored to industry‑specific risks. This regulatory flexibility encourages agile product development and market responsiveness, especially for SMEs. Collaboration between regulators, insurers, and insurtechs accelerates floating coverage models and risk sharing. As business structures diversify, modular policies allow customers to assemble bespoke packages for cyber‑risk, liability, and business interruption. The regulatory environment thus reinforces commercial insurance penetration while encouraging dynamic product design responsive to evolving enterprise needs. For instance, Brazil’s new Complementary Law No. 213/2025 broadens insurance cooperatives’ operational scope beyond previous sector limits, enabling them to offer diverse products across industries. This legislation fosters competition, expands consumer choice, and enhances regulatory oversight by SUSEP, boosting market stability and trust. Set to take effect at the end of 2025, the law supports cooperative growth, financial inclusion, and community-focused insurance models, challenging traditional commercial insurers and promoting a more inclusive Brazilian insurance market.

Brazil Commercial Insurance Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional level for 2025-2033. Our report has categorized the market based on type, enterprise size, distribution channel, and industry vertical.

Type Insights:

- Liability Insurance

- Commercial Motor Insurance

- Commercial Property Insurance

- Marine Insurance

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes liability insurance, commercial motor insurance, commercial property insurance, marine insurance, and others.

Enterprise Size Insights:

- Large Enterprises

- Small and Medium-sized Enterprises

The report has provided a detailed breakup and analysis of the market based on the enterprise size. This includes large enterprises and small and medium-sized enterprises.

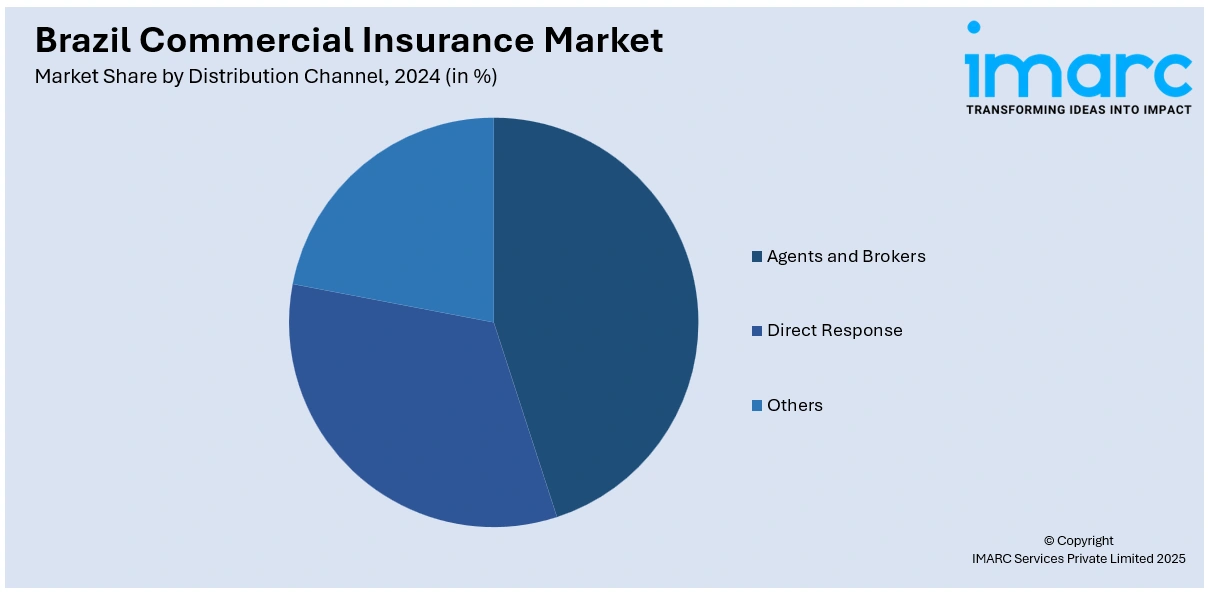

Distribution Channel Insights:

- Agents and Brokers

- Direct Response

- Others

The report has provided a detailed breakup and analysis of the market based on the distribution channel. This includes agents and brokers, direct response, and others.

Industry Vertical Insights:

- Transportation and Logistics

- Manufacturing

- Construction

- IT and Telecom

- Healthcare

- Energy and Utilities

- Others

The report has provided a detailed breakup and analysis of the market based on the industry vertical. This includes transportation and logistics, manufacturing, construction, it and telecom, healthcare, energy and utilities, and others.

Regional Insights:

- Southeast

- South

- Northeast

- North

- Central-West

The report has also provided a comprehensive analysis of all the major regional markets, which include Southeast, South, Northeast, North, and Central-West.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Brazil Commercial Insurance Market News:

- In August 2025, Brazil’s inaugural insurance-linked securities (ILS) issuance, sponsored by IRB(Re) through its Andrina SSPE, represented a significant regulatory advancement in the nation’s re/insurance sector. The newly established framework, authorised by SUSEP, permits the issuance of Insurance Risk Letters (LRS), legally guaranteed instruments that do not rely on catastrophe risk exposure. The structure is expected to enhance capital diversification, reduce reinsurance costs, and attract institutional investors.

- In January 2025, Brazilian insurer Porto Seguro reportedly entered discussions with private equity firms, including Summit Partners, to sell a minority stake of at least 5% in its health insurance division. The proposed deal would grant the investor a board seat and is intended to support the division’s growth and expansion. While no agreements have been finalized, UBS values the health unit at up to R$6.5 Billion (approximately $1.1 Billion).

Brazil Commercial Insurance Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Liability Insurance, Commercial Motor Insurance, Commercial Property Insurance, Marine Insurance, Others |

| Enterprise Sizes Covered | Large Enterprises, Small and Medium-Sized Enterprises |

| Distribution Channels Covered | Agents and Brokers, Direct Response, Others |

| Industry Verticals Covered | Transportation and Logistics, Manufacturing, Construction, IT and Telecom, Healthcare, Energy and Utilities, Others |

| Regions Covered | Southeast, South, Northeast, North, Central-West |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Brazil commercial insurance market performed so far and how will it perform in the coming years?

- What is the breakup of the Brazil commercial insurance market on the basis of type?

- What is the breakup of the Brazil commercial insurance market on the basis of enterprise size?

- What is the breakup of the Brazil commercial insurance market on the basis of distribution channel?

- What is the breakup of the Brazil commercial insurance market on the basis of industry vertical?

- What is the breakup of the Brazil commercial insurance market on the basis of region?

- What are the various stages in the value chain of the Brazil commercial insurance market?

- What are the key driving factors and challenges in the Brazil commercial insurance market?

- What is the structure of the Brazil commercial insurance market and who are the key players?

- What is the degree of competition in the Brazil commercial insurance market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Brazil commercial insurance market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Brazil commercial insurance market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Brazil commercial insurance industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)