Brazil Confectionery Market Size, Share, Trends and Forecast by Product Type, Age Group, Price Point, Distribution Channel, and Region, 2025-2033

Brazil Confectionery Market Overview:

The Brazil confectionery market size reached USD 3.37 Billion in 2024. The market is projected to reach USD 4.70 Billion by 2033, exhibiting a growth rate (CAGR) of 3.39% during 2025-2033. The market is growing steadily due to amplifying consumer demand for premium, health-oriented, and sustainably manufactured products. Urbanization and increased disposable incomes fuel the growth of artisanal and functional confectionery segments. Companies are innovating with distinctive flavors, nutritional properties, and ethical sourcing to respond to changing consumer tastes. These trends place Brazil as a major global confectionery player, further boosting its competitiveness and increasing market opportunities, propelling Brazil confectionery market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 3.37 Billion |

| Market Forecast in 2033 | USD 4.70 Billion |

| Market Growth Rate 2025-2033 | 3.39% |

Brazil Confectionery Market Trends:

Growing Demand for Premium and Artisanal Confectionery

The Brazil confectionery market is experiencing a pronounced shift toward premium and artisanal products. Customers increasingly demand superior quality, distinctive flavor profiles, and original craftsmanship, driving demand for gourmet chocolate, hand-made sweets, and specialty breads. This premiumization trend mirrors wider global confectionery market trends as a result of rising disposable incomes and changing consumer preferences in urban areas. Manufacturers are therefore responding by incorporating exotic ingredients and luxurious packaging to capture discerning consumers. This emphasis on quality rather than quantity is broadening the base of consumers prepared to pay a premium for premium products. The accelerating demand for handmade confections not only strengthens Brazil's domestic market potential but also reinforces its presence in the global confectionery market. This trend directly supports Brazil confectionery market growth by driving product value and responding to complex consumer trends.

Growth in Health-Conscious and Functional Confectionery

Health awareness is transforming the Brazil confectionery market patterns with customers demanding indulgent confectionery products with added health benefits. A growing demand for sugar-free, low-calorie, and functional confectionery with added vitamins, antioxidants, and probiotics has become prominent. This is supported by heightened health awareness and changing lifestyles such as demands for vegan, gluten-free, and plant-based products. Manufacturers are developing treats that marry flavor with health value, appealing to a broader demographic concerned with well-being without renouncing pleasure. This change opens up the confectionery market, reacting to customers who make healthier options a priority. The use of functional ingredients further ties into health-oriented patterns around the world, increasing Brazil's competitiveness in the confectionery market. The shift towards healthier confectionery products is an important driver favoring continued Brazil confectionery market growth through the upcoming years.

Growing Demand for Ethical and Sustainable Confectionery

Ethical practices and sustainability are emerging as the major drivers influencing Brazil confectionery market trends. Younger generations and consumers, in general, increasingly prefer brands that ensure transparency, fair trade, and eco-friendliness. This pressure invites companies to use cocoa and other raw materials in a sustainable manner, promote local farmers, and have environmentally friendly manufacturing processes. In addition, the trend towards recyclable and degradable packaging is on the rise, meeting boosting environmental pressures and regulatory demands. This moral transformation increases brand loyalty and creates new market possibilities at home and abroad. Sustainability commitment not only resonates with consumer values but also helps Brazil establish itself as a sustainable participant in the global confectionery market. The emphasis on sustainable and ethical practices is likely to spur the market growth by increasing consumer confidence and addressing changing market expectations.

Brazil Confectionery Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on product type, age group, price point, and distribution channel.

Product Type Insights:

- Hard-boiled Sweets

- Mints

- Gums and Jellies

- Chocolate

- Caramels and Toffees

- Medicated Confectionery

- Fine Bakery Wares

- Others

The report has provided a detailed breakup and analysis of the market based on the product type. This includes hard-boiled sweets, mints, gums and jellies, chocolate, caramels and toffees, medicated confectionery, fine bakery wares, and others.

Age Group Insights:

- Children

- Adult

- Geriatric

A detailed breakup and analysis of the market based on the age group have also been provided in the report. This includes children, adult, and geriatric.

Price Point Insights:

- Economy

- Mid-range

- Luxury

The report has provided a detailed breakup and analysis of the market based on the price point. This includes economy, mid-range, and luxury.

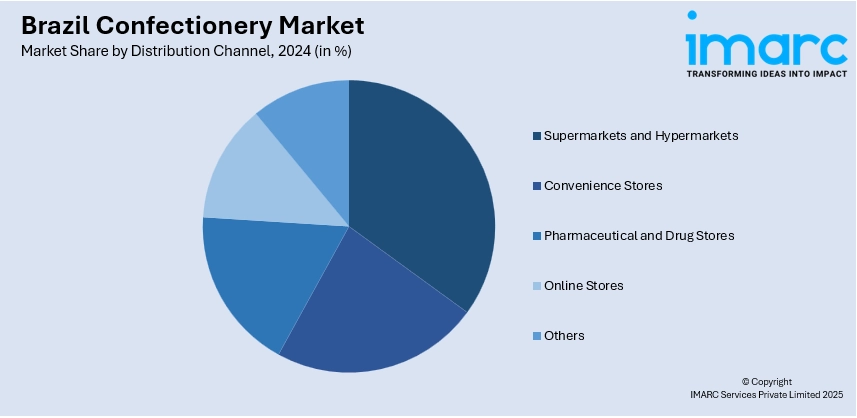

Distribution Channel Insights:

- Supermarkets and Hypermarkets

- Convenience Stores

- Pharmaceutical and Drug Stores

- Online Stores

- Others

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes supermarkets and hypermarkets, convenience stores, pharmaceutical and drug stores, online stores, and others.

Regional Insights:

- Southeast

- South

- Northeast

- North

- Central-West

The report has also provided a comprehensive analysis of all the major regional markets, which include Southeast, South, Northeast, North, and Central-West.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Brazil Confectionery Market News:

- In September 2024, Mix, the flagship brand of Duas Rodas Group, introduced 39 new products in the market of confectionery in Brazil. The new range of products contains powdered chocolates, homemade ice cream blends, toppings, fillings, and creative packaging suitable for small families, supporting Mix in its mission of assisting Brazilian confectioners with convenient and adaptable solutions.

- In September 2024, Ferrero Rocher introduced chocolate bars in Brazil, with white, milk, and dark chocolate (55% cocoa) products. This new packaging format is designed to increase the size of the brand's consumer base by providing a less formal and cheaper option for daily consumption, alongside its classic special occasion chocolates.

Brazil Confectionery Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Hard-Boiled Sweets, Mints, Gums and Jellies, Chocolate, Caramels and Toffees, Medicated Confectionery, Fine Bakery Wares, Others |

| Age Groups Covered | Children, Adult, Geriatric |

| Price Points Covered | Economy, Mid-Range, Luxury |

| Distribution Channels Covered | Supermarkets and Hypermarkets, Convenience Stores, Pharmaceutical and Drug Stores, Online Stores, Others |

| Regions Covered | Southeast, South, Northeast, North, Central-West |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Brazil confectionery market performed so far and how will it perform in the coming years?

- What is the breakup of the Brazil confectionery market on the basis of product type?

- What is the breakup of the Brazil confectionery market on the basis of age group?

- What is the breakup of the Brazil confectionery market on the basis of price point?

- What is the breakup of the Brazil confectionery market on the basis of distribution channel?

- What is the breakup of the Brazil confectionery market on the basis of region?

- What are the various stages in the value chain of the Brazil confectionery market?

- What are the key driving factors and challenges in the Brazil confectionery market?

- What is the structure of the Brazil confectionery market and who are the key players?

- What is the degree of competition in the Brazil confectionery market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Brazil confectionery market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Brazil confectionery market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Brazil confectionery industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)